Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 5

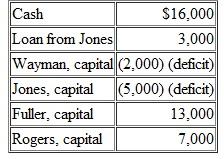

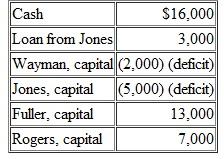

A partnership has gone through liquidation and now reports the following account balances:  Profits and losses are allocated on the following basis: Wayman, 30 percent; Jones, 20 percent; Fuller, 30 percent; and Rogers, 20 percent.Which of the following events should occur now

Profits and losses are allocated on the following basis: Wayman, 30 percent; Jones, 20 percent; Fuller, 30 percent; and Rogers, 20 percent.Which of the following events should occur now

a.Jones should receive $3,000 cash because of the loan balance.

b.Fuller should receive $11,800 and Rogers $4,200.

c.Fuller should receive $10,600 and Rogers $5,400.

d.Jones should receive $3,000, Fuller $8,800, and Rogers $4,200,

Profits and losses are allocated on the following basis: Wayman, 30 percent; Jones, 20 percent; Fuller, 30 percent; and Rogers, 20 percent.Which of the following events should occur now

Profits and losses are allocated on the following basis: Wayman, 30 percent; Jones, 20 percent; Fuller, 30 percent; and Rogers, 20 percent.Which of the following events should occur now a.Jones should receive $3,000 cash because of the loan balance.

b.Fuller should receive $11,800 and Rogers $4,200.

c.Fuller should receive $10,600 and Rogers $5,400.

d.Jones should receive $3,000, Fuller $8,800, and Rogers $4,200,

Explanation

Explanation :

The calculation of ending...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255