Deck 4: Accrual Accounting and Financial Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

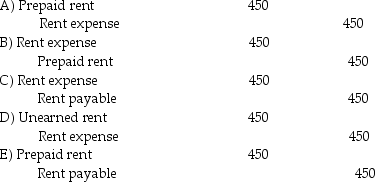

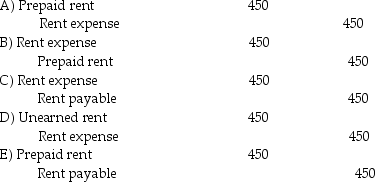

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

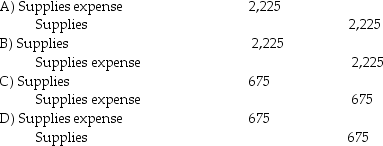

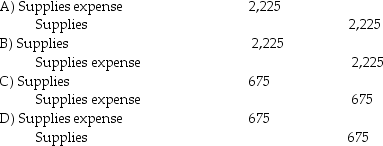

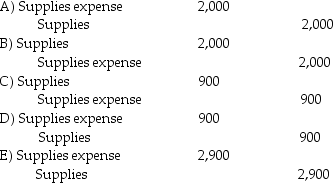

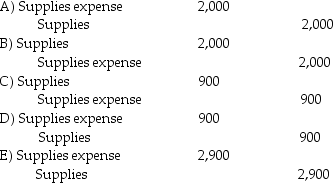

Question

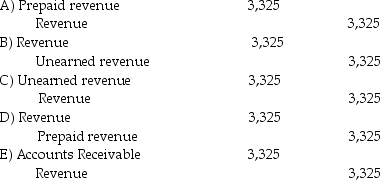

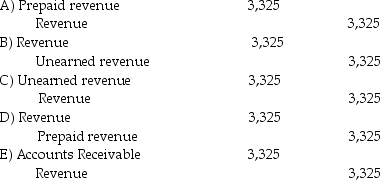

Question

Question

Question

Question

Question

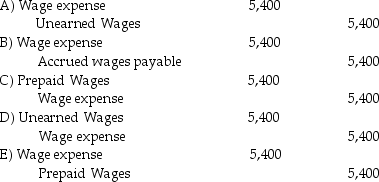

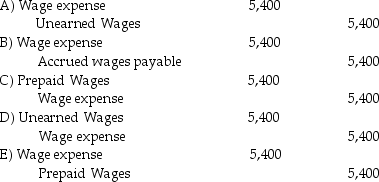

Question

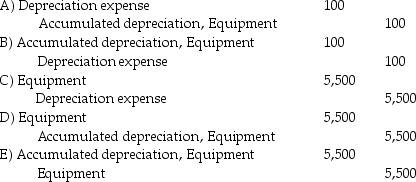

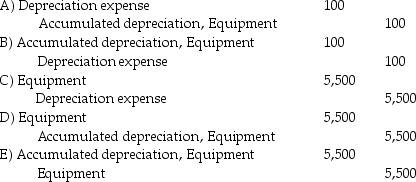

Question

Question

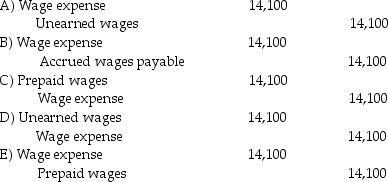

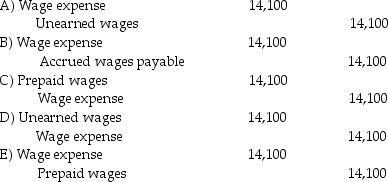

Question

Question

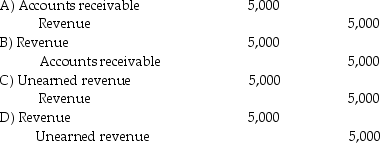

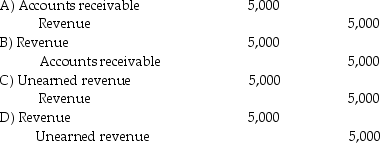

Question

Question

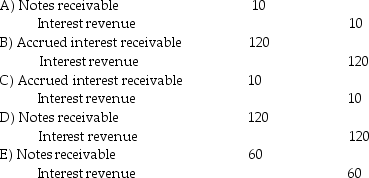

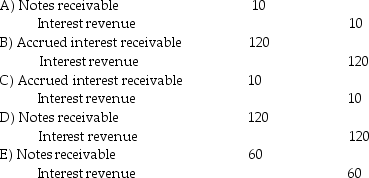

Question

Question

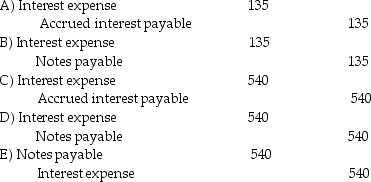

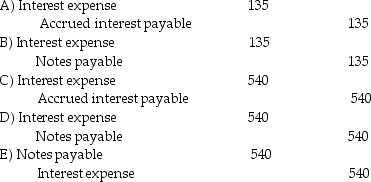

Question

Question

Question

Question

Question

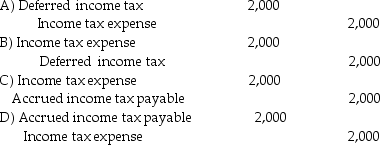

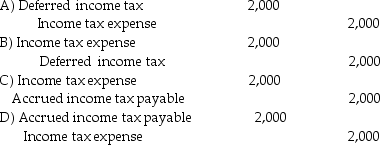

Question

Question

Question

Question

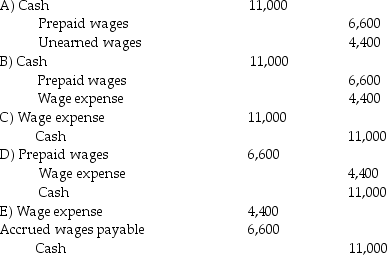

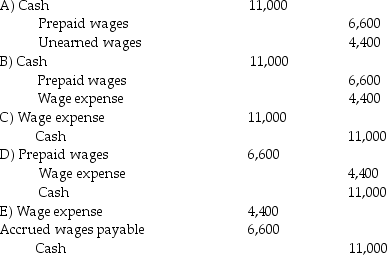

Question

Question

Question

Question

Question

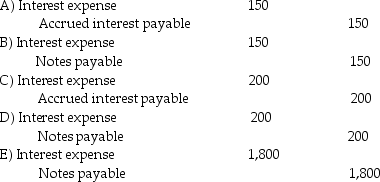

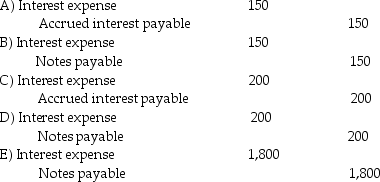

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

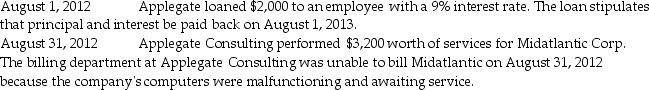

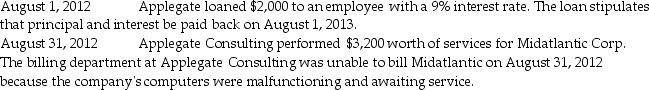

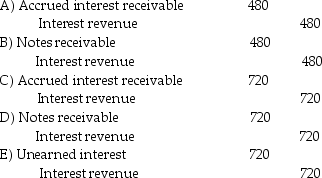

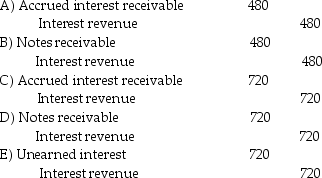

Question

Question

Question

Question

Question

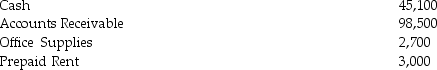

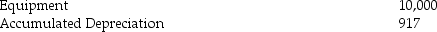

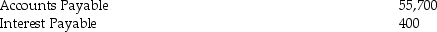

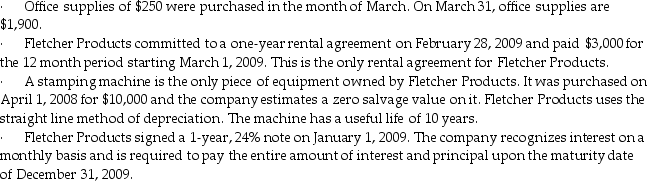

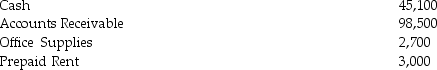

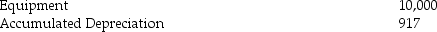

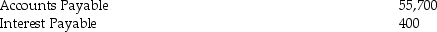

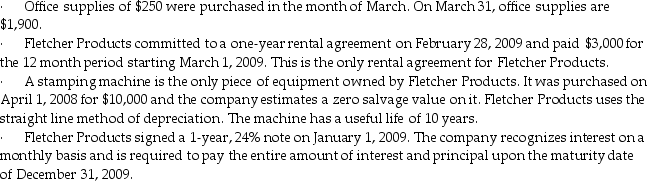

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/126

Play

Full screen (f)

Deck 4: Accrual Accounting and Financial Statements

1

Every adjusting entry affects one income statement account and one balance sheet account.

True

2

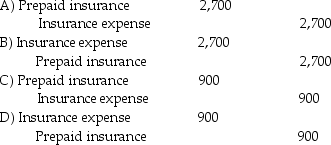

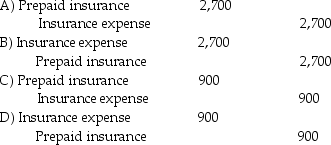

On October 1,Hurt Enterprises paid 4 months' insurance in advance for $3,600.At the time of the payment,prepaid insurance was increased by $3,600.What adjusting entry is necessary as of December 31?

E)No adjusting entry is necessary

E)No adjusting entry is necessary

B

3

Although it does not occur often,the Cash account can be used to record adjusting entries.

False

4

Some explicit transactions (e.g.,the loss of assets due to fire)do not involve actual exchanges of goods and services between parties.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

5

Implicit transactions are events such as cash receipts and disbursements that trigger nearly all day-to-day routine entries.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

6

Define the term "implicit transaction" and explain how these transactions are recorded in the financial records.In addition,list two of the four principal types of adjustments and give an example of each.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is an example of an accrual?

A)Wages incurred but not yet paid.

B)Payment of insurance 8 months in advance.

C)Purchase of equipment for use in the business.

D)Revenue collected in advance from customer.

E)All of the above.

A)Wages incurred but not yet paid.

B)Payment of insurance 8 months in advance.

C)Purchase of equipment for use in the business.

D)Revenue collected in advance from customer.

E)All of the above.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

8

An example of an adjusting entry is

A)cash collections from credit customers.

B)payment of the principal and interest on a note.

C)recognizing rent expense by reducing Prepaid Rent.

D)declaring a cash dividend.

E)buying inventory on open account.

A)cash collections from credit customers.

B)payment of the principal and interest on a note.

C)recognizing rent expense by reducing Prepaid Rent.

D)declaring a cash dividend.

E)buying inventory on open account.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

9

An example of an explicit transaction is

A)depreciation expense.

B)expiration of prepaid rent.

C)accrual of interest payable.

D)accrual of wages payable.

E)purchasing inventory on account.

A)depreciation expense.

B)expiration of prepaid rent.

C)accrual of interest payable.

D)accrual of wages payable.

E)purchasing inventory on account.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

10

The accountant uses adjusting entries to record implicit transactions at the end of each reporting period.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

11

An example of an implicit transaction is

A)a cash sale.

B)a credit purchase of inventory.

C)the receipt of cash in advance of providing services.

D)the expiration of prepaid rent.

E)a credit sale.

A)a cash sale.

B)a credit purchase of inventory.

C)the receipt of cash in advance of providing services.

D)the expiration of prepaid rent.

E)a credit sale.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

12

Adjusting entries affect

A)neither an income statement account nor a balance sheet account

B)an income statement account and a balance sheet account

C)income statement accounts only

D)balance sheet accounts only

E)a cash account

A)neither an income statement account nor a balance sheet account

B)an income statement account and a balance sheet account

C)income statement accounts only

D)balance sheet accounts only

E)a cash account

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

13

All creditor transactions will result in an adjusting entry.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

14

Recording an accrual entry involves recording a(n)________ or ________ at the end of an accounting period even though no explicit transaction occurs.

A)fixed asset; long-term liability

B)intangible asset; long-term liability

C)cash sale; credit sale

D)dividends; retained earnings

E)receivable; payable

A)fixed asset; long-term liability

B)intangible asset; long-term liability

C)cash sale; credit sale

D)dividends; retained earnings

E)receivable; payable

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

15

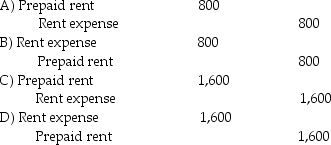

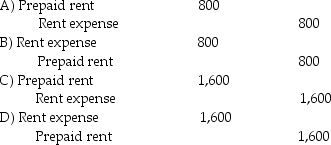

Blockade Consulting Services paid 3 months' rent in advance on July 1,at a total cost of $2,400.The rent covers the period from July 1 to September 30.At the time of the payment,prepaid rent was increased by $2,400.What adjusting entry is necessary on July 31?

E)No adjusting entry is necessary.

E)No adjusting entry is necessary.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements regarding adjusting entries is true?

A)Accountants use adjusting entries to record explicit transactions at the end of each reporting period.

B)Adjusting entries are made on a daily basis as cash is exchanged between parties.

C)Adjusting entries have nothing to do with accrual accounting.

D)Adjusting entries are made at periodic intervals,usually when the financial statements are about to be prepared.

E)The recording of cash receipts from customers is an example of an adjusting entry.

A)Accountants use adjusting entries to record explicit transactions at the end of each reporting period.

B)Adjusting entries are made on a daily basis as cash is exchanged between parties.

C)Adjusting entries have nothing to do with accrual accounting.

D)Adjusting entries are made at periodic intervals,usually when the financial statements are about to be prepared.

E)The recording of cash receipts from customers is an example of an adjusting entry.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following situations does NOT involve an adjusting entry?

A)Recording the expiration of prepaid insurance.

B)Recording depreciation on equipment.

C)Recording wages owed to employees.

D)Recording revenue earned when cash was received in advance.

E)Recognizing sales when they occur.

A)Recording the expiration of prepaid insurance.

B)Recording depreciation on equipment.

C)Recording wages owed to employees.

D)Recording revenue earned when cash was received in advance.

E)Recognizing sales when they occur.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

18

An example of an explicit transaction is

A)accruing interest payable at the end of the fiscal year.

B)recognizing depreciation expense.

C)cash disbursement for the payment of 3 months' rent in advance.

D)accruing wages payable at month end.

E)recognizing rent expense by reducing prepaid rent.

A)accruing interest payable at the end of the fiscal year.

B)recognizing depreciation expense.

C)cash disbursement for the payment of 3 months' rent in advance.

D)accruing wages payable at month end.

E)recognizing rent expense by reducing prepaid rent.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

19

An example of an entry that is not an adjusting entry is

A)reducing Prepaid Rent to record rent expense for the current month.

B)reducing Unearned Revenue to record revenue for services provided during the month.

C)accruing wage expense for labor costs which have been incurred but not yet paid.

D)purchase of land for cash and a note payable.

E)accruing revenue for services that have been provided but not yet billed.

A)reducing Prepaid Rent to record rent expense for the current month.

B)reducing Unearned Revenue to record revenue for services provided during the month.

C)accruing wage expense for labor costs which have been incurred but not yet paid.

D)purchase of land for cash and a note payable.

E)accruing revenue for services that have been provided but not yet billed.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

20

The adjusting entry to recognize periodic depreciation expense has what effect on the basic accounting equation?

A)Decrease in assets,decrease in liabilities

B)Decrease in assets,increase in liabilities

C)Decrease in assets,increase in stockholders' equity

D)Decrease in assets,decrease in stockholders' equity

E)None of these

A)Decrease in assets,decrease in liabilities

B)Decrease in assets,increase in liabilities

C)Decrease in assets,increase in stockholders' equity

D)Decrease in assets,decrease in stockholders' equity

E)None of these

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following situations involves a deferral?

A)Recording accrued interest

B)Recording accrued wages

C)Recording revenue earned but not yet received

D)Recording revenue earned that was collected in advance

E)None of the above are deferrals.

A)Recording accrued interest

B)Recording accrued wages

C)Recording revenue earned but not yet received

D)Recording revenue earned that was collected in advance

E)None of the above are deferrals.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

22

Oleke Manufacturing received $800 in advance on January 1 from Zinger Company for services to be performed over the next 3 months.If the $800 received from Zinger Company was placed into the Unearned Revenue account,and Oleke had completed 30% of the work as of the end of the month,what adjusting entry would Oleke Manufacturing make on January 31?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

23

On March 1,Getze Family Automotive received $7,000 cash for services to be rendered in March and April.The company recorded unearned revenue upon receipt of cash.What adjusting entry would Getze Family Automotive make on March 31,assuming that $2,000 of services was performed in March?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

24

Oleke Manufacturing borrowed $20,000 from Second National Bank on January 1.The note is for 9 months with all interest due at the end of the note.The bank is charging the company 9% interest.What adjusting entry is necessary for Oleke Manufacturing on January 31?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

25

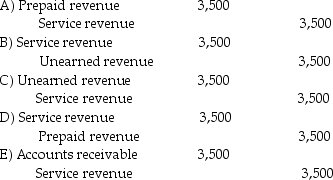

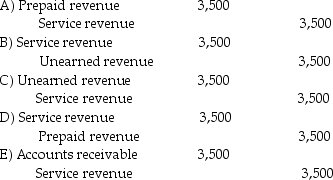

During March,Getze Family Automotive installed a new engine with a billed price of $3,500.The company did not bill for the engine until April 1.Ignore the cost of the engine installed.What adjusting entry would Getze Family Automotive make on March 31?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

26

On April 30,Hilte Corporation performed a month-end inventory and counted office supplies valued at $1,425.On April 1,the balance in the Supplies account was $750.Assuming that $2,900 of purchases for the month was posted to the Supplies account,what adjusting entry would Hilte Corporation make on April 30?

E)None of the above

E)None of the above

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

27

On April 30,Hilte Corporation performed services valued at $3,325.The company did not bill for the services until May 1.What adjusting entry would Hilte Corporation make on April 30?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

28

Oleke Manufacturing paid $1,800 for 4 months' rent in advance on January 1.Assuming only asset accounts were used in the January 1 journal entry,what adjusting entry is necessary on January 31?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

29

The adjusting entry to record $650 of expired insurance would include a debit to Unearned Insurance.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

30

The adjustment for revenue received in advance,which has been earned in the current period,involves a

A)debit to unearned revenue.

B)debit to accrued revenue.

C)credit to accrued revenue.

D)debit to cash.

E)credit to cash.

A)debit to unearned revenue.

B)debit to accrued revenue.

C)credit to accrued revenue.

D)debit to cash.

E)credit to cash.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

31

Failure to adjust for depreciation results in the overstatement of assets and the understatement of net income.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

32

At March 31,Getze Family Automotive owes $5,400 for wages to be paid on April 8.What adjusting entry is necessary on March 31?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

33

The entry to record equipment depreciation when the equipment depreciates $100 per month,the balance in the Accumulated Depreciation,Equipment account is $600 and the balance in the Equipment account is $5,600 is

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

34

If the adjusting entry to record the current period's prepaid rent that is expired is omitted,current assets will be overstated.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

35

On April 30,Hilte Corporation owes $14,100 for wages to be paid on May 6.What adjusting entry is necessary on April 30?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

36

Prepare any necessary adjusting or correcting entries called for by the following situations.Assume that no entries have been made regarding the situation other than those specifically described.

Consider each situation separately.

a.Equipment is repaired and maintained by an outside maintenance company on an annual fee basis,payable in advance.The $2,400 fee was paid in advance on September 1 (for 12 months beginning September 1)and was charged to Repair and Maintenance Expense.What adjustment is necessary on December 31?

b.On January 1,$10,500 of machinery was purchased.$500 cash was paid down and a 3-month,12% note payable was signed for the balance.The January 1 transaction was properly recorded.Prepare the adjustment for the interest as of January 31.

c.On February 1,$1,200 was paid in advance to the landlord for three month's rent.The tenant debited Prepaid Rent for $1,200 on February 1.What adjustment is necessary as of February 28?

Consider each situation separately.

a.Equipment is repaired and maintained by an outside maintenance company on an annual fee basis,payable in advance.The $2,400 fee was paid in advance on September 1 (for 12 months beginning September 1)and was charged to Repair and Maintenance Expense.What adjustment is necessary on December 31?

b.On January 1,$10,500 of machinery was purchased.$500 cash was paid down and a 3-month,12% note payable was signed for the balance.The January 1 transaction was properly recorded.Prepare the adjustment for the interest as of January 31.

c.On February 1,$1,200 was paid in advance to the landlord for three month's rent.The tenant debited Prepaid Rent for $1,200 on February 1.What adjustment is necessary as of February 28?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

37

Oleke Manufacturing performed services for a client during January valued at $5,000.The client was billed on February 9.What adjusting entry would Oleke Manufacturing make on January 31?

E)No adjusting entry is necessary on June 30.

E)No adjusting entry is necessary on June 30.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

38

On March 31,Getze Family Automotive performed a month-end inventory and counted office supplies valued at $2,100.On March 1,the balance in the Supplies account was $1,200.Assume that $2,900 of purchases for the month was posted to the Supplies account,what adjusting entry would Getze Family Automotive make on March 31?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

39

Milton Company,a valued customer,placed an order for $1,500 on January 1.Because Milton is experiencing financial difficulties,it has been allowed to pay with a 3-month note receivable.The interest rate on the note is 8%.What adjusting entry is necessary for Oleke Manufacturing on January 31?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

40

Examples of adjusting for asset expirations include the write-offs to expense of such assets as Office Supplies and Prepaid Insurance.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

41

Cupling Enterprises borrowed $6,000 from Escada Bank on October 1,2012.At that time,the company made the appropriate journal entry; however,no other journal entry pertaining to the note has been made.Given that the bank is charging interest at a rate of 9%,what adjusting entry is necessary as of Cupling Enterprise's year-end date of December 31,2012?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

42

The adjusting entry to record accrued salaries has what effect on the basic accounting equation?

A)Increases liabilities,decreases stockholders' equity

B)Increases liabilities,increases stockholders' equity

C)Decrease assets,decreases stockholders' equity

D)Decrease assets,increases stockholders' equity

E)Decrease liabilities,decrease assets

A)Increases liabilities,decreases stockholders' equity

B)Increases liabilities,increases stockholders' equity

C)Decrease assets,decreases stockholders' equity

D)Decrease assets,increases stockholders' equity

E)Decrease liabilities,decrease assets

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

43

Auto Detailing,Inc.had the following transactions on August 1:

a.The company sold $2,100 of inventory costing $1,400.The customer will not be billed until September.As of August 31,no entries have been made with respect to the inventory that has been sold or the sale.

b.The company received a $2,000 payment from a customer for services to be performed during August and September.On August 1,the entire $2,000 was placed in the Unearned Revenue account.As of August 31,40% of the work had been completed.

c.The company paid $7,200 for 4 months' rent in advance.The entire amount was placed into Prepaid Rent.

d.The company sold equipment costing $2,400 for $5,400 to a customer in return for a 3-month note.The sale was properly recorded on August 1.Auto Detailing,Inc.is charging 12% interest on the note.The customer will pay the note and all interest after 3 months.

Prepare the appropriate journal entries for Auto Detailing,Inc.as of August 31,for each of the above transactions.

a.The company sold $2,100 of inventory costing $1,400.The customer will not be billed until September.As of August 31,no entries have been made with respect to the inventory that has been sold or the sale.

b.The company received a $2,000 payment from a customer for services to be performed during August and September.On August 1,the entire $2,000 was placed in the Unearned Revenue account.As of August 31,40% of the work had been completed.

c.The company paid $7,200 for 4 months' rent in advance.The entire amount was placed into Prepaid Rent.

d.The company sold equipment costing $2,400 for $5,400 to a customer in return for a 3-month note.The sale was properly recorded on August 1.Auto Detailing,Inc.is charging 12% interest on the note.The customer will pay the note and all interest after 3 months.

Prepare the appropriate journal entries for Auto Detailing,Inc.as of August 31,for each of the above transactions.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

44

Scrumptious Donuts sold $2,000 worth of gift certificates in December.As of December 31,$500 worth of the $2,000 gift certificates had been redeemed.All gift certificates sold use the Deferred Revenue account.The balance in the Deferred Revenue account as of December 31 is

A)$2,000

B)$2,500

C)$500

D)$1,500

E)not enough information to answer

A)$2,000

B)$2,500

C)$500

D)$1,500

E)not enough information to answer

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

45

Circle Knitting,Inc.recorded $4,000 of unearned revenue being earned and the collection of $1,500 cash for services previously accrued.The impact of these two entries on total revenue is an increase of $5,500.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

46

The entry to accrue $2,000 of income tax monthly is

E)no entry is needed; taxes are recognized when paid

E)no entry is needed; taxes are recognized when paid

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

47

What is the effect on the basic accounting equation of the cash payment of accrued interest payable previously accrued?

A)Increase assets,increase liabilities

B)Decrease assets,decrease liabilities

C)Decrease assets,increase liabilities

D)Increase liabilities,decrease stockholders' equity

E)Decrease liabilities,increase stockholders' equity

A)Increase assets,increase liabilities

B)Decrease assets,decrease liabilities

C)Decrease assets,increase liabilities

D)Increase liabilities,decrease stockholders' equity

E)Decrease liabilities,increase stockholders' equity

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

48

The adjusting entry to record the accrual of interest expense has what effect on the basic accounting equation?

A)Increase assets,increase liabilities

B)Decrease assets,decrease liabilities

C)Increase assets,decrease liabilities

D)Increase liabilities,decrease stockholders' equity

E)Decrease liabilities,increase stockholders' equity

A)Increase assets,increase liabilities

B)Decrease assets,decrease liabilities

C)Increase assets,decrease liabilities

D)Increase liabilities,decrease stockholders' equity

E)Decrease liabilities,increase stockholders' equity

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

49

The adjusting entry to record $675 of earned revenue received in advance would include a debit to Unearned Revenue.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

50

Howard Products has a daily payroll of $2,200,5 days a week.The employees are paid every Friday for that week's wages.July 31 was on a Wednesday and the employees were paid $11,000 on August 2.What is the journal entry on August 2,assuming the appropriate month ending adjusting entry was made on July 31?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

51

The adjusting entry to record accrued salaries earned includes a debit to accrued salaries payable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

52

Income before income tax is

A)a subtotal before net income on the income statement

B)a subtotal after net income on the income statement

C)included in net income on the income statement

D)included in stockholders' equity on the income statement

E)included in stockholders' equity on the balance sheet

A)a subtotal before net income on the income statement

B)a subtotal after net income on the income statement

C)included in net income on the income statement

D)included in stockholders' equity on the income statement

E)included in stockholders' equity on the balance sheet

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

53

Chordall Authors Company circulates a monthly magazine,charging $36 to subscribers for a 12-month subscription.Subscribers are required to forward the entire $36 yearly subscription fee before Chordall Authors Company will furnish the subscriber with the magazine.Chordall Authors Company sold 300 magazine subscriptions in the month of March,while the balance in the Unearned Subscription Revenue account was $20,000 on March 1,2009.After the necessary adjusting entry for March,the balance in the Unearned Subscription Revenue account was $25,200.

Required:

1.Prepare the appropriate journal entry for Chordall Authors Company as of March 31.

2.How would net income be affected for the month ending March 31 if Chordall Authors Company did not record the above entry?

Required:

1.Prepare the appropriate journal entry for Chordall Authors Company as of March 31.

2.How would net income be affected for the month ending March 31 if Chordall Authors Company did not record the above entry?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

54

The adjustment for revenue received in advance that has now been earned involves a debit to

A)Cash and a credit to Prepaid Revenue.

B)Unearned Revenue and a credit to Revenue.

C)Prepaid Revenue and a credit to Unearned Revenue.

D)Revenue and a credit to Unearned Revenue.

E)Prepaid Revenue and a credit to Cash.

A)Cash and a credit to Prepaid Revenue.

B)Unearned Revenue and a credit to Revenue.

C)Prepaid Revenue and a credit to Unearned Revenue.

D)Revenue and a credit to Unearned Revenue.

E)Prepaid Revenue and a credit to Cash.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

55

An adjusting entry made to record accrued interest on a note payable involves a credit to

A)interest expense.

B)accrued interest payable.

C)interest revenue.

D)accrued interest receivable.

E)cash.

A)interest expense.

B)accrued interest payable.

C)interest revenue.

D)accrued interest receivable.

E)cash.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

56

What effect does the earning of revenue previously collected have on the basic accounting equation? Assume Unearned Revenue had been increased when the cash was collected in advance.

A)Increase in assets,decrease in liabilities

B)Decrease in assets,decrease in liabilities

C)Decrease in liabilities,increase in stockholders' equity

D)Decrease in assets,decrease in stockholders' equity

E)Increase in assets,increase in stockholders' equity

A)Increase in assets,decrease in liabilities

B)Decrease in assets,decrease in liabilities

C)Decrease in liabilities,increase in stockholders' equity

D)Decrease in assets,decrease in stockholders' equity

E)Increase in assets,increase in stockholders' equity

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

57

Module Accounting Services receives $8,000 cash for service revenue to be earned in the future.The company credits Service Revenue upon receipt of the cash.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

58

The entry to record the cash payment of salaries that had previously been accrued has what effect on the basic accounting equation?

A)Decrease liabilities,decrease assets

B)Decrease liabilities,decrease stockholders' equity

C)Decrease assets,decrease stockholders' equity

D)Decrease assets,increase stockholders' equity

E)Decrease assets,increase liabilities

A)Decrease liabilities,decrease assets

B)Decrease liabilities,decrease stockholders' equity

C)Decrease assets,decrease stockholders' equity

D)Decrease assets,increase stockholders' equity

E)Decrease assets,increase liabilities

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

59

An example of an adjusting entry is

A)the payment of wages that have been accrued.

B)the accruing of interest expense.

C)the return of defective inventory.

D)the payment of rent in advance.

E)collection of an accounts receivable.

A)the payment of wages that have been accrued.

B)the accruing of interest expense.

C)the return of defective inventory.

D)the payment of rent in advance.

E)collection of an accounts receivable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

60

Failure to adjust for an unrecorded expense such as wages expense will overstate net income and stockholders' equity for the period.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

61

Recording an unrecorded expense will increase expenses and decrease revenues.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

62

If Company A has an accrual of interest to be received on a note receivable,then the company should debit

A)Interest expense.

B)Accrued interest payable.

C)Accrued interest receivable.

D)Interest revenue.

E)Cash.

A)Interest expense.

B)Accrued interest payable.

C)Accrued interest receivable.

D)Interest revenue.

E)Cash.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

63

Journalizing amounts for unearned revenue can cause ethical dilemmas for many accountants since estimates are often used when exact completion amounts are uncertain.Discuss potential problems that this may cause for financial statement users.How does the concept of conservatism affect an accountant's recognition of revenue of a particular project? How would underestimating revenue of a project affect net income?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

64

The collection in cash of interest receivable previously accrued has what effect on the basic accounting equation?

A)Increase assets,increase liabilities

B)Decrease assets,decrease liabilities

C)Increase assets,decrease liabilities

D)Increase liabilities,decrease stockholders' equity

E)It has no effect as one asset increases while another asset decreases.

A)Increase assets,increase liabilities

B)Decrease assets,decrease liabilities

C)Increase assets,decrease liabilities

D)Increase liabilities,decrease stockholders' equity

E)It has no effect as one asset increases while another asset decreases.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

65

Failure to adjust for accrued revenue will understate stockholders' equity.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

66

The order of the steps in the recording process has

A)the adjusted trial balance after preparing the financial statements.

B)the journalization and posting of adjustments before the ledger.

C)the adjusted trial balance before the ledger.

D)journalization after the adjusted trial balance.

E)the unadjusted trial balance after the ledger.

A)the adjusted trial balance after preparing the financial statements.

B)the journalization and posting of adjustments before the ledger.

C)the adjusted trial balance before the ledger.

D)journalization after the adjusted trial balance.

E)the unadjusted trial balance after the ledger.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

67

Stake,Inc.,records the payment of $200 cash for a previously accrued expense and the accrual of $625 for another expense.The impact of these two entries is to decrease net income by $825.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is the correct order in the recording process?

A)Journalize and post adjustments,unadjusted trial balance,adjusted trial balance,ledger,financial statements

B)Ledger,journalize and post adjustments,unadjusted trial balance,adjusted trial balance,financial statements

C)Ledger,unadjusted trial balance,journalize and post adjustments,adjusted trial balance,and financial statements

D)Unadjusted trial balance,journalize and post adjustments,ledger,adjusted trial balance,financial statements

E)Journalize and post adjustments,adjusted trial balance,ledger,unadjusted trial balance,financial statements

A)Journalize and post adjustments,unadjusted trial balance,adjusted trial balance,ledger,financial statements

B)Ledger,journalize and post adjustments,unadjusted trial balance,adjusted trial balance,financial statements

C)Ledger,unadjusted trial balance,journalize and post adjustments,adjusted trial balance,and financial statements

D)Unadjusted trial balance,journalize and post adjustments,ledger,adjusted trial balance,financial statements

E)Journalize and post adjustments,adjusted trial balance,ledger,unadjusted trial balance,financial statements

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

69

The following transactions occurred in August,2012 for Applegate Consulting:

What adjusting entries should Applegate Consulting make on August 31,2012?

What adjusting entries should Applegate Consulting make on August 31,2012?

What adjusting entries should Applegate Consulting make on August 31,2012?

What adjusting entries should Applegate Consulting make on August 31,2012?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

70

Cash flows

A)always follow the adjusting entries.

B)always precede the adjusting entries.

C)may precede or follow the adjusting entries.

D)always follow the unadjusted trial balance.

E)always precede the closing entries.

A)always follow the adjusting entries.

B)always precede the adjusting entries.

C)may precede or follow the adjusting entries.

D)always follow the unadjusted trial balance.

E)always precede the closing entries.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is an example of an accrual of unrecorded revenues?

A)Interest accrues each month,but is paid quarterly.

B)Office supplies are purchased each month,but the account is not adjusted until the end of the month.

C)Wages have been earned,but have not been paid at the end of the month.

D)An attorney has performed work for a client,but has not billed the client yet.

E)Equipment purchased will be beneficial for several years.

A)Interest accrues each month,but is paid quarterly.

B)Office supplies are purchased each month,but the account is not adjusted until the end of the month.

C)Wages have been earned,but have not been paid at the end of the month.

D)An attorney has performed work for a client,but has not billed the client yet.

E)Equipment purchased will be beneficial for several years.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

72

Recording revenue in 2012 that is actually earned in 2013 will result in:

A)overstatement of net income in 2012

B)overstatement of net income in 2013

C)understatement of net income in 2013

D)an overstatement of net income in 2012 and an understatement in net income in 2013

E)an overstatement of net income in 2013 and an understatement in net income in 2012

A)overstatement of net income in 2012

B)overstatement of net income in 2013

C)understatement of net income in 2013

D)an overstatement of net income in 2012 and an understatement in net income in 2013

E)an overstatement of net income in 2013 and an understatement in net income in 2012

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

73

Small Business Bank loaned $9,000 to Weidenhammer Company on May 1,2012,accepting a 2-year,8% note.The bank recorded the transaction properly on May 1.No other journal entry pertaining to the note has been made since May 1.As of year-end on December 31,2012,what adjusting entry will the bank make with respect to this note?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

74

Fletcher Products records adjusting entries monthly.The accountant at Fletcher Products is having difficulty figuring out what amount to include as the adjustment.Below are the accounts and amounts from Fletcher Products' month-end balances on February 28.

Current assets

Current assets

Long-term assets

Long-term assets

Current liabilities

Current liabilities

Long-term liabilities

Long-term liabilities

Additional Information:

Additional Information:

Required:

Required:

Prepare any necessary adjusting entries on March 31 based on the above information.Assume that no adjusting entries have been made for the month ending March 31.

Current assets

Current assets Long-term assets

Long-term assets Current liabilities

Current liabilities Long-term liabilities

Long-term liabilities Additional Information:

Additional Information: Required:

Required:Prepare any necessary adjusting entries on March 31 based on the above information.Assume that no adjusting entries have been made for the month ending March 31.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

75

The adjusting entry to record accrued interest revenue includes a debit to interest payable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

76

Failure to adjust for an unrecorded expense such as interest expense will understate liabilities.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

77

Dell Catering accrues its income taxes quarterly for the sole manufacturing facility located in Brunswick,Florida.Although Dell Catering is not subject to local tax,it is required to pay both state and federal income taxes,which are 12% and 28% of net income,respectively.Second quarter income for Dell Catering amounted to $550,000.

Required:

1.Prepare the appropriate journal entry for Dell Catering as of June 30.

2.Explain how income taxes are shown on a multi-step income statement.

Required:

1.Prepare the appropriate journal entry for Dell Catering as of June 30.

2.Explain how income taxes are shown on a multi-step income statement.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

78

The adjusting entry to record accrued interest receivable has what effect on the basic accounting equation?

A)Increase assets,increase liabilities

B)Decrease assets,decrease liabilities

C)Increase assets,increase stockholders' equity

D)Increase assets,decrease stockholders' equity

E)Decrease liabilities,increase stockholders' equity

A)Increase assets,increase liabilities

B)Decrease assets,decrease liabilities

C)Increase assets,increase stockholders' equity

D)Increase assets,decrease stockholders' equity

E)Decrease liabilities,increase stockholders' equity

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

79

The adjusting entry to record revenue earned during the current period when cash was received in the last accounting period includes a credit to Unearned Revenue.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

80

Which one of the following adjustments will increase revenues?

A)Fees were not billed for services already performed.

B)Depreciation is recorded.

C)Supplies were used,but not recorded.

D)Interest is incurred on borrowed money,but not yet paid to the bank.

E)Wages have accrued,but will not be paid until next month.

A)Fees were not billed for services already performed.

B)Depreciation is recorded.

C)Supplies were used,but not recorded.

D)Interest is incurred on borrowed money,but not yet paid to the bank.

E)Wages have accrued,but will not be paid until next month.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck