An Introduction to Management Science 13th Edition by David Anderson,Dennis Sweeney ,Thomas Williams ,Jeffrey Camm, Kipp Martin

Edition 13ISBN: 978-1439043271

An Introduction to Management Science 13th Edition by David Anderson,Dennis Sweeney ,Thomas Williams ,Jeffrey Camm, Kipp Martin

Edition 13ISBN: 978-1439043271 Exercise 20

TRI-STATE CORPORATION

What will your portfolio be worth in 10 years? In 20 years? When you stop working? The Human Resources Department at Tri-State Corporation was asked to develop a financial planning model that would help employees address these question. Tom Gifford was asked to lead this effort and decided to begin by developing a financial plan for himself. Tom has a degree in business and, at the age of 25, is making $34, 000 per year. After two years of contributions to his company's retirement program and the receipt of a small inheritance, Tom has accumulate a portfolio valued at $14,500 Tom plans to work 30 more year and hopes has accumulate a portfolio valued at $1 million. Can he do it?

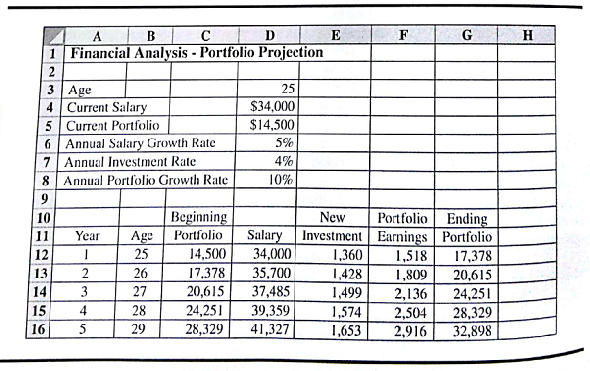

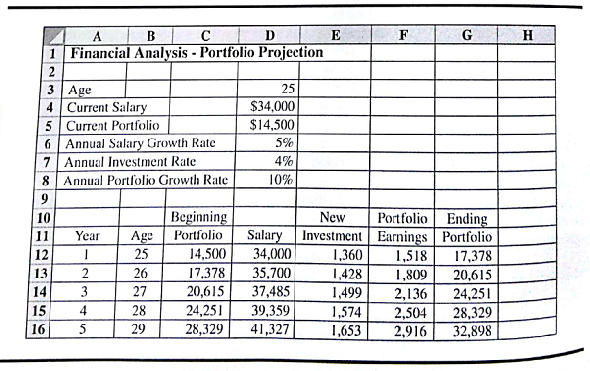

Tom began with a few assumptions about his future salary, his investment contributions, and his portfolio growth rate growth rate. He assumed 5% annual salary growth rate as reasonable and wants to make new investment contributions at 4% of his salary. After some research on historical stock market performance. Tom decided that a 10% annual portfolio growth rate was reasonable. Using these assumptions, Tom developed the Excel worksheet shown in Figure 12.18. Tom's specific situation and his assumptions are in the top portion of the worksheet (cells D3:D8). The worksheet provides a financial plan for the next five years. In computing the portfolio earnings for a given year, Tom assumed that his new investment contribution would occur evenly throughout the year and thus half of the new investment could be included in the computation of the portfolio earning for the year. Using Figure 12.18, we see that at age 29. Tom is projected to have a portfolio valued at $32,898.

Tom's plan was to use this worksheet as a template to develop financial plans for the company's employees. The assumptions in cells D3:D8 would be different for each employee, and rows would be added to the worksheet to reflect the number of years appropriate for each employee. After adding another 25 rows to the worksheet, Tom found that be could expect to have a portfolio of $627,937 after 30 years. Tom then took his results to, show his boss. Kale Riegle.

Although Kate was pleased with Tom's progress, she voiced several criticisms. One of the criticisms was the assumption of a constant annual salary growth rate. She noted that most employees experience some variation in the annual salary growth rate from year to year. In addition, she pointed out that the constant annual portfolio growth rate was unrealistic and that the actual growth rate would vary considerably from year to year. She further suggested that a simulation model for the portfolio projection might allow Tom to account for the random variability in the salary growth rate and the portfolio growth rate.

After some research, Tom and Kate decided to assume that the annual salary growth rate would vary from 0% to 10% and that a uniform probability distribution would provide a realistic approximation. Tri-State's accounting firm suggested that the annual portfolio growth rate could be approximated by a normal probability distribution with a mean of 10% and a standard deviation of 5%. With this information, Tom set off to develop a simulation model that could be used by the company's employees for financial planning.

FIGURE 12.18 FINANCIAL PLANNING WORKSHEET FOR TOM GIFFORD

Managerial Report

Play the role of Tom Gifford and develop a simulation model for financial planning. Write a report for Tom's boss and. at a minimum, include the following:

1. Without considering the random variability in growth rates, extend the worksheet in Figure 12.18 to 30 years. Confirm that by using the constant annual salary growth rate and the constant annual portfolio growth rate, Tom can expect to have a 30 year portfolio of $627,937. What would Tom's annual investment rate have to increase to in order for his portfolio to reach a 30-year, $ 1 million goal?

2. Incorporate the random variability of the annual salary growth rate and the annual portfolio growth rate into a simulation model. Assume that Tom is willing to use the annual investment rate that predicted a 30-year, $1 million portfolio in part 1. Show how to simulate Tom's 30-year financial plan. Use results from the simulation model to comment on the uncertainty associated with Tom reaching the 30-year, $1 million goal. Discuss the advantages of repeating the simulation numerous times.

3. What recommendations do you have for employees with a current profile similar to Tom's after seeing the impact of the uncertainty in the annual salary growth rate?

4. Assume that Tom is willing to consider working 35 years. What is your assessment of this strategy if Tom's goal is to have a portfolio worth $1 million?

5. Discuss how the financial planning model developed for Tom Gifford can be used as a template to develop a financial plan for any of the company's employees.

What will your portfolio be worth in 10 years? In 20 years? When you stop working? The Human Resources Department at Tri-State Corporation was asked to develop a financial planning model that would help employees address these question. Tom Gifford was asked to lead this effort and decided to begin by developing a financial plan for himself. Tom has a degree in business and, at the age of 25, is making $34, 000 per year. After two years of contributions to his company's retirement program and the receipt of a small inheritance, Tom has accumulate a portfolio valued at $14,500 Tom plans to work 30 more year and hopes has accumulate a portfolio valued at $1 million. Can he do it?

Tom began with a few assumptions about his future salary, his investment contributions, and his portfolio growth rate growth rate. He assumed 5% annual salary growth rate as reasonable and wants to make new investment contributions at 4% of his salary. After some research on historical stock market performance. Tom decided that a 10% annual portfolio growth rate was reasonable. Using these assumptions, Tom developed the Excel worksheet shown in Figure 12.18. Tom's specific situation and his assumptions are in the top portion of the worksheet (cells D3:D8). The worksheet provides a financial plan for the next five years. In computing the portfolio earnings for a given year, Tom assumed that his new investment contribution would occur evenly throughout the year and thus half of the new investment could be included in the computation of the portfolio earning for the year. Using Figure 12.18, we see that at age 29. Tom is projected to have a portfolio valued at $32,898.

Tom's plan was to use this worksheet as a template to develop financial plans for the company's employees. The assumptions in cells D3:D8 would be different for each employee, and rows would be added to the worksheet to reflect the number of years appropriate for each employee. After adding another 25 rows to the worksheet, Tom found that be could expect to have a portfolio of $627,937 after 30 years. Tom then took his results to, show his boss. Kale Riegle.

Although Kate was pleased with Tom's progress, she voiced several criticisms. One of the criticisms was the assumption of a constant annual salary growth rate. She noted that most employees experience some variation in the annual salary growth rate from year to year. In addition, she pointed out that the constant annual portfolio growth rate was unrealistic and that the actual growth rate would vary considerably from year to year. She further suggested that a simulation model for the portfolio projection might allow Tom to account for the random variability in the salary growth rate and the portfolio growth rate.

After some research, Tom and Kate decided to assume that the annual salary growth rate would vary from 0% to 10% and that a uniform probability distribution would provide a realistic approximation. Tri-State's accounting firm suggested that the annual portfolio growth rate could be approximated by a normal probability distribution with a mean of 10% and a standard deviation of 5%. With this information, Tom set off to develop a simulation model that could be used by the company's employees for financial planning.

FIGURE 12.18 FINANCIAL PLANNING WORKSHEET FOR TOM GIFFORD

Managerial Report

Play the role of Tom Gifford and develop a simulation model for financial planning. Write a report for Tom's boss and. at a minimum, include the following:

1. Without considering the random variability in growth rates, extend the worksheet in Figure 12.18 to 30 years. Confirm that by using the constant annual salary growth rate and the constant annual portfolio growth rate, Tom can expect to have a 30 year portfolio of $627,937. What would Tom's annual investment rate have to increase to in order for his portfolio to reach a 30-year, $ 1 million goal?

2. Incorporate the random variability of the annual salary growth rate and the annual portfolio growth rate into a simulation model. Assume that Tom is willing to use the annual investment rate that predicted a 30-year, $1 million portfolio in part 1. Show how to simulate Tom's 30-year financial plan. Use results from the simulation model to comment on the uncertainty associated with Tom reaching the 30-year, $1 million goal. Discuss the advantages of repeating the simulation numerous times.

3. What recommendations do you have for employees with a current profile similar to Tom's after seeing the impact of the uncertainty in the annual salary growth rate?

4. Assume that Tom is willing to consider working 35 years. What is your assessment of this strategy if Tom's goal is to have a portfolio worth $1 million?

5. Discuss how the financial planning model developed for Tom Gifford can be used as a template to develop a financial plan for any of the company's employees.

Explanation

Information given about TS Corporation: ...

An Introduction to Management Science 13th Edition by David Anderson,Dennis Sweeney ,Thomas Williams ,Jeffrey Camm, Kipp Martin

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255