Deck 12: Financial Statement Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/19

Play

Full screen (f)

Deck 12: Financial Statement Analysis

1

Changes in the structure of the business are clearer when common size statements are used.

True

2

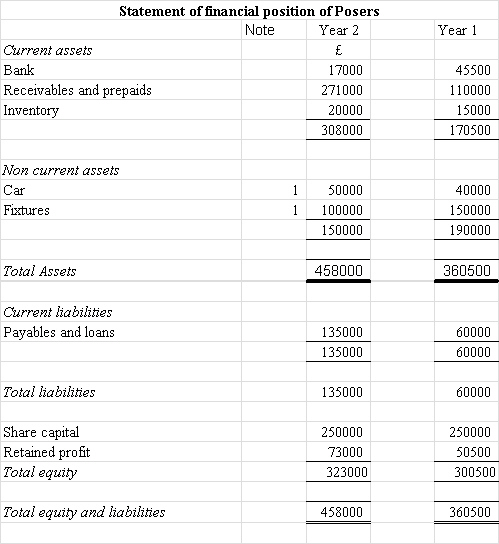

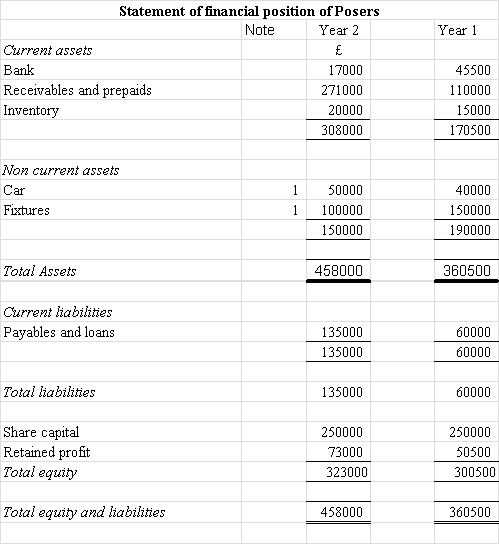

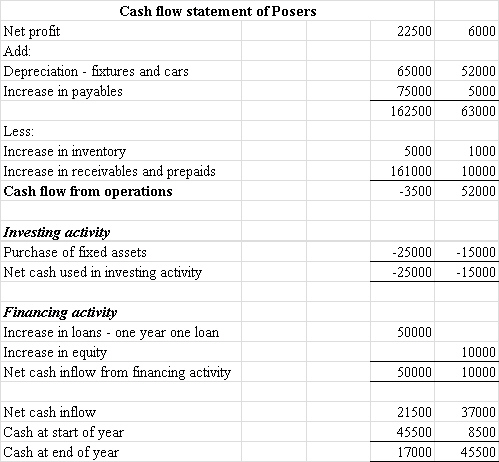

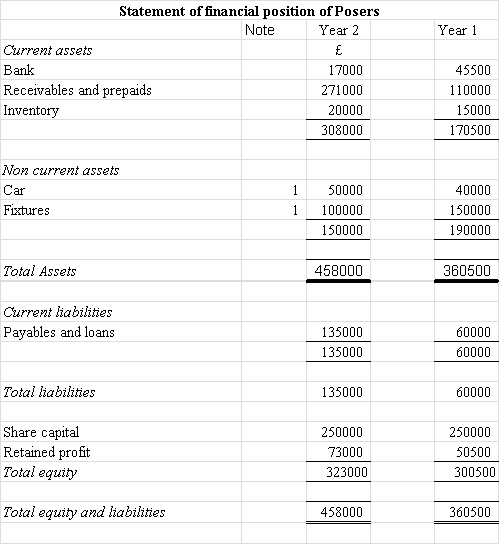

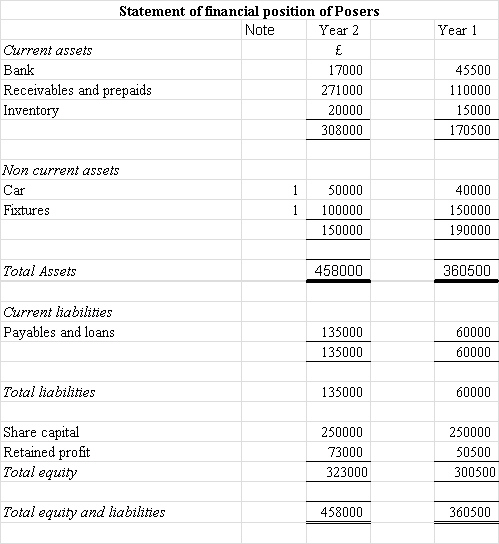

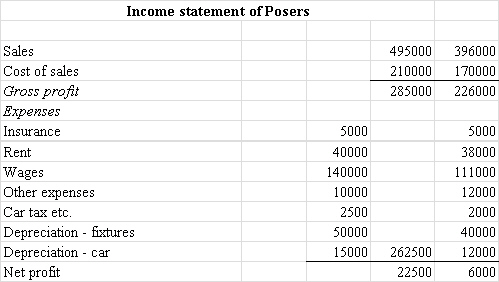

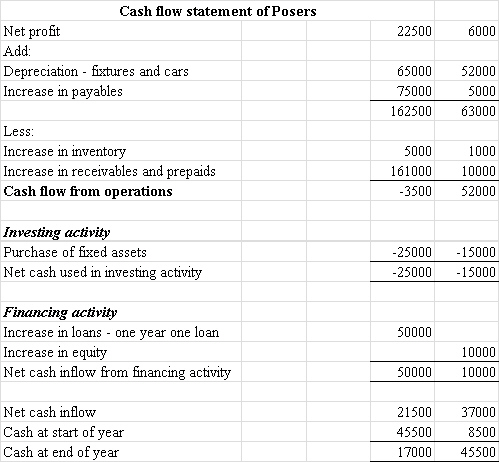

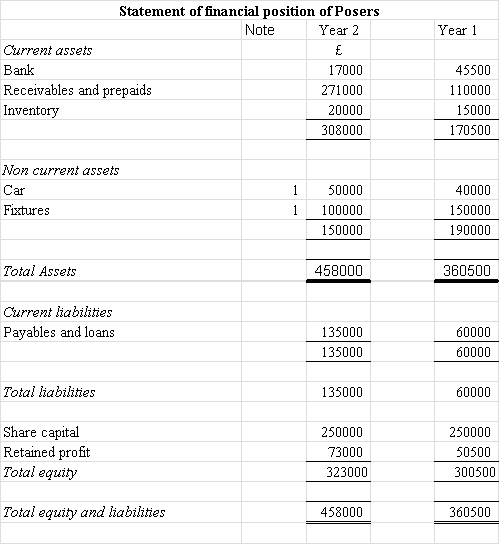

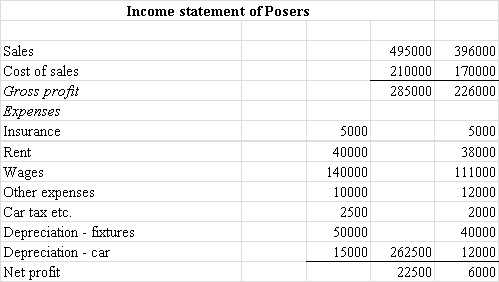

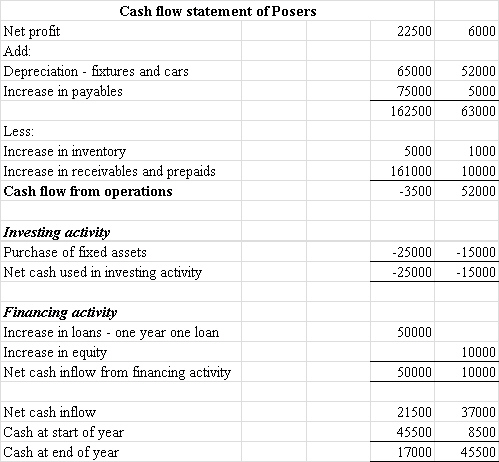

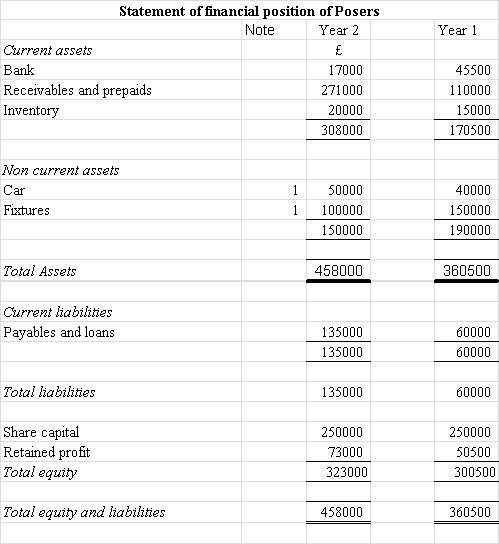

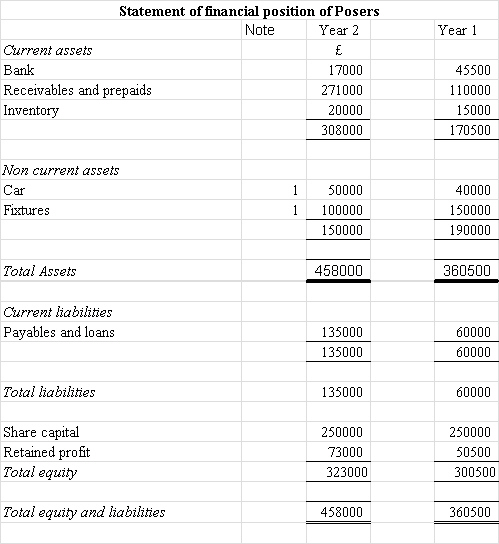

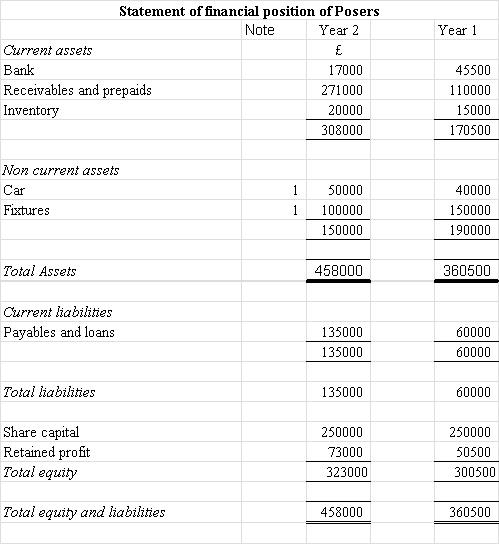

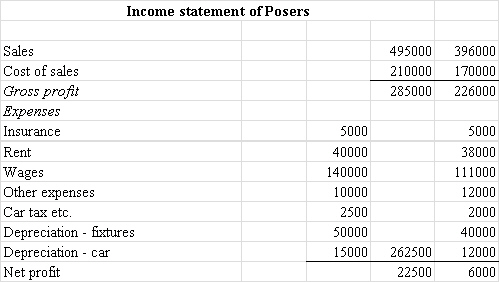

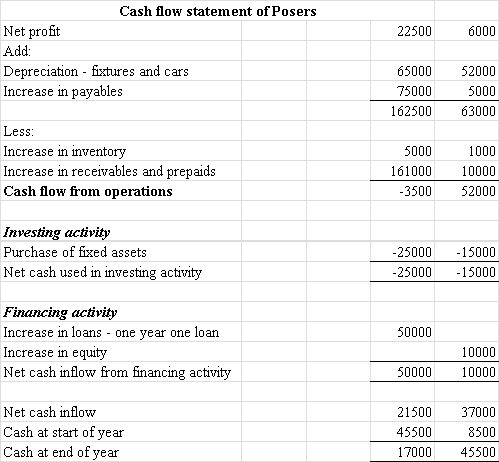

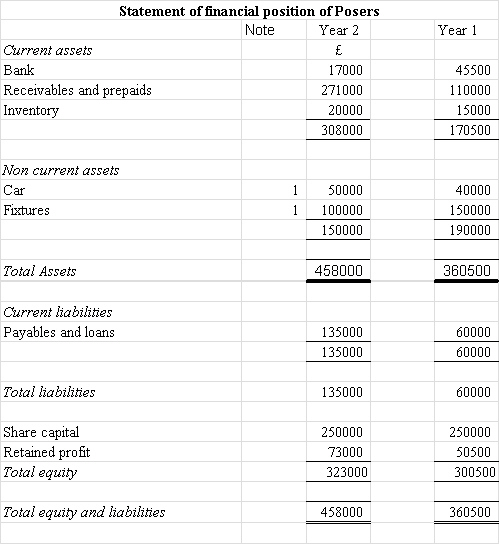

Which of the following statements in respect of the short term solvency best reflects the reality for Posers?

Which of the following statements in respect of the short term solvency best reflects the reality for Posers?A) The current ratio and the acid test (quick ratio) are stable

B) The current ratio is stable but the acid test is declining

C) The current ratio and the acid test are improving

D) The current ratio and the acid test are declining

D

3

Lenders are only interested in security and do not care about profitability.

False

4

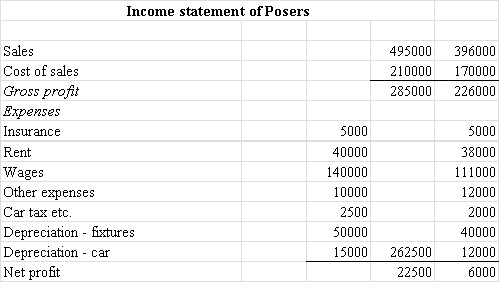

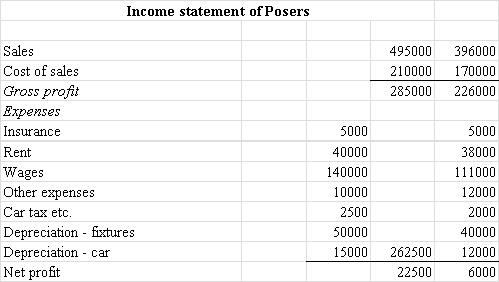

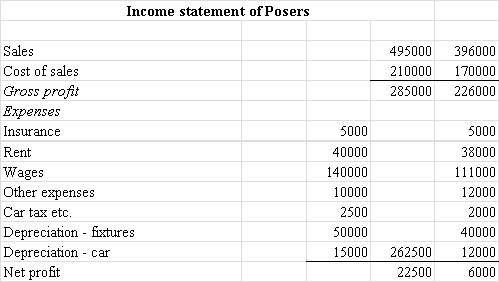

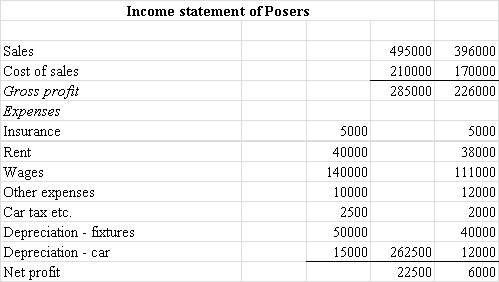

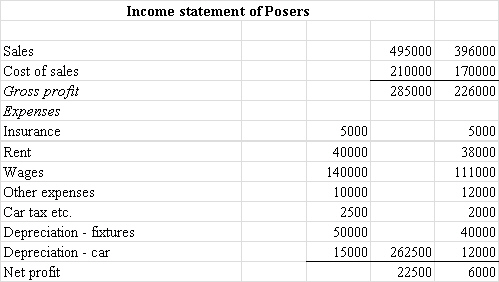

Which of the following statements in respect of the gross profit and net profit best reflects the reality for Posers?

Which of the following statements in respect of the gross profit and net profit best reflects the reality for Posers?A) The gross profit percentage is increasing while net profit remains the same

B) The gross profit and net profit percentages are increasing

C) Gross profit and net profit percentages remain the same

D) Gross profit percentage is virtually the same while the net profit percentage shows a considerable increase

E) All profit percentages are declining

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

5

There is only one ratio that measures long term solvency.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

6

Financial analysis is about whether ratios have gone up or down.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements in respect of the management of receivables best reflects the reality for Posers?

Which of the following statements in respect of the management of receivables best reflects the reality for Posers?A) Receivables have gone up as expected in line with the increase in sales

B) There is no cause for concern as they are stable over time

C) The collection period has increased by around 50% which is concerning

D) The collection period has nearly doubled which is very concerning

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

8

Financial risk and business risk are simply different ways of saying the same thing.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

9

Return on capital is another way of saying return on equity.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

10

It is always better to use the average figures from the statements of financial position when calculating efficiency ratios.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

11

Ratio analysis without comparatives is of little use.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

12

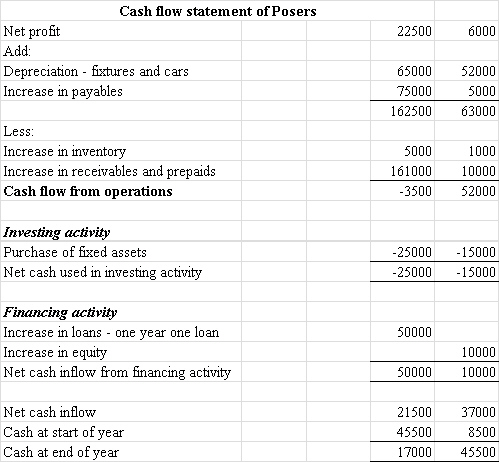

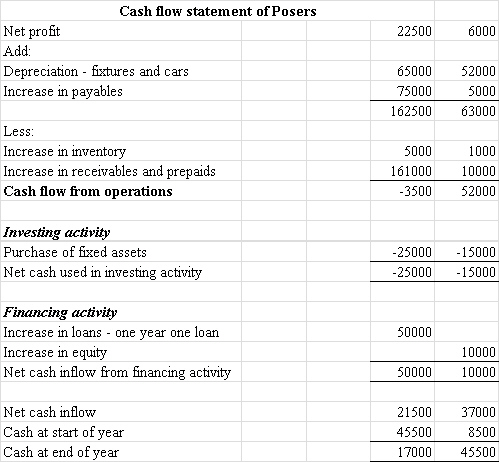

Which of the following statement best reflects the overall performance of Posers?

Which of the following statement best reflects the overall performance of Posers?A) Profits are increasing, cash flow is improving so all is well

B) Although profits are increasing they start from a low base year and there is cause for concern around the management of working capital

C) Although profits are increasing they start from a low base year and there is cause for concern around the management of working capital and the reliance on short term borrowing

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements in respect of the use of fixed assets, where the ratio of net fixed assets to turnover has moved from 2.1 times to 3.3 times, best reflects the reality for Posers?

Which of the following statements in respect of the use of fixed assets, where the ratio of net fixed assets to turnover has moved from 2.1 times to 3.3 times, best reflects the reality for Posers?A) There is considerable improvement which shows that management are using fixed assets more efficiently

B) The improvement in the use of fixed assets is overstated as depreciation will always cause the ratio to increase

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements in respect of the management of payables best reflects the reality for Posers?

Which of the following statements in respect of the management of payables best reflects the reality for Posers?A) There has been little change in payables days

B) The payables days are decreasing

C) Payables days are increasing

D) Payables days have almost doubled

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

15

The current ratio compares the current assets less inventory to the current liabilities.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements in respect of financial risk best reflects the reality for Posers?

Which of the following statements in respect of financial risk best reflects the reality for Posers?A) Financial risk has increased

B) Financial risk has decreased

C) Financial risk has remained stable

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

17

Summing up the results of Posers which of the following statements best reflects its performance in relation to profitability?

Summing up the results of Posers which of the following statements best reflects its performance in relation to profitability?A) It has increased profits dramatically and increased the return to shareholders

B) Although it has increased profits dramatically and increased the return to shareholders the gross profit margin shows that there are no new efficiencies in this area of activity

C) Although there has been an increase in the profit margin and an increase in the return to shareholders the starting point was so low that the rate of increase is meaningless

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

18

Ratios taken out of context are not always helpful and can be misleading.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

19

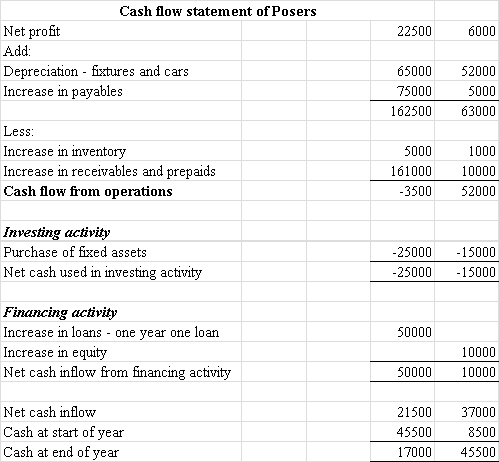

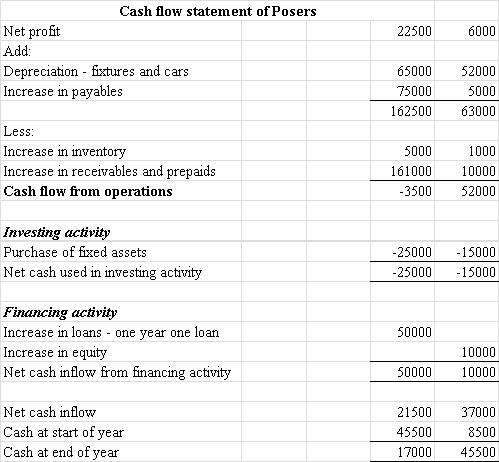

Which of the following statements in respect of the cash flows best reflects the reality for Posers?

Which of the following statements in respect of the cash flows best reflects the reality for Posers?A) Posers has positive cash flows each year and there is no cause for concern

B) Posers cash flow has declined but it has invested in new fixed assets

C) Posers cash flow has declined and the decline in cash flow from operations is concerning

D) Posers cash flow has declined and the decline in cash flow from operations when taken together with the short term loan is concerning

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck