Deck 19: Cost Management Systems: Activity-Based, just-In-Time, and Quality Management Systems

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/154

Play

Full screen (f)

Deck 19: Cost Management Systems: Activity-Based, just-In-Time, and Quality Management Systems

1

Why is using multiple predetermined overhead allocation rates more accurate than using a single plantwide allocation rate?

The allocation process is the same,except there are multiple cost pools and multiple allocation bases.Having more than one allocation rate more accurately reflects the way products actually use a company's resources.

2

Fill in the blanks:

-

Direct materials cost and direct labor cost can be ________ ________ to products.Manufacturing overhead costs are ________ in cost pools and then ________ to products.

-

Direct materials cost and direct labor cost can be ________ ________ to products.Manufacturing overhead costs are ________ in cost pools and then ________ to products.

easily traced ,accumulated ,allocated .

3

Powers,Inc.manufactures two kinds of bags-totes and satchels.The company allocates manufacturing overhead using a single plantwide rate with direct labor cost as the allocation base.Estimated overhead costs for the year are $25,750.Additional estimated information is given below. Calculate the amount of overhead to be allocated to Satchels,if the actual units produced and direct labor costs equal the estimated amounts.(Round any percentages to two decimal places and your final answer to the nearest dollar. )

A)$495

B)$13,733

C)$12,017

D)$22,750

A)$495

B)$13,733

C)$12,017

D)$22,750

$12,017

4

A modification of the overhead allocation method which uses a single plantwide rate,is to use multiple predetermined overhead allocation rates that have different allocation bases.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

5

Companies calculate the predetermined overhead rate at the beginning of an accounting period using the actual values of overhead costs.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

6

When a manufacturer changes from using a single plantwide predetermined overhead rate to multiple predetermined overhead allocation rates,the product unit cost may be more accurate.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

7

A furniture corporation manufactures two models of furniture-Standard and Deluxe.The total estimated manufacturing overhead costs are $64,300.The following estimates are available: The company uses direct labor costs as the base to allocate manufacturing overhead.Calculate the predetermined overhead rate.(Round your answer to two decimal places. )

A)32.15%

B)33.84%

C)190.52%

D)65.95%

A)32.15%

B)33.84%

C)190.52%

D)65.95%

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

8

The predetermined overhead allocation rate is an estimated overhead cost per unit of the allocation base and is calculated at the beginning of the accounting period.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

9

Direct material costs and direct labor costs cannot be easily traced to products.Therefore,they are allocated to products.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is true?

A)Indirect costs must be allocated based on a single plant wide rate.

B)Manufacturing overhead costs are accumulated in cost pools and then assigned to products.

C)Managers cannot wait until the end of the accounting period for product cost information.

D)Managers can choose to wait until the end of the accounting period to allocate manufacturing overhead costs.

A)Indirect costs must be allocated based on a single plant wide rate.

B)Manufacturing overhead costs are accumulated in cost pools and then assigned to products.

C)Managers cannot wait until the end of the accounting period for product cost information.

D)Managers can choose to wait until the end of the accounting period to allocate manufacturing overhead costs.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

11

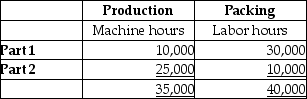

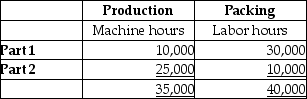

Brisbane,Inc. ,a leading manufacturer of car spare parts,divided its manufacturing process into two

Departments - Production and Packing.The estimated overhead costs for the Production and Packing

departments amounted to $14,000,000 and $20,000,000,respectively.The company produces two types of parts - Part 1 and Part 2.The total estimated labor hours for the year were 40,000,and estimated machine hours were 35,000.The Production department is mechanized,whereas the Packing department is labor oriented.Calculate the amount of manufacturing overhead costs allocated to Part 1.

Departments - Production and Packing.The estimated overhead costs for the Production and Packing

departments amounted to $14,000,000 and $20,000,000,respectively.The company produces two types of parts - Part 1 and Part 2.The total estimated labor hours for the year were 40,000,and estimated machine hours were 35,000.The Production department is mechanized,whereas the Packing department is labor oriented.Calculate the amount of manufacturing overhead costs allocated to Part 1.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

12

Modiste,Inc.manufactures two kinds of bags-totes and satchels.The company allocates manufacturing overhead using a single plantwide rate with direct labor cost as the allocation base.Estimated overhead costs for the year are $24,000.Additional estimated information is given below. Calculate the predetermined overhead allocation rate.(Round your answer to two decimal places. )

A)90.57%

B)48.31%

C)96.58%

D)1.36%

A)90.57%

B)48.31%

C)96.58%

D)1.36%

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

13

In selecting machine usage as the primary cost driver for the Production Department,management feels that there is a direct relationship between the number of machine hours used and the amount of overhead costs incurred.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

14

Oscar,Inc. ,a manufacturer of gift articles,uses a single plantwide rate to allocate indirect costs with machine hours as the allocation base.Estimated overhead costs for the year are $5,000,000.Estimated machine hours are 40,000.During the year,the actual machine hours used were 45,000.Calculate the predetermined overhead allocation rate.(Round your answer to the nearest dollar. )

A)$111

B)$91

C)$125

D)$63

A)$111

B)$91

C)$125

D)$63

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

15

A modification of the overhead allocation method which uses a single plantwide rate,is to use multiple predetermined overhead allocation rates that have a single allocation base.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

16

A furniture manufacturer has decided that its use of a single plantwide predetermined overhead allocation rate is no longer accurate.In making the transition to using multiple predetermined overhead allocation rates,which of the following statements is incorrect?

A)In selecting machine usage as the primary cost driver for the Production Department,management feels that there is a direct relationship between the number of machine hours used and the amount of overhead costs incurred.

B)Management must analyze the expected overhead costs and separate them into a cost pool for each department.

C)The allocation process changes because there are now multiple cost pools and multiple allocation bases.

D)The use of multiple predetermined overhead allocation rates is more complex,but it may be more accurate.

A)In selecting machine usage as the primary cost driver for the Production Department,management feels that there is a direct relationship between the number of machine hours used and the amount of overhead costs incurred.

B)Management must analyze the expected overhead costs and separate them into a cost pool for each department.

C)The allocation process changes because there are now multiple cost pools and multiple allocation bases.

D)The use of multiple predetermined overhead allocation rates is more complex,but it may be more accurate.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

17

Moonrays,Inc.manufactures both normal and premium tube lights.The company allocates manufacturing overhead using a single plantwide rate with machine hours as the allocation base.Estimated overhead costs for the year are $108,000.Additional estimated information is given below. Calculate the predetermined overhead allocation rate.(Round your answer to the nearest cent. )

A)$3.72 per direct labor hour

B)$1.40 per machine hour

C)$2.25 per machine hour

D)$0.22 per direct labor hour

A)$3.72 per direct labor hour

B)$1.40 per machine hour

C)$2.25 per machine hour

D)$0.22 per direct labor hour

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

18

Manufacturing overhead costs,which are also known as indirect costs,cannot be cost-effectively traced to products.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

19

Bag Ladies,Inc.manufactures two kinds of bags-totes and satchels.The company allocates manufacturing overhead using a single plantwide rate with direct labor cost as the allocation base.Estimated overhead costs for the year are $25,500.Additional estimated information is given below. Calculate the amount of overhead to be allocated to Totes.(Round any percentages to two decimal places and your final answer to the nearest dollar. )

A)$472

B)$347

C)$11,878

D)$13,620

A)$472

B)$347

C)$11,878

D)$13,620

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

20

A radial tire manufacturer produces products in two departments-Divisions A and B.The company uses separate predetermined overhead allocation rates for each department to allocate its overhead.Divisions A and B have estimated manufacturing overhead costs of $160,000 and $340,000,respectively.Division A uses machine hours as the allocation base,and Division B uses direct labor hours as the allocation base.The total estimated machine hours were 31,000,and direct labor hours were 22,000 for the year.Calculate the departmental predetermined overhead allocation rates.(Round your answer to the nearest cent. )

A)Division A-$5.16,Division B-$15.45

B)Division A-$15.45,Division B-$5.16

C)Division A-$7.27,Division B-$10.97

D)Division A-$10.97,Division B-$7.27

A)Division A-$5.16,Division B-$15.45

B)Division A-$15.45,Division B-$5.16

C)Division A-$7.27,Division B-$10.97

D)Division A-$10.97,Division B-$7.27

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

21

In the first step in developing an activity-based costing system for a manufacturing company,the management team must determine the activities that incur the majority of the manufacturing overhead costs.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

22

For each of the following activities,indicate an appropriate allocation base:

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

23

Cardec,Inc. ,a leading manufacturer of car spare parts,divided its manufacturing process into two

Departments - Production and Packing.The estimated overhead costs for the Production and Packing

departments amounted to $14,000,000 and $20,000,000,respectively.The company produces two types of parts - Part 1 and Part 2.The total estimated labor hours for the year were 40,000,and estimated machine hours were 35,000.The Production department is mechanized,whereas the Packing department is labor oriented.Calculate departmental predetermined overhead allocation rates.

Departments - Production and Packing.The estimated overhead costs for the Production and Packing

departments amounted to $14,000,000 and $20,000,000,respectively.The company produces two types of parts - Part 1 and Part 2.The total estimated labor hours for the year were 40,000,and estimated machine hours were 35,000.The Production department is mechanized,whereas the Packing department is labor oriented.Calculate departmental predetermined overhead allocation rates.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

24

Traditional costing provides more detailed information on costs of activities and the drivers of these costs than activity-based costing.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following would most likely be treated as an activity in an activity-based costing system?

A)direct labor cost

B)machine processing

C)direct materials cost

D)sales revenues

A)direct labor cost

B)machine processing

C)direct materials cost

D)sales revenues

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

26

Why is using a single plantwide predetermined overhead allocation rate not always accurate?

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

27

Myoung Company,a manufacturer of small appliances,had the following activities,allocated costs,and allocation bases: The above activities are carried out at two of its regional offices.

What is the cost per hour for the account inquiry activity? (Round your answer to the nearest cent. )

A)$0.65

B)$25.42

C)$11.00

D)$2.06

What is the cost per hour for the account inquiry activity? (Round your answer to the nearest cent. )

A)$0.65

B)$25.42

C)$11.00

D)$2.06

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

28

What is activity-based management? How is it different from activity-based costing?

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

29

Archid,Inc. ,a manufacturer of spare parts,has two production departments-Assembling and Packaging.The Assembling department is mechanized,while the Packaging department is labor oriented.Estimated manufacturing overhead costs for the year were $19,300,000 for Assembling and $13,900,000 for Packaging.Calculate the department predetermined overhead allocation rates for the Assembling and Packaging departments,respectively,if the total estimated machine hours were 30,000 and labor hours were 20,000 for the year.(Round your answer to the nearest cent. )

A)$965.00,$463.33

B)$643.33,$695.00

C)$463.33,$965.00

D)$643.33,$965.00

A)$965.00,$463.33

B)$643.33,$695.00

C)$463.33,$965.00

D)$643.33,$965.00

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

30

An activity-based costing system is developed in four steps: a.Compute the predetermined overhead allocation rate for each activity.

B.Identify activities and estimate their total costs.

C.Identify the cost driver for each activity and then estimate the quantity of each driver's allocation base.

D.Allocate the indirect costs to the cost object.

Which of the following is the correct order for performing these steps?

A)a,b,c,d

B)c,a,b,d

C)b,c,a,d

D)b,a,c,d

B.Identify activities and estimate their total costs.

C.Identify the cost driver for each activity and then estimate the quantity of each driver's allocation base.

D.Allocate the indirect costs to the cost object.

Which of the following is the correct order for performing these steps?

A)a,b,c,d

B)c,a,b,d

C)b,c,a,d

D)b,a,c,d

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

31

In the first step in developing an activity-based costing system for a manufacturing company,the management team must determine the activities that incur the majority of the product and period costs.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

32

In the first step in developing an activity-based costing system,the management team must think about how each activity for a product or service might be improved or whether is it necessary at all.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

33

Activity-based costing focuses on a single predetermined overhead rate for cost analysis.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

34

Traditional costing systems employ multiple allocation rates for manufacturing overhead costs,but an activity-based costing system uses only one rate for allocating manufacturing overhead costs.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is the most appropriate cost driver for allocating the cost of warranty services?

A)number of employees

B)number of materials purchased

C)number of machine hours

D)number of service calls

A)number of employees

B)number of materials purchased

C)number of machine hours

D)number of service calls

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

36

Activity-based costing uses a common allocation base for all activities.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

37

Eide Company,a manufacturer of small appliances,had the following activities,allocated costs,and allocation bases: The above activities are carried out at two of its regional offices.

What is the cost per account for the account verification activity? (Round your answer to the nearest cent. )

A)$27.50

B)$3.88

C)$10.00

D)$0.67

What is the cost per account for the account verification activity? (Round your answer to the nearest cent. )

A)$27.50

B)$3.88

C)$10.00

D)$0.67

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

38

Pitt Jones Company,a manufacturer of small appliances,had the following activities,allocated costs,and allocation bases: The above activities are carried out at two of its regional offices.

What is the cost per line for the account billing activity? (Round your answer to the nearest cent. )

A)$1.78

B)$23.46

C)$3.39

D)$12.31

What is the cost per line for the account billing activity? (Round your answer to the nearest cent. )

A)$1.78

B)$23.46

C)$3.39

D)$12.31

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

39

For a pharmaceutical company,the most suitable base for allocating research and development costs to the finished products would be the ________.

A)direct labor hours

B)cost of raw materials purchased

C)number of new patents filed

D)number of set ups

A)direct labor hours

B)cost of raw materials purchased

C)number of new patents filed

D)number of set ups

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

40

The main difference between activity-based costing and traditional costing systems is that activity-based costing uses a separate allocation base for each activity.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

41

Leyden Company,a manufacturer of small appliances,had the following activities,allocated costs,and allocation bases: The above activities are carried out at two of its regional offices.

How much of the correspondence cost will be assigned to the Northeast Office? (Round any intermediate calculations to the nearest cent and your final answer to the nearest dollar. )

A)$429

B)$12,000

C)$1,200

D)$5,143

How much of the correspondence cost will be assigned to the Northeast Office? (Round any intermediate calculations to the nearest cent and your final answer to the nearest dollar. )

A)$429

B)$12,000

C)$1,200

D)$5,143

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

42

Bendas Company,a manufacturer of small appliances,had the following activities,allocated costs,and allocation bases: The above activities are carried out at two of its regional offices.

How much of the account verification costs will be assigned to the Northeast Office? (Round any intermediate calculations to the nearest cent and your final answer to the nearest dollar. )

A)$371

B)$86

C)$627

D)$68

How much of the account verification costs will be assigned to the Northeast Office? (Round any intermediate calculations to the nearest cent and your final answer to the nearest dollar. )

A)$371

B)$86

C)$627

D)$68

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following statements is true of an activity-based costing system?

A)It uses separate predetermined overhead allocation rates for each activity.

B)It is not as accurate or precise as traditional costing systems.

C)It accumulates overhead costs by processing departments.

D)It is not as complex or as costly as traditional systems.

A)It uses separate predetermined overhead allocation rates for each activity.

B)It is not as accurate or precise as traditional costing systems.

C)It accumulates overhead costs by processing departments.

D)It is not as complex or as costly as traditional systems.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements is true of costing systems?

A)Many traditional costing systems can distort product costs and profitability.

B)Traditional costing systems tend to be more costly than activity-based costing systems.

C)Activity-based costing systems tend to combine various costs into a single cost pool.

D)Activity-based costing systems tend to use fewer cost pools than does a traditional costing system.

A)Many traditional costing systems can distort product costs and profitability.

B)Traditional costing systems tend to be more costly than activity-based costing systems.

C)Activity-based costing systems tend to combine various costs into a single cost pool.

D)Activity-based costing systems tend to use fewer cost pools than does a traditional costing system.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

45

Alpha Company manufactures breadboxes and uses an activity-based costing system.The following information is provided for the month of May: Each breadbox consists of four parts,and the direct materials cost per breadbox is $7.80.There is no direct labor.What is the total manufacturing cost per breadbox? (Round any intermediate calculations and your final answer to the nearest cent. )

A)$15.32

B)$23.12

C)$4.93

D)$18.73

A)$15.32

B)$23.12

C)$4.93

D)$18.73

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

46

Companies with diverse products can obtain better costing information by using a single plantwide rate for allocating manufacturing costs.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

47

Flannery Company,a manufacturer of small appliances,had the following activities,allocated costs,and allocation bases: The above activities are carried out at two of its regional offices.

What is the cost per letter for the correspondence activity? (Round your answer to the nearest cent. )

A)$12.00

B)$45.00

C)$4.44

D)$0.80

What is the cost per letter for the correspondence activity? (Round your answer to the nearest cent. )

A)$12.00

B)$45.00

C)$4.44

D)$0.80

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

48

Jennings Company manufactures ceiling fans and uses an activity-based costing system.Each ceiling fan has 20 separate parts.The direct materials cost is $85 and each ceiling fan requires 2.50 hours of machine time to manufacture.Additional information is as follows:

What is the total manufacturing cost per ceiling fan? (Round any intermediate calculations and your final answer to the nearest cent. )

A)$97.70

B)$104.80

C)$112.80

D)$116.70

What is the total manufacturing cost per ceiling fan? (Round any intermediate calculations and your final answer to the nearest cent. )

A)$97.70

B)$104.80

C)$112.80

D)$116.70

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

49

Reichert Company manufactures ceiling fans and uses an activity-based costing system.Each ceiling fan has 20 separate parts.The direct materials cost is $95,and each ceiling fan requires 3.00 hours of machine time to manufacture.Additional information is as follows: What is the cost of machining per ceiling fan? (Round any intermediate calculations and your final answer to the nearest cent. )

A)$18.00

B)$95.00

C)$120.00

D)$199.50

A)$18.00

B)$95.00

C)$120.00

D)$199.50

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is the last step in developing an activity-based costing system?

A)estimating the total quantity of the cost driver

B)estimating the total indirect costs of each activity

C)identifying the activities

D)allocating indirect costs to the cost object

A)estimating the total quantity of the cost driver

B)estimating the total indirect costs of each activity

C)identifying the activities

D)allocating indirect costs to the cost object

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

51

Activity-based costing refines the cost allocation process even more than traditional allocation costing systems.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

52

The first step in developing an activity-based costing system is to identify the activities that will be used to allocate the manufacturing overhead costs.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

53

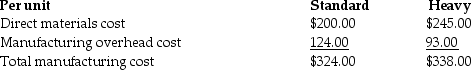

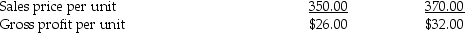

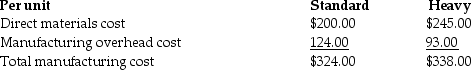

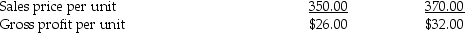

AAA Metal Bearings produces two sizes of metal bearings (sold by the crate)-standard and heavy.The standard bearings require $200 of direct materials per unit (per crate),and the heavy bearings require $245 of direct materials per unit.The operation is mechanized,and there is no direct labor.Previously AAA used a single plantwide allocation rate for manufacturing overhead,which was $1.55 per machine hour.Based on the single rate,gross profit was as follows:

Although the data showed that the heavy bearings were more profitable than the standard bearings,the plant manager knew that the heavy bearings required much more processing in the metal fabrication phase than the standard bearings,and that this factor was not adequately reflected in the single plantwide allocation rate.He suspected that it was distorting the profit data.He suggested adopting an activity-based costing approach.

Although the data showed that the heavy bearings were more profitable than the standard bearings,the plant manager knew that the heavy bearings required much more processing in the metal fabrication phase than the standard bearings,and that this factor was not adequately reflected in the single plantwide allocation rate.He suspected that it was distorting the profit data.He suggested adopting an activity-based costing approach.

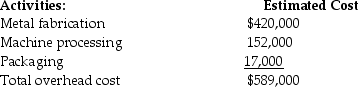

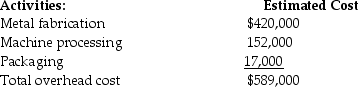

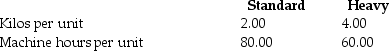

Working together,the engineers and accountants identified the following three manufacturing activities and broke down the annual overhead costs as shown below:

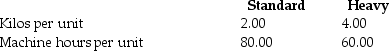

Engineers believed that metal fabrication costs should be allocated by weight and estimated that the plant processed 12,000 kilos of metal per year.Machine processing costs were correlated to machine hours,and the engineers estimated a total of 380,000 machine hours for the year.Packaging costs were the same for both types of products,and so they could be allocated simply by the number of units produced.The production plan provided for 4,000 units of standard and 1,000 units of heavy bearings to be produced during the year.Additional data on a per unit basis was as given below:

Engineers believed that metal fabrication costs should be allocated by weight and estimated that the plant processed 12,000 kilos of metal per year.Machine processing costs were correlated to machine hours,and the engineers estimated a total of 380,000 machine hours for the year.Packaging costs were the same for both types of products,and so they could be allocated simply by the number of units produced.The production plan provided for 4,000 units of standard and 1,000 units of heavy bearings to be produced during the year.Additional data on a per unit basis was as given below:

Using the data above,calculate the predetermined overhead allocation rates using activity-based costing.Then,following the ABC methodology,calculate the production cost and gross profit for one unit of standard bearings.(Round your intermediate calculations to two decimal places. )

Using the data above,calculate the predetermined overhead allocation rates using activity-based costing.Then,following the ABC methodology,calculate the production cost and gross profit for one unit of standard bearings.(Round your intermediate calculations to two decimal places. )

Although the data showed that the heavy bearings were more profitable than the standard bearings,the plant manager knew that the heavy bearings required much more processing in the metal fabrication phase than the standard bearings,and that this factor was not adequately reflected in the single plantwide allocation rate.He suspected that it was distorting the profit data.He suggested adopting an activity-based costing approach.

Although the data showed that the heavy bearings were more profitable than the standard bearings,the plant manager knew that the heavy bearings required much more processing in the metal fabrication phase than the standard bearings,and that this factor was not adequately reflected in the single plantwide allocation rate.He suspected that it was distorting the profit data.He suggested adopting an activity-based costing approach.Working together,the engineers and accountants identified the following three manufacturing activities and broke down the annual overhead costs as shown below:

Engineers believed that metal fabrication costs should be allocated by weight and estimated that the plant processed 12,000 kilos of metal per year.Machine processing costs were correlated to machine hours,and the engineers estimated a total of 380,000 machine hours for the year.Packaging costs were the same for both types of products,and so they could be allocated simply by the number of units produced.The production plan provided for 4,000 units of standard and 1,000 units of heavy bearings to be produced during the year.Additional data on a per unit basis was as given below:

Engineers believed that metal fabrication costs should be allocated by weight and estimated that the plant processed 12,000 kilos of metal per year.Machine processing costs were correlated to machine hours,and the engineers estimated a total of 380,000 machine hours for the year.Packaging costs were the same for both types of products,and so they could be allocated simply by the number of units produced.The production plan provided for 4,000 units of standard and 1,000 units of heavy bearings to be produced during the year.Additional data on a per unit basis was as given below: Using the data above,calculate the predetermined overhead allocation rates using activity-based costing.Then,following the ABC methodology,calculate the production cost and gross profit for one unit of standard bearings.(Round your intermediate calculations to two decimal places. )

Using the data above,calculate the predetermined overhead allocation rates using activity-based costing.Then,following the ABC methodology,calculate the production cost and gross profit for one unit of standard bearings.(Round your intermediate calculations to two decimal places. )

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

54

Indirect costs allocated to products using activity-based costing are more accurate than traditional allocation systems.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

55

Quality Stereo Company has provided the following information regarding its activity-based costing system: • Purchasing department costs are allocated based on purchase orders,and the predetermined overhead allocation rate is $79 per purchase order.

• Assembly department costs are allocated based on the number of parts used,and the predetermined overhead allocation rate is $2 per part.

• Packaging department costs are allocated based on the number of units produced,and the predetermined overhead allocation rate is $2 per unit produced.

Each stereo produced has 50 parts,and the direct materials cost per unit is $62.There are no direct labor costs.Quality Stereo has an order for 1,000 stereos,which will require 40 purchase orders in all.What is the total cost for the 1,000 stereos?

A)$167,160

B)$104,480

C)$103,160

D)$164,000

• Assembly department costs are allocated based on the number of parts used,and the predetermined overhead allocation rate is $2 per part.

• Packaging department costs are allocated based on the number of units produced,and the predetermined overhead allocation rate is $2 per unit produced.

Each stereo produced has 50 parts,and the direct materials cost per unit is $62.There are no direct labor costs.Quality Stereo has an order for 1,000 stereos,which will require 40 purchase orders in all.What is the total cost for the 1,000 stereos?

A)$167,160

B)$104,480

C)$103,160

D)$164,000

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

56

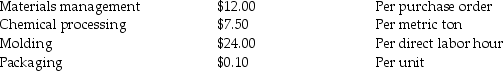

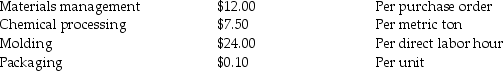

Ace Plastics produces different kinds of products,all in one manufacturing facility.They have identified four activities for their costing system:

Materials management-allocated by number of purchase orders

Chemical processing-allocated on metric tons

Molding-allocated on direct labor hours

Packaging-allocated by number of units produced

The activity rates are as follows:

Engineering design shows that the order will require direct materials that cost $540; direct labor cost will be $90.The order will also require four purchase orders to be placed,use two metric tons of chemical base,and need eight direct labor hours.The size of the order is to produce 3,000 units of product.Calculate the total production of the order.

Engineering design shows that the order will require direct materials that cost $540; direct labor cost will be $90.The order will also require four purchase orders to be placed,use two metric tons of chemical base,and need eight direct labor hours.The size of the order is to produce 3,000 units of product.Calculate the total production of the order.

Materials management-allocated by number of purchase orders

Chemical processing-allocated on metric tons

Molding-allocated on direct labor hours

Packaging-allocated by number of units produced

The activity rates are as follows:

Engineering design shows that the order will require direct materials that cost $540; direct labor cost will be $90.The order will also require four purchase orders to be placed,use two metric tons of chemical base,and need eight direct labor hours.The size of the order is to produce 3,000 units of product.Calculate the total production of the order.

Engineering design shows that the order will require direct materials that cost $540; direct labor cost will be $90.The order will also require four purchase orders to be placed,use two metric tons of chemical base,and need eight direct labor hours.The size of the order is to produce 3,000 units of product.Calculate the total production of the order.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

57

Orlando Avionics makes three types of radios for small aircraft-Model A,Model B,and Model C.The manufacturing operations are mechanized,and there is no direct labor.Manufacturing overhead costs are significant,and Orlando has adopted an activity-based costing system.Direct materials costs per unit for each model are as follows: Orlando has three activities-assembly,materials management,and testing.The cost driver for assembly is machine hours.The cost driver for materials management is the number of parts,and the cost driver for testing is the number of units of product.Total costs and production volumes for the year were estimated as follows:

The Model A radio requires 12 parts to construct and 20 machine hours of processing.What is the manufacturing cost to make one unit of Model A? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$168

B)$44

C)$152

D)$172

The Model A radio requires 12 parts to construct and 20 machine hours of processing.What is the manufacturing cost to make one unit of Model A? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$168

B)$44

C)$152

D)$172

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

58

Abadeer Company manufactures ceiling fans and uses an activity-based costing system.Each ceiling fan has 20 separate parts.The direct materials cost is $70,and each ceiling fan requires 4.00 hours of machine time to manufacture.Additional information is as follows:

What is the cost of assembling per ceiling fan? (Round any intermediate calculations and your final answer to the nearest cent. )

A)$70.00

B)$6.00

C)$24.80

D)$21.00

What is the cost of assembling per ceiling fan? (Round any intermediate calculations and your final answer to the nearest cent. )

A)$70.00

B)$6.00

C)$24.80

D)$21.00

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

59

Malloy Company,a manufacturer of small appliances,had the following activities,allocated costs,and allocation bases: The above activities are carried out at two of its regional offices.

How much of the account inquiry cost will be assigned to the Midwest Office? (Round any intermediate calculations to two decimal places and your final answer to the nearest dollar. )

A)$16,500

B)$77,000

C)$27,500

D)$8,250

How much of the account inquiry cost will be assigned to the Midwest Office? (Round any intermediate calculations to two decimal places and your final answer to the nearest dollar. )

A)$16,500

B)$77,000

C)$27,500

D)$8,250

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

60

Brannon Company manufactures ceiling fans and uses an activity-based costing system.Each ceiling fan has 20 separate parts.The direct material cost is $70,and each ceiling fan requires 4.00 hours of machine time to manufacture.Additional information is as follows: What is the cost of materials handling per ceiling fan? (Round any intermediate calculations and your final answer to two decimal places. )

A)$1.60

B)$6.20

C)$2.30

D)$9.20

A)$1.60

B)$6.20

C)$2.30

D)$9.20

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

61

________ is the maximum cost to develop,produce,and deliver a product or service and earn the desired profit.

A)Marginal cost

B)Target cost

C)Variable cost

D)Sunk cost

A)Marginal cost

B)Target cost

C)Variable cost

D)Sunk cost

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is true of target pricing?

A)It starts with the price that customers are willing to pay.

B)It uses the full product cost that a company estimates to arrive at the sales price.

C)It does not consider the nonmanufacturing costs when calculating the target cost.

D)It is the same as cost-based pricing.

A)It starts with the price that customers are willing to pay.

B)It uses the full product cost that a company estimates to arrive at the sales price.

C)It does not consider the nonmanufacturing costs when calculating the target cost.

D)It is the same as cost-based pricing.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

63

Activity-based management focuses on making decisions that improve customers' satisfaction while also increasing profits.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is a nonmanufacturing cost?

A)direct labor

B)direct materials

C)administrative expenses

D)indirect labor

A)direct labor

B)direct materials

C)administrative expenses

D)indirect labor

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

65

A product mix decision focuses on generating the maximum profit for a company but does not consider the company's limited production capabilities.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

66

Activity-based management (ABM)can be used to make pricing and product mix decisions.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

67

In target pricing,the target sales price is the ________.

A)total product cost incurred in producing a product

B)net profit desired by the company

C)amount customers are willing to pay for a product or service

D)price calculated by deducting the desired profit from the total production cost

A)total product cost incurred in producing a product

B)net profit desired by the company

C)amount customers are willing to pay for a product or service

D)price calculated by deducting the desired profit from the total production cost

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

68

Activity-based management (ABM)uses activity-based costs to make decisions that increase profits while meeting customer needs.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

69

Phoenix,Inc.manufactures widgets.The target sales price is $440 per unit.The company desires a 40% net profit margin on its products.What is the company's target full-product cost per unit using target pricing?

A)$176

B)$616

C)$704

D)$264

A)$176

B)$616

C)$704

D)$264

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

70

J-Time,Inc.is planning to launch a new brand of watches for kids.Similar watches are available in the market for $58.In order to penetrate the market,the company plans to use target pricing and desires a 22% net profit markup on total cost.Calculate the target cost.(Round your answer to the nearest cent. )

A)$70.76

B)$12.76

C)$47.54

D)$45.24

A)$70.76

B)$12.76

C)$47.54

D)$45.24

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

71

Webster,Inc.has received a bid for 14,000 units.The costing estimates show that the average cost per unit for this bid will be $500.The company uses cost-based pricing and adds 20% markup to total costs.What total price will Webster ask for the entire order?

A)$8,400,000

B)$7,000,000

C)$1,400,000

D)$5,600,000

A)$8,400,000

B)$7,000,000

C)$1,400,000

D)$5,600,000

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

72

Jetz,Inc.manufactures water bottles for children.Similar water bottles are available in the market for $8.00.Jetz desires a 24% net profit margin.Jetz's target cost is ________.(Round your answer to the nearest cent. )

A)$6.08

B)$9.92

C)$8.00

D)$1.92

A)$6.08

B)$9.92

C)$8.00

D)$1.92

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

73

Target cost is calculated by deducting desired gross profit from target sales price.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

74

Managers can use activity-based management to make what two kinds of decisions?

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

75

Value engineering means reevaluating activities to reduce costs while still satisfying customer needs.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

76

A company is most likely to use value engineering ________.

A)to allocate manufacturing overhead to departments

B)to reduce costs in order to achieve target costs

C)to determine accurate product costs for pricing

D)to make product mix decisions

A)to allocate manufacturing overhead to departments

B)to reduce costs in order to achieve target costs

C)to determine accurate product costs for pricing

D)to make product mix decisions

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

77

The activity-based costing system improves the allocation of ________.

A)indirect manufacturing costs

B)direct labor

C)direct materials

D)sales commissions

A)indirect manufacturing costs

B)direct labor

C)direct materials

D)sales commissions

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

78

Target pricing starts with the full product cost,and it then adds the desired profit to arrive at the sales price.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is the correct formula to calculate the target cost?

A)Target Cost = Target Sales Price + Desired Profit

B)Target Cost = Target Sales Price - Desired Profit

C)Target Cost = Target Sales Price

D)Target Cost = Desired Profit + Research and Development Expenses

A)Target Cost = Target Sales Price + Desired Profit

B)Target Cost = Target Sales Price - Desired Profit

C)Target Cost = Target Sales Price

D)Target Cost = Desired Profit + Research and Development Expenses

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following decisions will most likely involve the use of activity-based management?

A)decisions related to the financing of an investment using equity or debt

B)decisions related to the expansion operations in a particular geographic location

C)decisions related to the pricing of a product

D)decisions related to the payment of dividends

A)decisions related to the financing of an investment using equity or debt

B)decisions related to the expansion operations in a particular geographic location

C)decisions related to the pricing of a product

D)decisions related to the payment of dividends

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck