Deck 17: Partnership

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

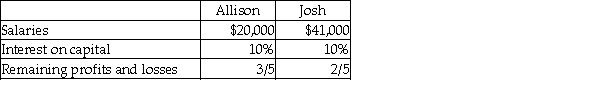

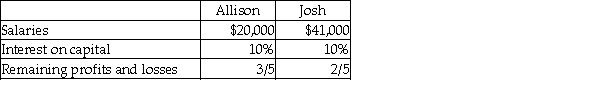

Question

Question

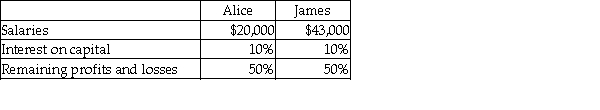

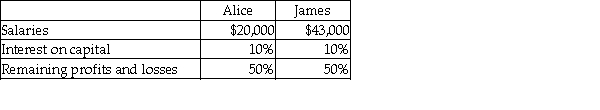

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/130

Play

Full screen (f)

Deck 17: Partnership

1

A partner that is personally liable for all of the debts of the partnership is known as:

A) a limited partner.

B) a general partner.

C) a mutual partner.

D) None of these answers is correct.

A) a limited partner.

B) a general partner.

C) a mutual partner.

D) None of these answers is correct.

B

2

Many associations, which include two or more persons that create a medical center or law firm could organize a:

A) sole proprietorship.

B) corporation.

C) partnership.

D) Both B and C are correct.

A) sole proprietorship.

B) corporation.

C) partnership.

D) Both B and C are correct.

D

3

Jane's investment in a new partnership includes $4,000 cash and equipment at a fair value of $10,000. The new partnership is assuming $2,200 of Jane's accounts payable. The partnership entry should be to:

A) debit Jane, Capital $11,800; debit Accounts Payable $2,200; credit Cash $4,000; credit Equipment $10,000.

B) debit Cash $4,000; debit Equipment $10,000; credit Jane, Capital $14,000.

C) debit Cash $4,000; debit Equipment $10,000; credit Accounts Payable $2,200; credit Jane, Capital $11,800.

D) debit Jane, Investment $14,000; credit Capital $14,000.

A) debit Jane, Capital $11,800; debit Accounts Payable $2,200; credit Cash $4,000; credit Equipment $10,000.

B) debit Cash $4,000; debit Equipment $10,000; credit Jane, Capital $14,000.

C) debit Cash $4,000; debit Equipment $10,000; credit Accounts Payable $2,200; credit Jane, Capital $11,800.

D) debit Jane, Investment $14,000; credit Capital $14,000.

debit Cash $4,000; debit Equipment $10,000; credit Accounts Payable $2,200; credit Jane, Capital $11,800.

4

All assets held by a partnership are:

A) co-owned by all partners.

B) owned by the partner(s) who purchased the assets.

C) owned by the partners based on investment percentage.

D) owned by the partnership.

A) co-owned by all partners.

B) owned by the partner(s) who purchased the assets.

C) owned by the partners based on investment percentage.

D) owned by the partnership.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

5

Nathan Long is entering into a partnership with Terri. Nathan is investing $4,000 cash and equipment currently on Nathan's books at $16,000 and accumulated depreciation of $4,000. The equipment has a fair market value of $10,000. The entry to record Nathan's investment should be to:

A) debit Cash $4,000; debit Equipment $16,000; credit Accumulated Depreciation $4,000; credit Long, Capital $16,000.

B) debit Cash $4,000; debit Equipment $10,000; credit Accumulated Depreciation $4,000; credit Long, Capital $10,000.

C) debit Long, Capital $12,000; debit Accumulated Depreciation $4,000; credit Cash $4,000; credit Equipment $12,000.

D) debit Cash $4,000; debit Equipment $10,000; credit Long, Capital $14,000.

A) debit Cash $4,000; debit Equipment $16,000; credit Accumulated Depreciation $4,000; credit Long, Capital $16,000.

B) debit Cash $4,000; debit Equipment $10,000; credit Accumulated Depreciation $4,000; credit Long, Capital $10,000.

C) debit Long, Capital $12,000; debit Accumulated Depreciation $4,000; credit Cash $4,000; credit Equipment $12,000.

D) debit Cash $4,000; debit Equipment $10,000; credit Long, Capital $14,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is true of a partnership?

A) Actions of one partner are not binding on all the other partners.

B) Each partner is individually liable for partnership debts.

C) All of the owners always share income and losses equally.

D) Both A and B are correct.

A) Actions of one partner are not binding on all the other partners.

B) Each partner is individually liable for partnership debts.

C) All of the owners always share income and losses equally.

D) Both A and B are correct.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

7

Since all partners are bound together in the agreement and each act on the behalf of the partnership, ________ has been established.

A) limited life

B) limited risk

C) mutual agency

D) unlimited liability

A) limited life

B) limited risk

C) mutual agency

D) unlimited liability

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is NOT generally written into the articles of partnership agreement?

A) How new partners are admitted

B) How accounting records will be maintained

C) The marital status of each partner

D) All are written into the agreement.

A) How new partners are admitted

B) How accounting records will be maintained

C) The marital status of each partner

D) All are written into the agreement.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

9

The accounting procedures are the same for sole proprietorships as for partnerships with the exception of:

A) the asset section includes more than one cash account.

B) the liability section.

C) the revenue section.

D) the capital section has separate capital sections for each partner.

A) the asset section includes more than one cash account.

B) the liability section.

C) the revenue section.

D) the capital section has separate capital sections for each partner.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

10

A partnership can be formed with an oral agreement.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

11

Articles of partnership:

A) are required to form a partnership by federal law.

B) are a formal written agreement that states the partners' relationship.

C) may be an oral agreement.

D) Both B and C are correct.

A) are required to form a partnership by federal law.

B) are a formal written agreement that states the partners' relationship.

C) may be an oral agreement.

D) Both B and C are correct.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

12

The characteristic that means the actions of one partner are binding on all other partners is known as:

A) mutual agency.

B) exclusive agency.

C) unlimited life.

D) limited liability.

A) mutual agency.

B) exclusive agency.

C) unlimited life.

D) limited liability.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

13

Dissolution of a partnership can occur under the limited life characteristic if a partner:

A) dies.

B) becomes incapacitated.

C) goes bankrupt.

D) All of the above are correct.

A) dies.

B) becomes incapacitated.

C) goes bankrupt.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

14

Tricia and Jennifer formed a partnership. Tricia invested $16,000 cash; Jennifer invested $12,000 cash, equipment with a fair value of $15,000, and $5,000 accounts payable. The proper entry to record this is:

A) debit Cash $28,000; debit Equipment $15,000; credit Accounts Payable $5,000; credit Tricia's Capital $16,000; and credit Jennifer's Capital $22,000.

B) debit Cash $28,000; debit Equipment $10,000; debit Accounts Payable $5,000; credit Tricia's Capital $21,500; and credit Jennifer's Capital $21,500.

C) debit Cash $28,000; debit Equipment $15,000; credit Tricia's Capital $21,500; and credit Jennifer's Capital $21,500.

D) debit Cash $23,000; debit Equipment $15,000; credit Tricia's Capital $16,000; and credit Jennifer's Capital $22,000.

A) debit Cash $28,000; debit Equipment $15,000; credit Accounts Payable $5,000; credit Tricia's Capital $16,000; and credit Jennifer's Capital $22,000.

B) debit Cash $28,000; debit Equipment $10,000; debit Accounts Payable $5,000; credit Tricia's Capital $21,500; and credit Jennifer's Capital $21,500.

C) debit Cash $28,000; debit Equipment $15,000; credit Tricia's Capital $21,500; and credit Jennifer's Capital $21,500.

D) debit Cash $23,000; debit Equipment $15,000; credit Tricia's Capital $16,000; and credit Jennifer's Capital $22,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

15

Bob and Sam formed a partnership. Bob invested $19,000, cash; Sam invested $8,000 cash and equipment with a fair value of $6,000. The proper entry to record this is to:

A) debit Cash $27,000; debit Equipment $6,000; credit Capital $33,000.

B) debit Cash $27,000; debit Equipment $6,000; credit Accounts Payable $33,000.

C) debit Cash $27,000; debit Equipment $6,000; credit Bob's Capital $19,000; and credit Sam's Capital $14,000.

D) debit Cash $27,000; credit Bob's Capital $19,000; and credit Sam's Capital $8,000.

A) debit Cash $27,000; debit Equipment $6,000; credit Capital $33,000.

B) debit Cash $27,000; debit Equipment $6,000; credit Accounts Payable $33,000.

C) debit Cash $27,000; debit Equipment $6,000; credit Bob's Capital $19,000; and credit Sam's Capital $14,000.

D) debit Cash $27,000; credit Bob's Capital $19,000; and credit Sam's Capital $8,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

16

Partner A invested furniture that was recorded at a value above the fair market value. This error would cause:

A) the period's net income to be overstated.

B) the period's end capital to be understated.

C) the period's end assets to be overstated.

D) the period's end assets to be understated.

A) the period's net income to be overstated.

B) the period's end capital to be understated.

C) the period's end assets to be overstated.

D) the period's end assets to be understated.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

17

Partner C invested equipment in the partnership that has a market value exceeding book value; the equipment was recorded at its book value. This error would cause:

A) future period's net income to be understated.

B) future period's net income to be overstated.

C) this period's end assets to be overstated.

D) None of these is correct.

A) future period's net income to be understated.

B) future period's net income to be overstated.

C) this period's end assets to be overstated.

D) None of these is correct.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

18

The characteristic that means if a partnership is unable to pay its obligations all general partners are individually liable is known as:

A) limited life.

B) unlimited liability.

C) limited liability.

D) mutual agreement.

A) limited life.

B) unlimited liability.

C) limited liability.

D) mutual agreement.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

19

When two proprietors decide to combine their businesses and form a partnership, GAAP usually requires that noncash assets be taken over at their:

A) residual value on the date of the formation of the partnership.

B) book value on the date of the partnership.

C) fair market value on the date of the partnership.

D) historical cost on the date of the partnership.

A) residual value on the date of the formation of the partnership.

B) book value on the date of the partnership.

C) fair market value on the date of the partnership.

D) historical cost on the date of the partnership.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

20

In comparison with the proprietorship form of business organization, forming a partnership offers which of the following advantages?

A) Limited life

B) Legal liability of each partner for all of the debts

C) Combination of ability and experience of the partners

D) Simple transfer of interest in the partnership to outsiders

A) Limited life

B) Legal liability of each partner for all of the debts

C) Combination of ability and experience of the partners

D) Simple transfer of interest in the partnership to outsiders

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

21

Sherry and Jim entered into a partnership agreement. However, the agreement did not state how income and losses would be divided. The law states that income will be divided:

A) equally.

B) according to investments.

C) according to abilities.

D) None of these answers is correct.

A) equally.

B) according to investments.

C) according to abilities.

D) None of these answers is correct.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

22

Indicate the account(s) to be debited and credited to record the following transactions.

-John accepted Joy into the partnership with an investment of cash, inventory, and store equipment, including accumulated depreciation.

Debit ________ & ________ & ________ Credit ________ & ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

-John accepted Joy into the partnership with an investment of cash, inventory, and store equipment, including accumulated depreciation.

Debit ________ & ________ & ________ Credit ________ & ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

23

Prepare the journal entry to record the partners' investment in the company.

Todd and Dillon combine their two businesses and enter into a partnership. Todd invests $10,000 cash and equipment on his books at $8,000 with accumulated depreciation of $3,000. The fair market value of the equipment is $7,000. Dillon is investing $6,000 cash and $500 accounts payable.

Todd and Dillon combine their two businesses and enter into a partnership. Todd invests $10,000 cash and equipment on his books at $8,000 with accumulated depreciation of $3,000. The fair market value of the equipment is $7,000. Dillon is investing $6,000 cash and $500 accounts payable.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

24

The Uniform Partnership Act defines a partnership as "an association of two or more persons to carry on as co-owners of a business for profit."

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

25

Indicate the account(s) to be debited and credited to record the following transactions.

-John partner invested cash in the business.

Debit ________ Credit ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

-John partner invested cash in the business.

Debit ________ Credit ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

26

Indicate the account(s) to be debited and credited to record the following transactions.

-The business paid an account.

Debit ________ Credit ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

-The business paid an account.

Debit ________ Credit ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

27

Jeff and Bob agreed on October 1, 201x to enter into a partnership. Jeff contributes $125,000 and Bob contributes $75,000. Journalize their initial investments.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

28

A partnership is defined by the Generally Accepted Accounting Principles.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

29

A method of dividing net income or loss between the partners is known as a(n):

A) salary allowance.

B) interest allowance.

C) payroll allowance.

D) Both A and B are correct.

A) salary allowance.

B) interest allowance.

C) payroll allowance.

D) Both A and B are correct.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

30

Which method of allocation of profits and losses is based on a percent of initial investment of the partners?

A) Salary allowance

B) Salary expense

C) Profit and loss ratio

D) Interest allowance

A) Salary allowance

B) Salary expense

C) Profit and loss ratio

D) Interest allowance

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

31

Apply the interest allowance method; each partner earns interest on their capital investment at a rate of 10%. Compute Julie and Jennifer's share of net income if Julie invested $52,000 and Jennifer invested $38,000. The remainder after distribution on interest on capital is to be divided equally. Net income was $12,000.

A) Julie $5,200; Jennifer $3,800

B) Julie $6,700; Jennifer $5,300

C) Julie $6,000; Jennifer $6,000

D) None of these answers is correct.

A) Julie $5,200; Jennifer $3,800

B) Julie $6,700; Jennifer $5,300

C) Julie $6,000; Jennifer $6,000

D) None of these answers is correct.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

32

Mutual agency means that the act of a single partner is binding on all the other partners.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

33

Discuss (a) the purpose of the articles of partnership, and (b) indicate the items that should be included.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

34

The agreed-upon ratio for dividing earnings or losses of a partnership is called:

A) interest allowance.

B) salary allowance.

C) profit and loss ratio.

D) profit and loss allowance.

A) interest allowance.

B) salary allowance.

C) profit and loss ratio.

D) profit and loss allowance.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

35

What is the closing entry to allocate net income of $48,000 to Sara, Ellen, and Mary? Respective capital balances are $50,000, $81,000, and $24,000. No agreement was made for division of income. (Round any intermediate calculations to two decimal places, and your final answers to the nearest dollar.)

A) Debit Income Summary $48,000; credit Sara, Capital $16,000; credit Ellen, Capital $16,000; credit Mary, Capital $16,000

B) Debit Income Summary $48,000; credit Sara, Capital $15,484; credit Ellen, Capital $25,084; credit Mary, Capital $7,432

C) Debit Salary Expense $48,000; credit Salaries Payable $48,000

D) Net income cannot be allocated.

A) Debit Income Summary $48,000; credit Sara, Capital $16,000; credit Ellen, Capital $16,000; credit Mary, Capital $16,000

B) Debit Income Summary $48,000; credit Sara, Capital $15,484; credit Ellen, Capital $25,084; credit Mary, Capital $7,432

C) Debit Salary Expense $48,000; credit Salaries Payable $48,000

D) Net income cannot be allocated.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

36

Discuss the following characteristics of partnerships:

a) Limited life

b) Mutual agency

c) Unlimited liability

a) Limited life

b) Mutual agency

c) Unlimited liability

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

37

Indicate the account(s) to be debited and credited to record the following transactions.

-The business bought store equipment on account.

Debit ________ Credit ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

-The business bought store equipment on account.

Debit ________ Credit ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

38

Indicate the account(s) to be debited and credited to record the following transactions.

-The business provided services on credit.

Debit ________ Credit ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

-The business provided services on credit.

Debit ________ Credit ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

39

Prepare the journal entry to record the partners' investment in the company.

Palmer invests $3,000 cash and equipment on his books at $6,000 with accumulated depreciation of $500. The fair market value of the equipment is $6,000. Evans is investing $6,000 cash and $1,000 accounts payable.

Palmer invests $3,000 cash and equipment on his books at $6,000 with accumulated depreciation of $500. The fair market value of the equipment is $6,000. Evans is investing $6,000 cash and $1,000 accounts payable.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

40

If Sam invests $11,000 cash in a partnership, Cash is debited and Sam, Capital is credited, $11,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

41

Applying the profit and loss ratio method, compute Taylor and Timmy's share of net income if Taylor invested $200,000 and Timmy invested $800,000 and the profit and loss ratio is 3:2. Net income was $70,000.

A) Taylor, $14,000; Timmy, $56,000

B) Taylor, $35,000; Timmy, $35,000

C) Taylor, $42,000; Timmy, $28,000

D) None of these answers is correct.

A) Taylor, $14,000; Timmy, $56,000

B) Taylor, $35,000; Timmy, $35,000

C) Taylor, $42,000; Timmy, $28,000

D) None of these answers is correct.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

42

The journal entry to close net income to the partners is to:

A) debit Income Summary; credit the capital accounts.

B) debit the capital accounts; credit Income Summary.

C) debit the capital accounts; credit Net Loss.

D) debit Net Loss; credit the capital accounts.

A) debit Income Summary; credit the capital accounts.

B) debit the capital accounts; credit Income Summary.

C) debit the capital accounts; credit Net Loss.

D) debit Net Loss; credit the capital accounts.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

43

Partners Brian, Josh, and Chad have capital balances of $11,000, $12,000, and $86,000, respectively. The losses for the year are $14,000. What will Josh's capital balance be if the three partners share profits and losses at a 2:2:6 ratio for Brian, Josh, and Chad, respectively?

A) $9,200 debit balance

B) $8,200 debit balance

C) $2,800 debit balance

D) $9,200 credit balance

A) $9,200 debit balance

B) $8,200 debit balance

C) $2,800 debit balance

D) $9,200 credit balance

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

44

The different partners are taxed on:

A) the gross revenue of the partnership.

B) the amount they withdraw from the partnership.

C) the total amount of the net profit of the partnership.

D) the partners' share of the net profit of the partnership.

A) the gross revenue of the partnership.

B) the amount they withdraw from the partnership.

C) the total amount of the net profit of the partnership.

D) the partners' share of the net profit of the partnership.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

45

The basis on which profits and losses are shared is governed by:

A) the SEC.

B) the IRS.

C) the partnership agreement.

D) the partners and must be shared equally.

A) the SEC.

B) the IRS.

C) the partnership agreement.

D) the partners and must be shared equally.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

46

A cash withdrawal of a partner was recorded the same as paying payroll. This error would cause:

A) the period's net income to be understated.

B) the period's net income to be overstated.

C) the period end assets to be overstated.

D) the period end assets to be understated.

A) the period's net income to be understated.

B) the period's net income to be overstated.

C) the period end assets to be overstated.

D) the period end assets to be understated.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

47

Allison and Josh are partners in a business. Allison's capital is $120,000 and Josh's capital is $120,000. Profits for the year are $80,000. They agree to share profits and losses as follows:  Allison's share of the profits before paying salaries and interest on capital is: (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

Allison's share of the profits before paying salaries and interest on capital is: (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

A) $48,000.

B) $70,500.

C) $40,000.

D) $11,400.

Allison's share of the profits before paying salaries and interest on capital is: (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

Allison's share of the profits before paying salaries and interest on capital is: (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)A) $48,000.

B) $70,500.

C) $40,000.

D) $11,400.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

48

What is the closing entry to allocate net income $210,000 to Eric, Von, and Derek? Their respective capital balances are $69,000, $69,000, and $92,000. Net income is shared in a ratio of their capital balances.

A) Debit Income Summary $210,000; credit Eric, Capital $63,000; credit Von, Capital $63,000; credit Derek, Capital $84,000

B) Debit Income Summary $210,000; credit Eric, Capital $70,000; credit Von, Capital $70,000; credit Derek, Capital $70,000

C) Debit Salary Expense $210,000; credit Salaries Payable $210,000

D) Net income cannot be allocated.

A) Debit Income Summary $210,000; credit Eric, Capital $63,000; credit Von, Capital $63,000; credit Derek, Capital $84,000

B) Debit Income Summary $210,000; credit Eric, Capital $70,000; credit Von, Capital $70,000; credit Derek, Capital $70,000

C) Debit Salary Expense $210,000; credit Salaries Payable $210,000

D) Net income cannot be allocated.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

49

Alice and James are partners in a business. Alice's capital is $130,000 and James's capital is $170,000. Profits for the year are $130,000. They agree to share profits and losses as follows:  James's share of the profit is:

James's share of the profit is:

A) $52,000.

B) $65,000.

C) 39,000.

D) None of the above

James's share of the profit is:

James's share of the profit is:A) $52,000.

B) $65,000.

C) 39,000.

D) None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

50

The net income earned by the Brian, Bill, and Bob partnership is $24,000. Their respective average capital balances are $28,000, $28,000, and $56,000. What is the closing entry to allocate the net income if no agreement was made for division of income?

A) Debit Income Summary $24,000; credit Brian, Capital $8,000; credit Bill, Capital $8,000; credit Bob, Capital $8,000

B) Debit Income Summary $24,000; credit Brian, Capital $6,000; credit Bill, Capital $6,000; credit Bob, Capital $12,000

C) Debit Brian, Capital $8,000; debit Bill, Capital $8,000; debit Bob, Capital $8,000; credit Income Summary $24,000

D) Not enough information given to allocate

A) Debit Income Summary $24,000; credit Brian, Capital $8,000; credit Bill, Capital $8,000; credit Bob, Capital $8,000

B) Debit Income Summary $24,000; credit Brian, Capital $6,000; credit Bill, Capital $6,000; credit Bob, Capital $12,000

C) Debit Brian, Capital $8,000; debit Bill, Capital $8,000; debit Bob, Capital $8,000; credit Income Summary $24,000

D) Not enough information given to allocate

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

51

Applying the interest allowance method, compute Taylor and Timmy's share of net income if Taylor invested $370,000 and Timmy invested $780,000 at a 6% interest rate, for each partner with the remainder to be divided equally. Net income was $90,000.

A) Taylor, $28,957; Timmy, $61,043

B) Taylor, $45,000; Timmy, $45,000

C) Taylor, $32,700; Timmy, $57,300

D) None of these answers is correct.

A) Taylor, $28,957; Timmy, $61,043

B) Taylor, $45,000; Timmy, $45,000

C) Taylor, $32,700; Timmy, $57,300

D) None of these answers is correct.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

52

The original investment balances of partners Bridget and Emily are $9,000 and $19,000, respectively. Bridget and Emily work full time in the business. The business earned net income of $20,000 for the period. The partners have agreed to share earnings based upon the percentage of original investment. Bridget's share of the net income is: (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

A) $9,474.

B) $10,000.

C) $6,400.

D) indeterminable.

A) $9,474.

B) $10,000.

C) $6,400.

D) indeterminable.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

53

Partner B invested inventory using the retail selling price for valuation. Some of the inventory is unsold at period end. This error would cause:

A) the period's net income to be overstated.

B) the period's net income to be understated.

C) the ending assets to be overstated.

D) Both B and C are correct.

A) the period's net income to be overstated.

B) the period's net income to be understated.

C) the ending assets to be overstated.

D) Both B and C are correct.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

54

Partners Brian, Josh, and Chad have average capital balances of $11,000, $10,000, and $90,000, respectively. Net income for the year is $20,000. Salary allowances are $19,000 for Brian and $8,000 for Josh. Chad gets 10% interest on his capital balance with the remainder being divided at a 1:1:2 ratio for Brian, Josh, and Chad, respectively. What is Brian's capital balance after distributing the net income? (Assume no change in capital balances during the year.)

A) $26,000 credit balance

B) $5,000 debit balance

C) $16,000 debit balance

D) $11,000 debit balance

A) $26,000 credit balance

B) $5,000 debit balance

C) $16,000 debit balance

D) $11,000 debit balance

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

55

Partners Jessica and Jill receive salary allowances of $8,000 and $17,000, respectively. They share income and losses in a 3:1 ratio for Jessica and Jill, respectively. If the partnership suffers a $23,000 loss, by how much would Jessica's capital decrease?

A) $17,250

B) $9,250

C) $15,000

D) $28,000

A) $17,250

B) $9,250

C) $15,000

D) $28,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

56

The two types of allowances that may be considered before the division of profits and losses are:

A) interest and salary allowances.

B) interest and bonus allowances.

C) salary and bonus allowances.

D) bonus and liquidation allowances.

A) interest and salary allowances.

B) interest and bonus allowances.

C) salary and bonus allowances.

D) bonus and liquidation allowances.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

57

Kim and John formed a partnership in 2015. John invested $140,000 and Kim invested $90,000. The partnership had $100,000 in income during 2017. There is no agreement as to how income is divided. Kim and John's share is:

A) Kim gets $100,000 and John gets $90,000.

B) Kim gets $90,000 and John gets $100,000.

C) Kim gets $50,000 and John gets $50,000.

D) some other division.

A) Kim gets $100,000 and John gets $90,000.

B) Kim gets $90,000 and John gets $100,000.

C) Kim gets $50,000 and John gets $50,000.

D) some other division.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

58

The income/loss agreement was ignored when closing the income summary and all income was distributed evenly. This error would cause:

A) the total partners' equity to be overstated.

B) the total partners' equity to be understated.

C) the total partners' equity to be unaffected.

D) the ending assets to be overstated.

A) the total partners' equity to be overstated.

B) the total partners' equity to be understated.

C) the total partners' equity to be unaffected.

D) the ending assets to be overstated.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

59

Applying the ratio based on investment method, compute Tom and Troy's share of net income if Tom invested $300,000 and Troy invested $500,000. Net income was $130,000. (Round any intermediate calculations to two decimal places, and your final answers to the nearest dollar.)

A) Tom, $80,000; Troy, $50,000

B) Tom, $65,000; Troy, $65,000

C) Tom, $49,400; Troy, $81,900

D) None of these answers is correct.

A) Tom, $80,000; Troy, $50,000

B) Tom, $65,000; Troy, $65,000

C) Tom, $49,400; Troy, $81,900

D) None of these answers is correct.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

60

Jan and Ben are partners, with beginning capital balances of $70,000 and $62,000 respectively. During the year, Jan withdrew $12,000 and Ben withdrew $23,000. The year's net income of $48,000 was distributed $19,000 to Jan and $29,000 to Ben. Calculate the ending balances in the capital accounts.

A) Jan, $58,000; Ben, $39,000

B) Jan, $77,000; Ben, $68,000

C) Jan, $90,000; Ben, $90,000

D) Jan, $70,000; Ben, $62,000

A) Jan, $58,000; Ben, $39,000

B) Jan, $77,000; Ben, $68,000

C) Jan, $90,000; Ben, $90,000

D) Jan, $70,000; Ben, $62,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

61

A statement of partner's equity is the same as a statement of owner's equity except:

A) there is a capital account for each partner.

B) net income is assigned to one partner.

C) no additional investment by partners is shown on the statement.

D) There is no difference in the statements.

A) there is a capital account for each partner.

B) net income is assigned to one partner.

C) no additional investment by partners is shown on the statement.

D) There is no difference in the statements.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

62

Mary sold Jill her equity in the Mary and Jill partnership for $31,000. If both Mary and Jill had a $16,000 capital balance, the entry to record this transaction would be to:

A) debit Cash $31,000; credit Jill, Capital $31,000.

B) debit Mary, Capital $16,000; credit Jill, Capital $16,000.

C) debit Cash $16,000; credit Mary, Capital $16,000.

D) debit Jill, Capital $16,000; credit Mary, Capital $16,000.

A) debit Cash $31,000; credit Jill, Capital $31,000.

B) debit Mary, Capital $16,000; credit Jill, Capital $16,000.

C) debit Cash $16,000; credit Mary, Capital $16,000.

D) debit Jill, Capital $16,000; credit Mary, Capital $16,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

63

Jan and Bill have average capital balances of $35,000 and $20,000, respectively. The partners have agreed to allow $20,000 salary allowances. The partners will share income and losses in a 1:2 ratio for Jan and Bill, respectively. How much will each partner's capital account change if net income is $130,000?

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

64

Jim wants to invest cash so that he will have a one-third interest in Tom and Steve's company. The capital balances are $12,000 Tom, $23,000 Steve. The admission of Jim would be to:

A) debit Cash $7,667; credit Jim, Capital $7,667.

B) debit Cash $11,667; credit Jim, Capital $11,667.

C) debit Cash $17,500; credit Jim, Capital $17,500.

D) debit Cash $24,000; credit Jim, Capital $24,000.

A) debit Cash $7,667; credit Jim, Capital $7,667.

B) debit Cash $11,667; credit Jim, Capital $11,667.

C) debit Cash $17,500; credit Jim, Capital $17,500.

D) debit Cash $24,000; credit Jim, Capital $24,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

65

An interest allowance is based on a partner's individual investment of capital.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

66

Indicate the account(s) to be debited and credited to record the following transactions.

-Closed the income summary, there is a net loss.

Debit ________ & ________ Credit ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

-Closed the income summary, there is a net loss.

Debit ________ & ________ Credit ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

67

After calculating salary and interest allowances, it is necessary to determine whether net income will cover these expenses.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

68

The partnership of Smith and Jones, who have average capital balances of $17,000 and $23,000, respectively, earned $90,000 net income. Under each of the following independent situations, calculate the distribution of the $90,000.

a) No agreement was established.

b) Share based on their average capital balances.

a) No agreement was established.

b) Share based on their average capital balances.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

69

A profit and loss ratio must be based on capital contributions.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

70

A loss occurs when net income is not large enough to cover salary and interest allowances for the partners.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

71

Jean and Joy are partners, with beginning capital balances of $100,000 and $70,000 respectively. During the year, Jean withdrew $20,000 and Joy withdrew $15,000. The year's net income of $40,000 was distributed $15,000 to Jean and $25,000 to Joy. Prepare a statement of Partners' equity.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

72

Indicate the account(s) to be debited and credited to record the following transactions.

-Closed the income summary to the partners' accounts with a net income.

Debit ________ Credit ________ & ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

-Closed the income summary to the partners' accounts with a net income.

Debit ________ Credit ________ & ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

73

The Ben and Jill partnership agree to admit Fred with a one-third interest for $14,000. Ben and Jill's capital balances are $18,000, and $8,000, respectively, and they share profits and losses equally. The entry to admit Fred would include:

A) debit Cash $14,000; credit Fred, Capital $14,000.

B) debit Cash $14,000; credit Ben, Capital $3,500; debit Jill, Capital $3,500; credit Fred, Capital $7,000.

C) debit Cash $26,000; credit Ben, Capital $13,000; credit Jill, Capital $13,000.

D) debit Cash $26,000; debit Ben, Capital $6,500; credit Jill, Capital $6,500; credit Fred, Capital $13,000.

A) debit Cash $14,000; credit Fred, Capital $14,000.

B) debit Cash $14,000; credit Ben, Capital $3,500; debit Jill, Capital $3,500; credit Fred, Capital $7,000.

C) debit Cash $26,000; credit Ben, Capital $13,000; credit Jill, Capital $13,000.

D) debit Cash $26,000; debit Ben, Capital $6,500; credit Jill, Capital $6,500; credit Fred, Capital $13,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

74

The profit or loss is required to be divided equally between the partners if otherwise not stated.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

75

An interest allowance is based on the beginning capital balance of each partner.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

76

The statement of partners' equity reveals each partner's ownership percentage of the firm's capital.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

77

Partners are required to report their share of partnership earnings on their personal tax return.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

78

Partnerships are subject to federal income tax.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

79

When a partnership is worth more than the amounts recorded, an incoming partner may:

A) be required to pay a bonus to the other partners.

B) pay a smaller amount as an initial investment.

C) have to pay the same as other partners.

D) None of these answers is correct.

A) be required to pay a bonus to the other partners.

B) pay a smaller amount as an initial investment.

C) have to pay the same as other partners.

D) None of these answers is correct.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

80

Indicate the account(s) to be debited and credited to record the following transactions.

-Jim, a partner, withdrew cash from the business.

Debit ________ Credit ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

-Jim, a partner, withdrew cash from the business.

Debit ________ Credit ________

A)Cash

B)Accounts receivable

C)Allowance for doubtful accounts

D)Merchandise inventory

E)Store supplies

F)Store equipment

G)Accumulated depreciation

H)Notes payable

I)Accounts payable

J)John Partner's, Capital

K)Joy Partner's, Capital

L)John Partner's, withdrawals

M)Joy Partner's, withdrawals

N)Income summary

O)Service revenue

P)Gain on realization

Q)Loss on realization

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck