Deck 17: Activity-Based Absorption Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 17: Activity-Based Absorption Costing

1

The manufacturing overhead that would be applied to a unit of product I63E under the company's traditional costing system is closest to:

A) $12.80

B) $39.35

C) $76.03

D) $36.68

A) $12.80

B) $39.35

C) $76.03

D) $36.68

D

Explanation:

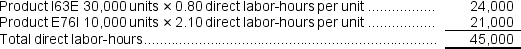

Predetermined overhead rate = $2,063,250 ÷ 45,000 direct labor-hours = $45.85 per direct labor-hour

Predetermined overhead rate = $2,063,250 ÷ 45,000 direct labor-hours = $45.85 per direct labor-hour

Overhead applied to a unit of product T37C = $45.85 per direct labor-hours × 0.80 direct labor-hours per unit = $36.68 per unit

Explanation:

Predetermined overhead rate = $2,063,250 ÷ 45,000 direct labor-hours = $45.85 per direct labor-hour

Predetermined overhead rate = $2,063,250 ÷ 45,000 direct labor-hours = $45.85 per direct labor-hourOverhead applied to a unit of product T37C = $45.85 per direct labor-hours × 0.80 direct labor-hours per unit = $36.68 per unit

2

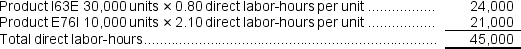

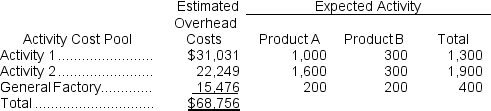

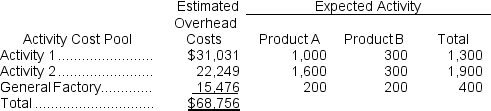

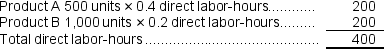

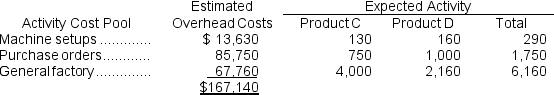

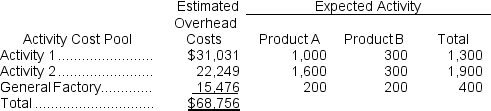

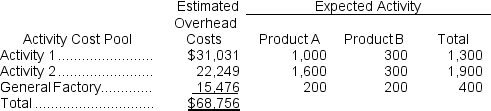

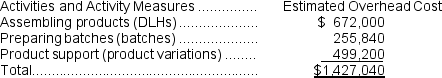

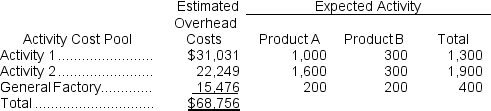

(Appendix 2A) Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

The predetermined overhead rate under the traditional costing system is closest to:

A) $11.71

B) $38.69

C) $171.89

D) $23.87

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)The predetermined overhead rate under the traditional costing system is closest to:

A) $11.71

B) $38.69

C) $171.89

D) $23.87

C

Explanation:

Predetermined overhead rate = Total estimated overhead ÷ Total estimated direct labor-hours

Predetermined overhead rate = Total estimated overhead ÷ Total estimated direct labor-hours

= $68,756 ÷ 400 direct labor-hours = $171.89 per direct labor-hour

Explanation:

Predetermined overhead rate = Total estimated overhead ÷ Total estimated direct labor-hours

Predetermined overhead rate = Total estimated overhead ÷ Total estimated direct labor-hours= $68,756 ÷ 400 direct labor-hours = $171.89 per direct labor-hour

3

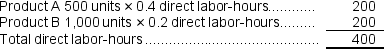

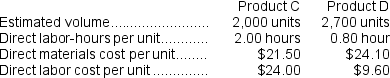

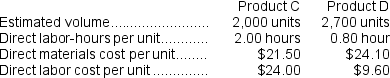

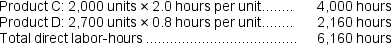

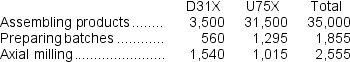

Cabigas Corporation manufactures two products,Product C and Product D.The company estimated it would incur $167,140 in manufacturing overhead costs during the current period.Overhead currently is applied to the products on the basis of direct labor-hours.Data concerning the current period's operations appear below:

Required:

Required:

a.Compute the predetermined overhead rate under the current method,and determine the unit product cost of each product for the current year.

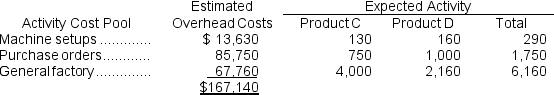

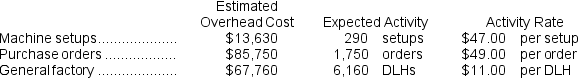

b.The company is considering using an activity-based costing system to compute unit product costs for external financial reports instead of its traditional system based on direct labor-hours.The activity-based costing system would use three activity cost pools.Data relating to these activities for the current period are given below:

Determine the unit product cost of each product for the current period using the activity-based costing approach.General factory overhead is allocated based on direct labor-hours.

Determine the unit product cost of each product for the current period using the activity-based costing approach.General factory overhead is allocated based on direct labor-hours.

Required:

Required:a.Compute the predetermined overhead rate under the current method,and determine the unit product cost of each product for the current year.

b.The company is considering using an activity-based costing system to compute unit product costs for external financial reports instead of its traditional system based on direct labor-hours.The activity-based costing system would use three activity cost pools.Data relating to these activities for the current period are given below:

Determine the unit product cost of each product for the current period using the activity-based costing approach.General factory overhead is allocated based on direct labor-hours.

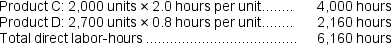

Determine the unit product cost of each product for the current period using the activity-based costing approach.General factory overhead is allocated based on direct labor-hours.a.The expected total direct labor-hours during the period are computed as follows:

Using these hours as a base,the predetermined overhead using direct labor-hours would be:

Using these hours as a base,the predetermined overhead using direct labor-hours would be:

Predetermined overhead rate = Estimated total overhead cost ÷ Estimated total direct labor-hours

= $167,140 ÷ 6,160 DLHs = $27.13 per DLH

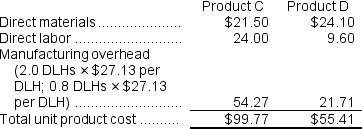

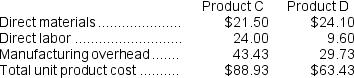

Using this overhead rate,the unit product costs are:

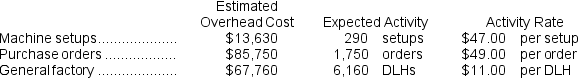

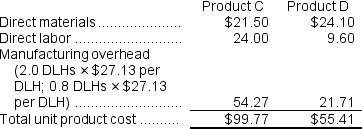

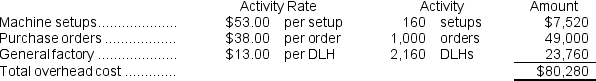

b.The activity rates for each activity cost pool are as follows:

b.The activity rates for each activity cost pool are as follows:

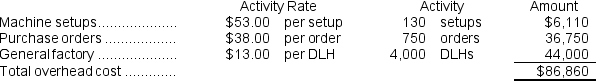

The overhead cost charged to Product C is:

The overhead cost charged to Product C is:

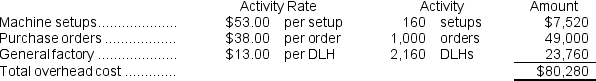

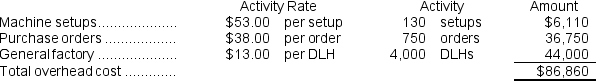

The overhead cost charged to Product D is:

The overhead cost charged to Product D is:

Overhead cost per unit:

Overhead cost per unit:

Product C: $86,860 ÷ 2,000 units = $43.43 per unit.

Product D: $80,280 ÷ 2,700 units = $29.73 per unit.

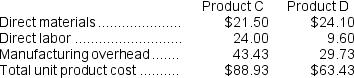

Using activity based costing,the unit product cost of each product would be:

Using these hours as a base,the predetermined overhead using direct labor-hours would be:

Using these hours as a base,the predetermined overhead using direct labor-hours would be:Predetermined overhead rate = Estimated total overhead cost ÷ Estimated total direct labor-hours

= $167,140 ÷ 6,160 DLHs = $27.13 per DLH

Using this overhead rate,the unit product costs are:

b.The activity rates for each activity cost pool are as follows:

b.The activity rates for each activity cost pool are as follows: The overhead cost charged to Product C is:

The overhead cost charged to Product C is: The overhead cost charged to Product D is:

The overhead cost charged to Product D is: Overhead cost per unit:

Overhead cost per unit:Product C: $86,860 ÷ 2,000 units = $43.43 per unit.

Product D: $80,280 ÷ 2,700 units = $29.73 per unit.

Using activity based costing,the unit product cost of each product would be:

4

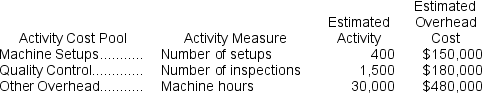

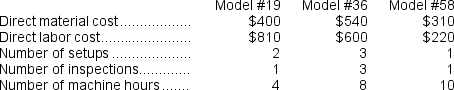

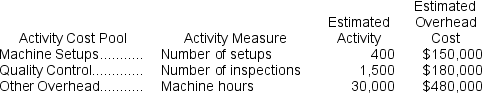

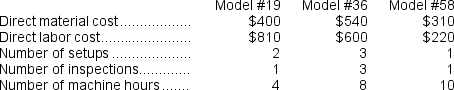

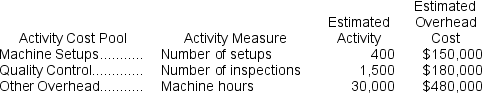

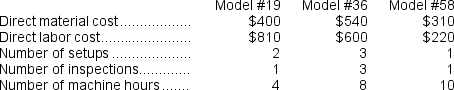

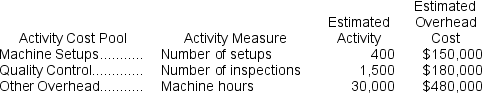

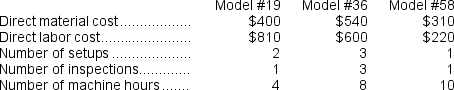

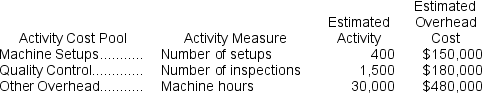

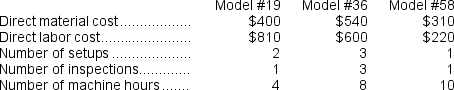

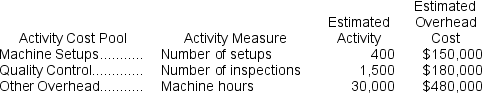

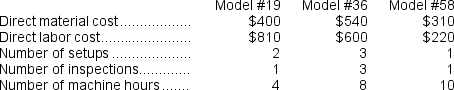

(Appendix 2A) Njombe Corporation manufactures a variety of products. In the past, Njombe has been using a traditional costing system in which the predetermined overhead rate was 150% of direct labor cost. Selling prices had been set by multiplying total product cost by 200%. Sensing that this system was distorting costs and selling prices, Njombe has decided to switch to an activity-based costing system for manufacturing overhead costs that uses the three activity cost pools listed below. Selling prices are still to be set at 200% of unit product cost under the new system. Information on these cost pools for next year are as follows:

Information (on a per unit basis) related to three popular products at Njombe are as follows:

Information (on a per unit basis) related to three popular products at Njombe are as follows:

In comparing the traditional system with the activity-based costing system,which of Njombe's Models had higher unit product costs under the traditional system?

A) #19

B) #58

C) #19 and #58

D) #36 and #58

Information (on a per unit basis) related to three popular products at Njombe are as follows:

Information (on a per unit basis) related to three popular products at Njombe are as follows:

In comparing the traditional system with the activity-based costing system,which of Njombe's Models had higher unit product costs under the traditional system?

A) #19

B) #58

C) #19 and #58

D) #36 and #58

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

(Appendix 2A) Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

The overhead cost per unit of Product B under the traditional costing system is closest to:

A) $2.34

B) $7.74

C) $4.77

D) $34.38

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)The overhead cost per unit of Product B under the traditional costing system is closest to:

A) $2.34

B) $7.74

C) $4.77

D) $34.38

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

(Appendix 2A) Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

The overhead cost per unit of Product B under the activity-based costing system is closest to:

A) $45.84

B) $7.74

C) $34.38

D) $18.41

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)The overhead cost per unit of Product B under the activity-based costing system is closest to:

A) $45.84

B) $7.74

C) $34.38

D) $18.41

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

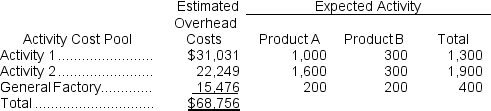

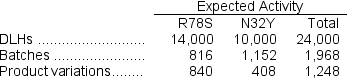

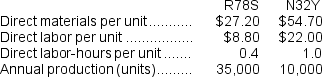

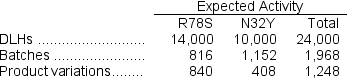

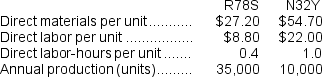

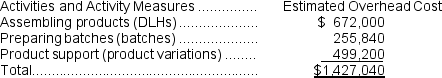

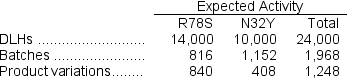

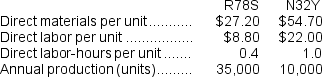

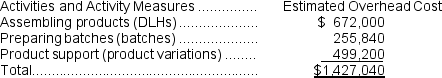

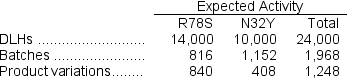

(Appendix 2A) Poma Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, R78S and N32Y, about which it has provided the following data:

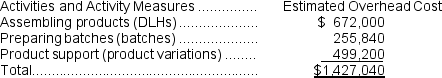

The company's estimated total manufacturing overhead for the year is $1,427,040 and the company's estimated total direct labor-hours for the year is 24,000.

The company's estimated total manufacturing overhead for the year is $1,427,040 and the company's estimated total direct labor-hours for the year is 24,000.

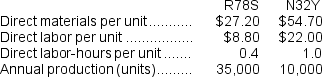

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The unit product cost of product N32Y under the activity-based costing system is closest to:

A) $136.00

B) $76.70

C) $59.30

D) $136.16

The company's estimated total manufacturing overhead for the year is $1,427,040 and the company's estimated total direct labor-hours for the year is 24,000.

The company's estimated total manufacturing overhead for the year is $1,427,040 and the company's estimated total direct labor-hours for the year is 24,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The unit product cost of product N32Y under the activity-based costing system is closest to:

A) $136.00

B) $76.70

C) $59.30

D) $136.16

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

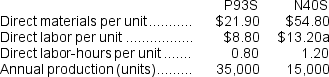

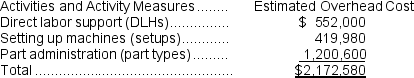

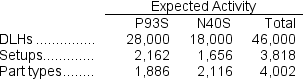

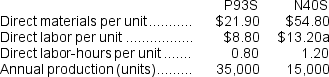

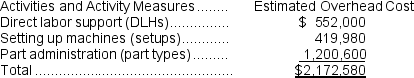

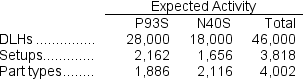

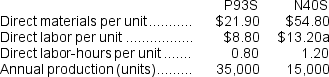

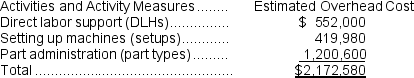

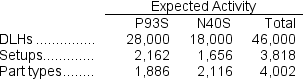

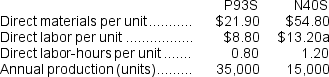

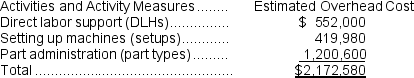

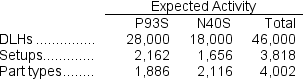

(Appendix 2A) Coudriet Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, P93S and N40S, about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $2,172,580 and the company's estimated total direct labor-hours for the year is 46,000.

The company's estimated total manufacturing overhead for the year is $2,172,580 and the company's estimated total direct labor-hours for the year is 46,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The unit product cost of product P93S under the company's traditional costing system is closest to:

A) $68.48

B) $63.26

C) $30.70

D) $40.30

The company's estimated total manufacturing overhead for the year is $2,172,580 and the company's estimated total direct labor-hours for the year is 46,000.

The company's estimated total manufacturing overhead for the year is $2,172,580 and the company's estimated total direct labor-hours for the year is 46,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The unit product cost of product P93S under the company's traditional costing system is closest to:

A) $68.48

B) $63.26

C) $30.70

D) $40.30

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

The manufacturing overhead that would be applied to a unit of product E76I under the activity-based costing system is closest to:

A) $88.28

B) $96.29

C) $184.57

D) $10.13

A) $88.28

B) $96.29

C) $184.57

D) $10.13

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

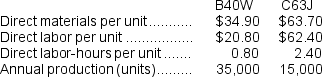

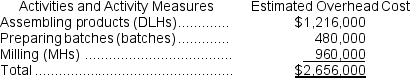

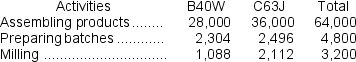

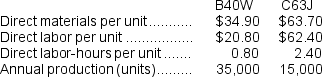

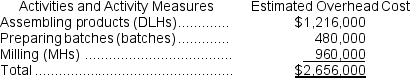

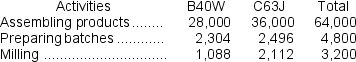

Torri Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,B40W and C63J,about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $2,656,000 and the company's estimated total direct labor-hours for the year is 64,000.

The company's estimated total manufacturing overhead for the year is $2,656,000 and the company's estimated total direct labor-hours for the year is 64,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:

a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

The company's estimated total manufacturing overhead for the year is $2,656,000 and the company's estimated total direct labor-hours for the year is 64,000.

The company's estimated total manufacturing overhead for the year is $2,656,000 and the company's estimated total direct labor-hours for the year is 64,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

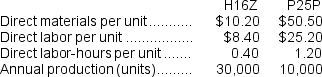

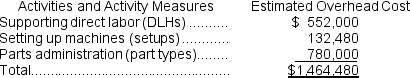

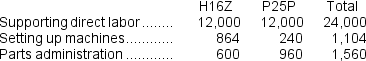

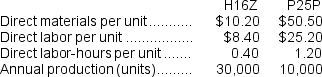

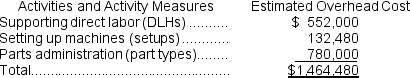

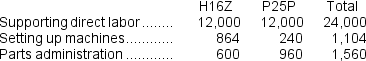

Welk Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,H16Z and P25P,about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,464,480 and the company's estimated total direct labor-hours for the year is 24,000.

The company's estimated total manufacturing overhead for the year is $1,464,480 and the company's estimated total direct labor-hours for the year is 24,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:

a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

The company's estimated total manufacturing overhead for the year is $1,464,480 and the company's estimated total direct labor-hours for the year is 24,000.

The company's estimated total manufacturing overhead for the year is $1,464,480 and the company's estimated total direct labor-hours for the year is 24,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

(Appendix 2A) Poma Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, R78S and N32Y, about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,427,040 and the company's estimated total direct labor-hours for the year is 24,000.

The company's estimated total manufacturing overhead for the year is $1,427,040 and the company's estimated total direct labor-hours for the year is 24,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The unit product cost of product R78S under the company's traditional costing system is closest to:

A) $36.00

B) $59.83

C) $47.20

D) $59.78

The company's estimated total manufacturing overhead for the year is $1,427,040 and the company's estimated total direct labor-hours for the year is 24,000.

The company's estimated total manufacturing overhead for the year is $1,427,040 and the company's estimated total direct labor-hours for the year is 24,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The unit product cost of product R78S under the company's traditional costing system is closest to:

A) $36.00

B) $59.83

C) $47.20

D) $59.78

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

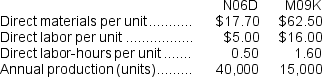

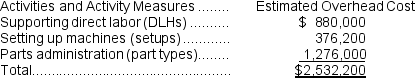

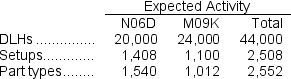

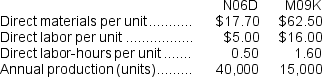

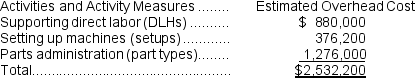

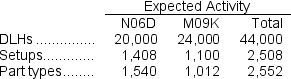

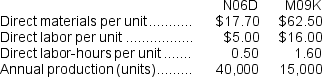

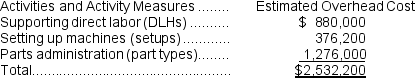

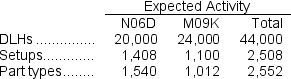

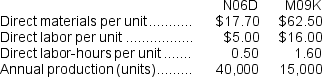

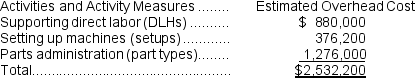

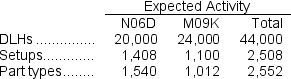

(Appendix 2A) Look Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, N06D and M09K, about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $2,532,200 and the company's estimated total direct labor-hours for the year is 44,000.

The company's estimated total manufacturing overhead for the year is $2,532,200 and the company's estimated total direct labor-hours for the year is 44,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The manufacturing overhead that would be applied to a unit of product M09K under the activity-based costing system is closest to:

A) $76.73

B) $92.08

C) $11.00

D) $168.81

The company's estimated total manufacturing overhead for the year is $2,532,200 and the company's estimated total direct labor-hours for the year is 44,000.

The company's estimated total manufacturing overhead for the year is $2,532,200 and the company's estimated total direct labor-hours for the year is 44,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The manufacturing overhead that would be applied to a unit of product M09K under the activity-based costing system is closest to:

A) $76.73

B) $92.08

C) $11.00

D) $168.81

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

(Appendix 2A) Njombe Corporation manufactures a variety of products. In the past, Njombe has been using a traditional costing system in which the predetermined overhead rate was 150% of direct labor cost. Selling prices had been set by multiplying total product cost by 200%. Sensing that this system was distorting costs and selling prices, Njombe has decided to switch to an activity-based costing system for manufacturing overhead costs that uses the three activity cost pools listed below. Selling prices are still to be set at 200% of unit product cost under the new system. Information on these cost pools for next year are as follows:

Information (on a per unit basis) related to three popular products at Njombe are as follows:

Information (on a per unit basis) related to three popular products at Njombe are as follows:

Under the activity-based costing system,what would be the selling price of one unit of Model #36?

A) $2,536

B) $2,712

C) $4,080

D) $5,506

Information (on a per unit basis) related to three popular products at Njombe are as follows:

Information (on a per unit basis) related to three popular products at Njombe are as follows:

Under the activity-based costing system,what would be the selling price of one unit of Model #36?

A) $2,536

B) $2,712

C) $4,080

D) $5,506

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

(Appendix 2A) Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

The predetermined overhead rate (i.e.,activity rate)for Activity 2 under the activity-based costing system is closest to:

A) $13.91

B) $11.71

C) $74.16

D) $36.19

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)The predetermined overhead rate (i.e.,activity rate)for Activity 2 under the activity-based costing system is closest to:

A) $13.91

B) $11.71

C) $74.16

D) $36.19

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

(Appendix 2A) Coudriet Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, P93S and N40S, about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $2,172,580 and the company's estimated total direct labor-hours for the year is 46,000.

The company's estimated total manufacturing overhead for the year is $2,172,580 and the company's estimated total direct labor-hours for the year is 46,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The unit product cost of product N40S under the activity-based costing system is closest to:

A) $68.00

B) $68.86

C) $124.68

D) $136.86

The company's estimated total manufacturing overhead for the year is $2,172,580 and the company's estimated total direct labor-hours for the year is 46,000.

The company's estimated total manufacturing overhead for the year is $2,172,580 and the company's estimated total direct labor-hours for the year is 46,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The unit product cost of product N40S under the activity-based costing system is closest to:

A) $68.00

B) $68.86

C) $124.68

D) $136.86

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

(Appendix 2A) Look Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, N06D and M09K, about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $2,532,200 and the company's estimated total direct labor-hours for the year is 44,000.

The company's estimated total manufacturing overhead for the year is $2,532,200 and the company's estimated total direct labor-hours for the year is 44,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The manufacturing overhead that would be applied to a unit of product N06D under the company's traditional costing system is closest to:

A) $28.78

B) $10.00

C) $63.31

D) $34.53

The company's estimated total manufacturing overhead for the year is $2,532,200 and the company's estimated total direct labor-hours for the year is 44,000.

The company's estimated total manufacturing overhead for the year is $2,532,200 and the company's estimated total direct labor-hours for the year is 44,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The manufacturing overhead that would be applied to a unit of product N06D under the company's traditional costing system is closest to:

A) $28.78

B) $10.00

C) $63.31

D) $34.53

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

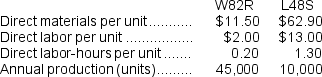

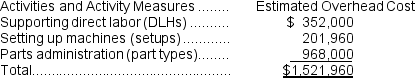

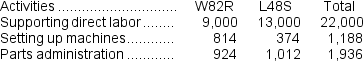

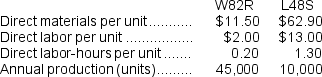

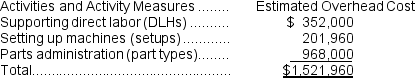

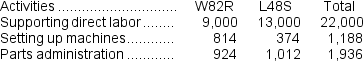

Werger Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,W82R and L48S,about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,521,960 and the company's estimated total direct labor-hours for the year is 22,000.

The company's estimated total manufacturing overhead for the year is $1,521,960 and the company's estimated total direct labor-hours for the year is 22,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:

a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

The company's estimated total manufacturing overhead for the year is $1,521,960 and the company's estimated total direct labor-hours for the year is 22,000.

The company's estimated total manufacturing overhead for the year is $1,521,960 and the company's estimated total direct labor-hours for the year is 22,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

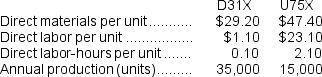

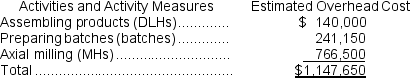

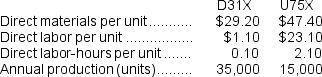

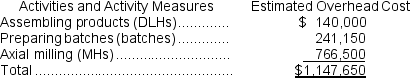

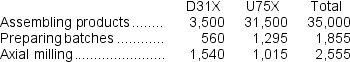

Bullie Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,D31X and U75X,about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,147,650 and the company's estimated total direct labor-hours for the year is 35,000.

The company's estimated total manufacturing overhead for the year is $1,147,650 and the company's estimated total direct labor-hours for the year is 35,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:

a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

The company's estimated total manufacturing overhead for the year is $1,147,650 and the company's estimated total direct labor-hours for the year is 35,000.

The company's estimated total manufacturing overhead for the year is $1,147,650 and the company's estimated total direct labor-hours for the year is 35,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

(Appendix 2A) Njombe Corporation manufactures a variety of products. In the past, Njombe has been using a traditional costing system in which the predetermined overhead rate was 150% of direct labor cost. Selling prices had been set by multiplying total product cost by 200%. Sensing that this system was distorting costs and selling prices, Njombe has decided to switch to an activity-based costing system for manufacturing overhead costs that uses the three activity cost pools listed below. Selling prices are still to be set at 200% of unit product cost under the new system. Information on these cost pools for next year are as follows:

Information (on a per unit basis) related to three popular products at Njombe are as follows:

Information (on a per unit basis) related to three popular products at Njombe are as follows:

Under the traditional costing system,what would be the selling price of one unit of Model #36?

A) $2,536

B) $2,712

C) $4,080

D) $5,506

Information (on a per unit basis) related to three popular products at Njombe are as follows:

Information (on a per unit basis) related to three popular products at Njombe are as follows:

Under the traditional costing system,what would be the selling price of one unit of Model #36?

A) $2,536

B) $2,712

C) $4,080

D) $5,506

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck