Deck 10: Credit Risk I: Individual Loan Risk

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/66

Play

Full screen (f)

Deck 10: Credit Risk I: Individual Loan Risk

1

The term 'spot loan' refers a loan:

A)that is granted on the spot.

B)that needs to be repaid on the spot.

C)granted at the spot rate.

D)for which the full loan amount is withdrawn by the borrower on the spot.

A)that is granted on the spot.

B)that needs to be repaid on the spot.

C)granted at the spot rate.

D)for which the full loan amount is withdrawn by the borrower on the spot.

D

2

The term 'loan rating' refers to the process of individual loans being given credit rating by:

A)rating agencies dependent on the lender's credit assessment.

B)rating agencies dependent on the lender's credit assessment.

C)lenders dependent on a credit rating agency's credit assessment.

D)lenders independent of a credit rating agency's credit assessment.

A)rating agencies dependent on the lender's credit assessment.

B)rating agencies dependent on the lender's credit assessment.

C)lenders dependent on a credit rating agency's credit assessment.

D)lenders independent of a credit rating agency's credit assessment.

A B

3

Which of the following statements is true?

A)A line of credit facility is a credit facility with a maximum size and a minimum period of time over which the borrower can withdraw funds.

B)A line of credit facility is a credit facility with a minimum size and a minimum period of time over which the borrower can withdraw funds.

C)A line of credit facility is a credit facility with a maximum size and a maximum period of time over which the borrower can withdraw funds.

D)A line of credit facility is a credit facility with a minimum size and a maximum period of time over which the borrower can withdraw funds.

A)A line of credit facility is a credit facility with a maximum size and a minimum period of time over which the borrower can withdraw funds.

B)A line of credit facility is a credit facility with a minimum size and a minimum period of time over which the borrower can withdraw funds.

C)A line of credit facility is a credit facility with a maximum size and a maximum period of time over which the borrower can withdraw funds.

D)A line of credit facility is a credit facility with a minimum size and a maximum period of time over which the borrower can withdraw funds.

C

4

Which of the following statements is true?

A)Arbitrage means the inability to make a profit without taking risk.

B)Arbitrage means that an FI takes risks in order to make a profit.

C)Arbitrage means that an FI does not take any and thus does not make a profit.

D)Arbitrage means the ability to make a profit without taking risk.

A)Arbitrage means the inability to make a profit without taking risk.

B)Arbitrage means that an FI takes risks in order to make a profit.

C)Arbitrage means that an FI does not take any and thus does not make a profit.

D)Arbitrage means the ability to make a profit without taking risk.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is true?

A)A commercial paper is an unsecured long-term debt instrument issued by corporations.

B)A commercial paper is a secured long-term debt instrument issued by corporations.

C)A commercial paper is a secured short-term debt instrument issued by corporations.

D)A commercial paper is an unsecured short-term debt instrument issued by corporations.

A)A commercial paper is an unsecured long-term debt instrument issued by corporations.

B)A commercial paper is a secured long-term debt instrument issued by corporations.

C)A commercial paper is a secured short-term debt instrument issued by corporations.

D)A commercial paper is an unsecured short-term debt instrument issued by corporations.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is true?

A)Marginal mortality rate is the historic default rate experience of a bond or loan.

B)The mortality rate is the probability of a bond or loan defaulting over a specified multi-year period.

C)Marginal mortality rate is the probability of a bond or loan defaulting in any given year of issue.

D)Marginal mortality rate is the probability of a bond or loan defaulting over a specified multi-year period.

A)Marginal mortality rate is the historic default rate experience of a bond or loan.

B)The mortality rate is the probability of a bond or loan defaulting over a specified multi-year period.

C)Marginal mortality rate is the probability of a bond or loan defaulting in any given year of issue.

D)Marginal mortality rate is the probability of a bond or loan defaulting over a specified multi-year period.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is true?

A)Cumulative default probability is the probability that a borrower will default over a specified multi-year period.

B)Cumulative default probability is the probability that a borrower will default in any given year.

C)Marginal default probability is the probability that a cluster of borrowers will default over a specified multi-year period.

D)None of the listed options are correct.

A)Cumulative default probability is the probability that a borrower will default over a specified multi-year period.

B)Cumulative default probability is the probability that a borrower will default in any given year.

C)Marginal default probability is the probability that a cluster of borrowers will default over a specified multi-year period.

D)None of the listed options are correct.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements is true?

A)An example of a covenant is a restriction that limits those actions of the borrower that have an impact on the probability of repayment.

B)An example of a covenant is a restriction that encourages those actions of the borrower that have an impact on the probability of repayment.

C)A covenant is a restriction written into either bond or loan contracts.

D)All of the listed options are correct.

A)An example of a covenant is a restriction that limits those actions of the borrower that have an impact on the probability of repayment.

B)An example of a covenant is a restriction that encourages those actions of the borrower that have an impact on the probability of repayment.

C)A covenant is a restriction written into either bond or loan contracts.

D)All of the listed options are correct.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

9

A loan provided by a group of FIs as opposed to a single lender is called:

A)a joint loan.

B)project finance.

C)a syndicated loan.

D)a multiple loan.

A)a joint loan.

B)project finance.

C)a syndicated loan.

D)a multiple loan.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is false?

A)Default risk is the risk that the borrower is willing but unable to fulfil the terms promised under loan contract.

B)Default risk is the risk that the borrower refinances the loan before maturity.

C)Default risk is the risk that the borrower is able but unwilling to fulfil the terms promised under loan contract.

D)Default risk is the risk that the borrower is unable and unwilling to fulfil the terms promised under loan contract.

A)Default risk is the risk that the borrower is willing but unable to fulfil the terms promised under loan contract.

B)Default risk is the risk that the borrower refinances the loan before maturity.

C)Default risk is the risk that the borrower is able but unwilling to fulfil the terms promised under loan contract.

D)Default risk is the risk that the borrower is unable and unwilling to fulfil the terms promised under loan contract.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

11

The prime lending rate is the:

A)risk premium periodically set by the RBA.

B)base lending rate periodically set by banks.

C)base lending rate periodically set by the RBA.

D)risk premium periodically set by banks.

A)risk premium periodically set by the RBA.

B)base lending rate periodically set by banks.

C)base lending rate periodically set by the RBA.

D)risk premium periodically set by banks.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

12

The term 'asset-backed loan' refers to a loan that is backed by a:

A)first claim on certain assets of the borrower if default occurs.

B)second claim on certain assets of the borrower at maturity.

C)first claim on certain assets of the borrower at maturity.

D)None of the listed options are correct.

A)first claim on certain assets of the borrower if default occurs.

B)second claim on certain assets of the borrower at maturity.

C)first claim on certain assets of the borrower at maturity.

D)None of the listed options are correct.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements is true?

A)Zero-coupon corporate bonds are bonds without any intervening cash flows between issue and maturity and thus these bonds typically sell at a large discount from face value.

B)Zero-coupon corporate bonds are bonds with semi-annual cash flows between issue and maturity and thus these bonds typically sell at a large discount from face value.

C)Zero-coupon corporate bonds are bonds without any intervening cash flows between issue and maturity and thus these bonds typically sell at a small discount from face value.

D)Zero-coupon corporate bonds are bonds with annual cash flows between issue and maturity and thus these bonds typically sell at a large discount from face value.

A)Zero-coupon corporate bonds are bonds without any intervening cash flows between issue and maturity and thus these bonds typically sell at a large discount from face value.

B)Zero-coupon corporate bonds are bonds with semi-annual cash flows between issue and maturity and thus these bonds typically sell at a large discount from face value.

C)Zero-coupon corporate bonds are bonds without any intervening cash flows between issue and maturity and thus these bonds typically sell at a small discount from face value.

D)Zero-coupon corporate bonds are bonds with annual cash flows between issue and maturity and thus these bonds typically sell at a large discount from face value.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

14

An unsecured loan is also referred to as:

A)non-asset backed loan.

B)mezzanine debt.

C)junior debt.

D)senior debt.

A)non-asset backed loan.

B)mezzanine debt.

C)junior debt.

D)senior debt.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements is true?

A)A credit scoring model is a mathematical model that considers a borrower's credit rating to make loan decisions.

B)A credit scoring model is a model that relies on expert knowledge to make loan decisions.

C)A credit scoring model is a mathematical model that uses observed borrower characteristics to calculate a score representing the applicant's probability of default or to sort borrowers into different default classes.

D)A credit scoring model is a mathematical model that uses neural networks to make loan decisions.

A)A credit scoring model is a mathematical model that considers a borrower's credit rating to make loan decisions.

B)A credit scoring model is a model that relies on expert knowledge to make loan decisions.

C)A credit scoring model is a mathematical model that uses observed borrower characteristics to calculate a score representing the applicant's probability of default or to sort borrowers into different default classes.

D)A credit scoring model is a mathematical model that uses neural networks to make loan decisions.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is true?

A)RAROC is the risk-adjusted return on capital.

B)RAROC is calculated as the capital at risk divided by the loan's income.

C)RAROC should always be below an FI's RAROC benchmark as otherwise the FI increases its default risk exposure.

D)None of the listed options are correct.

A)RAROC is the risk-adjusted return on capital.

B)RAROC is calculated as the capital at risk divided by the loan's income.

C)RAROC should always be below an FI's RAROC benchmark as otherwise the FI increases its default risk exposure.

D)None of the listed options are correct.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

17

The term disintermediation refers to the process in which firms access:

A)money markets directly.

B)money markets via financial intermediaries.

C)capital markets directly.

D)capital markets via financial intermediaries.

A)money markets directly.

B)money markets via financial intermediaries.

C)capital markets directly.

D)capital markets via financial intermediaries.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is true?

A)Credit rationing means that the FI restricts the quantity of loans made available to an individual borrower.

B)Credit rationing means that the FI restricts the type of loans made available to an individual borrower.

C)Credit rationing means that the FI restricts the quality of loans made available to an individual borrower.

D)Credit rationing means that the FI does not have sufficient funds available for lending and thus only grants loans to selected borrowers.

A)Credit rationing means that the FI restricts the quantity of loans made available to an individual borrower.

B)Credit rationing means that the FI restricts the type of loans made available to an individual borrower.

C)Credit rationing means that the FI restricts the quality of loans made available to an individual borrower.

D)Credit rationing means that the FI does not have sufficient funds available for lending and thus only grants loans to selected borrowers.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

19

A credit line on which a borrower can both draw and repay many times over the life of the loan contract is called a:

A)reviving loan.

B)revolving loan.

C)refilling loan.

D)A credit line does not exist.

A)reviving loan.

B)revolving loan.

C)refilling loan.

D)A credit line does not exist.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is the correct definition of leverage?

A)The ratio of equity to debt.

B)The ratio of assets to debt.

C)The ratio of debt to assets.

D)The ratio of debt to equity.

A)The ratio of equity to debt.

B)The ratio of assets to debt.

C)The ratio of debt to assets.

D)The ratio of debt to equity.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

21

In the context of the KMV Credit Monitor Model, the market value of a risky loan made by a lender to a borrower can be expressed as:

A)F(r) = Be-i/r[(1/d)N(h1) + N(h2)]

B)F(r) = Be-ir[(1/d)N(h1) + N(h2)]

C)F(r) = Be-ir[(1/d)- N(h1) + N(h2)]

D)F(r) = Be-ir[(1/d)N(h1) *N(h2)]

A)F(r) = Be-i/r[(1/d)N(h1) + N(h2)]

B)F(r) = Be-ir[(1/d)N(h1) + N(h2)]

C)F(r) = Be-ir[(1/d)- N(h1) + N(h2)]

D)F(r) = Be-ir[(1/d)N(h1) *N(h2)]

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

22

How would you interpret a Z score of 2.25?

A)The Z score lies within the 'safe' zone and thus a loan should be granted.

B)The Z score lies within the 'high default' zone and thus a loan should be granted.

C)The Z score lies within the 'zone of ignorance' and thus the borrower may or may not default.

D)The interpretation of the Z score is always dependent on an FI manager's subjective opinion.

A)The Z score lies within the 'safe' zone and thus a loan should be granted.

B)The Z score lies within the 'high default' zone and thus a loan should be granted.

C)The Z score lies within the 'zone of ignorance' and thus the borrower may or may not default.

D)The interpretation of the Z score is always dependent on an FI manager's subjective opinion.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

23

Assume the interest rate in the market for one-year zero-coupon government bonds is i = 7.5 per cent and the rate for one-year zero-coupon grade BB bonds is k = 11.8 per cent.What is the implied probability of default on the corporate bond (round to two decimals)?

A)3.85 per cent

B)4.00 per cent

C)96.00 per cent

D)96.15 per cent

A)3.85 per cent

B)4.00 per cent

C)96.00 per cent

D)96.15 per cent

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

24

Assume that i1 = 11 per cent and i2 = 12 per cent, and that k1 = 14.50 per cent and k2 = 16.50 per cent.What is the expected probability of repayment on the one-year corporate bonds in one year's time (round to two decimals)?

A)86.99 per cent

B)81.47 per cent

C)86.50 per cent

D)95.34 per cent

A)86.99 per cent

B)81.47 per cent

C)86.50 per cent

D)95.34 per cent

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

25

Consider the case of ABC Company.The company's marginal probability of default in year 1 is 0.03 and 0.08 in year 2.What is ABC Company's cumulative default probability (round to two decimals)?

A)14.00 per cent

B)11.00 per cent

C)99.76 per cent

D)10.76 per cent

A)14.00 per cent

B)11.00 per cent

C)99.76 per cent

D)10.76 per cent

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

26

The current required yields on one- and two-year government bonds are i1 = 12 per cent and i2 = 13 per cent.What are the market's expectations of the one-year forward rate, f1 (round to two decimals)?

A)13.50 per cent

B)14.00 per cent

C)14.50 per cent

D)15.00 per cent

A)13.50 per cent

B)14.00 per cent

C)14.50 per cent

D)15.00 per cent

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

27

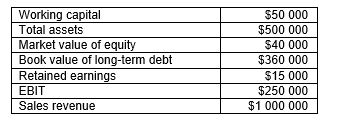

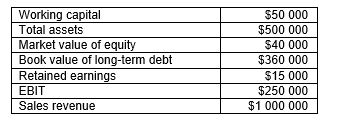

Consider the following data of a prospective borrower.  What is this company's Z score (round to two decimals)?

What is this company's Z score (round to two decimals)?

A)3.78

B)3.88

C)3.98

D)4.08

What is this company's Z score (round to two decimals)?

What is this company's Z score (round to two decimals)?A)3.78

B)3.88

C)3.98

D)4.08

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

28

Consider the case of a simple one-period framework.If i = 12.30 per cent and k = 13.87 per cent, what is the risk premium on the corporate loan (round to two decimals)?

A)13.87% - 12.30% = 1.57%.

B)13.87% * 12.30% = 0.0171 = 1.71%.

C)13.87% / 12.30% = 1.13%.

D)The risk premium equals k = 13.87 per cent.

A)13.87% - 12.30% = 1.57%.

B)13.87% * 12.30% = 0.0171 = 1.71%.

C)13.87% / 12.30% = 1.13%.

D)The risk premium equals k = 13.87 per cent.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements is true?

A)Borrower-specific factors are factors that affect all borrowers operating in the same industry.

B)Market-specific factors are factors that are idiosyncratic factors arising from the market that affect s single or a small number of borrowers.

C)Market-specific factors carry a higher weight compared to borrower-specific factors when deciding on whether to accept or to reject a loan application.

D)None of the listed options are correct.

A)Borrower-specific factors are factors that affect all borrowers operating in the same industry.

B)Market-specific factors are factors that are idiosyncratic factors arising from the market that affect s single or a small number of borrowers.

C)Market-specific factors carry a higher weight compared to borrower-specific factors when deciding on whether to accept or to reject a loan application.

D)None of the listed options are correct.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

30

Consider the following scenario: an FI charges a 0.5 per cent loan origination fee and imposes a 10 per cent compensating balance requirement to be held as non-interest bearing demand deposits.It further sets aside reserves held at the central bank.The value of these reserves is 15 per cent of deposits.What is the base lending rate if the credit risk premium is 3.055 per cent and the ROA on the loan is 17 per cent?

A)11.5 per cent

B)13.945 per cent

C)12 per cent

D)20.055 per cent

A)11.5 per cent

B)13.945 per cent

C)12 per cent

D)20.055 per cent

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

31

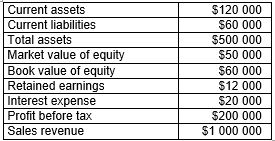

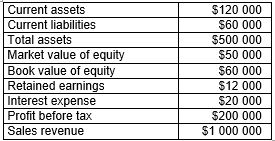

Consider the following data of a prospective borrower.  What is this company's Z score?

What is this company's Z score?

A)2.70

B)2.80

C)2.90

D)3.00

What is this company's Z score?

What is this company's Z score?A)2.70

B)2.80

C)2.90

D)3.00

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements in relation to Altman's discriminant function is true?

A)The higher the Z score the higher the probability of default.

B)The loan size does not influence the result of the Altman Z score model.

C)The size of the borrower does not influence the result of the Altman Z score model.

D)The Altman Z score model always produces an exact reject or accept decision.

A)The higher the Z score the higher the probability of default.

B)The loan size does not influence the result of the Altman Z score model.

C)The size of the borrower does not influence the result of the Altman Z score model.

D)The Altman Z score model always produces an exact reject or accept decision.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

33

Consider the following scenario: an FI charges a 0.5 per cent loan origination fee and imposes an 8 per cent compensating balance requirement to be held as non-interest bearing demand deposits.It further sets aside reserves held at the central bank.The value of these reserves is 10 per cent of deposits.The base lending rate is 9 per cent and the credit risk premium for a specific borrower is 3 per cent.What is the ROA on the loan?

A)12.60 per cent

B)11.00 per cent

C)11.50 per cent

D)Not enough information to solve the question.

A)12.60 per cent

B)11.00 per cent

C)11.50 per cent

D)Not enough information to solve the question.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

34

Assume that there are two factors influencing the past default behaviour of borrowers; these being the debt to equity ratio and the sales to assets ratio.Based on past default (repayment) experience, the linear probability model is estimated as Zi = 0.3(D/Ei) + 0.15 (S/Ai).Assume that a prospective borrower has a D/E ratio of 0.9 and a sales to assets ratio of 2.5.What is the borrower's probability of default?

A)0.885

B)0.645

C)0.45

D)3.4

A)0.885

B)0.645

C)0.45

D)3.4

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

35

Assume the interest rate in the market for one-year zero-coupon government bonds is i = 8 per cent and the rate for one-year zero-coupon grade BBB bonds is k = 10.2 per cent.What is the implied probability of repayment on the corporate bond (round to two decimals)?

A)2.00 per cent

B)2.04 per cent

C)97.96 per cent

D)98.00 per cent

A)2.00 per cent

B)2.04 per cent

C)97.96 per cent

D)98.00 per cent

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is true?

A)Moody's KMV Credit Monitor Model compares loans with the pay-off functions of swaps.

B)Moody's KMV Credit Monitor Model uses rating migrations data to calculate hypothetical loan values.

C)Moody's KMV Credit Monitor Model discriminates between two types of borrowers, i.e.borrowers that are likely to default and borrowers that are unlikely to default.

D)None of the listed options are correct.

A)Moody's KMV Credit Monitor Model compares loans with the pay-off functions of swaps.

B)Moody's KMV Credit Monitor Model uses rating migrations data to calculate hypothetical loan values.

C)Moody's KMV Credit Monitor Model discriminates between two types of borrowers, i.e.borrowers that are likely to default and borrowers that are unlikely to default.

D)None of the listed options are correct.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

37

Assume that f1 = 13.50 per cent and c1 = 17.40 per cent.Which of the following statements is true?

A)The expected default probability of repayment is 96.10 per cent.

B)The expected probability of repayment is 3.32 per cent.

C)The one-year rate expected on corporate securities one year into the future is 13.50 per cent.

D)The current one-year rate on corporate securities is 17.40 per cent.

A)The expected default probability of repayment is 96.10 per cent.

B)The expected probability of repayment is 3.32 per cent.

C)The one-year rate expected on corporate securities one year into the future is 13.50 per cent.

D)The current one-year rate on corporate securities is 17.40 per cent.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

38

Assume a $500 000 loan has a duration of 2.5 years.The current interest rate level is 10 per cent and a sudden change in the credit premium of 1 per cent is expected.Further assume that the one-year income on the loan is $2500.What is the loan's RAROC (round to two decimals)?

A)10.00 per cent

B)11.00 per cent

C)22.00 per cent

D)50.00 per cent

A)10.00 per cent

B)11.00 per cent

C)22.00 per cent

D)50.00 per cent

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

39

Consider the case of a simple one-period framework.If i = 12.50 per cent, k = 14.85 per cent, p = 0.98, and = 0.85 what is the required risk premium (round to two decimals)?

A)0.34 per cent

B)0.35 per cent

C)0.98 per cent

D)2.35 per cent

A)0.34 per cent

B)0.35 per cent

C)0.98 per cent

D)2.35 per cent

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

40

Consider the following formula for calculating the contractually promised gross return on a loan k, per dollar lent: (1 + k) = 1 + [f + (BR + m)]/ {1 - [b(1 - R)]}.Which of the following statements is true?

A)The denominator is the promised gross cash inflow to the FI per dollar.

B)The denominator reflects direct fees plus the loan interest rate consisting of both, the base lending rate and the credit risk premium.

C)The formula ignores present value aspects.

D)The FI's net benefit from requiring compensating balances must consider the benefits of holding additional non-interest bearing reserve requirements.

A)The denominator is the promised gross cash inflow to the FI per dollar.

B)The denominator reflects direct fees plus the loan interest rate consisting of both, the base lending rate and the credit risk premium.

C)The formula ignores present value aspects.

D)The FI's net benefit from requiring compensating balances must consider the benefits of holding additional non-interest bearing reserve requirements.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

41

Credit scoring models include:

A)linear probability models.

B)logit models.

C)linear discriminant analysis.

D)All of the listed options are correct.

A)linear probability models.

B)logit models.

C)linear discriminant analysis.

D)All of the listed options are correct.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

42

Assume that B = $200 000, r = 1 year, i = 7 per cent, d = 0.9, N(h1) = 0.174120 and N(h2) = 0.793323.Using Moody's KMV Credit Monitor Model, what is the current market value of the loan (round to two decimals)?

A)$184 015.32

B)$186 478.64

C)$200 000.00

D)$214 000.00

A)$184 015.32

B)$186 478.64

C)$200 000.00

D)$214 000.00

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

43

A company with an Altman Z score of 3.15 should not be granted a loan due to a high default probability.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

44

Models of credit risk measurement include:

A)term structure of credit risk approach.

B)mortality rate approach

C)RAROC and option models.

D)All of the listed options are correct.

A)term structure of credit risk approach.

B)mortality rate approach

C)RAROC and option models.

D)All of the listed options are correct.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

45

Assume that B = $200 000, r = 1 year, i = 7 per cent, d = 0.9, N(h1) = 0.174120 and N(h2) = 0.793323.Using Moody's KMV Credit Monitor Model, what is the required risk premium on the loan (round to two decimal places)?

A)0.13 per cent

B)0.91 per cent

C)1.64 per cent

D)6.30 per cent

A)0.13 per cent

B)0.91 per cent

C)1.64 per cent

D)6.30 per cent

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

46

By selecting and combining different economic and financial borrower characteristics, an FI manager may be able to improve the pricing of default risk.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

47

The linear probability model uses:

A)forecasted data, such as predicted future prices, as inputs into a model to explain repayment experience on old loans.

B)current indices, such as consumer price index, as inputs into a model to explain repayment experience on old loans.

C)past data, such as financial ratios, as inputs into a model to explain repayment experience on old loans.

D)None of the listed options are correct.

A)forecasted data, such as predicted future prices, as inputs into a model to explain repayment experience on old loans.

B)current indices, such as consumer price index, as inputs into a model to explain repayment experience on old loans.

C)past data, such as financial ratios, as inputs into a model to explain repayment experience on old loans.

D)None of the listed options are correct.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

48

The zone of ignorance in the Altman Z score model indicates that it is difficult to predict whether or not the prospective borrower will default in the future.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

49

Credit card facilities is a revolving loan product.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

50

The position of the business cycle in the economy is not important in assessing the default probability of a borrower.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

51

Banks have been partially responsible for big corporate collapses such as Enron.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

52

Non-performing loans are loans:

A)given out to corporations with low credit ratings.

B)that require re-evaluating of credit terms after every six months.

C)characterised by some type of default-from non-payment to delays in payment of interest and/or principal.

D)None of the listed options are correct.

A)given out to corporations with low credit ratings.

B)that require re-evaluating of credit terms after every six months.

C)characterised by some type of default-from non-payment to delays in payment of interest and/or principal.

D)None of the listed options are correct.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

53

The key factors entering into the credit decision include:

A)borrower-specific factors that are idiosyncratic to the individual borrower.

B)market-specific factors that have an impact on all borrowers at the time of the credit decision.

C)global-economic factors that have an impact on all FI's at the time of credit decision.

D)borrower-specific factors that are idiosyncratic to the individual borrower and market-specific factors that have an impact on all borrowers at the time of the credit decision.

A)borrower-specific factors that are idiosyncratic to the individual borrower.

B)market-specific factors that have an impact on all borrowers at the time of the credit decision.

C)global-economic factors that have an impact on all FI's at the time of credit decision.

D)borrower-specific factors that are idiosyncratic to the individual borrower and market-specific factors that have an impact on all borrowers at the time of the credit decision.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

54

Using term structure derivation of credit risk on a one-year loan, it is possible to simply calculate the risk premium on the loan by deducting the market rate for a one-year zero-coupon government bond from the market rate for a one-year zero-coupon corporate bond of a credit rating equivalent to that of the prospective borrower.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

55

A borrower's leverage refers to the payment capacity, that is, the 'leverage' the borrower has to service its loans.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

56

In its simplest form the rate on a loan is set as the base lending rate plus a credit risk premium.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

57

Linear discriminant models rely on a company's forecasted financial data so that the FI manager is able to assess the borrower's future payment ability.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

58

Loan to value ratio is the:

A)loan amount divided by the book value of the property to be mortgaged.

B)loan amount divided by the perceived value of the property to be mortgaged.

C)investment amount divided by the appraised value of the property to be mortgaged.

D)loan amount divided by the appraised value of the property to be mortgaged.

A)loan amount divided by the book value of the property to be mortgaged.

B)loan amount divided by the perceived value of the property to be mortgaged.

C)investment amount divided by the appraised value of the property to be mortgaged.

D)loan amount divided by the appraised value of the property to be mortgaged.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

59

Term structure of credit risk approach models are also known as:

A)reduced-form models.

B)mortality rate models.

C)RAROC models.

D)structural models.

A)reduced-form models.

B)mortality rate models.

C)RAROC models.

D)structural models.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

60

Compensating balance is a proportion of:

A)a loan that a borrower is required to hold on deposit at a correspondent bank.

B)a loan that a borrower is required to hold on deposit in foreign reserves.

C)a loan that a borrower is required to hold on deposit at the lending institution.

D)the investment that a borrower is required to hold on deposit at the lending institution.

A)a loan that a borrower is required to hold on deposit at a correspondent bank.

B)a loan that a borrower is required to hold on deposit in foreign reserves.

C)a loan that a borrower is required to hold on deposit at the lending institution.

D)the investment that a borrower is required to hold on deposit at the lending institution.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

61

Explain the concept of RAROC and the major role RAROC models play in credit risk analysis.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

62

Explain the major concept of Altman's linear discriminant model.What would you consider to be the major disadvantages of this model?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

63

Moody's KMV Credit Monitor Model compares loans with option payoffs.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

64

Mortality rates analyse historic default risk experience of bonds and loans of similar quality.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

65

The estimate of loan (or capital) risk (?L) can be calculated as follows: DL * L * [?R / (1+R)].

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

66

What are the major ideas behind KMV's Credit Monitor Model?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck