Deck 12: Completion of the Accounting Cycle for a Merchandise Company

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

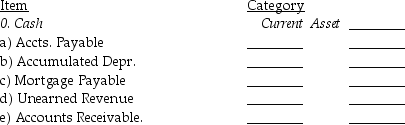

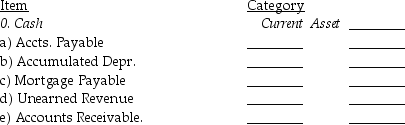

Question

Question

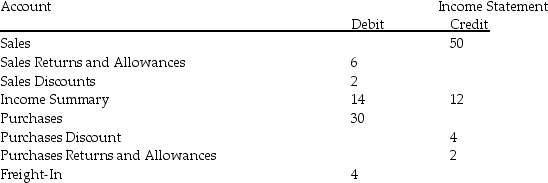

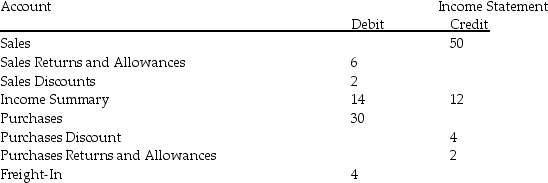

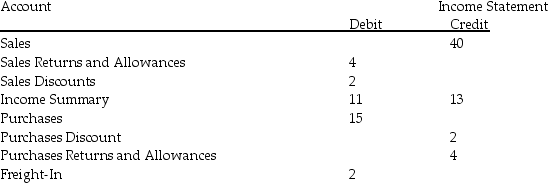

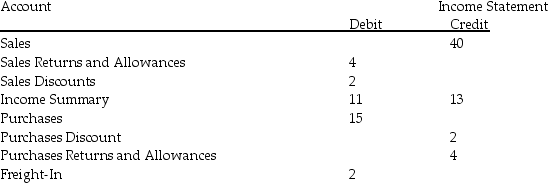

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/125

Play

Full screen (f)

Deck 12: Completion of the Accounting Cycle for a Merchandise Company

1

Cost of Goods Sold is calculated on the:

A)Balance Sheet.

B)Trial Balance.

C)Income Statement.

D)Statement of Owner's Equity.

A)Balance Sheet.

B)Trial Balance.

C)Income Statement.

D)Statement of Owner's Equity.

C

2

Selling expenses include:

A)Advertising Expense.

B)Cost of Goods Sold.

C)Office Supplies Expense.

D)All of the above are correct.

A)Advertising Expense.

B)Cost of Goods Sold.

C)Office Supplies Expense.

D)All of the above are correct.

A

3

Cost of Goods Sold includes:

A)Freight-in.

B)Freight-out.

C)Interest Income.

D)Net Sales.

A)Freight-in.

B)Freight-out.

C)Interest Income.

D)Net Sales.

A

4

In which section does Interest Revenue appear in the Income Statement?

A)Other Income

B)Other Expense

C)Selling Expenses

D)Administrative Expenses

A)Other Income

B)Other Expense

C)Selling Expenses

D)Administrative Expenses

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is not an operating expense?

A)Payroll Tax Expense

B)Freight-in

C)Supplies Expense

D)Salaries Expense

A)Payroll Tax Expense

B)Freight-in

C)Supplies Expense

D)Salaries Expense

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

6

Net Sales - Cost of Goods Sold is equal to:

A)Net Income from Operations.

B)Operating Expenses.

C)Gross Profit.

D)Gross Expenses.

A)Net Income from Operations.

B)Operating Expenses.

C)Gross Profit.

D)Gross Expenses.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

7

Which amount is directly found on the worksheet?

A)Cost of Goods Sold

B)Purchases

C)Gross Profit

D)Net Sales

A)Cost of Goods Sold

B)Purchases

C)Gross Profit

D)Net Sales

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

8

The amount found in the Income Statement debit column on the worksheet for Income Summary is the:

A)total amount of expenses.

B)total amount of revenues.

C)beginning inventory.

D)ending inventory.

A)total amount of expenses.

B)total amount of revenues.

C)beginning inventory.

D)ending inventory.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

9

What is the name of the revenue account used by merchandise companies?

A)Sales

B)Interest Income

C)Merchandise Inventory

D)Capital

A)Sales

B)Interest Income

C)Merchandise Inventory

D)Capital

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

10

Freight-in is:

A)a Cost of Selling Goods.

B)a Cost of Purchasing Goods.

C)recorded as an Operating Expense.

D)recorded as an asset.

A)a Cost of Selling Goods.

B)a Cost of Purchasing Goods.

C)recorded as an Operating Expense.

D)recorded as an asset.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is an operating expense?

A)Salaries Expense

B)Payroll Tax Expense

C)Purchases

D)Both A and B are correct.

A)Salaries Expense

B)Payroll Tax Expense

C)Purchases

D)Both A and B are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

12

Net Sales are:

A)Gross Sales + Sales Discounts + Sales Returns and Allowances.

B)Gross Sales - Sales Discounts - Sales Returns and Allowances.

C)Revenue - Sales Discounts + Sales Returns and Allowances.

D)Gross Sales + Sales Discounts - Sales Returns and Allowances.

A)Gross Sales + Sales Discounts + Sales Returns and Allowances.

B)Gross Sales - Sales Discounts - Sales Returns and Allowances.

C)Revenue - Sales Discounts + Sales Returns and Allowances.

D)Gross Sales + Sales Discounts - Sales Returns and Allowances.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

13

To determine how much merchandise was returned from a company's customers,the company should review the:

A)Purchases Returns and Allowances Account.

B)Purchases Discount Account.

C)Sales Returns and Allowances Account.

D)Freight-In.

A)Purchases Returns and Allowances Account.

B)Purchases Discount Account.

C)Sales Returns and Allowances Account.

D)Freight-In.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

14

The income statement is prepared from the:

A)Post-Closing Trial Balance.

B)worksheet.

C)general journal.

D)statement of owner's equity.

A)Post-Closing Trial Balance.

B)worksheet.

C)general journal.

D)statement of owner's equity.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is an operating expense?

A)Interest expense

B)Interest revenue

C)Salaries expense

D)Freight-In

A)Interest expense

B)Interest revenue

C)Salaries expense

D)Freight-In

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

16

Net Purchases + Purchases Returns and Allowances + Purchase Discount equals:

A)Net Loss.

B)Net Income.

C)Gross Profit.

D)Gross Purchases.

A)Net Loss.

B)Net Income.

C)Gross Profit.

D)Gross Purchases.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

17

Gross Profit equals:

A)Net sales - Other Expenses.

B)Sales - Sales Returns and Allowances - Sales Discounts - Cost of Goods Sold.

C)Cost of Goods Sold - Other Expenses.

D)Cost of Goods Sold - Operating Expenses.

A)Net sales - Other Expenses.

B)Sales - Sales Returns and Allowances - Sales Discounts - Cost of Goods Sold.

C)Cost of Goods Sold - Other Expenses.

D)Cost of Goods Sold - Operating Expenses.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

18

Net Purchases are:

A)Total Purchases + Purchases Discounts + Purchases Returns and Allowances.

B)Total Purchases + Purchases Discounts - Purchases Returns and Allowances.

C)Total Purchases - Purchases Discounts - Purchases Returns and Allowances.

D)None of these are correct.

A)Total Purchases + Purchases Discounts + Purchases Returns and Allowances.

B)Total Purchases + Purchases Discounts - Purchases Returns and Allowances.

C)Total Purchases - Purchases Discounts - Purchases Returns and Allowances.

D)None of these are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

19

The calculation of Net Purchases does not include:

A)Purchases Returns and Allowances.

B)Purchases Discounts.

C)Purchases.

D)Freight-in.

A)Purchases Returns and Allowances.

B)Purchases Discounts.

C)Purchases.

D)Freight-in.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

20

Net Sales + Sales Discounts + Sales Returns and Allowances equals:

A)Net Loss.

B)Gross Sales.

C)Net Income from Operations.

D)Gross Profit.

A)Net Loss.

B)Gross Sales.

C)Net Income from Operations.

D)Gross Profit.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

21

To determine how much merchandise a company has returned to its vendors,it should review the:

A)Purchases Returns & Allowances account.

B)Purchases Discount account.

C)Sales Returns & Allowances account.

D)Sales Discounts account.

A)Purchases Returns & Allowances account.

B)Purchases Discount account.

C)Sales Returns & Allowances account.

D)Sales Discounts account.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

22

Liquidity is:

A)how quickly loans can be paid.

B)how easily an asset can be converted to cash.

C)how much cash a company has on its balance sheet.

D)None of the above are correct.

A)how quickly loans can be paid.

B)how easily an asset can be converted to cash.

C)how much cash a company has on its balance sheet.

D)None of the above are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

23

The ending merchandise inventory was overstated.This error would cause:

A)net income to be understated.

B)assets to be understated.

C)net income to be overstated.

D)expense to be overstated.

A)net income to be understated.

B)assets to be understated.

C)net income to be overstated.

D)expense to be overstated.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

24

If beginning inventory is $5,000,ending inventory is $3,000,net purchases is $12,000 and Freight-in is $400,what is the Cost of Goods Available for Sale?

A)$17,400

B)$17,000

C)$14,400

D)$14,000

A)$17,400

B)$17,000

C)$14,400

D)$14,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

25

Other Income is used to:

A)record payments from sales customers.

B)record any revenue from activities other than sales.

C)record all revenue.

D)record owner investments.

A)record payments from sales customers.

B)record any revenue from activities other than sales.

C)record all revenue.

D)record owner investments.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

26

Administrative Expenses include:

A)Insurance Expense.

B)Delivery Expense.

C)Advertising Expense.

D)None of the above are correct.

A)Insurance Expense.

B)Delivery Expense.

C)Advertising Expense.

D)None of the above are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

27

In what category in a classified balance sheet is Accounts Receivable found?

A)Plant and Equipment

B)Current Liabilities

C)Current Assets

D)Owner's Equity

A)Plant and Equipment

B)Current Liabilities

C)Current Assets

D)Owner's Equity

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

28

In what category in a classified balance sheet is Store Equipment found?

A)Plant and Equipment

B)Current Liabilities

C)Current Assets

D)Owner's Equity

A)Plant and Equipment

B)Current Liabilities

C)Current Assets

D)Owner's Equity

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

29

The ending merchandise inventory was understated.This error would cause:

A)assets to be understated.

B)assets to be overstated.

C)net income to be overstated.

D)None of these are correct.

A)assets to be understated.

B)assets to be overstated.

C)net income to be overstated.

D)None of these are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

30

Merchandise purchased for resale under the perpetual inventory method is added to:

A)Merchandise Inventory.

B)Sales.

C)Purchases.

D)Inventory Expense.

A)Merchandise Inventory.

B)Sales.

C)Purchases.

D)Inventory Expense.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

31

Plant and Equipment is usually listed:

A)in alphabetical order.

B)in order of liquidity.

C)by how long they will last.

D)dollar value.

A)in alphabetical order.

B)in order of liquidity.

C)by how long they will last.

D)dollar value.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

32

An item that can be converted into cash or used up during the normal operating cycle is:

A)a current asset.

B)Plant and Equipment.

C)a current liability.

D)a long-term liability.

A)a current asset.

B)Plant and Equipment.

C)a current liability.

D)a long-term liability.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

33

Merchandise purchased for resale under the periodic inventory method is added to:

A)Merchandise Inventory.

B)Sales.

C)Purchases.

D)Inventory Expense.

A)Merchandise Inventory.

B)Sales.

C)Purchases.

D)Inventory Expense.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

34

If beginning inventory is $5,000,ending inventory is $3,000,net purchases is $12,000 and Freight-in is $400,what is the Cost of Goods Sold?

A)$17,400

B)$17,000

C)$14,400

D)$14,000

A)$17,400

B)$17,000

C)$14,400

D)$14,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

35

Plant and Equipment includes which of the following?

A)Cash

B)Accounts Receivable

C)Accumulated Depreciation on Equipment

D)All of these are correct.

A)Cash

B)Accounts Receivable

C)Accumulated Depreciation on Equipment

D)All of these are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

36

The information to prepare the Statement of Owner's Equity comes from the:

A)income statement columns on the worksheet.

B)adjustments columns on the worksheet.

C)balance sheet columns on the worksheet.

D)general ledger.

A)income statement columns on the worksheet.

B)adjustments columns on the worksheet.

C)balance sheet columns on the worksheet.

D)general ledger.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

37

Other Expense is used to record:

A)selling expenses.

B)administrative expenses.

C)operating expenses.

D)non-operating expenses.

A)selling expenses.

B)administrative expenses.

C)operating expenses.

D)non-operating expenses.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

38

A classified balance sheet provides more information about the company to:

A)owners.

B)creditors.

C)suppliers.

D)All of the above answers are correct.

A)owners.

B)creditors.

C)suppliers.

D)All of the above answers are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

39

A company paid next month's rent in advance.This would be classified as a(n):

A)current asset.

B)Expense.

C)Revenue.

D)current liability.

A)current asset.

B)Expense.

C)Revenue.

D)current liability.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

40

If Net Sales is $8,000,Cost of Goods Sold is $3,000,Gross Profit is $5,000 and Operating Expenses are $1,000,what is the Net Income from Operations?

A)$2,000

B)$4,000

C)$1,000

D)$3,000

A)$2,000

B)$4,000

C)$1,000

D)$3,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

41

A balance sheet where assets and liabilities are broken down into more detail is called a comprehensive balance sheet.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

42

The Statement of Owner's Equity is the same for a service business as for a merchandise business.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

43

The formal income statement can be prepared from the income statement columns of the worksheet.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

44

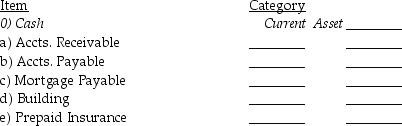

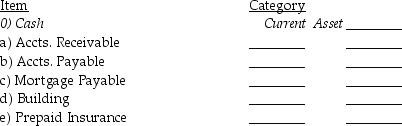

Identify the category(s)of each of the accounts below.

Current Asset

Plant and Equipment

Current Liabilities

Long-Term Liabilities

Current Asset

Plant and Equipment

Current Liabilities

Long-Term Liabilities

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

45

The amount for Cost of Goods Sold is found on the worksheet.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

46

The following amounts are on the Bear Sporting Goods worksheet for the month ended October 31.Required: Calculate the following:

a)Net sales

b)Net purchases

c)Net cost of purchases

d)Cost of goods available for sale

e)Cost of goods sold

f)Gross profit

a)Net sales

b)Net purchases

c)Net cost of purchases

d)Cost of goods available for sale

e)Cost of goods sold

f)Gross profit

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

47

Identify the category(s)of each of the accounts below.

Current Asset

Plant and Equipment

Current Liabilities

Long-Term Liabilities

Current Asset

Plant and Equipment

Current Liabilities

Long-Term Liabilities

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

48

Land is listed first under Plant,Property and Equipment.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

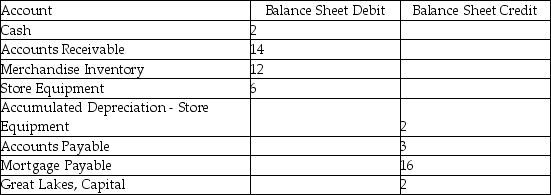

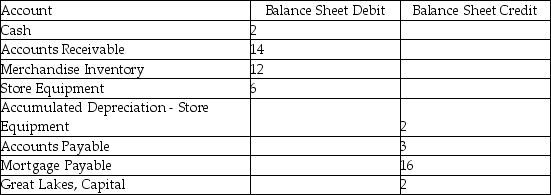

49

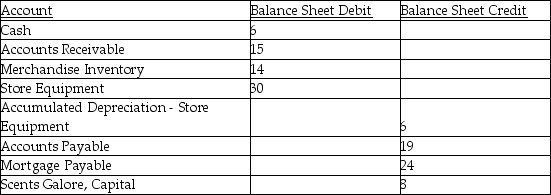

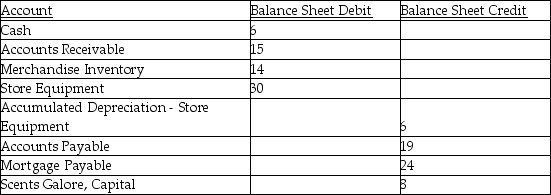

The following accounts are on the Balance Sheet section of Great Lakes Camping worksheet for the month ended January 31,200x.Required: Prepare a classified balance sheet.

Additional information: Withdrawals for the period are $2,and Net Income is $3.

Additional information: Withdrawals for the period are $2,and Net Income is $3.

Additional information: Withdrawals for the period are $2,and Net Income is $3.

Additional information: Withdrawals for the period are $2,and Net Income is $3.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

50

Non-operating expenses are found in the Cost of Goods Sold section of the income statement.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

51

The following amounts are on the Riley's Clothing worksheet for the month ended March 30.

Required: Calculate the following:

a)Net sales

b)Net purchases

c)Net cost of purchases

d)Cost of goods available for sale

e)Cost of goods sold

f)Gross profit

Required: Calculate the following:

a)Net sales

b)Net purchases

c)Net cost of purchases

d)Cost of goods available for sale

e)Cost of goods sold

f)Gross profit

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

52

The following accounts are on the Balance Sheet section of Scents Galore worksheet for the date November 30,200X.

Additional information: Withdrawals for the period are $4,and Net Income is $12.

Additional information: Withdrawals for the period are $4,and Net Income is $12.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

53

The left and right columns on the financial statements are used for debits and credits.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

54

When calculating Cost of Goods Sold on the Income Statement,the beginning and ending inventory values are both required.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

55

Gross profit minus Operating Expenses equals Net Income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

56

The average time it takes to buy and sell merchandise and collect Accounts Receivable is the normal operating cycle for a business.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

57

The statement of owner's equity ending capital is equal to the capital on the worksheet.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

58

In what category in a classified balance sheet is Mortgage Payable found?

A)Plant and Equipment

B)Current Liabilities

C)Long-term Liabilities

D)Both B and C are correct.

A)Plant and Equipment

B)Current Liabilities

C)Long-term Liabilities

D)Both B and C are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

59

Discuss the purpose of a detailed income statement.Briefly describe the major kinds of business activities covered on a detailed income statement.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

60

Cost of goods available for sale is equal to beginning inventory + Cost of Goods Sold.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

61

The first step in the closing process is to:

A)close all balances on the income statement debit column of the worksheet except Income Summary.

B)transfer the balance from the Income Summary Account to the Capital Account.

C)close all balances on the income statement credit column of the worksheet except Income Summary.

D)transfer the balance of the Owner's Withdrawals Account to Capital.

A)close all balances on the income statement debit column of the worksheet except Income Summary.

B)transfer the balance from the Income Summary Account to the Capital Account.

C)close all balances on the income statement credit column of the worksheet except Income Summary.

D)transfer the balance of the Owner's Withdrawals Account to Capital.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

62

The amount shown in the adjustments credit column for Merchandise Inventory on the worksheet is:

A)beginning inventory.

B)ending inventory.

C)total purchases.

D)Cost of Goods Sold.

A)beginning inventory.

B)ending inventory.

C)total purchases.

D)Cost of Goods Sold.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

63

Determine the beginning inventory of a business having:

Beginning Capital balance of $11,000

No additional investments or withdrawals

Net sales of $43,500

Net purchases $26,000

Ending inventory of $4,250

Ending Capital balance of $10,000

Operating expenses of $16,500

$ ________

Beginning Capital balance of $11,000

No additional investments or withdrawals

Net sales of $43,500

Net purchases $26,000

Ending inventory of $4,250

Ending Capital balance of $10,000

Operating expenses of $16,500

$ ________

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

64

Income Summary,before closing to Capital,contains a debit balance of $86 and a credit balance of $100.What is the entry to close Income Summary to Capital?

A)Debit Income Summary $100; credit Capital $100

B)Debit Income Summary $86; credit Capital $86

C)Debit Capital $14; credit Income Summary $14

D)Debit Income Summary $14; credit Capital $14

A)Debit Income Summary $100; credit Capital $100

B)Debit Income Summary $86; credit Capital $86

C)Debit Capital $14; credit Income Summary $14

D)Debit Income Summary $14; credit Capital $14

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

65

Discuss the purpose of a classified balance sheet.Include a description of the major balance sheet classifications including: current assets,plant and equipment,current liabilities,and long-term liabilities.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

66

Determine the ending Capital amount of a business having:

Beginning Capital amount of $30,000

Withdrawals of $ 1,500

Net sales of $150,000

Net purchases of $80,000

Freight-in of $1,500

Beginning inventory of $6,000

Ending inventory of $7,000

Operating expenses of $ 32,000

$ ________

Beginning Capital amount of $30,000

Withdrawals of $ 1,500

Net sales of $150,000

Net purchases of $80,000

Freight-in of $1,500

Beginning inventory of $6,000

Ending inventory of $7,000

Operating expenses of $ 32,000

$ ________

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

67

Determine the ending inventory of a business having:

Beginning Capital $6,000

Net sales of $50,000

Net purchases of $30,500

Freight-in of $2,000

Beginning inventory of $4,000

Ending Capital of $10,000

Operating expenses of $14,000

$ ________

Beginning Capital $6,000

Net sales of $50,000

Net purchases of $30,500

Freight-in of $2,000

Beginning inventory of $4,000

Ending Capital of $10,000

Operating expenses of $14,000

$ ________

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

68

The entry to close the expense account(s)was entered in reverse-Income Summary was credited and the expense account(s)was/were debited.This error would cause:

A)assets to be overstated.

B)liabilities to be overstated.

C)Capital account to be understated.

D)Capital account to be overstated.

A)assets to be overstated.

B)liabilities to be overstated.

C)Capital account to be understated.

D)Capital account to be overstated.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

69

The entry to close the Income Summary to Capital was omitted,there was a net income.This error would cause:

A)the Capital account to be understated.

B)net income to be overstated.

C)net income to be understated.

D)the Capital account to be overstated.

A)the Capital account to be understated.

B)net income to be overstated.

C)net income to be understated.

D)the Capital account to be overstated.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

70

Adjusting entries from the worksheet:

A)are journalized and posted to the ledger.

B)are posted directly to the ledger.

C)are closed to the Income Summary account.

D)affect only balance sheet accounts.

A)are journalized and posted to the ledger.

B)are posted directly to the ledger.

C)are closed to the Income Summary account.

D)affect only balance sheet accounts.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

71

The goal of closing entries is:

A)to clear revenue and expense accounts.

B)to update the Capital account balance.

C)to clear the Withdrawal account.

D)All of these answers are correct.

A)to clear revenue and expense accounts.

B)to update the Capital account balance.

C)to clear the Withdrawal account.

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

72

The entry to close the Withdrawal account was entered in reverse-the Withdrawal account was debited and Capital credited.This error would cause:

A)Capital to be understated.

B)net income to be overstated.

C)net income to be understated.

D)Withdrawals to be overstated.

A)Capital to be understated.

B)net income to be overstated.

C)net income to be understated.

D)Withdrawals to be overstated.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

73

The amount shown in the balance sheet debit column of worksheet for Merchandise Inventory is:

A)the Cost of Goods Sold.

B)net purchases.

C)the ending inventory.

D)the beginning inventory.

A)the Cost of Goods Sold.

B)net purchases.

C)the ending inventory.

D)the beginning inventory.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

74

The entry to close the Withdrawals account to Capital was omitted.This error would cause:

A)the Capital account to be understated.

B)net income to be overstated.

C)net income to be understated.

D)the Capital account to be overstated.

A)the Capital account to be understated.

B)net income to be overstated.

C)net income to be understated.

D)the Capital account to be overstated.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

75

Determine the ending Capital balance of a business having:

Beginning Capital of $50,000

No investments or withdrawals

Beginning inventory of $10,000

Net Purchases of $90,000

Ending inventory of $12,000

Operating expenses of $72,000

Net sales $190,000

$ ________

Beginning Capital of $50,000

No investments or withdrawals

Beginning inventory of $10,000

Net Purchases of $90,000

Ending inventory of $12,000

Operating expenses of $72,000

Net sales $190,000

$ ________

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

76

How is Income Summary closed if the company had a net loss?

A)Credit Income Summary; debit Capital

B)Debit Income Summary; credit Capital

C)Debit Capital; credit Withdrawals

D)Debit Withdrawals; credit Capital

A)Credit Income Summary; debit Capital

B)Debit Income Summary; credit Capital

C)Debit Capital; credit Withdrawals

D)Debit Withdrawals; credit Capital

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

77

The entry to adjust salaries was done twice.This error would cause:

A)liabilities to be understated.

B)liabilities to be overstated.

C)expenses to be understated.

D)Capital to be overstated.

A)liabilities to be understated.

B)liabilities to be overstated.

C)expenses to be understated.

D)Capital to be overstated.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

78

After the closing entries have been posted:

A)the temporary accounts are zeroed out.

B)the Capital account includes the current net profit or loss.

C)the post-closing trial balance is prepared.

D)All of these answers are correct.

A)the temporary accounts are zeroed out.

B)the Capital account includes the current net profit or loss.

C)the post-closing trial balance is prepared.

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

79

How is Income Summary closed if the company had a net income?

A)Debit Capital; credit Income Summary

B)Debit Income Summary; credit Capital

C)Debit Capital; credit Withdrawals

D)Debit Withdrawals; credit Capital

A)Debit Capital; credit Income Summary

B)Debit Income Summary; credit Capital

C)Debit Capital; credit Withdrawals

D)Debit Withdrawals; credit Capital

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

80

Closing entries:

A)are posted to the general ledger.

B)are done to update Cash.

C)can be done before adjusting entries.

D)All of the above are correct.

A)are posted to the general ledger.

B)are done to update Cash.

C)can be done before adjusting entries.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck