Deck 3: Cost-Volume-Profit Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

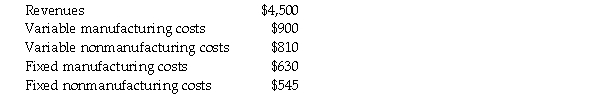

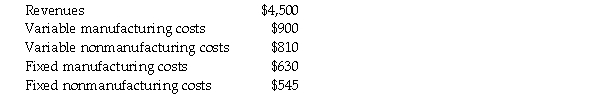

Question

Question

Question

Question

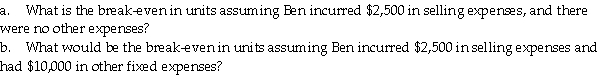

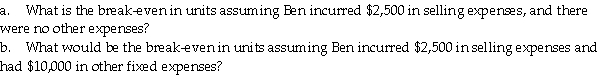

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

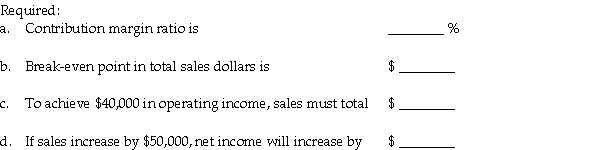

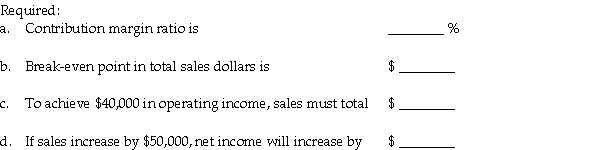

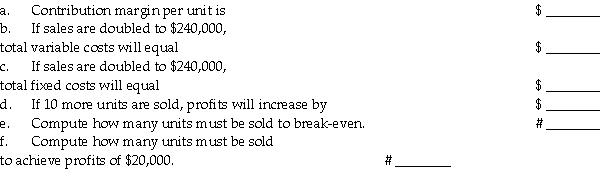

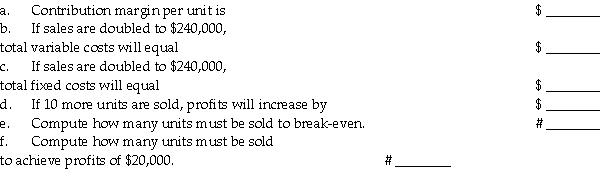

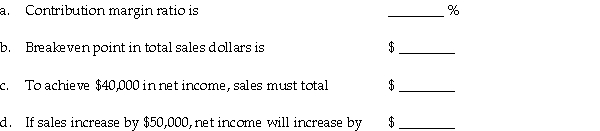

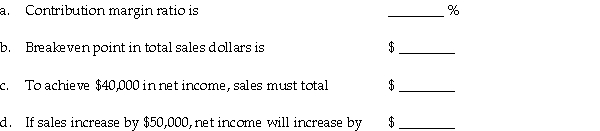

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

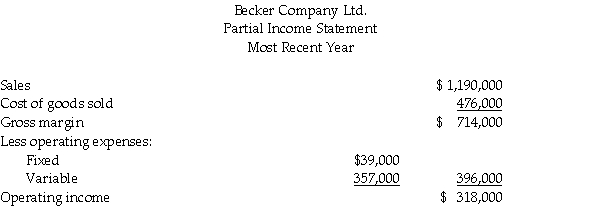

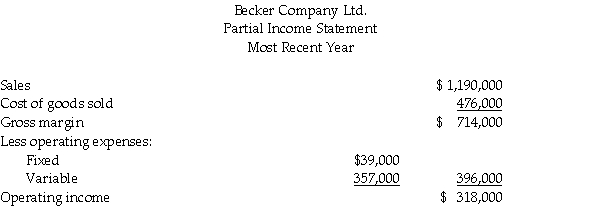

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/156

Play

Full screen (f)

Deck 3: Cost-Volume-Profit Analysis

1

In the graph method of CVP analysis,the break-even point is the (X-axis)quantity of units sold for which the total revenues line crosses the total costs line.

True

2

Variable operating costs and fixed operating costs constitute total operating costs.

True

3

The contribution margin is computed by deducting all costs which vary on the basis of an output-related cost driver from revenues.

True

4

The contribution margin method of CVP analysis uses the equation: break-even units = unit contribution margin/fixed costs.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

5

To perform cost-volume-profit analysis,a company must be able to separate costs into fixed and variable components.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

6

A profit-volume graph shows the impact on operating income from changes in the output level.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

7

In cost-volume-profit analysis (CVP)it is assumed that both the product mix and the volume sold are dynamic variables.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

8

Cost-volume-profit analysis is useful for

A)helping managers to answer "what-if" questions.

B)implementing a differentiation strategy.

C)eliminating uncertainty about external factors,such as interest rates.

D)for long-range planning.

E)assigning costs to products.

A)helping managers to answer "what-if" questions.

B)implementing a differentiation strategy.

C)eliminating uncertainty about external factors,such as interest rates.

D)for long-range planning.

E)assigning costs to products.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

9

Total revenues less total fixed costs equal the contribution margin.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

10

The total costs line includes all variable costs and all fixed costs when using the graph method of CVP analysis.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

11

The contribution margin method can be used to verify a break-even calculation.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

12

At the break-even point of 200 units,variable costs total $400 and fixed costs total $600.The 201st unit sold will contribute ________ to profits.

A)$1

B)$2

C)$3

D)$5

E)$6

A)$1

B)$2

C)$3

D)$5

E)$6

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

13

Schuppener Company sells its only product for $18 per unit;variable production costs are $6 per unit,and variable selling and administrative costs are $3 per unit;fixed costs for 10,000 units are $10,000.The contribution margin is

A)$12 per unit.

B)$9 per unit.

C)$11 per unit.

D)$8 per unit.

E)$18 per unit.

A)$12 per unit.

B)$9 per unit.

C)$11 per unit.

D)$8 per unit.

E)$18 per unit.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

14

CVP analysis assumes that the behaviour of total costs is non-linear.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

15

In cost-volume-profit (CVP)analysis relevant costs include variable,fixed,and mixed costs.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

16

CVP analysis assumes that total costs can be separated into the fixed component and variable component with respect to the level of output.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

17

CVP analysis requires the time value of money to be factored into formula when comparing revenues and costs.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

18

In CVP analysis,an assumption is made that the total revenues are linear with respect to output units,but that total costs are non-linear with respect to output units.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

19

In CVP analysis,total costs can be separated into a fixed component that does not vary with output and a component that is variable with output level.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following are necessary assumptions when using the contribution margin method of determining the break-even point?

A)Average unit costs must be known.

B)There must be an input-related cost driver.

C)Fixed costs are irrelevant.

D)Total variable cost must be known.

E)Unit selling price and unit variable cost must be known.

A)Average unit costs must be known.

B)There must be an input-related cost driver.

C)Fixed costs are irrelevant.

D)Total variable cost must be known.

E)Unit selling price and unit variable cost must be known.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

21

The break-even point in CVP analysis is defined as the point

A)where output units equal input units.

B)where total revenue equals fixed costs.

C)where revenues less variable costs equal operating income.

D)where the unit contribution margin equals the selling price less the unit variable cost.

E)where total revenue equals total costs.

A)where output units equal input units.

B)where total revenue equals fixed costs.

C)where revenues less variable costs equal operating income.

D)where the unit contribution margin equals the selling price less the unit variable cost.

E)where total revenue equals total costs.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

22

Use the information below to answer the following question(s).

Jill Bishop makes homemade soap.She sells it for $100 a case.Her variable costs are $40 per case.She has fixed costs of $600

What is the break-even point in cases?

A)6 cases

B)10 cases

C)15 cases

D)20 cases

E)100 cases

Jill Bishop makes homemade soap.She sells it for $100 a case.Her variable costs are $40 per case.She has fixed costs of $600

What is the break-even point in cases?

A)6 cases

B)10 cases

C)15 cases

D)20 cases

E)100 cases

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements about contribution margin and gross margin in CVP analysis is TRUE?

A)Contribution margin equals total revenue minus cost of goods sold.

B)Contribution margin equals total revenue minus non-variable costs.

C)Gross margin equals total revenue minus cost of goods sold.

D)Service companies can compute a gross margin but not a contribution margin.

E)Gross margin equals total revenue minus non-variable costs.

A)Contribution margin equals total revenue minus cost of goods sold.

B)Contribution margin equals total revenue minus non-variable costs.

C)Gross margin equals total revenue minus cost of goods sold.

D)Service companies can compute a gross margin but not a contribution margin.

E)Gross margin equals total revenue minus non-variable costs.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

24

How many units would have to be sold to yield a target operating income of $22,000,assuming variable costs are $15 per unit,total fixed costs are $2,000,and the unit selling price is $20?

A)4,800 units

B)4,400 units

C)4,000 units

D)3,600 units

E)1,600 units

A)4,800 units

B)4,400 units

C)4,000 units

D)3,600 units

E)1,600 units

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

25

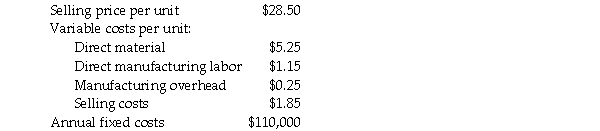

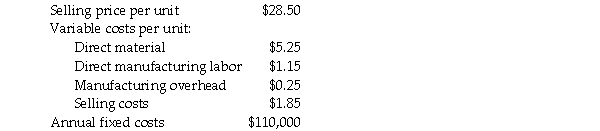

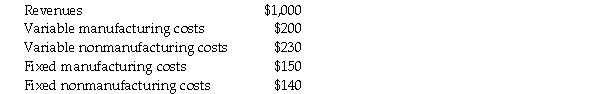

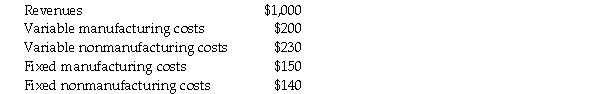

Use the information below to answer the following question(s).

Franscioso Company sells several products.Information of average revenue and costs is as follows:

The Franscioso Company contribution margin ratio is

A)1.102:1.

B)1.425:1.

C)0.298:1.

D)0.637:1.

E)0.702:1.

Franscioso Company sells several products.Information of average revenue and costs is as follows:

The Franscioso Company contribution margin ratio is

A)1.102:1.

B)1.425:1.

C)0.298:1.

D)0.637:1.

E)0.702:1.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

26

List the assumptions required to identify relevant information in cost-volume-profit analysis.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

27

What is meant by the term break-even point? Why should a manager be concerned about the break-even point?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

28

Use the information below to answer the following question(s).

Franscioso Company sells several products.Information of average revenue and costs is as follows:

The Franscioso Company break-even in sales dollars is

A)$99,819.

B)$77,193.

C)$369,128.

D)$172,684.

E)$156,695.

Franscioso Company sells several products.Information of average revenue and costs is as follows:

The Franscioso Company break-even in sales dollars is

A)$99,819.

B)$77,193.

C)$369,128.

D)$172,684.

E)$156,695.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

29

Ben's Custom Golf sells special clubs.Ben is able to purchase equipment from a manufacturing company for $100 each.The equipment is sold for $150 each.

Required:

Required:

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

30

Explain when a manager would use cost-volume-profit analysis and sensitivity analysis.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

31

Cost-volume profit is used to analyze

A)the behaviour of some costs and revenues as changes occur in the output level.

B)the behaviour of total costs,total revenues,and operating income as changes occur in the output level.

C)a single revenue driver and multiple cost drivers in special case CVP.

D)multiple revenue drivers and a single cost driver in special case CVP.

E)the behaviour of variable costs at all levels of output.

A)the behaviour of some costs and revenues as changes occur in the output level.

B)the behaviour of total costs,total revenues,and operating income as changes occur in the output level.

C)a single revenue driver and multiple cost drivers in special case CVP.

D)multiple revenue drivers and a single cost driver in special case CVP.

E)the behaviour of variable costs at all levels of output.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

32

Sales total $200,000 when variable costs total $150,000 and fixed costs total $30,000.The break-even point in sales dollars is

A)$200,000.

B)$120,000.

C)$40,000.

D)$30,000.

E)$180,000.

A)$200,000.

B)$120,000.

C)$40,000.

D)$30,000.

E)$180,000.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

33

Use the information below to answer the following question(s).

Jill Bishop makes homemade soap.She sells it for $100 a case.Her variable costs are $40 per case.She has fixed costs of $600

What is the contribution margin per case?

A)$100.00

B)$60.00

C)$40.00

D)$15.00

E)$10.00

Jill Bishop makes homemade soap.She sells it for $100 a case.Her variable costs are $40 per case.She has fixed costs of $600

What is the contribution margin per case?

A)$100.00

B)$60.00

C)$40.00

D)$15.00

E)$10.00

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

34

The contribution income statement highlights

A)gross margin.

B)products costs and period costs.

C)different product lines.

D)variable and fixed costs.

E)gross margin and net operating income.

A)gross margin.

B)products costs and period costs.

C)different product lines.

D)variable and fixed costs.

E)gross margin and net operating income.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

35

If unit sales exceed the break-even point when using the graph method

A)there is a loss because the total cost line exceeds the total revenue line.

B)total sales exceed total costs.

C)there is a profit because the total cost line exceeds the total revenue line.

D)expenses are extremely high relative to revenues.

E)operating income is negative (an operating loss).

A)there is a loss because the total cost line exceeds the total revenue line.

B)total sales exceed total costs.

C)there is a profit because the total cost line exceeds the total revenue line.

D)expenses are extremely high relative to revenues.

E)operating income is negative (an operating loss).

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

36

How many units would have to be sold to yield a target income of $11,000 assuming variable costs are $30 per unit,total fixed costs are $1,000,and the unit selling price is $40?

A)1,200 units

B)1,100 units

C)1,000 units

D)900 units

E)300 units

A)1,200 units

B)1,100 units

C)1,000 units

D)900 units

E)300 units

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

37

What is the break-even point in units,assuming a product's selling price is $100,fixed costs are $8,000,unit variable costs are $20,and operating income is $32,000?

A)100 units

B)300 units

C)400 units

D)500 units

E)600 units

A)100 units

B)300 units

C)400 units

D)500 units

E)600 units

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

38

What is the break-even point in units for a product line,assuming a unit selling price of $200,total fixed costs are $4,000,unit variable costs are $40,and target operating income is $16,000,000?

A)25 units

B)75 units

C)100 units

D)125 units

E)100,000 units

A)25 units

B)75 units

C)100 units

D)125 units

E)100,000 units

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

39

What would target operating income be when fixed costs equal $6,000,unit contribution margin equals $40.00,and the number of units equals 400?

A)$6,000

B)$10,000

C)$16,000

D)$20,000

E)$60,000

A)$6,000

B)$10,000

C)$16,000

D)$20,000

E)$60,000

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is an assumption of CVP analysis?

A)Costs must be separated into separate fixed and variable components.

B)Total revenues and total costs are curvilinear in relation to output units.

C)Given revenue mixed of products is dynamic.

D)There will be a change between beginning and ending levels of inventory.

E)The time value of money must be taken into account.

A)Costs must be separated into separate fixed and variable components.

B)Total revenues and total costs are curvilinear in relation to output units.

C)Given revenue mixed of products is dynamic.

D)There will be a change between beginning and ending levels of inventory.

E)The time value of money must be taken into account.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following formulae is correct when using the contribution margin method to determine the break-even point?

A)Revenues less operating income equal variable costs plus fixed costs.

B)Unit contribution margin times unit variable cost equals the break-even number of units.

C)Unit contribution margin times the break-even number of units equals total variable costs.

D)Selling price less unit contribution margin equals unit fixed cost for all values below or at the break-even number of units.

E)Unit contribution margin times the break-even number of units equals fixed costs.

A)Revenues less operating income equal variable costs plus fixed costs.

B)Unit contribution margin times unit variable cost equals the break-even number of units.

C)Unit contribution margin times the break-even number of units equals total variable costs.

D)Selling price less unit contribution margin equals unit fixed cost for all values below or at the break-even number of units.

E)Unit contribution margin times the break-even number of units equals fixed costs.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

42

Operating margin is the same as gross margin in CVP analysis.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

43

The gross margin is revenue minus all variable manufacturing costs.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

44

Target net income is computed by multiplying operating income by one minus the entity's tax rate,or by multiplying operating income by the tax rate,and subtracting that amount from operating income.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

45

Blankinship,Inc. ,sells a single product.The company's most recent income statement is given below.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

46

Symbol Manufacturing Inc.makes component parts for automobile navigation systems.For component A14 direct materials cost $47,and the assembly technicians are paid $42 per hour.A technician can produce two components per hour.Fixed manufacturing costs for A14 are $70,000 per unit based on current production of 12,000 units.Non-manufacturing costs are fixed at $120,000 per period.Each A14 component sells for $195.

Required:

a.Prepare an income statement in gross margin format.

b.Calculate the dollar sales required to generate an operating profit of $1,500,000 and prepare an income statement in contribution margin format.

c.What actions could Symbol Manufacturing Inc.management take to lower the required number of units sold necessary to generate the desired operating profit?

Required:

a.Prepare an income statement in gross margin format.

b.Calculate the dollar sales required to generate an operating profit of $1,500,000 and prepare an income statement in contribution margin format.

c.What actions could Symbol Manufacturing Inc.management take to lower the required number of units sold necessary to generate the desired operating profit?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

47

Revenues less all costs that vary with respect to an output level is the gross margin.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

48

Gilley Inc. ,sells a single product.The company's most recent income statement is given below.

Required:

Required:

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

49

If planned net income is $21,000 and the tax rate is 30%,then planned operating income would be $27,300.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

50

Operating income is equal to net income plus income taxes.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

51

When making net income evaluations,CVP calculations for target income must be stated in terms of target operating income instead of target net income.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

52

Black Pearl,Inc. ,sells a single product.The company's most recent income statement is given below.

Required:

Required:

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

53

An increase in the tax rate will increase the break-even point.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

54

Berhannan's Cellular sells phones for $100.The unit variable cost per phone is $50 plus a selling commission of 10%.Fixed manufacturing costs total $1,250 per month,while fixed selling and administrative costs total $2,500.

Required:

a.What is the contribution margin per phone?

b.What is the break-even point in phones?

c.How many phones must be sold to earn pre-tax income of $7,500?

Required:

a.What is the contribution margin per phone?

b.What is the break-even point in phones?

c.How many phones must be sold to earn pre-tax income of $7,500?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

55

Answer the following question(s)using the information below.

Kaiser's Kraft Korner sells a single product.7,000 units were sold resulting in $70,000 of sales revenue,$28,000 of variable costs,and $12,000 of fixed costs.

Break-even point in units is

A)2,000 units.

B)3,000 units.

C)5,000 units.

D)7,000 units.

E)2,797 units.

Kaiser's Kraft Korner sells a single product.7,000 units were sold resulting in $70,000 of sales revenue,$28,000 of variable costs,and $12,000 of fixed costs.

Break-even point in units is

A)2,000 units.

B)3,000 units.

C)5,000 units.

D)7,000 units.

E)2,797 units.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

56

Answer the following question(s)using the information below.

Kaiser's Kraft Korner sells a single product.7,000 units were sold resulting in $70,000 of sales revenue,$28,000 of variable costs,and $12,000 of fixed costs.

Contribution margin per unit is

A)$4.00

B)$4.29

C)$6.00

D)$10.00

E)$5.71

Kaiser's Kraft Korner sells a single product.7,000 units were sold resulting in $70,000 of sales revenue,$28,000 of variable costs,and $12,000 of fixed costs.

Contribution margin per unit is

A)$4.00

B)$4.29

C)$6.00

D)$10.00

E)$5.71

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

57

Answer the following question(s)using the information below.

Kaiser's Kraft Korner sells a single product.7,000 units were sold resulting in $70,000 of sales revenue,$28,000 of variable costs,and $12,000 of fixed costs.

The number of units that must be sold to achieve $60,000 of operating income is

A)10,000 units.

B)11,666 units.

C)15,000 units.

D)18,000 units.

E)12,000 units.

Kaiser's Kraft Korner sells a single product.7,000 units were sold resulting in $70,000 of sales revenue,$28,000 of variable costs,and $12,000 of fixed costs.

The number of units that must be sold to achieve $60,000 of operating income is

A)10,000 units.

B)11,666 units.

C)15,000 units.

D)18,000 units.

E)12,000 units.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements about using the equation method to determine the break-even point is TRUE?

A)Operating income in the equation is set equal to the target income for the year.

B)Operating income in the equation assumes that fixed costs are nil.

C)Revenue in the equation includes only operating revenues plus fixed costs.

D)The number of units required to reach the break-even point tends to be higher (as it incorporates total costs)using this method than when using the contribution margin method.

E)Operating income in the equation is set equal to nil.

A)Operating income in the equation is set equal to the target income for the year.

B)Operating income in the equation assumes that fixed costs are nil.

C)Revenue in the equation includes only operating revenues plus fixed costs.

D)The number of units required to reach the break-even point tends to be higher (as it incorporates total costs)using this method than when using the contribution margin method.

E)Operating income in the equation is set equal to nil.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

59

Answer the following question(s)using the information below.

Kaiser's Kraft Korner sells a single product.7,000 units were sold resulting in $70,000 of sales revenue,$28,000 of variable costs,and $12,000 of fixed costs.

If sales increase by $25,000,operating income will increase by

A)$10,000.

B)$15,000.

C)$22,200.

D)$12,500.

E)$8,000.

Kaiser's Kraft Korner sells a single product.7,000 units were sold resulting in $70,000 of sales revenue,$28,000 of variable costs,and $12,000 of fixed costs.

If sales increase by $25,000,operating income will increase by

A)$10,000.

B)$15,000.

C)$22,200.

D)$12,500.

E)$8,000.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

60

Answer the following question(s)using the information below.

Kaiser's Kraft Korner sells a single product.7,000 units were sold resulting in $70,000 of sales revenue,$28,000 of variable costs,and $12,000 of fixed costs.

Following is the Becker Company Ltd.partial income statement for the most recent year:

What would the Becker Company sales have to be in order for the company to have an operating income of $500,000?

A)$1,796,667

B)$2,001,988

C)$1,372,000

D)$1,411,000

E)$1,567,824

Kaiser's Kraft Korner sells a single product.7,000 units were sold resulting in $70,000 of sales revenue,$28,000 of variable costs,and $12,000 of fixed costs.

Following is the Becker Company Ltd.partial income statement for the most recent year:

What would the Becker Company sales have to be in order for the company to have an operating income of $500,000?

A)$1,796,667

B)$2,001,988

C)$1,372,000

D)$1,411,000

E)$1,567,824

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

61

Gates Rubber Company sells cases of hydraulic hoses for $80.The unit variable costs per case are $40 plus a selling commission of 10 percent of sales.Fixed manufacturing costs total $1,000 per month,while fixed selling and administrative costs total $2,000.The company has a tax rate of 40%.

Required:

a.What is the contribution margin per case?

b.What is the break-even point in cases?

c.How many cases must be sold to earn pre-tax profit of $6,000?

d.How many cases must be sold to earn an after-tax income of $6,000?

Required:

a.What is the contribution margin per case?

b.What is the break-even point in cases?

c.How many cases must be sold to earn pre-tax profit of $6,000?

d.How many cases must be sold to earn an after-tax income of $6,000?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

62

Use the information below to answer the following question(s).

Brian O'Neil intends to sell his customers a special round-trip airline ticket package.He is able to purchase the package from the airline carrier for $400 each.The airline intends to reimburse Brian for any unsold ticket packages.The round-trip tickets will be sold for $500 each.Brian has a tax rate of 30% on his business income.

What is the dollar amount of sales required for Brian to earn an after-tax profit of $7,000 if fixed costs are $10,000?

A)$17,000

B)$50,000

C)$70,588

D)$85,000

E)$100,000

Brian O'Neil intends to sell his customers a special round-trip airline ticket package.He is able to purchase the package from the airline carrier for $400 each.The airline intends to reimburse Brian for any unsold ticket packages.The round-trip tickets will be sold for $500 each.Brian has a tax rate of 30% on his business income.

What is the dollar amount of sales required for Brian to earn an after-tax profit of $7,000 if fixed costs are $10,000?

A)$17,000

B)$50,000

C)$70,588

D)$85,000

E)$100,000

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

63

How many dresses are sold when operating income is zero?

A)225 dresses

B)150 dresses

C)100 dresses

D)90 dresses

E)60 dresses

A)225 dresses

B)150 dresses

C)100 dresses

D)90 dresses

E)60 dresses

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

64

Use the information below to answer the following question(s).

Brian O'Neil intends to sell his customers a special round-trip airline ticket package.He is able to purchase the package from the airline carrier for $400 each.The airline intends to reimburse Brian for any unsold ticket packages.The round-trip tickets will be sold for $500 each.Brian has a tax rate of 30% on his business income.

How many units will he need to sell in order to break-even assuming Brian incurred $10,000 in expenses to advertise the sale,and there are no other expenses?

A)20 packages

B)25 packages

C)75 packages

D)100 packages

E)125 packages

Brian O'Neil intends to sell his customers a special round-trip airline ticket package.He is able to purchase the package from the airline carrier for $400 each.The airline intends to reimburse Brian for any unsold ticket packages.The round-trip tickets will be sold for $500 each.Brian has a tax rate of 30% on his business income.

How many units will he need to sell in order to break-even assuming Brian incurred $10,000 in expenses to advertise the sale,and there are no other expenses?

A)20 packages

B)25 packages

C)75 packages

D)100 packages

E)125 packages

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

65

Operating costs include

A)interest costs.

B)income taxes.

C)only cost of goods sold.

D)all fixed and variable costs.

E)operating expenses and cost of goods sold.

A)interest costs.

B)income taxes.

C)only cost of goods sold.

D)all fixed and variable costs.

E)operating expenses and cost of goods sold.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

66

Big Ben Golf Accessories makes novelty electronic equipment for golf enthusiasts.One of their most popular accessories is the "Putting Magician." This electronic device analyses puts and provides instruction on the direction and pace of a put.Although not allowed under the rules amateur golfers have purchased or received as a gift 17,300 of these last year from a total production of 18,000 units.The recommended retail price is $139 and the wholesale price received by Big Ben Golf Accessories is $90.

The company's variable production costs are $62 per unit.Per unit fixed manufacturing costs are $7.Other fixed costs are $65,000 for rent;$290,000 in salaries;$75,000 for a product endorsement.The tax rate is 25%.

Required:

a.How many units must be sold to breakeven?

b.What is the amount of sales in dollars required to earn an after-tax profit of $300,000?

The company's variable production costs are $62 per unit.Per unit fixed manufacturing costs are $7.Other fixed costs are $65,000 for rent;$290,000 in salaries;$75,000 for a product endorsement.The tax rate is 25%.

Required:

a.How many units must be sold to breakeven?

b.What is the amount of sales in dollars required to earn an after-tax profit of $300,000?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

67

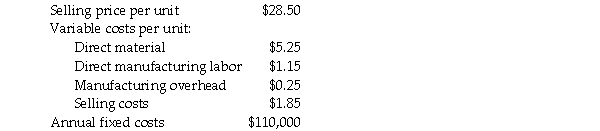

The Holiday Card Company,a producer of specialty cards,has asked you to complete several

calculations based upon the following information:

Required:

a.What is the break-even point in cards?

b.What sales volume is needed to earn an after-tax net income of $13,028.40?

c.How many cards must be sold to earn an after-tax net income of $18,480?

calculations based upon the following information:

Required:

a.What is the break-even point in cards?

b.What sales volume is needed to earn an after-tax net income of $13,028.40?

c.How many cards must be sold to earn an after-tax net income of $18,480?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements about net income (NI)is TRUE?

A)NI = operating income - income taxes

B)NI = operating income + operating costs

C)NI = operating income + non-operating revenues less non-operating costs

D)NI = operating income less Cost of Goods Sold

E)NI = operating revenue less Cost of Goods Sold

A)NI = operating income - income taxes

B)NI = operating income + operating costs

C)NI = operating income + non-operating revenues less non-operating costs

D)NI = operating income less Cost of Goods Sold

E)NI = operating revenue less Cost of Goods Sold

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

69

Arthur's Plumbing reported the following:

Required:

a.Compute contribution margin.

b.Compute contribution margin percentage.

c.Compute gross margin.

d.Compute gross margin percentage.

e.Compute operating income.

Required:

a.Compute contribution margin.

b.Compute contribution margin percentage.

c.Compute gross margin.

d.Compute gross margin percentage.

e.Compute operating income.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

70

Gross margin in a merchandising organization is considered to be

A)the same as the contribution margin.

B)all revenues less costs which do not change with respect to an output-related driver.

C)all revenues less cost of goods sold.

D)all revenues plus costs which change with respect to an output-related driver.

E)all revenues.

A)the same as the contribution margin.

B)all revenues less costs which do not change with respect to an output-related driver.

C)all revenues less cost of goods sold.

D)all revenues plus costs which change with respect to an output-related driver.

E)all revenues.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

71

How many dresses must the Bridal Shoppe sell to yield after-tax net income of $18,000,assuming the tax rate is 40%?

A)180 dresses

B)170 dresses

C)150 dresses

D)200 dresses

E)270 dresses

A)180 dresses

B)170 dresses

C)150 dresses

D)200 dresses

E)270 dresses

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

72

Comparing contribution margin [CM] to gross margin [GM],which of the following is TRUE?

A)If Cost of goods sold includes fixed costs,then CM will exceed GM.

B)If Cost of goods sold does not include any fixed costs,then CM will equal GM.

C)In the merchandising sector,CM and GM are equivalent terms.

D)If CM and GM remain constant from one period to the next,operating income has to remain constant as well.

E)CM is computed after all variable costs are deducted,but GM is computed by deducting only cost of goods sold from revenues.

A)If Cost of goods sold includes fixed costs,then CM will exceed GM.

B)If Cost of goods sold does not include any fixed costs,then CM will equal GM.

C)In the merchandising sector,CM and GM are equivalent terms.

D)If CM and GM remain constant from one period to the next,operating income has to remain constant as well.

E)CM is computed after all variable costs are deducted,but GM is computed by deducting only cost of goods sold from revenues.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

73

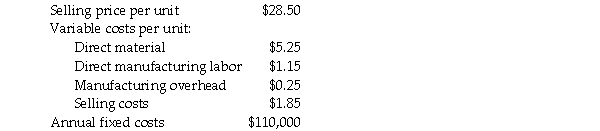

Stephanie's Stuffed Animals reported the following:

Required:

a.Compute contribution margin.

b.Compute gross margin.

c.Compute operating income.

Required:

a.Compute contribution margin.

b.Compute gross margin.

c.Compute operating income.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

74

If the tax rate is t,it is possible to calculate planned operating income by

A)dividing net operating income by t.

B)dividing net operating income by 1 - t.

C)multiplying net operating income by t.

D)multiplying net operating income by 1 - t.

E)dividing net operating income by t - 1.

A)dividing net operating income by t.

B)dividing net operating income by 1 - t.

C)multiplying net operating income by t.

D)multiplying net operating income by 1 - t.

E)dividing net operating income by t - 1.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

75

Heady Company sells headbands to retailers for $5.The variable cost of goods sold per headband is $1,with a selling commission of 10 percent of sales.Fixed manufacturing costs total $25,000 per month,while fixed selling and administrative costs total $10,500.The income tax rate for Heady Company is 30 percent.

Required:

a.What is the break-even point in headbands?

b.What are target sales in headbands to generate a before-tax income of $3,000?

c.What are target sales in headbands to generate an after-tax income of $3,080?

d.What is net income assuming Heady sells total 15,000 headbands?

Required:

a.What is the break-even point in headbands?

b.What are target sales in headbands to generate a before-tax income of $3,000?

c.What are target sales in headbands to generate an after-tax income of $3,080?

d.What is net income assuming Heady sells total 15,000 headbands?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

76

Answer the following question(s)using the information below.

Stephanie's Bridal Shoppe sells wedding dresses.The average selling price of each dress is $1,000,variable costs are $400,and fixed costs are $90,000.

What is the Bridal Shoppe's operating income when 200 dresses are sold?

A)$120,000

B)$80,000

C)$200,000

D)$100,000

E)$30,000

Stephanie's Bridal Shoppe sells wedding dresses.The average selling price of each dress is $1,000,variable costs are $400,and fixed costs are $90,000.

What is the Bridal Shoppe's operating income when 200 dresses are sold?

A)$120,000

B)$80,000

C)$200,000

D)$100,000

E)$30,000

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

77

Information Inc. ,sells accounting software.Each unit's cost may be separated as follows: selling price of $100 and variable costs of $30.Fixed costs are $10,000.

What is Information Inc.'s operating income assuming 1,000 units are sold?

A)$100,000

B)$90,000

C)$60,000

D)$40,000

E)$20,000

What is Information Inc.'s operating income assuming 1,000 units are sold?

A)$100,000

B)$90,000

C)$60,000

D)$40,000

E)$20,000

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

78

To determine the effect of income tax on a CVP calculation,managers should consider

A)target operating income.

B)contribution margin.

C)tax as a variable expense in determining contribution margin.

D)selling price.

E)target net income.

A)target operating income.

B)contribution margin.

C)tax as a variable expense in determining contribution margin.

D)selling price.

E)target net income.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

79

Use the information below to answer the following question(s).

Brian O'Neil intends to sell his customers a special round-trip airline ticket package.He is able to purchase the package from the airline carrier for $400 each.The airline intends to reimburse Brian for any unsold ticket packages.The round-trip tickets will be sold for $500 each.Brian has a tax rate of 30% on his business income.

What would his break-even point be assuming Brian incurred $31,200 in fixed expenses?

A)312 packages

B)232 packages

C)125 packages

D)110 packages

E)100 packages

Brian O'Neil intends to sell his customers a special round-trip airline ticket package.He is able to purchase the package from the airline carrier for $400 each.The airline intends to reimburse Brian for any unsold ticket packages.The round-trip tickets will be sold for $500 each.Brian has a tax rate of 30% on his business income.

What would his break-even point be assuming Brian incurred $31,200 in fixed expenses?

A)312 packages

B)232 packages

C)125 packages

D)110 packages

E)100 packages

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

80

Widget Company sells widgets for $20.00 each.The manufacturing costs,all variable,are $6 each.The company is planning on renting an exhibition booth,for both display and selling purposes,at the annual candy convention.The company's sales manager will earn a vacation bonus if she can earn a target net income of $150,000,for the sales operation at the convention.The convention organizers provide the advertising and guarantee a certain level of traffic,in exchange for 15% of the net income.The 15% surcharge operates like a tax on net income.The company absorbs all of the fixed costs of production for the sales made at the convention.

How many widgets does the sales manager have to sell to earn the vacation bonus?

How many widgets does the sales manager have to sell to earn the vacation bonus?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck