Deck 1: The Cash Budget

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/10

Play

Full screen (f)

Deck 1: The Cash Budget

1

Which of the following is not a valid reason for preparing a cash budget?

A) It enables required overdrafts to be anticipated and arranged with the bank.

B) It reveals the expected bank balance as at the end of each month.

C) It allows the business owner to see whether the business is likely to make a profit or a loss.

D) It enables the timing of fixed asset expenditure to be planned.

A) It enables required overdrafts to be anticipated and arranged with the bank.

B) It reveals the expected bank balance as at the end of each month.

C) It allows the business owner to see whether the business is likely to make a profit or a loss.

D) It enables the timing of fixed asset expenditure to be planned.

C

2

A cash budget for the six months ended 30 June shows an anticipated overdraft of approximately £4,500. Which of the following would not reduce the expected overdraft?

A) Allowing customers one month's credit, instead of two months in which to pay.

B) Suppliers allowing one month's credit on purchases made, instead of cash terms.

C) Assets being leased rather than purchased for cash during the six month period.

D) Charging depreciation on fixed assets at 20% on the straight line basis, rather than 25%.

A) Allowing customers one month's credit, instead of two months in which to pay.

B) Suppliers allowing one month's credit on purchases made, instead of cash terms.

C) Assets being leased rather than purchased for cash during the six month period.

D) Charging depreciation on fixed assets at 20% on the straight line basis, rather than 25%.

D

3

Laura sells goods at a gross profit margin of 40%. Which of the following statements is true?

A) Goods sold for £900 will have cost Laura £642.80.

B) Goods sold for £900 will have cost Laura £562.50.

C) Goods sold for £900 will have cost Laura £540.

D) Goods sold for £900 will have cost Laura £360.

A) Goods sold for £900 will have cost Laura £642.80.

B) Goods sold for £900 will have cost Laura £562.50.

C) Goods sold for £900 will have cost Laura £540.

D) Goods sold for £900 will have cost Laura £360.

C

4

Lisa sells jumpers at a gross profit margin of 30%. Which one of the following statements is true?

A) Jumpers costing £500 will be sold for £800.

B) Jumpers costing £500 will be sold for £700.

C) Jumpers costing £700 will be sold for £1,000.

D) Jumpers costing £600 will be sold for £900.

A) Jumpers costing £500 will be sold for £800.

B) Jumpers costing £500 will be sold for £700.

C) Jumpers costing £700 will be sold for £1,000.

D) Jumpers costing £600 will be sold for £900.

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

5

Shirley has made the following predictions for her business for the first six months of trading to 30 June:

Sales in Jan, Feb and March = £30,000 per month.

Sales in Apr, May and June = £45,000 per month.

Sales will be on one month's credit,

Purchases will be for cash.

The total cash received from customers during the six months ended 30 June, will be:

A) £180,000.

B) £225,000.

C) £195,000.

D) £210,000.

Sales in Jan, Feb and March = £30,000 per month.

Sales in Apr, May and June = £45,000 per month.

Sales will be on one month's credit,

Purchases will be for cash.

The total cash received from customers during the six months ended 30 June, will be:

A) £180,000.

B) £225,000.

C) £195,000.

D) £210,000.

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

6

Shirley has made the following predictions for her business for the first six months of trading to 30 June:

Sales in Jan, Feb and March = £30,000 per month.

Sales in Apr, May and June = £45,000 per month.

Sales will be on one month's credit.

The cash received in April will be:

A) £30,000.

B) £45,000.

C) £75,000.

D) Nil.

Sales in Jan, Feb and March = £30,000 per month.

Sales in Apr, May and June = £45,000 per month.

Sales will be on one month's credit.

The cash received in April will be:

A) £30,000.

B) £45,000.

C) £75,000.

D) Nil.

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

7

Shirley has made the following predictions for her business for the first six months of trading to 30 June:

Sales in Jan, Feb and March = £30,000 per month.

Sales in Apr, May and June = £45,000 per month.

Sales will be on one month's credit.

Purchases will be for cash.

If goods are sold at a gross profit margin of 33.33%, and goods are replaced as soon as they are sold, the amount payable to suppliers in March, will be:

A) £15,000.

B) £30,000.

C) £45,000.

D) £20,000.

Sales in Jan, Feb and March = £30,000 per month.

Sales in Apr, May and June = £45,000 per month.

Sales will be on one month's credit.

Purchases will be for cash.

If goods are sold at a gross profit margin of 33.33%, and goods are replaced as soon as they are sold, the amount payable to suppliers in March, will be:

A) £15,000.

B) £30,000.

C) £45,000.

D) £20,000.

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

8

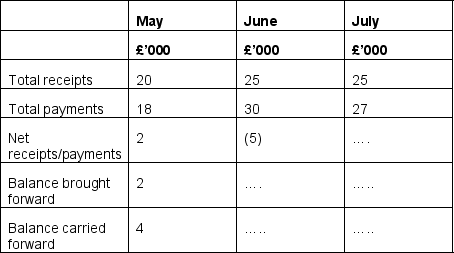

An extract from Bridget's Cash Budget is given below:

What is the expected bank overdraft at the end of June?

What is the expected bank overdraft at the end of June?

A) £5,000.

B) £4,000.

C) £1,000.

D) £9,000.

What is the expected bank overdraft at the end of June?

What is the expected bank overdraft at the end of June?A) £5,000.

B) £4,000.

C) £1,000.

D) £9,000.

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

9

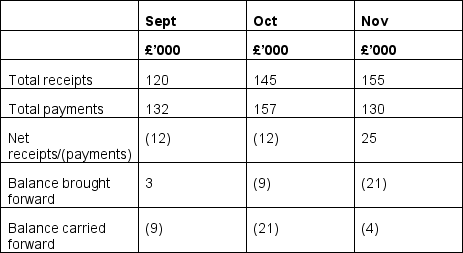

An extract from Hazel's Cash Budget is given below:

Which of the following overdraft facilities would you advise Hazel to request for the three months ended 30 November?

Which of the following overdraft facilities would you advise Hazel to request for the three months ended 30 November?

A) A little more than £9,000.

B) A little more than £21,000.

C) A little more than £4,000.

D) No overdraft facility will be needed.

Which of the following overdraft facilities would you advise Hazel to request for the three months ended 30 November?

Which of the following overdraft facilities would you advise Hazel to request for the three months ended 30 November?A) A little more than £9,000.

B) A little more than £21,000.

C) A little more than £4,000.

D) No overdraft facility will be needed.

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

10

During July, Alison's first month of trading, she purchased 5,000 plates at £5 each and sold 4,000 plates at £7 each.

If half of Alison's sales were for cash and half were on one month's credit, Alison's Cash Budget for July would show the following:

A) Receipts from customers of £14,000.

B) Receipts from customers of £28,000.

C) Receipts from customers of £12,500.

D) Receipts from customers of £25,000.

If half of Alison's sales were for cash and half were on one month's credit, Alison's Cash Budget for July would show the following:

A) Receipts from customers of £14,000.

B) Receipts from customers of £28,000.

C) Receipts from customers of £12,500.

D) Receipts from customers of £25,000.

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck