Deck 9: Decision Making Under Uncertainty

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/30

Play

Full screen (f)

Deck 9: Decision Making Under Uncertainty

1

Bayes' rule is used for updating the probability of an uncertain outcome after observing the results of a test or study.

True

2

Probabilities on the branches of a chance node may be ____ events that have occurred earlier in the decision tree.

A) marginal due to

B) conditional on

C) averaged with

D) increased by

A) marginal due to

B) conditional on

C) averaged with

D) increased by

B

3

The strategy region graph is a type of sensitivity analysis chart that:

A) is useful in determining whether the optimal decision changes over the range of the input variable.

B) ranks the sensitivity of the EMV to the input variables.

C) reflects how the value of information changes over a range of probabilities.

D) None of these

A) is useful in determining whether the optimal decision changes over the range of the input variable.

B) ranks the sensitivity of the EMV to the input variables.

C) reflects how the value of information changes over a range of probabilities.

D) None of these

A

4

For each possible decision and each possible outcome,the payoff table lists the associated monetary value.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

5

The risk profile from Precision Tree shows the probability distribution of monetary outcomes in both graphical and tabular form.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

6

Expected monetary value (EMV)is:

A) the average or expected value of the decision if you knew what would happen ahead of time

B) the weighted average of possible monetary values, weighted by their probabilities

C) the average or expected value of the information if it was completely accurate

D) the amount that you would lose by not picking the best alternative

A) the average or expected value of the decision if you knew what would happen ahead of time

B) the weighted average of possible monetary values, weighted by their probabilities

C) the average or expected value of the information if it was completely accurate

D) the amount that you would lose by not picking the best alternative

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

7

Prior probabilities are sometimes called likelihoods,the probabilities that are influenced by information about the outcome of an earlier uncertainty.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

8

The solution procedure for solving decision trees is called:

A) sensitivity analysis

B) policy iteration

C) risk profiling

D) folding back

A) sensitivity analysis

B) policy iteration

C) risk profiling

D) folding back

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

9

In general,the expected monetary value (EMV)of a decision will be equal to one of the possible payoffs.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is true concerning decision tree conventions

A) Time proceeds from right to left.

B) The trees are composed of circles, triangles and ovals.

C) The nodes represent points in time.

D) Probabilities of outcomes are shown to the right of the end nodes.

A) Time proceeds from right to left.

B) The trees are composed of circles, triangles and ovals.

C) The nodes represent points in time.

D) Probabilities of outcomes are shown to the right of the end nodes.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

11

The expected value of information (EVI)is the difference between the EMV obtained with free sample information and the EMV obtained without any information.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

12

The denominator of Bayes' rule:

A) is the same as the simple probability of an outcome O.

B) decomposes the probability of the new information I into all possibilities.

C) is sometimes called the law of complementary probabilities.

D) is unique for each possible outcome.

A) is the same as the simple probability of an outcome O.

B) decomposes the probability of the new information I into all possibilities.

C) is sometimes called the law of complementary probabilities.

D) is unique for each possible outcome.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

13

A utility function for risk averse individuals is ____ and/or ____.

A) decreasing, linear

B) decreasing, convex

C) increasing, linear

D) increasing, concave

A) decreasing, linear

B) decreasing, convex

C) increasing, linear

D) increasing, concave

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

14

The expected monetary value (EMV)criterion represents the long-run average of uncertain outcomes,so it should only be used for recurring decisions.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

15

For a risk averse decision maker,the certainty equivalent is less than the expected monetary value (EMV).

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

16

The certainty equivalent is the certain dollar amount a risk-averse decision maker would accept in order to avoid a gamble altogether.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

17

The expected value of perfect information (EVPI)is a largely irrelevant concept since perfect information is almost never available at any price.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

18

Bayes' rule is used to:

A) update the prior probabilities once new information is observed.

B) turn the given conditional probabilities (i.e. likelihoods) around.

C) update the posterior probabilities once new information is observed.

D) All of the above are uses for Bayes' rule.

A) update the prior probabilities once new information is observed.

B) turn the given conditional probabilities (i.e. likelihoods) around.

C) update the posterior probabilities once new information is observed.

D) All of the above are uses for Bayes' rule.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

19

All problems related to decision making under uncertainty have three common elements:

A) the mean, median, and mode

B) the set of decisions, the cost of each decision and the profit that can be made from each decision

C) the set of possible outcomes, the set of decision variables and the constraints

D) the set of decisions, the set of possible outcomes, and a value model that prescribes results

A) the mean, median, and mode

B) the set of decisions, the cost of each decision and the profit that can be made from each decision

C) the set of possible outcomes, the set of decision variables and the constraints

D) the set of decisions, the set of possible outcomes, and a value model that prescribes results

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following are probabilities that are conditioned on information that is obtained

A) Prior probabilities

B) Posterior probabilities

C) Marginal probabilities

D) Objective probabilities

A) Prior probabilities

B) Posterior probabilities

C) Marginal probabilities

D) Objective probabilities

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

21

Exhibit 9-2

A customer has approached a local credit union for a $20,000 1-year loan at a 10% interest rate. If the credit union does not approve the loan application, the $20,000 will be invested in bonds that earn a 6% annual return. Without additional information, the credit union believes that there is a 5% chance that this customer will default on the loan, assuming that the loan is approved. If the customer defaults on the loan, the credit union will lose the $20,000.

Refer to Exhibit 9-2.Suppose that an actual (not perfectly reliable)credit report has the following characteristics based on historical data; in cases where the customer did not default on the approved loan,the probability of receiving a favorable recommendation on the basis of the credit investigation was 80%,while in cases where the customer defaulted on the approved loan,the probability of receiving a favorable recommendation on the basis of the credit investigation was 25%.Given this information,what are the posterior probabilities that default will and will not occur,given the credit report

A customer has approached a local credit union for a $20,000 1-year loan at a 10% interest rate. If the credit union does not approve the loan application, the $20,000 will be invested in bonds that earn a 6% annual return. Without additional information, the credit union believes that there is a 5% chance that this customer will default on the loan, assuming that the loan is approved. If the customer defaults on the loan, the credit union will lose the $20,000.

Refer to Exhibit 9-2.Suppose that an actual (not perfectly reliable)credit report has the following characteristics based on historical data; in cases where the customer did not default on the approved loan,the probability of receiving a favorable recommendation on the basis of the credit investigation was 80%,while in cases where the customer defaulted on the approved loan,the probability of receiving a favorable recommendation on the basis of the credit investigation was 25%.Given this information,what are the posterior probabilities that default will and will not occur,given the credit report

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

22

Exhibit 9-2

A customer has approached a local credit union for a $20,000 1-year loan at a 10% interest rate. If the credit union does not approve the loan application, the $20,000 will be invested in bonds that earn a 6% annual return. Without additional information, the credit union believes that there is a 5% chance that this customer will default on the loan, assuming that the loan is approved. If the customer defaults on the loan, the credit union will lose the $20,000.

Refer to Exhibit 9-2.The bank can thoroughly investigate the customer's credit record and obtain a favorable or unfavorable recommendation.If the credit report is perfectly reliable,what is the most the credit union should be willing to pay for the report

A customer has approached a local credit union for a $20,000 1-year loan at a 10% interest rate. If the credit union does not approve the loan application, the $20,000 will be invested in bonds that earn a 6% annual return. Without additional information, the credit union believes that there is a 5% chance that this customer will default on the loan, assuming that the loan is approved. If the customer defaults on the loan, the credit union will lose the $20,000.

Refer to Exhibit 9-2.The bank can thoroughly investigate the customer's credit record and obtain a favorable or unfavorable recommendation.If the credit report is perfectly reliable,what is the most the credit union should be willing to pay for the report

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

23

Exhibit 9-2

A customer has approached a local credit union for a $20,000 1-year loan at a 10% interest rate. If the credit union does not approve the loan application, the $20,000 will be invested in bonds that earn a 6% annual return. Without additional information, the credit union believes that there is a 5% chance that this customer will default on the loan, assuming that the loan is approved. If the customer defaults on the loan, the credit union will lose the $20,000.

Refer to Exhibit 9-2.Construct a decision tree to help the credit union decide whether or not to make the loan.Make sure to label all decision and chance nodes and include appropriate costs,payoffs and probabilities.

A customer has approached a local credit union for a $20,000 1-year loan at a 10% interest rate. If the credit union does not approve the loan application, the $20,000 will be invested in bonds that earn a 6% annual return. Without additional information, the credit union believes that there is a 5% chance that this customer will default on the loan, assuming that the loan is approved. If the customer defaults on the loan, the credit union will lose the $20,000.

Refer to Exhibit 9-2.Construct a decision tree to help the credit union decide whether or not to make the loan.Make sure to label all decision and chance nodes and include appropriate costs,payoffs and probabilities.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

24

Exhibit 9-1

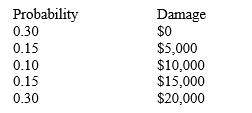

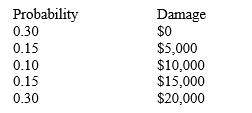

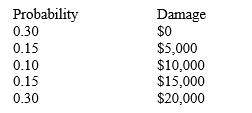

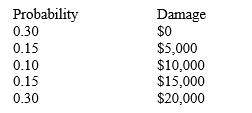

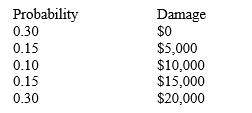

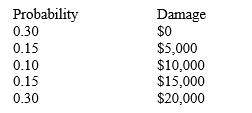

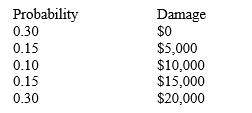

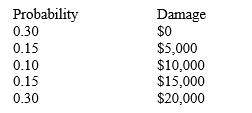

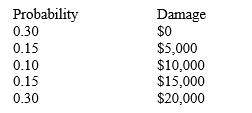

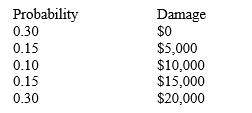

A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the event that the overnight temperature falls to a level well below freezing. If the temperature drops too low he runs the risk of losing his entire crop, valued at $75,000. Based on the National Weather Service, the probability of such a temperature drop is 60%. He can insulate his crop by spraying water on all the trees, which will cost $20,000. This action might succeed in protecting the crop, with the following

Refer to Exhibit 9-1.Find the highest cost of insulating the grapefruits for which the farmer prefers to insulate his crop.

A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the event that the overnight temperature falls to a level well below freezing. If the temperature drops too low he runs the risk of losing his entire crop, valued at $75,000. Based on the National Weather Service, the probability of such a temperature drop is 60%. He can insulate his crop by spraying water on all the trees, which will cost $20,000. This action might succeed in protecting the crop, with the following

Refer to Exhibit 9-1.Find the highest cost of insulating the grapefruits for which the farmer prefers to insulate his crop.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

25

Exhibit 9-2

A customer has approached a local credit union for a $20,000 1-year loan at a 10% interest rate. If the credit union does not approve the loan application, the $20,000 will be invested in bonds that earn a 6% annual return. Without additional information, the credit union believes that there is a 5% chance that this customer will default on the loan, assuming that the loan is approved. If the customer defaults on the loan, the credit union will lose the $20,000.

Refer to Exhibit 9-2.What should the credit union do

What is their expected profit

A customer has approached a local credit union for a $20,000 1-year loan at a 10% interest rate. If the credit union does not approve the loan application, the $20,000 will be invested in bonds that earn a 6% annual return. Without additional information, the credit union believes that there is a 5% chance that this customer will default on the loan, assuming that the loan is approved. If the customer defaults on the loan, the credit union will lose the $20,000.

Refer to Exhibit 9-2.What should the credit union do

What is their expected profit

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

26

Exhibit 9-1

A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the event that the overnight temperature falls to a level well below freezing. If the temperature drops too low he runs the risk of losing his entire crop, valued at $75,000. Based on the National Weather Service, the probability of such a temperature drop is 60%. He can insulate his crop by spraying water on all the trees, which will cost $20,000. This action might succeed in protecting the crop, with the following

Refer to Exhibit 9-1.Suppose the farmer is uncertain about the reliability of the National Weather Service forecast.If he thinks the probability of a freeze occurring could be anywhere between 40% and 80%,would that change his decision

A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the event that the overnight temperature falls to a level well below freezing. If the temperature drops too low he runs the risk of losing his entire crop, valued at $75,000. Based on the National Weather Service, the probability of such a temperature drop is 60%. He can insulate his crop by spraying water on all the trees, which will cost $20,000. This action might succeed in protecting the crop, with the following

Refer to Exhibit 9-1.Suppose the farmer is uncertain about the reliability of the National Weather Service forecast.If he thinks the probability of a freeze occurring could be anywhere between 40% and 80%,would that change his decision

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

27

Exhibit 9-1

A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the event that the overnight temperature falls to a level well below freezing. If the temperature drops too low he runs the risk of losing his entire crop, valued at $75,000. Based on the National Weather Service, the probability of such a temperature drop is 60%. He can insulate his crop by spraying water on all the trees, which will cost $20,000. This action might succeed in protecting the crop, with the following

Refer to Exhibit 9-1.Construct a decision tree to help the farmer make his decision.What should he do

Explain your answer.

A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the event that the overnight temperature falls to a level well below freezing. If the temperature drops too low he runs the risk of losing his entire crop, valued at $75,000. Based on the National Weather Service, the probability of such a temperature drop is 60%. He can insulate his crop by spraying water on all the trees, which will cost $20,000. This action might succeed in protecting the crop, with the following

Refer to Exhibit 9-1.Construct a decision tree to help the farmer make his decision.What should he do

Explain your answer.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

28

Exhibit 9-1

A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the event that the overnight temperature falls to a level well below freezing. If the temperature drops too low he runs the risk of losing his entire crop, valued at $75,000. Based on the National Weather Service, the probability of such a temperature drop is 60%. He can insulate his crop by spraying water on all the trees, which will cost $20,000. This action might succeed in protecting the crop, with the following

Refer to Exhibit 9-1.Construct a risk profile and from that determine the probability that no additional cost is incurred if the decision to insulate at a cost of $20,000 is made.

A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the event that the overnight temperature falls to a level well below freezing. If the temperature drops too low he runs the risk of losing his entire crop, valued at $75,000. Based on the National Weather Service, the probability of such a temperature drop is 60%. He can insulate his crop by spraying water on all the trees, which will cost $20,000. This action might succeed in protecting the crop, with the following

Refer to Exhibit 9-1.Construct a risk profile and from that determine the probability that no additional cost is incurred if the decision to insulate at a cost of $20,000 is made.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

29

Exhibit 9-1

A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the event that the overnight temperature falls to a level well below freezing. If the temperature drops too low he runs the risk of losing his entire crop, valued at $75,000. Based on the National Weather Service, the probability of such a temperature drop is 60%. He can insulate his crop by spraying water on all the trees, which will cost $20,000. This action might succeed in protecting the crop, with the following

Refer to Exhibit 9-1.Suppose the farmer is not risk-neutral,but instead his behavior can be modeled using an exponential utility function with a risk tolerance parameter of 100,000.What is the most he would be willing to pay for insulation in that case

A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the event that the overnight temperature falls to a level well below freezing. If the temperature drops too low he runs the risk of losing his entire crop, valued at $75,000. Based on the National Weather Service, the probability of such a temperature drop is 60%. He can insulate his crop by spraying water on all the trees, which will cost $20,000. This action might succeed in protecting the crop, with the following

Refer to Exhibit 9-1.Suppose the farmer is not risk-neutral,but instead his behavior can be modeled using an exponential utility function with a risk tolerance parameter of 100,000.What is the most he would be willing to pay for insulation in that case

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

30

Exhibit 9-2

A customer has approached a local credit union for a $20,000 1-year loan at a 10% interest rate. If the credit union does not approve the loan application, the $20,000 will be invested in bonds that earn a 6% annual return. Without additional information, the credit union believes that there is a 5% chance that this customer will default on the loan, assuming that the loan is approved. If the customer defaults on the loan, the credit union will lose the $20,000.

Refer to Exhibit 9-2.Should the credit union purchase the report if it costs $150

A customer has approached a local credit union for a $20,000 1-year loan at a 10% interest rate. If the credit union does not approve the loan application, the $20,000 will be invested in bonds that earn a 6% annual return. Without additional information, the credit union believes that there is a 5% chance that this customer will default on the loan, assuming that the loan is approved. If the customer defaults on the loan, the credit union will lose the $20,000.

Refer to Exhibit 9-2.Should the credit union purchase the report if it costs $150

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck