Essentials of Business Analytics 1st Edition by Jeffrey Camm,James Cochran,Michael Fry,Jeffrey Ohlmann ,David Anderson

Edition 1ISBN: 978-1285187273

Essentials of Business Analytics 1st Edition by Jeffrey Camm,James Cochran,Michael Fry,Jeffrey Ohlmann ,David Anderson

Edition 1ISBN: 978-1285187273 Exercise 3

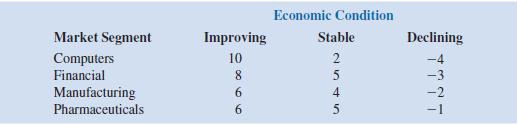

Investment advisors estimated the stock market returns for four market segments: computers, financial, manufacturing, and pharmaceuticals. Annual return projections vary depending on whether the general economic conditions are improving, stable, or declining. The anticipated annual return percentages for each market segment under each economic

condition are as follows:

a. Assume that an individual investor wants to select one market segment for a new investment. A forecast shows improving to declining economic conditions with the following probabilities: improving (0.2), stable (0.5), and declining (0.3). What is the preferred market segment for the investor, and what is the expected return percentage

b. At a later date, a revised forecast shows a potential for an improvement in economic conditions. New probabilities are as follows: improving (0.4), stable (0.4), and declining (0.2). What is the preferred market segment for the investor based on these new probabilities What is the expected return percentage

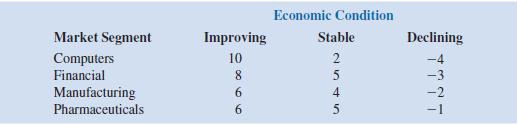

condition are as follows:

a. Assume that an individual investor wants to select one market segment for a new investment. A forecast shows improving to declining economic conditions with the following probabilities: improving (0.2), stable (0.5), and declining (0.3). What is the preferred market segment for the investor, and what is the expected return percentage

b. At a later date, a revised forecast shows a potential for an improvement in economic conditions. New probabilities are as follows: improving (0.4), stable (0.4), and declining (0.2). What is the preferred market segment for the investor based on these new probabilities What is the expected return percentage

Explanation

a.

Suppose that an individual investor ...

Essentials of Business Analytics 1st Edition by Jeffrey Camm,James Cochran,Michael Fry,Jeffrey Ohlmann ,David Anderson

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255