Deck 23: Other Topics in Working Capital Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/29

Play

Full screen (f)

Deck 23: Other Topics in Working Capital Management

1

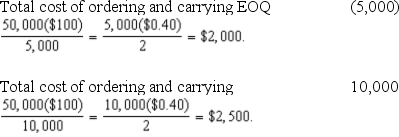

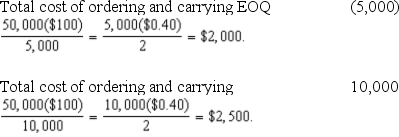

Suppose Stanley's Office Supply purchases 50,000 boxes of pens every year. Ordering costs are $100 per order and carrying costs are $0.40 per box. Moreover, management has determined that the EOQ is 5,000 boxes. The vendor now offers a quantity discount of $0.20 per box if the company buys pens in order sizes of 10,000 boxes. Determine the before-tax benefit or loss of accepting the quantity discount. (Assume the carrying cost remains at $0.40 per box whether or not the discount is taken.)

A) $1,000 loss

B) $1,000 benefit

C) $500 loss

D) $500 benefit

E) $0 (the change would not affect profits.)

A) $1,000 loss

B) $1,000 benefit

C) $500 loss

D) $500 benefit

E) $0 (the change would not affect profits.)

D

Cost of increase = $500. Savings from discount = $0.02(50,000) = $1,000. Net benefit = $1,000 ? $500 = $500.

Cost of increase = $500. Savings from discount = $0.02(50,000) = $1,000. Net benefit = $1,000 ? $500 = $500.

2

For some firms, holding highly liquid marketable securities is a substitute for holding cash because a marketable securities portfolio can accomplish the same objective as cash.

True

3

A just-in-time system is designed to stretch accounts payable as long as possible.

False

4

Which of the following is true of the EOQ model? Note that the optimal order quantity, Q, will be called EOQ.

A) if the annual sales, in units, increases by 20%, then eoq will increase by 20%.

B) if the average inventory increases by 20%, then the total carrying costs will increase by 20%.

C) if the average inventory increases by 20% the total order costs will increase by 20%.

D) the eoc is the same for all companies.

E) if the fixed per order cost increases by 20%, then eoq will increase by 20%.

A) if the annual sales, in units, increases by 20%, then eoq will increase by 20%.

B) if the average inventory increases by 20%, then the total carrying costs will increase by 20%.

C) if the average inventory increases by 20% the total order costs will increase by 20%.

D) the eoc is the same for all companies.

E) if the fixed per order cost increases by 20%, then eoq will increase by 20%.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

5

If a company increases its safety stock, then its average inventory will go up.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

6

Gemini Inc.'s optimal cash transfer amount, using the Baumol model, is $60,000. The firm's fixed cost per cash transfer of marketable securities to cash is $180, and the total cash needed for transactions annually is $960,000. On what opportunity cost of holding cash was this analysis based?

A) 19.2%

B) 10.4%

C) 6.3%

D) 12.1%

E) 9.6%

A) 19.2%

B) 10.4%

C) 6.3%

D) 12.1%

E) 9.6%

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

7

If a company increases its safety stock, then its EOQ will go up.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

8

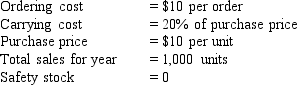

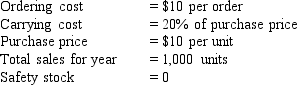

New England Charm, Inc. specializes in selling scented candles. The company has established a policy of reordering inventory every 30 days. A recently employed MBA has considered New England's inventory problem from the EOQ model viewpoint. If the following constitute the relevant data, how does the current policy compare with the optimal policy?

A) total costs will be the same, since the current policy is optimal.

B) total costs under the current policy will be less than total costs under the eoq by $10.

C) total costs under the current policy exceed those under the eoq by $3.

D) total costs under the current policy exceed those under the eoq by $10.

E) cannot be determined due to insufficient information.

A) total costs will be the same, since the current policy is optimal.

B) total costs under the current policy will be less than total costs under the eoq by $10.

C) total costs under the current policy exceed those under the eoq by $3.

D) total costs under the current policy exceed those under the eoq by $10.

E) cannot be determined due to insufficient information.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

9

Exhibit Duckett Group

The Duckett Group is trying to determine its optimal average cash balance. The firm has determined that it will need $5,000,000 net new cash during the coming year. The fixed transaction cost of converting securities to cash is $50, and the firm earns 10 percent on its marketable securities investments.

Refer to Exhibit Duckett Group. According to the Baumol model, what should be Duckett's average cash balance?

A) $35,356

B) $3,536

C) $22,157

D) $70,711

E) $42,918

The Duckett Group is trying to determine its optimal average cash balance. The firm has determined that it will need $5,000,000 net new cash during the coming year. The fixed transaction cost of converting securities to cash is $50, and the firm earns 10 percent on its marketable securities investments.

Refer to Exhibit Duckett Group. According to the Baumol model, what should be Duckett's average cash balance?

A) $35,356

B) $3,536

C) $22,157

D) $70,711

E) $42,918

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

10

Exhibit Duckett Group

The Duckett Group is trying to determine its optimal average cash balance. The firm has determined that it will need $5,000,000 net new cash during the coming year. The fixed transaction cost of converting securities to cash is $50, and the firm earns 10 percent on its marketable securities investments.

Refer to Exhibit Duckett Group. According to the Baumol model, what is the optimal transaction size for transfers from marketable securities to cash?

A) $7,071

B) $38,357

C) $70,711

D) $102,956

E) $87,000

The Duckett Group is trying to determine its optimal average cash balance. The firm has determined that it will need $5,000,000 net new cash during the coming year. The fixed transaction cost of converting securities to cash is $50, and the firm earns 10 percent on its marketable securities investments.

Refer to Exhibit Duckett Group. According to the Baumol model, what is the optimal transaction size for transfers from marketable securities to cash?

A) $7,071

B) $38,357

C) $70,711

D) $102,956

E) $87,000

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following would cause average inventory holdings to decrease, other things held constant?

A) the purchase price of inventory items decreases by 50 percent.

B) the carrying price of an item decreases (as a percent of purchase price).

C) the sales forecast is revised downward by 10 percent.

D) interest rates fall.

E) fixed order costs double.

A) the purchase price of inventory items decreases by 50 percent.

B) the carrying price of an item decreases (as a percent of purchase price).

C) the sales forecast is revised downward by 10 percent.

D) interest rates fall.

E) fixed order costs double.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

12

Gemini Inc.'s optimal cash transfer amount, using the Baumol model, is $60,000. The firm's fixed cost per cash transfer of marketable securities to cash is $180. In addition, the total estimated cash costs (transfers and carrying cost) for the firm, based on 16 transactions per year, are $5,760. On what opportunity cost of holding cash was this analysis based?

A) 19.2%

B) 10.4%

C) 6.3%

D) 12.1%

E) 9.6%

A) 19.2%

B) 10.4%

C) 6.3%

D) 12.1%

E) 9.6%

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

13

Exhibit Cartwright Computing

Cartwright Computing expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

Refer to Exhibit Cartwright Computing. What is the economic ordering quantity for chips?

A) 12,088

B) 3,175

C) 6,243

D) 13,675

E) 8,124

Cartwright Computing expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

Refer to Exhibit Cartwright Computing. What is the economic ordering quantity for chips?

A) 12,088

B) 3,175

C) 6,243

D) 13,675

E) 8,124

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

14

The cash balances of most firms consist of transactions, compensating, precautionary, and speculative balances. We can produce a total desired cash balance by calculating the amount needed for each purpose and then summing them together.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

15

Each year, Holly's Best Salad Dressing, Inc. (HBSD) purchases 50,000 gallons of extra virgin olive oil. Ordering costs are $100 per order, and the carrying cost, as a percentage of inventory value, is 80 percent. The purchase price to HBSD is $0.50 per gallon. Management currently orders the EOQ each time an order is placed. No safety stock is carried. The supplier is now offering a quantity discount of $0.03 per gallon if HBSD orders 10,000 gallons at a time. Should HBSD take the discount?

A) from a cost standpoint, hbsd is indifferent.

B) no, the cost exceeds the benefit by $500.

C) no, the cost exceeds the benefit by $1,000.

D) yes, the benefit exceeds the cost by $500.

E) yes, the benefit exceeds the cost by $1,120.

A) from a cost standpoint, hbsd is indifferent.

B) no, the cost exceeds the benefit by $500.

C) no, the cost exceeds the benefit by $1,000.

D) yes, the benefit exceeds the cost by $500.

E) yes, the benefit exceeds the cost by $1,120.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

16

The easier a firm's access to borrowed funds the higher its precautionary balances will be, in order to protect against sudden increases in interest rates.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

17

Halliday Inc. receives a $2 million payment once a year. Of this amount, $700,000 is needed for cash payments made during the next year. Each time Halliday deposits money in its account, a charge of $2.00 is assessed to cover clerical costs. If Halliday can hold marketable securities that yield 5 percent, and then convert these securities to cash at a cost of only the $2 deposit charge, what is the total cost for one year of holding the minimum cost cash balance according to the Baumol model?

A) $7,483

B) $187

C) $3,741

D) $374

E) $748

A) $7,483

B) $187

C) $3,741

D) $374

E) $748

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

18

Humphrey's Housing has been practicing cash management for some time by using the Baumol model for determining cash balances. Some time ago, the model called for an average balance (C*/2) of $500; at that time, the rate on marketable securities was 4 percent. A rapid increase in interest rates has driven the interest rate up to 9 percent. What is the appropriate average cash balance now?

A) $200

B) $333

C) $414

D) $500

E) $666

A) $200

B) $333

C) $414

D) $500

E) $666

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is true of the Baumol model? Note that the optimal cash transfer amount is C*.

A) if the total amount of cash needed during the year increases by 20%, then c* will increase by 20%.

B) if the average cash balance increases by 20%, then the total holding costs will increase by 20%.

C) if the average cash balance increases by 20% the total transactions costs will increase by 20%.

D) the optimal transfer amount is the same for all companies.

E) if the fixed costs of selling securities or obtaining a loan (cost per transaction) increase by 20%, then c* will increase by 20%.

A) if the total amount of cash needed during the year increases by 20%, then c* will increase by 20%.

B) if the average cash balance increases by 20%, then the total holding costs will increase by 20%.

C) if the average cash balance increases by 20% the total transactions costs will increase by 20%.

D) the optimal transfer amount is the same for all companies.

E) if the fixed costs of selling securities or obtaining a loan (cost per transaction) increase by 20%, then c* will increase by 20%.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

20

Exhibit Duckett Group

The Duckett Group is trying to determine its optimal average cash balance. The firm has determined that it will need $5,000,000 net new cash during the coming year. The fixed transaction cost of converting securities to cash is $50, and the firm earns 10 percent on its marketable securities investments.

Refer to Exhibit Duckett Group. What will be the total cost to Duckett of maintaining the optimal average cash balance, as determined by the Baumol model?

A) $35,356

B) $7,071

C) $18,493

D) $70,711

E) $53,190

The Duckett Group is trying to determine its optimal average cash balance. The firm has determined that it will need $5,000,000 net new cash during the coming year. The fixed transaction cost of converting securities to cash is $50, and the firm earns 10 percent on its marketable securities investments.

Refer to Exhibit Duckett Group. What will be the total cost to Duckett of maintaining the optimal average cash balance, as determined by the Baumol model?

A) $35,356

B) $7,071

C) $18,493

D) $70,711

E) $53,190

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

21

Exhibit Cartwright Computing

Cartwright Computing expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

Refer to Exhibit Cartwright Computing. If Cartwright holds a safety stock equal to a 30-day supply of chips, what is Cartwright's minimum cost of ordering and carrying inventory?

A) $28,500

B) $15,950

C) $68,440

D) $34,220

E) $47,693

Cartwright Computing expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

Refer to Exhibit Cartwright Computing. If Cartwright holds a safety stock equal to a 30-day supply of chips, what is Cartwright's minimum cost of ordering and carrying inventory?

A) $28,500

B) $15,950

C) $68,440

D) $34,220

E) $47,693

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

22

Exhibit Palmer Pens

Assume that Palmer Executive Pens uses 1,440,000 gallons of ink each year. Further, assume that Palmer can order the ink at a cost of $2 per gallon plus fixed ordering costs of $100 per order. The firm's carrying cost is 20 percent of the inventory value, at cost.

Refer to Exhibit Palmer Pens. Now, suppose the manufacturer offers a discount of 0.5 percent for orders of a least 40,000 gallons. Should Palmer increase its ordering quantity to take the discount?

A) yes; it will save $827 if it takes the discount.

B) no; it will lose $827 if it takes the discount.

C) yes; it will save $14,400 if it takes the discount.

D) yes; it will save $13,573 if it takes the discount.

E) no; it will lose $13,573 if it takes the discount.

Assume that Palmer Executive Pens uses 1,440,000 gallons of ink each year. Further, assume that Palmer can order the ink at a cost of $2 per gallon plus fixed ordering costs of $100 per order. The firm's carrying cost is 20 percent of the inventory value, at cost.

Refer to Exhibit Palmer Pens. Now, suppose the manufacturer offers a discount of 0.5 percent for orders of a least 40,000 gallons. Should Palmer increase its ordering quantity to take the discount?

A) yes; it will save $827 if it takes the discount.

B) no; it will lose $827 if it takes the discount.

C) yes; it will save $14,400 if it takes the discount.

D) yes; it will save $13,573 if it takes the discount.

E) no; it will lose $13,573 if it takes the discount.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

23

Exhibit Cartwright Computing

Cartwright Computing expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

Refer to Exhibit Cartwright Computing. If the lead time for placing an order is 5 days, and Cartwright holds a safety stock equal to a 30-day supply of chips, then at what inventory level should an order be placed?

A) 15,570

B) 3,175

C) 12,250

D) 13,675

E) 8,124

Cartwright Computing expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

Refer to Exhibit Cartwright Computing. If the lead time for placing an order is 5 days, and Cartwright holds a safety stock equal to a 30-day supply of chips, then at what inventory level should an order be placed?

A) 15,570

B) 3,175

C) 12,250

D) 13,675

E) 8,124

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

24

Exhibit Cartwright Computing

Cartwright Computing expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

Refer to Exhibit Cartwright Computing. If Cartwright holds a safety stock equal to a 30-day supply of chips, what is its average inventory level?

A) 12,088

B) 3,175

C) 15,750

D) 13,675

E) 8,124

Cartwright Computing expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

Refer to Exhibit Cartwright Computing. If Cartwright holds a safety stock equal to a 30-day supply of chips, what is its average inventory level?

A) 12,088

B) 3,175

C) 15,750

D) 13,675

E) 8,124

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

25

Exhibit Palmer Pens

Assume that Palmer Executive Pens uses 1,440,000 gallons of ink each year. Further, assume that Palmer can order the ink at a cost of $2 per gallon plus fixed ordering costs of $100 per order. The firm's carrying cost is 20 percent of the inventory value, at cost.

Refer to Exhibit Palmer Pens. What is Palmer's minimum costs of ordering and holding inventory?

A) $6,254

B) $10,733

C) $11,560

D) $13,563

E) $19,825

Assume that Palmer Executive Pens uses 1,440,000 gallons of ink each year. Further, assume that Palmer can order the ink at a cost of $2 per gallon plus fixed ordering costs of $100 per order. The firm's carrying cost is 20 percent of the inventory value, at cost.

Refer to Exhibit Palmer Pens. What is Palmer's minimum costs of ordering and holding inventory?

A) $6,254

B) $10,733

C) $11,560

D) $13,563

E) $19,825

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

26

During times of inflation, which of these inventory accounting methods is best for cash flow?

A) lifo, because the most expensive goods are recorded as being sold first, resulting in a higher cost of goods sold and a lower reported net income.

B) specific identification, because it correctly identifies the actual item sold and so the actual cost is recorded on the income statement.

C) weighted average, because it smoothes the reported cost of goods sold over time.

D) it doesn't matter which you use since cash flow is unaffected by the choice of inventory identification method.

E) fifo, because the cheapest goods are recorded as being sold first, resulting in lower cost of goods sold and higher reported net income.

A) lifo, because the most expensive goods are recorded as being sold first, resulting in a higher cost of goods sold and a lower reported net income.

B) specific identification, because it correctly identifies the actual item sold and so the actual cost is recorded on the income statement.

C) weighted average, because it smoothes the reported cost of goods sold over time.

D) it doesn't matter which you use since cash flow is unaffected by the choice of inventory identification method.

E) fifo, because the cheapest goods are recorded as being sold first, resulting in lower cost of goods sold and higher reported net income.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

27

Exhibit Palmer Pens

Assume that Palmer Executive Pens uses 1,440,000 gallons of ink each year. Further, assume that Palmer can order the ink at a cost of $2 per gallon plus fixed ordering costs of $100 per order. The firm's carrying cost is 20 percent of the inventory value, at cost.

Refer to Exhibit Palmer Pens. What is the firm's EOQ?

A) 26,833

B) 30,040

C) 43,987

D) 13,563

E) 21,456

Assume that Palmer Executive Pens uses 1,440,000 gallons of ink each year. Further, assume that Palmer can order the ink at a cost of $2 per gallon plus fixed ordering costs of $100 per order. The firm's carrying cost is 20 percent of the inventory value, at cost.

Refer to Exhibit Palmer Pens. What is the firm's EOQ?

A) 26,833

B) 30,040

C) 43,987

D) 13,563

E) 21,456

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

28

Exhibit Cartwright Computing

Cartwright Computing expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

Refer to Exhibit Cartwright Computing. Assume that Cartwright holds a safety stock equal to a 30-day supply of chips. What is the maximum amount of inventory that will have on hand at any time, that is, what will be the inventory level right after a delivery is made?

A) 9,216

B) 3,175

C) 6,243

D) 13,675

E) 8,124

Cartwright Computing expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

Refer to Exhibit Cartwright Computing. Assume that Cartwright holds a safety stock equal to a 30-day supply of chips. What is the maximum amount of inventory that will have on hand at any time, that is, what will be the inventory level right after a delivery is made?

A) 9,216

B) 3,175

C) 6,243

D) 13,675

E) 8,124

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

29

Exhibit Cartwright Computing

Cartwright Computing expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

Refer to Exhibit Cartwright Computing. How many orders should Cartwright place during the year?

A) 12

B) 25

C) 30

D) 40

E) 60

Cartwright Computing expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are $200 per order; the purchase price per chip is $25; and the firm's inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

Refer to Exhibit Cartwright Computing. How many orders should Cartwright place during the year?

A) 12

B) 25

C) 30

D) 40

E) 60

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck