Deck 17: Divisional Performance Evaluation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/35

Play

Full screen (f)

Deck 17: Divisional Performance Evaluation

1

Transfer price refers to the price at which:

A)goods are transferred from one location to another.

B)services are transferred overseas for a cheaper rate.

C)goods are sold to loyal customers without shipping and delivery cost.

D)goods and services are transferred within a business.

A)goods are transferred from one location to another.

B)services are transferred overseas for a cheaper rate.

C)goods are sold to loyal customers without shipping and delivery cost.

D)goods and services are transferred within a business.

D

2

Clearly,an economist would like to see a profit center implement a system that most closely approximates the rule of profit maximization,MR = MC,in building a system of prices for other divisions.What are the pluses and minuses of allowing a division to engage in this type of activity?

MR = MC will drive a division to its most efficient production level,all else constant.However,this ignores possible linkages between divisions.For example,if a higher MR for an upstream division yields a higher MC for a downstream division,as in some transfer pricing scenarios,the value of the firm will decrease.One solution is to centrally control transfer prices to minimize negative impacts of an upstream division on a downstream division.

3

The accounting department had a plumbing problem and they called the maintenance department to fix this.After the job was done,the maintenance department sent the accounting department a bill for services rendered.Does this make sense? After all they are all a part of the same company?

No,this is not strange.These are called charge-backs.The maintenance department sent its workers to the accounting department instead of working elsewhere for actual payment.So their opportunity cost has to be borne by the accounting department.

4

One of the problems of transfer prices comes from the successive impact of the prices as the product moves downstream toward the consumer.At each step,the transfer price becomes the ______ for the next part of the company.

A)market price

B)total cost

C)marginal cost

D)negotiated price

A)market price

B)total cost

C)marginal cost

D)negotiated price

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

5

Consider a particular division that earns an after-tax profit of $40 million and has total assets worth $120 million.The residual income of the division is ______ if its required cost of capital is 20%.

A)$16 million

B)$40 million

C)$24 million

D)$8 million

A)$16 million

B)$40 million

C)$24 million

D)$8 million

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

6

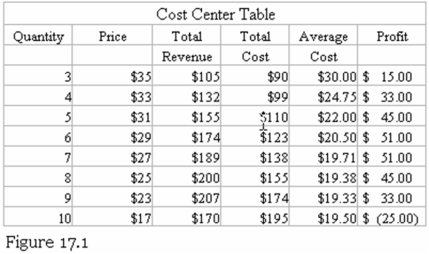

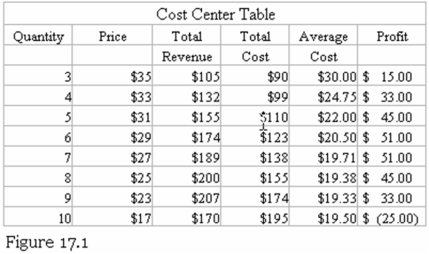

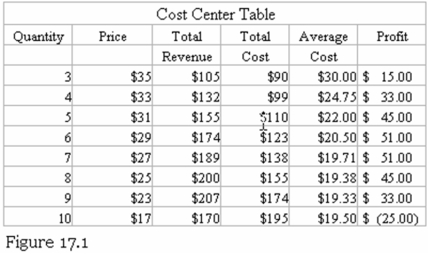

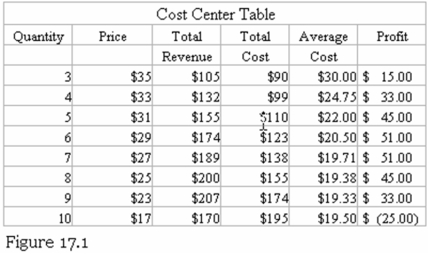

Refer to Figure 17.1.Which of these will hold true if the manager is given a budget of $155?

A)She should produce 6 units of output because profits are maximized.

B)She should produce 8 units of output to maximize output for the budget.

C)She should try to produce 9 units of output because average costs are minimized.

D)She should lobby her boss for more money.

A)She should produce 6 units of output because profits are maximized.

B)She should produce 8 units of output to maximize output for the budget.

C)She should try to produce 9 units of output because average costs are minimized.

D)She should lobby her boss for more money.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

7

What are the measures of performance for investment centers? How do they work?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

8

Always Round Tire's new division,Start-up Batteries,finds that its total cost curve,TC = 300 + 2Q + 2Q2 and its demand curve,P = 130 - 2Q.

If the division is operated as an independent profit center,what will be the price and quantity sold each day? Will the division make a profit?

If the division is operated purely as a revenue center,how many batteries will they sell each day?

If the division is operated as a cost center and told to produce 20 batteries per day,what would be the cost per battery?

If the division is operated as an independent profit center,what will be the price and quantity sold each day? Will the division make a profit?

If the division is operated purely as a revenue center,how many batteries will they sell each day?

If the division is operated as a cost center and told to produce 20 batteries per day,what would be the cost per battery?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

9

Economists often remark that accounting data are purely historical and at an aggregate level and do not provide information on incremental changes.So why is it the key data source for decision control and important in decision management?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

10

The CEO of Always Round Tires has decided to open a battery division.He thinks that batteries would sell well with tires at their outlets and that Always Round's quality reputation will be transferred to the batteries.Should he set up the new division as a Revenue Center,as a Profit Center,or as an Investment Center? Why?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

11

Which of these is a commonly used measure of performance for investment centers?

A)Residual income

B)Total assets

C)Total income

D)Variable cost

A)Residual income

B)Total assets

C)Total income

D)Variable cost

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

12

What is transfer pricing?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

13

Cost center managers are evaluated on their efficiency in using an input-mix to:

A)produce a stipulated level of output.

B)generate a stipulated amount of revenue.

C)produce a pre-decided level of net profit.

D)generate a certain amount of return on investment.

A)produce a stipulated level of output.

B)generate a stipulated amount of revenue.

C)produce a pre-decided level of net profit.

D)generate a certain amount of return on investment.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

14

If a company division is operated as a revenue center and its demand curve is P = 200 - 2Q,how many units should it produce per day?

A)0

B)25

C)50

D)100

A)0

B)25

C)50

D)100

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

15

A manager in an investment center is offered a potential investment that would have an ROA of 15 percent.After the investment,it would make up 20 percent of his total portfolio.Currently,he makes 20 percent on his portfolio,though the company requires only 12 percent.Which of the following is true?

A)He will make the investment since it is 3 percent greater than the company's required return.

B)He will make the investment because a larger portfolio is always better than a smaller portfolio.

C)He will not make the investment because the company prefers 12 percent.

D)He will not make the investment because it lowers his overall return to 19 percent.

A)He will make the investment since it is 3 percent greater than the company's required return.

B)He will make the investment because a larger portfolio is always better than a smaller portfolio.

C)He will not make the investment because the company prefers 12 percent.

D)He will not make the investment because it lowers his overall return to 19 percent.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

16

Refer to Figure 17.1.What is the output level where the average cost is at its minimum?

A)6 units

B)7 units

C)8 units

D)9 units

A)6 units

B)7 units

C)8 units

D)9 units

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

17

If a corporation operates two divisions that supply one another,and each division is located in a different country,then transfer prices are:

A)set to allocate profit to the low tax rate country.

B)set to allocate all costs to the low tax rate country.

C)set to allocate profit to the high tax rate country.

D)not allowed between most countries.

A)set to allocate profit to the low tax rate country.

B)set to allocate all costs to the low tax rate country.

C)set to allocate profit to the high tax rate country.

D)not allowed between most countries.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

18

Profit center managers are allocated decision rights for:

A)input mix,product mix,and selling prices.

B)selling prices and capital expenditures.

C)product mix and selling price only.

D)input mix and product mix only.

A)input mix,product mix,and selling prices.

B)selling prices and capital expenditures.

C)product mix and selling price only.

D)input mix and product mix only.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

19

What are the common transfer pricing methods?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

20

Measuring the success of a divisional Investment Center is closely tied to understanding whether or not the division meets profit expectations.To understand profits,two alternatives are proposed for tracking profitability: ROA and EVA.From the point of view of an economist,why is EVA usually preferred?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

21

In terms of using accounting data to build an effective management control system,what is the nirvana fallacy?

A)It is the tendency to use market-based transfer prices.

B)It is the system of using accounting data for both decision management and decision control.

C)It is the tendency to use cost centers rather than profit centers as the core of business structure.

D)It is the belief that a perfect control system can be invented that will stop all fraud.

A)It is the tendency to use market-based transfer prices.

B)It is the system of using accounting data for both decision management and decision control.

C)It is the tendency to use cost centers rather than profit centers as the core of business structure.

D)It is the belief that a perfect control system can be invented that will stop all fraud.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

22

In the Celtex case study,Leo Garcia,President of the synthetic chemical division,regularly fails to sell his products to and through the consumer products division.This is because:

A)there is a market-based alternative to his products that are cheaper.

B)Celtex has a faulty organizational structure that regularly cheats Garcia.

C)the head of the consumer products division does not understand the difference between price and value.

D)Garcia produces inferior products.

A)there is a market-based alternative to his products that are cheaper.

B)Celtex has a faulty organizational structure that regularly cheats Garcia.

C)the head of the consumer products division does not understand the difference between price and value.

D)Garcia produces inferior products.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

23

Marginal-cost transfer-pricing creates incentives for manufacturing to distort MC:

A)upward and then downward.

B)downward and then upward.

C)downward.

D)upward.

A)upward and then downward.

B)downward and then upward.

C)downward.

D)upward.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

24

Full-cost transfer-pricing frequently:

A)understates the opportunity costs of external transfers.

B)overstates the opportunity costs of external transfers.

C)understates the opportunity costs of internal transfers.

D)overstates the opportunity costs of internal transfers.

A)understates the opportunity costs of external transfers.

B)overstates the opportunity costs of external transfers.

C)understates the opportunity costs of internal transfers.

D)overstates the opportunity costs of internal transfers.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

25

If there exists an external market for an intermediate good produced by a company,then an easy way to set a transfer price would be to use a:

A)market-based transfer price.

B)marginal-cost transfer price.

C)full-cost transfer price.

D)monopoly transfer price.

A)market-based transfer price.

B)marginal-cost transfer price.

C)full-cost transfer price.

D)monopoly transfer price.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

26

The choice of transfer-pricing method:

A)merely reallocates total company profits among its smaller units.

B)does nothing to profits of sub-units.

C)merely reallocates total company profits among its bigger units.

D)affects the firm's total profits.

A)merely reallocates total company profits among its smaller units.

B)does nothing to profits of sub-units.

C)merely reallocates total company profits among its bigger units.

D)affects the firm's total profits.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

27

If a company adds up all the costs of producing an intermediate product - direct labor,materials,and overhead - to establish a transfer price,then it is using a:

A)market-based transfer price.

B)marginal-cost transfer price.

C)full-cost transfer price.

D)monopoly transfer prices.

A)market-based transfer price.

B)marginal-cost transfer price.

C)full-cost transfer price.

D)monopoly transfer prices.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

28

Holmstrom and Tirole note "The economist's first instinct is to set transfer price equal to marginal cost." However,a distinct plurality of companies uses the full-cost method.That is because:

A)most companies do not employ economists.

B)it is simple and has a low cost of implementation.

C)it is identical to using a marginal cost approach to transfer prices.

D)the results are much better in the field with full-cost method.

A)most companies do not employ economists.

B)it is simple and has a low cost of implementation.

C)it is identical to using a marginal cost approach to transfer prices.

D)the results are much better in the field with full-cost method.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

29

Full-cost transfer-pricing creates an incentive for:

A)distribution to be inefficient.

B)distribution to be over-efficient.

C)manufacturing to be over-efficient.

D)manufacturing to be less efficient.

A)distribution to be inefficient.

B)distribution to be over-efficient.

C)manufacturing to be over-efficient.

D)manufacturing to be less efficient.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

30

The basic incentive problem associated with internal transfers is that:

A)divisional managers have private information about opportunity costs.

B)divisional managers have only public information about opportunity costs.

C)senior management have private information about opportunity costs.

D)senior management make all information about opportunity costs public.

A)divisional managers have private information about opportunity costs.

B)divisional managers have only public information about opportunity costs.

C)senior management have private information about opportunity costs.

D)senior management make all information about opportunity costs public.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

31

The accounting-based performance analysis:

A)provides aggregate level data that is insufficient for decision making.

B)is completely under the control of the operating managers.

C)is a true reflector of a particular management center's functioning.

D)provides inexpensive information on opportunity costs.

A)provides aggregate level data that is insufficient for decision making.

B)is completely under the control of the operating managers.

C)is a true reflector of a particular management center's functioning.

D)provides inexpensive information on opportunity costs.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

32

In general,the use of accounting-based performance analysis is more effective in:

A)decision management.

B)decision control.

C)audit review of failed enterprises.

D)residual income.

A)decision management.

B)decision control.

C)audit review of failed enterprises.

D)residual income.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

33

You can manufacture a product in the US and transfer it to Europe.If the marginal cost (MC)is $3 per unit,and the market price in Europe is $5 per unit,should the product be manufactured?

A)No,because the net receipt of $5 is larger than the MC in the US.

B)Yes,because the gross receipt of $3 is larger than the MC in the US.

C)No,because the net receipt of $3 is the same as the MC in the US.

D)Yes,because the net receipts in Europe will exceed the MC in the US.

A)No,because the net receipt of $5 is larger than the MC in the US.

B)Yes,because the gross receipt of $3 is larger than the MC in the US.

C)No,because the net receipt of $3 is the same as the MC in the US.

D)Yes,because the net receipts in Europe will exceed the MC in the US.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

34

Which one of the following is not a method used to set transfer prices?

A)Market price method

B)Marginal production cost method

C)Negotiated pricing method

D)Opportunity cost method

A)Market price method

B)Marginal production cost method

C)Negotiated pricing method

D)Opportunity cost method

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

35

If each division of a company with a monopoly niche is allowed to set its transfer price at the profit-maximizing level for the next division as the product flows toward the consumer (assuming no external market for the product),then prices will:

A)be higher and profits lower than with non-divisional organization.

B)be lower and profits higher than with a non-divisional organization.

C)be the same and profits will be the same as with a non-divisional organization.

D)match the competitive benchmark and profits will be zero.

A)be higher and profits lower than with non-divisional organization.

B)be lower and profits higher than with a non-divisional organization.

C)be the same and profits will be the same as with a non-divisional organization.

D)match the competitive benchmark and profits will be zero.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck