Deck 3: The Accounting Information System

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/145

Play

Full screen (f)

Deck 3: The Accounting Information System

1

The normal balance of a liability account is a debit.

False

2

The normal balance of the Dividends Declared account is a debit.

True

3

In its simplest form, a T account consists of three parts: (1) its title, (2) a left or credit side and (3) a right or debit side.

False

4

The double-entry accounting system records the dual effect of each transaction.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

5

Revenue is only recorded when cash is received.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

6

The double-entry system of accounting refers to the placement of a double line at the end of a column of figures.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

7

If a revenue account is credited, this must increase shareholders' equity.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

8

Assets are decreased with a credit.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

9

A decrease in a liability account is recorded by a debit.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

10

Collection of an account receivable will increase total assets.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

11

An expense account is a subdivision of the retained earnings account and decreases shareholders' equity.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

12

Revenues are a subdivision of shareholders' equity.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

13

A debit increases an account and a credit decreases an account.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

14

A credit means that an account has been increased.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

15

An increase in an asset is recorded by a debit.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

16

Economic events that require recording in the accounting records are called accounting transactions.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

17

The normal balance of an asset is a credit.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

18

Cash received from a customer in advance of work being performed or goods provided is recorded as revenue.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

19

Under the double-entry system, revenues must always equal expenses.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

20

An individual accounting record for a specific asset, liability or shareholders' equity item is called an account.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

21

The chart of accounts is the framework for the accounting database.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

22

Prepaid expenses are recorded as

(a)expenses on the statement of income.

(b)assets on the statement of financial position.

(c)revenues on the statement of income.

(d)liabilities on the statement of financial position.

(a)expenses on the statement of income.

(b)assets on the statement of financial position.

(c)revenues on the statement of income.

(d)liabilities on the statement of financial position.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

23

A list of accounts and their account numbers is called the chart of accounts.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

24

The main purpose of the trial balance is to check that debits equal credits.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

25

A trial balance can still balance even if an entry is posted to the wrong account.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

26

The chart of accounts is a special ledger used in accounting systems.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

27

If a journal entry is posted twice, this will be discovered by preparing a trial balance.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

28

A compound journal entry affects more than two accounts.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

29

An increase in the Dividends Declared account will result in

(a)an increase in the Retained Earnings account.

(b)an increase in expenses.

(c)a decrease in the Retained Earnings account.

(d)a decrease in expenses.

(a)an increase in the Retained Earnings account.

(b)an increase in expenses.

(c)a decrease in the Retained Earnings account.

(d)a decrease in expenses.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

30

Posting is the process of proving the equality of debits and credits in the trial balance.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

31

The account titles used in journalizing transactions need not be identical to the account titles in the ledger.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

32

Entering transactions into the journal is called posting.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

33

The retained earnings on the trial balance prepared immediately after posting represents the retained earnings at the beginning of the period.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

34

The first step in the recording process is entering the transaction into the general journal.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

35

Each transaction must be analyzed in terms of its effect on the accounts before it can be recorded in a journal.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

36

The journal is a chronological record of all transactions.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

37

Source documents can provide evidence that a transaction has occurred.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

38

The account to be credited is entered first in a journal entry.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

39

If total assets are increased, there must be a corresponding

(a)increase in liabilities only.

(b)increase in shareholders' equity only.

(c)increase in liabilities and decrease in shareholders' equity.

(d)increase in liabilities and/or increase in shareholders' equity.

(a)increase in liabilities only.

(b)increase in shareholders' equity only.

(c)increase in liabilities and decrease in shareholders' equity.

(d)increase in liabilities and/or increase in shareholders' equity.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

40

A general ledger should be arranged in financial statement order beginning with the statement of financial position accounts.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

41

A paid dividend

(a)decreases assets and shareholders' equity.

(b)increases assets and shareholders' equity.

(c)increases assets and decreases shareholders' equity.

(d)decreases assets and increases shareholders' equity.

(a)decreases assets and shareholders' equity.

(b)increases assets and shareholders' equity.

(c)increases assets and decreases shareholders' equity.

(d)decreases assets and increases shareholders' equity.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

42

The payment of an account payable

(a)decreases total assets.

(b)increases total assets.

(c)has no effect on total assets.

(d)increases total liabilities.

(a)decreases total assets.

(b)increases total assets.

(c)has no effect on total assets.

(d)increases total liabilities.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

43

Accounting systems should record

(a)all economic events.

(b)events that result in a change in assets, liabilities, or shareholders' equity items.

(c)only events that involve cash.

(d)only events that include revenues, expenses, and cash.

(a)all economic events.

(b)events that result in a change in assets, liabilities, or shareholders' equity items.

(c)only events that involve cash.

(d)only events that include revenues, expenses, and cash.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

44

When an asset increases which of the following does not occur:

(a)decrease in another asset

(b)increase in revenue

(c)increase in common shares

(d)decrease in a liability

(a)decrease in another asset

(b)increase in revenue

(c)increase in common shares

(d)decrease in a liability

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

45

Shareholders' equity is increased by

(a)dividends declared.

(b)revenues.

(c)expenses.

(d)liabilities.

(a)dividends declared.

(b)revenues.

(c)expenses.

(d)liabilities.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

46

An expense

(a)decreases assets and liabilities.

(b)decreases shareholders' equity.

(c)has no effect on shareholders' equity.

(d)increases assets and decreases shareholder' equity.

(a)decreases assets and liabilities.

(b)decreases shareholders' equity.

(c)has no effect on shareholders' equity.

(d)increases assets and decreases shareholder' equity.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

47

If services are performed on credit, then

(a)assets will decrease.

(b)liabilities will increase.

(c)shareholders' equity will increase.

(d)liabilities will decrease.

(a)assets will decrease.

(b)liabilities will increase.

(c)shareholders' equity will increase.

(d)liabilities will decrease.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

48

Recording revenue

(a)increases assets and liabilities.

(b)increases assets and shareholders' equity.

(c)increases assets and decreases shareholders' equity.

(d)has no effect on total assets.

(a)increases assets and liabilities.

(b)increases assets and shareholders' equity.

(c)increases assets and decreases shareholders' equity.

(d)has no effect on total assets.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following items has no effect on retained earnings?

(a)expenses

(b)dividends declared

(c)revenues

(d)hiring a new employee

(a)expenses

(b)dividends declared

(c)revenues

(d)hiring a new employee

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

50

An investment by the shareholders in a company increases

(a)assets and shareholders' equity.

(b)assets and liabilities.

(c)liabilities and shareholders' equity.

(d)assets only.

(a)assets and shareholders' equity.

(b)assets and liabilities.

(c)liabilities and shareholders' equity.

(d)assets only.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

51

A payment of a portion of accounts payable will

(a)not affect total assets.

(b)increase liabilities.

(c)not affect shareholders' equity.

(d)decrease net income.

(a)not affect total assets.

(b)increase liabilities.

(c)not affect shareholders' equity.

(d)decrease net income.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

52

If expenses are paid in cash, then

(a)assets will increase.

(b)liabilities will decrease.

(c)shareholders' equity will increase.

(d)assets will decrease.

(a)assets will increase.

(b)liabilities will decrease.

(c)shareholders' equity will increase.

(d)assets will decrease.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

53

The payment of a liability

(a)decreases assets and shareholders' equity.

(b)increases assets and decreases liabilities.

(c)decreases assets and increases liabilities.

(d)decreases assets and liabilities.

(a)decreases assets and shareholders' equity.

(b)increases assets and decreases liabilities.

(c)decreases assets and increases liabilities.

(d)decreases assets and liabilities.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

54

The purchase of an asset for cash

(a)increases assets and shareholders' equity.

(b)increases assets and liabilities.

(c)decreases assets and increases liabilities.

(d)has no effect on total assets.

(a)increases assets and shareholders' equity.

(b)increases assets and liabilities.

(c)decreases assets and increases liabilities.

(d)has no effect on total assets.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

55

If total liabilities increased by $22,500, then

(a)assets must have increased by $22,500.

(b)only shareholders' equity must have increased by $22,500.

(c)assets must have increased by $22,500, or shareholders' equity must have decreased by $22,500.

(d)assets and shareholders' equity must have both decreased by $22,500.

(a)assets must have increased by $22,500.

(b)only shareholders' equity must have increased by $22,500.

(c)assets must have increased by $22,500, or shareholders' equity must have decreased by $22,500.

(d)assets and shareholders' equity must have both decreased by $22,500.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

56

The purchase of an asset on credit

(a)increases assets and shareholders' equity.

(b)increases assets and liabilities.

(c)decreases assets and increases liabilities.

(d)has no effect on total assets.

(a)increases assets and shareholders' equity.

(b)increases assets and liabilities.

(c)decreases assets and increases liabilities.

(d)has no effect on total assets.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

57

Collection of an $800 accounts receivable

(a)increases an asset $800; decreases a liability $800.

(b)decreases a liability $800; increases shareholders' equity $800.

(c)decreases an asset $800; decreases a liability $800.

(d)has no effect on total assets.

(a)increases an asset $800; decreases a liability $800.

(b)decreases a liability $800; increases shareholders' equity $800.

(c)decreases an asset $800; decreases a liability $800.

(d)has no effect on total assets.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

58

If an individual asset is increased, then

(a)there could be an equal decrease in a specific liability.

(b)there could be an equal decrease in shareholders' equity.

(c)there could be an equal decrease in another asset.

(d)none of these is possible.

(a)there could be an equal decrease in a specific liability.

(b)there could be an equal decrease in shareholders' equity.

(c)there could be an equal decrease in another asset.

(d)none of these is possible.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

59

When a liability decreases:

(a)the account is credited and the normal balance is a debit balance.

(b)the account is debited and the normal balance is a credit balance.

(c)the account is credited and the normal balance is a credit.

(d)the account is debited and the normal balance is a credit.

(a)the account is credited and the normal balance is a debit balance.

(b)the account is debited and the normal balance is a credit balance.

(c)the account is credited and the normal balance is a credit.

(d)the account is debited and the normal balance is a credit.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

60

A paid income tax instalment

(a)increases assets and shareholders' equity.

(b)decreases assets and shareholders' equity.

(c)increases assets and decreases shareholders' equity.

(d)decreases assets and increases shareholders' equity.

(a)increases assets and shareholders' equity.

(b)decreases assets and shareholders' equity.

(c)increases assets and decreases shareholders' equity.

(d)decreases assets and increases shareholders' equity.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

61

An accountant has debited an asset account for $2,000 and credited an expense account for $4,000.Which of the following would be the correct way to complete the recording of the transaction?

(a)Credit an asset account for $4,000.

(b)Credit a liability account for $2,000.

(c)Credit a shareholders' equity account for $2,000.

(d)Debit a shareholders' equity account for $2,000.

(a)Credit an asset account for $4,000.

(b)Credit a liability account for $2,000.

(c)Credit a shareholders' equity account for $2,000.

(d)Debit a shareholders' equity account for $2,000.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

62

In recording an accounting transaction in a double-entry system,

(a)the number of accounts to be debited must equal the number of accounts to be credited.

(b)there must always be entries made on both sides of the accounting equation.

(c)the amount of the debits must equal the amount of the credits.

(d)there must only be two accounts affected by any transaction.

(a)the number of accounts to be debited must equal the number of accounts to be credited.

(b)there must always be entries made on both sides of the accounting equation.

(c)the amount of the debits must equal the amount of the credits.

(d)there must only be two accounts affected by any transaction.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

63

Which pair of accounts follows the rules of debit and credit in the same manner?

(a)Accounts Payable and Rent Expense

(b)Repair and Maintenance Expense and Bank Loan Payable

(c)Prepaid Insurance and Advertising Expense

(d)Service Revenue and Accounts Receivable

(a)Accounts Payable and Rent Expense

(b)Repair and Maintenance Expense and Bank Loan Payable

(c)Prepaid Insurance and Advertising Expense

(d)Service Revenue and Accounts Receivable

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

64

A T account is

(a)a way of illustrating the basic form of an account.

(b)a special account used to record only debits.

(c)a special account used to record only credits.

(d)the actual account form used in real accounting systems.

(a)a way of illustrating the basic form of an account.

(b)a special account used to record only debits.

(c)a special account used to record only credits.

(d)the actual account form used in real accounting systems.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

65

An account will have a credit balance if the

(a)credits exceed the debits.

(b)first transaction entered was a credit.

(c)debits exceed the credits.

(d)last transaction entered was a credit.

(a)credits exceed the debits.

(b)first transaction entered was a credit.

(c)debits exceed the credits.

(d)last transaction entered was a credit.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

66

An accountant has debited an asset account for $5,000 and credited a revenue account for $10,000.What can be done to complete the recording of the transaction?

(a)Nothing further can be done.

(b)Credit a shareholders' equity account for $5,000.

(c)Debit another asset account for $5,000.

(d)Credit another asset account for $5,000.

(a)Nothing further can be done.

(b)Credit a shareholders' equity account for $5,000.

(c)Debit another asset account for $5,000.

(d)Credit another asset account for $5,000.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

67

Debit and credit can be interpreted to mean

(a)"bad" and "good," respectively.

(b)increase and decrease, respectively.

(c)decrease and increase, respectively.

(d)either an increase or decrease depending on the account.

(a)"bad" and "good," respectively.

(b)increase and decrease, respectively.

(c)decrease and increase, respectively.

(d)either an increase or decrease depending on the account.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

68

Which one of the following represents the expanded basic accounting equation?

(a)Assets = Liabilities + Common Shares + Retained Earnings + Revenues - Expenses - Dividends Declared.

(b)Assets + Liabilities = Dividends Declared + Expenses + Common Shares + Revenues.

(c)Assets - Liabilities - Dividends Declared = Common Shares + Revenues - Expenses.

(d)Assets = Revenues + Expenses - Liabilities.

(a)Assets = Liabilities + Common Shares + Retained Earnings + Revenues - Expenses - Dividends Declared.

(b)Assets + Liabilities = Dividends Declared + Expenses + Common Shares + Revenues.

(c)Assets - Liabilities - Dividends Declared = Common Shares + Revenues - Expenses.

(d)Assets = Revenues + Expenses - Liabilities.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

69

An individual accounting record of increases and decreases in a specific asset, liability, or shareholders' equity item is called a(n)

(a)single-entry accounting system.

(b)accounting transaction.

(c)account.

(d)normal balance.

(a)single-entry accounting system.

(b)accounting transaction.

(c)account.

(d)normal balance.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

70

The normal balance of any account is the

(a)left side.

(b)right side.

(c)side which increases the account.

(d)side which decreases the account.

(a)left side.

(b)right side.

(c)side which increases the account.

(d)side which decreases the account.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

71

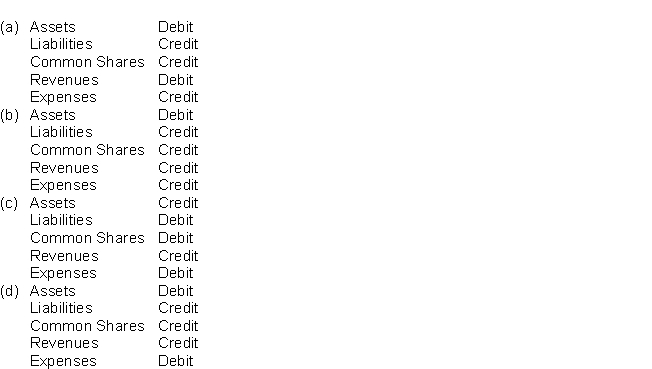

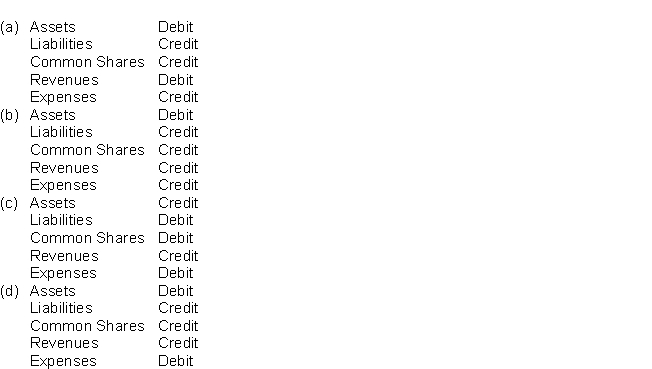

Which of the following correctly identifies the normal balances of accounts?

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following is not true of the terms debit and credit?

(a)They can be abbreviated as Dr.and Cr.

(b)They can be interpreted to mean increase and decrease.

(c)They can be used to describe the balance of an account.

(d)They can be interpreted to mean left and right.

(a)They can be abbreviated as Dr.and Cr.

(b)They can be interpreted to mean increase and decrease.

(c)They can be used to describe the balance of an account.

(d)They can be interpreted to mean left and right.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

73

The right side of an account is

(a)always used to record increases.

(b)the credit side.

(c)the debit side.

(d)always used to record decreases.

(a)always used to record increases.

(b)the credit side.

(c)the debit side.

(d)always used to record decreases.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

74

The equality of debits and credits is the basis for

(a)the double-entry accounting system.

(b)the single-entry accounting system.

(c)the T account.

(d)all accounting systems.

(a)the double-entry accounting system.

(b)the single-entry accounting system.

(c)the T account.

(d)all accounting systems.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

75

A credit is not the normal balance for

(a)common shares.

(b)revenues.

(c)liabilities.

(d)cash.

(a)common shares.

(b)revenues.

(c)liabilities.

(d)cash.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

76

The best interpretation of the word credit is the

(a)left side of an account.

(b)increase side of an account.

(c)right side of an account.

(d)decrease side of an account.

(a)left side of an account.

(b)increase side of an account.

(c)right side of an account.

(d)decrease side of an account.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

77

A credit to an asset account indicates a(n)

(a)error.

(b)credit was made to a liability account.

(c)decrease in the asset.

(d)increase in the asset.

(a)error.

(b)credit was made to a liability account.

(c)decrease in the asset.

(d)increase in the asset.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

78

The double-entry system requires that each transaction must be recorded

(a)in at least two different accounts.

(b)in a T account.

(c)first as a revenue and then as an expense.

(d)twice.

(a)in at least two different accounts.

(b)in a T account.

(c)first as a revenue and then as an expense.

(d)twice.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

79

A T account consists of

(a)a title, a debit balance, and a credit balance.

(b)a title, a left side, and a debit balance.

(c)a title, a debit side, and a credit side.

(d)a title, a right side, and a debit balance.

(a)a title, a debit balance, and a credit balance.

(b)a title, a left side, and a debit balance.

(c)a title, a debit side, and a credit side.

(d)a title, a right side, and a debit balance.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

80

The left side of a T account is the

(a)credit side.

(b)debit side.

(c)description of the account.

(d)balance of the account.

(a)credit side.

(b)debit side.

(c)description of the account.

(d)balance of the account.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck