Macroeconomics 5th Edition by Olivier Blanchard

Edition 5ISBN: 978-0132159869

Macroeconomics 5th Edition by Olivier Blanchard

Edition 5ISBN: 978-0132159869 Exercise 3

Nominal and real interest parity

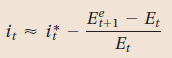

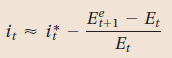

In equation (18.4), we wrote the nominal interest parity condition as

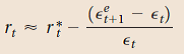

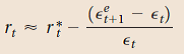

In Appendix 2 to this chapter, we derive a real interest parity condition. We can rewrite the real interest parity condition in a manner analogous to equation (18.4):

a. Interpret this equation. Under what circumstances will the domestic real interest rate exceed the foreign real interest rate Assume that the one-year nominal interest rate is 10% in the domestic economy and 6% in the foreign economy. Also assume that inflation over the coming year is expected to be 6% in the domestic economy and 3% in the foreign economy. Suppose that interest parity holds.

b. What is the expected nominal depreciation of the domestic currency over the coming year

c. What is the expected real depreciation over the coming year

d. If you expected a nominal appreciation of the currency over the coming year, should you hold domestic or foreign bonds

In equation (18.4), we wrote the nominal interest parity condition as

In Appendix 2 to this chapter, we derive a real interest parity condition. We can rewrite the real interest parity condition in a manner analogous to equation (18.4):

a. Interpret this equation. Under what circumstances will the domestic real interest rate exceed the foreign real interest rate Assume that the one-year nominal interest rate is 10% in the domestic economy and 6% in the foreign economy. Also assume that inflation over the coming year is expected to be 6% in the domestic economy and 3% in the foreign economy. Suppose that interest parity holds.

b. What is the expected nominal depreciation of the domestic currency over the coming year

c. What is the expected real depreciation over the coming year

d. If you expected a nominal appreciation of the currency over the coming year, should you hold domestic or foreign bonds

Explanation

(a) To interpret this equation it is bes...

Macroeconomics 5th Edition by Olivier Blanchard

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255