Deck 3: Consolidations - Subsequent to the Date of Acquisition

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

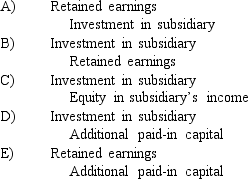

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

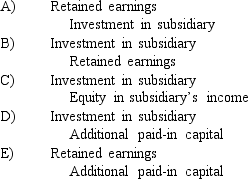

Question

Question

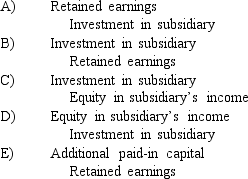

Question

Question

Question

Question

Question

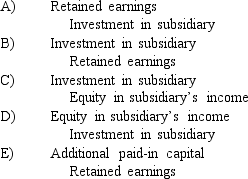

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/120

Play

Full screen (f)

Deck 3: Consolidations - Subsequent to the Date of Acquisition

1

Parrett Corp.acquired one hundred percent of Jones Inc.on January 1, 2016, at a price in excess of the subsidiary's fair value.On that date, Parrett's equipment (ten-year life) had a book value of $360,000 but a fair value of $480,000.Jones had equipment (ten-year life) with a book value of $240,000 and a fair value of $350,000.Parrett used the partial equity method to record its investment in Jones.On December 31, 2018, Parrett had equipment with a book value of $250,000 and a fair value of $400,000.Jones had equipment with a book value of $170,000 and a fair value of $320,000.What is the consolidated balance for the Equipment account as of December 31, 2018?

A) $387,000.

B) $497,000.

C) $508.000.

D) $537,000.

E) $570,000.

A) $387,000.

B) $497,000.

C) $508.000.

D) $537,000.

E) $570,000.

B

2

What is the amount of consolidated net income for the year 2017?

A) $3,180,000.

B) $3,612,000.

C) $3,300,000.

D) $3,588,000.

E) $3,420,000.

A) $3,180,000.

B) $3,612,000.

C) $3,300,000.

D) $3,588,000.

E) $3,420,000.

D

3

On the consolidated financial statements for 2017, what amount should have been shown for consolidated dividends?

A) $ 900,000.

B) $1,020,000.

C) $ 876,000.

D) $ 996,000.

E) $ 948,000.

A) $ 900,000.

B) $1,020,000.

C) $ 876,000.

D) $ 996,000.

E) $ 948,000.

A

4

How much difference would there have been in Franel's income with regard to the effect of the investment, between using the equity method or using the initial value method of internal recordkeeping?

A) $190,000.

B) $360,000.

C) $164,000.

D) $354,000.

E) $150,000.

A) $190,000.

B) $360,000.

C) $164,000.

D) $354,000.

E) $150,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

5

Which one of the following accounts would not appear in the consolidated financial statements at the end of the first fiscal period of the combination?

A) Goodwill.

B) Equipment.

C) Investment in Subsidiary.

D) Common Stock.

E) Additional Paid-In Capital.

A) Goodwill.

B) Equipment.

C) Investment in Subsidiary.

D) Common Stock.

E) Additional Paid-In Capital.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

6

If Cale Corp.had net income of $444,000 in 2017, exclusive of the investment, what is the amount of consolidated net income?

A) $569,000.

B) $570,000.

C) $571,000.

D) $566,400.

E) $444,000.

A) $569,000.

B) $570,000.

C) $571,000.

D) $566,400.

E) $444,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

7

Under the partial equity method, the parent recognizes income when

A) Dividends are received from the investee.

B) Dividends are declared by the investee.

C) The related expense has been incurred.

D) The related contract is signed by the subsidiary.

E) It is earned by the subsidiary.

A) Dividends are received from the investee.

B) Dividends are declared by the investee.

C) The related expense has been incurred.

D) The related contract is signed by the subsidiary.

E) It is earned by the subsidiary.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

8

Which one of the following varies between the equity, initial value, and partial equity methods of accounting for an investment?

A) The amount of consolidated net income.

B) Total assets on the consolidated balance sheet.

C) Total liabilities on the consolidated balance sheet.

D) The balance in the investment account on the parent's books.

E) The amount of consolidated cost of goods sold.

A) The amount of consolidated net income.

B) Total assets on the consolidated balance sheet.

C) Total liabilities on the consolidated balance sheet.

D) The balance in the investment account on the parent's books.

E) The amount of consolidated cost of goods sold.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

9

The 2017 total excess amortization of fair-value allocations is calculated to be

A) $4,000.

B) $6,400.

C) ($2,400).

D) ($1,000).

E) $3,800.

A) $4,000.

B) $6,400.

C) ($2,400).

D) ($1,000).

E) $3,800.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

10

On the consolidated financial statements for 2017, what amount should have been shown for Equity in Subsidiary Earnings?

A) $432,000.

B) $ -0-

C) $408,000.

D) $120,000.

E) $288,000.

A) $432,000.

B) $ -0-

C) $408,000.

D) $120,000.

E) $288,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

11

Jansen Inc.acquired all of the outstanding common stock of Merriam Co.on January 1, 2017, for $257,000.Annual amortization of $19,000 resulted from this acquisition.Jansen reported net income of $70,000 in 2017 and $50,000 in 2018 and paid $22,000 in dividends each year.Merriam reported net income of $40,000 in 2017 and $47,000 in 2018 and paid $10,000 in dividends each year.What is the Investment in Merriam Co.balance on Jansen's books as of December 31, 2018, if the equity method has been applied?

A) $286,000.

B) $295,000.

C) $276,000.

D) $344,000.

E) $324,000.

A) $286,000.

B) $295,000.

C) $276,000.

D) $344,000.

E) $324,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

12

How does the partial equity method differ from the equity method?

A) In the total assets reported on the consolidated balance sheet.

B) In the treatment of dividends.

C) In the total liabilities reported on the consolidated balance sheet.

D) Under the partial equity method, subsidiary income does not increase the balance in the parent's investment account.

E) Under the partial equity method, the balance in the investment account is not decreased by amortization on allocations made in the acquisition of the subsidiary.

A) In the total assets reported on the consolidated balance sheet.

B) In the treatment of dividends.

C) In the total liabilities reported on the consolidated balance sheet.

D) Under the partial equity method, subsidiary income does not increase the balance in the parent's investment account.

E) Under the partial equity method, the balance in the investment account is not decreased by amortization on allocations made in the acquisition of the subsidiary.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

13

What is the balance in Cale's investment in subsidiary account at the end of 2017?

A) $1,099,000.

B) $1,020,000.

C) $1,096,200.

D) $1,098,000.

E) $1,144,400.

A) $1,099,000.

B) $1,020,000.

C) $1,096,200.

D) $1,098,000.

E) $1,144,400.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

14

Racer Corp.acquired all of the common stock of Tangiers Co.in 2016.Tangiers maintained its incorporation.Which of Racer's account balances would vary between the equity method and the initial value method?

A) Goodwill, Investment in Tangiers Co., and Retained Earnings.

B) Expenses, Investment in Tangiers Co., and Equity in Subsidiary Earnings.

C) Investment in Tangiers Co., Equity in Subsidiary Earnings, and Retained Earnings.

D) Common Stock, Goodwill, and Investment in Tangiers Co.

E) Expenses, Goodwill, and Investment in Tangiers Co.

A) Goodwill, Investment in Tangiers Co., and Retained Earnings.

B) Expenses, Investment in Tangiers Co., and Equity in Subsidiary Earnings.

C) Investment in Tangiers Co., Equity in Subsidiary Earnings, and Retained Earnings.

D) Common Stock, Goodwill, and Investment in Tangiers Co.

E) Expenses, Goodwill, and Investment in Tangiers Co.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

15

How much difference would there have been in Franel's income with regard to the effect of the investment, between using the equity method or using the partial equity method of internal recordkeeping?

A) $170,000.

B) $354,000.

C) $164,000.

D) $ 6,000.

E) $174,000.

A) $170,000.

B) $354,000.

C) $164,000.

D) $ 6,000.

E) $174,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

16

An impairment model is used

A) To assess whether asset write-downs are appropriate for indefinite-lived assets.

B) To calculate the fair value of intangible assets.

C) To calculate the amortization of indefinite-lived assets over their useful lives.

D) To determine whether the fair value of assets should be recognized.

E) To determine the likelihood that the fair value of an assumed liability will increase.

A) To assess whether asset write-downs are appropriate for indefinite-lived assets.

B) To calculate the fair value of intangible assets.

C) To calculate the amortization of indefinite-lived assets over their useful lives.

D) To determine whether the fair value of assets should be recognized.

E) To determine the likelihood that the fair value of an assumed liability will increase.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following internal record-keeping methods can a parent choose to account for a subsidiary acquired in a business combination?

A) Initial value or book value.

B) Initial value, lower-of-cost-or-market-value, or equity.

C) Initial value, equity, or partial equity.

D) Initial value, equity, or book value.

E) Initial value, lower-of-cost-or-market-value, or partial equity.

A) Initial value or book value.

B) Initial value, lower-of-cost-or-market-value, or equity.

C) Initial value, equity, or partial equity.

D) Initial value, equity, or book value.

E) Initial value, lower-of-cost-or-market-value, or partial equity.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is not an example of an intangible asset?

A) Customer list

B) Database

C) Lease agreement

D) Broken equipment

E) Trademark

A) Customer list

B) Database

C) Lease agreement

D) Broken equipment

E) Trademark

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

19

At the end of 2017, the consolidation entry to eliminate Cale's accrual of Kaltop's earnings would include a credit to Investment in Kaltop Co.for

A) $124,400.

B) $126,000.

C) $127,000.

D) $ 76,400.

E) $ 0.

A) $124,400.

B) $126,000.

C) $127,000.

D) $ 76,400.

E) $ 0.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

20

In Cale's accounting records, what amount would appear on December 31, 2017 for equity in subsidiary earnings?

A) $77,000.

B) $79,000.

C) $125,000.

D) $127,000.

E) $81,800.

A) $77,000.

B) $79,000.

C) $125,000.

D) $127,000.

E) $81,800.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

21

Under the equity method of accounting for an investment:

A) The investment account remains at initial value.

B) Dividends received are recorded as revenue.

C) Goodwill is amortized over 20 years.

D) Income reported by the subsidiary increases the investment account.

E) Dividends received increase the investment account.

A) The investment account remains at initial value.

B) Dividends received are recorded as revenue.

C) Goodwill is amortized over 20 years.

D) Income reported by the subsidiary increases the investment account.

E) Dividends received increase the investment account.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

22

With respect to identifiable intangible assets other than goodwill, which of the following is true?

A) If the value of the identified asset meets a de minimis exception, the entity may elect to treat it as goodwill.

B) An identifiable intangible asset with an indefinite useful life must be assessed for impairment once every three years.

C) If the average fair value of the asset is less than the average carrying amount of the asset with respect to, and determined for, the preceding three-year period, the asset is considered impaired and the entity may recognize a loss.

D) A quantitative evaluation of value is required each year regardless of circumstances.

E) If a qualitative assessment of the asset performed by an entity indicates impairment is likely, a quantitative assessment must be performed to determine whether there has been a loss in fair value.

A) If the value of the identified asset meets a de minimis exception, the entity may elect to treat it as goodwill.

B) An identifiable intangible asset with an indefinite useful life must be assessed for impairment once every three years.

C) If the average fair value of the asset is less than the average carrying amount of the asset with respect to, and determined for, the preceding three-year period, the asset is considered impaired and the entity may recognize a loss.

D) A quantitative evaluation of value is required each year regardless of circumstances.

E) If a qualitative assessment of the asset performed by an entity indicates impairment is likely, a quantitative assessment must be performed to determine whether there has been a loss in fair value.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is false regarding contingent consideration in business combinations?

A) Contingent consideration payable in cash is reported under liabilities.

B) Contingent consideration payable in stock shares is reported under stockholders' equity.

C) Contingent consideration is recorded because of its substantial probability of eventual payment.

D) The contingent consideration fair value is recognized as part of the acquisition regardless of whether eventual payment is based on future performance of the target firm or future stock price of the acquirer.

E) Contingent consideration is reflected in the acquirer's balance sheet at the present value of the potential expected future payment.

A) Contingent consideration payable in cash is reported under liabilities.

B) Contingent consideration payable in stock shares is reported under stockholders' equity.

C) Contingent consideration is recorded because of its substantial probability of eventual payment.

D) The contingent consideration fair value is recognized as part of the acquisition regardless of whether eventual payment is based on future performance of the target firm or future stock price of the acquirer.

E) Contingent consideration is reflected in the acquirer's balance sheet at the present value of the potential expected future payment.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

24

According to GAAP regarding amortization of goodwill, which of the following statements is true?

A) Goodwill recognized in consolidation must be amortized over 20 years.

B) Goodwill recognized in consolidation must be expensed in the period of acquisition.

C) Goodwill recognized in consolidation will not be amortized but subject to an annual test for impairment.

D) Goodwill recognized in consolidation can never be written off.

E) Goodwill recognized in consolidation must be amortized over 40 years.

A) Goodwill recognized in consolidation must be amortized over 20 years.

B) Goodwill recognized in consolidation must be expensed in the period of acquisition.

C) Goodwill recognized in consolidation will not be amortized but subject to an annual test for impairment.

D) Goodwill recognized in consolidation can never be written off.

E) Goodwill recognized in consolidation must be amortized over 40 years.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

25

When consolidating a subsidiary under the equity method, which of the following statements is true with regard to the subsidiary subsequent to the year of acquisition?

A) All net assets are revalued to fair value and must be amortized over their useful lives.

B) Only net assets that had excess fair value over book value when acquired by the parent must be amortized over their useful lives.

C) All depreciable net assets are revalued to fair value at date of acquisition and must be amortized over their useful lives.

D) Only depreciable net assets that have excess fair value over book value must be amortized over their useful lives.

E) Only assets that have excess fair value over book value must be amortized over their useful lives.

A) All net assets are revalued to fair value and must be amortized over their useful lives.

B) Only net assets that had excess fair value over book value when acquired by the parent must be amortized over their useful lives.

C) All depreciable net assets are revalued to fair value at date of acquisition and must be amortized over their useful lives.

D) Only depreciable net assets that have excess fair value over book value must be amortized over their useful lives.

E) Only assets that have excess fair value over book value must be amortized over their useful lives.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

26

When a company applies the initial value method in accounting for its investment in a subsidiary and the subsidiary reports income less than dividends paid, what entry would be made for a consolidation worksheet in the second year?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

27

Compute goodwill, if any, at January 1, 2017.

A) $ 150.

B) $ 250.

C) $ 700.

D) $1,200.

E) $ 550.

A) $ 150.

B) $ 250.

C) $ 700.

D) $1,200.

E) $ 550.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

28

Consolidated net income using the equity method for an acquisition combination is computed as follows:

A) Parent company's revenues from its own operations plus subsidiary retained earnings.

B) Parent's reported net income plus subsidiary dividends.

C) Combined revenues less combined expenses less equity in subsidiary's earnings less amortization of fair-value allocations in excess of book value.

D) Parent's revenues less expenses for its own operations plus the equity from subsidiary's earnings less subsidiary dividends.

E) None of these answer choices are correct.

A) Parent company's revenues from its own operations plus subsidiary retained earnings.

B) Parent's reported net income plus subsidiary dividends.

C) Combined revenues less combined expenses less equity in subsidiary's earnings less amortization of fair-value allocations in excess of book value.

D) Parent's revenues less expenses for its own operations plus the equity from subsidiary's earnings less subsidiary dividends.

E) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

29

Compute the consideration transferred in excess of book value acquired at January 1, 2017.

A) $ 150.

B) $ 700.

C) $2,200.

D) $ 550.

E) $2,900.

A) $ 150.

B) $ 700.

C) $2,200.

D) $ 550.

E) $2,900.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

30

Compute the amount of Hurley's inventory that would be reported in a January 1, 2017, consolidated balance sheet.

A) $800.

B) $100.

C) $900.

D) $150.

E) $ 0.

A) $800.

B) $100.

C) $900.

D) $150.

E) $ 0.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

31

Under the initial value method, when accounting for an investment in a subsidiary,

A) Dividends received by the subsidiary decrease the investment account.

B) The investment account is adjusted to fair value at year-end.

C) Income reported by the subsidiary increases the investment account.

D) The investment account does not change from year to year.

E) Dividends received are ignored.

A) Dividends received by the subsidiary decrease the investment account.

B) The investment account is adjusted to fair value at year-end.

C) Income reported by the subsidiary increases the investment account.

D) The investment account does not change from year to year.

E) Dividends received are ignored.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

32

Under the partial equity method of accounting for an investment,

A) The investment account remains at initial value.

B) Dividends received are recorded as revenue.

C) The allocations for excess fair value allocations over book value of net assets at date of acquisition are applied over their useful lives to reduce the investment account.

D) Amortization of the excess of fair value allocations over book value is ignored in regard to the investment account.

E) Dividends received increase the investment account.

A) The investment account remains at initial value.

B) Dividends received are recorded as revenue.

C) The allocations for excess fair value allocations over book value of net assets at date of acquisition are applied over their useful lives to reduce the investment account.

D) Amortization of the excess of fair value allocations over book value is ignored in regard to the investment account.

E) Dividends received increase the investment account.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

33

All of the following are acceptable methods to account for a majority-owned investment in subsidiary except

A) The equity method.

B) The initial value method.

C) The partial equity method.

D) The fair-value method.

E) Book value method.

A) The equity method.

B) The initial value method.

C) The partial equity method.

D) The fair-value method.

E) Book value method.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

34

When consolidating parent and subsidiary financial statements, which of the following statements is true?

A) Goodwill is never recognized.

B) Goodwill required is amortized over 20 years.

C) Goodwill may be recorded on the parent company's books.

D) The value of any goodwill should be tested annually for impairment in value.

E) Goodwill should be expensed in the year of acquisition.

A) Goodwill is never recognized.

B) Goodwill required is amortized over 20 years.

C) Goodwill may be recorded on the parent company's books.

D) The value of any goodwill should be tested annually for impairment in value.

E) Goodwill should be expensed in the year of acquisition.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is not a factor to be considered when determining the useful life of an intangible asset?

A) Legal, regulatory or contractual provisions.

B) The effects of obsolescence.

C) The expected use of the asset by the organization.

D) The fair value of the asset.

E) The level of maintenance expenditures that will be required to obtain expected future benefits.

A) Legal, regulatory or contractual provisions.

B) The effects of obsolescence.

C) The expected use of the asset by the organization.

D) The fair value of the asset.

E) The level of maintenance expenditures that will be required to obtain expected future benefits.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

36

If the equity method had been applied, what would be the Investment in Tysk Corp.account balance within the records of Jans at the end of 2018?

A) $612,100.

B) $744,000.

C) $774,150.

D) $372,000.

E) $844,150.

A) $612,100.

B) $744,000.

C) $774,150.

D) $372,000.

E) $844,150.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

37

When a company applies the initial value method in accounting for its investment in a subsidiary, and the subsidiary reports income in excess of dividends paid, what entry would be made for a consolidation worksheet for the second year?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

38

Red Co.acquired 100% of Green, Inc.on January 1, 2017.On that date, Green had land with a book value of $42,000 and a fair value of $52,000.Also, on the date of acquisition, Green had a building with a book value of $200,000 and a fair value of $390,000.Green had equipment with a book value of $350,000 and a fair value of $280,000.The building had a 10-year remaining useful life and the equipment had a 5-year remaining useful life.How much total expense will be in the consolidated financial statements for the year ended December 31, 2017 related to the acquisition allocations of Green?

A) $43,000.

B) $33,000.

C) $ 5,000.

D) $15,000.

E) $0.

A) $43,000.

B) $33,000.

C) $ 5,000.

D) $15,000.

E) $0.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

39

When a company applies the partial equity method in accounting for its investment in a subsidiary and the subsidiary's equipment has a fair value greater than its book value, what consolidation worksheet entry is made in a year subsequent to the initial acquisition of the subsidiary?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

40

If the partial equity method had been applied, what was 2018 consolidated net income?

A) $840,000.

B) $768,400.

C) $822,000.

D) $240,000.

E) $600,000.

A) $840,000.

B) $768,400.

C) $822,000.

D) $240,000.

E) $600,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

41

Compute the December 31, 2020, consolidated buildings.

A) $1,037,500.

B) $1,007,500.

C) $1,000,000.

D) $1,022,500.

E) $1,012,500.

A) $1,037,500.

B) $1,007,500.

C) $1,000,000.

D) $1,022,500.

E) $1,012,500.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

42

Assume the equity method is applied.How much equity income will Kaye report on its internal accounting records as a result of Fiore's operations?

A) $400

B) $300

C) $380

D) $280

E) $480

A) $400

B) $300

C) $380

D) $280

E) $480

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

43

Compute the amount of Hurley's buildings that would be reported in a December 31, 2017, consolidated balance sheet.

A) $1,560.

B) $1,260.

C) $1,440.

D) $1,160.

E) $1,140.

A) $1,560.

B) $1,260.

C) $1,440.

D) $1,160.

E) $1,140.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

44

Assume the partial equity method is used.In the years following acquisition, what additional worksheet entry must be made for consolidation purposes, but is not required for the equity method?

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) Entry E.

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) Entry E.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

45

Compute the amount of Hurley's equipment that would be reported in a December 31, 2017, consolidated balance sheet.

A) $1,000.

B) $1,250.

C) $ 875.

D) $1,125.

E) $ 750.

A) $1,000.

B) $1,250.

C) $ 875.

D) $1,125.

E) $ 750.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

46

Compute the December 31, 2020, consolidated trademark.

A) $50,000.

B) $46,875.

C) $ 0.

D) $34,375.

E) $37,500.

A) $50,000.

B) $46,875.

C) $ 0.

D) $34,375.

E) $37,500.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

47

Compute the amount of Hurley's long-term liabilities that would be reported in a December 31, 2017, consolidated balance sheet.

A) $1,800.

B) $1,700.

C) $1,725.

D) $1,675.

E) $3,500.

A) $1,800.

B) $1,700.

C) $1,725.

D) $1,675.

E) $3,500.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

48

Assume the initial value method is applied.How much equity income will Kaye report on its internal accounting records as a result of Fiore's operations?

A) $400

B) $300

C) $380

D) $100

E) $210

A) $400

B) $300

C) $380

D) $100

E) $210

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

49

Assume the initial value method is used.In the year subsequent to acquisition, what additional worksheet entry must be made for consolidation purposes that is not required for the equity method?

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) Entry E.

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) Entry E.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

50

Compute the amount of Hurley's long-term liabilities that would be reported in a December 31, 2018, consolidated balance sheet.

A) $1,700.

B) $1,800.

C) $1,650.

D) $1,750.

E) $3,500.

A) $1,700.

B) $1,800.

C) $1,650.

D) $1,750.

E) $3,500.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

51

Assume the partial equity method is applied.How much equity income will Kaye report on its internal accounting records as a result of Fiore's operations?

A) $400

B) $300

C) $380

D) $280

E) $480

A) $400

B) $300

C) $380

D) $280

E) $480

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

52

Hoyt Corporation agreed to the following terms in order to acquire the net assets of Brown Company on January 1, 2018: (1.) To issue 400 shares of common stock ($10 par) with a fair value of $45 per share.

(2)) To assume Brown's liabilities which have a book value of $1,600 and a fair value of $1,500.

On the date of acquisition, the consideration transferred for Hoyt's acquisition of Brown would be

A) $18,000.

B) $16,500.

C) $20,000.

D) $18,500.

E) $19,500.

(2)) To assume Brown's liabilities which have a book value of $1,600 and a fair value of $1,500.

On the date of acquisition, the consideration transferred for Hoyt's acquisition of Brown would be

A) $18,000.

B) $16,500.

C) $20,000.

D) $18,500.

E) $19,500.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

53

Compute the amount of Hurley's land that would be reported in a December 31, 2018, consolidated balance sheet.

A) $ 900.

B) $1,300.

C) $ 400.

D) $1,450.

E) $2,200.

A) $ 900.

B) $1,300.

C) $ 400.

D) $1,450.

E) $2,200.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

54

Compute the December 31, 2020, consolidated equipment.

A) $800,000.

B) $808,000.

C) $840,000.

D) $760,000.

E) $848,000.

A) $800,000.

B) $808,000.

C) $840,000.

D) $760,000.

E) $848,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

55

Compute the amount of Hurley's buildings that would be reported in a December 31, 2018, consolidated balance sheet.

A) $1,620.

B) $1,380.

C) $1,320.

D) $1,080.

E) $1,500.

A) $1,620.

B) $1,380.

C) $1,320.

D) $1,080.

E) $1,500.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

56

Compute the December 31, 2020, consolidated revenues.

A) $1,400,000.

B) $ 800,000.

C) $ 500,000.

D) $1,590,375.

E) $1,390,375.

A) $1,400,000.

B) $ 800,000.

C) $ 500,000.

D) $1,590,375.

E) $1,390,375.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

57

Compute the December 31, 2020, consolidated total expenses.

A) $620,000.

B) $280,000.

C) $900,000.

D) $909,625.

E) $299,625.

A) $620,000.

B) $280,000.

C) $900,000.

D) $909,625.

E) $299,625.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

58

Compute the amount of Hurley's equipment that would be reported in a December 31, 2018, consolidated balance sheet.

A) $ 0.

B) $1,000.

C) $1,250.

D) $1,125.

E) $1,200.

A) $ 0.

B) $1,000.

C) $1,250.

D) $1,125.

E) $1,200.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

59

Compute the book value of Vega at January 1, 2016.

A) $ 997,500.

B) $ 857,500.

C) $1,200,000.

D) $1,600,000.

E) $ 827,500.

A) $ 997,500.

B) $ 857,500.

C) $1,200,000.

D) $1,600,000.

E) $ 827,500.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

60

Compute the December 31, 2020, consolidated land.

A) $220,000.

B) $180,000.

C) $670,000.

D) $630,000.

E) $450,000.

A) $220,000.

B) $180,000.

C) $670,000.

D) $630,000.

E) $450,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

61

When is a goodwill impairment loss recognized?

A) Annually on a systematic and rational basis.

B) Never.

C) When both the fair value of a reporting unit and its associated implied goodwill fall below their respective carrying values.

D) If the fair value of a reporting unit falls below its original acquisition price.

E) Whenever the fair value of the entity declines significantly.

A) Annually on a systematic and rational basis.

B) Never.

C) When both the fair value of a reporting unit and its associated implied goodwill fall below their respective carrying values.

D) If the fair value of a reporting unit falls below its original acquisition price.

E) Whenever the fair value of the entity declines significantly.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

62

Using the acquisition method, how will Beatty record the stock contingency?

A) Credit Contingent Performance Obligation, $20,000.

B) Debit Additional Paid-In Capital, $20,000.

C) Credit Additional Paid-In Capital, $2,884.

D) Debit Contingent Performance Obligation, $2,884.

E) No entry.

A) Credit Contingent Performance Obligation, $20,000.

B) Debit Additional Paid-In Capital, $20,000.

C) Credit Additional Paid-In Capital, $2,884.

D) Debit Contingent Performance Obligation, $2,884.

E) No entry.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

63

Assuming Rhine generates cash flow from operations of $27,200 in 2017, how will Harrison record the $16,500 payment of cash on April 15, 2018 in satisfaction of its contingent obligation?

A) Debit Contingent performance obligation $16,500, and Credit Cash $16,500.

B) Debit Contingent performance obligation $3,142, debit Loss from revaluation of contingent performance obligation $13,358, and Credit Cash $16,500.

C) Debit Investment in Subsidiary and Credit Cash, $16,500.

D) Debit Goodwill and Credit Cash, $16,500.

E) No entry.

A) Debit Contingent performance obligation $16,500, and Credit Cash $16,500.

B) Debit Contingent performance obligation $3,142, debit Loss from revaluation of contingent performance obligation $13,358, and Credit Cash $16,500.

C) Debit Investment in Subsidiary and Credit Cash, $16,500.

D) Debit Goodwill and Credit Cash, $16,500.

E) No entry.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

64

Compute the December 31, 2020, consolidated common stock.

A) $450,000.

B) $530,000.

C) $555,000.

D) $635,000.

E) $525,000.

A) $450,000.

B) $530,000.

C) $555,000.

D) $635,000.

E) $525,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

65

If Goehler applies the initial value method in accounting for Kenneth, what is the consolidated balance for the Equipment account as of December 31, 2018?

A) $1,080,000.

B) $1,104,000.

C) $1,100,000.

D) $1,468,000.

E) $1,475,000.

A) $1,080,000.

B) $1,104,000.

C) $1,100,000.

D) $1,468,000.

E) $1,475,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

66

How is the fair value allocation of an intangible asset allocated to expense when the asset has no legal, regulatory, contractual, competitive, economic, or other factors that limit its life?

A) Equally over 20 years.

B) Equally over 40 years.

C) Equally over 20 years with an annual impairment review.

D) No amortization, but annually reviewed for impairment and adjusted accordingly.

E) No amortization over an indefinite period time.

A) Equally over 20 years.

B) Equally over 40 years.

C) Equally over 20 years with an annual impairment review.

D) No amortization, but annually reviewed for impairment and adjusted accordingly.

E) No amortization over an indefinite period time.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following will result in the recognition of an impairment loss on goodwill?

A) Goodwill amortization is to be recognized annually on a systematic and rational basis.

B) Both the fair value of a reporting unit and its associated implied goodwill fall below their respective carrying values.

C) The fair value of the entity declines significantly.

D) The fair value of a reporting unit falls below the original consideration transferred for the acquisition.

E) The entity is investigated by the SEC and its reputation has been severely damaged.

A) Goodwill amortization is to be recognized annually on a systematic and rational basis.

B) Both the fair value of a reporting unit and its associated implied goodwill fall below their respective carrying values.

C) The fair value of the entity declines significantly.

D) The fair value of a reporting unit falls below the original consideration transferred for the acquisition.

E) The entity is investigated by the SEC and its reputation has been severely damaged.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

68

One company acquires another company in a combination accounted for under the acquisition method.The acquiring company decides to apply the equity method in accounting for the combination.What is one reason the acquiring company might have made this decision?

A) It is the only method allowed by the SEC.

B) It is relatively easy to apply.

C) It is the only internal reporting method allowed by generally accepted accounting principles.

D) Operating results on the parent's financial records reflect consolidated totals.

E) When the equity method is used, no worksheet entries are required in the consolidation process.

A) It is the only method allowed by the SEC.

B) It is relatively easy to apply.

C) It is the only internal reporting method allowed by generally accepted accounting principles.

D) Operating results on the parent's financial records reflect consolidated totals.

E) When the equity method is used, no worksheet entries are required in the consolidation process.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

69

If Watkins pays $450,000 in cash for Glen, what amount would be represented as the subsidiary's Building in a consolidation at December 31, 2019, assuming the book value of the building at that date is still $200,000?

A) $200,000.

B) $285,000.

C) $290,000.

D) $295,000.

E) $300,000.

A) $200,000.

B) $285,000.

C) $290,000.

D) $295,000.

E) $300,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

70

Prince Company acquires Duchess, Inc.on January 1, 2016.At the date of acquisition, Duchess has long-term debt with a fair value of $1,500,000 and a carrying amount of $1,200,000. With respect to long-term debt consolidation worksheet adjustments in periods following the acquisition, which of the following is correct:

A) Debit Interest Expense and Credit Long-Term Debt Expense.

B) Prince must recognize an increase in interest expense if the amount is material.

C) Do not adjust the value of the debt because Prince is not obligated to repay the debt.

D) Credit Long-Term Debt and Debit Interest Expense on the balance sheet of Duchess

E) Debit Long-Term Debt and Credit Interest Expense

A) Debit Interest Expense and Credit Long-Term Debt Expense.

B) Prince must recognize an increase in interest expense if the amount is material.

C) Do not adjust the value of the debt because Prince is not obligated to repay the debt.

D) Credit Long-Term Debt and Debit Interest Expense on the balance sheet of Duchess

E) Debit Long-Term Debt and Credit Interest Expense

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

71

What will Beatty record as its Investment in Gataux on January 1, 2017?

A) $500,000.

B) $503,461.

C) $506,345.

D) $532,000.

E) $546,500.

A) $500,000.

B) $503,461.

C) $506,345.

D) $532,000.

E) $546,500.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

72

If Goehler applies the partial equity method in accounting for Kenneth, what is the consolidated balance for the Equipment account as of December 31, 2018?

A) $1,080,000.

B) $1,104,000.

C) $1,100,000.

D) $1,468,000.

E) $1,475,000.

A) $1,080,000.

B) $1,104,000.

C) $1,100,000.

D) $1,468,000.

E) $1,475,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

73

When recording consideration transferred for the acquisition of Rhine on January 1, 2017, Harrison will record a contingent performance obligation in the amount of:

A) $ 628.40

B) $ 2,671.60

C) $ 3,142.00

D) $13,358.00

E) $16,500.00

A) $ 628.40

B) $ 2,671.60

C) $ 3,142.00

D) $13,358.00

E) $16,500.00

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

74

With respect to the recognition of goodwill in a business combination, which of the following statements is true?

A) Only US GAAP requires recognition of goodwill when the fair value of the consideration transferred exceeds the net fair value of assets and liabilities.

B) US GAAP standards require goodwill to be allocated to reporting units expected to benefit from the goodwill.

C) Only IFRS standards require annual assessments for goodwill impairment.

D) IFRS requires a reporting unit's implied fair value for goodwill to be calculated as the excess of such unit's fair value over the fair value of its identifiable net assets.

E) Neither US GAAP, nor IFRS, provide that goodwill impairments will not be recoverable once recognized.

A) Only US GAAP requires recognition of goodwill when the fair value of the consideration transferred exceeds the net fair value of assets and liabilities.

B) US GAAP standards require goodwill to be allocated to reporting units expected to benefit from the goodwill.

C) Only IFRS standards require annual assessments for goodwill impairment.

D) IFRS requires a reporting unit's implied fair value for goodwill to be calculated as the excess of such unit's fair value over the fair value of its identifiable net assets.

E) Neither US GAAP, nor IFRS, provide that goodwill impairments will not be recoverable once recognized.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

75

If Goehler applies the equity method in accounting for Kenneth, what is the consolidated balance for the Equipment account as of December 31, 2018?

A) $1,080,000.

B) $1,104,000.

C) $1,100,000.

D) $1,468,000.

E) $1,475,000.

A) $1,080,000.

B) $1,104,000.

C) $1,100,000.

D) $1,468,000.

E) $1,475,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

76

What will Harrison record as its Investment in Rhine on January 1, 2017?

A) $400,000.

B) $403,142.

C) $406,000.

D) $409,142.

E) $416,500.

A) $400,000.

B) $403,142.

C) $406,000.

D) $409,142.

E) $416,500.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

77

Compute the December 31, 2020 consolidated retained earnings.

A) $1,645,375.

B) $1,350,000.

C) $1,565,375.

D) $1,840,375.

E) $1,265,375.

A) $1,645,375.

B) $1,350,000.

C) $1,565,375.

D) $1,840,375.

E) $1,265,375.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

78

Compute the December 31, 2020, consolidated additional paid-in capital.

A) $210,000.

B) $75,000.

C) $1,102,500.

D) $942,500.

E) $525,000.

A) $210,000.

B) $75,000.

C) $1,102,500.

D) $942,500.

E) $525,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

79

One company acquires another company in a combination accounted for under the acquisition method.The acquiring company decides to apply the initial value method in accounting for the combination.What is one reason the acquiring company might have made this decision?

A) It is the only method allowed by the SEC.

B) It is relatively easy to apply.

C) It is the only internal reporting method allowed by generally accepted accounting principles.

D) Operating results on the parent's financial records reflect consolidated totals.

E) When the initial method is used, no worksheet entries are required in the consolidation process.

A) It is the only method allowed by the SEC.

B) It is relatively easy to apply.

C) It is the only internal reporting method allowed by generally accepted accounting principles.

D) Operating results on the parent's financial records reflect consolidated totals.

E) When the initial method is used, no worksheet entries are required in the consolidation process.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

80

On April 1, 2018, Beatty stock closes with a market value of $8.98 per share.How many shares of stock, rounded to the next whole number, must it issue to the former owners of Gateax?

A) 682

B) 2,000

C) 2,228

D) 2,884

E) 6,000

A) 682

B) 2,000

C) 2,228

D) 2,884

E) 6,000

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck