Deck 3: Understanding Financial Statements, taxes, and Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/63

Play

Full screen (f)

Deck 3: Understanding Financial Statements, taxes, and Cash Flows

1

Which of the following streams of income is not affected by how a firm is financed (whether with debt or equity)?

A)Net profit after tax but before dividends

B)Net working capital

C)Operating income

D)Income before tax

A)Net profit after tax but before dividends

B)Net working capital

C)Operating income

D)Income before tax

C

2

What is sales revenue,minus cost of goods sold and operating expenses,known as for income statement purposes?

A)Net profit

B)Retained earnings

C)Net income available to preferred shareholders

D)EBIT

A)Net profit

B)Retained earnings

C)Net income available to preferred shareholders

D)EBIT

D

3

Which of the following best represents the stream of income that is available to common stockholders?

A)Net profit after tax and after preferred dividend payments

B)Earnings before interest and taxes

C)Gross profit

D)Operating profit

A)Net profit after tax and after preferred dividend payments

B)Earnings before interest and taxes

C)Gross profit

D)Operating profit

A

4

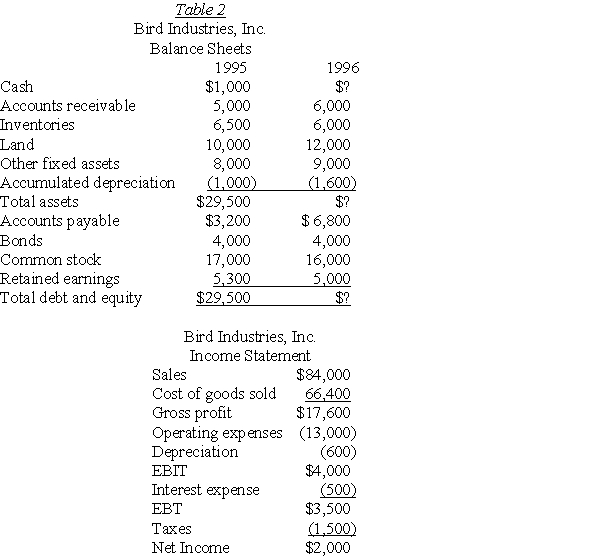

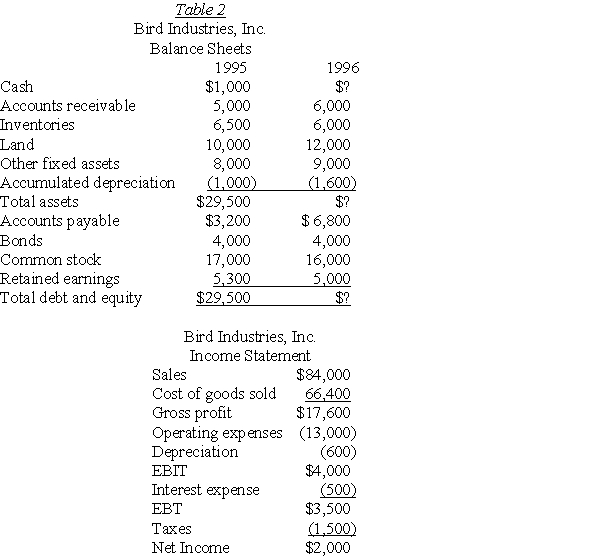

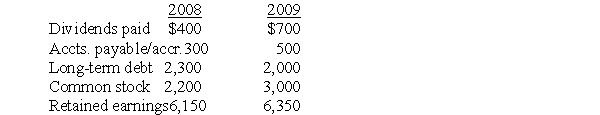

Based on the information contained in Table 2,what was the total amount of Bird Industries' common stock dividend for 1996?

A)$800

B)$2,300

C)$2,000

D)Cannot be determined with available information

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

5

Your firm has the following income statement items: sales of $50,250,000;income tax of $1,744,000;operating expenses of $8,750,000;cost of goods sold of $35,025,000;depreciation and amortization of $1,365,000;and interest expense of $750,000.For purposes of determining free cash flow,what is the amount of the firm's after-tax cash flow from operations?

A)$255,223

B)$4,731,000

C)$2,385,000

D)$7,775,000

A)$255,223

B)$4,731,000

C)$2,385,000

D)$7,775,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

6

Stock that is repurchased by the issuing company is called:

A)paid in capital.

B)treasury stock.

C)retained capital.

D)par value stock.

A)paid in capital.

B)treasury stock.

C)retained capital.

D)par value stock.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

7

Your firm has the following income statement items: sales of $50,250,000;income tax of $1,744,000;operating expenses of $10,115,000;cost of goods sold of $35,025,000;and interest expense of $750,000.What is the amount of the firm's income before tax?

A)$4,360,000

B)$750,000

C)$10,865,000

D)$25,115,000

A)$4,360,000

B)$750,000

C)$10,865,000

D)$25,115,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

8

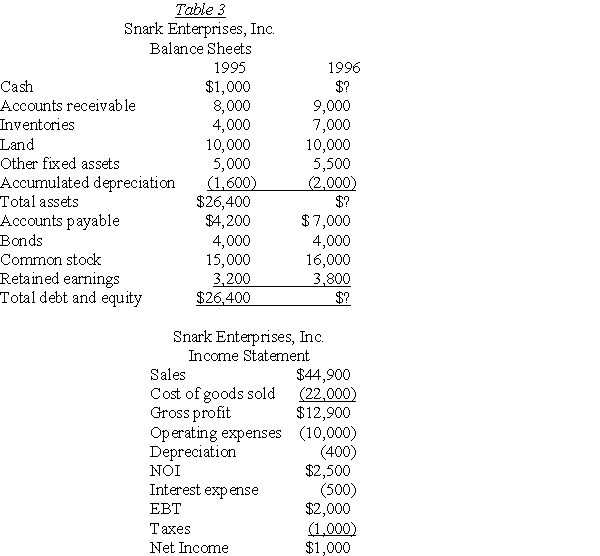

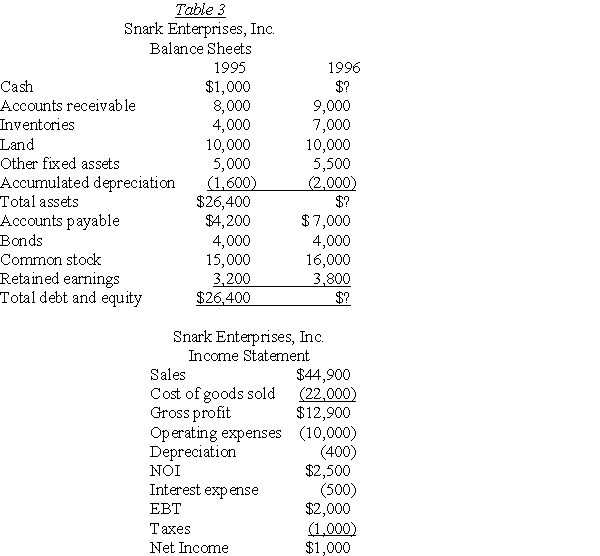

Based on the information contained in Table 3,what was the total amount of Snark Enterprise's common stock dividend for 1996?

A)$0

B)$400

C)$600

D)Cannot be determined with available information

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the basic financial statements is best used to answer the question,"How profitable is the business?"

A)Balance sheet

B)Statement of shareholder's equity

C)Income statement

D)Accounts receivable aging schedule

A)Balance sheet

B)Statement of shareholder's equity

C)Income statement

D)Accounts receivable aging schedule

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

10

Your firm has the following income statement items: sales of $50,250,000;income tax of $1,744,000;operating expenses of $10,115,000;cost of goods sold of $35,025,000;and interest expense of $750,000.What is the amount of the firm's EBIT?

A)$15,552,000

B)$58,000,000

C)$5,110,000

D)$4,630,000

A)$15,552,000

B)$58,000,000

C)$5,110,000

D)$4,630,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

11

Based on the information contained in Table 3,what is Snark Enterprise's cash balance as of December 31,1996?

A)$1,100

B)$900

C)$1,300

D)None of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

12

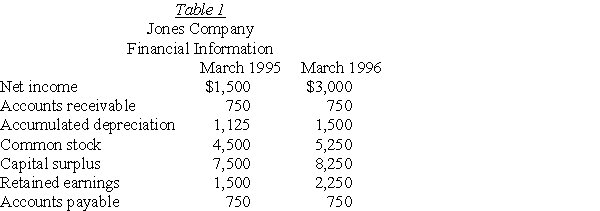

Based on the information given in Table 1,calculate the dividends paid in 1996.

A)$3,750

B)$3,000

C)$750

D)$2,250

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following best represents operating income?

A)Income after financing activities

B)Earnings before interest and taxes

C)Income from capital gains

D)Income from discontinued operations

A)Income after financing activities

B)Earnings before interest and taxes

C)Income from capital gains

D)Income from discontinued operations

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

14

Based on the information contained in Table 2,what was Bird Industries' cash balance as of December 31,1996?

A)$300

B)$400

C)$100

D)$1,100

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

15

Your firm has the following income statement items: sales of $52,000,000;income tax of $1,880,000;operating expenses of $9,000,000;cost of goods sold of $36,000,000;depreciation and amortization of $1,500,000;and interest expense of $800,000.For purposes of determining free cash flow,what is the amount of the firm's after-tax cash flow from operations?

A)$1,008,000

B)$3,600,000

C)$5,120,000

D)$750,000

A)$1,008,000

B)$3,600,000

C)$5,120,000

D)$750,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is NOT included in operating income?

A)Cost of goods sold

B)Sales

C)Taxes

D)Operating expenses

A)Cost of goods sold

B)Sales

C)Taxes

D)Operating expenses

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

17

You are about to determine your corporation's taxable income.Which of the below would NOT be included as a tax-deductible expense?

A)Marketing expenses

B)Depreciation expense

C)Cost of goods sold

D)Dividend expense

A)Marketing expenses

B)Depreciation expense

C)Cost of goods sold

D)Dividend expense

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

18

Who owns the retained earnings of a public firm?

A)The IRS

B)Common stockholders

C)Bondholders

D)Preferred stockholders

A)The IRS

B)Common stockholders

C)Bondholders

D)Preferred stockholders

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following represents an attempt to measure the earnings of the firm's operations over a given time period?

A)Balance sheet

B)Cash flow statement

C)Income statement

D)None of the above

A)Balance sheet

B)Cash flow statement

C)Income statement

D)None of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

20

Your firm has the following income statement items: sales of $50,250,000;income tax of $1,744,000;operating expenses of $10,115,000;cost of goods sold of $35,025,000;and interest expense of $750,000.What is the amount of the firm's gross profit?

A)$18,000,000

B)$15,225,000

C)$5,000,110

D)$6,632,000

A)$18,000,000

B)$15,225,000

C)$5,000,110

D)$6,632,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

21

On an accrual basis income statement,revenues and expenses always match the firm's cash flow.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is the least liquid current asset?

A)Accruals

B)Marketable securities

C)Accounts receivable

D)Inventory

A)Accruals

B)Marketable securities

C)Accounts receivable

D)Inventory

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

23

Pearls,Inc.had sales in 1993 of $2.1 million.The common stockholders received $400,000 in cash dividends and preferred stockholders were paid $200,000.Interest totaling $150,000 was paid on outstanding debts.Operating expenses totaled $300,000,and cost of goods sold was $500,000.Stock that had been purchased for $50,000 in 1987 was sold for $70,000.What is the tax liability of Pearls,Inc.?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

24

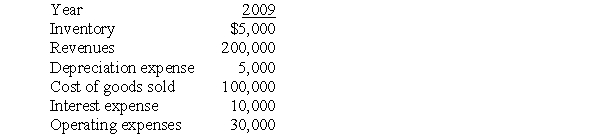

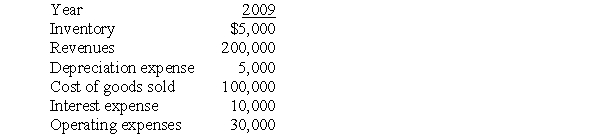

Using the information provided,calculate net income for 2009.Assume a tax rate of 40 percent.

A)$33,000

B)$44,000

C)$55,000

D)$66,000

A)$33,000

B)$44,000

C)$55,000

D)$66,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following would be included in the calculation of net operating working capital?

A)Accounts payable

B)Accruals

C)Short-term notes payable

D)Both A and B

E)All of the above

A)Accounts payable

B)Accruals

C)Short-term notes payable

D)Both A and B

E)All of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

26

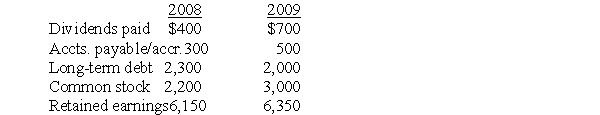

Based on the following selected financial information for Sheets Metalworks,calculate net income for 2009.

A)$100

B)$300

C)$500

D)$700

E)$900

A)$100

B)$300

C)$500

D)$700

E)$900

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

27

An income statement reports a firm's profit relative to its total investment in plant and equipment.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

28

The income statement represents a snapshot of account balances at one point in time.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

29

The interest payments on corporate bonds are tax-deductible.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

30

Corporate income statements are usually compiled on an accrual,rather than cash,basis.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

31

Dividends paid to a firm's stockholders,both preferred and common stockholders,are tax-deductible to the paying company.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

32

The income statement provides a statement of results for the firm's operations.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

33

Browning Cookware,Inc.has the following income statement items: sales of $50,250,000;operating expenses of $10,115,000;cost of goods sold of $35,025,000;and interest expense of $750,000.If the firm's income tax rate is 34%,what is the amount of the firm's income tax liability?

A)$1,665,000

B)$725,000

C)$385,000

D)$1,482,400

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

34

Use the following information to answer the following question(s).

In 2004,A & K,Inc.expects operating income (earnings before interest and taxes)of $18,000,000.In addition,the corporation has $20,000,000 of debt outstanding with a 10 percent interest rate and will pay $1,000,000 in dividends to its common stockholders.

A & K's marginal tax rate for 2004 will be:

A)38 percent.

B)35 percent.

C)34 percent.

D)unknown because too little information is provided.

In 2004,A & K,Inc.expects operating income (earnings before interest and taxes)of $18,000,000.In addition,the corporation has $20,000,000 of debt outstanding with a 10 percent interest rate and will pay $1,000,000 in dividends to its common stockholders.

A & K's marginal tax rate for 2004 will be:

A)38 percent.

B)35 percent.

C)34 percent.

D)unknown because too little information is provided.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

35

Use the following information to answer the following question(s).

In 2004,A & K,Inc.expects operating income (earnings before interest and taxes)of $18,000,000.In addition,the corporation has $20,000,000 of debt outstanding with a 10 percent interest rate and will pay $1,000,000 in dividends to its common stockholders.

Tax tables are based on ________ tax rates.

A)marginal

B)average

C)implied

D)investment

In 2004,A & K,Inc.expects operating income (earnings before interest and taxes)of $18,000,000.In addition,the corporation has $20,000,000 of debt outstanding with a 10 percent interest rate and will pay $1,000,000 in dividends to its common stockholders.

Tax tables are based on ________ tax rates.

A)marginal

B)average

C)implied

D)investment

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

36

The marginal tax rate would equal the average tax rate for firms with earnings less than $50,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

37

Use the following information to answer the following question(s).

In 2004,A & K,Inc.expects operating income (earnings before interest and taxes)of $18,000,000.In addition,the corporation has $20,000,000 of debt outstanding with a 10 percent interest rate and will pay $1,000,000 in dividends to its common stockholders.

A & K's total tax liability for 2004 will be:

A)$5,488,250.

B)$5,530,000.

C)$5,600,000.

D)$6,080,000.

In 2004,A & K,Inc.expects operating income (earnings before interest and taxes)of $18,000,000.In addition,the corporation has $20,000,000 of debt outstanding with a 10 percent interest rate and will pay $1,000,000 in dividends to its common stockholders.

A & K's total tax liability for 2004 will be:

A)$5,488,250.

B)$5,530,000.

C)$5,600,000.

D)$6,080,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

38

The income statement describes the financial position of a firm on a given date.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

39

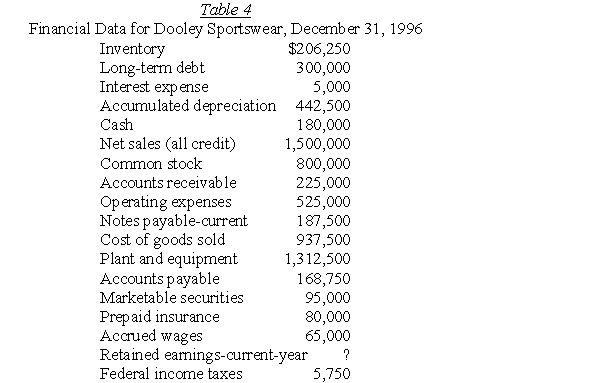

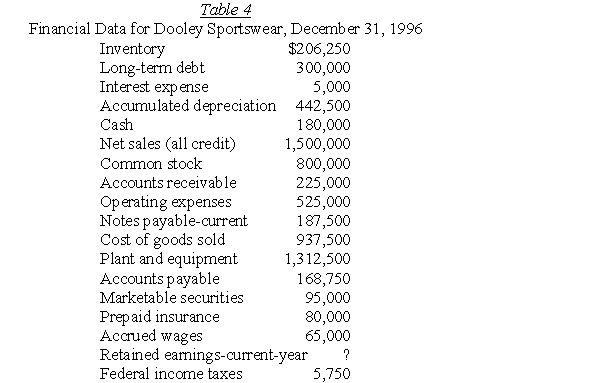

From the scrambled list of items presented in Table 4,prepare an income statement and a balance sheet for Dooley Sportswear Company.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

40

Use the following information to answer the following question(s).

In 2004,A & K,Inc.expects operating income (earnings before interest and taxes)of $18,000,000.In addition,the corporation has $20,000,000 of debt outstanding with a 10 percent interest rate and will pay $1,000,000 in dividends to its common stockholders.

Assume that A & K will receive no other sources of income during 2004.A & K's taxable income for 2004 will be:

A)$18,000,000.

B)$17,000,000.

C)$16,000,000.

D)$15,000,000.

In 2004,A & K,Inc.expects operating income (earnings before interest and taxes)of $18,000,000.In addition,the corporation has $20,000,000 of debt outstanding with a 10 percent interest rate and will pay $1,000,000 in dividends to its common stockholders.

Assume that A & K will receive no other sources of income during 2004.A & K's taxable income for 2004 will be:

A)$18,000,000.

B)$17,000,000.

C)$16,000,000.

D)$15,000,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following would NOT be included as equity in a corporate balance sheet?

A)Cash

B)Paid in capital

C)Preferred stock

D)Retained earnings

E)Common stock

A)Cash

B)Paid in capital

C)Preferred stock

D)Retained earnings

E)Common stock

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

42

Under current accounting rules,plant and equipment appear on a company's balance sheet valued at replacement value.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

43

The balance sheet provides a statement of the firm's financial position.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following best describes a balance sheet?

A)Reports cash receipts and cash disbursements for a specific accounting period

B)Reports investment activities for a specified accounting period

C)Reports revenues and expenses for a specific accounting period

D)Reports the amount and composition of assets and liabilities at a specified point in time

A)Reports cash receipts and cash disbursements for a specific accounting period

B)Reports investment activities for a specified accounting period

C)Reports revenues and expenses for a specific accounting period

D)Reports the amount and composition of assets and liabilities at a specified point in time

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following items is part of the computation of net operating working capital for purposes of determining free cash flow?

A)Accounts payable

B)Fixed assets

C)Interest expense

D)Dividend payments

A)Accounts payable

B)Fixed assets

C)Interest expense

D)Dividend payments

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

46

The balance sheet describes the financial position of a firm on a given date.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

47

Fixed assets includes which of the below?

A)Inventory

B)Patents

C)Land

D)Copyrights

A)Inventory

B)Patents

C)Land

D)Copyrights

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

48

Total equity on the balance sheet increases as dividends paid increases.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

49

An advantage of balance sheet numbers is that assets reflect current market values.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

50

A firm's balance sheet provides a representation of the current market value of the company.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following would NOT be included as an asset on a corporate balance sheet?

A)Accounts receivable

B)Common stock

C)Inventory

D)Buildings

A)Accounts receivable

B)Common stock

C)Inventory

D)Buildings

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following would NOT be included as a liability in a corporate balance sheet?

A)Accruals

B)Notes payable

C)Accounts payable

D)Bonds

E)Depreciation

A)Accruals

B)Notes payable

C)Accounts payable

D)Bonds

E)Depreciation

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

53

Grass Gadgets had sales of $30 million and net income of $2 million in 2008.Grass paid a dividend of $1.5 million.Assuming that their beginning balance for retained earnings was $3 million,calculate their ending balance for retained earnings.

A)$2.5 million

B)$3 million

C)$3.5 million

D)$4 million

A)$2.5 million

B)$3 million

C)$3.5 million

D)$4 million

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

54

Your firm has the following balance sheet statement items: total current liabilities of $805,000;total assets of $2,655,000;fixed and other assets of $1,770,000;and long-term debt of $200,000.What is the amount of the firm's total current assets?

A)$885,000

B)$1,550,000

C)$600,000

D)$325,000

A)$885,000

B)$1,550,000

C)$600,000

D)$325,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

55

A balance sheet is a statement of the financial position of the firm on a given date,including its asset holdings,liabilities,and equity.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is NOT considered a fixed asset?

A)Land

B)Equipment

C)Patents

D)Building

A)Land

B)Equipment

C)Patents

D)Building

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following does NOT represent cash outflows to the firm?

A)Taxes

B)Interest payments

C)Dividends

D)Purchase of plant and equipment

E)Depreciation

A)Taxes

B)Interest payments

C)Dividends

D)Purchase of plant and equipment

E)Depreciation

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

58

Your firm has the following balance sheet statement items: total current liabilities of $805,000;total assets of $2,655,000;fixed and other assets of $1,770,000;and long-term debt of $200,000.What is the amount of the firm's net working capital?

A)$25,000

B)$325,000

C)$770,000

D)$80,000

A)$25,000

B)$325,000

C)$770,000

D)$80,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

59

How does "free cash flow" differ from net profit?

A)It is determined by accrual basis accounting.

B)It takes into consideration a firm's ongoing investment in working capital and fixed assets.

C)It ignores depreciation and taxes.

D)It is less expensive.

A)It is determined by accrual basis accounting.

B)It takes into consideration a firm's ongoing investment in working capital and fixed assets.

C)It ignores depreciation and taxes.

D)It is less expensive.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

60

Holding all other variables constant,which of the following will decrease total equity? An increase in:

A)common stock issued

B)dividends paid

C)net income

D)interest expense

A)common stock issued

B)dividends paid

C)net income

D)interest expense

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

61

Cash flows from assets will always be less than cash flows from financing due to dividends.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is NOT included in the calculation of free cash flows?

A)Interest expense

B)Operating income

C)Depreciation

D)Net operating working capital

A)Interest expense

B)Operating income

C)Depreciation

D)Net operating working capital

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

63

Free cash flow will increase with a decrease in ________.

A)tax rate

B)accruals

C)depreciation expense

D)both A and C

A)tax rate

B)accruals

C)depreciation expense

D)both A and C

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck