Deck 18: Accounting for Not-For-Profit Entities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/72

Play

Full screen (f)

Deck 18: Accounting for Not-For-Profit Entities

1

The following gifts are received in 2016 by a not-for-profit entity:

I.$2,000 specified by the donor to be used to pay salaries.

II.$10,000 specified by the donor for new conference room furniture.

III.$5,000 specified by the donor to be held for one year before being expended.

The salaries are paid in 2017 and the conference room furniture is purchased in 2016. The donor did not specify any time restriction on holding the conference room furniture.

With respect to the donations received in 2016, what total amount should be recorded as an increase to Temporarily Restricted Net Assets?

A) $ 2,000

B) $ 7,000

C) $12,000

D) $15,000

E) $17,000

I.$2,000 specified by the donor to be used to pay salaries.

II.$10,000 specified by the donor for new conference room furniture.

III.$5,000 specified by the donor to be held for one year before being expended.

The salaries are paid in 2017 and the conference room furniture is purchased in 2016. The donor did not specify any time restriction on holding the conference room furniture.

With respect to the donations received in 2016, what total amount should be recorded as an increase to Temporarily Restricted Net Assets?

A) $ 2,000

B) $ 7,000

C) $12,000

D) $15,000

E) $17,000

E

2

Prior to ASU 2016-14, what are the three categories of net assets required by GAAP in reporting of a not-for-profit entity?

A) Unrestricted, Temporarily Restricted, and Permanently Restricted.

B) Unrestricted, Restricted, and Fund Balance.

C) Restricted, Permanently Restricted, and Fund Balance.

D) Unrestricted, Temporarily Restricted, and Fund Balance.

E) None of these answer choices are correct.

A) Unrestricted, Temporarily Restricted, and Permanently Restricted.

B) Unrestricted, Restricted, and Fund Balance.

C) Restricted, Permanently Restricted, and Fund Balance.

D) Unrestricted, Temporarily Restricted, and Fund Balance.

E) None of these answer choices are correct.

A

3

Which one of the following financial statements is not required by GAAP regarding a voluntary health and welfare entity?

A) Statement of Financial Position.

B) Statement of Functional Expenses.

C) Statement of Activities and Changes in Net Assets.

D) Statement of Cash Flows.

E) Statement of Operations.

A) Statement of Financial Position.

B) Statement of Functional Expenses.

C) Statement of Activities and Changes in Net Assets.

D) Statement of Cash Flows.

E) Statement of Operations.

E

4

Historically, what pattern of reporting was used by private not-for-profit entities? (1) The same as used with respect to for-profit entities.

(2) Reporting that utilizes a fund accounting approach.

(3) A pattern of reporting that does not consider the entire entity.

A) 1 only.

B) 2 only.

C) 1 and 2 only.

D) 1, 2 and 3.

E) 2 and 3 only.

(2) Reporting that utilizes a fund accounting approach.

(3) A pattern of reporting that does not consider the entire entity.

A) 1 only.

B) 2 only.

C) 1 and 2 only.

D) 1, 2 and 3.

E) 2 and 3 only.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is a voluntary health and welfare entity?

A) A charity raising money for underprivileged children.

B) A nursing home.

C) A private medical school.

D) A hospital.

E) A preschool.

A) A charity raising money for underprivileged children.

B) A nursing home.

C) A private medical school.

D) A hospital.

E) A preschool.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

6

Unconditional transfers of cash or other resources to an entity in a voluntary nonreciprocal transaction is the GAAP definition of

A) Miscellaneous revenues.

B) Contributions.

C) Unconditional promises to give.

D) Exchange transactions.

E) Pledges.

A) Miscellaneous revenues.

B) Contributions.

C) Unconditional promises to give.

D) Exchange transactions.

E) Pledges.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is required for voluntary health and welfare entities, but not for other not-for-profit entities?

A) Statement of Activities and Changes in Net Assets.

B) Statement of Functional Expenses.

C) Statement of Financial Position.

D) Statement of Cash Flows.

E) Statement of Budget to Actual.

A) Statement of Activities and Changes in Net Assets.

B) Statement of Functional Expenses.

C) Statement of Financial Position.

D) Statement of Cash Flows.

E) Statement of Budget to Actual.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

8

Which account should be credited to record a gift of cash which is from an outside party to an animal rescue agency and is used for expenses to care for the animals?

A) Non-Operating Gain - Special Revenues.

B) Contractual Adjustments.

C) Patient Service Revenues.

D) Drugs and Medicines.

E) Unrestricted net assets - contributions.

A) Non-Operating Gain - Special Revenues.

B) Contractual Adjustments.

C) Patient Service Revenues.

D) Drugs and Medicines.

E) Unrestricted net assets - contributions.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

9

On a statement of functional expenses for a voluntary health and welfare entity, how are expenses classified?

A) Health services expenses and operating expenses.

B) Program services expenses and administrative services expenses.

C) Program services expenses and supporting services expenses.

D) Operating expenses and supporting services expenses.

E) Operating expenses and administrative expenses.

A) Health services expenses and operating expenses.

B) Program services expenses and administrative services expenses.

C) Program services expenses and supporting services expenses.

D) Operating expenses and supporting services expenses.

E) Operating expenses and administrative expenses.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

10

When are unconditional promises to give recognized as revenues?

A) In the period the promise is received.

B) In the period the promise is collected.

C) In the period in which the conditions upon which they are contingent are substantially met.

D) In the period in which the conditions upon which they are contingent have begun to be met.

E) Unconditional promises from potential donors are not revenues.

A) In the period the promise is received.

B) In the period the promise is collected.

C) In the period in which the conditions upon which they are contingent are substantially met.

D) In the period in which the conditions upon which they are contingent have begun to be met.

E) Unconditional promises from potential donors are not revenues.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

11

In accruing patient charges for the current month, which one of the following accounts should a hospital credit?

A) Accounts Payable.

B) Deferred Revenue.

C) Public Support Revenue.

D) Patient Service Revenues.

E) Accounts Receivable.

A) Accounts Payable.

B) Deferred Revenue.

C) Public Support Revenue.

D) Patient Service Revenues.

E) Accounts Receivable.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

12

When individuals are considering whether to make a donation to a not-for-profit entity, the answer to which of the following questions is not typically sought?

A) Will donated funds be used effectively by the entity to accomplish its purpose?

B) Will the donated funds be wasted?

C) How much should this entity receive?

D) Is this entity profitable?

E) Is contributing to this charity a wise allocation of resources?

A) Will donated funds be used effectively by the entity to accomplish its purpose?

B) Will the donated funds be wasted?

C) How much should this entity receive?

D) Is this entity profitable?

E) Is contributing to this charity a wise allocation of resources?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

13

Unconditional promises to transfer cash or other resources to an entity in a voluntary nonreciprocal transaction is the GAAP definition of

A) Miscellaneous revenues.

B) Contributions.

C) Unconditional promises to give.

D) Exchange transactions.

E) Pledges.

A) Miscellaneous revenues.

B) Contributions.

C) Unconditional promises to give.

D) Exchange transactions.

E) Pledges.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

14

Reciprocal transfers where both parties give and receive something of value are

A) Donated supplies and materials.

B) Unconditional promises to give.

C) Endowment transactions.

D) Exchange transactions.

E) Required contributions.

A) Donated supplies and materials.

B) Unconditional promises to give.

C) Endowment transactions.

D) Exchange transactions.

E) Required contributions.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

15

What is the basis of accounting used in reporting the Statement of Activities?

A) Cash basis.

B) Modified accrual basis.

C) Accrual basis.

D) Either cash basis or accrual basis, depending on the type of revenue.

E) Either modified accrual basis or accrual basis, depending on the type of revenue.

A) Cash basis.

B) Modified accrual basis.

C) Accrual basis.

D) Either cash basis or accrual basis, depending on the type of revenue.

E) Either modified accrual basis or accrual basis, depending on the type of revenue.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

16

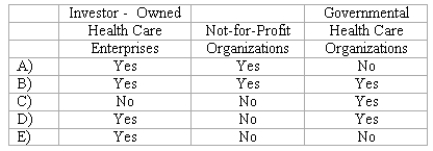

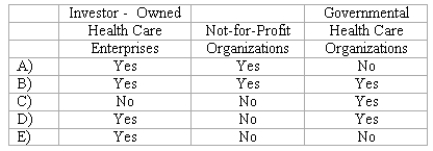

Which of the following types of health care entities follow FASB Accounting Standards Codification for preparing financial statements?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

17

On a Statement of Activities for a not-for-profit entity, what is the minimum required classification for categories of expenses?

A) Fund-raising expenses and operating expenses.

B) Program services expenses and administrative services expenses.

C) Program services expenses and supporting services expenses.

D) Operating expenses and supporting services expenses.

E) Operating expenses and administrative expenses.

A) Fund-raising expenses and operating expenses.

B) Program services expenses and administrative services expenses.

C) Program services expenses and supporting services expenses.

D) Operating expenses and supporting services expenses.

E) Operating expenses and administrative expenses.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

18

The following gifts are received in 2016 by a not-for-profit entity:

I.$2,000 specified by the donor to be used to pay salaries.

II.$10,000 specified by the donor for new conference room furniture.

III.$5,000 specified by the donor to be held for one year before being expended.

The salaries are paid in 2017 and the conference room furniture is purchased in 2016. The donor did not specify any time restriction on holding the conference room furniture.

With respect to the donations received in 2016, what amount should be reported in the Statement of Activities as net increase to Temporarily Restricted Net Assets for the year 2016?

A) $ 2,000

B) $ 7,000

C) $12,000

D) $15,000

E) $17,000

I.$2,000 specified by the donor to be used to pay salaries.

II.$10,000 specified by the donor for new conference room furniture.

III.$5,000 specified by the donor to be held for one year before being expended.

The salaries are paid in 2017 and the conference room furniture is purchased in 2016. The donor did not specify any time restriction on holding the conference room furniture.

With respect to the donations received in 2016, what amount should be reported in the Statement of Activities as net increase to Temporarily Restricted Net Assets for the year 2016?

A) $ 2,000

B) $ 7,000

C) $12,000

D) $15,000

E) $17,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

19

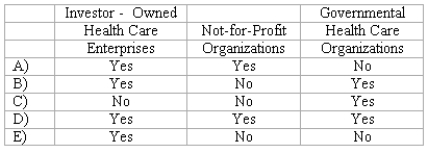

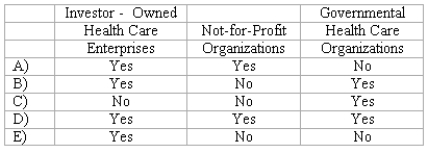

Which of the following types of health care entitys recognize depreciation expense?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

20

On a Statement of Activities for a not-for-profit entity, what are the broad categories of supporting service costs required to be reported?

A) Fund-raising expenses and operating expenses.

B) Program services expenses and administrative services expenses.

C) Fund-raising expenses and supporting services expenses.

D) Fund-raising expenses and administrative expenses.

E) Operating expenses and administrative expenses.

A) Fund-raising expenses and operating expenses.

B) Program services expenses and administrative services expenses.

C) Fund-raising expenses and supporting services expenses.

D) Fund-raising expenses and administrative expenses.

E) Operating expenses and administrative expenses.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

21

A gift to a not-for-profit school that is not restricted by the donor is recorded with a credit to:

A) Fund Balance.

B) Deferred Revenues.

C) Contribution Revenues.

D) Non-Operating Revenues.

E) Encumbrances.

A) Fund Balance.

B) Deferred Revenues.

C) Contribution Revenues.

D) Non-Operating Revenues.

E) Encumbrances.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is not true about a merger of two not-for-profit entities?

A) The two entities will continue to legally exist but there will be a new governing board.

B) Neither entity is considered to be acquired.

C) Identifiable assets and liabilities are not adjusted to their fair values at the date of the merger.

D) The two entities will together form an entirely new entity with a new governing board.

E) There will be no acquisition value or goodwill determination.

A) The two entities will continue to legally exist but there will be a new governing board.

B) Neither entity is considered to be acquired.

C) Identifiable assets and liabilities are not adjusted to their fair values at the date of the merger.

D) The two entities will together form an entirely new entity with a new governing board.

E) There will be no acquisition value or goodwill determination.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

23

When an acquisition occurs in not-for-profit accounting, recognition of goodwill depends on:

A) Whether control has been achieved by the acquiring not-for-profit entity.

B) Whether the acquired not-for-profit entity has the ability to generate significant amounts of revenue from providing goods or services or from membership fees, or whether it is expected to generate primarily contribution and investment revenue in the future.

C) Whether the acquired not-for-profit entity has the ability to generate significant amounts of revenues from goods or services or membership fees, as well as significant amounts of contribution revenues in the future.

D) Whether the acquired not-for-profit entity has a history of generating significant revenues of any type.

E) None of these answer choices are correct. Goodwill can only be recognized in an acquisition of a for-profit entity.

A) Whether control has been achieved by the acquiring not-for-profit entity.

B) Whether the acquired not-for-profit entity has the ability to generate significant amounts of revenue from providing goods or services or from membership fees, or whether it is expected to generate primarily contribution and investment revenue in the future.

C) Whether the acquired not-for-profit entity has the ability to generate significant amounts of revenues from goods or services or membership fees, as well as significant amounts of contribution revenues in the future.

D) Whether the acquired not-for-profit entity has a history of generating significant revenues of any type.

E) None of these answer choices are correct. Goodwill can only be recognized in an acquisition of a for-profit entity.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following topics are not included in the Form 990 which tax-exempt entities file to maintain their tax-exempt status?

A) Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees and Independent Contractors.

B) Donor Disclosure: Identification of Every Donor by Name, Contribution Value & Contribution Type.

C) Statement of Revenue.

D) Balance Sheet.

E) Statement of Functional Expenses.

A) Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees and Independent Contractors.

B) Donor Disclosure: Identification of Every Donor by Name, Contribution Value & Contribution Type.

C) Statement of Revenue.

D) Balance Sheet.

E) Statement of Functional Expenses.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

25

The following gifts are received in 2016 by a not-for-profit entity:

I.$2,000 specified by the donor to be used to pay salaries.

II.$10,000 specified by the donor for new conference room furniture.

III.$5,000 specified by the donor to be held for one year before being expended.

The salaries are paid in 2017 and the conference room furniture is purchased in 2016. The donor did not specify any time restriction on holding the conference room furniture.

What amount should be reclassified on the Statement of Activities for 2017 from the Temporarily Restricted column to the Unrestricted column?

A) $ 2,000.

B) $ 5,000.

C) $ 7,000.

D) $10,000.

E) $12,000.

I.$2,000 specified by the donor to be used to pay salaries.

II.$10,000 specified by the donor for new conference room furniture.

III.$5,000 specified by the donor to be held for one year before being expended.

The salaries are paid in 2017 and the conference room furniture is purchased in 2016. The donor did not specify any time restriction on holding the conference room furniture.

What amount should be reclassified on the Statement of Activities for 2017 from the Temporarily Restricted column to the Unrestricted column?

A) $ 2,000.

B) $ 5,000.

C) $ 7,000.

D) $10,000.

E) $12,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

26

Which entry would be the correct entry on the not-for-profit entity's books to record a donor's gift when the donor retains power over the assets? DEBIT CREDIT

A) Expense-charitable contribution Cash

B) Refundable advance to charity Cash

C) Cash Liability to beneficiary

D) Cash Refundable advance

E) Cash Contribution revenue

A) Expense-charitable contribution Cash

B) Refundable advance to charity Cash

C) Cash Liability to beneficiary

D) Cash Refundable advance

E) Cash Contribution revenue

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

27

Which entry would be the correct entry to record that a hospital has provided patient services for $200,000, of which 25% will be billed to a third party? DEBIT CREDIT

A) Accounts Receivable-Patients $200,000 Patient Service Revenue $200,000

B) Accounts Receivable-Patients $150,000 Patient Service Revenue $200,000 Accounts Receivable-Third Party $50,000

C) Accounts Receivable-Patients $50,000 Accounts Receivable-Third Party $150,000 Patient Service Revenue $200,000

D) Accounts Receivable-Patients $200,000 Patient Service Revenue $50,000 Accounts Receivable - Third Party $150,000

E) Patient Service Revenue $200,000 Accounts Receivable-Patients $150,000 Accounts Receivable-Third Party $50,000

A) Accounts Receivable-Patients $200,000 Patient Service Revenue $200,000

B) Accounts Receivable-Patients $150,000 Patient Service Revenue $200,000 Accounts Receivable-Third Party $50,000

C) Accounts Receivable-Patients $50,000 Accounts Receivable-Third Party $150,000 Patient Service Revenue $200,000

D) Accounts Receivable-Patients $200,000 Patient Service Revenue $50,000 Accounts Receivable - Third Party $150,000

E) Patient Service Revenue $200,000 Accounts Receivable-Patients $150,000 Accounts Receivable-Third Party $50,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

28

What is the appropriate account to credit when estimating a portion of health care entity's receivables that will prove to be uncollectible?

A) Bad Debt Expense.

B) Allowance for Uncollectible Accounts.

C) Patient Service Revenues.

D) Accounts Receivable.

E) Contractual Adjustments.

A) Bad Debt Expense.

B) Allowance for Uncollectible Accounts.

C) Patient Service Revenues.

D) Accounts Receivable.

E) Contractual Adjustments.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

29

Which entry would be the correct entry on the donor's books when the donor retains control of an asset, such as cash, which it contributes to a not-for-profit entity? DEBIT CREDIT

A) Expense-charitable contribution Cash

B) Refundable advance to charity Cash

C) Charitable pledge Cash

D) Cash Liability to beneficiary

E) Cash Refundable advance

A) Expense-charitable contribution Cash

B) Refundable advance to charity Cash

C) Charitable pledge Cash

D) Cash Liability to beneficiary

E) Cash Refundable advance

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

30

Which statement below is not correct for financial statements of not-for-profit entities?

A) Pledged contributions are recognized in the accounting period in which pledged by donors.

B) A not-for-profit entity's Statement of Financial Position includes a section specifically for net assets.

C) Contributed assets are recognized by a not-for-profit entity as public support contribution revenue.

D) Depreciation expense is not recognized by not-for-profit entities.

E) Not-for-profit entities issue a Statement of Activities.

A) Pledged contributions are recognized in the accounting period in which pledged by donors.

B) A not-for-profit entity's Statement of Financial Position includes a section specifically for net assets.

C) Contributed assets are recognized by a not-for-profit entity as public support contribution revenue.

D) Depreciation expense is not recognized by not-for-profit entities.

E) Not-for-profit entities issue a Statement of Activities.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

31

In not-for-profit accounting, an acquisition occurs when one not-for-profit entity obtains:

A) Significant influence over another not-for-profit entity.

B) More than 50% of another not-for-profit entity's fixed assets.

C) The right to collect more than 20% of pledged contributions.

D) Control over another not-for-profit entity.

E) None of these answer choices are correct. An acquisition can only occur for profit-oriented entities.

A) Significant influence over another not-for-profit entity.

B) More than 50% of another not-for-profit entity's fixed assets.

C) The right to collect more than 20% of pledged contributions.

D) Control over another not-for-profit entity.

E) None of these answer choices are correct. An acquisition can only occur for profit-oriented entities.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

32

How are investments in equity securities with readily determinable market values, and their related unrealized gains and losses, reported by a not-for-profit entity?

A) At lower of cost or market in the Statement of Financial Position, with unrealized losses in the Statement of Activities.

B) At fair value in the Statement of Financial Position, with unrealized gains and losses in the Statement of Activities.

C) At lower of cost or market in the Statement of Financial Position, with unrealized losses in Temporarily Restricted Net Assets.

D) At original cost in the Statement of Financial Position, with unrealized gains and losses in the Statement of Activities.

E) At original cost in the Statement of Financial Position, with unrealized gains and losses disclosed in the notes to the financial statements.

A) At lower of cost or market in the Statement of Financial Position, with unrealized losses in the Statement of Activities.

B) At fair value in the Statement of Financial Position, with unrealized gains and losses in the Statement of Activities.

C) At lower of cost or market in the Statement of Financial Position, with unrealized losses in Temporarily Restricted Net Assets.

D) At original cost in the Statement of Financial Position, with unrealized gains and losses in the Statement of Activities.

E) At original cost in the Statement of Financial Position, with unrealized gains and losses disclosed in the notes to the financial statements.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

33

Which entry would be the correct entry to record that a not-for-profit entity collected $80,000 of amounts pledged and also wrote off $3,000 of amounts pledged that were previously estimated as amounts uncollectible? DEBIT CREDIT

A) Pledges Receivable $80,000 Cash $80,000

B) Cash $80,000 Pledges Receivable $80,000

C) Pledges Receivable $80,000 Allowance for uncollectible pledges 3,000 Cash $83,000

D) Cash $80,000 Pledges Receivable $83,000 Allowance for uncollectible

Pledges $3,000

E) Cash $80,000 Unrestricted net assets-contributions $83,000 Allowance for uncollectible

Pledges $3,000

A) Pledges Receivable $80,000 Cash $80,000

B) Cash $80,000 Pledges Receivable $80,000

C) Pledges Receivable $80,000 Allowance for uncollectible pledges 3,000 Cash $83,000

D) Cash $80,000 Pledges Receivable $83,000 Allowance for uncollectible

Pledges $3,000

E) Cash $80,000 Unrestricted net assets-contributions $83,000 Allowance for uncollectible

Pledges $3,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

34

If the total acquisition value of an acquired not-for-profit entity is greater than the fair value of all identifiable net assets of the entity, and that entity's revenues are not generated by rendering goods or services or from membership dues, then the excess of acquisition value over identifiable net assets is immediately reported:

A) As goodwill on the consolidated Statement of Position.

B) As a pro-rata increase to the identifiable assets and liabilities acquired.

C) As a direct reduction in unrestricted net assets on the Statement of Financial Position.

D) As a reduction in unrestricted net assets on the Statement of Activities.

E) As an increase in other assets on the Statement of Financial Position.

A) As goodwill on the consolidated Statement of Position.

B) As a pro-rata increase to the identifiable assets and liabilities acquired.

C) As a direct reduction in unrestricted net assets on the Statement of Financial Position.

D) As a reduction in unrestricted net assets on the Statement of Activities.

E) As an increase in other assets on the Statement of Financial Position.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

35

Not-for-profit entities that are eligible to obtain tax-exempt status under Internal Revenue Code section 501(c)(4) are

A) Those promoting literacy.

B) Those promoting scientific research.

C) Chambers of Commerce.

D) Professional sports leagues.

E) Those functioning exclusively to promote social welfare.

A) Those promoting literacy.

B) Those promoting scientific research.

C) Chambers of Commerce.

D) Professional sports leagues.

E) Those functioning exclusively to promote social welfare.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

36

Which entry would be the correct entry on the donor's books when the donor relinquishes control of an asset, such as cash, which it contributes to a not-for-profit entity? DEBIT CREDIT

A) Expense-charitable contribution Cash

B) Refundable advance to charity Cash

C) Charitable pledge Cash

D) Cash Liability to beneficiary

E) Cash Refundable advance

A) Expense-charitable contribution Cash

B) Refundable advance to charity Cash

C) Charitable pledge Cash

D) Cash Liability to beneficiary

E) Cash Refundable advance

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

37

Give several examples, by name, of specific not-for-profit entities that are voluntary health and welfare entities.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

38

Which entry would be the correct entry on the not-for-profit entity's books to record a donor's gift when the money is simply passing through the not-for-profit entity, it creates no direct benefit, and control of the assets has been relinquished by the donor? DEBIT CREDIT

A) Expense-charitable contribution Cash

B) Refundable advance to charity Cash

C) Cash Liability to beneficiary

D) Cash Refundable advance

E) Cash Contribution revenue

A) Expense-charitable contribution Cash

B) Refundable advance to charity Cash

C) Cash Liability to beneficiary

D) Cash Refundable advance

E) Cash Contribution revenue

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

39

Which entry would be the correct entry to record pledges of $100,000 for a telethon event to raise money for a not-for-profit public television station? The public television entity estimates that 5% of the funds will be uncollectible. DEBIT CREDIT

A) Pledges Receivable $100,000 Unrestricted net assets-contributions $100,000

B) Cash $100,000 Unrestricted net assets-contributions $100,000

C) Pledges Receivable $100,000 Unrestricted net assets-contributions $95,000 Allowance for uncollectible pledges $ 5,000

D) Pledges Receivable $95,000 Unrestricted net assets-contributions $100,000 Allowance for uncollectible

Pledges $5,000

E) Cash $95,000 Unrestricted net assets-contributions $100,000 Allowance for uncollectible

Pledges $5,000

A) Pledges Receivable $100,000 Unrestricted net assets-contributions $100,000

B) Cash $100,000 Unrestricted net assets-contributions $100,000

C) Pledges Receivable $100,000 Unrestricted net assets-contributions $95,000 Allowance for uncollectible pledges $ 5,000

D) Pledges Receivable $95,000 Unrestricted net assets-contributions $100,000 Allowance for uncollectible

Pledges $5,000

E) Cash $95,000 Unrestricted net assets-contributions $100,000 Allowance for uncollectible

Pledges $5,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

40

What is the appropriate account to debit when reducing net patient service revenue as a result of arrangements with third party payors?

A) Contractual Adjustments.

B) Allowance for uncollectible and reduced accounts.

C) Patient Service Revenues.

D) Account Receivable-Patients.

E) Accounts Receivable-Third Party.

A) Contractual Adjustments.

B) Allowance for uncollectible and reduced accounts.

C) Patient Service Revenues.

D) Account Receivable-Patients.

E) Accounts Receivable-Third Party.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

41

$520,000 of the $2,720,000 was expected to be uncollectible.

Required:

Prepare the necessary journal entry to record the anticipated uncollectible amount.

Required:

Prepare the necessary journal entry to record the anticipated uncollectible amount.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

42

For not-for-profit entities, what is the difference in identification of "control" between a merger and an acquisition?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

43

What is the main source of financial support for most voluntary health and welfare entities?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

44

The hospital estimated that contractual adjustments would reduce the amount collected from third-party payors to $1,710,000.

Required:

Prepare the necessary journal entry to record the contractual adjustments.

Required:

Prepare the necessary journal entry to record the contractual adjustments.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

45

What term is often used by voluntary health and welfare entities as a category for resources received from contributions, as opposed to those from providing goods or services?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

46

How does a not-for-profit entity account for: 1) cash contributions, and 2) donated goods that are received for operating purposes? What types of revenues are recognized by voluntary health and welfare entities?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

47

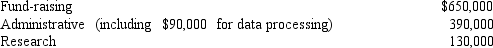

Dura Foundation, a voluntary health and welfare entity dedicated to finding medical cures and supported by contributions from the general public, included the following costs in its Statement of Functional Expenses for the year ended December 31, 2018:

What should Dura Foundation report as supporting service expenses?

What should Dura Foundation report as supporting service expenses?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

48

What are third party payors? Why are their interests important in accounting for health care entities?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

49

For May 2018, Carlington Hospital's charges for patient services were $608,000, of which 80% was billed to third-party payors.

Required:

Prepare the journal entry to accrue patient charges for the month.

Required:

Prepare the journal entry to accrue patient charges for the month.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

50

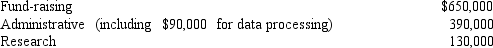

Dura Foundation, a voluntary health and welfare entity dedicated to finding medical cures and supported by contributions from the general public, included the following costs in its Statement of Functional Expenses for the year ended December 31, 2018:

What should Dura Foundation report as program service expenses?

What should Dura Foundation report as program service expenses?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

51

How does a recipient not-for-profit entity record the receipt of a gift that will be transferred without restriction to another charitable entity? What if the donor retains the right to revoke or redirect the gift?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

52

In this month, there were several patients that had no health insurance and due to their low income level, the hospital decided that $85,000 of receivables would not be collectible.

Required:

Prepare the necessary journal entry to reflect the decision to consider the $85,000 as charity care.

Required:

Prepare the necessary journal entry to reflect the decision to consider the $85,000 as charity care.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

53

What criteria must be met before a not-for-profit entity can recognize contributed services as a means of support?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

54

Prepare the necessary journal entry to record the revenue and receivables.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

55

During 2017, the Garfield Humane Society, a voluntary health and welfare entity, received cash donations of $892,000 and membership dues of $62,000.A member of the Humane Society donated services valued at $8,000 that would otherwise have been performed by a paid staff member.A pet food manufacturer donated dog food valued at $16,400.The Humane Society received a gift of $140,000, to be used in building a new animal shelter.Also during 2017, investments held by the Humane Society earned interest of $2,000.

Required:

Prepare a schedule showing the amount that the Garfield Humane Society should have recorded for contributions from public support for 2017.

Required:

Prepare a schedule showing the amount that the Garfield Humane Society should have recorded for contributions from public support for 2017.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

56

For a not-for-profit entity, what are supporting services expenses?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

57

What two classifications are used for the expenses incurred by voluntary health and welfare entities?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

58

What financial statements would normally be prepared by a voluntary health and welfare entity?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

59

What are the objectives of accounting for a not-for-profit entity?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

60

For a not-for-profit entity, when is recognition of contributions of artworks and historical treasures not required?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

61

During 2018, the Garfield Humane Society, a voluntary health and welfare entity, received cash donations of $892,000 and membership dues of $62,000.A member of the Humane Society donated services valued at $8,000 that would otherwise have been performed by a paid staff member.A pet food manufacturer donated dog food valued at $16,400.The Humane Society received a gift of $140,000, to be used for building a new animal shelter.Also during 2018, investments held by the Humane Society earned interest of $2,000.

Required:

Prepare a schedule showing the amount that the Garfield Humane Society should have recorded for contributions from public support for 2018, according to ASU 2016-14.

Required:

Prepare a schedule showing the amount that the Garfield Humane Society should have recorded for contributions from public support for 2018, according to ASU 2016-14.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

62

The Wakefield Home incurred the following liabilities that need to be recorded at the end of 2017: $110,000 salaries, $30,000 medical equipment, $10,000 utilities expense.

Prepare the journal entries for these transactions.

Prepare the journal entries for these transactions.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

63

Record the journal entries that reflect all of this information.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

64

Turnaround Childcare Agency is a private not-for-profit entity providing child care for a fee.The agency has a permanent endowment and the income may be used to sponsor families that are unable to pay for services but the principal must be preserved.In addition, various fundraising activities take place during the year.

When the agency held its annual holiday fundraiser in 2017, pledges of $50,000 were received.The administration expected 5% of the pledges to be uncollectible.

In addition, income of $10,000 was received from the permanent endowment to sponsor children to be placed with foster families.

Prepare the journal entries for these transactions.

When the agency held its annual holiday fundraiser in 2017, pledges of $50,000 were received.The administration expected 5% of the pledges to be uncollectible.

In addition, income of $10,000 was received from the permanent endowment to sponsor children to be placed with foster families.

Prepare the journal entries for these transactions.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

65

A not-for-profit entity receives a computer as a donation (valued at $2,000).Prepare the journal entry for the transaction.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

66

A local social worker, earning $12 per hour working for the state government, contributed 600 hours of time at no charge to the Sunny Homeless Shelter, a voluntary health and welfare entity.If not for these donated services, an additional staff person would have been hired by the entity.

Required:

How should the Sunny Homeless Shelter record the contributed services?

Required:

How should the Sunny Homeless Shelter record the contributed services?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

67

The Yelton Center is a voluntary health and welfare entity.During 2017, unrestricted pledges of $780,000 were received by the Yelton Center, sixty percent of which were fulfilled in 2017.Officials estimated that fifteen percent of the original amount of pledges will be uncollectible.The remainder of the amount expected to be collected from pledges will be received in 2018 (for use in 2018).

Required:

1) Show with appropriate amounts how the Yelton Center would present the pledges on its Statement of Financial Position on the day the pledges are recorded in 2017.

2) Show with appropriate amounts the effect on net assets the Yelton Center would report for contributions for 2017.

Required:

1) Show with appropriate amounts how the Yelton Center would present the pledges on its Statement of Financial Position on the day the pledges are recorded in 2017.

2) Show with appropriate amounts the effect on net assets the Yelton Center would report for contributions for 2017.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

68

A local business donated medical supplies to Wakefield Home with a value of $40,000.

Prepare the journal entry for the receipt of these supplies.

Prepare the journal entry for the receipt of these supplies.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

69

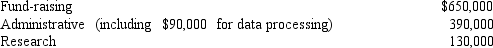

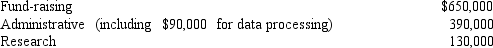

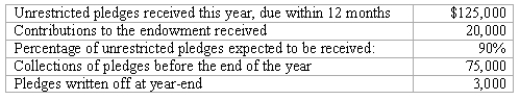

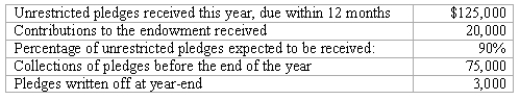

A not-for-profit entity provides the following information for the year 2017:  Required: Prepare the journal entries for these transactions for the year 2017.

Required: Prepare the journal entries for these transactions for the year 2017.

Required: Prepare the journal entries for these transactions for the year 2017.

Required: Prepare the journal entries for these transactions for the year 2017.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

70

Assume that the donor retains the right to revoke or redirect the gift.

Prepare the journal entries for Charity A and Charity B.The entries should be for the gift when received by Charity A, and when the gift is distributed for Charity B.

Prepare the journal entries for Charity A and Charity B.The entries should be for the gift when received by Charity A, and when the gift is distributed for Charity B.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

71

During 2017, the Garfield Humane Society, a voluntary health and welfare entity, received cash donations of $892,000 and membership dues of $62,000.A member of the Humane Society donated services valued at $8,000 that would otherwise have been performed by a paid staff member.A pet food manufacturer donated dog food valued at $16,400.The Humane Society received a gift of $140,000, to be used in building a new animal shelter.Also during 2017, investments held by the Humane Society earned interest of $2,000.

Required:

Prepare a schedule showing the amount that the Garfield Humane Society should have recorded for contributions from public support for 2017.

Required:

Prepare a schedule showing the amount that the Garfield Humane Society should have recorded for contributions from public support for 2017.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

72

Assume there are no donor rights to revoke or redirect the gift.

Prepare the journal entries for Charity A when the gift is received, and for Charity A and Charity B when the gift is distributed.

Prepare the journal entries for Charity A when the gift is received, and for Charity A and Charity B when the gift is distributed.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck