Deck 17: Accounting for State and Local Governments,part II

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

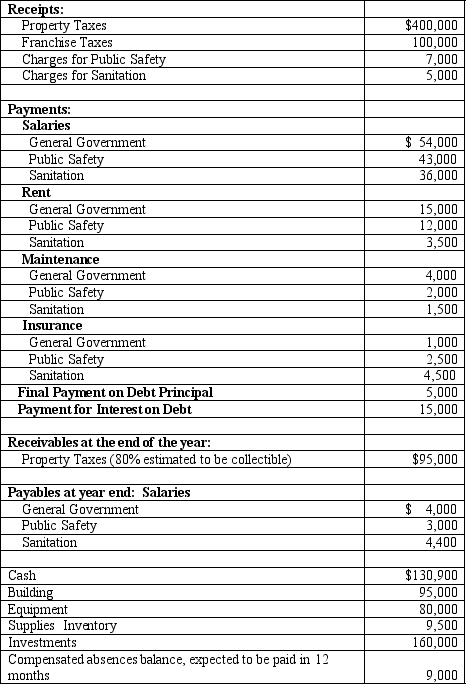

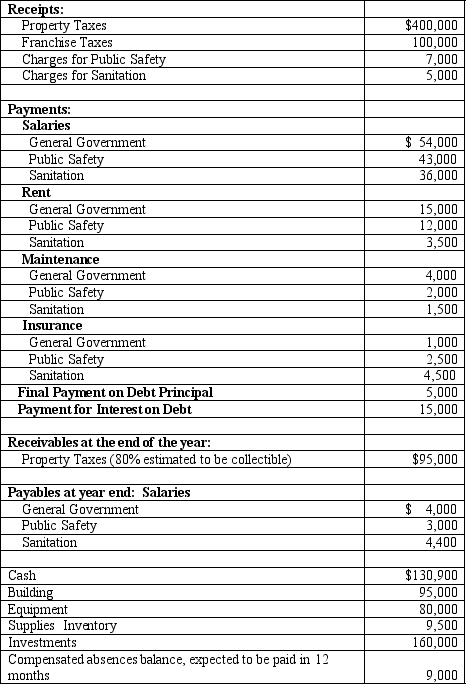

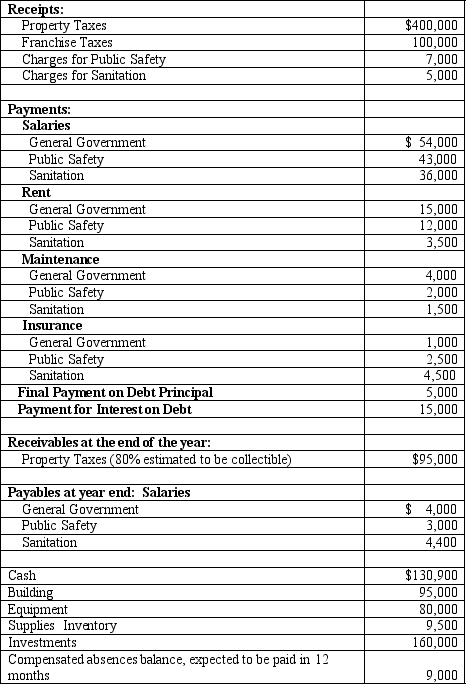

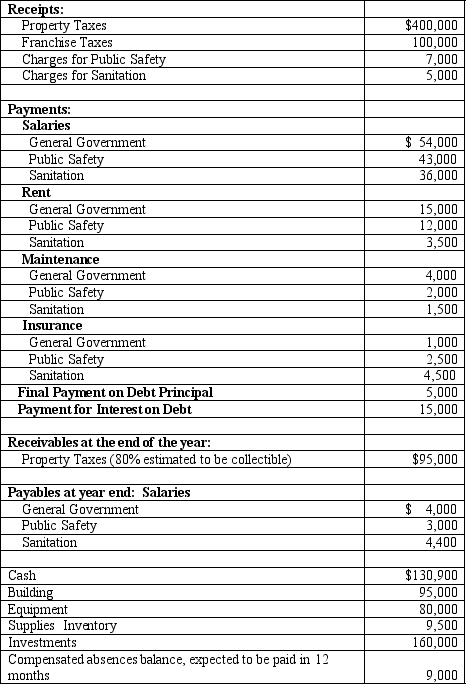

Question

Question

Question

Question

Question

Question

Question

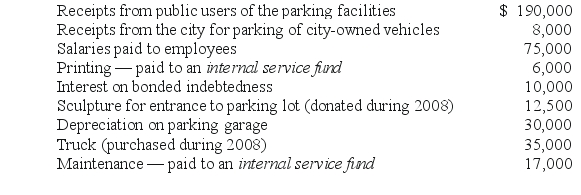

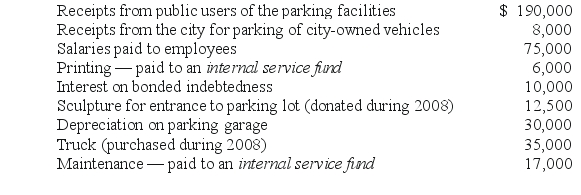

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/53

Play

Full screen (f)

Deck 17: Accounting for State and Local Governments,part II

1

A local government's basic financial statements would include a statement of cash flows for all

A)proprietary fund types.

B)governmental fund types.

C)fund types.

D)fiduciary fund types.

E)A statement of cash flows is not required for any fund types.

A)proprietary fund types.

B)governmental fund types.

C)fund types.

D)fiduciary fund types.

E)A statement of cash flows is not required for any fund types.

A

2

A method of depreciation for infrastructure assets that allows the expensing of all maintenance costs each year instead of computing depreciation is called

A)Government-wide depreciation.

B)Proprietary depreciation.

C)GASB depreciation.

D)Modified approach.

E)Alternative depreciation.

A)Government-wide depreciation.

B)Proprietary depreciation.

C)GASB depreciation.

D)Modified approach.

E)Alternative depreciation.

D

3

Which of the following is a financial statement of a fiduciary fund?

A)Balance sheet.

B)Statement of Operations.

C)Statement of Cash Flows.

D)Statement of Fiduciary Net Assets.

E)Statement of Revenues,Expenditures,and Changes in Fund Balance.

A)Balance sheet.

B)Statement of Operations.

C)Statement of Cash Flows.

D)Statement of Fiduciary Net Assets.

E)Statement of Revenues,Expenditures,and Changes in Fund Balance.

D

4

GASB No.34 makes which of the following statements regarding Management's Discussion and Analysis?

A)MD&A is required only for Proprietary Fund Financial Statements.

B)MD&A is required for all state and local government financial statements.

C)MD&A is only required for comprehensive annual financial reports.

D)MD&A for state and local government financial statements must include an analysis of potential,untapped revenue sources.

E)MD&A is an optional inclusion for state and local government financial statements.

A)MD&A is required only for Proprietary Fund Financial Statements.

B)MD&A is required for all state and local government financial statements.

C)MD&A is only required for comprehensive annual financial reports.

D)MD&A for state and local government financial statements must include an analysis of potential,untapped revenue sources.

E)MD&A is an optional inclusion for state and local government financial statements.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

5

Which criteria must be met to be considered a special purpose government?

(1) )Have a separately elected governing body

(2) )Be legally independent

(3) )Be fiscally independent

A)1 only.

B)1 and 2.

C)2 and 3.

D)1 and 3.

E)1,2,and 3.

(1) )Have a separately elected governing body

(2) )Be legally independent

(3) )Be fiscally independent

A)1 only.

B)1 and 2.

C)2 and 3.

D)1 and 3.

E)1,2,and 3.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

6

For the purpose of government-wide financial statements,the cost of cleaning up a government-owned landfill and closing the landfill

A)Is not recognized until the costs are actually incurred.

B)Is accrued and amortized over the expected useful life of the landfill.

C)Is accrued on a pro-rated basis each period based on how full the landfill is.

D)Is accrued in full at the time the costs become estimable.

E)Is treated as an encumbrance at the time it become estimable and as an expenditure when it is actually paid.

A)Is not recognized until the costs are actually incurred.

B)Is accrued and amortized over the expected useful life of the landfill.

C)Is accrued on a pro-rated basis each period based on how full the landfill is.

D)Is accrued in full at the time the costs become estimable.

E)Is treated as an encumbrance at the time it become estimable and as an expenditure when it is actually paid.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

7

For fund-based financial statements,what account is credited when a piece of equipment is leased on a capital lease?

A)Equipment - Capital Lease.

B)Encumbrances - Long Term.

C)Encumbrances - Lease Obligations.

D)Capital Lease Obligation.

E)Other Financing Sources - Capital Lease.

A)Equipment - Capital Lease.

B)Encumbrances - Long Term.

C)Encumbrances - Lease Obligations.

D)Capital Lease Obligation.

E)Other Financing Sources - Capital Lease.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

8

For government-wide financial statements,what account is credited when a piece of equipment is leased on a capital lease?

A)Equipment - Capital Lease

B)Encumbrances - Long Term

C)Encumbrances - Lease Obligations

D)Capital Lease Obligation

E)The lease is not recorded.

A)Equipment - Capital Lease

B)Encumbrances - Long Term

C)Encumbrances - Lease Obligations

D)Capital Lease Obligation

E)The lease is not recorded.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

9

What are the three broad sections of a state or local government's CAFR?

A)Introductory,financial,and statistical.

B)Financial statements,notes to the financial statements,and component units.

C)Introductory,statistical,and component units.

D)Component units,financial,and statistical.

E)Financial statements,notes to the financial statements,and statistical.

A)Introductory,financial,and statistical.

B)Financial statements,notes to the financial statements,and component units.

C)Introductory,statistical,and component units.

D)Component units,financial,and statistical.

E)Financial statements,notes to the financial statements,and statistical.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

10

According to the GASB (Governmental Accounting Standards Board),which one of the following is not a criterion for determining whether a government is legally separate?

A)The government can determine its own budget.

B)The government can issue debt.

C)The government has corporate powers including the right to sue and be sued.

D)The government has the power to levy taxes.

E)The government can issue preferred stock.

A)The government can determine its own budget.

B)The government can issue debt.

C)The government has corporate powers including the right to sue and be sued.

D)The government has the power to levy taxes.

E)The government can issue preferred stock.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

11

A five-year lease is signed by the City of Wachovia for equipment with a seven-year life.The asset will be returned to the lessor at the end of the lease.The present value of the lease is $20,000,and annual payments of $5,411.41 are payable beginning on the date the lease is signed.The interest portion of the second payment is $1,604.75.The equipment is to be used in City Hall and was purchased from appropriated funds of the General Fund.

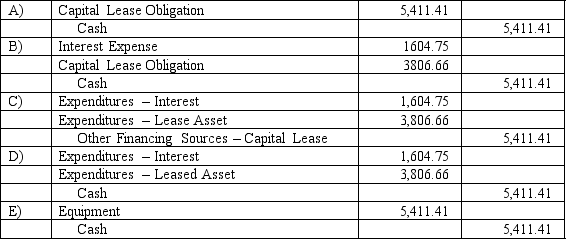

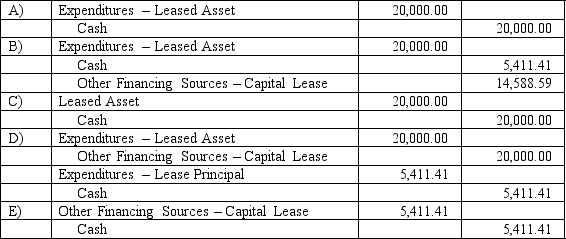

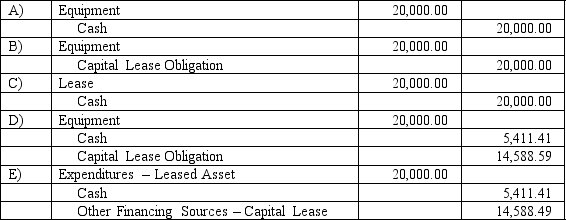

What entry should be made for the government-wide financial statements one year from the date the lease is signed?

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

What entry should be made for the government-wide financial statements one year from the date the lease is signed?

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

12

Which one of the following is a criterion for identifying a primary government?

A)it has an appointed board of directors.

B)it is fiscally dependent.

C)it is a local government.

D)it has a separately elected governing body.

E)it must prepare financial statements.

A)it has an appointed board of directors.

B)it is fiscally dependent.

C)it is a local government.

D)it has a separately elected governing body.

E)it must prepare financial statements.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is a section of the general purpose external financial statements of a state or local government?

(1)Management's discussion and analysis (MD&A).

(2)Required supplementary information (other than MD&A).

(3) )Basic financial statements and notes to financial statements.

A)1 and 2.

B)2 and 3.

C)1 and 3.

D)3 only.

E)1,2,and 3.

(1)Management's discussion and analysis (MD&A).

(2)Required supplementary information (other than MD&A).

(3) )Basic financial statements and notes to financial statements.

A)1 and 2.

B)2 and 3.

C)1 and 3.

D)3 only.

E)1,2,and 3.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

14

A five-year lease is signed by the City of Wachovia for equipment with a seven-year life.The asset will be returned to the lessor at the end of the lease.The present value of the lease is $20,000,and annual payments of $5,411.41 are payable beginning on the date the lease is signed.The interest portion of the second payment is $1,604.75.The equipment is to be used in City Hall and was purchased from appropriated funds of the General Fund.

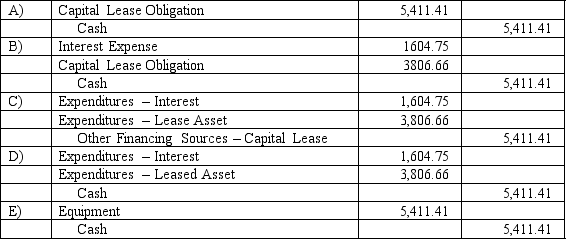

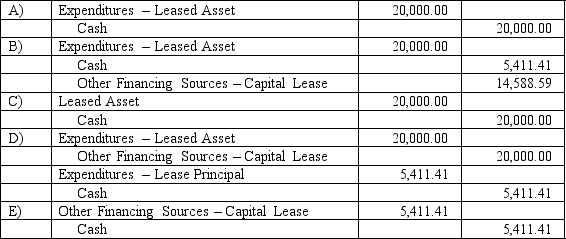

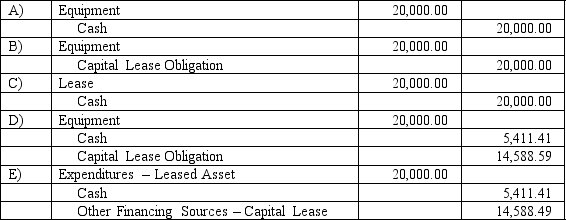

What should be recorded in the General Fund one year from the date the lease is signed?

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

What should be recorded in the General Fund one year from the date the lease is signed?

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

15

A five-year lease is signed by the City of Wachovia for equipment with a seven-year life.The asset will be returned to the lessor at the end of the lease.The present value of the lease is $20,000,and annual payments of $5,411.41 are payable beginning on the date the lease is signed.The interest portion of the second payment is $1,604.75.The equipment is to be used in City Hall and was purchased from appropriated funds of the General Fund.

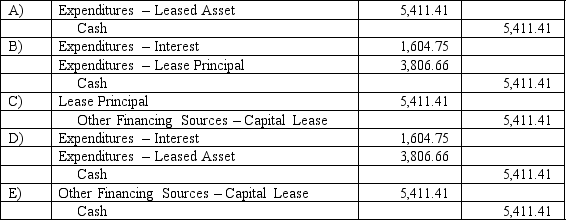

What should be recorded in the General Fund on the date the lease is signed?

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

What should be recorded in the General Fund on the date the lease is signed?

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

16

Jones College,a public institution of higher education,must prepare financial statements

A)As if the college was an enterprise fund.

B)Following the same rules as state and local governments.

C)According to GAAP.

D)As if the college was a fiduciary fund.

E)In the same manner as private colleges and universities.

A)As if the college was an enterprise fund.

B)Following the same rules as state and local governments.

C)According to GAAP.

D)As if the college was a fiduciary fund.

E)In the same manner as private colleges and universities.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following must be presented in the MD&A of a government?

A)A brief discussion of the basic financial statements.

B)Total assets.

C)Total liabilities.

D)Net assets.

E)An organization chart of government officials.

A)A brief discussion of the basic financial statements.

B)Total assets.

C)Total liabilities.

D)Net assets.

E)An organization chart of government officials.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

18

Drye Township has received a donation of a rare painting worth $1,000,000.For Drye's government-wide financial statements,three criteria must be met before Drye can opt not to recognize the painting as an asset.Which of the following is not one of the three criteria?

(1) )The painting is held for public exhibition,education,or research in furtherance of public service,rather than financial gain.

(2) )The painting is scheduled to be sold immediately at auction.

(3) )The painting is protected,kept unencumbered,cared for,and preserved.

A)Item 1 is not one of the three criteria.

B)Item 2 is not one of the three criteria.

C)Item 3 is not one of the three criteria.

D)All three items are required criteria.

E)None of the three items are required criteria.

(1) )The painting is held for public exhibition,education,or research in furtherance of public service,rather than financial gain.

(2) )The painting is scheduled to be sold immediately at auction.

(3) )The painting is protected,kept unencumbered,cared for,and preserved.

A)Item 1 is not one of the three criteria.

B)Item 2 is not one of the three criteria.

C)Item 3 is not one of the three criteria.

D)All three items are required criteria.

E)None of the three items are required criteria.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is not a criterion of a capital lease?

A)The lease transfers ownership of the property to the lessee by the end of the lease term.

B)The present value of the minimum lease payments equals or exceeds 90 percent of the fair value of the leased property,net of lessor's investment tax credit.

C)The lease contains an option to purchase the leased property at a bargain price.

D)The lease contains an option to renew.

E)The lease term is equal to or greater than 75 percent of the estimated economic life of the leased property.

A)The lease transfers ownership of the property to the lessee by the end of the lease term.

B)The present value of the minimum lease payments equals or exceeds 90 percent of the fair value of the leased property,net of lessor's investment tax credit.

C)The lease contains an option to purchase the leased property at a bargain price.

D)The lease contains an option to renew.

E)The lease term is equal to or greater than 75 percent of the estimated economic life of the leased property.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

20

A five-year lease is signed by the City of Wachovia for equipment with a seven-year life.The asset will be returned to the lessor at the end of the lease.The present value of the lease is $20,000,and annual payments of $5,411.41 are payable beginning on the date the lease is signed.The interest portion of the second payment is $1,604.75.The equipment is to be used in City Hall and was purchased from appropriated funds of the General Fund.

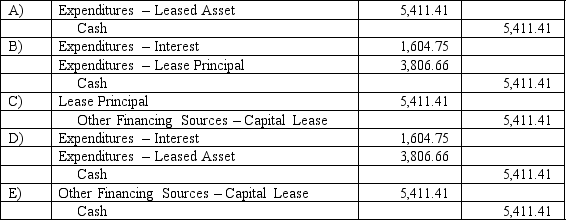

What entry should be made for the government-wide financial statements on the date the lease is signed?

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

What entry should be made for the government-wide financial statements on the date the lease is signed?

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

21

Which item is not included on the government-wide Statement of Activities?

A)revenues.

B)expenses.

C)assets.

D)operating grants.

E)capital contributions.

A)revenues.

B)expenses.

C)assets.

D)operating grants.

E)capital contributions.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

22

How is the Statement of Cash Flows for Proprietary Funds similar and dissimilar to a Statement of Cash Flows for a for-profit business?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

23

What three criteria must be met before a governmental unit can elect to not capitalize and therefore report a work of art or historical treasure as an asset?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

24

The City of Wetteville has a fiscal year ending June 30.Examine the following transactions for Wetteville:

(A. )On 6/1/08,Wetteville enters into a 5-year lease on a copying machine.The lease meets the criteria of a capital lease and carries an implied interest rate of 10%.The copier has a present value of $2,300.Wetteville has to put a $300 down payment on the lease at the beginning of the lease with monthly payments thereafter of $42.49.

(B. )On 6/5/08,Wetteville opens a new landfill.The engineers estimate that at the end of 10 years the landfill will be full.Estimated costs to close the landfill are currently at $3,500,000.

(C. )On 6/15/08,the end of the two-week pay period,Wetteville has $20,000 in accrued vacation pay related to the payroll for the period.The city estimates that $5,000 of this pay will be taken by the end of this summer and the rest will be used next summer.

(D. )On 6/18/08,Wetteville receives a donation of a vintage railroad steam engine.The engine will be put on display at the local town park.A fee will be charged to actually climb up into the engine.The engine has been valued at $500,000.

(E. )On 6/30/08,Wetteville makes its first payment on the leased copier.The $42.49 payment includes $16.68 interest.

(F. )On 6/30/08,Wetteville estimates that the landfill is 2% filled.

Required:

Prepare the journal entries for the above transactions in the general fund,on the dates mentioned for each lettered item,for the purposes of preparing the fund-based financial statements.

(A. )On 6/1/08,Wetteville enters into a 5-year lease on a copying machine.The lease meets the criteria of a capital lease and carries an implied interest rate of 10%.The copier has a present value of $2,300.Wetteville has to put a $300 down payment on the lease at the beginning of the lease with monthly payments thereafter of $42.49.

(B. )On 6/5/08,Wetteville opens a new landfill.The engineers estimate that at the end of 10 years the landfill will be full.Estimated costs to close the landfill are currently at $3,500,000.

(C. )On 6/15/08,the end of the two-week pay period,Wetteville has $20,000 in accrued vacation pay related to the payroll for the period.The city estimates that $5,000 of this pay will be taken by the end of this summer and the rest will be used next summer.

(D. )On 6/18/08,Wetteville receives a donation of a vintage railroad steam engine.The engine will be put on display at the local town park.A fee will be charged to actually climb up into the engine.The engine has been valued at $500,000.

(E. )On 6/30/08,Wetteville makes its first payment on the leased copier.The $42.49 payment includes $16.68 interest.

(F. )On 6/30/08,Wetteville estimates that the landfill is 2% filled.

Required:

Prepare the journal entries for the above transactions in the general fund,on the dates mentioned for each lettered item,for the purposes of preparing the fund-based financial statements.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

25

What is meant by the term fiscally independent?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

26

The employees of the City of Raymond earn vacation compensation that totals $1,500 per week.During 2008,$30,000 in vacation time was taken and the remainder is expected to be used next year.On the government-wide financial statements,assuming there was no beginning balance,what liability should be reported at the end of 2008?

A)$0.

B)$1,500.

C)$30,000.

D)$48,000.

E)$78,000.

A)$0.

B)$1,500.

C)$30,000.

D)$48,000.

E)$78,000.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

27

A city starts a solid waste landfill during 2007.When the landfill was opened the city estimated that it would fill to capacity within 5 years and that the cost to cover the facility would be $1.5 million which will not be paid until the facility is closed.At the end of 2007,the facility was 20% full,and at the end of 2008 the facility was 45% full.If the landfill is judged to be a governmental fund,what liability is reported on the fund-based financial statements at the end of 2008?

A)$0.

B)$300,000.

C)$375,000.

D)$600,000.

E)$675,000.

A)$0.

B)$300,000.

C)$375,000.

D)$600,000.

E)$675,000.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

28

What are the three broad sections of a state or local government's CAFR?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

29

The city operates a public pool where each person is assessed a $2 entrance fee.Which fund is most appropriate to record these revenues?

A)General Fund.

B)Enterprise Fund.

C)Special Revenue Fund.

D)Internal Service Fund.

E)Capital Projects Fund.

A)General Fund.

B)Enterprise Fund.

C)Special Revenue Fund.

D)Internal Service Fund.

E)Capital Projects Fund.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

30

Which statement is false regarding the Statement of Revenues,Expenditures,and Changes in Fund Balance when it is included with government-wide financial statements?

A)The Statement of Revenues,Expenditures,and Changes in Fund Balance uses the modified accrual method for timing purposes.

B)The Statement of Revenues,Expenditures,and Changes in Fund Balance presents revenues as either program revenues or general revenues.

C)A presentation reconciles the the change in governmental fund balance to the change in net assets for governmental activities.

D)Other financing sources are presented on the Statement of Revenues,Expenditures,and Changes in Fund Balance.

E)All nonmajor funds are combined and reported together.

A)The Statement of Revenues,Expenditures,and Changes in Fund Balance uses the modified accrual method for timing purposes.

B)The Statement of Revenues,Expenditures,and Changes in Fund Balance presents revenues as either program revenues or general revenues.

C)A presentation reconciles the the change in governmental fund balance to the change in net assets for governmental activities.

D)Other financing sources are presented on the Statement of Revenues,Expenditures,and Changes in Fund Balance.

E)All nonmajor funds are combined and reported together.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

31

The employees of the City of Raymond earn vacation compensation that totals $1,500 per week.During 2008,$30,000 in vacation time was taken and $48,000 is expected to be used during the latter part of next year.On fund-based financial statements,what liability should be reported at the end of 2008?

A)$0.

B)$1,500.

C)$30,000.

D)$48,000.

E)$78,000.

A)$0.

B)$1,500.

C)$30,000.

D)$48,000.

E)$78,000.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

32

Which statement is false regarding the government-wide Statement of Net Assets?

A)the purpose of the Statement of Net Assets is to report the economic resources of the government as a whole.

B)assets are reported excluding capital assets.

C)capital assets are reported net of depreciation.

D)investments are reported at fair value rather than historical cost.

E)Business-type activities include Enterprise Funds.

A)the purpose of the Statement of Net Assets is to report the economic resources of the government as a whole.

B)assets are reported excluding capital assets.

C)capital assets are reported net of depreciation.

D)investments are reported at fair value rather than historical cost.

E)Business-type activities include Enterprise Funds.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

33

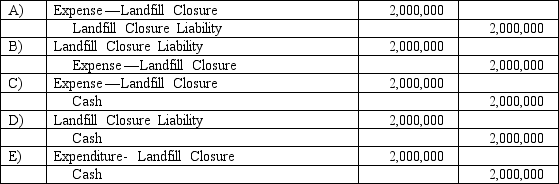

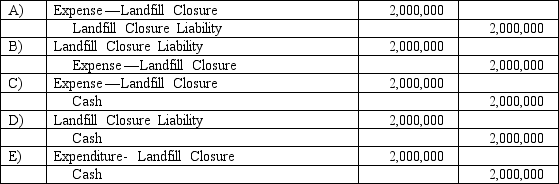

The town of Conway opened a solid waste landfill in 1998 that is now filled to capacity.The city initially anticipated closure costs of $2 million.These costs were not expected to be incurred until the landfill is closed.What is the final journal entry to record these costs assuming the estimated $2 million closure costs were properly recorded and the landfill is accounted for in an enterprise fund?

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

34

What three criteria must be met to identify a governmental unit as a primary government?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

35

Which statement is false regarding the Balance Sheet for Fund-Based Statements?

A)The Balance Sheet for Fund-Based Statements measures only current financial resources of the governmental entity.

B)The Balance Sheet for Fund-Based Statements uses the modified accrual method for timing purposes.

C)Capital assets are not reported on the Balance Sheet for Fund-Based Statements.

D)The Balance Sheet for Fund-Based Statements measures only long-term financial resources of the governmental entity.

E)Long-term debts are not reported on the Balance Sheet for Fund-Based Statements.

A)The Balance Sheet for Fund-Based Statements measures only current financial resources of the governmental entity.

B)The Balance Sheet for Fund-Based Statements uses the modified accrual method for timing purposes.

C)Capital assets are not reported on the Balance Sheet for Fund-Based Statements.

D)The Balance Sheet for Fund-Based Statements measures only long-term financial resources of the governmental entity.

E)Long-term debts are not reported on the Balance Sheet for Fund-Based Statements.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

36

.The City of Wetteville has a fiscal year ending June 30.Examine the following transactions for Wetteville:

(A. )On 6/1/08,Wetteville enters into a 5-year lease on a copying machine.The lease meets the criteria of a capital lease and carries an implied interest rate of 10%.The copier has a present value of $2,300.Wetteville has to put a $300 down payment on the lease at the beginning of the lease with monthly payments thereafter of $42.49.

(B. )On 6/5/08,Wetteville opens a new landfill.The engineers estimate that at the end of 10 years the landfill will be full.Estimated costs to close the landfill are currently at $3,500,000.

(C. )On 6/15/08,the end of the two-week pay period,Wetteville has $20,000 in accrued vacation pay related to the payroll for the period.The city estimates that $5,000 of this pay will be taken by the end of this summer and the rest will be used next summer.

(D. )On 6/18/08,Wetteville receives a donation of a vintage railroad steam engine.The engine will be put on display at the local town park.A fee will be charged to actually climb up into the engine.The engine has been valued at $500,000.

(E. )On 6/30/08,Wetteville makes its first payment on the leased copier.The $42.49 payment includes $16.68 interest.

(F. )On 6/30/08,Wetteville estimates that the landfill is 2% filled.

Required:

Prepare the journal entries for the above transactions,on the dates mentioned for each lettered item,for the purposes of preparing the government-wide financial statements.

(A. )On 6/1/08,Wetteville enters into a 5-year lease on a copying machine.The lease meets the criteria of a capital lease and carries an implied interest rate of 10%.The copier has a present value of $2,300.Wetteville has to put a $300 down payment on the lease at the beginning of the lease with monthly payments thereafter of $42.49.

(B. )On 6/5/08,Wetteville opens a new landfill.The engineers estimate that at the end of 10 years the landfill will be full.Estimated costs to close the landfill are currently at $3,500,000.

(C. )On 6/15/08,the end of the two-week pay period,Wetteville has $20,000 in accrued vacation pay related to the payroll for the period.The city estimates that $5,000 of this pay will be taken by the end of this summer and the rest will be used next summer.

(D. )On 6/18/08,Wetteville receives a donation of a vintage railroad steam engine.The engine will be put on display at the local town park.A fee will be charged to actually climb up into the engine.The engine has been valued at $500,000.

(E. )On 6/30/08,Wetteville makes its first payment on the leased copier.The $42.49 payment includes $16.68 interest.

(F. )On 6/30/08,Wetteville estimates that the landfill is 2% filled.

Required:

Prepare the journal entries for the above transactions,on the dates mentioned for each lettered item,for the purposes of preparing the government-wide financial statements.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

37

What is meant by the term legally independent?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

38

A city starts a solid waste landfill during 2007.When the landfill was opened the city estimated that it would fill to capacity within 5 years and that the cost to cover the facility would be $1.5 million which will not be paid until the facility is closed.At the end of 2007,the facility was 20% full,and at the end of 2008 the facility was 45% full.On government-wide financial statements,which of the following are the appropriate amounts to present in the financial statements for 2008?

A)Both expense and liability will be zero

B)Expense will be $300,000 and liability will be $600,000.

C)Expense will be $600,000 and liability will be $600,000.

D)Expense will be $675,000 and liability will be $600,000.

E)Expense will be $375,000 and liability will be $675,000.

A)Both expense and liability will be zero

B)Expense will be $300,000 and liability will be $600,000.

C)Expense will be $600,000 and liability will be $600,000.

D)Expense will be $675,000 and liability will be $600,000.

E)Expense will be $375,000 and liability will be $675,000.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

39

What information is required in the introductory section of a state or local government's CAFR?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

40

What information is required in the financial section of a state or local government's CAFR?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

41

The town of Wakefield opened a solid waste landfill in 2007 that was at 20% capacity on December 31,2007 and at 50% capacity on December 31,2008.The city initially anticipated closure costs of $2.3 million but in 2008 estimated the closure costs would be $2.7 million.None of these costs will be incurred until the landfill is scheduled to be closed.

Assuming the landfill is recorded within the General fund,what is the journal entry that should be recorded in the Fundbased Financial Statements on December 31,2008?

Assuming the landfill is recorded within the General fund,what is the journal entry that should be recorded in the Fundbased Financial Statements on December 31,2008?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

42

Marie Todd works for the City of Rochester and volunteered to work the New Years Eve holiday in December,2008.In exchange for working the holiday,the city will grant her 2 vacation days compensated at $500 per day.Marie decided to take these vacation days during January,2009.

For Government-wide financial statements,what are the journal entries to record these events in 2008 and in 2009?

For Government-wide financial statements,what are the journal entries to record these events in 2008 and in 2009?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

43

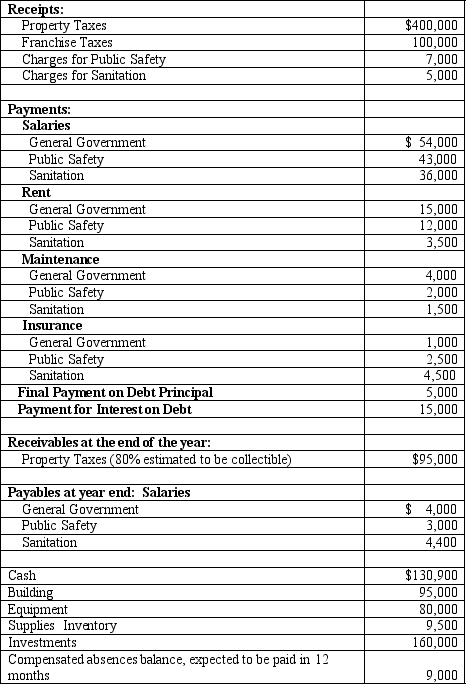

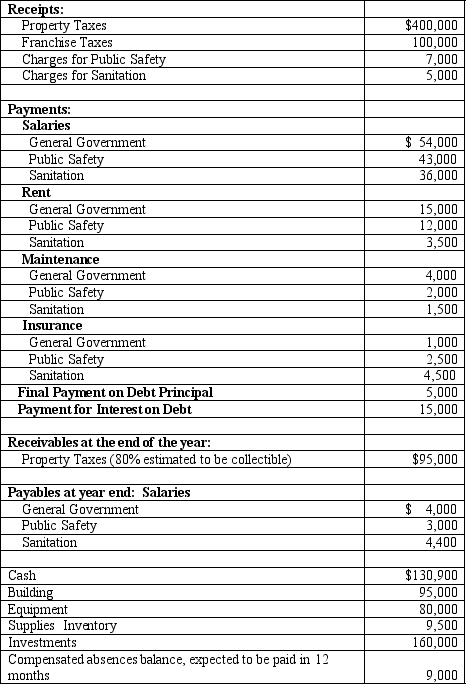

REFERENCE: Ref.17_01

The Town of Portsmouth has at the beginning of the year a $213,000 Net Asset balance,and a $52,000 Fund Balance.

The following information relates to the activities within the town of Portsmouth for the year of 2008.

Prepare a Statement of Revenues,Expenditures and Changes in Fund Balances

The Town of Portsmouth has at the beginning of the year a $213,000 Net Asset balance,and a $52,000 Fund Balance.

The following information relates to the activities within the town of Portsmouth for the year of 2008.

Prepare a Statement of Revenues,Expenditures and Changes in Fund Balances

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

44

REFERENCE: Ref.17_01

The Town of Portsmouth has at the beginning of the year a $213,000 Net Asset balance,and a $52,000 Fund Balance.

The following information relates to the activities within the town of Portsmouth for the year of 2008.

Prepare a Statement of Net Assets

The Town of Portsmouth has at the beginning of the year a $213,000 Net Asset balance,and a $52,000 Fund Balance.

The following information relates to the activities within the town of Portsmouth for the year of 2008.

Prepare a Statement of Net Assets

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

45

The town of Wakefield opened a solid waste landfill in 2007 that was at 20% capacity on December 31,2007 and at 50% capacity on December 31,2008.The city initially anticipated closure costs of $2.3 million but in 2008 estimated the closure costs would be $2.7 million.None of these costs will be incurred until the landfill is scheduled to be closed.

What is the journal entry that should be recorded on December 31,2008 for Government-wide Financial Statements?

What is the journal entry that should be recorded on December 31,2008 for Government-wide Financial Statements?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

46

The city of Kamen collected $17,000 from parking meters that must be transferred to the county government.

Required:

For fund-based financial statements,prepare the journal entry for this transaction including the fund type in which the entry would have been recorded.

Required:

For fund-based financial statements,prepare the journal entry for this transaction including the fund type in which the entry would have been recorded.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

47

The city of Kamen maintains a collection of paintings of a former citizen in its City Hall building.During the year,one painting was purchased by the city for $2,000 at an auction using appropriated funds in the General Fund.Also during the year,a donation of a painting valued at $3,000 was made to the city and the city has appropriately decided to record this painting as an asset.

Required:

Prepare the journal entry(ies)for the two transactions for the purposes of preparing the government-wide financial statements.

Required:

Prepare the journal entry(ies)for the two transactions for the purposes of preparing the government-wide financial statements.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

48

The city of Kamen transferred $27,000 into a Pension Trust Fund.Of this amount,$19,000 was contributed by the city with the remainder coming from the employees.

Required:

For fund-based financial statements,prepare the journal entry for this transaction including the fund type in which the entry would have been recorded.

Required:

For fund-based financial statements,prepare the journal entry for this transaction including the fund type in which the entry would have been recorded.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

49

Marie Todd works for the City of Rochester and volunteered to work the New Years Eve holiday in December,2008.In exchange for working the holiday,the city will grant her 2 vacation days compensated at $500 per day.Marie decided to take these vacation days during January,2009.

Assuming that Marie works in an activity reported within the General fund,for Fund-based financial statements,what are the journal entries to record these events?

Assuming that Marie works in an activity reported within the General fund,for Fund-based financial statements,what are the journal entries to record these events?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

50

The parking garage and parking lots owned by the city of Danton reported the following balances for 2008:

SHAPE \* MERGEFORMAT

Required:

What amount of net revenue (or expense)should be reported by the fund that was used to account for parking operations assuming the preparation of government-wide financial statements?

SHAPE \* MERGEFORMAT

Required:

What amount of net revenue (or expense)should be reported by the fund that was used to account for parking operations assuming the preparation of government-wide financial statements?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

51

REFERENCE: Ref.17_01

The Town of Portsmouth has at the beginning of the year a $213,000 Net Asset balance,and a $52,000 Fund Balance.

The following information relates to the activities within the town of Portsmouth for the year of 2008.

Prepare a Statement of Activities

The Town of Portsmouth has at the beginning of the year a $213,000 Net Asset balance,and a $52,000 Fund Balance.

The following information relates to the activities within the town of Portsmouth for the year of 2008.

Prepare a Statement of Activities

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

52

The city of Kamen maintains a collection of paintings of a former citizen in its City Hall building.During the year,one painting was purchased by the city for $2,000 at an auction using appropriated funds in the General Fund.Also during the year,a donation of a painting valued at $3,000 was made to the city.

Required:

Prepare the journal entry(ies)for the two transactions for the purposes of preparing the fund-based financial statements.

Required:

Prepare the journal entry(ies)for the two transactions for the purposes of preparing the fund-based financial statements.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

53

The city of Nextville operates a motor pool serving all city-owned vehicles.The motor pool bought a new garage by paying $29,000 in cash and signing a note with the local bank for $280,000.Subsequently,the motor pool performed work for the police department at a cost of $17,000,which had not yet been paid.Depreciation on the garage amounted to $20,000.The first $12,000 payment made on the note included $4,800 in interest.

Required:

Prepare all of the journal entries for these transactions that are necessary to prepare government-wide financial statements.

Required:

Prepare all of the journal entries for these transactions that are necessary to prepare government-wide financial statements.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck