Deck 10: Performance Measurement in Decentralized Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

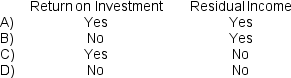

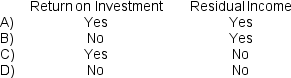

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/180

Play

Full screen (f)

Deck 10: Performance Measurement in Decentralized Organizations

1

A manufacturing cycle efficiency (MCE)of less than one is impossible.

False

2

Residual income should be used to evaluate an investment center rather than a cost or profit center.

True

3

A change in sales has no effect on margin and turnover.

False

4

A manufacturing cycle efficiency (MCE)ratio of less than 1.00 is desirable because this is the ratio of non-value-added time to throughput time.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

5

Land held for possible plant expansion would be included as an operating asset when computing return on investment (ROI).

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

6

A manager would generally like to see a trend indicating a decrease in setup time.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

7

Net operating income is income before interest and taxes.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

8

When used in return on investment (ROI)calculations, turnover equals sales divided by average operating assets.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose a company evaluates divisional performance using both ROI and residual income.The company's minimum required rate of return for the purposes of residual income calculations is 12%.If a division has a residual income of $6,000, then its ROI is less than 12%.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

10

All other things the same, an increase in unit sales will normally result in an increase in the return on investment.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

11

Move time is considered non-value-added time.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

12

The use of return on investment (ROI)as a performance measure may lead managers to reject a project that would be favorable for the company as a whole.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

13

An advantage of using ROI to evaluate performance is that it encourages the manager to reduce the investment in operating assets as well as increase net operating income.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

14

Throughput time is the amount of time required to move a completed unit from the factory floor to the warehouse.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

15

Return on investment (ROI)equals margin multiplied by sales.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

16

If the MCE is equal to 0.6, then 60% of the time a unit is in process is spent on activities that add value to the product.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

17

Residual income can be used most effectively in comparing the performance of divisions of different size.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

18

ROI and residual income are tools used to evaluate managerial performance in investment centers.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

19

If a company contains a number of investment centers of differing sizes, return on investment (ROI)should be used rather than residual income to rank the financial performance of the divisions.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

20

Residual income is the difference between net operating income and the product of average operating assets and the minimum rate of return.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

21

If a strategy is not working, it should become evident on the balanced scorecard when some of the predicted effects don't occur.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

22

In essence, a balanced scorecard lays out a theory of how the company can take concrete actions to attain its desired outcomes.The strategy should seem plausible, but it should be regarded as only a theory.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following will not result in an increase in return on investment (ROI), assuming other factors remain the same?

A)A reduction in expenses.

B)An increase in net operating income.

C)An increase in operating assets.

D)An increase in sales.

A)A reduction in expenses.

B)An increase in net operating income.

C)An increase in operating assets.

D)An increase in sales.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

24

A cost center is a responsibility center.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

25

Queue time is considered non-value-added time.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

26

Financial measures tend to be lag indicators that report on the results of past actions.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

27

If the balanced scorecard is correctly constructed, the performance measures should be independent of each other so that bad performance on one measure will not result in bad performance on another performance measure.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following would be an argument for using the gross cost of plant and equipment as part of operating assets in return on investment computations?

A)It is consistent with the computation of net operating income, which includes depreciation as an operating expense.

B)It is consistent with the balance sheet presentation of plant and equipment.

C)It eliminates the age of equipment as a factor in ROI computations.

D)It discourages the replacement of old, worn-out equipment because of the dramatic, adverse effect on ROI.

A)It is consistent with the computation of net operating income, which includes depreciation as an operating expense.

B)It is consistent with the balance sheet presentation of plant and equipment.

C)It eliminates the age of equipment as a factor in ROI computations.

D)It discourages the replacement of old, worn-out equipment because of the dramatic, adverse effect on ROI.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

29

Under a responsibility accounting system, fewer expenses are charged against managers the higher one moves upward in an organization.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

30

If improvement in a performance measure on a balanced scorecard should lead to improvement in another performance measure, but does not, then employees must work harder.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following would not be included in operating assets in return on investment calculations?

A)Cash.

B)Accounts Receivable.

C)Equipment

D)Factory building rented to (and occupied by)another company.

A)Cash.

B)Accounts Receivable.

C)Equipment

D)Factory building rented to (and occupied by)another company.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

32

Incentive compensation for employees, such as bonuses, should be tied to balanced scorecard performance measures only if managers are confident that the performance measures are easily manipulated by those being evaluated.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

33

Inspection Time is generally considered to be value-added time.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

34

The performance measures on a balanced scorecard tend to fall into four groups: financial measures, customer measures, internal business process measures, and learning and growth measures.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

35

A profit center is responsible for generating revenue, but it is not responsible for controlling costs.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

36

Financial measures such as ROI are generally better than nonfinancial measures of key success drivers such as customer satisfaction as leading indicators of future financial performance.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

37

A balanced scorecard consists of a report showing a performance measure such as ROI or residual income for all of the divisions in a company that generate profits.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

38

A balanced scorecard contains both customer and internal business process performance measures because improvements in internal business process should result in improvements in customer satisfaction.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

39

Financial measures such as ROI and residual income as well as operating measures may be included in a balanced scorecard.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

40

The basic objective of responsibility accounting is to charge each manager with those costs and/or revenues over which he has control.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

41

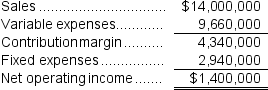

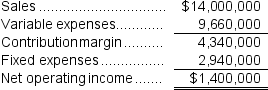

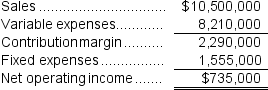

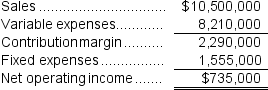

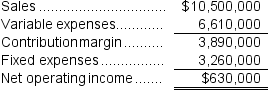

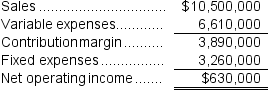

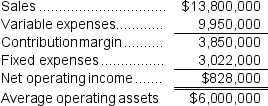

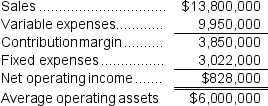

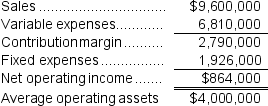

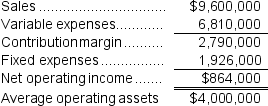

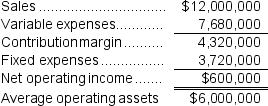

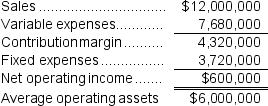

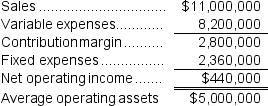

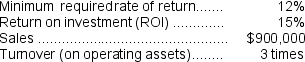

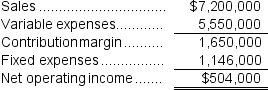

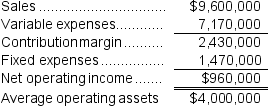

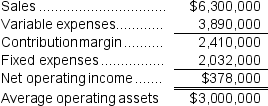

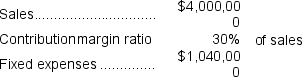

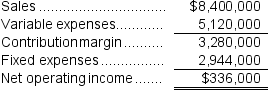

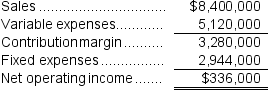

Leete Inc.reported the following results from last year's operations:  Last year's margin was closest to:

Last year's margin was closest to:

A)79.0%

B)31.0%

C)20.0%

D)10.0%

Last year's margin was closest to:

Last year's margin was closest to:A)79.0%

B)31.0%

C)20.0%

D)10.0%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following measures of performance encourages continued expansion by an investment center so long as it is able to earn a return in excess of the minimum required return on average operating assets?

A)return on investment

B)transfer pricing

C)the contribution approach

D)residual income

A)return on investment

B)transfer pricing

C)the contribution approach

D)residual income

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

43

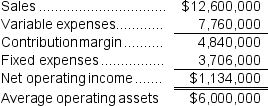

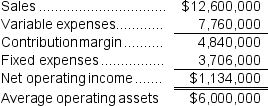

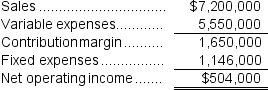

Nasser Inc.reported the following results from last year's operations:  Last year's return on investment (ROI)was closest to:

Last year's return on investment (ROI)was closest to:

A)9.0%

B)47.6%

C)18.9%

D)80.7%

Last year's return on investment (ROI)was closest to:

Last year's return on investment (ROI)was closest to:A)9.0%

B)47.6%

C)18.9%

D)80.7%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following would be considered an operating asset in return on investment computations?

A)Land being held for plant expansion.

B)Treasury stock.

C)Accounts receivable.

D)Common stock.

A)Land being held for plant expansion.

B)Treasury stock.

C)Accounts receivable.

D)Common stock.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

45

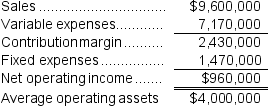

Anguiano Inc.reported the following results from last year's operations:  The company's average operating assets were $5,000,000.

The company's average operating assets were $5,000,000.

Last year's return on investment (ROI)was closest to:

A)7.0%

B)14.7%

C)45.8%

D)47.6%

The company's average operating assets were $5,000,000.

The company's average operating assets were $5,000,000. Last year's return on investment (ROI)was closest to:

A)7.0%

B)14.7%

C)45.8%

D)47.6%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

46

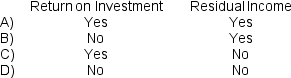

Which of the following segment performance measures will decrease if there is an increase in the interest expense for that segment?

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

47

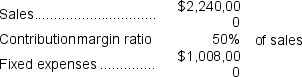

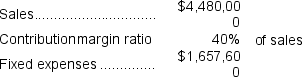

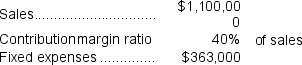

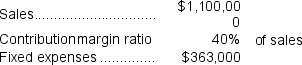

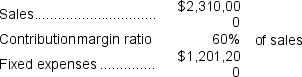

Othman Inc.has a $800,000 investment opportunity with the following characteristics:  The margin for this investment opportunity is closest to:

The margin for this investment opportunity is closest to:

A)50.0%

B)45.0%

C)5.0%

D)55.0%

The margin for this investment opportunity is closest to:

The margin for this investment opportunity is closest to:A)50.0%

B)45.0%

C)5.0%

D)55.0%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

48

Runyon Inc.reported the following results from last year's operations:  The company's average operating assets were $7,000,000.

The company's average operating assets were $7,000,000.

Last year's turnover was closest to:

A)0.42

B)14.29

C)0.07

D)2.40

The company's average operating assets were $7,000,000.

The company's average operating assets were $7,000,000. Last year's turnover was closest to:

A)0.42

B)14.29

C)0.07

D)2.40

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

49

All other things equal, which of the following would increase a division's residual income?

A)Increase in expenses.

B)Decrease in average operating assets.

C)Increase in minimum required return.

D)Decrease in net operating income.

A)Increase in expenses.

B)Decrease in average operating assets.

C)Increase in minimum required return.

D)Decrease in net operating income.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

50

BR Company has a contribution margin of 40%.Sales are $312,500, net operating income is $25,000, and average operating assets are $200,000.What is the company's return on investment (ROI)?

A)12.5%

B)62.5%

C)8.0%

D)64.0%

A)12.5%

B)62.5%

C)8.0%

D)64.0%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

51

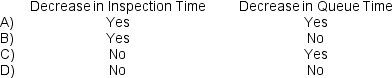

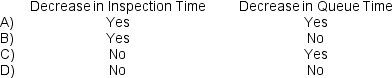

Which of the following will increase a company's manufacturing cycle efficiency (MCE)?

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

52

Youns Inc.reported the following results from last year's operations:  The company's average operating assets were $5,000,000.

The company's average operating assets were $5,000,000.

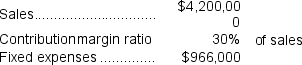

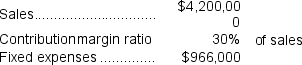

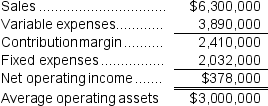

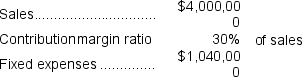

At the beginning of this year, the company has a $1,400,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $616,000, and a contribution margin ratio of 30% of sales.

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

A)9.50

B)1.64

C)2.66

D)2.08

The company's average operating assets were $5,000,000.

The company's average operating assets were $5,000,000. At the beginning of this year, the company has a $1,400,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $616,000, and a contribution margin ratio of 30% of sales.

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

A)9.50

B)1.64

C)2.66

D)2.08

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

53

Selma Inc.reported the following results from last year's operations:  Last year's margin was closest to:

Last year's margin was closest to:

A)78.1%

B)6.0%

C)13.8%

D)27.9%

Last year's margin was closest to:

Last year's margin was closest to:A)78.1%

B)6.0%

C)13.8%

D)27.9%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

54

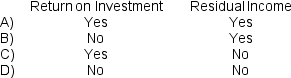

Which of the following performance measures will increase if inventory decreases and all else remains the same?

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

55

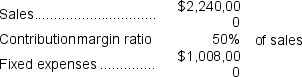

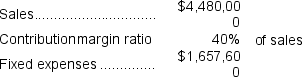

Tennill Inc.has a $1,400,000 investment opportunity with the following characteristics:  The ROI for this year's investment opportunity considered alone is closest to:

The ROI for this year's investment opportunity considered alone is closest to:

A)8.1%

B)128.0%

C)3.0%

D)9.6%

The ROI for this year's investment opportunity considered alone is closest to:

The ROI for this year's investment opportunity considered alone is closest to:A)8.1%

B)128.0%

C)3.0%

D)9.6%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

56

A segment of a business responsible for both revenues and expenses would be called:

A)a cost center.

B)an investment center.

C)a profit center.

D)residual income.

A)a cost center.

B)an investment center.

C)a profit center.

D)residual income.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

57

Chiodini Inc.has a $900,000 investment opportunity that involves sales of $2,430,000, fixed expenses of $1,044,900, and a contribution margin ratio of 50% of sales.The ROI for this year's investment opportunity considered alone is closest to:

A)16.3%

B)18.9%

C)7.0%

D)135.0%

A)16.3%

B)18.9%

C)7.0%

D)135.0%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

58

Some investment opportunities that should be accepted from the viewpoint of the entire company may be rejected by a manager who is evaluated on the basis of:

A)return on investment.

B)residual income.

C)contribution margin.

D)segment margin.

A)return on investment.

B)residual income.

C)contribution margin.

D)segment margin.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

59

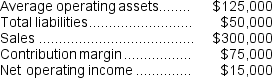

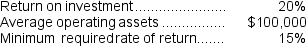

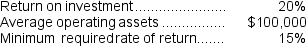

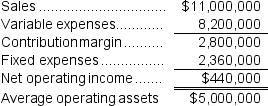

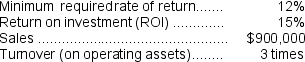

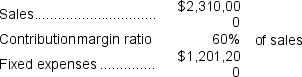

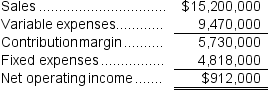

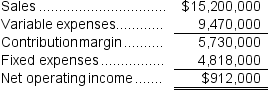

Given the following data:  Return on investment (ROI)is:

Return on investment (ROI)is:

A)30%

B)5%

C)20%

D)12%

Return on investment (ROI)is:

Return on investment (ROI)is:A)30%

B)5%

C)20%

D)12%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

60

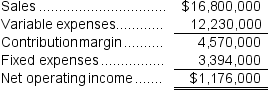

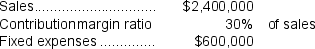

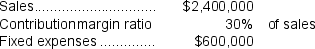

Cirone Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:  If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

A)3.1%

B)8.4%

C)6.3%

D)12.1%

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:  If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:A)3.1%

B)8.4%

C)6.3%

D)12.1%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

61

Tallon Inc.has a $1,200,000 investment opportunity that involves sales of $1,680,000, fixed expenses of $336,000, and a contribution margin ratio of 30% of sales.The turnover for this investment opportunity is closest to:

A)1.40

B)0.10

C)10.00

D)0.71

A)1.40

B)0.10

C)10.00

D)0.71

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

62

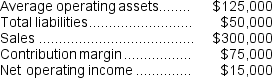

The following data has been provided for a company's most recent year of operations:  The residual income for the year was closest to:

The residual income for the year was closest to:

A)$20,000

B)$3,000

C)$5,000

D)$15,000

The residual income for the year was closest to:

The residual income for the year was closest to:A)$20,000

B)$3,000

C)$5,000

D)$15,000

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

63

Mike Corporation uses residual income to evaluate the performance of its divisions.The company's minimum required rate of return is 14%.In January, the Commercial Products Division had average operating assets of $970,000 and net operating income of $143,700.What was the Commercial Products Division's residual income in January?

A)$7,900

B)-$20,118

C)$20,118

D)-$7,900

A)$7,900

B)-$20,118

C)$20,118

D)-$7,900

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

64

Chavin Company had the following results during August: net operating income, $220,000; turnover, 5; and ROI 25%.Chavin Company's average operating assets were:

A)$880,000

B)$44,000

C)$55,000

D)$1,100,000

A)$880,000

B)$44,000

C)$55,000

D)$1,100,000

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

65

Boespflug Inc.has a $1,000,000 investment opportunity that involves sales of $900,000, fixed expenses of $225,000, and a contribution margin ratio of 30% of sales.The margin for this investment opportunity is closest to:

A)5.0%

B)25.0%

C)75.0%

D)30.0%

A)5.0%

B)25.0%

C)75.0%

D)30.0%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

66

Lumsden Inc.has a $1,200,000 investment opportunity with the following characteristics:  The company's minimum required rate of return is 7%.The residual income for this year's investment opportunity is closest to:

The company's minimum required rate of return is 7%.The residual income for this year's investment opportunity is closest to:

A)$120,000

B)$36,000

C)$0

D)$84,000

The company's minimum required rate of return is 7%.The residual income for this year's investment opportunity is closest to:

The company's minimum required rate of return is 7%.The residual income for this year's investment opportunity is closest to:A)$120,000

B)$36,000

C)$0

D)$84,000

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

67

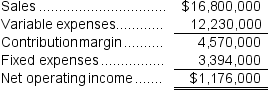

Condren Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:  If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:

A)1.1%

B)8.6%

C)9.7%

D)11.3%

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:  If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:A)1.1%

B)8.6%

C)9.7%

D)11.3%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

68

If net operating income is $70,000, average operating assets are $250,000, and the minimum required rate of return is 16%, what is the residual income?

A)$11,200

B)$40,000

C)$110,000

D)$30,000

A)$11,200

B)$40,000

C)$110,000

D)$30,000

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

69

Worsell Inc.reported the following results from last year's operations:  The company's minimum required rate of return is 10%.Last year's residual income was closest to:

The company's minimum required rate of return is 10%.Last year's residual income was closest to:

A)$440,000

B)$490,000

C)($638,000)

D)($60,000)

The company's minimum required rate of return is 10%.Last year's residual income was closest to:

The company's minimum required rate of return is 10%.Last year's residual income was closest to:A)$440,000

B)$490,000

C)($638,000)

D)($60,000)

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

70

The following information relates to last year's operations at the Legumes Division of Gervani Corporation:  What was the Legume Division's net operating income last year?

What was the Legume Division's net operating income last year?

A)$108,000

B)$135,000

C)$36,000

D)$45,000

What was the Legume Division's net operating income last year?

What was the Legume Division's net operating income last year?A)$108,000

B)$135,000

C)$36,000

D)$45,000

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

71

Salvey Inc.reported the following results from last year's operations:

The company's average operating assets were $3,000,000.

At the beginning of this year, the company has a $300,000 investment opportunity that involves sales of $480,000, fixed expenses of $100,800, and a contribution margin ratio of 30% of sales.

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:

A)16.6%

B)1.3%

C)18.2%

D)15.3%

The company's average operating assets were $3,000,000.

At the beginning of this year, the company has a $300,000 investment opportunity that involves sales of $480,000, fixed expenses of $100,800, and a contribution margin ratio of 30% of sales.

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:

A)16.6%

B)1.3%

C)18.2%

D)15.3%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

72

Last year a company had sales of $600,000, a turnover of 3.6, and a return on investment of 18%.The company's net operating income for the year was:

A)$166,667

B)$108,000

C)$30,000

D)$15,000

A)$166,667

B)$108,000

C)$30,000

D)$15,000

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

73

Canedo Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $700,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $700,000 investment opportunity with the following characteristics:  If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

A)2.98

B)17.01

C)2.53

D)2.04

At the beginning of this year, the company has a $700,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $700,000 investment opportunity with the following characteristics:  If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:A)2.98

B)17.01

C)2.53

D)2.04

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

74

Bungert Inc.reported the following results from last year's operations:  The company's minimum required rate of return is 12% and its average operating assets were $8,000,000.Last year's residual income was closest to:

The company's minimum required rate of return is 12% and its average operating assets were $8,000,000.Last year's residual income was closest to:

A)$912,000

B)($48,000)

C)$992,000

D)($972,800)

The company's minimum required rate of return is 12% and its average operating assets were $8,000,000.Last year's residual income was closest to:

The company's minimum required rate of return is 12% and its average operating assets were $8,000,000.Last year's residual income was closest to:A)$912,000

B)($48,000)

C)$992,000

D)($972,800)

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

75

Verbeke Inc.reported the following results from last year's operations:  Last year's turnover was closest to:

Last year's turnover was closest to:

A)16.67

B)0.06

C)2.10

D)0.48

Last year's turnover was closest to:

Last year's turnover was closest to:A)16.67

B)0.06

C)2.10

D)0.48

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

76

In November, the Universal Solutions Division of Keaffaber Corporation had average operating assets of $480,000 and net operating income of $46,200.The company uses residual income, with a minimum required rate of return of 11%, to evaluate the performance of its divisions.What was the Universal Solutions Division's residual income in November?

A)-$6,600

B)$5,082

C)$6,600

D)-$5,082

A)-$6,600

B)$5,082

C)$6,600

D)-$5,082

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

77

Braymiller Inc.has a $1,600,000 investment opportunity with the following characteristics:  The turnover for this investment opportunity is closest to:

The turnover for this investment opportunity is closest to:

A)0.04

B)0.40

C)2.50

D)25.00

The turnover for this investment opportunity is closest to:

The turnover for this investment opportunity is closest to:A)0.04

B)0.40

C)2.50

D)25.00

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

78

Tadman Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $800,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $756,000, and a contribution margin ratio of 30% of sales.

At the beginning of this year, the company has a $800,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $756,000, and a contribution margin ratio of 30% of sales.

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

A)1.0%

B)3.0%

C)5.0%

D)3.8%

At the beginning of this year, the company has a $800,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $756,000, and a contribution margin ratio of 30% of sales.

At the beginning of this year, the company has a $800,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $756,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

A)1.0%

B)3.0%

C)5.0%

D)3.8%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

79

Pankey Inc.has a $700,000 investment opportunity that would involve sales of $1,050,000, a contribution margin ratio of 40% of sales, and fixed expenses of $325,500.The company's minimum required rate of return is 18%.The residual income for this year's investment opportunity is closest to:

A)($31,500)

B)$0

C)$94,500

D)$124,600

A)($31,500)

B)$0

C)$94,500

D)$124,600

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

80

Largo Company recorded for the past year sales of $750,000 and average operating assets of $375,000.What is the margin that Largo Company needed to earn in order to achieve an ROI of 15%?

A)2.00%

B)15.00%

C)9.99%

D)7.50%

A)2.00%

B)15.00%

C)9.99%

D)7.50%

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck