Deck 13: Long-Run Investment Decisions: Capital Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/10

Play

Full screen (f)

Deck 13: Long-Run Investment Decisions: Capital Budgeting

1

A firm has found that the net present value of a project is equal to zero. The net present value was calculated using the firm's risk-adjusted discount rate of 15%. Based on this information, your conclusion is

A) the internal rate of return on the project is greater than 15%.

B) the internal rate of return on the project is equal to 15%.

C) the internal rate of return on the project is less than 15%.

D) the internal rate of return on the project may be greater than, equal to, or less than 15% depending on which method was used to adjust the firm's discount rate for risk.

A) the internal rate of return on the project is greater than 15%.

B) the internal rate of return on the project is equal to 15%.

C) the internal rate of return on the project is less than 15%.

D) the internal rate of return on the project may be greater than, equal to, or less than 15% depending on which method was used to adjust the firm's discount rate for risk.

the internal rate of return on the project is equal to 15%.

2

A firm is considering three investment projects which we will refer to as A, B, and C. Each project has an initial cost of $10 million. Investment A offers an expected rate of return of 16%, B of 8%, and C of 12%. The firm's cost of capital is 6% if it borrows $10 million, 10% if it borrows $20 million, and 15% if it borrows $30 million. Which project(s) should the firm invest in?

A) Just A, because it offers the highest rate of return and is the only investment that has a rate of return higher than 15%

B) All three should be undertaken, because the rate of return on B is above 6%, on C is above 10%, and on A is above 15%.

C) Only A and C should be undertaken because both have rates of return that are greater than 10%.

D) None of the above is correct.

A) Just A, because it offers the highest rate of return and is the only investment that has a rate of return higher than 15%

B) All three should be undertaken, because the rate of return on B is above 6%, on C is above 10%, and on A is above 15%.

C) Only A and C should be undertaken because both have rates of return that are greater than 10%.

D) None of the above is correct.

Only A and C should be undertaken because both have rates of return that are greater than 10%.

3

Firms generally use only one of the three equity capital valuation methods.

False

4

According to the 1977 study by Gitman and Forrester, the single most commonly used capital budgeting technique among the firms surveyed was the internal rate of return method.

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

5

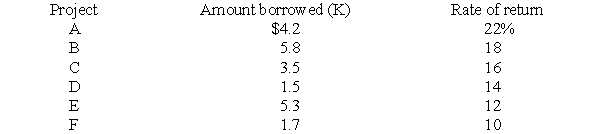

A firm's marginal cost of capital (i) in percentage terms is a linear function of the total amount it chooses to borrow (K) in millions of dollars during the current time period. The function is i = 5 + 0.8K. The firm is considering six projects which will have to be financed entirely by borrowing. The amount the firm must borrow for each project and the expected rates of return are listed below:

Which projects should the firm undertake, if any, and what will the firm's marginal cost of capital be if it borrows the optimal amount?

Which projects should the firm undertake, if any, and what will the firm's marginal cost of capital be if it borrows the optimal amount?

Which projects should the firm undertake, if any, and what will the firm's marginal cost of capital be if it borrows the optimal amount?

Which projects should the firm undertake, if any, and what will the firm's marginal cost of capital be if it borrows the optimal amount?

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

6

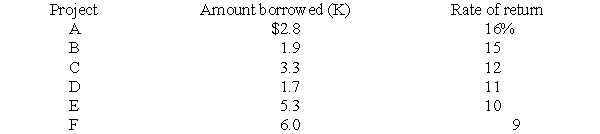

A firm's marginal cost of capital (i) in percentage terms is a linear function of the total amount it chooses to borrow (K) in millions of dollars during the current time period. The function is i = 4.5 + 0.5K. The firm is considering six projects which will have to be financed entirely by borrowing. The amount the firm must borrow for each project and the expected rates of return are listed below:

Which projects should the firm undertake, if any, and what will the firm's marginal cost of capital be if it borrows the optimal amount?

Which projects should the firm undertake, if any, and what will the firm's marginal cost of capital be if it borrows the optimal amount?

Which projects should the firm undertake, if any, and what will the firm's marginal cost of capital be if it borrows the optimal amount?

Which projects should the firm undertake, if any, and what will the firm's marginal cost of capital be if it borrows the optimal amount?

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

7

A firm is considering two capital investment projects. Project A involves an initial cost of $15,000. The discounted present value of all future cash flows is $18,000. Project B requires an initial expenditure of $25,000. The discounted present value of all future cash flows is $29,000.

(i) Calculate the net present value of each of the two projects. Which would be preferred according to the net present value criterion?

(ii) Calculate the profitability index of each of the two projects. Which would be preferred according to the profitability index criterion?

(i) Calculate the net present value of each of the two projects. Which would be preferred according to the net present value criterion?

(ii) Calculate the profitability index of each of the two projects. Which would be preferred according to the profitability index criterion?

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

8

A firm is considering two capital investment projects. Project A involves an initial cost of $125,000. The discounted present value of all future cash flows is $145,000. Project B requires an initial expenditure of $85,000. The discounted present value of all future cash flows is $102,000.

(i) Calculate the net present value of each of the two projects. Which would be preferred according to the net present value criterion?

(ii) Calculate the profitability index of each of the two projects. Which would be preferred according to the profitability index criterion?

(i) Calculate the net present value of each of the two projects. Which would be preferred according to the net present value criterion?

(ii) Calculate the profitability index of each of the two projects. Which would be preferred according to the profitability index criterion?

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

9

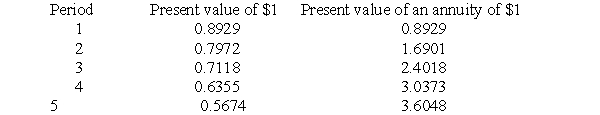

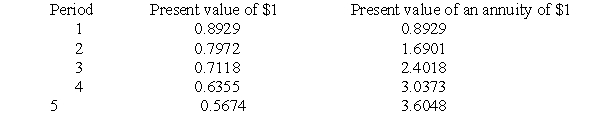

A firm is considering two alternative projects. Project A requires an initial expenditure of $50,000 plus an expenditure of $10,000 at the end of each the next five years. It will yield $75,000 in revenue at the end of the first year and at the end of the fifth year. Project B requires an initial expenditure of $100,000. It will yield $40,000 in net revenue at the end of each of the next five years. Both projects have a life of five years with no salvage value or disposal cost. The table below provides present value factors for the firm's discount rate of 12%. Calculate the net present value and profitability index of each project. Which project is preferred by each criterion?

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

10

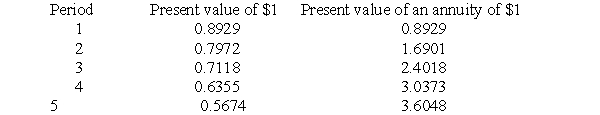

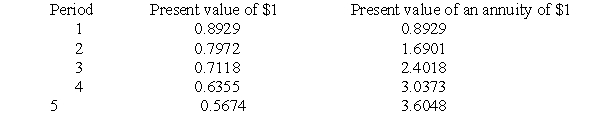

A firm is considering two alternative projects. Project A requires an initial expenditure of $100,000 plus an expenditure of $10,000 at the end of each the next five years. It will yield $98,000 in revenue at the end of the first year and at the end of the fifth year. Project B requires an initial expenditure of $50,000. It will yield $15,000 in net revenue at the end of each of the next five years. Both projects have a life of five years with no salvage value or disposal cost. The table below provides present value factors for the firm's discount rate of 12%. Calculate the net present value and profitability index of each project. Which project is preferred by each criterion?

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck