Deck 19: Valuation and Financial Modeling: a Case Study

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/49

Play

Full screen (f)

Deck 19: Valuation and Financial Modeling: a Case Study

1

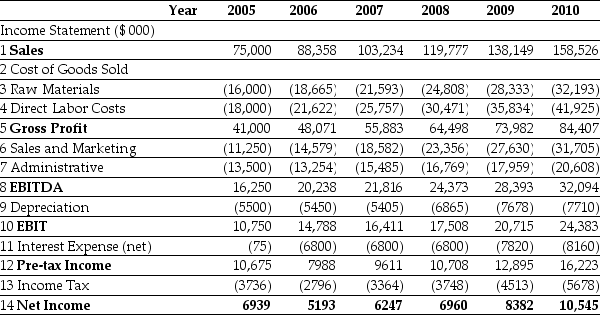

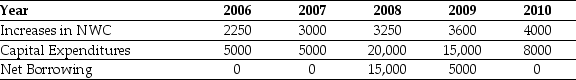

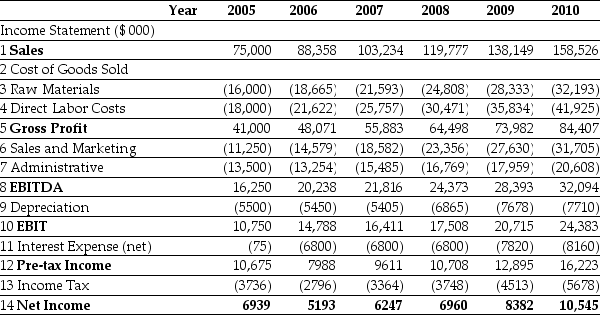

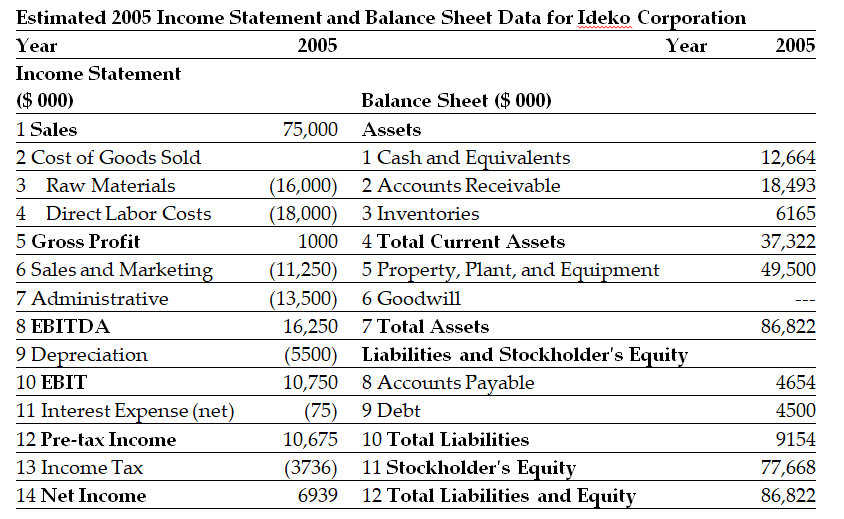

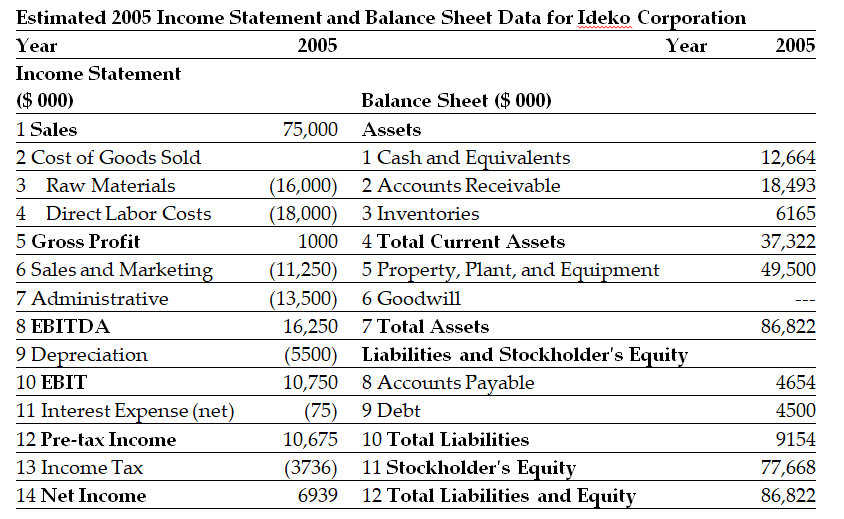

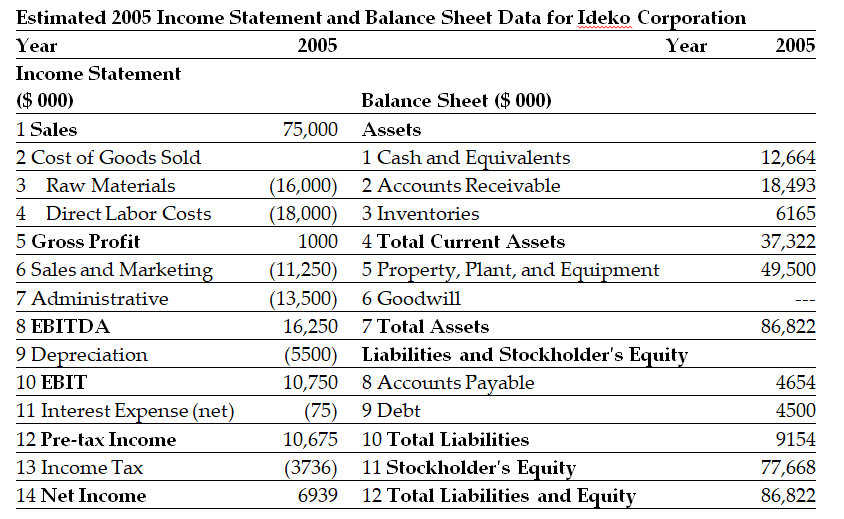

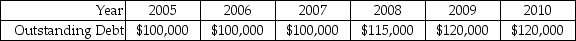

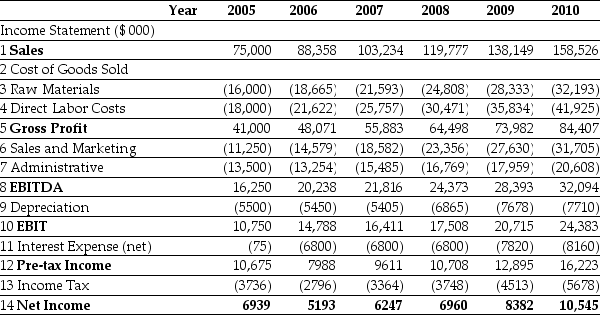

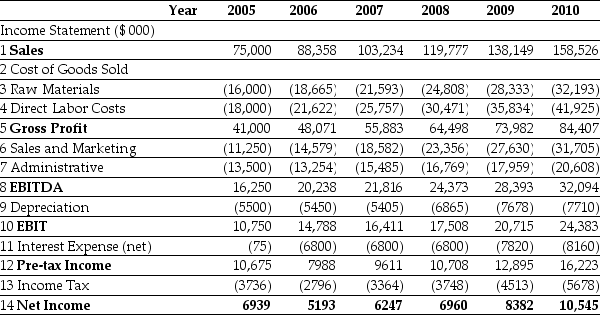

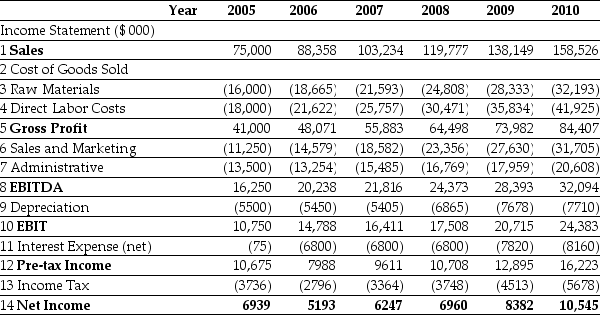

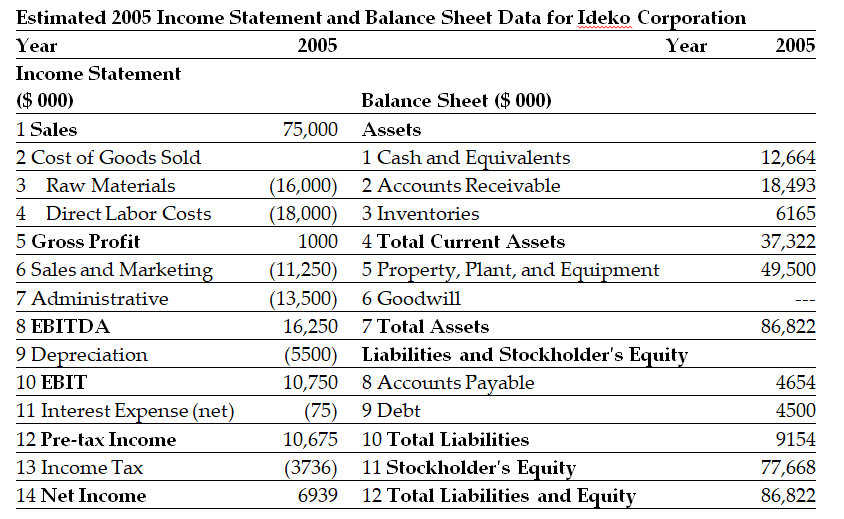

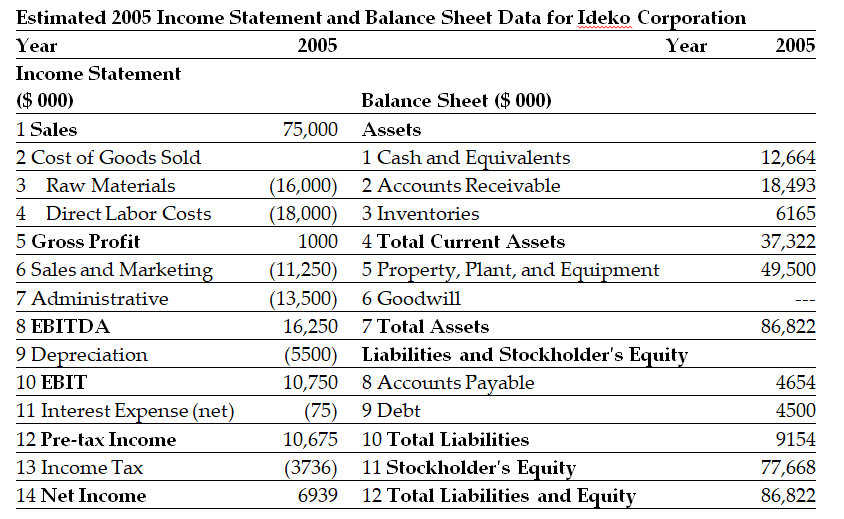

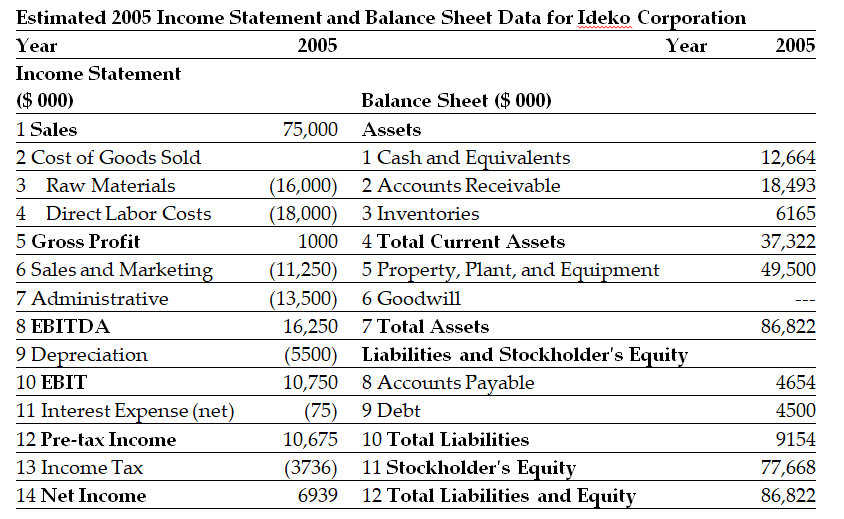

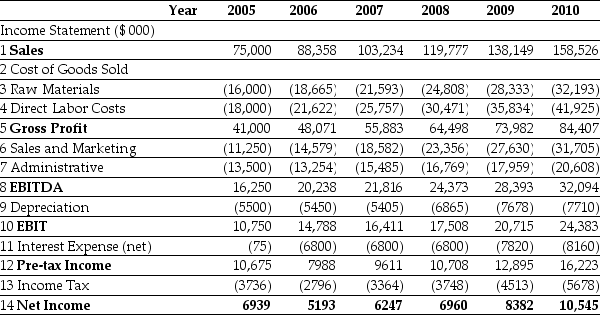

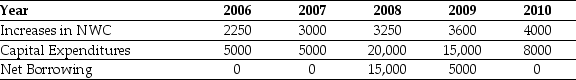

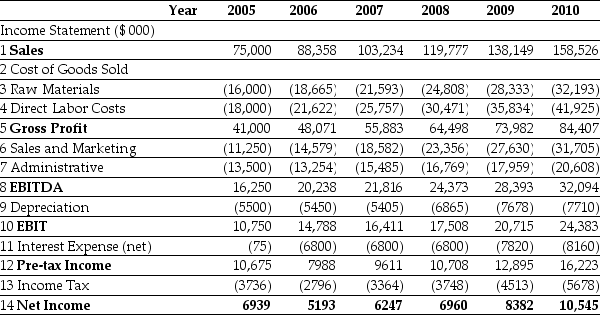

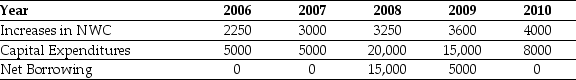

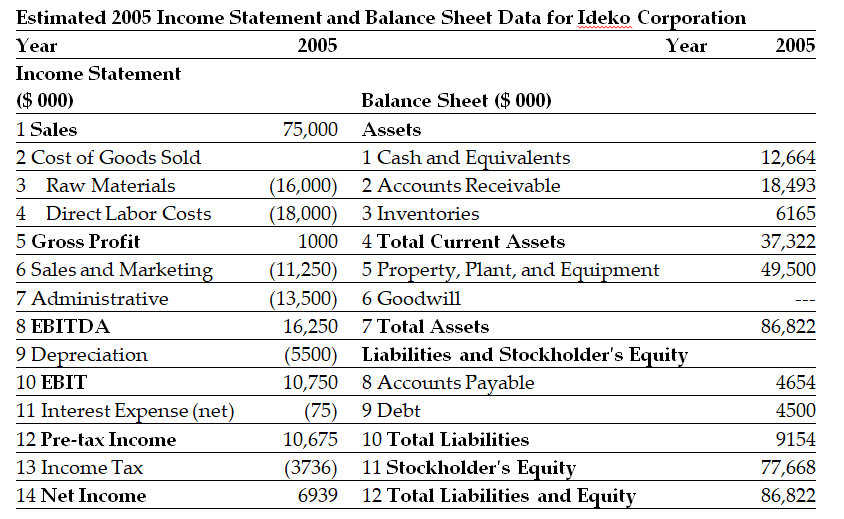

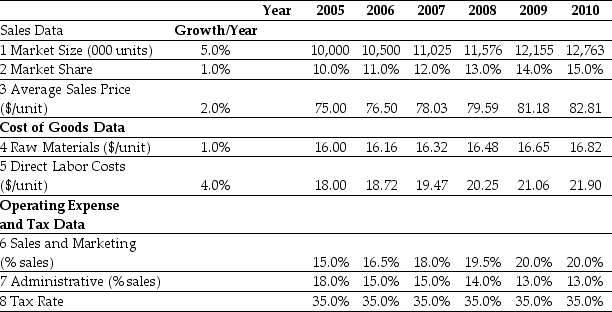

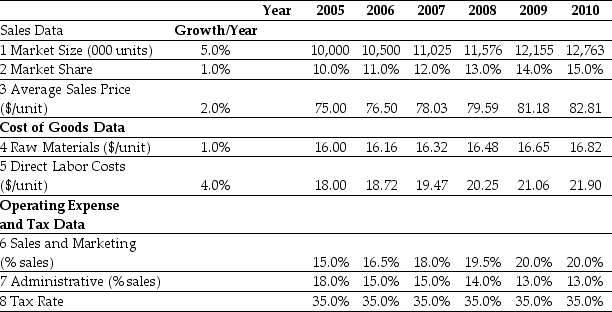

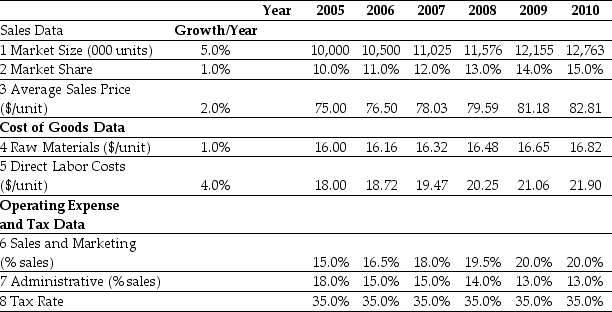

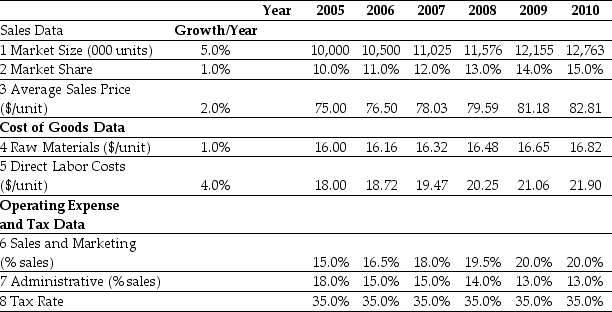

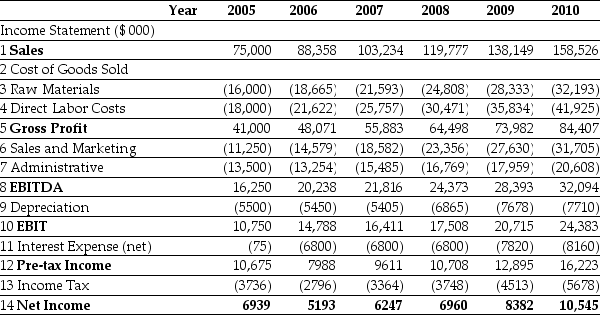

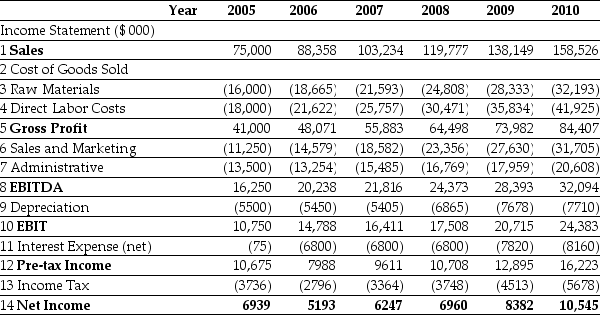

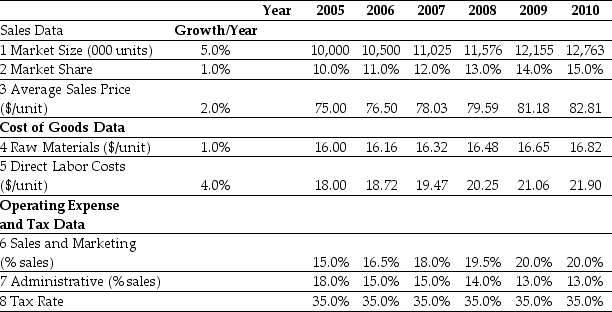

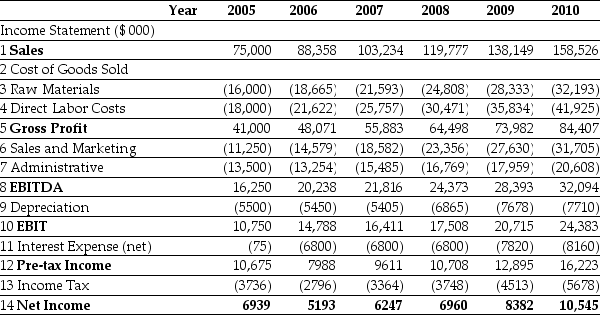

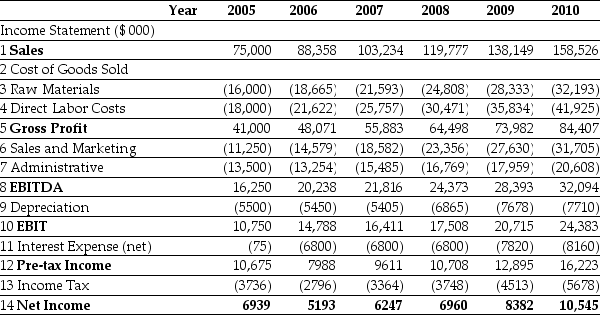

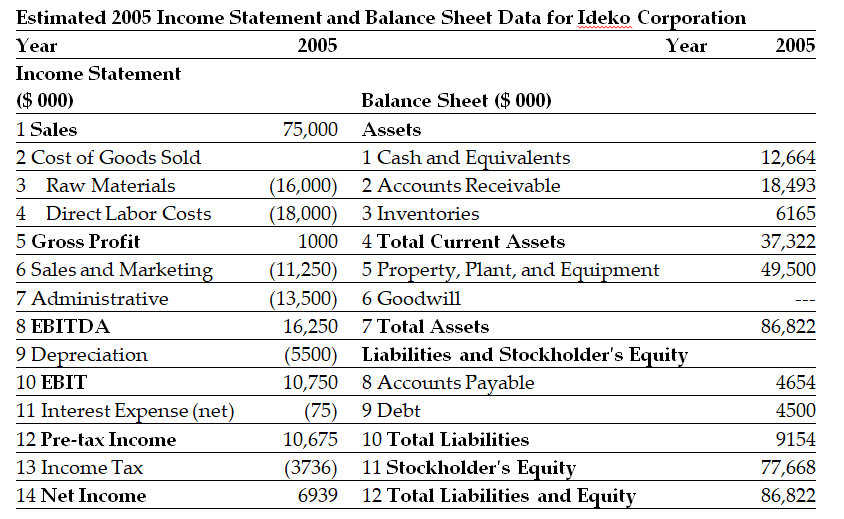

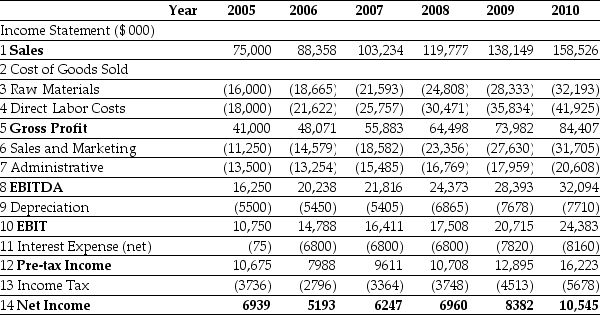

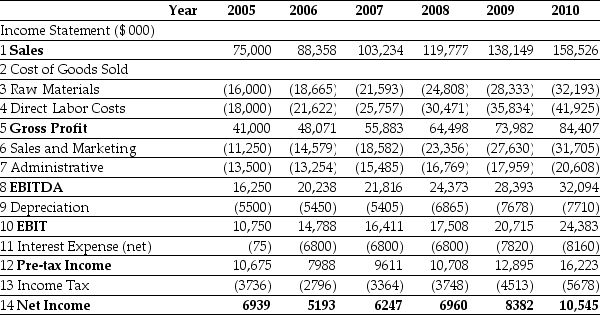

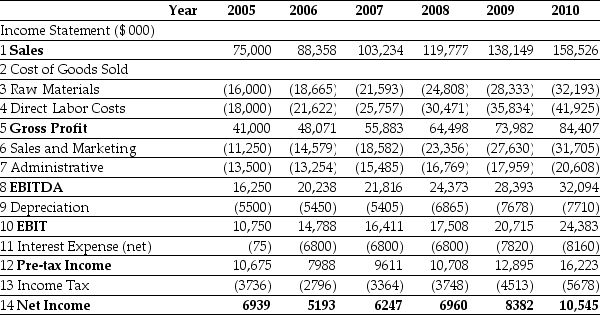

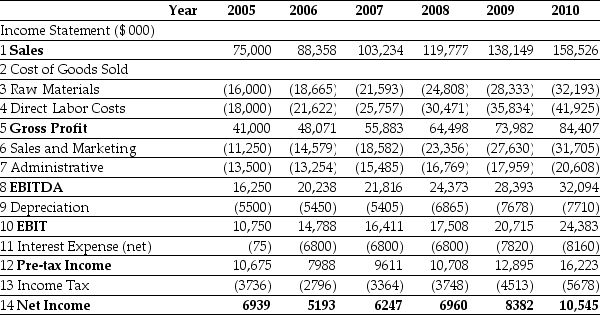

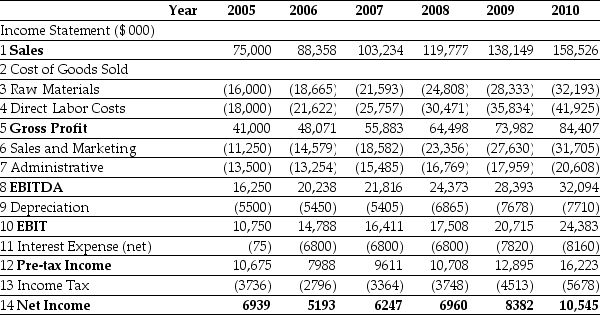

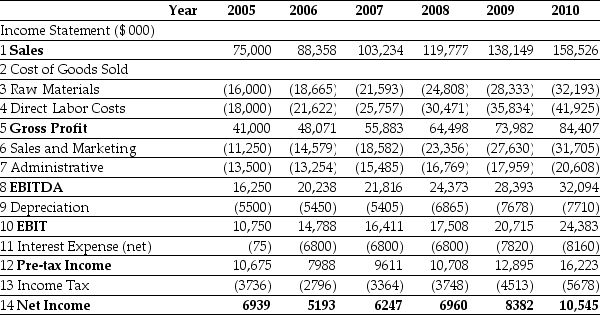

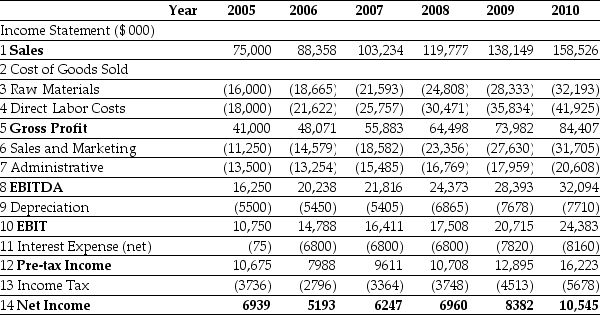

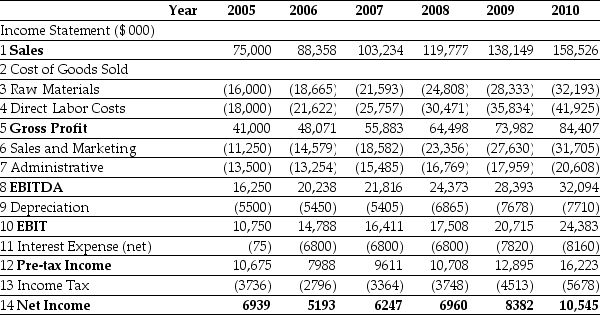

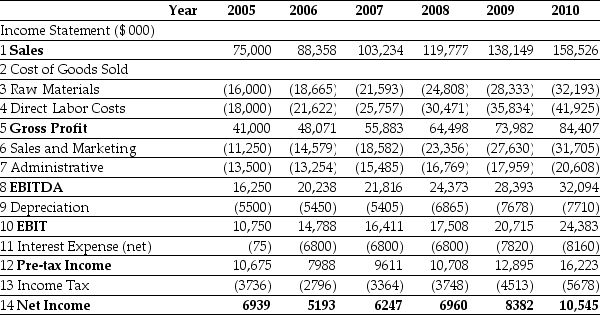

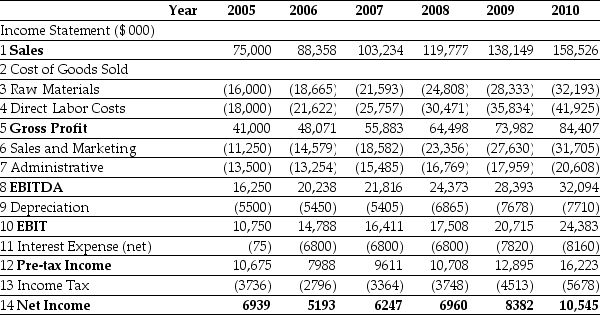

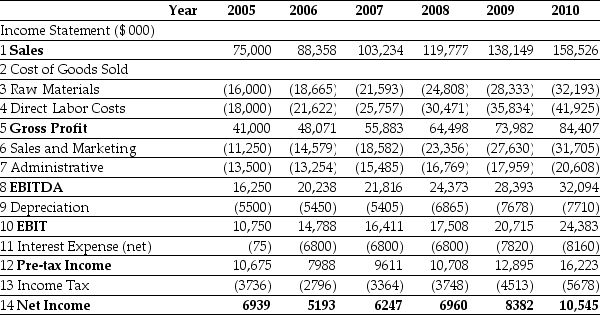

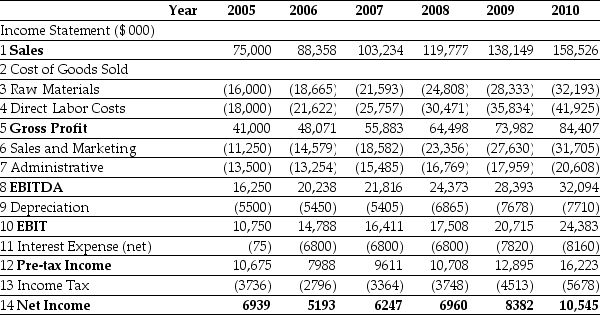

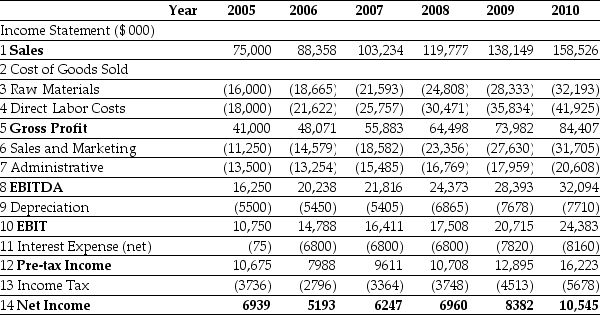

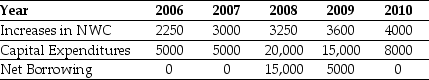

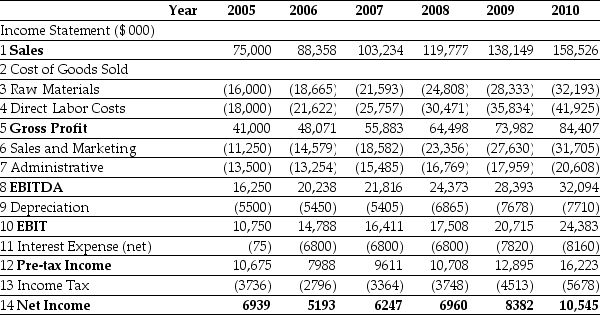

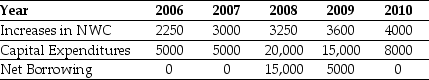

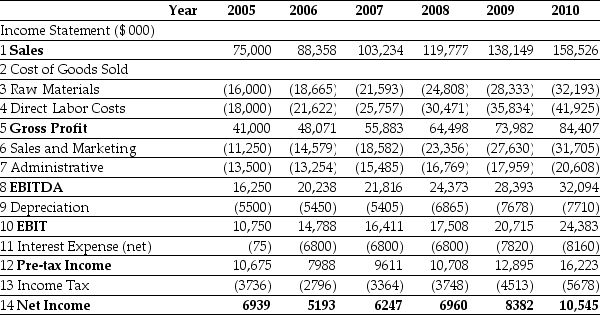

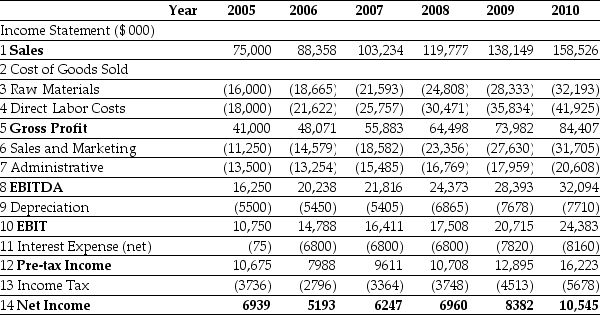

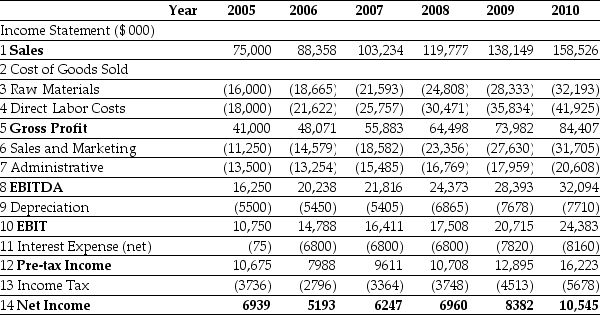

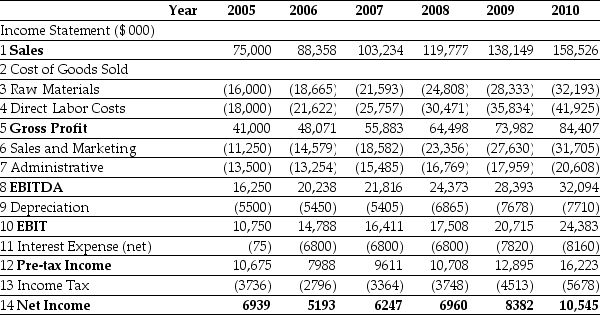

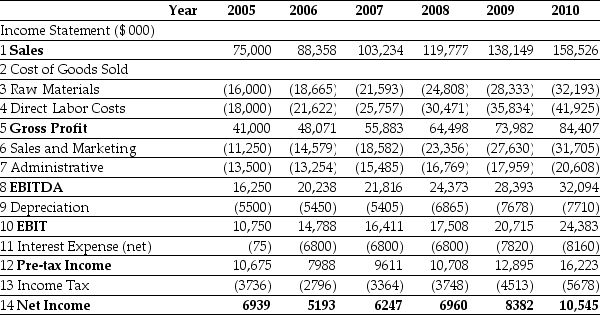

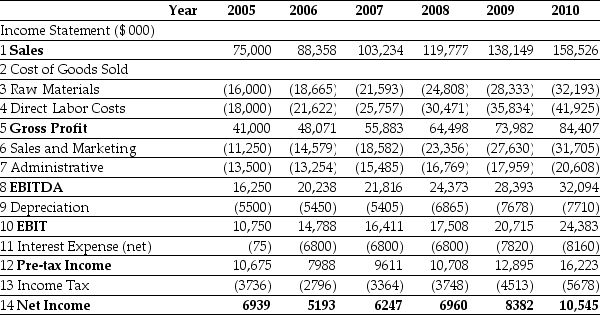

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

The free cash flow (in 000's)to the firm in 2010 is closest to:

A)$10,684.

B)$11,559.

C)$23,698.

D)$26,394.

Pro Forma Income Statement for Ideko,2005-2010

The free cash flow (in 000's)to the firm in 2010 is closest to:

A)$10,684.

B)$11,559.

C)$23,698.

D)$26,394.

$11,559.

2

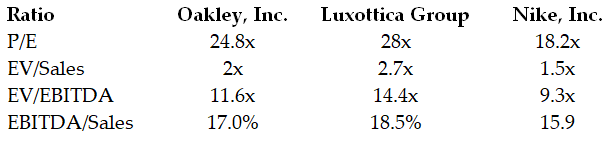

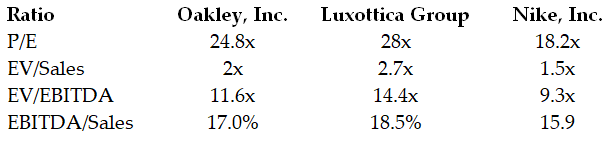

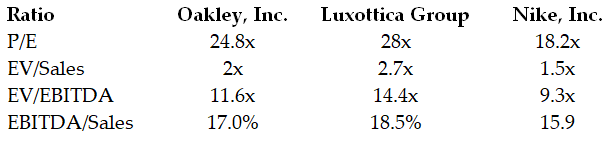

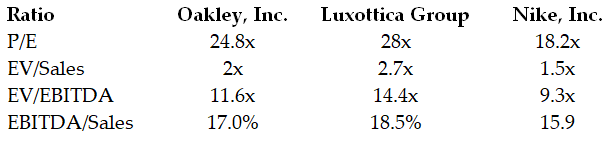

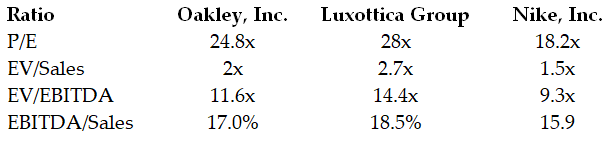

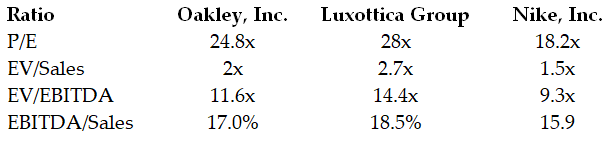

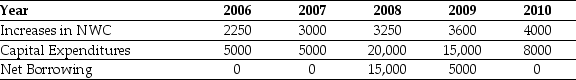

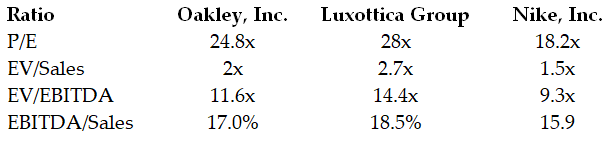

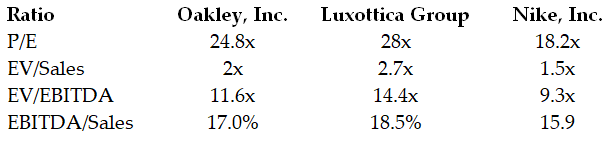

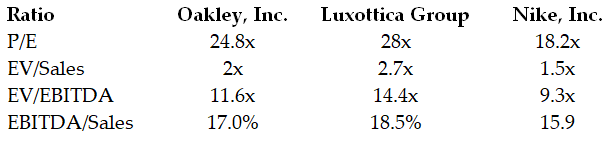

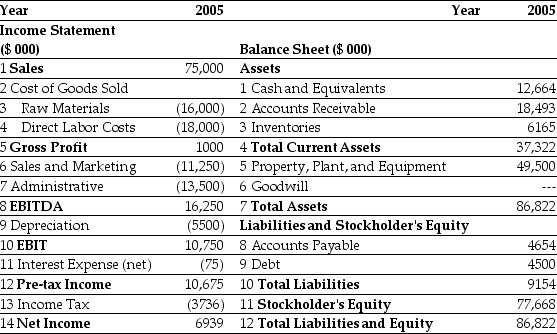

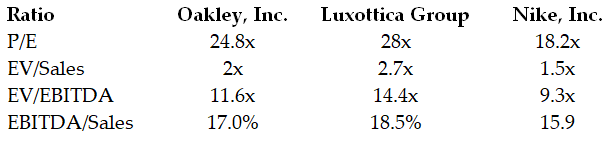

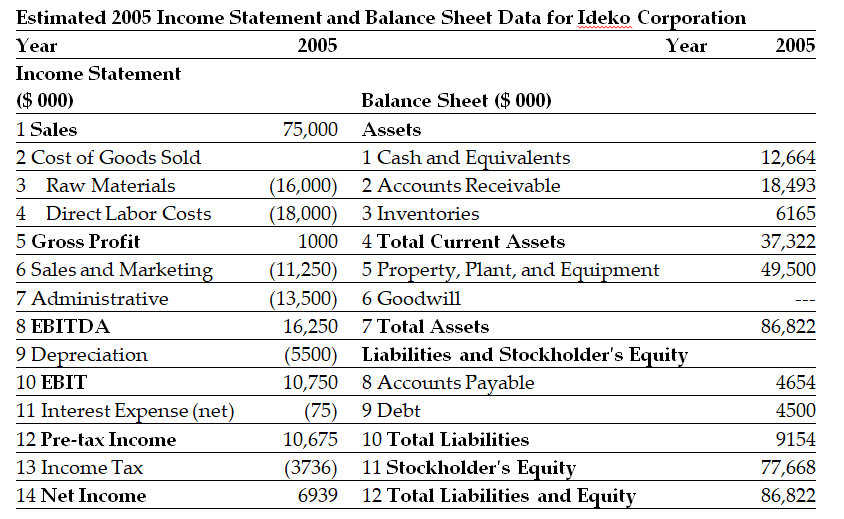

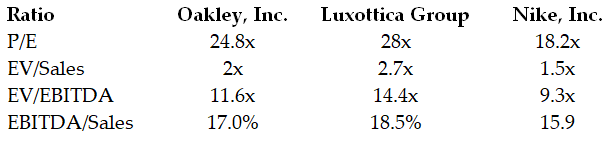

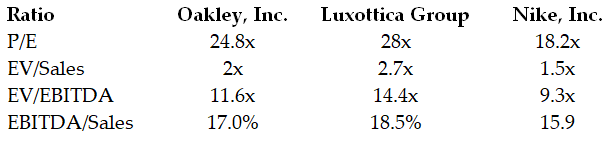

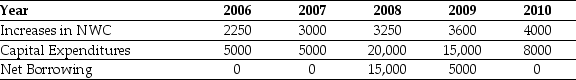

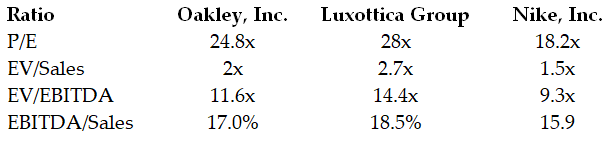

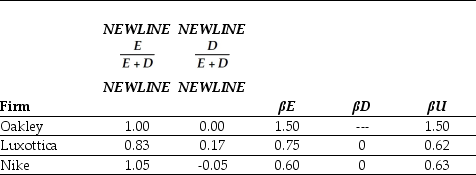

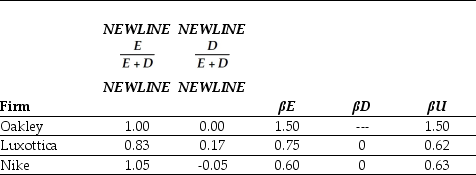

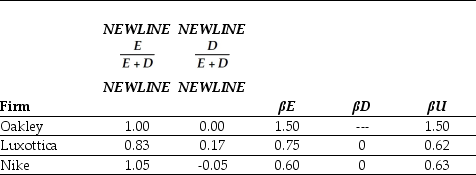

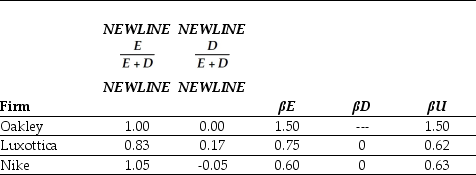

Use the tables for the question(s) below.

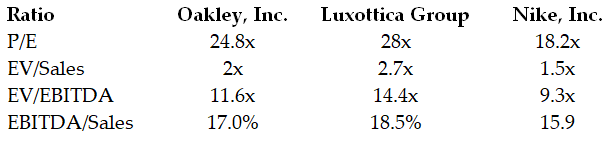

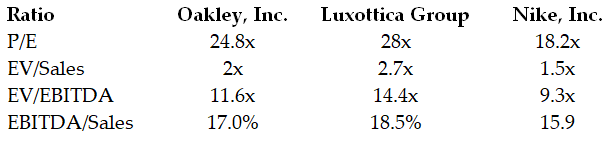

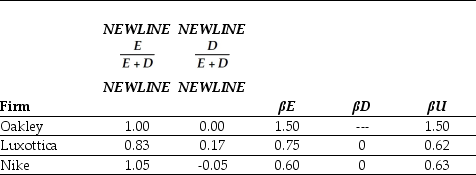

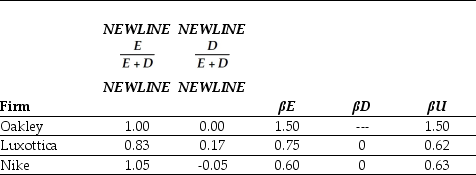

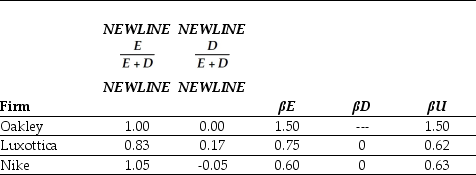

The following are financial ratios for three comparable companies:

Based upon the average EV/EBITDA ratio of the comparable firms,if Ideko holds $6.5 million of cash in excess of its working capital needs,then Ideko's target market value of equity is closest to:

A)$155 million.

B)$157 million.

C)$165 million.

D)$193 million.

The following are financial ratios for three comparable companies:

Based upon the average EV/EBITDA ratio of the comparable firms,if Ideko holds $6.5 million of cash in excess of its working capital needs,then Ideko's target market value of equity is closest to:

A)$155 million.

B)$157 million.

C)$165 million.

D)$193 million.

$193 million.

3

Use the tables for the question(s) below.

The following are financial ratios for three comparable companies:

Based upon the average P/E ratio of the comparable firms,Ideko's target market value of equity is closest to:

A)$157 million.

B)$155 million.

C)$193 million.

D)$164 million.

The following are financial ratios for three comparable companies:

Based upon the average P/E ratio of the comparable firms,Ideko's target market value of equity is closest to:

A)$157 million.

B)$155 million.

C)$193 million.

D)$164 million.

$164 million.

4

Use the tables for the question(s) below.

The following are financial ratios for three comparable companies:

What range for the market value of equity for Ideko is implied by the range of EV/Sales multiples for the comparable firms if Ideko holds $6.5 million of cash in excess of its working capital needs?

The following are financial ratios for three comparable companies:

What range for the market value of equity for Ideko is implied by the range of EV/Sales multiples for the comparable firms if Ideko holds $6.5 million of cash in excess of its working capital needs?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

5

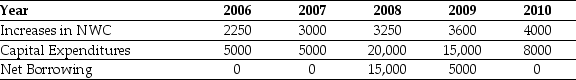

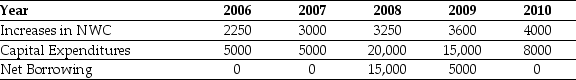

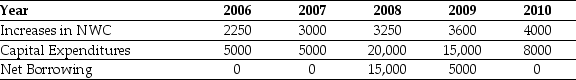

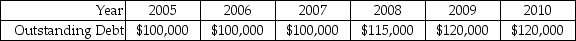

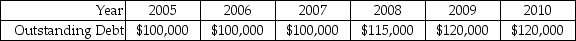

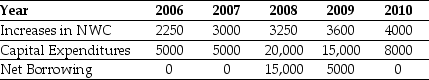

Use the following information to answer the question(s)below:

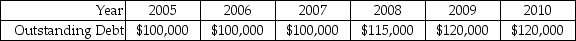

Ideko's Planned Debt (000's)

If Ideko's loans will have an interest rate of 6.8%,then the interest expense (in 000's)paid in 2008 is closest to:

A)$6800.

B)$7310.

C)$7820.

D)$7990.

Ideko's Planned Debt (000's)

If Ideko's loans will have an interest rate of 6.8%,then the interest expense (in 000's)paid in 2008 is closest to:

A)$6800.

B)$7310.

C)$7820.

D)$7990.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

6

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

The after-tax interest expense (in 000's)in 2010 is closest to:

A)$0.

B)$2856.

C)$5304.

D)$8160.

Pro Forma Income Statement for Ideko,2005-2010

The after-tax interest expense (in 000's)in 2010 is closest to:

A)$0.

B)$2856.

C)$5304.

D)$8160.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

7

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

The free cash flow to equity (in 000's)in 2010 is closest to:

A)$6255.

B)$10,684.

C)$11,559.

D)$18,394.

Pro Forma Income Statement for Ideko,2005-2010

The free cash flow to equity (in 000's)in 2010 is closest to:

A)$6255.

B)$10,684.

C)$11,559.

D)$18,394.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

8

Use the tables for the question(s) below.

The following are financial ratios for three comparable companies:

Based upon the average EV/EBITDA ratio of the comparable firms,Ideko's target economic value is closest to:

A)$191 million.

B)$155 million.

C)$157 million.

D)$193 million.

The following are financial ratios for three comparable companies:

Based upon the average EV/EBITDA ratio of the comparable firms,Ideko's target economic value is closest to:

A)$191 million.

B)$155 million.

C)$157 million.

D)$193 million.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

9

Use the tables for the question(s) below.

The following are financial ratios for three comparable companies:

Based upon the average EV/Sales ratio of the comparable firms,if Ideko holds $6.5 million of cash in excess of its working capital needs,then Ideko's target market value of equity is closest to:

A)$165 million.

B)$157 million.

C)$193 million.

D)$191 million.

The following are financial ratios for three comparable companies:

Based upon the average EV/Sales ratio of the comparable firms,if Ideko holds $6.5 million of cash in excess of its working capital needs,then Ideko's target market value of equity is closest to:

A)$165 million.

B)$157 million.

C)$193 million.

D)$191 million.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

10

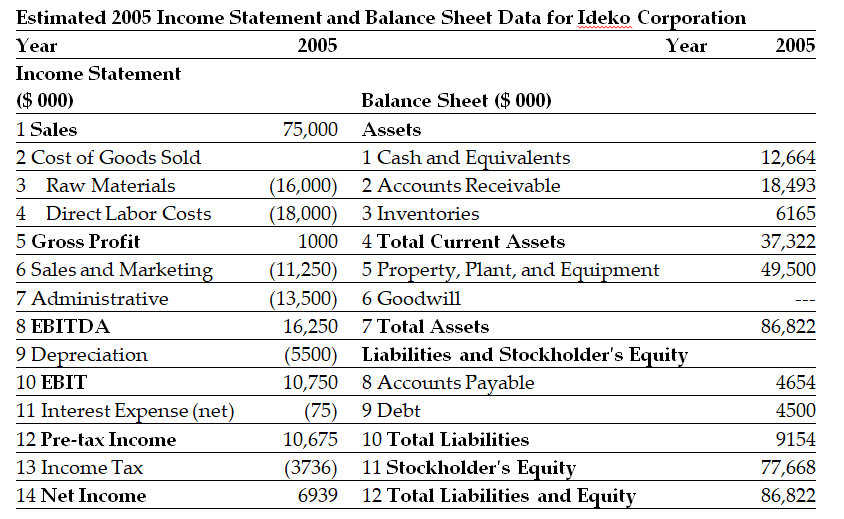

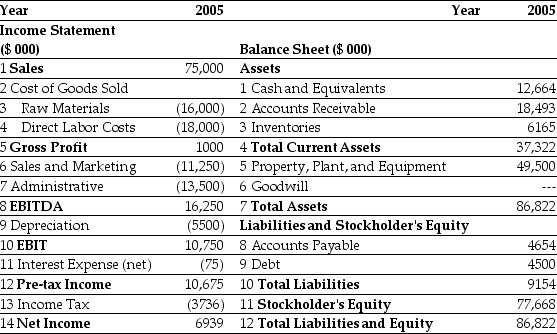

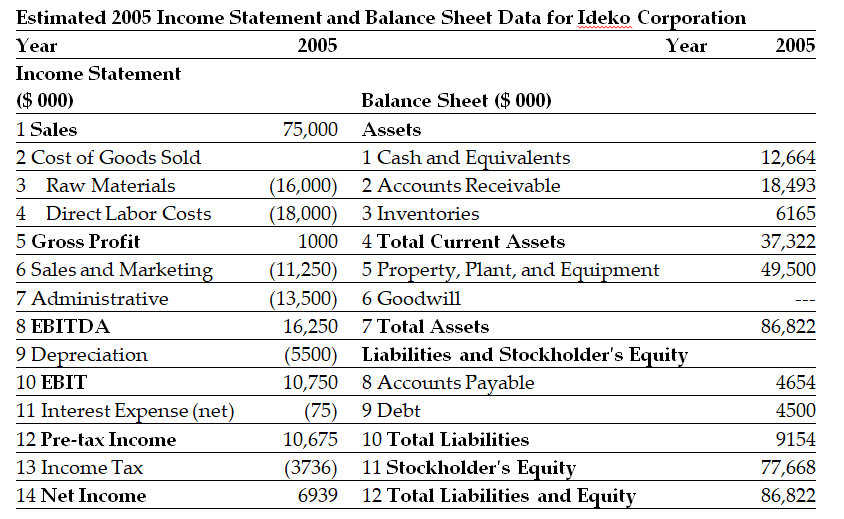

Use the tables for the question(s)below.

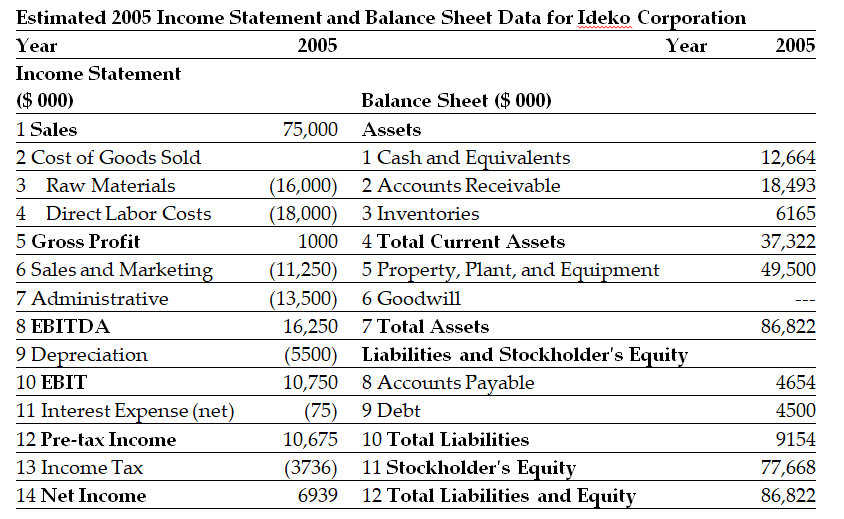

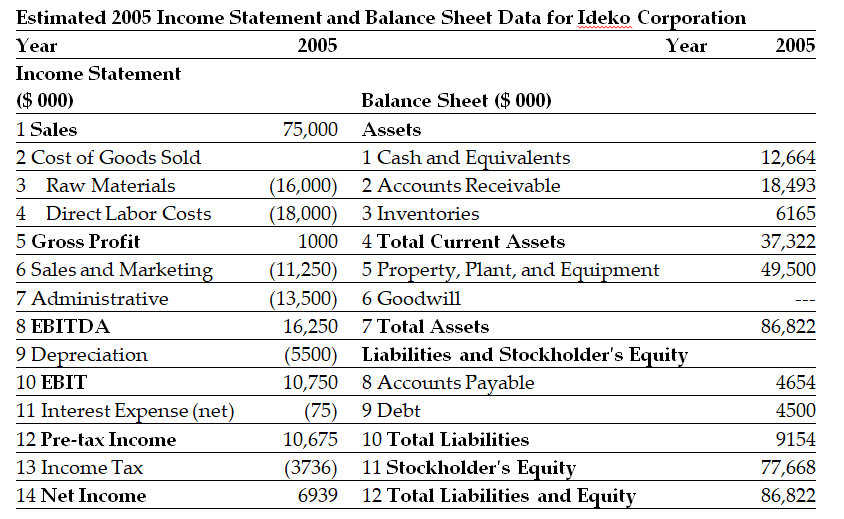

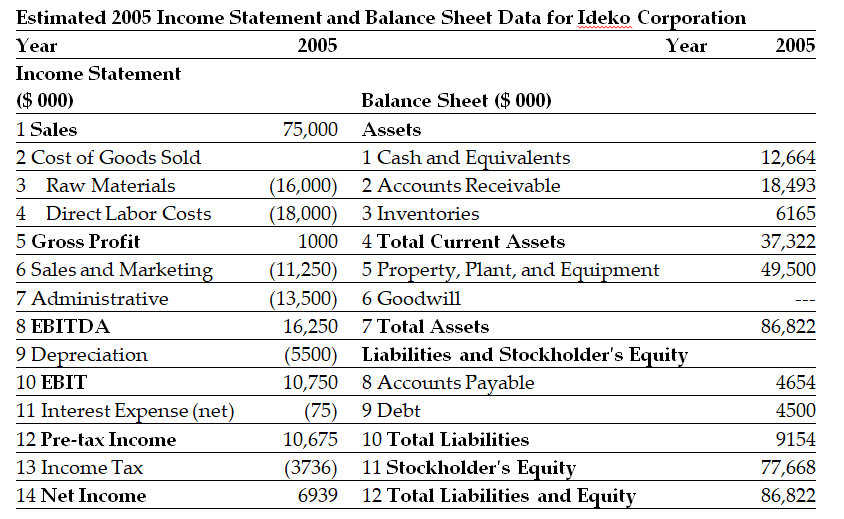

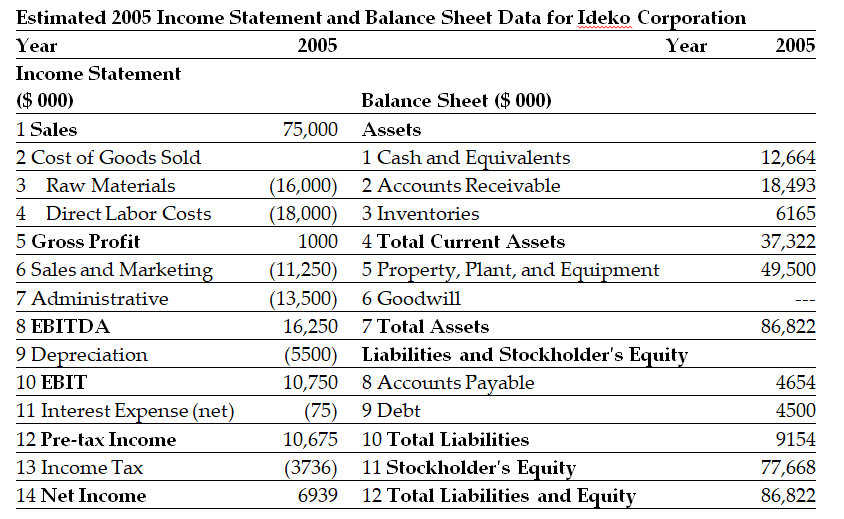

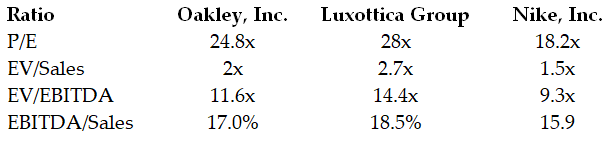

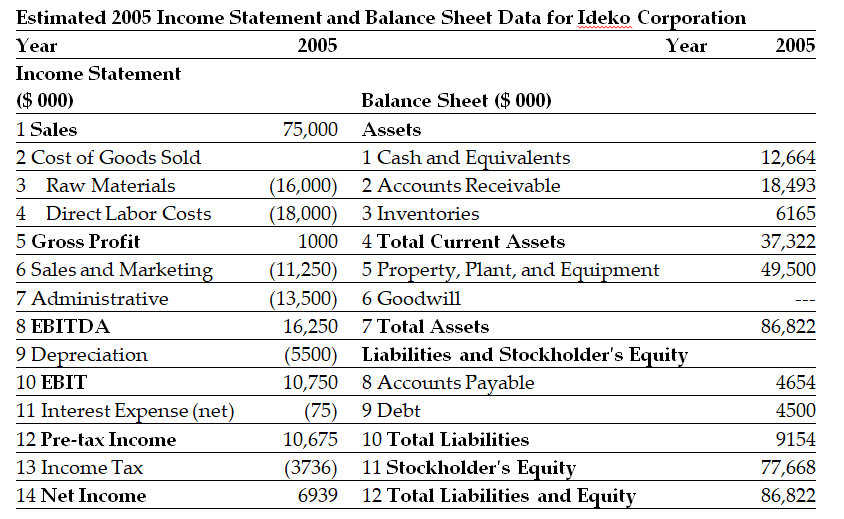

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

Ideko's Accounts Receivable Days is closest to:

A)84 days.

B)95 days.

C)90 days.

D)75 days.

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

Ideko's Accounts Receivable Days is closest to:

A)84 days.

B)95 days.

C)90 days.

D)75 days.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

11

Use the tables for the question(s) below.

The following are financial ratios for three comparable companies:

Based upon the average EV/Sales ratio of the comparable firms,Ideko's target economic value is closest to:

A)$191 million.

B)$155 million.

C)$165 million.

D)$157 million.

The following are financial ratios for three comparable companies:

Based upon the average EV/Sales ratio of the comparable firms,Ideko's target economic value is closest to:

A)$191 million.

B)$155 million.

C)$165 million.

D)$157 million.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

12

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

The free cash flow to the firm (in 000's)in 2008 is closest to:

A)-$5005.

B)-$1755.

C)$5575.

D)$14,995.

Pro Forma Income Statement for Ideko,2005-2010

The free cash flow to the firm (in 000's)in 2008 is closest to:

A)-$5005.

B)-$1755.

C)$5575.

D)$14,995.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

13

Use the tables for the question(s) below.

The following are financial ratios for three comparable companies:

What range for the market value of equity for Ideko is implied by the range of P/E multiples for the comparable firms?

The following are financial ratios for three comparable companies:

What range for the market value of equity for Ideko is implied by the range of P/E multiples for the comparable firms?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

14

Use the table for the question(s)below.

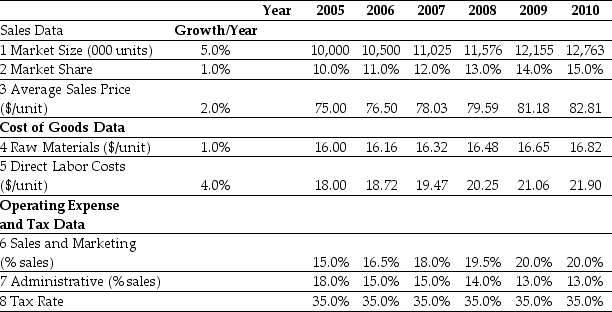

Ideko Sales and Operating Cost Assumptions

Based upon Ideko's Sales and Operating Cost Assumptions,what production capacity (in 000's)will Ideko require in 2007?

A)1505 units

B)1323 units

C)1914 units

D)1115 units

Ideko Sales and Operating Cost Assumptions

Based upon Ideko's Sales and Operating Cost Assumptions,what production capacity (in 000's)will Ideko require in 2007?

A)1505 units

B)1323 units

C)1914 units

D)1115 units

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

15

Use the table for the question(s)below.

Ideko Sales and Operating Cost Assumptions

Based upon Ideko's Sales and Operating Cost Assumptions,what production capacity (in 000's)will Ideko require in 2008?

A)1702 units

B)1323 units

C)1505 units

D)1914 units

Ideko Sales and Operating Cost Assumptions

Based upon Ideko's Sales and Operating Cost Assumptions,what production capacity (in 000's)will Ideko require in 2008?

A)1702 units

B)1323 units

C)1505 units

D)1914 units

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

16

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

The free cash flow to equity (in 000's)in 2008 is closest to:

A)-5005.

B)-1755.

C)5575.

D)9995.

Pro Forma Income Statement for Ideko,2005-2010

The free cash flow to equity (in 000's)in 2008 is closest to:

A)-5005.

B)-1755.

C)5575.

D)9995.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

17

Use the table for the question(s)below.

Ideko Sales and Operating Cost Assumptions

Based upon Ideko's Sales and Operating Cost Assumptions,what production capacity (in 000's)will Ideko require in 2009?

A)1505 units

B)1115 units

C)1323 units

D)1702 units

Ideko Sales and Operating Cost Assumptions

Based upon Ideko's Sales and Operating Cost Assumptions,what production capacity (in 000's)will Ideko require in 2009?

A)1505 units

B)1115 units

C)1323 units

D)1702 units

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

18

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

The after-tax interest expense (in 000's)in 2008 is closest to:

A)$2380.

B)$4420.

C)$6800.

D)$7820.

Pro Forma Income Statement for Ideko,2005-2010

The after-tax interest expense (in 000's)in 2008 is closest to:

A)$2380.

B)$4420.

C)$6800.

D)$7820.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

19

Use the tables for the question(s) below.

The following are financial ratios for three comparable companies:

What range for the market value of equity for Ideko is implied by the range of EV/EBITDA multiples for the comparable firms if Ideko holds $6.5 million of cash in excess of its working capital needs?

The following are financial ratios for three comparable companies:

What range for the market value of equity for Ideko is implied by the range of EV/EBITDA multiples for the comparable firms if Ideko holds $6.5 million of cash in excess of its working capital needs?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

20

Use the following information to answer the question(s)below:

Ideko's Planned Debt (000's)

If Ideko's loans will have an interest rate of 6.8%,then the interest expense (in 000's)paid in 2009 is closest to:

A)$6800.

B)$7310.

C)$7820.

D)$7990.

Ideko's Planned Debt (000's)

If Ideko's loans will have an interest rate of 6.8%,then the interest expense (in 000's)paid in 2009 is closest to:

A)$6800.

B)$7310.

C)$7820.

D)$7990.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

21

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

With the proper changes it is believed that Ideko's credit policies will allow for an accounts receivable days of 60.The forecasted accounts receivable (in 000's)for Ideko in 2008 is closest to:

A)$14,525.

B)$19,690.

C)$22,710.

D)$16,970.

Pro Forma Income Statement for Ideko,2005-2010

With the proper changes it is believed that Ideko's credit policies will allow for an accounts receivable days of 60.The forecasted accounts receivable (in 000's)for Ideko in 2008 is closest to:

A)$14,525.

B)$19,690.

C)$22,710.

D)$16,970.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

22

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

The amount of the increase in net working capital (in 000's)for Ideko in 2007 is closest to:

A)$4090.

B)$4685.

C)$3665.

D)$5230.

Pro Forma Income Statement for Ideko,2005-2010

The amount of the increase in net working capital (in 000's)for Ideko in 2007 is closest to:

A)$4090.

B)$4685.

C)$3665.

D)$5230.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

23

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010 Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

If Ideko's future expected growth rate is 5% and its WACC is 9%,then the continuation value (in 000's)in 2010 is closest to:

A)$164,200.

B)$278,775.

C)$280,450.

D)$303,425.

Pro Forma Income Statement for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

If Ideko's future expected growth rate is 5% and its WACC is 9%,then the continuation value (in 000's)in 2010 is closest to:

A)$164,200.

B)$278,775.

C)$280,450.

D)$303,425.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

24

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010 Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 8.5,then the continuation enterprise value of Ideko in 2010 is closest to:

A)$152.8 million.

B)$272.8 million.

C)$301.7 million.

D)$181.7 million.

Pro Forma Income Statement for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 8.5,then the continuation enterprise value of Ideko in 2010 is closest to:

A)$152.8 million.

B)$272.8 million.

C)$301.7 million.

D)$181.7 million.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

25

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

With the proper changes it is believed that Ideko's credit policies will allow for an accounts receivable days of 60.The forecasted accounts receivable (in 000's)for Ideko in 2007 is closest to:

A)$14,525.

B)$16,970.

C)$22,710.

D)$19,690.

Pro Forma Income Statement for Ideko,2005-2010

With the proper changes it is believed that Ideko's credit policies will allow for an accounts receivable days of 60.The forecasted accounts receivable (in 000's)for Ideko in 2007 is closest to:

A)$14,525.

B)$16,970.

C)$22,710.

D)$19,690.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

26

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010 Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

If Ideko's future expected growth rate is 5%,then the estimated free cash flow (in 000's)for 2011 is closest to:

A)$6568.

B)$11,151.

C)$11,218.

D)$12,137.

Pro Forma Income Statement for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

If Ideko's future expected growth rate is 5%,then the estimated free cash flow (in 000's)for 2011 is closest to:

A)$6568.

B)$11,151.

C)$11,218.

D)$12,137.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

27

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

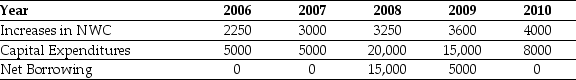

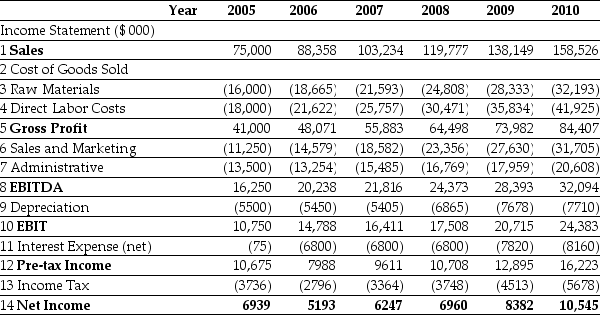

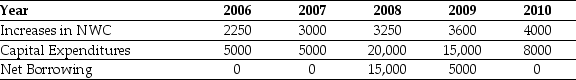

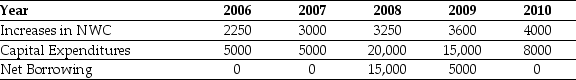

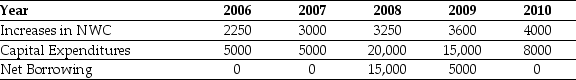

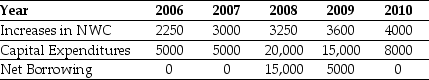

Using the income statement above and the following information (in $000's): Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2009.

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2009.

Pro Forma Income Statement for Ideko,2005-2010

Using the income statement above and the following information (in $000's):

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2009.

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2009.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

28

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

The amount of net working capital (in 000's)for Ideko in 2006 is closest to:

A)$22,750.

B)$35,195.

C)$30,510.

D)$26,420.

Pro Forma Income Statement for Ideko,2005-2010

The amount of net working capital (in 000's)for Ideko in 2006 is closest to:

A)$22,750.

B)$35,195.

C)$30,510.

D)$26,420.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

29

Use the table for the question(s)below.

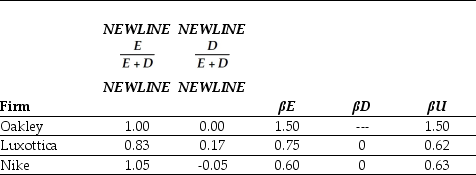

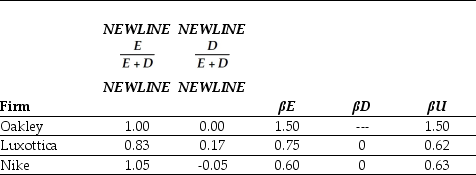

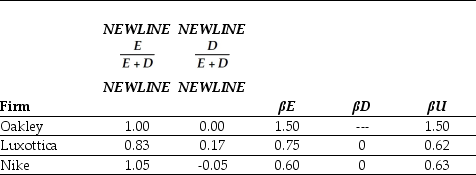

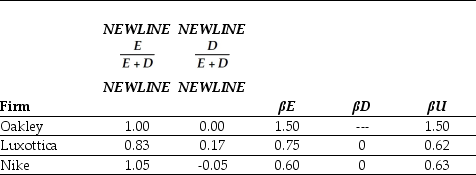

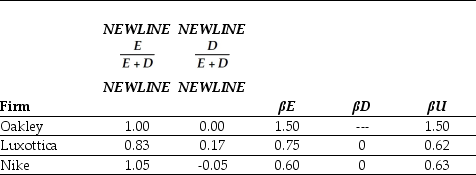

Capital Structure and Unlevered Beta Estimates for Comparable Firms

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Oakley is closest to:

A)13.5%.

B)10.2%.

C)9.1%.

D)14.7%.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Oakley is closest to:

A)13.5%.

B)10.2%.

C)9.1%.

D)14.7%.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

30

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

The amount of net working capital (in 000's)for Ideko in 2008 is closest to:

A)$35,195.

B)$26,420.

C)$22,170.

D)$30,510.

Pro Forma Income Statement for Ideko,2005-2010

The amount of net working capital (in 000's)for Ideko in 2008 is closest to:

A)$35,195.

B)$26,420.

C)$22,170.

D)$30,510.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

31

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

Using the income statement above and the following information (in $000's): Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2007.

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2007.

Pro Forma Income Statement for Ideko,2005-2010

Using the income statement above and the following information (in $000's):

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2007.

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2007.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

32

Use the table for the question(s)below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

The unlevered beta for Nike is closest to:

A)0.70.

B)1.00.

C)1.50.

D)0.60.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

The unlevered beta for Nike is closest to:

A)0.70.

B)1.00.

C)1.50.

D)0.60.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

33

Use the table for the question(s)below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

The unlevered beta for Luxottica is closest to:

A)1.00.

B)0.60.

C)0.70.

D)1.50.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

The unlevered beta for Luxottica is closest to:

A)1.00.

B)0.60.

C)0.70.

D)1.50.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

34

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010 Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 8.5,then the continuation equity value of Ideko in 2010 is closest to:

A)$181.7 million.

B)$272.8 million.

C)$152.8 million.

D)$301.7 million.

Pro Forma Income Statement for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 8.5,then the continuation equity value of Ideko in 2010 is closest to:

A)$181.7 million.

B)$272.8 million.

C)$152.8 million.

D)$301.7 million.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

35

Use the table for the question(s)below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

The unlevered beta for Oakley is closest to:

A)0.70.

B)1.50.

C)1.00.

D)0.60.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

The unlevered beta for Oakley is closest to:

A)0.70.

B)1.50.

C)1.00.

D)0.60.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

36

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

With the proper changes it is believed that Ideko's credit policies will allow for an accounts receivable days of 60.The forecasted accounts receivable (in 000's)for Ideko in 2006 is closest to:

A)$19,690.

B)$16,970.

C)$22,710.

D)$14,525.

Pro Forma Income Statement for Ideko,2005-2010

With the proper changes it is believed that Ideko's credit policies will allow for an accounts receivable days of 60.The forecasted accounts receivable (in 000's)for Ideko in 2006 is closest to:

A)$19,690.

B)$16,970.

C)$22,710.

D)$14,525.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

37

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

The amount of net working capital (in 000's)for Ideko in 2007 is closest to:

A)$30,510.

B)$26,420.

C)$22,170.

D)$35,195.

Pro Forma Income Statement for Ideko,2005-2010

The amount of net working capital (in 000's)for Ideko in 2007 is closest to:

A)$30,510.

B)$26,420.

C)$22,170.

D)$35,195.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

38

Use the table for the question(s)below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Luxottica is closest to:

A)10.2%.

B)13.5%.

C)9.1%.

D)14.7%.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Luxottica is closest to:

A)10.2%.

B)13.5%.

C)9.1%.

D)14.7%.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

39

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010

The amount of the increase in net working capital (in 000's)for Ideko in 2008 is closest to:

A)$4685.

B)$3665.

C)$4090.

D)$5230.

Pro Forma Income Statement for Ideko,2005-2010

The amount of the increase in net working capital (in 000's)for Ideko in 2008 is closest to:

A)$4685.

B)$3665.

C)$4090.

D)$5230.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

40

Use the table for the question(s)below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Nike is closest to:

A)14.7%.

B)10.2%.

C)9.1%.

D)13.5%.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Nike is closest to:

A)14.7%.

B)10.2%.

C)9.1%.

D)13.5%.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

41

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010 Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 9.4,then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

A)1.9.

B)1.7.

C)1.6.

D)1.8.

Pro Forma Income Statement for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 9.4,then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

A)1.9.

B)1.7.

C)1.6.

D)1.8.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

42

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010 Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 8.5,then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

A)1.7.

B)1.9.

C)1.6.

D)1.8.

Pro Forma Income Statement for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 8.5,then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

A)1.7.

B)1.9.

C)1.6.

D)1.8.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

43

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010 Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 9.4,then the continuation equity value of Ideko in 2010 is closest to:

A)$152.8 million.

B)$181.7 million.

C)$301.7 million.

D)$272.8 million.

Pro Forma Income Statement for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 9.4,then the continuation equity value of Ideko in 2010 is closest to:

A)$152.8 million.

B)$181.7 million.

C)$301.7 million.

D)$272.8 million.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

44

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010 Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 9.4,then the continuation enterprise value of Ideko in 2010 is closest to:

A)$181.7 million.

B)$152.8 million.

C)$272.8 million.

D)$301.7 million.

Pro Forma Income Statement for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 9.4,then the continuation enterprise value of Ideko in 2010 is closest to:

A)$181.7 million.

B)$152.8 million.

C)$272.8 million.

D)$301.7 million.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

45

What is the purpose of the sensitivity analysis?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

46

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010 Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 9.4,then the continuation levered P/E ratio of Ideko in 2010 is closest to:

A)17.2.

B)14.5.

C)19.0.

D)16.4.

Pro Forma Income Statement for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 9.4,then the continuation levered P/E ratio of Ideko in 2010 is closest to:

A)17.2.

B)14.5.

C)19.0.

D)16.4.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

47

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010 Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has a EBITDA multiple of 8.5,then the continuation levered P/E ratio of Ideko in 2010 is closest to:

A)19.0.

B)17.2.

C)16.4.

D)14.5.

Pro Forma Income Statement for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has a EBITDA multiple of 8.5,then the continuation levered P/E ratio of Ideko in 2010 is closest to:

A)19.0.

B)17.2.

C)16.4.

D)14.5.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

48

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010 Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 8.5,then the continuation unlevered P/E ratio of Ideko in 2010 is closest to:

A)17.6.

B)16.4.

C)14.5.

D)19.0.

Pro Forma Income Statement for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 8.5,then the continuation unlevered P/E ratio of Ideko in 2010 is closest to:

A)17.6.

B)16.4.

C)14.5.

D)19.0.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

49

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko,2005-2010 Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 9.4,then the continuation unlevered P/E ratio of Ideko in 2010 is closest to:

A)17.2.

B)16.4.

C)14.5.

D)19.4.

Pro Forma Income Statement for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Pro Forma Balance Sheet for Ideko,2005-2010

Assuming that Ideko has an EBITDA multiple of 9.4,then the continuation unlevered P/E ratio of Ideko in 2010 is closest to:

A)17.2.

B)16.4.

C)14.5.

D)19.4.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck