Deck 22: Decision Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

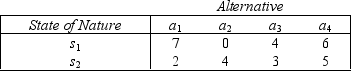

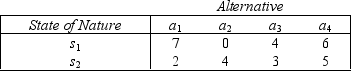

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

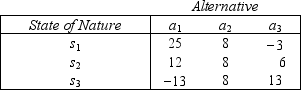

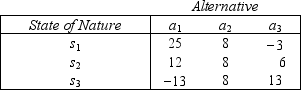

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/121

Play

Full screen (f)

Deck 22: Decision Analysis

1

Opportunity loss is the difference between the lowest profit for an event and the actual profit obtained for an action taken.

False

2

An opportunity loss is the difference between what the decision maker's profit for an act (alternative)is and what the profit could have been had the best decision been made.

True

3

The payoff table is a table in which the rows are states of nature,the columns are decision alternatives,and the entry at each intersection of a row and column is a numerical payoff such as a profit or loss.

True

4

Incentive programs for sales staff would be considered a state of nature for a business firm.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

5

We can use the payoff table to calculate the expected monetary value (EMV)and the expected opportunity loss (EOL)of each act (alternative).

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

6

In general,the branches of a decision tree represent acts and states of nature.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

7

In making decisions,we choose the decision with the largest expected monetary value,or the smallest expected opportunity loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

8

A payoff table lists the monetary values for each possible combination of the

A) event (state of nature)and act (alternative).

B) mean and standard deviation.

C) mean and median.

D) None of these choices.

A) event (state of nature)and act (alternative).

B) mean and standard deviation.

C) mean and median.

D) None of these choices.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

9

If EMV(a1)= $50,000,EMV(a2)= $65,000,and EMV(a3)= $45,000,then EMV* = $160,000.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

10

Worker safety laws would be considered a state of nature for a business firm.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

11

The expected monetary value decision is always the same as the expected opportunity loss decision.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

12

The expected monetary value (EMV)decision is always the same as the expected opportunity loss (EOL)decision because the opportunity loss table is produced directly from the payoff table.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

13

All entries of any opportunity loss table are negative values since they represent losses.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following would not be considered a state of nature for a business firm?

A) Federal Reserve regulations

B) Food and Drug Administration regulations

C) The number of employees to hire

D) Minimum wage regulations

A) Federal Reserve regulations

B) Food and Drug Administration regulations

C) The number of employees to hire

D) Minimum wage regulations

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

15

A surgeon is involved in a $3 million malpractice suit.He can either settle out of court for $750,000 or go to court.If he goes to court and loses,he must pay $2,500,000 plus $500,000 in court costs.If he wins in court the plaintiffs pay the court costs.Identify the actions of this decision-making problem.

A) Two choices: (1)go to court and (2)settle out of court.

B) Two choices: (1)win the case in court and (2)lose the case in court.

C) Four consequences resulting from Go/Settle and Win/Lose combinations.

D) The amount of money paid by the doctor.

A) Two choices: (1)go to court and (2)settle out of court.

B) Two choices: (1)win the case in court and (2)lose the case in court.

C) Four consequences resulting from Go/Settle and Win/Lose combinations.

D) The amount of money paid by the doctor.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

16

A tabular presentation that shows the outcome for each decision alternative under the various states of nature is called a:

A) payback period matrix.

B) decision matrix.

C) decision tree.

D) payoff table.

A) payback period matrix.

B) decision matrix.

C) decision tree.

D) payoff table.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

17

The expected monetary value (EMV)of a decision alternative is the sum of the products of the payoffs and the state of nature probabilities.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following would be considered a state of nature for a business firm?

A) Inventory levels

B) Worker safety laws

C) Site for new plant

D) Salaries for employees

A) Inventory levels

B) Worker safety laws

C) Site for new plant

D) Salaries for employees

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

19

In general,the expected monetary values (EMV)represent possible payoffs.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

20

If EOL(a1)= $13,000,EOL(a2)= $25,000,and EOL(a3)= $20,000,then EOL* = $13,000.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

21

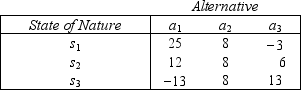

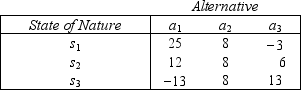

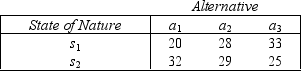

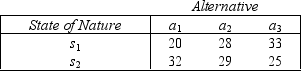

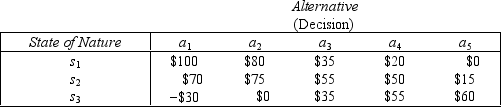

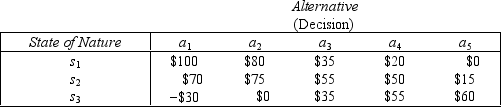

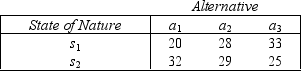

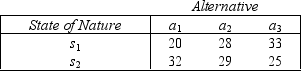

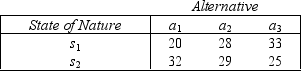

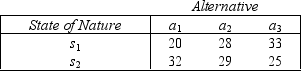

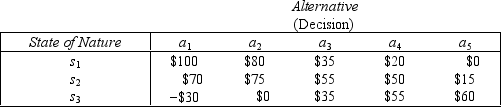

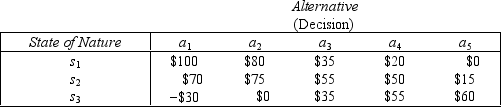

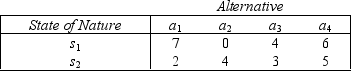

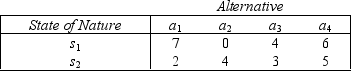

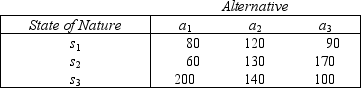

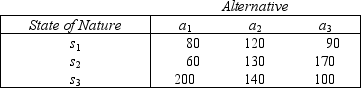

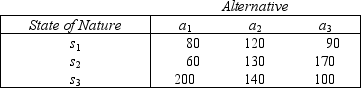

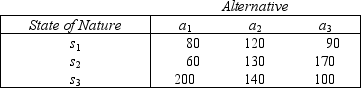

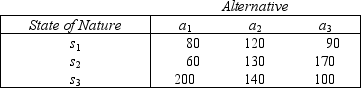

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected monetary value (EMV)for a1 is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected monetary value (EMV)for a1 is ____________________.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements is false regarding the expected monetary value (EMV)?

A) To calculate the EMV,the probabilities of the states of nature must be already decided upon.

B) We choose the decision with the largest EMV.

C) In general,the expected monetary values represent possible payoffs.

D) None of these choices.

A) To calculate the EMV,the probabilities of the states of nature must be already decided upon.

B) We choose the decision with the largest EMV.

C) In general,the expected monetary values represent possible payoffs.

D) None of these choices.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

23

Gas Company

A payoff table for an electric company is shown below:

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

{Gas Company Narrative} Calculate the expected monetary value for each act with present information.What decision should be made using the EMV criterion?

A payoff table for an electric company is shown below:

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.{Gas Company Narrative} Calculate the expected monetary value for each act with present information.What decision should be made using the EMV criterion?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

24

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.2,the optimal alternative using EOL is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.2,the optimal alternative using EOL is ____________________.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

25

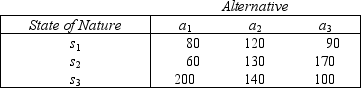

Sporting Goods Store

A payoff table for a clothing store is shown below.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

{Sporting Goods Store Narrative} Set up the opportunity loss table.

A payoff table for a clothing store is shown below.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.{Sporting Goods Store Narrative} Set up the opportunity loss table.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

26

Sporting Goods Store

A payoff table for a clothing store is shown below.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

-{Sporting Goods Store Narrative} Determine the EMV decision.

A payoff table for a clothing store is shown below.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

-{Sporting Goods Store Narrative} Determine the EMV decision.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

27

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.2 and s2 is 0.8,then the expected monetary value (EMV)of a1 is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.2 and s2 is 0.8,then the expected monetary value (EMV)of a1 is ____________________.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

28

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected monetary value (EMV)for a2 is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected monetary value (EMV)for a2 is ____________________.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is true?

A) The process of determining the EMV decision is called the rollback technique.

B) We choose the act that produces the smallest expected opportunity loss (EOL)

C) The EMV decision is always the same as the EOL decision.

D) All of these choices are true.

A) The process of determining the EMV decision is called the rollback technique.

B) We choose the act that produces the smallest expected opportunity loss (EOL)

C) The EMV decision is always the same as the EOL decision.

D) All of these choices are true.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

30

Sporting Goods Store

A payoff table for a clothing store is shown below.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

{Sporting Goods Store Narrative} Determine the EOL decision.

A payoff table for a clothing store is shown below.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.{Sporting Goods Store Narrative} Determine the EOL decision.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

31

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected opportunity loss (EOL)for a1 is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected opportunity loss (EOL)for a1 is ____________________.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

32

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected opportunity loss (EOL)for a3 is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected opportunity loss (EOL)for a3 is ____________________.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

33

A company that manufactures baseball gloves is contemplating whether to increase its advertising budget by $3 million for next year.If the expanded advertising campaign is successful,the company expects sales to increase by $4.8 million next year.If the advertising campaign fails,the company expects sales to increase by only $900,000 next year.If the advertising budget is not increased,the company expects sales to increase by $450,000.Identify the possible outcomes in this decision-making problem.

A) Two choices: (1)increase the budget and (2)do not increase the budget.

B) Four consequences resulting from the Increase/Do Not Increase and Successful/Not Successful combinations.

C) Two choices: (1)campaign is successful and (2)campaign is not successful.

D) The increase in sales dollars next year.

A) Two choices: (1)increase the budget and (2)do not increase the budget.

B) Four consequences resulting from the Increase/Do Not Increase and Successful/Not Successful combinations.

C) Two choices: (1)campaign is successful and (2)campaign is not successful.

D) The increase in sales dollars next year.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

34

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} The opportunity loss for a3 when s2 occurs is________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} The opportunity loss for a3 when s2 occurs is________________.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

35

What is meant by the expected monetary value (EMV)of a decision alternative?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

36

What is meant by a payoff table?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

37

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.4,then the probability of s2 is______________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.4,then the probability of s2 is______________.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

38

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.2 and s2 is 0.8,then the expected opportunity loss (EOL)for a1 is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.2 and s2 is 0.8,then the expected opportunity loss (EOL)for a1 is ____________________.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

39

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} The opportunity loss for a2 when s1 occurs is________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} The opportunity loss for a2 when s1 occurs is________________.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

40

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the optimal alternative using EMV is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the optimal alternative using EMV is ____________________.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

41

Container Company

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future.

Scenario 1:

The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now.

Scenario 2:

The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now.

Scenario 3:

The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now.

The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} Develop a payoff table for this decision situation.

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future.

Scenario 1:

The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now.

Scenario 2:

The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now.

Scenario 3:

The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now.

The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} Develop a payoff table for this decision situation.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

42

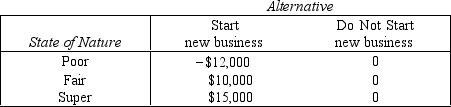

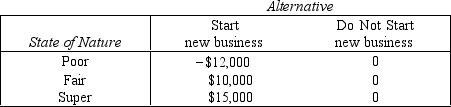

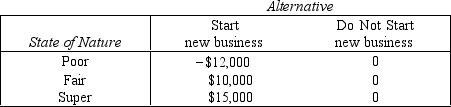

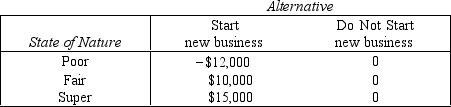

Video Business

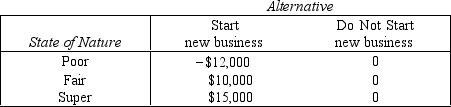

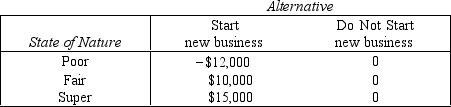

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is:

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

{Video Business Narrative} Review the decisions made in the previous questions.Is this a coincidence? Explain.

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is:

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.{Video Business Narrative} Review the decisions made in the previous questions.Is this a coincidence? Explain.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

43

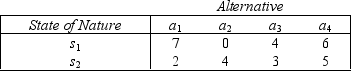

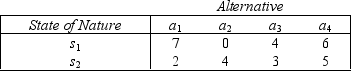

Hobby Shop

A payoff table and the prior probabilities for two states of nature for a Hobby Shop are shown below:

Payoff Table:

Prior Probabilities:

Prior Probabilities:

P(s1)= 0.4,and P(s2)= 0.6.

{Hobby Shop Narrative} Determine the EOL decision.

A payoff table and the prior probabilities for two states of nature for a Hobby Shop are shown below:

Payoff Table:

Prior Probabilities:

Prior Probabilities:P(s1)= 0.4,and P(s2)= 0.6.

{Hobby Shop Narrative} Determine the EOL decision.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

44

Food Market

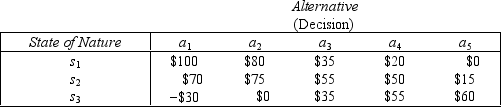

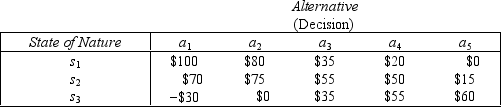

The following table displays the payoffs (in thousands of dollars)for five different decision alternatives under three possible states of nature for a new food market:

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

-{Food Market Narrative} Calculate the expected monetary value for each alternative with present information.What decision should be made using the EMV criterion?

The following table displays the payoffs (in thousands of dollars)for five different decision alternatives under three possible states of nature for a new food market:

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.-{Food Market Narrative} Calculate the expected monetary value for each alternative with present information.What decision should be made using the EMV criterion?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

45

Food Market

The following table displays the payoffs (in thousands of dollars)for five different decision alternatives under three possible states of nature for a new food market:

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

{Food Market Narrative} Convert the payoff table to an opportunity loss table.

The following table displays the payoffs (in thousands of dollars)for five different decision alternatives under three possible states of nature for a new food market:

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.{Food Market Narrative} Convert the payoff table to an opportunity loss table.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

46

Container Company

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future.

Scenario 1:

The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now.

Scenario 2:

The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now.

Scenario 3:

The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now.

The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} What decision will be made to maximize expected payoff?

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future.

Scenario 1:

The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now.

Scenario 2:

The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now.

Scenario 3:

The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now.

The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} What decision will be made to maximize expected payoff?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

47

Video Business

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is:

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

{Video Business Narrative} Convert the payoff table to an opportunity loss table.

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is:

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.{Video Business Narrative} Convert the payoff table to an opportunity loss table.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

48

Hobby Shop

A payoff table and the prior probabilities for two states of nature for a Hobby Shop are shown below:

Payoff Table:

Prior Probabilities:

Prior Probabilities:

P(s1)= 0.4,and P(s2)= 0.6.

{Hobby Shop Narrative} Determine the EMV decision.

A payoff table and the prior probabilities for two states of nature for a Hobby Shop are shown below:

Payoff Table:

Prior Probabilities:

Prior Probabilities:P(s1)= 0.4,and P(s2)= 0.6.

{Hobby Shop Narrative} Determine the EMV decision.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

49

Video Business

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is:

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

-{Video Business Narrative} Calculate the expected monetary value for each act with present information.What decision should be made using the EMV criterion?

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is:

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

-{Video Business Narrative} Calculate the expected monetary value for each act with present information.What decision should be made using the EMV criterion?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

50

Dishwasher Designs

Three different designs are being considered for a new dishwasher,and profits will depend on the combination of the dishwasher design and market condition.The following payoff table summarizes the decision situation,with amounts in millions of dollars.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

{Dishwasher Designs Narrative} Calculate the expected monetary value for each design with present information.Which design should be selected in order to maximize the firm's expected profit?

Three different designs are being considered for a new dishwasher,and profits will depend on the combination of the dishwasher design and market condition.The following payoff table summarizes the decision situation,with amounts in millions of dollars.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.{Dishwasher Designs Narrative} Calculate the expected monetary value for each design with present information.Which design should be selected in order to maximize the firm's expected profit?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

51

Hobby Shop

A payoff table and the prior probabilities for two states of nature for a Hobby Shop are shown below:

Payoff Table:

Prior Probabilities:

Prior Probabilities:

P(s1)= 0.4,and P(s2)= 0.6.

{Hobby Shop Narrative} Set up the opportunity loss table.

A payoff table and the prior probabilities for two states of nature for a Hobby Shop are shown below:

Payoff Table:

Prior Probabilities:

Prior Probabilities:P(s1)= 0.4,and P(s2)= 0.6.

{Hobby Shop Narrative} Set up the opportunity loss table.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

52

Dishwasher Designs

Three different designs are being considered for a new dishwasher,and profits will depend on the combination of the dishwasher design and market condition.The following payoff table summarizes the decision situation,with amounts in millions of dollars.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

{Dishwasher Designs Narrative} Calculate the expected opportunity loss for each design with present information.Which design should be selected in order to minimize the firm's expected loss?

Three different designs are being considered for a new dishwasher,and profits will depend on the combination of the dishwasher design and market condition.The following payoff table summarizes the decision situation,with amounts in millions of dollars.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.{Dishwasher Designs Narrative} Calculate the expected opportunity loss for each design with present information.Which design should be selected in order to minimize the firm's expected loss?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

53

Dishwasher Designs

Three different designs are being considered for a new dishwasher,and profits will depend on the combination of the dishwasher design and market condition.The following payoff table summarizes the decision situation,with amounts in millions of dollars.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

{Dishwasher Designs Narrative} Convert the payoff table to an opportunity loss table.

Three different designs are being considered for a new dishwasher,and profits will depend on the combination of the dishwasher design and market condition.The following payoff table summarizes the decision situation,with amounts in millions of dollars.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.{Dishwasher Designs Narrative} Convert the payoff table to an opportunity loss table.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

54

Food Market

The following table displays the payoffs (in thousands of dollars)for five different decision alternatives under three possible states of nature for a new food market:

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

{Food Market Narrative} Calculate the expected opportunity loss for each act with present information.What decision should be made using the EOL criterion?

The following table displays the payoffs (in thousands of dollars)for five different decision alternatives under three possible states of nature for a new food market:

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.{Food Market Narrative} Calculate the expected opportunity loss for each act with present information.What decision should be made using the EOL criterion?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

55

Container Company

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future.

Scenario 1:

The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now.

Scenario 2:

The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now.

Scenario 3:

The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now.

The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} Set up the opportunity loss table.

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future.

Scenario 1:

The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now.

Scenario 2:

The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now.

Scenario 3:

The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now.

The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} Set up the opportunity loss table.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

56

Gas Company

A payoff table for an electric company is shown below:

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

{Gas Company Narrative} Convert the payoff table to an opportunity loss table.

A payoff table for an electric company is shown below:

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.{Gas Company Narrative} Convert the payoff table to an opportunity loss table.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

57

Video Business

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is:

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

{Video Business Narrative} Calculate the expected opportunity loss for each act with present information.What decision should be made using the EOL criterion?

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is:

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.{Video Business Narrative} Calculate the expected opportunity loss for each act with present information.What decision should be made using the EOL criterion?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

58

Container Company

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future.

Scenario 1:

The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now.

Scenario 2:

The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now.

Scenario 3:

The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now.

The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} Which decision has the minimum expected opportunity loss?

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future.

Scenario 1:

The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now.

Scenario 2:

The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now.

Scenario 3:

The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now.

The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} Which decision has the minimum expected opportunity loss?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

59

Gas Company

A payoff table for an electric company is shown below:

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

{Gas Company Narrative} Calculate the expected opportunity loss for each act with present information.What decision should be made using the EOL criterion?

A payoff table for an electric company is shown below:

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.{Gas Company Narrative} Calculate the expected opportunity loss for each act with present information.What decision should be made using the EOL criterion?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

60

Demolition Company

The payoff table and the prior probabilities for three states of nature for a demolition company are shown below:

Prior Probabilities:

Prior Probabilities:

P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

{Demolition Company Narrative} Determine the EMV decision.

The payoff table and the prior probabilities for three states of nature for a demolition company are shown below:

Prior Probabilities:

Prior Probabilities:P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

{Demolition Company Narrative} Determine the EMV decision.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

61

The expected value of sample information (EVSI)is the difference between the expected monetary value with additional information (EMV')and the expected monetary value without additional information (EMV*).That is,EVSI = (EMV')- EMV*.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is correct?

A) The expected value of perfect information (EVPI)equals the largest expected monetary value (EMV*).

B) The expected value of perfect information (EVPI)equals the smallest expected opportunity loss (EOL*).

C) The expected value of perfect information (EVPI)equals the expected payoff with perfect information (EPPI).

D) All of these choices are true

A) The expected value of perfect information (EVPI)equals the largest expected monetary value (EMV*).

B) The expected value of perfect information (EVPI)equals the smallest expected opportunity loss (EOL*).

C) The expected value of perfect information (EVPI)equals the expected payoff with perfect information (EPPI).

D) All of these choices are true

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

63

The objective of a preposterior analysis is to determine whether the value of the prediction is greater or less than the cost of the information.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

64

The minimum expected opportunity loss is also equal to the:

A) expected profit under certainty.

B) expected value of perfect information.

C) coefficient of variation.

D) expected value under certainty minus the expected monetary value of the worst alternative.

A) expected profit under certainty.

B) expected value of perfect information.

C) coefficient of variation.

D) expected value under certainty minus the expected monetary value of the worst alternative.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

65

We calculate the expected payoff with perfect information (EPPI)by multiplying the probability of each state of nature by the smallest payoff associated with that state of nature,and then summing the products.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

66

The expected value of perfect information (EVPI)is the difference between the expected payoff with perfect information (EPPI)and the expected monetary value (EMV*).That is,EVPI = EPPI - EMV*.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements is correct?

A) The EMV criterion selects the act with the largest expected monetary value.

B) The EOL criterion selects the act with the smallest expected opportunity loss.

C) The expected value of perfect information (EVPI)equals the smallest expected opportunity loss.

D) All of these choices are true.

A) The EMV criterion selects the act with the largest expected monetary value.

B) The EOL criterion selects the act with the smallest expected opportunity loss.

C) The expected value of perfect information (EVPI)equals the smallest expected opportunity loss.

D) All of these choices are true.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

68

The preposterior analysis determines whether or not sample information should be purchased to revise the prior probabilities associated with the states of nature.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

69

Removal of uncertainty from a decision-making problem leads to a case referred to as perfect information.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

70

The expected value of sample information (EVSI)is the difference between:

A) the posterior probabilities and the prior probabilities of the states of nature.

B) the expected payoff with perfect information (EPPI)and the expected monetary value for the best decision (EMV*).

C) the expected monetary value with additional information (EMV')and the expected monetary value for the best decision (EMV*).

D) the expected value of perfect information (EVPI)and the smallest expected opportunity loss (EOL*).

A) the posterior probabilities and the prior probabilities of the states of nature.

B) the expected payoff with perfect information (EPPI)and the expected monetary value for the best decision (EMV*).

C) the expected monetary value with additional information (EMV')and the expected monetary value for the best decision (EMV*).

D) the expected value of perfect information (EVPI)and the smallest expected opportunity loss (EOL*).

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

71

The expected value of perfect information (EVPI)is always the same as the expected opportunity loss for the best alternative.That is,EVPI = EOL*.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

72

The procedure for revising probabilities based upon additional information is referred to as:

A) utility theory.

B) Bernoulli's theorem.

C) central limit theorem.

D) Bayes Law.

A) utility theory.

B) Bernoulli's theorem.

C) central limit theorem.

D) Bayes Law.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

73

Demolition Company

The payoff table and the prior probabilities for three states of nature for a demolition company are shown below:

Prior Probabilities:

Prior Probabilities:

P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

{Demolition Company Narrative} Determine the EOL decision.

The payoff table and the prior probabilities for three states of nature for a demolition company are shown below:

Prior Probabilities:

Prior Probabilities:P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

{Demolition Company Narrative} Determine the EOL decision.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

74

Demolition Company

The payoff table and the prior probabilities for three states of nature for a demolition company are shown below:

Prior Probabilities:

Prior Probabilities:

P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

{Demolition Company Narrative} Set up the opportunity loss table.

The payoff table and the prior probabilities for three states of nature for a demolition company are shown below:

Prior Probabilities:

Prior Probabilities:P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

{Demolition Company Narrative} Set up the opportunity loss table.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

75

The EVPI represents the ____________________ amount that a decision maker should be willing to pay for perfect information.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

76

To calculate expected profit under certainty,we need to have perfect information about which event will occur.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

77

The expected value of perfect information is the same as the:

A) expected monetary value for the best alternative.

B) expected monetary value for worst alternative.

C) expected opportunity loss for the best alternative.

D) expected opportunity loss for the worst alternative.

A) expected monetary value for the best alternative.

B) expected monetary value for worst alternative.

C) expected opportunity loss for the best alternative.

D) expected opportunity loss for the worst alternative.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

78

The expected value of perfect information (EVPI)equals the largest expected opportunity loss (EOL*).

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

79

The difference between expected payoff under certainty and expected value of the best act without certainty is the:

A) expected monetary value.

B) expected net present value.

C) expected value of perfect information.

D) expected rate of return.

A) expected monetary value.

B) expected net present value.

C) expected value of perfect information.

D) expected rate of return.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

80

The expected payoff with perfect information (EPPI)represents the maximum amount a decision maker would be willing to pay for perfect information.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck