Deck 14: The Cost of Capital

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/140

Play

Full screen (f)

Deck 14: The Cost of Capital

1

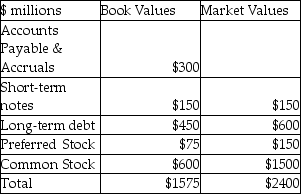

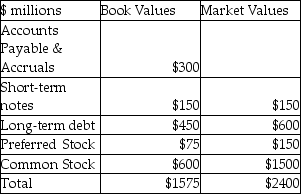

Use the following information to answer the following question(s).

The following data concerning

Spencer Transgenics' capital structure is available.

The percentage of debt in Spencer's weighted average cost of capital is

A)38.1%.

B)31.25.

C)25%.

D)57.14%.

The following data concerning

Spencer Transgenics' capital structure is available.

The percentage of debt in Spencer's weighted average cost of capital is

A)38.1%.

B)31.25.

C)25%.

D)57.14%.

B

2

Business risk reflects the added variability in earnings available to a firm's shareholders.

False

3

The cost of capital is

A)the opportunity cost of using funds to invest in new projects.

B)the rate of return the firm must earn on its investments in order to satisfy the required rate of return of the firm's investors.

C)the required rate of return for new capital investments which have typical or average risk.

D)all of the above.

A)the opportunity cost of using funds to invest in new projects.

B)the rate of return the firm must earn on its investments in order to satisfy the required rate of return of the firm's investors.

C)the required rate of return for new capital investments which have typical or average risk.

D)all of the above.

D

4

Which of the following best describes a firm's cost of capital?

A)The average yield to maturity on debt

B)The average cost of the firm's assets

C)The rate of return that must be earned on its investments in order to satisfy the firm's investors

D)The coupon rate on preferred stock

A)The average yield to maturity on debt

B)The average cost of the firm's assets

C)The rate of return that must be earned on its investments in order to satisfy the firm's investors

D)The coupon rate on preferred stock

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

5

The investor's required rate of return differs from the firm's cost of capital due to the

A)firm's beta.

B)tax deductibility of interest.

C)CAPM.

D)time value of money.

A)firm's beta.

B)tax deductibility of interest.

C)CAPM.

D)time value of money.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

6

The weights used to determine the relative importance of the firm's sources of capital should reflect

A)book values in accord with generally accepted accounting principles.

B)current market values for bonds,common stock,and preferred stock and book values for retained earnings.

C)current market values.

D)subjective adjustments for firm risk.

A)book values in accord with generally accepted accounting principles.

B)current market values for bonds,common stock,and preferred stock and book values for retained earnings.

C)current market values.

D)subjective adjustments for firm risk.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

7

Cost of capital is

A)the coupon rate of debt.

B)a minimum rate of return set by the board of directors.

C)the rate of return that must be earned on additional investment if firm value is to remain unchanged.

D)the average cost of the firm's assets.

A)the coupon rate of debt.

B)a minimum rate of return set by the board of directors.

C)the rate of return that must be earned on additional investment if firm value is to remain unchanged.

D)the average cost of the firm's assets.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following must be adjusted for the firm's tax rate when estimating the weighted average cost of capital WACC?

A)Cost of common equity

B)Cost of preferred stock

C)Cost of debt

D)All of the above

A)Cost of common equity

B)Cost of preferred stock

C)Cost of debt

D)All of the above

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

9

For tax purposes,interest on corporate debt is

A)deductible for the investor,but not for the borrower.

B)deductible for the borrower,but not for the investor.

C)fully taxable for both the borrower and the investor.

D)fully deductible for both the borrower and the investor.

A)deductible for the investor,but not for the borrower.

B)deductible for the borrower,but not for the investor.

C)fully taxable for both the borrower and the investor.

D)fully deductible for both the borrower and the investor.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

10

A firm's capital structure consists of which of the following?

A)Common stock

B)Preferred stock

C)Bonds

D)All of the above

A)Common stock

B)Preferred stock

C)Bonds

D)All of the above

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is a correct formula for calculating the cost of capital?

A)WACC = weighted after-tax cost of debt + weighted cost of preferred stock + weighted cost of common stock

B)WACC = weighted after-tax cost of debt + weighted after-tax cost of preferred stock + weighted after-tax cost of common stock

C)WACC = (after-tax cost of debt + cost of preferred stock + cost of common stock )/3

D)WACC = weighted cost of debt + weighted cost of preferred stock + weighted cost of common stock

A)WACC = weighted after-tax cost of debt + weighted cost of preferred stock + weighted cost of common stock

B)WACC = weighted after-tax cost of debt + weighted after-tax cost of preferred stock + weighted after-tax cost of common stock

C)WACC = (after-tax cost of debt + cost of preferred stock + cost of common stock )/3

D)WACC = weighted cost of debt + weighted cost of preferred stock + weighted cost of common stock

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

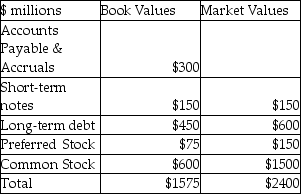

12

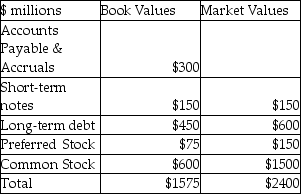

Use the following information to answer the following question(s).

The following data concerning

Spencer Transgenics' capital structure is available.

The percentage of common stock in Spencer's weighted average cost of capital is

A)62.5%.

B)66.7%.

C)6.25%.

D)38.1%.

The following data concerning

Spencer Transgenics' capital structure is available.

The percentage of common stock in Spencer's weighted average cost of capital is

A)62.5%.

B)66.7%.

C)6.25%.

D)38.1%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

13

The firm should continue to invest in new projects up to the point where the marginal rate of return earned on a new investment equals the marginal cost of new capital.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

14

Briefly identify and describe some important uses of a firm's weighted average cost of capital.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following reasons causes bonds to be a less expensive form of capital for a public firm than the issuance of common stock? Bondholders

A)bear less risk than common stockholders bear.

B)have prior voting rights over common stockholders.

C)receive greater returns than common stockholders.

D)investors pay a lower tax rate on bond interest

A)bear less risk than common stockholders bear.

B)have prior voting rights over common stockholders.

C)receive greater returns than common stockholders.

D)investors pay a lower tax rate on bond interest

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

16

When investors increase their required rate of return,the cost of capital increases simultaneously.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

17

In order to maximize firm value,management should invest in new assets when cash flows from the assets are discounted at the firm's ________ and result in a positive NPV.

A)cost of capital

B)cost of debt used to finance the project

C)rate of return on equity

D)internal rate of return

A)cost of capital

B)cost of debt used to finance the project

C)rate of return on equity

D)internal rate of return

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

18

The minimum rate of return necessary to attract an investor to purchase or hold a security is called the cost of capital.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

19

The weighted average cost of capital is computed using before-tax costs of each of the sources of financing that a firm uses to finance a project.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

20

The after-tax cost of capital is computed by multiplying the before-tax cost of capital by 1 minus the tax rate.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

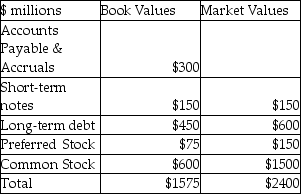

21

The total capital that should be used in computing the weights for Spencer's WACC is

A)$1,275.

B)$2,400.

C)$2,250.

D)$1,575.

A)$1,275.

B)$2,400.

C)$2,250.

D)$1,575.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

22

The cost of preferred stock is equal to

A)the preferred stock dividend divided by market price.

B)the preferred stock dividend divided by its par value.

C)(1 - tax rate)times the preferred stock dividend divided by net price.

D)the preferred stock dividend divided by the net market price.

A)the preferred stock dividend divided by market price.

B)the preferred stock dividend divided by its par value.

C)(1 - tax rate)times the preferred stock dividend divided by net price.

D)the preferred stock dividend divided by the net market price.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

23

The percentage of debt in the firm's capital structure should be adjusted by multiplying by 1 minus the firm's marginal tax rate.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

24

A firm's weighted marginal cost of capital increases when internal equity financing is exhausted but is unaffected by an increase in the cost of other financing sources.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

25

When computing a firm's cost of capital,book values should be used be used because they are more objective.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

26

PVE,Inc.has $15 million of debt outstanding with a coupon rate of 9%.Currently,the yield to maturity on these bonds is 7%.If the firm's tax rate is 35%,what is the after-tax cost of debt to J & B?

A)10.76%

B)5.85%

C)4.55%

D)5.4%

A)10.76%

B)5.85%

C)4.55%

D)5.4%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

27

Most firms use Treasury securities with maturities of ________ to determine the appropriate risk-free rate to use in the CAPM.

A)90 days

B)180 days

C)10 years

D)30 years

A)90 days

B)180 days

C)10 years

D)30 years

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

28

The most expensive source of capital is usually

A)preferred stock.

B)new common stock.

C)debt.

D)retained earnings.

A)preferred stock.

B)new common stock.

C)debt.

D)retained earnings.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is NOT used to calculate the cost of debt?

A)Face value of the debt

B)Market price of the debt

C)Number of years to maturity

D)Risk-free rate

A)Face value of the debt

B)Market price of the debt

C)Number of years to maturity

D)Risk-free rate

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

30

When calculating the weighted average cost of capital,which of the following has to be adjusted for taxes?

A)Common stock

B)Retained earnings

C)Debt

D)Preferred stock

A)Common stock

B)Retained earnings

C)Debt

D)Preferred stock

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

31

The expected dividend is $2.50 for a share of stock priced at $25.What is the cost of common equity if the long-term growth in dividends is projected to be 4%?

A)10%

B)8%

C)14%

D)18%

A)10%

B)8%

C)14%

D)18%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is a valid issue in implementing the dividend growth model? The model

A)is too complex to be used to estimate value.

B)does not require an accurate estimate of the rate of growth in future dividends.

C)is based upon the assumption that dividends are expected to grow at a constant rate forever.

D)both A and C.

A)is too complex to be used to estimate value.

B)does not require an accurate estimate of the rate of growth in future dividends.

C)is based upon the assumption that dividends are expected to grow at a constant rate forever.

D)both A and C.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

33

An increase in ________ will increase the cost of common equity.

A)the expected growth rate of dividends

B)the risk-free rate

C)the dividend

D)both A and B

A)the expected growth rate of dividends

B)the risk-free rate

C)the dividend

D)both A and B

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

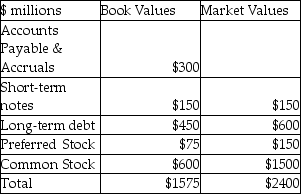

34

Use the following information to answer the following question(s).

The following data concerning

Spencer Transgenics' capital structure is available.

The percentage of preferred stock in Spencer's weighted average cost of capital is

A)5.9%.

B)62.5%.

C)4.76%.

D)6.25%.

The following data concerning

Spencer Transgenics' capital structure is available.

The percentage of preferred stock in Spencer's weighted average cost of capital is

A)5.9%.

B)62.5%.

C)4.76%.

D)6.25%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

35

Capital structure represents the mix of equity and interest-bearing debt used by a firm.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is true?

A)The level of general economic conditions will determine whether a firm should utilize an arithmetic average cost of capital or a weighted average cost of capital.

B)A firm should utilize a weighted average cost of capital for evaluating investment decisions rather than an arithmetic average cost of capital.

C)For an average firm that is capitalized with 65% equity,usage of an arithmetic average cost of capital will usually overstate the true cost of capital.

D)All of the above are true.

E)None of the above is true.

A)The level of general economic conditions will determine whether a firm should utilize an arithmetic average cost of capital or a weighted average cost of capital.

B)A firm should utilize a weighted average cost of capital for evaluating investment decisions rather than an arithmetic average cost of capital.

C)For an average firm that is capitalized with 65% equity,usage of an arithmetic average cost of capital will usually overstate the true cost of capital.

D)All of the above are true.

E)None of the above is true.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

37

Why are market values preferred to book (balance sheet)values when computing a firm's weighted average cost of capital.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

38

Sonderson Corporation is undertaking a capital budgeting analysis.The firm's beta is 1.5.The rate on six-month T-bills is 5%,and the return on the S&P 500 index is 12%.What is the appropriate cost of common equity in determining the firm's cost of capital?

A)13.1%

B)15.5%

C)17.7%

D)19.9%

A)13.1%

B)15.5%

C)17.7%

D)19.9%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

39

Bender and Co.is issuing a $1,000 par value bond that pays 9% interest annually.Investors are expected to pay $918 for the 10-year bond.What is the after-tax cost of debt if the firm is in the 34% tax bracket?

A)6.83%

B)9.00%

C)10.35%

D)15.68%

A)6.83%

B)9.00%

C)10.35%

D)15.68%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

40

The amount of debt in the firm's capital structure should include all interest-bearing debt,both long-term and short-term.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

41

Use the following information to answer the following question(s).

Berlioz Inc.is trying to estimate its cost of common equity,and it has the following information.The firm has a beta of 0.90,the before-tax cost of the firm's debt is 7.75%,and the firm estimates that the risk-free rate is 4% while the current market return is 12%.Berlioz stock currently sells for $35.00 per share.The firm pays dividends annually and expects dividends to grow at a constant rate of 5% indefinitely.The most recent dividend per share,paid yesterday,is $2.00.Finally,the firm has a marginal tax rate of 34%.

The cost of common equity using the CAPM is

A)11.00%.

B)11.20%.

C)11.50%.

D)11.72%.

Berlioz Inc.is trying to estimate its cost of common equity,and it has the following information.The firm has a beta of 0.90,the before-tax cost of the firm's debt is 7.75%,and the firm estimates that the risk-free rate is 4% while the current market return is 12%.Berlioz stock currently sells for $35.00 per share.The firm pays dividends annually and expects dividends to grow at a constant rate of 5% indefinitely.The most recent dividend per share,paid yesterday,is $2.00.Finally,the firm has a marginal tax rate of 34%.

The cost of common equity using the CAPM is

A)11.00%.

B)11.20%.

C)11.50%.

D)11.72%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

42

A firm has an issue of preferred stock that pays an annual dividend of $2.00 per share and currently is selling for $18.50 per share.Finally,the firm's marginal tax rate is 34%.This firm's cost of financing with new preferred stock is

A)10%.

B)7.13%.

C)10.81%.

D)6.6%.

A)10%.

B)7.13%.

C)10.81%.

D)6.6%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

43

Use the following information to answer the following question(s).

The current market price of an existing debt issue is $1,125.The bonds have a $1,000 par value,pay interest annually at a 12% coupon rate,and mature in 10 years.The firm has a marginal tax rate of 34%.

The after-tax cost of this debt issue is

A)7.92%.

B)6.58%.

C)12%.

D)3.39%.

The current market price of an existing debt issue is $1,125.The bonds have a $1,000 par value,pay interest annually at a 12% coupon rate,and mature in 10 years.The firm has a marginal tax rate of 34%.

The after-tax cost of this debt issue is

A)7.92%.

B)6.58%.

C)12%.

D)3.39%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

44

XYZ Corporation is trying to determine the appropriate cost of preferred stock to use in determining the firm's cost of capital.This firm's preferred stock is currently selling for $29.89 and pays a perpetual annual dividend of $2.60 per share.Compute the cost of preferred stock for XYZ.

A)7.2%

B)6.2%

C)8.7%

D)16.7%

A)7.2%

B)6.2%

C)8.7%

D)16.7%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

45

The CAPM approach is used to determine the cost of

A)debt.

B)preferred stock.

C)common equity.

D)long term funds.

A)debt.

B)preferred stock.

C)common equity.

D)long term funds.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

46

Alpha has an outstanding bond issue that has a 7.75% semiannual coupon,a current maturity of 20 years,and sells for $967.97.The firm's income tax rate is 40%.What should Alpha use as an after-tax cost of debt for cost of capital purposes?

A)2.42%

B)4.04%

C)4.85%

D)8.08%

A)2.42%

B)4.04%

C)4.85%

D)8.08%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

47

Many corporate finance professionals favor the CAPM for determining the cost of equity.Which of the following is a reason for this preference?

A)The data is less expensive.

B)The variables in the model that apply to public corporations are readily available from public sources.

C)Because the CAPM gives better treatment to flotation costs.

D)The CAPM uses data from the firm's financial statements.

A)The data is less expensive.

B)The variables in the model that apply to public corporations are readily available from public sources.

C)Because the CAPM gives better treatment to flotation costs.

D)The CAPM uses data from the firm's financial statements.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

48

Given the following information,determine the risk-free rate.

Cost of equity = 12%

Beta = 1.50

Market risk premium = 6%

A)6.0%

B)3.0%

C)9.0%

D)6.5%

Cost of equity = 12%

Beta = 1.50

Market risk premium = 6%

A)6.0%

B)3.0%

C)9.0%

D)6.5%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

49

Pony Corporation is undertaking a capital budgeting analysis.The firm's beta is 1.5.The rate on 10-year U.S.Treasury bonds is 5%,and the return on the S & P 500 index is 12%.What is the cost of Pony's common equity?

A)13.3%

B)15.5%

C)17.7%

D)19.9%

A)13.3%

B)15.5%

C)17.7%

D)19.9%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

50

The last paid dividend is $2 for a share of common stock that is currently selling for $20.What is the cost of common equity if the long-term growth rate in dividends for the firm is expected to be 8%?

A)10.8%

B)12.8%

C)14.8%

D)16.8%

E)18.8%

A)10.8%

B)12.8%

C)14.8%

D)16.8%

E)18.8%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

51

Verigreen Lawn Care products just paid a dividend of $1.85.This dividend is expected to grow at a constant rate of 3% per year,so the next expected dividend is $1.90.The stock price is currently $12.50.New stock can be sold at this price subject to flotation costs of 15%.The company's marginal tax rate is 40%.Compute the cost of common equity.

A)18.0%

B)17.8%

C)18.2%

D)15.2%

A)18.0%

B)17.8%

C)18.2%

D)15.2%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

52

MTD Inc.has a new bond issue that will net the firm $1,603,500.The bonds have a $1,500,000 par value,pay interest annually at a 6% coupon rate,and mature in 10 years.The firm has a marginal tax rate of 34%.The after-tax cost of the debt issue is

A)5.1%.

B)3.37%.

C)5.6%.

D)6.58%.

A)5.1%.

B)3.37%.

C)5.6%.

D)6.58%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

53

Hill Town Motels has $5 million of debt outstanding with a coupon rate of 12%.Currently,the yield to maturity on these bonds is 14%.If the firm's tax rate is 40%,what is the after-tax cost of debt to Hill Town Motels?

A)5.43%

B)11.2%

C)8.4%

D)5.6%

A)5.43%

B)11.2%

C)8.4%

D)5.6%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

54

In calculating the cost of capital for an average firm,which of the following statements is true?

A)The cost of a firm's bonds is greater than the cost of its common stock.

B)The cost of a firm's preferred stock is greater than the cost of its common stock.

C)The cost of a firm's retained earnings is less than the cost of its bonds.

D)The cost of a firm's common stock is greater than the cost of its bonds.

A)The cost of a firm's bonds is greater than the cost of its common stock.

B)The cost of a firm's preferred stock is greater than the cost of its common stock.

C)The cost of a firm's retained earnings is less than the cost of its bonds.

D)The cost of a firm's common stock is greater than the cost of its bonds.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

55

Walker & Son is issuing a 10-year,$1,000 par value bond that pays 9% interest annually.The bond is expected to sell for $885.What is Walker & Son's after-tax cost of debt if the firm is in the 34% tax bracket?

A)7.23%

B)8.01%

C)9.15%

D)10.35%

A)7.23%

B)8.01%

C)9.15%

D)10.35%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

56

Use the following information to answer the following question(s).

Berlioz Inc.is trying to estimate its cost of common equity,and it has the following information.The firm has a beta of 0.90,the before-tax cost of the firm's debt is 7.75%,and the firm estimates that the risk-free rate is 4% while the current market return is 12%.Berlioz stock currently sells for $35.00 per share.The firm pays dividends annually and expects dividends to grow at a constant rate of 5% indefinitely.The most recent dividend per share,paid yesterday,is $2.00.Finally,the firm has a marginal tax rate of 34%.

The cost of common equity using the dividend-growth model is

A)11.00%.

B)11.32%.

C)11.50%.

D)11.72%.

Berlioz Inc.is trying to estimate its cost of common equity,and it has the following information.The firm has a beta of 0.90,the before-tax cost of the firm's debt is 7.75%,and the firm estimates that the risk-free rate is 4% while the current market return is 12%.Berlioz stock currently sells for $35.00 per share.The firm pays dividends annually and expects dividends to grow at a constant rate of 5% indefinitely.The most recent dividend per share,paid yesterday,is $2.00.Finally,the firm has a marginal tax rate of 34%.

The cost of common equity using the dividend-growth model is

A)11.00%.

B)11.32%.

C)11.50%.

D)11.72%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

57

Sola Cola Corporation is undertaking a capital budgeting analysis.The rate on 10-year U.S.Treasury bonds is 3.60%,and the return on the S & P 500 index is 11.6%.If the cost of Sola Cola's common equity is 19.6%,calculate their beta.

A)1.69

B)5.4

C)2.0

D)1.38

A)1.69

B)5.4

C)2.0

D)1.38

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

58

Use the following information to answer the following question(s).

The current market price of an existing debt issue is $1,125.The bonds have a $1,000 par value,pay interest annually at a 12% coupon rate,and mature in 10 years.The firm has a marginal tax rate of 34%.

The before-tax cost of this debt issue is

A)12%.

B)7.92%.

C)9.97%.

D)13%.

The current market price of an existing debt issue is $1,125.The bonds have a $1,000 par value,pay interest annually at a 12% coupon rate,and mature in 10 years.The firm has a marginal tax rate of 34%.

The before-tax cost of this debt issue is

A)12%.

B)7.92%.

C)9.97%.

D)13%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

59

The best estimate of the cost of new common equity is

A)11.00%.

B)between 11.0% and 11.2%.

C)11.50%.

D)between 10% and 12%.

A)11.00%.

B)between 11.0% and 11.2%.

C)11.50%.

D)between 10% and 12%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

60

Dublin International Corporation's marginal tax rate is 40%.It can issue three-year bonds with a coupon rate of 8.5% and par value of $1,000.The bonds can be sold now at a price of $938.90 each.Determine the appropriate after-tax cost of debt for Dublin International to use in a capital budgeting analysis.

A)11.0%

B)5.2%

C)6.6%

D)7.2%

A)11.0%

B)5.2%

C)6.6%

D)7.2%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

61

If the before-tax cost of debt is 9% and the firm has a 34% marginal tax rate,the after-tax cost of debt is 5.94%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

62

The firm's weighted average cost of capital is

A)10.47%.

B)9.29%.

C)8.63%.

D)7.71%.

A)10.47%.

B)9.29%.

C)8.63%.

D)7.71%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

63

The firm financed completely with equity capital has a cost of capital equal to the required return on common stock.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

64

The proportion of debt in this firm's capital structure is

A)40%.

B)50%.

C)60%.

D)70%.

A)40%.

B)50%.

C)60%.

D)70%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

65

The George Company,Inc. ,has two issues of debt.Issue A has a maturity value of 8 million dollars,a coupon rate of 8%,paid annually,and is selling at par.Issue B was issued as a 15 year bond 5 years ago.Its coupon rate is 9%,paid annually.Investors demand a pre-tax return of 9.3% on this bond.The maturity value of Issue B is 6 million dollars.The George company has a marginal tax rate of 35%.What is the company's after tax cost of debt?

A)4.73%

B)5.56%

C)7.36%

D)8.47%

A)4.73%

B)5.56%

C)7.36%

D)8.47%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

66

Alpha's beta is 1.06,the present T-bond rate is 6%,and the return on the S & P 500 is 15.25%.What is Alpha's cost of common equity using the CAPM approach?

A)21.25%

B)15.81%

C)9.25%

D)6.32%

A)21.25%

B)15.81%

C)9.25%

D)6.32%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

67

The after-tax cost of debt is

A)6.20%.

B)5.40%.

C)4.60%.

D)3.80%.

A)6.20%.

B)5.40%.

C)4.60%.

D)3.80%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

68

Explain why the investor's required return on debt is not equal to the corporation's cost of debt,and explain why the investor's required return on equity is not equal to the corporation's cost of equity.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

69

Assuming an after-tax cost of preferred stock of 12% and a corporate tax rate of 40%,a firm must earn at least $20 before tax on every $100 invested.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

70

It is not possible for a firm's after-tax cost of common equity to be lower than its after-tax cost of debt.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

71

The after-tax cost of common stock is

A)14.67%.

B)13.23%.

C)12.41%.

D)11.65%.

A)14.67%.

B)13.23%.

C)12.41%.

D)11.65%.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

72

A bond with a Moody's rating of Aaa and an S&P rating of AAA will have a higher required return than a bond with a Moody's rating of Aa1 and an S&P rating of AA+.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

73

A firm can estimate its cost of debt by finding the yield on bonds issued by other firms with similar ratings and maturities.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

74

Discuss the primary advantages of the CAPM approach in determining the cost of common equity.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

75

Because issuing common equity entails less risk to the firm,it is always less expensive than borrowing.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

76

Use the following information to answer the following question(s).

A firm currently has the following capital structure which it intends to maintain.Debt: $3,000,000 par value of 9% bonds outstanding with an annual before-tax yield to maturity of 7.67% on a new issue.The bonds currently sell for $115 per $100 par value.Common stock: 46,000 shares outstanding currently selling for $50 per share.The firm expects to pay a $5.50 dividend per share one year from now and is experiencing a 3.67% growth rate in dividends,which it expects to continue indefinitely.The firm's marginal tax rate is 40%.The company has no plans to issue new securities.

The current total value of the firm is

A)$6,450,000.

B)$5,750,000.

C)$4,950,000.

D)$3,250,000.

A firm currently has the following capital structure which it intends to maintain.Debt: $3,000,000 par value of 9% bonds outstanding with an annual before-tax yield to maturity of 7.67% on a new issue.The bonds currently sell for $115 per $100 par value.Common stock: 46,000 shares outstanding currently selling for $50 per share.The firm expects to pay a $5.50 dividend per share one year from now and is experiencing a 3.67% growth rate in dividends,which it expects to continue indefinitely.The firm's marginal tax rate is 40%.The company has no plans to issue new securities.

The current total value of the firm is

A)$6,450,000.

B)$5,750,000.

C)$4,950,000.

D)$3,250,000.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

77

The cost of debt is equal to one minus the marginal tax rate times the coupon rate of interest on the firm's outstanding debt.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

78

The cost of common equity is already on an after-tax basis since dividends paid to common stockholders are not tax-deductible.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

79

No adjustment is made in the cost of preferred stock for taxes since preferred stock dividends are not tax-deductible.

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck

80

Paramount,Inc.just paid a dividend of $2.05 per share,and the firm is expected to experience constant growth of 12.50% over the foreseeable future.The common stock is currently selling for $65.90 per share.What is Paramount's cost of retained earnings using the Dividend Growth Model approach?

A)12.50%

B)17.90%

C)16.00%

D)14.55%

A)12.50%

B)17.90%

C)16.00%

D)14.55%

Unlock Deck

Unlock for access to all 140 flashcards in this deck.

Unlock Deck

k this deck