Deck 13: Qualitative Stock Selection

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/45

Play

Full screen (f)

Deck 13: Qualitative Stock Selection

1

The closer the specific attributes of companies,the greater the difference between the value of their shares will occur.

False

Explanation: No two shares are the same.A share represents an equity claim on a company's net assets.Each company is unique in terms of its investment assets,intangible assets,financing structure,management personnel,market share,products and services and so on.Thus,each share must by necessity be different.However,the closer the specific attributes of companies,the closer the value of their shares.In some cases,we may view two companies as being so similar that their shares are seen as interchangeable.In this case,the two shares are good substitutes for each other.However,they will not be perfect substitutes,as there will always be some difference in the structure of the underlying company.

Explanation: No two shares are the same.A share represents an equity claim on a company's net assets.Each company is unique in terms of its investment assets,intangible assets,financing structure,management personnel,market share,products and services and so on.Thus,each share must by necessity be different.However,the closer the specific attributes of companies,the closer the value of their shares.In some cases,we may view two companies as being so similar that their shares are seen as interchangeable.In this case,the two shares are good substitutes for each other.However,they will not be perfect substitutes,as there will always be some difference in the structure of the underlying company.

2

Blue-chip shares usually move against the market and therefore they have a relatively low level of risk.

False

Explanation: Financial advisers often prescribe that blue-chip shares are an essential component of a successful equity portfolio.While there is no formal definition as to what constitutes blue-chip shares,they can be regarded as an equity investment in a large established firm that has a relatively low level of risk.A blue-chip share is regarded as stable,and a sound financial investment.The word quality is often associated with blue-chip shares.The advantage of blue-chip shares is that they generally move with the market,which is not surprising,as their large size means that they represent a large proportion of the value-weighted market portfolio.Blue-chip shares tend to have equity betas close to one,which means that they generally yield returns close to that earned by the market.Further,blue-chip shares tend to have stable dividend yields.

Explanation: Financial advisers often prescribe that blue-chip shares are an essential component of a successful equity portfolio.While there is no formal definition as to what constitutes blue-chip shares,they can be regarded as an equity investment in a large established firm that has a relatively low level of risk.A blue-chip share is regarded as stable,and a sound financial investment.The word quality is often associated with blue-chip shares.The advantage of blue-chip shares is that they generally move with the market,which is not surprising,as their large size means that they represent a large proportion of the value-weighted market portfolio.Blue-chip shares tend to have equity betas close to one,which means that they generally yield returns close to that earned by the market.Further,blue-chip shares tend to have stable dividend yields.

3

Fama and French (1992)showed that,over 20 years,value firms outperformed growth firms in the USA by approximately __________ p.a.

B

Explanation: In a famous study,which was voted best paper of the year in 1992 by the prestigious Journal of Finance,two researchers,Gene Fama and Ken French,showed that value shares outperformed growth shares in the USA over a 20-year period from 1963.Moreover,the difference in performance was a staggering 21.4% p.a.for the value shares,compared to only 8% p.a.for the growth shares;that is,more than 13% p.a.

Explanation: In a famous study,which was voted best paper of the year in 1992 by the prestigious Journal of Finance,two researchers,Gene Fama and Ken French,showed that value shares outperformed growth shares in the USA over a 20-year period from 1963.Moreover,the difference in performance was a staggering 21.4% p.a.for the value shares,compared to only 8% p.a.for the growth shares;that is,more than 13% p.a.

4

The study by Fama and French (1992)showed that,on average,value firms outperformed growth firms by 13% p.a.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

5

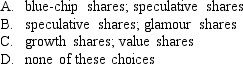

Fama and French (1992)find that,over a 20-year period in the USA,__________ outperformed __________.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

6

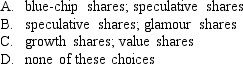

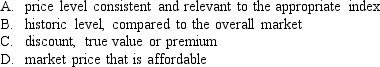

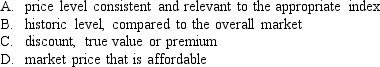

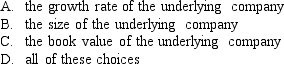

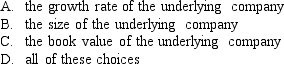

Shares that are classified as __________ have a high book-to-market ratio.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

7

The classification of a share into either the growth or value category:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

8

A value firm will not have a relatively high book-to-market ratio.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

9

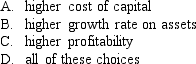

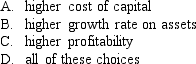

Other things being equal,a growth firm compared with a value firm will have:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

10

Charles Dow postulated that share price movements followed three types of behavior patterns over time,namely;pricing follows major trends,intermediate trends and long term trends.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

11

Technical analysts will only ever use 'candle-stick' information when using charting techniques.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

12

Fundamental analysis focus more on past price movements of a firm's stock than on the underlying determinants of its future profitability.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

13

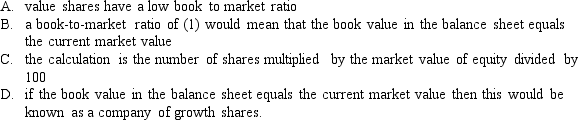

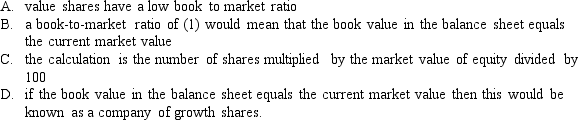

Which statement is true in relation to the book-to-market ratio:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

14

A growth firm has a relatively high book-to-market ratio.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

15

According to technical analysis,a series of price increases supported by heavy volume,interspersed with price falls on light volume,may be indicative of a bear market.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

16

Other things being equal,a value firm compared with a growth firm will have:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

17

Firms that have shares with a relatively high value of historical assets in place,are typically growth shares.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

18

Assuming a cost of equity capital of 18.5%,a growth rate of 9.5% and a rate of return on the (net)assets in place of 12%,what is the book-to-market ratio of this firm?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

19

A blue-chip share generally exhibits __________ over time.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

20

Other things being equal,a value firm compared with a growth firm will have:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

21

In technical analysis,__________ is a value below which the market is relatively unlikely to fall.

A)book value

B)resistance level

C)support level

D)the Dow line

A)book value

B)resistance level

C)support level

D)the Dow line

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

21

threat of new entrants to the market place

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

22

In reference to moving averages,another traditional technique used in charting:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is NOT one of Reilly and Norton's (1995)competition determinants?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

24

When the market breaks through the moving average line from below,a technical analyst would probably suggest that it is a good time to ___________.

A)buy the stock

B)hold the stock

C)sell the stock

D)short the stock

A)buy the stock

B)hold the stock

C)sell the stock

D)short the stock

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

25

An important assumption underlying the use of technical analysis techniques is that ___________________.

A)security prices adjust rapidly to new information

B)security prices adjust gradually to new information

C)security dealers will provide enough liquidity to keep price changes relatively small

D)all investors have immediate and costless access to information

A)security prices adjust rapidly to new information

B)security prices adjust gradually to new information

C)security dealers will provide enough liquidity to keep price changes relatively small

D)all investors have immediate and costless access to information

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

25

potential substitutes for the firm and its products and services

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

26

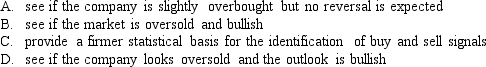

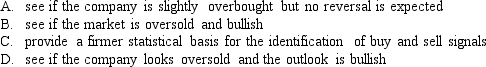

Pattern - recognition statistical tools are used in technical analysis to:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

27

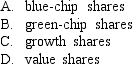

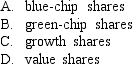

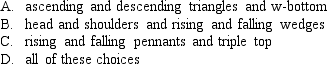

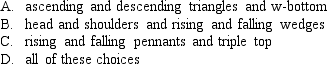

The various terms that are assigned to more complex charting that involves the plotting of daily high-low closing prices and volume across time are:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

28

The process of fundamental analysis establishes whether the share is trading at a:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

29

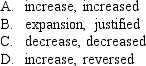

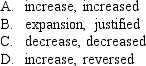

A resistant level is the range of prices at which the technician expects an __________ in the supply of shares such that any price will be ____________.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

30

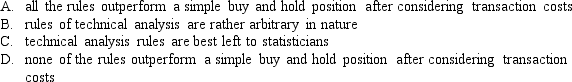

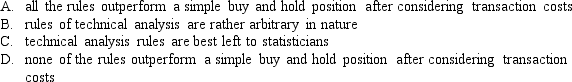

Batten and Ellis (1996)examine the performance of various technical trading rules in Australia and find:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

31

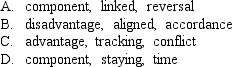

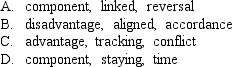

A ____________ of blue-chip shares is that because they are _________ so closely to the market,a portfolio consisting of almost exclusively blue-chip shares will simply perform in _________ with the market.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

32

The most significant determinant of a share price is a company's:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

33

In which of the following industries is a speculative investment NOT likely to be found?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

34

bargaining power of buyers.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

34

'Resistance levels' are most frequently used in the area of:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

35

__________ involves the examination of historical data on prices and volume to determine futures prices on the basis of trends.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

35

bargaining power of suppliers

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

36

A _________ is a value above which it is difficult for the market to rise.

A)book value

B)resistance level

C)support level

D)confidence level

A)book value

B)resistance level

C)support level

D)confidence level

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

37

The distinguishing feature between blue-chip and green-chip shares is:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

37

current rivals in existing markets

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

38

In the Australian share market,how much of the total market capitalisation is represented by the 10 largest companies?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

39

BMIG Ltd has a current share price of $12.13.It is expected to pay $0.73 in dividends next period and it has a growth rate of 12%.What is the cost of equity capital for BMIG Ltd?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

40

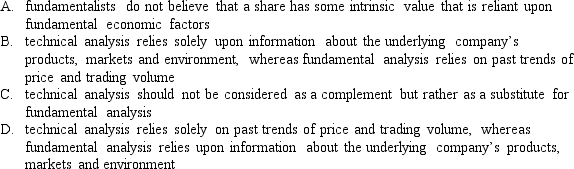

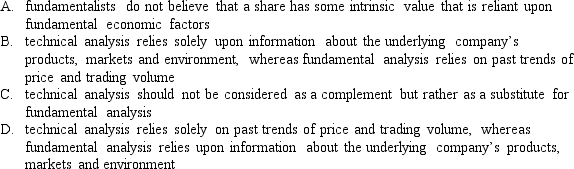

Technical and fundamental analysis differ in that:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck