Deck 11: Allocation of Joint Costs and Accounting for By-Products

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

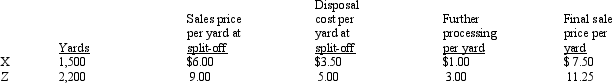

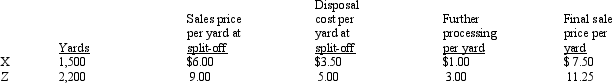

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/133

Play

Full screen (f)

Deck 11: Allocation of Joint Costs and Accounting for By-Products

1

If incremental revenues beyond split-off are less than incremental costs, a product should be sold at the split-off point.

True

2

Joint costs occur after the split-off point in a production process.

False

3

The primary distinction between by-products and scrap is the difference in volume produced.

False

4

A decision that must be made at split-off is to sell a product or process it further.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

5

If incremental revenues beyond split-off exceed incremental costs, a product should be processed further.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

6

Net realizable value equals product sales revenue at split-off minus any costs necessary to prepare and dispose of the product.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

7

Monetary allocation measures recognize the revenue generating ability of each product in a joint process.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

8

Joint costs may be allocated to by-products as well as primary products.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

9

Joint costs occur before the split-off point in a production process.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

10

Joint costs include all materials, labor and overhead that are incurred before the split-off point.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

11

Joint costs may be allocated to main products, but not to by-products.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

12

Two methods of allocating joint costs to products are physical measure allocation and monetary allocation.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

13

The primary distinction between by-products and scrap is the difference in sales value.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

14

Net realizable value is considered to be the best measure of the expected contribution of each product to the coverage of joint costs.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

15

Allocating joint costs based upon a physical measure considers the revenue-generating ability of individual products.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

16

Net realizable value equals product sales revenue at split-off plus any costs necessary to prepare and dispose of the product.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

17

The net realizable value approach requires that the net realizable value of by-products and scrap be treated as a reduction in joint costs allocated to primary products.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

18

Allocating joint costs based upon a physical measure ignores the revenue-generating ability of individual products.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

19

The relative sales value method requires a common physical unit for measuring the output of each product.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

20

The point at which individual products are first identifiable in a joint process is referred to as the split-off point.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

21

Joint costs are allocated to joint products to

A) obtain a cost per unit for financial statement purposes.

B) provide accurate management information on production costs of each type of product.

C) compute variances from expected costs for each joint product.

D) allow the use of high-low analysis by the company.

A) obtain a cost per unit for financial statement purposes.

B) provide accurate management information on production costs of each type of product.

C) compute variances from expected costs for each joint product.

D) allow the use of high-low analysis by the company.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

22

Costs that are incurred in the manufacture of two or more products from a common process are referred to as _________________________.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

23

The net realizable value approach is used to account for scrap and by-products when the net realizable value is insignificant.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

24

The point at which individual products are first identifiable in a joint process is referred to as the _________________________.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

25

Two methods of allocating joint costs to individual products are ________________________________________ and ________________________________________.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

26

The net realizable value approach is used to account for scrap and by-products when the net realizable value is significant.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

27

Under the realized value approach, no value is recognized for by-products or scrap until they are actually sold.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

28

Two incidental products of a joint process are ____________________ and ____________________.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

29

If a company obtains two salable products from the refining of one ore, the refining process should be accounted for as a(n)

A) mixed cost process.

B) joint process.

C) extractive process.

D) reduction process.

A) mixed cost process.

B) joint process.

C) extractive process.

D) reduction process.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

30

Sales revenue at split-off less disposal costs equals ______________________________.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

31

Costs that are incurred after the split-off point in a production process are referred to as ______________________________.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following components of production are allocable as joint costs when a single manufacturing process produces several salable products?

A) direct material, direct labor, and overhead

B) direct material and direct labor only

C) direct labor and overhead only

D) overhead and direct material only

A) direct material, direct labor, and overhead

B) direct material and direct labor only

C) direct labor and overhead only

D) overhead and direct material only

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

33

Not-for-profit entities are required to allocate joint costs among fund-raising, program, and administrative functions.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

34

Joint cost allocation is useful for

A) decision making.

B) product costing.

C) control.

D) evaluating managers' performance.

A) decision making.

B) product costing.

C) control.

D) evaluating managers' performance.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

35

Joint costs are allocated to which of the following products?

A) yes yes

B) yes no

C) no no

D) no yes

A) yes yes

B) yes no

C) no no

D) no yes

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

36

Three types of products that result from a joint process are _________________________, ____________________, and ____________________.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

37

Under the net realizable value approach, no value is recognized for by-products or scrap until they are actually sold.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

38

Three monetary measures used to allocate joint costs to products are ________________________________________, ________________________________________, and ____________________________________________________________.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

39

Joint costs are useful for

A) setting the selling price of a product.

B) determining whether to continue producing an item.

C) evaluating management by means of a responsibility reporting system.

D) determining inventory cost for accounting purposes.

A) setting the selling price of a product.

B) determining whether to continue producing an item.

C) evaluating management by means of a responsibility reporting system.

D) determining inventory cost for accounting purposes.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

40

A single process in which one product cannot be manufactured without producing others is referred to as a _________________________.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

41

In a lumber mill, which of the following would most likely be considered a primary product?

A) 2 ´ 4 studs

B) sawdust

C) wood chips

D) tree bark

A) 2 ´ 4 studs

B) sawdust

C) wood chips

D) tree bark

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

42

A product may be processed beyond the split-off point if management believes that

A) its marketability will be enhanced.

B) the incremental cost of further processing will be less than the incremental revenue of further processing.

C) the joint cost assigned to it is not already greater than its prospective selling price.

D) both a and b.

A) its marketability will be enhanced.

B) the incremental cost of further processing will be less than the incremental revenue of further processing.

C) the joint cost assigned to it is not already greater than its prospective selling price.

D) both a and b.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

43

In a joint costing process, which of the following would not be considered a sunk cost?

A) direct material cost

B) direct labor cost

C) joint cost

D) costs incurred to further refine a product created by the process

A) direct material cost

B) direct labor cost

C) joint cost

D) costs incurred to further refine a product created by the process

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

44

The split-off point is the point at which

A) output is first identifiable as individual products.

B) joint costs are allocated to joint products.

C) some products may first be sold.

D) all of the above.

A) output is first identifiable as individual products.

B) joint costs are allocated to joint products.

C) some products may first be sold.

D) all of the above.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements is true regarding by-products or scrap?

A) Process costing is the only method that should result in by-products or scrap.

B) Job order costing systems will never have by-products or scrap.

C) Job order costing systems may have instances where by-products or scrap result from the production process.

D) Process costing will never have by-products or scrap from the production process.

A) Process costing is the only method that should result in by-products or scrap.

B) Job order costing systems will never have by-products or scrap.

C) Job order costing systems may have instances where by-products or scrap result from the production process.

D) Process costing will never have by-products or scrap from the production process.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

46

Under an acceptable method of costing by-products, inventory costs of the by-product are based on the portion of the joint production cost allocated to the by-product

A) but any subsequent processing cost is debited to the cost of the main product.

B) but any subsequent processing cost is debited to revenue of the main product.

C) plus any subsequent processing cost.

D) minus any subsequent processing cost.

A) but any subsequent processing cost is debited to the cost of the main product.

B) but any subsequent processing cost is debited to revenue of the main product.

C) plus any subsequent processing cost.

D) minus any subsequent processing cost.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

47

While preparing a salad, the chef removes the core from a head of lettuce. This core would be classified as

A) defective.

B) shrinkage.

C) waste.

D) scrap.

A) defective.

B) shrinkage.

C) waste.

D) scrap.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

48

Each of the following is a method to allocate joint costs except

A) relative sales value.

B) relative net realizable value.

C) relative weight, volume, or linear measure.

D) average unit cost.

A) relative sales value.

B) relative net realizable value.

C) relative weight, volume, or linear measure.

D) average unit cost.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following has sales value?

A) no no

B) yes no

C) yes yes

D) no yes

A) no no

B) yes no

C) yes yes

D) no yes

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is a false statement about scrap and by-products?

A) Both by-products and scrap are salable.

B) A by-product has a higher sales value than does scrap.

C) By-products and scrap are the primary reason that management undertakes the joint process.

D) Both scrap and by-products are incidental outputs to the joint process.

A) Both by-products and scrap are salable.

B) A by-product has a higher sales value than does scrap.

C) By-products and scrap are the primary reason that management undertakes the joint process.

D) Both scrap and by-products are incidental outputs to the joint process.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

51

Waste created by a production process is

A) accounted for in the same manner as defective units.

B) accounted for as an abnormal loss.

C) material that can be sold as an irregular product.

D) discarded rather than sold.

A) accounted for in the same manner as defective units.

B) accounted for as an abnormal loss.

C) material that can be sold as an irregular product.

D) discarded rather than sold.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

52

By-products are

A) items resulting from a joint process that have no further value.

B) not sufficient alone, in terms of sales value, for management to justify undertaking the joint process.

C) also known as scrap.

D) the primary reason management undertook the production process.

A) items resulting from a joint process that have no further value.

B) not sufficient alone, in terms of sales value, for management to justify undertaking the joint process.

C) also known as scrap.

D) the primary reason management undertook the production process.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

53

Hairell Company produces three products from a joint process. The products can be sold at split-off or processed further. In deciding whether to sell at split-off or process further, management should

A) allocate the joint cost to the products based on relative sales value prior to making the decision.

B) allocate the joint cost to the products based on a physical quantity measure prior to making the decision.

C) subtract the joint cost from the total sales value of the products before determining relative sales value and making the decision.

D) ignore the joint cost in making the decision.

A) allocate the joint cost to the products based on relative sales value prior to making the decision.

B) allocate the joint cost to the products based on a physical quantity measure prior to making the decision.

C) subtract the joint cost from the total sales value of the products before determining relative sales value and making the decision.

D) ignore the joint cost in making the decision.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

54

The definition of a sunk cost is

A) a cost that cannot be recovered regardless of what happens.

B) a cost that relates to money poured into the ground.

C) considered the original cost of an item.

D) also known as an opportunity cost.

A) a cost that cannot be recovered regardless of what happens.

B) a cost that relates to money poured into the ground.

C) considered the original cost of an item.

D) also known as an opportunity cost.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

55

Scrap is defined as a

A) finished unit of product that has no sales value.

B) residual of the production process that has limited sales value.

C) residual of the production process that can be reworked for sale as an irregular unit of product.

D) residual of the production process that has no sales value.

A) finished unit of product that has no sales value.

B) residual of the production process that has limited sales value.

C) residual of the production process that can be reworked for sale as an irregular unit of product.

D) residual of the production process that has no sales value.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is/are synonyms for joint products?

A) no no

B) yes yes

C) yes no

D) no yes

A) no no

B) yes yes

C) yes no

D) no yes

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

57

The net realizable value approach mandates that the NRV of the by-products/scrap be treated as

A) an increase in joint costs.

B) a sunk cost.

C) a reduction of joint costs.

D) a cost that can be ignored totally.

A) an increase in joint costs.

B) a sunk cost.

C) a reduction of joint costs.

D) a cost that can be ignored totally.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

58

Joint costs are most frequently allocated based upon relative

A) profitability.

B) conversion costs.

C) prime costs.

D) sales value.

A) profitability.

B) conversion costs.

C) prime costs.

D) sales value.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

59

When allocating joint process cost based on tons of output, all products will

A) be salable at split-off.

B) have the same joint cost per ton.

C) have a sales value greater than their costs.

D) have no disposal costs at the split-off point.

A) be salable at split-off.

B) have the same joint cost per ton.

C) have a sales value greater than their costs.

D) have no disposal costs at the split-off point.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

60

If two or more products share a common process before they are separated, the joint costs should be assigned in a manner that

A) assigns a proportionate amount of the total cost to each product on a quantitative basis.

B) maximizes total earnings.

C) minimizes variations in unit production costs.

D) does not introduce an element of estimation into the process of accumulating costs for each product.

A) assigns a proportionate amount of the total cost to each product on a quantitative basis.

B) maximizes total earnings.

C) minimizes variations in unit production costs.

D) does not introduce an element of estimation into the process of accumulating costs for each product.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

61

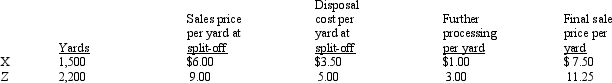

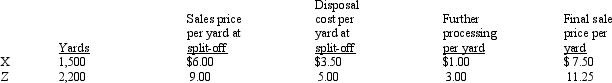

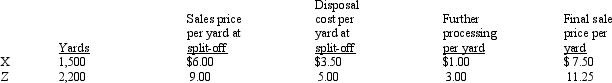

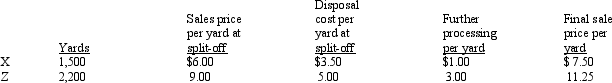

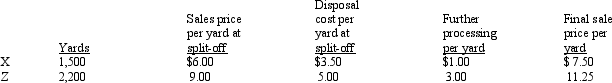

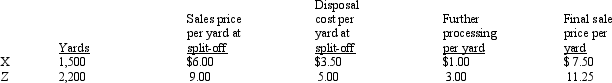

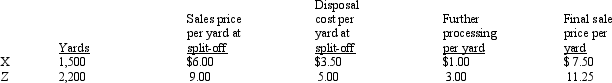

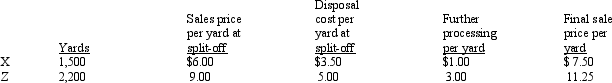

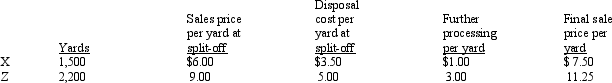

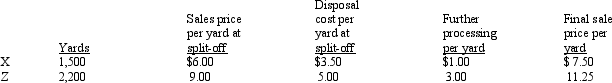

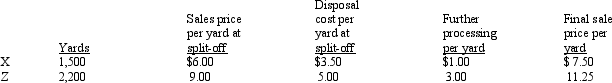

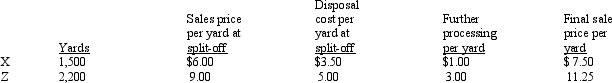

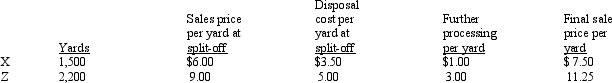

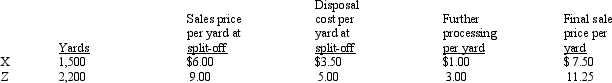

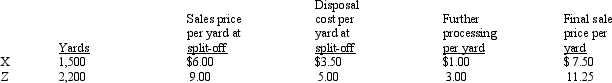

Ellis Company Ellis Company produces two products from a joint process: X and Z. Joint processing costs for this production cycle are $8,000.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Ellis Company. Using approximated net realizable value at split-off, what amount of joint processing cost is allocated to Product Z (round to the nearest dollar)?

A) $2,796

B) $4,910

C) $4,000

D) $2,390

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.Refer to Ellis Company. Using approximated net realizable value at split-off, what amount of joint processing cost is allocated to Product Z (round to the nearest dollar)?

A) $2,796

B) $4,910

C) $4,000

D) $2,390

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

62

Approximated net realizable value at split-off for joint products is computed as

A) selling price at split-off minus further processing and disposal costs.

B) final selling price minus further processing and disposal costs.

C) selling price at split-off minus allocated joint processing costs.

D) final selling price minus a normal profit margin.

A) selling price at split-off minus further processing and disposal costs.

B) final selling price minus further processing and disposal costs.

C) selling price at split-off minus allocated joint processing costs.

D) final selling price minus a normal profit margin.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

63

Incremental revenues and costs need to be considered when using which allocation method?

A) yes yes

B) yes no

C) no no

D) no yes

A) yes yes

B) yes no

C) no no

D) no yes

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

64

Ellis Company Ellis Company produces two products from a joint process: X and Z. Joint processing costs for this production cycle are $8,000.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Ellis Company. Using a physical measure, what amount of joint processing cost is allocated to Product Z (round to the nearest dollar)?

A) $4,000

B) $3,243

C) $5,500

D) $4,757

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.Refer to Ellis Company. Using a physical measure, what amount of joint processing cost is allocated to Product Z (round to the nearest dollar)?

A) $4,000

B) $3,243

C) $5,500

D) $4,757

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

65

Ellis Company Ellis Company produces two products from a joint process: X and Z. Joint processing costs for this production cycle are $8,000.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Ellis Company. Using net realizable value at split-off, what amount of joint processing cost is allocated to Product Z (round to the nearest dollar)?

A) $5,500

B) $4,000

C) $2,390

D) $5,610

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.Refer to Ellis Company. Using net realizable value at split-off, what amount of joint processing cost is allocated to Product Z (round to the nearest dollar)?

A) $5,500

B) $4,000

C) $2,390

D) $5,610

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

66

Ellis Company Ellis Company produces two products from a joint process: X and Z. Joint processing costs for this production cycle are $8,000.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Ellis Company. Which products would be processed further?

A) only Product X

B) only Product Z

C) both Products X and Z

D) neither Product X or Z

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.Refer to Ellis Company. Which products would be processed further?

A) only Product X

B) only Product Z

C) both Products X and Z

D) neither Product X or Z

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

67

Incremental separate costs are defined as all costs incurred between ____ and the point of sale.

A) inception

B) split-off point

C) transfer to finished goods inventory

D) point of addition of disposal costs

A) inception

B) split-off point

C) transfer to finished goods inventory

D) point of addition of disposal costs

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

68

Ellis Company Ellis Company produces two products from a joint process: X and Z. Joint processing costs for this production cycle are $8,000.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Ellis Company. Using approximated net realizable value at split-off, what amount of joint processing cost is allocated to Product X (round to the nearest dollar)?

A) $3,090

B) $5,204

C) $4,000

D) $2,390

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.Refer to Ellis Company. Using approximated net realizable value at split-off, what amount of joint processing cost is allocated to Product X (round to the nearest dollar)?

A) $3,090

B) $5,204

C) $4,000

D) $2,390

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

69

For purposes of allocating joint costs to joint products using the relative sales value at split-off method, the costs beyond split-off

A) are allocated in the same manner as the joint costs.

B) are deducted from the relative sales value at split-off.

C) are deducted from the sales value at the point of sale.

D) do not affect the allocation of the joint costs.

A) are allocated in the same manner as the joint costs.

B) are deducted from the relative sales value at split-off.

C) are deducted from the sales value at the point of sale.

D) do not affect the allocation of the joint costs.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

70

Ellis Company Ellis Company produces two products from a joint process: X and Z. Joint processing costs for this production cycle are $8,000.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Ellis Company. Using a physical measure, what amount of joint processing cost is allocated to Product X (round to the nearest dollar)?

A) $4,000

B) $4,757

C) $5,500

D) $3,243

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.Refer to Ellis Company. Using a physical measure, what amount of joint processing cost is allocated to Product X (round to the nearest dollar)?

A) $4,000

B) $4,757

C) $5,500

D) $3,243

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

71

Relative sales value at split-off is used to allocate

A) yes yes

B) yes no

C) no yes

D) no no

A) yes yes

B) yes no

C) no yes

D) no no

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

72

In joint-product costing and analysis, which of the following costs is relevant in the decision when a product should be sold to maximize profits?

A) Separable costs after the split-off point

B) Joint costs to the split-off point

C) Sales salaries for the production period

D) Costs of raw materials purchased for the joint process.

A) Separable costs after the split-off point

B) Joint costs to the split-off point

C) Sales salaries for the production period

D) Costs of raw materials purchased for the joint process.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

73

The net realizable value approach is normally used when the NRV is expected to be

A) yes yes

B) no yes

C) no no

D) yes no

A) yes yes

B) no yes

C) no no

D) yes no

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

74

All costs that are incurred between the split-off point and the point of sale are known as

A) sunk costs.

B) incremental separate costs.

C) joint cost.

D) committed costs.

A) sunk costs.

B) incremental separate costs.

C) joint cost.

D) committed costs.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is a commonly used joint cost allocation method?

A) high-low method

B) regression analysis

C) approximated sales value at split-off method

D) weighted average quantity technique

A) high-low method

B) regression analysis

C) approximated sales value at split-off method

D) weighted average quantity technique

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

76

Ellis Company Ellis Company produces two products from a joint process: X and Z. Joint processing costs for this production cycle are $8,000.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Ellis Company. Using sales value at split-off, what amount of joint processing cost is allocated to Product X (round to the nearest dollar)?

A) $5,500

B) $2,500

C) $4,000

D) $3,243

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.Refer to Ellis Company. Using sales value at split-off, what amount of joint processing cost is allocated to Product X (round to the nearest dollar)?

A) $5,500

B) $2,500

C) $4,000

D) $3,243

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

77

Not-for-profit organizations are required by the ____ to allocate joint costs.

A) AICPA

B) FASB

C) CASB

D) GASB

A) AICPA

B) FASB

C) CASB

D) GASB

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

78

Ellis Company Ellis Company produces two products from a joint process: X and Z. Joint processing costs for this production cycle are $8,000.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Ellis Company. Using sales value at split-off, what amount of joint processing cost is allocated to Product Z (round to the nearest dollar)?

A) $5,500

B) $4,000

C) $2,500

D) $4,757

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.Refer to Ellis Company. Using sales value at split-off, what amount of joint processing cost is allocated to Product Z (round to the nearest dollar)?

A) $5,500

B) $4,000

C) $2,500

D) $4,757

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

79

The method of pricing by-products/scrap where no value is assigned to these items until they are sold is known as the

A) net realizable value at split-off point method.

B) sales value at split-off method.

C) realized value approach.

D) approximated net realizable value at split-off method.

A) net realizable value at split-off point method.

B) sales value at split-off method.

C) realized value approach.

D) approximated net realizable value at split-off method.

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck

80

Ellis Company Ellis Company produces two products from a joint process: X and Z. Joint processing costs for this production cycle are $8,000.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Ellis Company. Using net realizable value at split-off, what amount of joint processing cost is allocated to Product X (round to the nearest dollar)?

A) $4,000

B) $5,610

C) $2,390

D) $5,500

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.Refer to Ellis Company. Using net realizable value at split-off, what amount of joint processing cost is allocated to Product X (round to the nearest dollar)?

A) $4,000

B) $5,610

C) $2,390

D) $5,500

Unlock Deck

Unlock for access to all 133 flashcards in this deck.

Unlock Deck

k this deck