An Introduction to Management Science 13th Edition by David Anderson,Dennis Sweeney ,Thomas Williams ,Jeffrey Camm, Kipp Martin

Edition 13ISBN: 978-1439043271

An Introduction to Management Science 13th Edition by David Anderson,Dennis Sweeney ,Thomas Williams ,Jeffrey Camm, Kipp Martin

Edition 13ISBN: 978-1439043271 Exercise 8

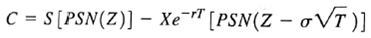

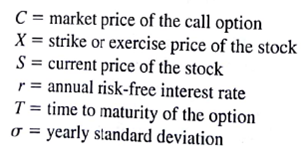

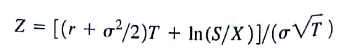

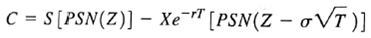

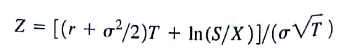

Options are popular instruments in the world of finance. A call option on a stock gives the owner the right to buy the stock at a predetermined price before the expiration date of the option. For example, on Friday, August 25, 2006, call options were selling for Procter Gamble stock that save the owner of the option the right to buy a share of stock for $60 on or before September 15, 2006. The asking price on the option was $1.45 at the market close. How are options priced? A pricing formula for options was developed by Fischer Black and Myron Scholes and published in 1973. Scholes was later awarded the Nobel Prize for this work in 1997 (Black was deceased). The Black-Scholes pricing model is widely used today by hedge funds and traders. The Black-Scholes formula for the price of a call option is

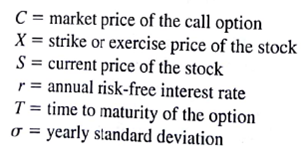

where

In the Black-Scholes formula, and PSN ( Z ) is the probability of an observation of Z or less for a normal distribution with mean 0 and variance 1.

and PSN ( Z ) is the probability of an observation of Z or less for a normal distribution with mean 0 and variance 1.

The purpose of this exercise is to price a Procter Gamble call option offered on August 25, 2006. The option expires September 15, 2006, which includes 21 days between the market close on August 25, 2006, and the expiration of the option on September 15, 2006. Use the yield on three-month Treasury bills as the risk-free interest rate. As of August 25, 2006, this yield was 0.0494. The strike price on the option is $60 and at the market close on August 25, 2006, the stock was trading at $60.87. In order to use the Black-Scholes formula, the yearly standard deviation, ? is required. One way to obtain this number is to estimate the weekly variance of Procter Gamble, multiply the weekly variance by 52, and then take the square root to get the annual standard deviation. For this problem, use a weekly variance of 0.000479376. Use these data to calculate the option price using the Black-Scholes formula. For Friday, August 25, 2006, the actual bid on this option was $1.35 and actual ask was $1.45.

where

In the Black-Scholes formula,

and PSN ( Z ) is the probability of an observation of Z or less for a normal distribution with mean 0 and variance 1.

and PSN ( Z ) is the probability of an observation of Z or less for a normal distribution with mean 0 and variance 1.The purpose of this exercise is to price a Procter Gamble call option offered on August 25, 2006. The option expires September 15, 2006, which includes 21 days between the market close on August 25, 2006, and the expiration of the option on September 15, 2006. Use the yield on three-month Treasury bills as the risk-free interest rate. As of August 25, 2006, this yield was 0.0494. The strike price on the option is $60 and at the market close on August 25, 2006, the stock was trading at $60.87. In order to use the Black-Scholes formula, the yearly standard deviation, ? is required. One way to obtain this number is to estimate the weekly variance of Procter Gamble, multiply the weekly variance by 52, and then take the square root to get the annual standard deviation. For this problem, use a weekly variance of 0.000479376. Use these data to calculate the option price using the Black-Scholes formula. For Friday, August 25, 2006, the actual bid on this option was $1.35 and actual ask was $1.45.

Explanation

This question doesn’t have an expert verified answer yet, let Examlex AI Copilot help.

An Introduction to Management Science 13th Edition by David Anderson,Dennis Sweeney ,Thomas Williams ,Jeffrey Camm, Kipp Martin

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255