Deck 23: Present Discounted Value

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/16

Play

Full screen (f)

Deck 23: Present Discounted Value

1

With zero inflation, a dollar received today is worth ____ a dollar received one year from now.

A) the same as

B) more than

C) less than

D) There is not enough information provided to answer this question.

A) the same as

B) more than

C) less than

D) There is not enough information provided to answer this question.

more than

2

The percentage rate used to calculate the value of a future sum is called the

A) discount rate.

B) calculation rate.

C) interest rate.

D) future rate.

E) present rate.

A) discount rate.

B) calculation rate.

C) interest rate.

D) future rate.

E) present rate.

discount rate.

3

The present discounted value is today's value of future payments.

True

4

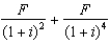

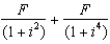

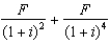

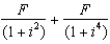

The proper equation to use in calculating the present discounted value of a sum F received in two years and again in four years is

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

5

Suppose you win a million dollars in the state lottery. What is the present discounted value of your winnings if you are scheduled to receive $200,000 at the end of each year for the next five years, and the rate of interest is 5 percent?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

6

The process of determining how much a sum paid or received in the future is worth in the present is called

A) appraisal.

B) valuing.

C) discounting.

D) dealing.

E) inflating.

A) appraisal.

B) valuing.

C) discounting.

D) dealing.

E) inflating.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

7

The present discounted value of $75 to be received in two years with no interest is ____ when the interest rate is 8 percent.

A) $64.30

B) $69.44

C) $87.48

D) $75

E) $81

A) $64.30

B) $69.44

C) $87.48

D) $75

E) $81

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

8

Discounting implies that a given amount of money is worth more today than in the future.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

9

Discounting is the process of calculating how much future sums of money are worth today.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

10

A dollar in the future is worth more than a dollar today.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

11

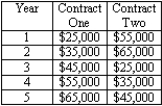

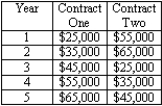

You are considering two work contracts, each of which lasts for five years. The two contracts are summarized in the following table.  Assume that you will be paid at the end of each year. Contract 1 includes a signing bonus of $5,000 to be paid at the beginning of year 1, whereas contract 2 does not include a signing bonus. If the interest rate is 5 percent, which is the better offer?

Assume that you will be paid at the end of each year. Contract 1 includes a signing bonus of $5,000 to be paid at the beginning of year 1, whereas contract 2 does not include a signing bonus. If the interest rate is 5 percent, which is the better offer?

Assume that you will be paid at the end of each year. Contract 1 includes a signing bonus of $5,000 to be paid at the beginning of year 1, whereas contract 2 does not include a signing bonus. If the interest rate is 5 percent, which is the better offer?

Assume that you will be paid at the end of each year. Contract 1 includes a signing bonus of $5,000 to be paid at the beginning of year 1, whereas contract 2 does not include a signing bonus. If the interest rate is 5 percent, which is the better offer?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

12

The value of a sum of money or an asset to be paid or received in the future is called the

A) rated value.

B) present calculated value.

C) future present value.

D) present rated value.

E) present discounted value.

A) rated value.

B) present calculated value.

C) future present value.

D) present rated value.

E) present discounted value.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

13

Find an expression for the present discounted value of

(A)$500 to be paid at the end of five years.

(B)$100 to be paid at the end of two years and $100 to be paid at the end of three years.

(C)$8 to be paid at the end of one year, $8 to be paid at the end of two years, and $80 to be paid at the end of three years.

(A)$500 to be paid at the end of five years.

(B)$100 to be paid at the end of two years and $100 to be paid at the end of three years.

(C)$8 to be paid at the end of one year, $8 to be paid at the end of two years, and $80 to be paid at the end of three years.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

14

The discount rate is commonly measured by the

A) stock market returns.

B) rate of inflation.

C) interest rate.

D) unemployment rate.

E) rate of economic growth.

A) stock market returns.

B) rate of inflation.

C) interest rate.

D) unemployment rate.

E) rate of economic growth.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

15

Suppose a friend wants to borrow $500 and offers to pay you back over the next five years by paying $100 at the end of two years, $200 at the end of three years, $150 at the end of four years, and $125 at the end of five years. You want to at least break even over the five years, and you could earn 7 percent interest on the money if you kept it. Should you make the loan? (Hint: Calculate the present discounted value of the payments. Show your work.)

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

16

The present discounted value of a $35 payment with an interest rate of 12 percent received every year for three years is

A) $94.15.

B) $84.06.

C) $105.00.

D) $24.91.

A) $94.15.

B) $84.06.

C) $105.00.

D) $24.91.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck