Deck 2: Determinants of Interest Rates

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/57

Play

Full screen (f)

Deck 2: Determinants of Interest Rates

1

For any positive interest rate the present value of a given annuity will be less than the sum of the cash flows,and the future value of the same annuity will be greater than the sum of the cash flows.

True

2

The traditional liquidity premium theory states that long-term interest rates are greater than the average of expected future interest rates.

True

3

Households generally supply more funds to the markets as their income and wealth increase,ceteris paribus.

True

4

The term structure of interest rates is the relationship between interest rates on bonds similar in terms except for maturity.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

5

An increase in the marginal tax rates for all U.S. taxpayers would probably result in reduced supply of funds by households.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

6

Earning a 5 percent interest rate with annual compounding is better than earning a 4.95 percent interest rate with semiannual compounding.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

7

The real risk-free rate is the increment to purchasing power that the lender earns in order to induce him or her to forego current consumption.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

8

Everything else equal,the interest rate required on a callable bond will be less than the interest rate on a convertible bond.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

9

According to the market segmentation theory,short-term investors will not normally switch to intermediate- or long-term investments.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

10

An investor earned a 5 percent nominal risk-free rate over the year. However,over the year,prices increased by 2 percent. The investor's real risk-free rate was less than his nominal rate of return.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

11

When the quantity of a financial security supplied or demanded changes at every given interest rate in response to a change in a factor,this causes a shift in the supply or demand curve.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

12

We expect liquidity premiums to move inversely with interest rate volatility.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

13

The risk that a security cannot be sold at a predictable price with low transaction costs at short notice is called liquidity risk.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

14

An increase in the perceived riskiness of investments would cause a movement up along the supply curve.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

15

If you earn 0.5 percent a month in your bank account,this would be the same as earning a 6 percent annual interest rate with annual compounding.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

16

With a zero interest rate both the present value and the future value of an N payment annuity would equal N × payment.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

17

Convertible bonds will normally have lower promised yields than straight bonds of similar terms and quality.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

18

Simple interest calculations assume that interest earned is never reinvested.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

19

An improvement in economic conditions would likely shift the supply curve down and to the right and shift the demand curve for funds up and to the right.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

20

The unbiased expectations hypothesis of the term structure posits that long-term interest rates are unrelated to expected future short-term rates.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

21

A 15-payment annual annuity has its first payment in nine years. If the payment amount is $1,400 and the interest rate is 7 percent,what is the most you should be willing to pay today for this investment?

A)$6,416.67

B)$12,751.08

C)$6,935.74

D)$5,825.11

E)$7,421.24

A)$6,416.67

B)$12,751.08

C)$6,935.74

D)$5,825.11

E)$7,421.24

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

22

Classify each of the following in terms of their effect on interest rates (increase or decrease):

I) Covenants on borrowing become more restrictive.

II) The Federal Reserve increases the money supply.

III) Total household wealth increases.

A)I increases,II increases,III increases

B)I increases,II decreases,III decreases

C)I decreases,II increases,III increases

D)I decreases,II decreases,III decreases

E)None of the options

I) Covenants on borrowing become more restrictive.

II) The Federal Reserve increases the money supply.

III) Total household wealth increases.

A)I increases,II increases,III increases

B)I increases,II decreases,III decreases

C)I decreases,II increases,III increases

D)I decreases,II decreases,III decreases

E)None of the options

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

23

Upon graduating from college this year,you expect to earn $25,000 per year. If you get your MBA,in one year you can expect to start at $35,000 per year. Over the year,inflation is expected to be 5 percent. In today's dollars,how much additional (less)money will you make from getting your MBA (to the nearest dollar)in your first year?

A)$10,000

B)$8,750

C)$8,333

D)-$2,462

E)$9,524

A)$10,000

B)$8,750

C)$8,333

D)-$2,462

E)$9,524

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

24

An investment pays $400 in one year,X amount of dollars in two years,and $500 in three years. The total present value of all the cash flows (including X)is equal to $1,500. If i is 6 percent,what is X?

A)$749.67

B)$789.70

C)$600.00

D)$822.41

E)$702.83

A)$749.67

B)$789.70

C)$600.00

D)$822.41

E)$702.83

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

25

According to the liquidity premium theory of interest rates,

A)long-term spot rates are totally unrelated to expectations of future short-term rates.

B)the term structure must always be upward sloping.

C)investors prefer certain maturities and will not normally switch out of those maturities.

D)long-term spot rates are higher than the average of current and expected future short-term rates.

E)investors are indifferent between different maturities if the long-term spot rates are equal to the average of current and expected future short-term rates.

A)long-term spot rates are totally unrelated to expectations of future short-term rates.

B)the term structure must always be upward sloping.

C)investors prefer certain maturities and will not normally switch out of those maturities.

D)long-term spot rates are higher than the average of current and expected future short-term rates.

E)investors are indifferent between different maturities if the long-term spot rates are equal to the average of current and expected future short-term rates.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following would normally be expected to result in an increase in the supply of funds,all else equal?

I) The perceived riskiness of all investments decreases.

II) Expected inflation increases.

III) Current income and wealth levels increase.

IV) Near term spending needs of households increase as energy costs rise.

A)II and III only

B)I and IV only

C)I,II,III,and IV

D)I and III only

E)II,III,and IV only

I) The perceived riskiness of all investments decreases.

II) Expected inflation increases.

III) Current income and wealth levels increase.

IV) Near term spending needs of households increase as energy costs rise.

A)II and III only

B)I and IV only

C)I,II,III,and IV

D)I and III only

E)II,III,and IV only

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

27

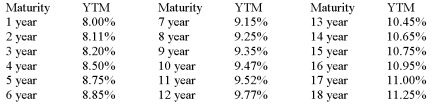

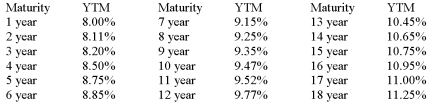

YIELD CURVE FOR ZERO COUPON BONDS RATED AA  Assume that there are no liquidity premiums. To the nearest basis point,what is the expected interest rate on a four-year maturity AA zero coupon bond purchased six years from today?

Assume that there are no liquidity premiums. To the nearest basis point,what is the expected interest rate on a four-year maturity AA zero coupon bond purchased six years from today?

A)9.96 percent

B)10.41 percent

C)10.05 percent

D)10.56 percent

E)9.16 percent

Assume that there are no liquidity premiums. To the nearest basis point,what is the expected interest rate on a four-year maturity AA zero coupon bond purchased six years from today?

Assume that there are no liquidity premiums. To the nearest basis point,what is the expected interest rate on a four-year maturity AA zero coupon bond purchased six years from today?A)9.96 percent

B)10.41 percent

C)10.05 percent

D)10.56 percent

E)9.16 percent

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

28

If M > 1 and you solve the following equation to find i: PV * (1 + (i/M))M*N= FV,the i you get will be

A)the rate per compounding period.

B)the EYE.

C)the bond equivalent yield.

D)the TOE.

E)the EAR.

A)the rate per compounding period.

B)the EYE.

C)the bond equivalent yield.

D)the TOE.

E)the EAR.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

29

You buy a car for $38,000. You agree to a 60-month loan with a monthly interest rate of 0.55 percent. What is your required monthly payment?

A)$634.24

B)$745.29

C)$605.54

D)$764.07

E)None of the options

A)$634.24

B)$745.29

C)$605.54

D)$764.07

E)None of the options

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

30

Inflation causes the demand curve for loanable funds to shift to the _____ and causes the supply curve to shift to the _____.

A)left; right

B)left; left

C)right; left

D)right; right

A)left; right

B)left; left

C)right; left

D)right; right

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

31

Of the following,the most likely effect of an increase in income tax rates would be to

A)decrease the savings rate.

B)decrease the supply of loanable funds.

C)increase interest rates.

D)All of the options.

A)decrease the savings rate.

B)decrease the supply of loanable funds.

C)increase interest rates.

D)All of the options.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

32

An investor wants to be able to buy 4 percent more goods and services in the future in order to induce her to invest today. During the investment period prices are expected to rise by 2 percent. Which statement(s)below is/are true?

I) 4 percent is the desired real risk-free interest rate.

II) 6 percent is the approximate nominal rate of interest required.

III) 2 percent is the expected inflation rate over the period.

A)I only

B)II only

C)III only

D)I and II only

E)I,II,and III are true

I) 4 percent is the desired real risk-free interest rate.

II) 6 percent is the approximate nominal rate of interest required.

III) 2 percent is the expected inflation rate over the period.

A)I only

B)II only

C)III only

D)I and II only

E)I,II,and III are true

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

33

An annuity and an annuity due with the same number of payments have the same future value if r = 10%. Which one has the higher payment?

A)An annuity and an annuity due cannot have the same future value.

B)There is no way to tell which has the higher payment.

C)The annuity due has the higher payment.

D)They both must have the same payment since the future values are the same.

E)The annuity has the higher payment.

A)An annuity and an annuity due cannot have the same future value.

B)There is no way to tell which has the higher payment.

C)The annuity due has the higher payment.

D)They both must have the same payment since the future values are the same.

E)The annuity has the higher payment.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

34

Investment A pays 8 percent simple interest for 10 years. Investment B pays 7.75 percent compound interest for 10 years. Both require an initial $10,000 investment. The future value of A minus the future value of B is equal to ______________ (to the nearest penny).

A)-$3,094.67

B)$3,094.67

C)$1,643.32

D)$2,500.00

E)-$2,500.00

A)-$3,094.67

B)$3,094.67

C)$1,643.32

D)$2,500.00

E)-$2,500.00

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

35

An insurance company is trying to sell you a retirement annuity. The annuity will give you 20 payments with the first payment in 12 years when you retire. The insurance firm is asking you to pay $50,000 today. If this is a fair deal,what must the payment amount be (to the dollar)if the interest rate is 8 percent?

A)$9,472

B)$10,422

C)$12,824

D)$5,093

E)$11,874

A)$9,472

B)$10,422

C)$12,824

D)$5,093

E)$11,874

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

36

An individual actually earned a 4 percent nominal return last year. Prices went up by 3 percent over the year. Given that the investment income was subject to a federal tax rate of 28 percent and a state and local tax rate of 6 percent,what was the investor's actual real after-tax rate of return?

A)-0.36 percent

B)0.66 percent

C)2.64 percent

D)0.72 percent

E)1.45 percent

A)-0.36 percent

B)0.66 percent

C)2.64 percent

D)0.72 percent

E)1.45 percent

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

37

Classify each of the following in terms of their effect on interest rates (increase or decrease):

I) Perceived risk of financial securities increases.

II) Near term spending needs decrease.

III) Future profitability of real investments increases.

A)I increases,II increases,III increases

B)I increases,II decreases,III decreases

C)I decreases,II increases,III increases

D)I decreases,II decreases,III decreases

E)None of the options

I) Perceived risk of financial securities increases.

II) Near term spending needs decrease.

III) Future profitability of real investments increases.

A)I increases,II increases,III increases

B)I increases,II decreases,III decreases

C)I decreases,II increases,III increases

D)I decreases,II decreases,III decreases

E)None of the options

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

38

You want to have $5 million when you retire in 40 years. You believe you can earn 9 percent per year on your investment. How much must you invest each year to achieve your goal when you retire? (Ignore all taxes.)

A)$10,412

B)$11,619

C)$14,798

D)$15,295

E)None of the options

A)$10,412

B)$11,619

C)$14,798

D)$15,295

E)None of the options

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

39

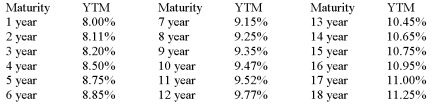

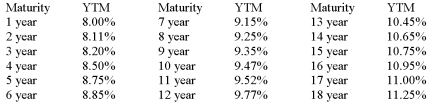

YIELD CURVE FOR ZERO COUPON BONDS RATED AA  Assume that there are no liquidity premiums. You just bought a 15-year maturity Xerox corporate bond rated AA with a 0 percent coupon. You expect to sell the bond in eight years. Find the expected interest rate at the time of sale (watch out for rounding error).

Assume that there are no liquidity premiums. You just bought a 15-year maturity Xerox corporate bond rated AA with a 0 percent coupon. You expect to sell the bond in eight years. Find the expected interest rate at the time of sale (watch out for rounding error).

A)8.85 percent

B)11.00 percent

C)12.80 percent

D)13.92 percent

E)12.49 percent

Assume that there are no liquidity premiums. You just bought a 15-year maturity Xerox corporate bond rated AA with a 0 percent coupon. You expect to sell the bond in eight years. Find the expected interest rate at the time of sale (watch out for rounding error).

Assume that there are no liquidity premiums. You just bought a 15-year maturity Xerox corporate bond rated AA with a 0 percent coupon. You expect to sell the bond in eight years. Find the expected interest rate at the time of sale (watch out for rounding error).A)8.85 percent

B)11.00 percent

C)12.80 percent

D)13.92 percent

E)12.49 percent

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

40

You go to the Wall Street Journal and notice that yields on almost all corporate and Treasury bonds have decreased. The yield decreases may be explained by which one of the following?

A)Newly expected decline in the value of the dollar

B)Increases in the U.S. government budget deficit

C)Decreased Japanese purchases of U.S. Treasury bills/bonds

D)An increase in current and expected future returns of real corporate investments

E)A decrease in U.S. inflationary expectations

A)Newly expected decline in the value of the dollar

B)Increases in the U.S. government budget deficit

C)Decreased Japanese purchases of U.S. Treasury bills/bonds

D)An increase in current and expected future returns of real corporate investments

E)A decrease in U.S. inflationary expectations

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

41

In October 1987 stock prices fell 22 percent in one day and bond rates fell also. Use the loanable funds theory to explain what happened.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

42

Can the actual real rate of interest be negative?

When?

Can the expected real rate be negative?

When?

Can the expected real rate be negative?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

43

What is the difference between the expected real interest rate and the real risk-free interest rate actually earned?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

44

A foreign investor placing money in dollar-denominated assets desires a 4 percent real rate of return. Global inflation is running about 3 percent,and the dollar is expected to decline against her home currency by 1.5 percent over the investment period. What is her minimum required rate of return?

Explain.

Explain.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

45

An investor requires a 3 percent increase in purchasing power in order to induce her to lend. She expects inflation to be 2 percent next year. The nominal rate she must charge is about

A)1 percent.

B)5 percent.

C)2 percent.

D)3 percent.

E)7 percent.

A)1 percent.

B)5 percent.

C)2 percent.

D)3 percent.

E)7 percent.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

46

According to the unbiased expectations theory,

A)the term structure will most often be upward sloping.

B)liquidity premiums are negative and time varying.

C)the long-term spot rate is an average of the current and expected future short-term interest rates.

D)markets are segmented and buyers stay in their own segment.

E)forward rates are less than the expected future spot rates.

A)the term structure will most often be upward sloping.

B)liquidity premiums are negative and time varying.

C)the long-term spot rate is an average of the current and expected future short-term interest rates.

D)markets are segmented and buyers stay in their own segment.

E)forward rates are less than the expected future spot rates.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

47

Would you expect the demand curve for businesses to be steeper than the demand curve for funds by the federal government?

Explain.

Explain.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

48

The one-year spot rate is currently 4 percent; the one-year spot rate one year from now will be 3 percent; and the one-year spot rate two years from now will be 6 percent. Under the unbiased expectations theory,what must today's three-year spot rate be?

Suppose the three-year spot rate is actually 3.75 percent,how could you take advantage of this?

Explain.

Suppose the three-year spot rate is actually 3.75 percent,how could you take advantage of this?

Explain.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

49

What is the loanable funds theory of interest rates?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

50

Who are the major suppliers and demanders of funds in the United States and what is their typical position?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

51

According to current projections,Social Security and other entitlement programs will soon be severely underfunded. If the government decides to cut Social Security benefits to future retirees and raise Social Security taxes on all workers,what will probably happen to the supply of funds available to the capital markets?

What will be the effect on interest rates?

What will be the effect on interest rates?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

52

Suppose you borrow $15,000 and then repay the loan by making 12 monthly payments of $1,297.92 each. What rate will you be quoted on the loan?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

53

The relationship between maturity and yield to maturity is called the __________________.

A)Fisher effect

B)DRP structure

C)bond indenture

D)term structure

E)loan covenant

A)Fisher effect

B)DRP structure

C)bond indenture

D)term structure

E)loan covenant

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following bond types pays interest that is exempt from federal taxation?

A)Municipal bonds

B)Corporate bonds

C)Treasury bonds

D)Convertible bonds

E)Municipal bonds and Treasury bonds

A)Municipal bonds

B)Corporate bonds

C)Treasury bonds

D)Convertible bonds

E)Municipal bonds and Treasury bonds

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

55

Explain the logic of the liquidity premium theory of the term structure.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

56

Explain the market segmentation theory of the term structure.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

57

The term structure of interest rates is upward sloping for all bond types. A certain AAA rated non-callable 10-year corporate bond has been issued at a 6.15 percent promised yield. Which one of the following bonds probably has a higher promised yield?

A)A similar quality municipal bond.

B)A non-callable AAA rated corporate bond with a five-year maturity.

C)A callable AAA rated corporate bond with a 15-year maturity.

D)A non-callable AAA rated convertible corporate bond with a 10-year maturity.

E)All of the options would have a higher promised yield.

A)A similar quality municipal bond.

B)A non-callable AAA rated corporate bond with a five-year maturity.

C)A callable AAA rated corporate bond with a 15-year maturity.

D)A non-callable AAA rated convertible corporate bond with a 10-year maturity.

E)All of the options would have a higher promised yield.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck