Deck 16: Topic Focus Standard Costing Systems

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/42

Play

Full screen (f)

Deck 16: Topic Focus Standard Costing Systems

1

When using a standard costing system,recording events related to variable overhead requires four separate entries.

False

2

When using a standard costing system,the direct materials price variance is recorded at the time direct materials are purchased.

True

3

When using a standard costing system,at the end of the accounting period,the balances in all inventory and cost of goods sold accounts will be at standard amounts.

True

4

When using a normal costing system,only over- or under-applied overhead cost needs to be adjusted to the actual overhead cost.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

5

Using a normal costing system,direct materials and direct labor are recorded at actual cost,and overhead is applied to products using a predetermined overhead rate.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

6

Using a normal costing system,direct materials and direct labor are recorded at standard cost,and overhead is applied to products using a predetermined overhead rate.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

7

When using a standard costing system,the direct materials quantity variance is recorded at the time direct materials are transferred to the production floor.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

8

When using a standard costing system,all product costs are recorded at standard cost while the products are being made.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

9

When using a standard costing system,when materials are purchased,the transaction is recorded in the inventory account at the standard price and accounts payable is charged for the full amount owed to the supplier.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

10

A costing system where direct material and direct labor are recorded at actual cost and overhead is applied to products using a predetermined overhead rate is referred to as

A)Normal costing

B)Variable costing

C)Full costing

D)Standard costing

A)Normal costing

B)Variable costing

C)Full costing

D)Standard costing

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

11

When using a normal costing system

A)Direct material and direct labor are recorded at standard cost and overhead is applied to products using a predetermined overhead rate.

B)Direct material and direct labor are recorded at actual cost and overhead is treated as a period cost.

C)Direct material and direct labor are recorded at actual cost and overhead is applied to products using a predetermined overhead rate.

D)Direct material and direct labor are recorded at standard cost and overhead is treated as a period cost.

A)Direct material and direct labor are recorded at standard cost and overhead is applied to products using a predetermined overhead rate.

B)Direct material and direct labor are recorded at actual cost and overhead is treated as a period cost.

C)Direct material and direct labor are recorded at actual cost and overhead is applied to products using a predetermined overhead rate.

D)Direct material and direct labor are recorded at standard cost and overhead is treated as a period cost.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

12

When using a standard costing system,which of the following statements is true?

A)There is never any question about the recorded cost of a unit in inventory; it is always at the standard cost.

B)There is always a question about the recorded cost of a unit in inventory; the standard cost differs with each purchase.

C)A unit recorded in inventory last week and one recorded in inventory today will not have the same recorded cost.

D)None of these ans choices are true.

A)There is never any question about the recorded cost of a unit in inventory; it is always at the standard cost.

B)There is always a question about the recorded cost of a unit in inventory; the standard cost differs with each purchase.

C)A unit recorded in inventory last week and one recorded in inventory today will not have the same recorded cost.

D)None of these ans choices are true.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

13

A costing system where all product costs are recorded at standard cost while the products are being made is referred to as

A)Normal costing

B)Variable costing

C)Full costing

D)Standard costing

A)Normal costing

B)Variable costing

C)Full costing

D)Standard costing

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

14

The easiest approach to close variances accounts is to the Raw Materials Inventory account.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

15

When using a standard costing system,direct material and direct labor are recorded at actual cost while manufacturing over is applied at a standard rate.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

16

When using a standard costing system,the direct materials price variance is recorded at the time direct materials are transferred to the production floor.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

17

When using a standard costing system,at the end of an accounting period,the balances in which of the following accounts will be at standard amounts?

A)Raw materials inventory and Work in process only

B)Cost of goods sold only

C)Finished goods and cost of goods sold only

D)Raw materials,Work in process,Finished goods,and Cost of goods sold

A)Raw materials inventory and Work in process only

B)Cost of goods sold only

C)Finished goods and cost of goods sold only

D)Raw materials,Work in process,Finished goods,and Cost of goods sold

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

18

Manufacturing Overhead is a temporary account that must have a zero balance at the end of the accounting period.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

19

An advantage of standard costing is that it gives visibility to the variances that arise in the production process.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

20

The standard cost of labor consists of two components: standard quantity of direct labor hours allowed for actual production and standard direct labor rate per hour.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

21

When using a standard costing system,which of the following should be recorded when direct materials are transferred to the production floor?

A)Debit raw materials inventory for the actual amount at the standard price and credit work in process for the actual amount at the standard price

B)Debit raw materials inventory for the standard amount at the standard price and credit work in process for the actual amount at the actual price with a debit or credit to direct material quantity variance

C)Credit raw materials inventory for the standard amount at the standard price and debit work in process for the standard amount at the actual price with a debit or credit to direct material quantity variance

D)Credit raw materials inventory for the actual amount at the standard price and debit work in process for the standard amount at the standard price with a debit or credit to direct material quantity variance

A)Debit raw materials inventory for the actual amount at the standard price and credit work in process for the actual amount at the standard price

B)Debit raw materials inventory for the standard amount at the standard price and credit work in process for the actual amount at the actual price with a debit or credit to direct material quantity variance

C)Credit raw materials inventory for the standard amount at the standard price and debit work in process for the standard amount at the actual price with a debit or credit to direct material quantity variance

D)Credit raw materials inventory for the actual amount at the standard price and debit work in process for the standard amount at the standard price with a debit or credit to direct material quantity variance

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

22

The easiest way to dispose of variances at the end of the period is to

A)Ignore the variances as they will cancel out during the following period.

B)Close the variances to raw materials inventory.

C)Close the variances to the appropriate raw materials inventory,work in process inventory,and finished goods inventory accounts.

D)Close the variances to the cost of goods sold account.

A)Ignore the variances as they will cancel out during the following period.

B)Close the variances to raw materials inventory.

C)Close the variances to the appropriate raw materials inventory,work in process inventory,and finished goods inventory accounts.

D)Close the variances to the cost of goods sold account.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

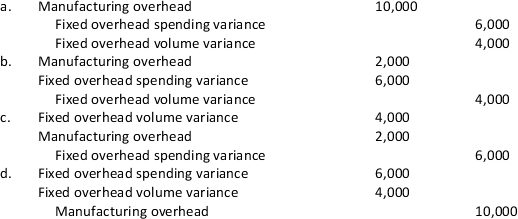

23

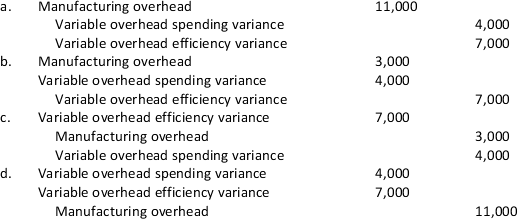

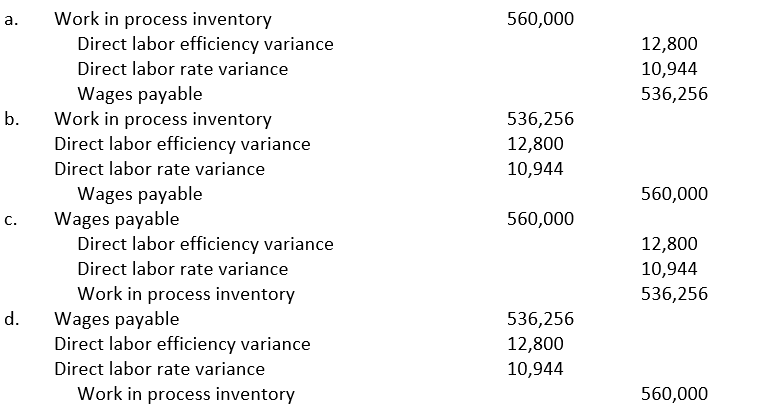

The following information relating to variable overhead is available for Haven Industries:

Spending variance $4,000 unfavorable

Efficiency variance $7,000 favorable

Which of the following is the correct journal entry to record the spending and efficiency variances?

Spending variance $4,000 unfavorable

Efficiency variance $7,000 favorable

Which of the following is the correct journal entry to record the spending and efficiency variances?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

24

When using a standard costing system,which of the following should be recorded for labor as a product is being made?

A)Debit wages payable for the actual hours of labor at the standard rate and credit work in process for the actual hours worked at the standard rate

B)Debit payable wages for the standard hours at the standard rate and credit work in process for the actual hours at the actual rate

C)Credit wages payable for the standard hours at the standard rate and debit work In process for the standard hours at the actual rate

D)Credit wages payable for the actual hours at the actual rate and debit work in process for the standard hours at the standard rate

A)Debit wages payable for the actual hours of labor at the standard rate and credit work in process for the actual hours worked at the standard rate

B)Debit payable wages for the standard hours at the standard rate and credit work in process for the actual hours at the actual rate

C)Credit wages payable for the standard hours at the standard rate and debit work In process for the standard hours at the actual rate

D)Credit wages payable for the actual hours at the actual rate and debit work in process for the standard hours at the standard rate

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

25

When using a standard costing system,which of the following should be recorded when variable overhead is applied during the period?

A)Debit manufacturing overhead for the actual overhead costs and credit work in process inventory using a predetermined variable overhead rate

B)Debit work in process inventory for the actual overhead costs and credit manufacturing overhead using a predetermined variable overhead rate

C)Credit manufacturing overhead for actual overhead rate and debit work in process inventory using a predetermined variable overhead rate

D)Credit work in process inventory for the actual overhead and debit manufacturing overhead using a predetermined variable overhead rate

A)Debit manufacturing overhead for the actual overhead costs and credit work in process inventory using a predetermined variable overhead rate

B)Debit work in process inventory for the actual overhead costs and credit manufacturing overhead using a predetermined variable overhead rate

C)Credit manufacturing overhead for actual overhead rate and debit work in process inventory using a predetermined variable overhead rate

D)Credit work in process inventory for the actual overhead and debit manufacturing overhead using a predetermined variable overhead rate

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

26

What is the difference between a normal costing system and a standard costing system?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

27

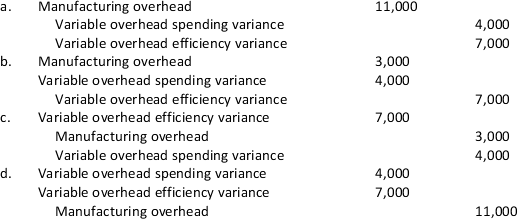

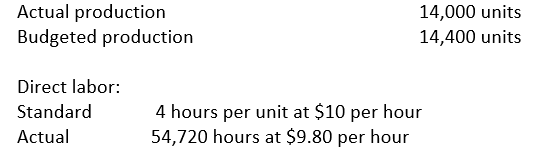

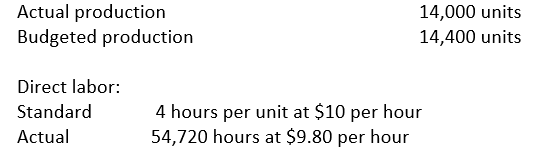

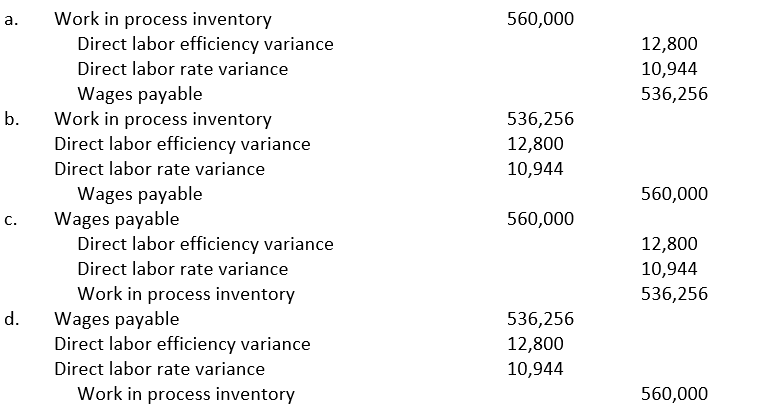

The following information is available for Haven Industries:

Which of the following is the correct journal entry to record the direct labor payroll?

Which of the following is the correct journal entry to record the direct labor payroll?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

28

When using a standard costing system,which of the following should be recorded when recording the purchase of direct materials?

A)Debit raw materials inventory at the standard price and credit accounts payable at the standard price

B)Debit raw materials inventory at the standard price and credit accounts payable at the actual price with a debit or credit to direct materials price variance

C)Credit raw materials inventory at the standard price and debit accounts payable at the actual price with a debit or credit to direct materials price variance

D)Credit raw materials inventory at the standard price and debit accounts payable at the standard price

A)Debit raw materials inventory at the standard price and credit accounts payable at the standard price

B)Debit raw materials inventory at the standard price and credit accounts payable at the actual price with a debit or credit to direct materials price variance

C)Credit raw materials inventory at the standard price and debit accounts payable at the actual price with a debit or credit to direct materials price variance

D)Credit raw materials inventory at the standard price and debit accounts payable at the standard price

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

29

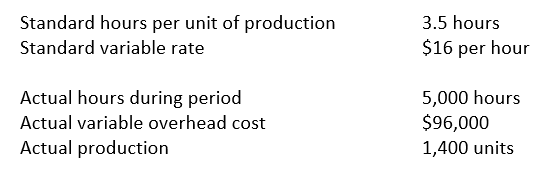

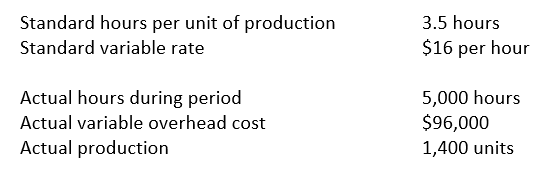

Wolfe Manufacturing Company has the following information related to variable overhead:

a.Calculate the variable overhead spending variance for the period.

b.Calculate the variable overhead efficiency variance for the period.

a.Calculate the variable overhead spending variance for the period.

b.Calculate the variable overhead efficiency variance for the period.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

30

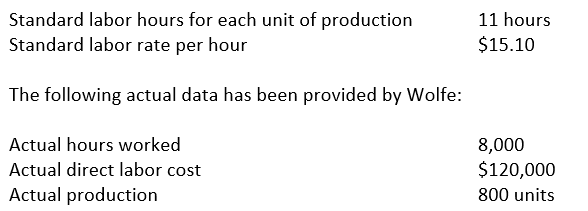

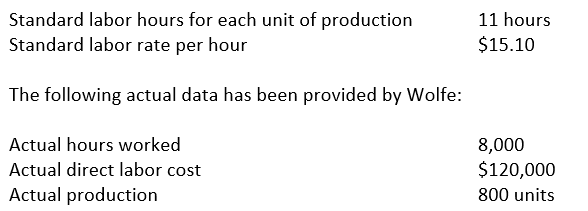

Wolfe Manufacturing Company has the following direct labor standards:

Required:

a. Calculate the direct labor rate variance.

b. Calculate the direct labor efficiency variance.

Required:

a. Calculate the direct labor rate variance.

b. Calculate the direct labor efficiency variance.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

31

When using a standard costing system,which of the following should be recorded when invoices are received for variable overhead costs?

A)Debit manufacturing overhead for the actual overhead costs and credit accounts payable or cash for the actual amount invoiced

B)Debit work in process inventory for the actual overhead costs and credit accounts payable or cash using a predetermined variable overhead rate

C)Credit manufacturing overhead for actual overhead rate and debit work in process inventory using a predetermined variable overhead rate

D)Credit work in process inventory for the actual overhead and debit accounts payable or cash using a predetermined variable overhead rate

A)Debit manufacturing overhead for the actual overhead costs and credit accounts payable or cash for the actual amount invoiced

B)Debit work in process inventory for the actual overhead costs and credit accounts payable or cash using a predetermined variable overhead rate

C)Credit manufacturing overhead for actual overhead rate and debit work in process inventory using a predetermined variable overhead rate

D)Credit work in process inventory for the actual overhead and debit accounts payable or cash using a predetermined variable overhead rate

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

32

When using a standard costing system,which of the following should be recorded when finished goods are sold?

A)Debit cost of goods sold for actual cost and credit finished goods for actual cost

B)Debit cost of goods sold for standard cost and credit finished goods for actual cost

C)Debit cost of goods sold for standard cost and credit finished goods for standard cost

D)Debit cost of goods sold for actual cost and credit finished goods for standard cost

A)Debit cost of goods sold for actual cost and credit finished goods for actual cost

B)Debit cost of goods sold for standard cost and credit finished goods for actual cost

C)Debit cost of goods sold for standard cost and credit finished goods for standard cost

D)Debit cost of goods sold for actual cost and credit finished goods for standard cost

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

33

At what amount will the inventory and cost of goods sold amounts be reported on the financial statements?

A)Inventory at standard and cost of goods sold at actual

B)Inventory at actual and cost of goods sold at actual

C)Inventory at standard and cost of goods sold at standard

D)Inventory at actual and cost of goods sold at standard

A)Inventory at standard and cost of goods sold at actual

B)Inventory at actual and cost of goods sold at actual

C)Inventory at standard and cost of goods sold at standard

D)Inventory at actual and cost of goods sold at standard

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

34

Wolfe Manufacturing Company’s standards are set at one gallon of liquid for each unit of production at a cost of $2.10 per gallon. Actual production was 50,000 units using 45,000 gallons of liquid at a cost of $2.20 per gallon.

Required:

a. Calculate the direct material price variance.

b. Calculate the direct material quantity variance.

Required:

a. Calculate the direct material price variance.

b. Calculate the direct material quantity variance.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

35

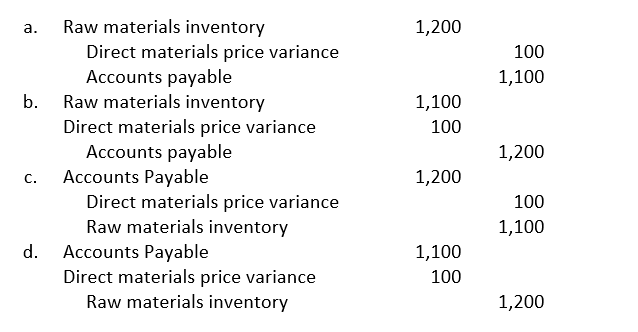

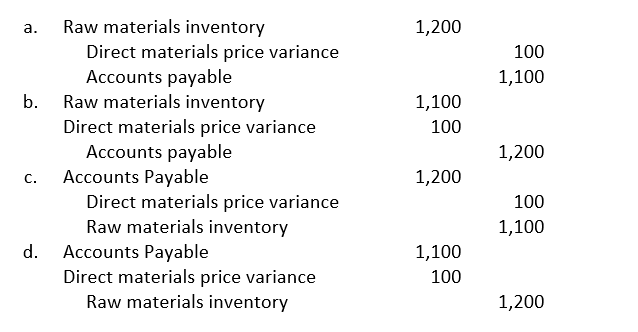

Haven Industries purchased 1,000 units of product at a cost of $1.20 per unit. Haven’s standard price per unit was set at $1.10. Which of the following is the correct journal entry to record the purchase?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

36

When using a standard costing system,which of the following should be recorded when fixed overhead is applied during the period?

A)Debit manufacturing overhead for the actual overhead costs and credit work in process inventory using a predetermined fixed overhead rate

B)Debit work in process inventory for the actual overhead costs and credit manufacturing overhead using a predetermined fixed overhead rate

C)Credit work in process inventory for the actual overhead and debit manufacturing overhead using a predetermined fixed overhead rate

D)Credit manufacturing overhead and debit work in process inventory for the standard quantity of the application base allowed using a predetermined fixed overhead rate

A)Debit manufacturing overhead for the actual overhead costs and credit work in process inventory using a predetermined fixed overhead rate

B)Debit work in process inventory for the actual overhead costs and credit manufacturing overhead using a predetermined fixed overhead rate

C)Credit work in process inventory for the actual overhead and debit manufacturing overhead using a predetermined fixed overhead rate

D)Credit manufacturing overhead and debit work in process inventory for the standard quantity of the application base allowed using a predetermined fixed overhead rate

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

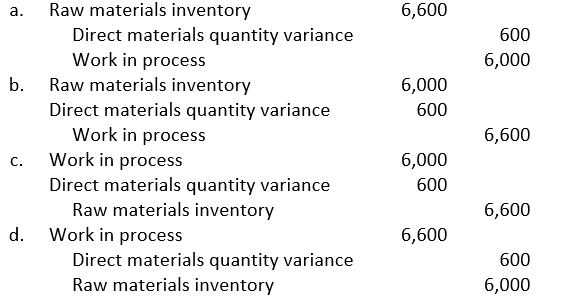

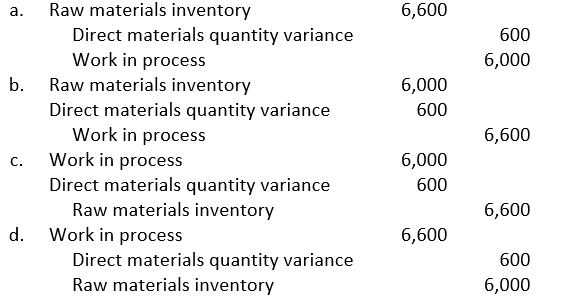

37

Haven Industries transferred 5,500 units of raw material into production to produce 2,500 units. The standard quantity of raw material required for each unit is 2 and the standard cost is $1.20 per unit. Which of the following is the correct journal entry to record the transfer?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

38

When using a standard costing system,which of the following should be recorded to transfer

A)Debit finished goods for actual cost and credit work in process for actual cost

B)Debit finished goods for standard cost and credit work in process for standard cost

C)Debit finished goods for standard cost and credit work in process for actual cost

D)Debit finished goods for actual cost and credit work in process for standard cost

A)Debit finished goods for actual cost and credit work in process for actual cost

B)Debit finished goods for standard cost and credit work in process for standard cost

C)Debit finished goods for standard cost and credit work in process for actual cost

D)Debit finished goods for actual cost and credit work in process for standard cost

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

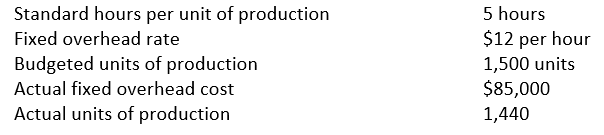

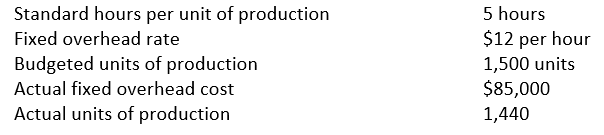

39

Wolfe Manufacturing has provided the following information related to fixed overhead.

a.Calculate the fixed overhead spending variance for the period.

b.Calculate the fixed overhead volume variance for the period.

a.Calculate the fixed overhead spending variance for the period.

b.Calculate the fixed overhead volume variance for the period.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

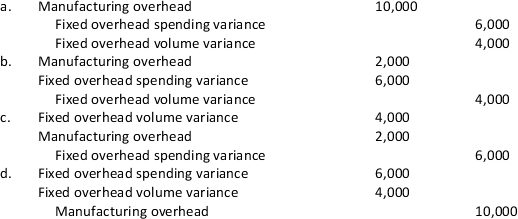

40

The following information relating to fixed overhead is available for Haven Industries:

Spending variance $6,000 favorable

Volume variance $4,000 unfavorable

Which of the following is the correct journal entry to record the spending and efficiency variances?

Spending variance $6,000 favorable

Volume variance $4,000 unfavorable

Which of the following is the correct journal entry to record the spending and efficiency variances?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

41

Answer the following questions regarding costing systems.

a. What is the difference between a normal costing system and a standard costing system?

b. What adjustments are required at the end of each period for each?

c. What is an advantage of standard costing?

d. Are inventory and costs of goods sold accounts reported on financial statements at actual cost or standard cost?

a. What is the difference between a normal costing system and a standard costing system?

b. What adjustments are required at the end of each period for each?

c. What is an advantage of standard costing?

d. Are inventory and costs of goods sold accounts reported on financial statements at actual cost or standard cost?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

42

Suggest one reason for each of the following variances.

a.Unfavorable direct material quantity variance

b.Favorable direct labor rate variance

c.Favorable variable overhead spending variance

d.Unfavorable fixed overhead volume variance

a.Unfavorable direct material quantity variance

b.Favorable direct labor rate variance

c.Favorable variable overhead spending variance

d.Unfavorable fixed overhead volume variance

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck