Deck 16: Cost-Volume-Profit Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/138

Play

Full screen (f)

Deck 16: Cost-Volume-Profit Analysis

1

Uncertainty regarding costs, prices, and sales mix affect the break-even point.

True

2

To earn a target profit, total costs plus the amount of target profit must equal total sales revenue.

True

3

The profit-volume graph depicts the relationship among cost, volume, and profit.

False

4

In multiple-product analysis, the break-even units for each product will change as the sales mix changes.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

5

The term net income is used to mean operating income before income taxes.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

6

Income taxes are generally calculated as a percentage of income.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

7

Multiple-product break-even analysis requires a constant sales mix, which is difficult to predict with certainty.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

8

The cost-volume-profit graph portrays the relationship between profits and sales volume.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

9

Units to earn target profit equal total fixed costs plus target profit divided by the contribution margin ratio.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

10

When using either the equation or the contribution margin approach, the after-tax profit must be converted to a before-tax profit target.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

11

Increases in sales of low contribution margin products decrease the break-even point.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

12

Sensitivity analysis is a what-if technique that examines the impact of changes in assumptions.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

13

Under ABC, cost drivers are separated into unit-based and non-unit-based drivers.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

14

In a CVP graph, the intersection of the total costs line and the total sales revenue line is the break-even point in units.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

15

Sales revenue to earn target profits equals total fixed costs plus target profit divided by the contribution margin.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

16

The break-even point is the point where total costs equal sales revenues.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

17

Increased sales of high contribution margin products increase the break-even point.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

18

Cost-volume-profit analysis focuses on the break-even point and the impact of changes in fixed costs and price.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

19

The operating leverage shows how far the company's actual sales or units are from the break-even point.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

20

CVP analysis is a short-run decision-making tool since some costs are fixed.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

21

In cost-volume-profit analysis income taxes __________ the break even point.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

22

The break-even point in units can be calculated using the contribution margin approach in the formula

A) Total Costs / Unit Contribution Margin.

B) Total Costs / Fixed Costs.

C) Fixed Costs / Selling Price per unit.

D) Fixed Costs / Unit Contribution Margin.

A) Total Costs / Unit Contribution Margin.

B) Total Costs / Fixed Costs.

C) Fixed Costs / Selling Price per unit.

D) Fixed Costs / Unit Contribution Margin.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

23

Biscuit Company sells its product for $50. In addition, it has a variable cost ratio of 45 percent and total fixed costs of $6,875. What is the break-even point in sales dollars for Biscuit Company?

A) $2,750

B) $3,125

C) $6,875

D) $12,500

A) $2,750

B) $3,125

C) $6,875

D) $12,500

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is NOT a use of CVP (Cost-Volume-Profit) analysis?

A) the ability to conduct sensitivity analysis of cost or price changes

B) the identification of price and efficiency variances

C) how many units must be sold to break even

D) what is the impact on the break-even point of an increase or decrease in fixed costs

A) the ability to conduct sensitivity analysis of cost or price changes

B) the identification of price and efficiency variances

C) how many units must be sold to break even

D) what is the impact on the break-even point of an increase or decrease in fixed costs

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

25

Target after-tax profit must be converted into __________ profit to calculate units or revenue needed.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

26

Biscuit Company sells its product for $50. In addition, it has a variable cost ratio of 45 percent and total fixed costs of $6,875. What is the break-even point in units for Biscuit Company?

A) 250 units

B) 3,600 units

C) 375 units

D) 2,400 units

A) 250 units

B) 3,600 units

C) 375 units

D) 2,400 units

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

27

On a profit-volume graph, the __________ line intersects the horizontal axis at the break-even point.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

28

The use of fixed costs to increase the percentage changes in profits as sales activities change is called the __________ leverage.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

29

The __________ ratio expresses variable costs in terms of sales dollars.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

30

The break-even point is

A) the volume of activity where all fixed costs are recovered.

B) where fixed costs equal total variable costs.

C) where total revenues equal total costs.

D) where total costs equal total contribution margin.

A) the volume of activity where all fixed costs are recovered.

B) where fixed costs equal total variable costs.

C) where total revenues equal total costs.

D) where total costs equal total contribution margin.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

31

The __________ is where total revenues equal total costs.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

32

Biscuit Company sells its product for $50. In addition, it has a variable cost ratio of 55 percent and total fixed costs of $6,875. How many units must be sold in order to obtain a before-tax profit of $12,000?

A) 480 units

B) 240 units

C) 600 units

D) 839 units

A) 480 units

B) 240 units

C) 600 units

D) 839 units

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

33

Total contribution margin is calculated by subtracting

A) cost of goods sold from total revenues.

B) fixed costs from total revenues.

C) total manufacturing costs from total revenues.

D) total variable costs from total revenues.

A) cost of goods sold from total revenues.

B) fixed costs from total revenues.

C) total manufacturing costs from total revenues.

D) total variable costs from total revenues.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

34

The variable cost ratio

A) expresses variable costs as a percentage of total costs.

B) expresses the proportion between fixed costs and variable costs.

C) expresses variable cost in terms of sales dollars.

D) expresses the proportion of sales dollars available to cover fixed costs and provide for a profit.

A) expresses variable costs as a percentage of total costs.

B) expresses the proportion between fixed costs and variable costs.

C) expresses variable cost in terms of sales dollars.

D) expresses the proportion of sales dollars available to cover fixed costs and provide for a profit.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following equations is CORRECT?

A) Sales revenues = Variable expenses - (Fixed expenses + Operating income)

B) Sales revenues - Variable expenses - Fixed expenses = Operating income

C) Sales revenues + Variable expenses + Fixed expenses = Operating income

D) Sales revenues - Fixed expenses = Variable expenses - Operating income

A) Sales revenues = Variable expenses - (Fixed expenses + Operating income)

B) Sales revenues - Variable expenses - Fixed expenses = Operating income

C) Sales revenues + Variable expenses + Fixed expenses = Operating income

D) Sales revenues - Fixed expenses = Variable expenses - Operating income

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

36

Sales ´ Contribution Margin is a short-cut of what formula?

A) Sales - (Variable cost ratio ´ Sales)

B) Sales - (Fixed Costs + Variable Costs)

C) Sales / Fixed Costs

D) Fixed Costs / Unit Contribution Margin

A) Sales - (Variable cost ratio ´ Sales)

B) Sales - (Fixed Costs + Variable Costs)

C) Sales / Fixed Costs

D) Fixed Costs / Unit Contribution Margin

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

37

Increased sales of high contribution margin items __________ the break-even point.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

38

If all else is the same, if the break-even point increases, then the variable cost per unit must

have __________ .

have __________ .

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

39

When a company sells more units than the break-even point, the __________ are positive.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

40

In multiple-product analysis, direct fixed costs can be __________ to each segment.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

41

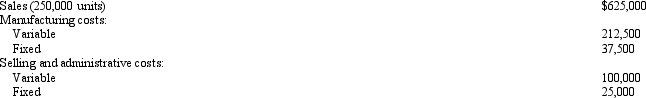

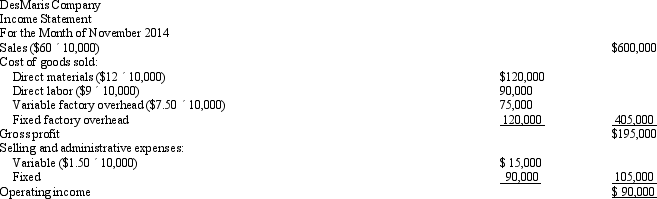

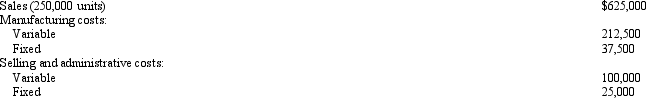

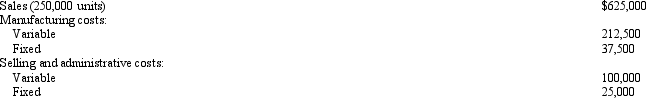

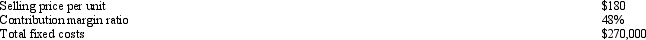

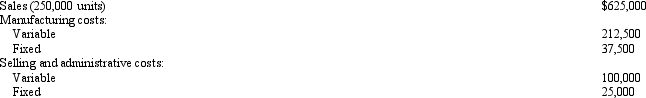

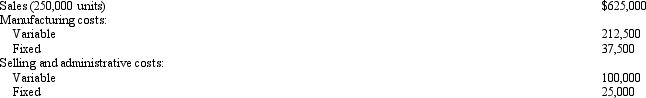

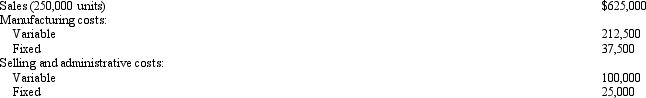

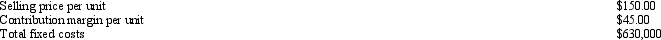

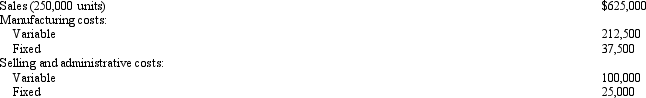

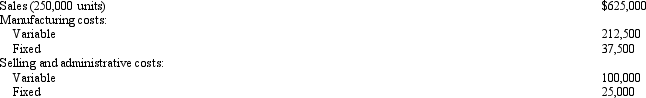

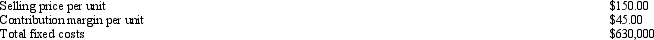

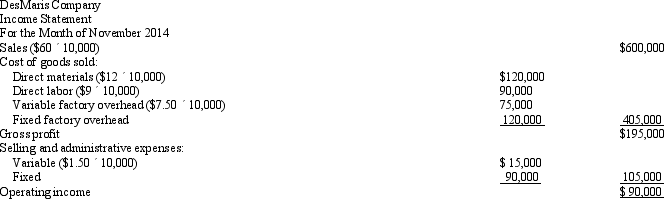

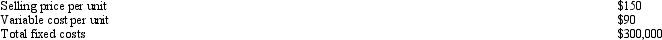

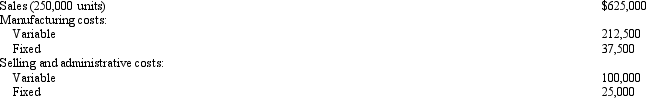

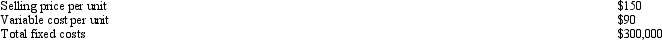

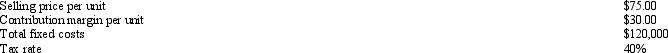

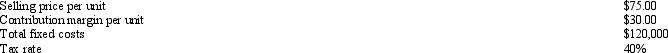

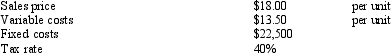

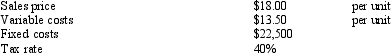

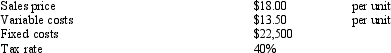

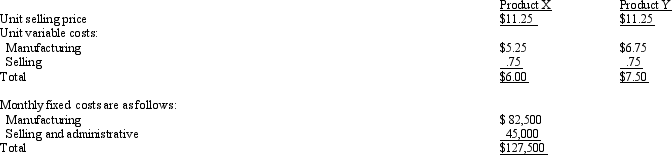

Figure 16 - 1 The Cumberland Company provides the following information:

Refer to Figure 16-1. What is the break-even point in units for Cumberland?

Refer to Figure 16-1. What is the break-even point in units for Cumberland?

A) 41,668 units

B) 50,000 units

C) 125,000 units

D) 250,000 units

Refer to Figure 16-1. What is the break-even point in units for Cumberland?

Refer to Figure 16-1. What is the break-even point in units for Cumberland?A) 41,668 units

B) 50,000 units

C) 125,000 units

D) 250,000 units

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

42

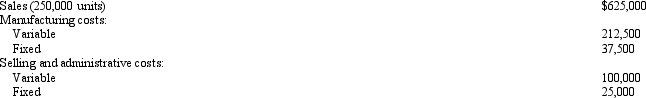

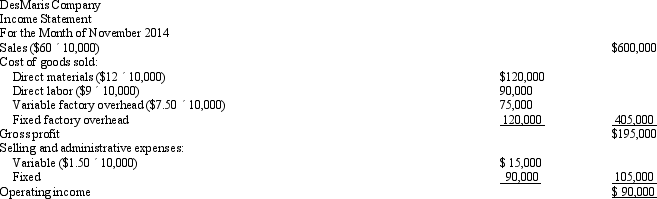

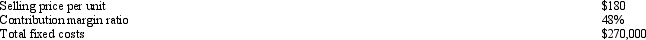

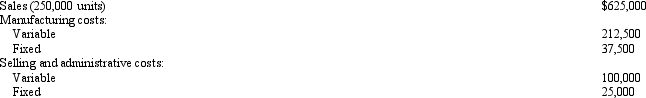

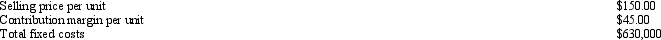

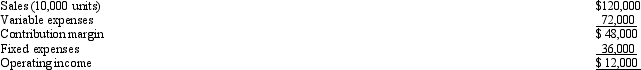

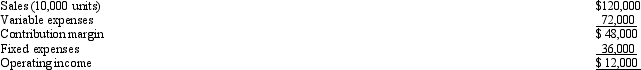

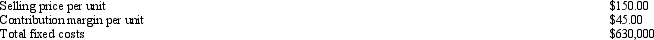

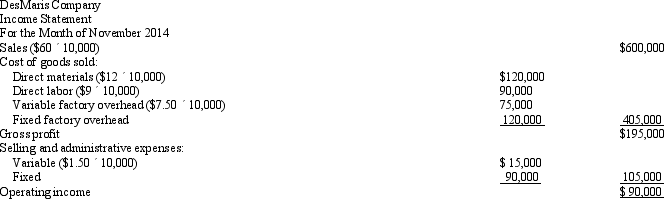

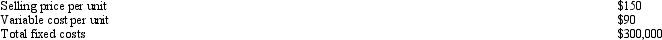

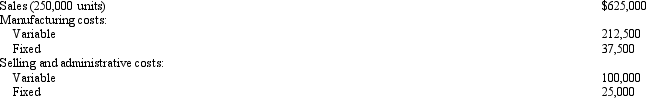

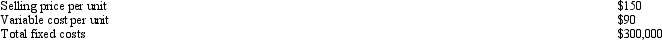

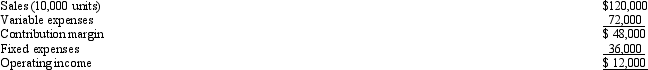

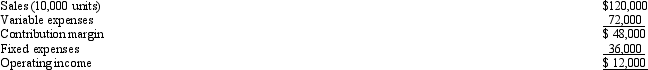

The DesMaris Company had the following income statement for the month of November 2014:  DesMaris Company's break-even sales volume is

DesMaris Company's break-even sales volume is

A) 7,000 units.

B) 20,000 units.

C) 11,211 units.

D) 10,000 units.

DesMaris Company's break-even sales volume is

DesMaris Company's break-even sales volume isA) 7,000 units.

B) 20,000 units.

C) 11,211 units.

D) 10,000 units.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

43

Figure 16 - 1 The Cumberland Company provides the following information:

Refer to Figure 16-1. What is the total contribution margin for Cumberland?

Refer to Figure 16-1. What is the total contribution margin for Cumberland?

A) $312,500

B) $250,000

C) $625,000

D) $50,000

Refer to Figure 16-1. What is the total contribution margin for Cumberland?

Refer to Figure 16-1. What is the total contribution margin for Cumberland?A) $312,500

B) $250,000

C) $625,000

D) $50,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

44

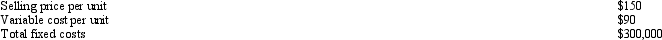

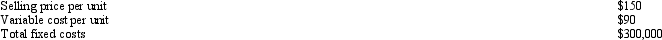

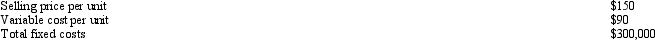

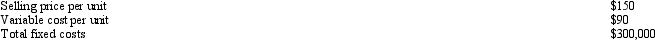

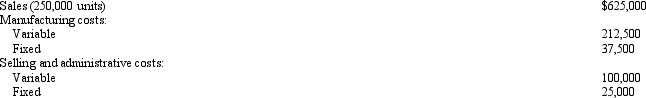

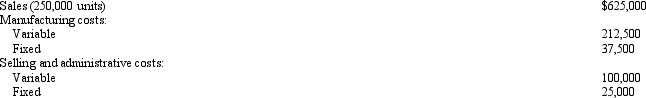

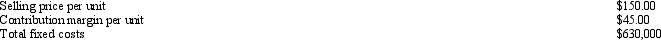

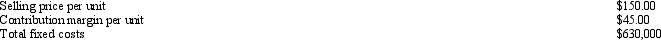

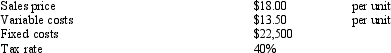

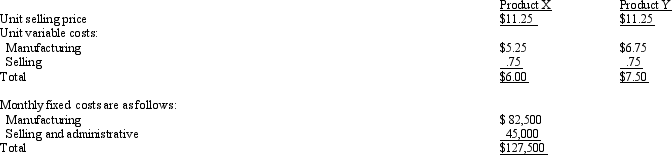

Summersville Production Company had the following projected information for 2014:  What is the profit when one unit more than the break-even point is sold?

What is the profit when one unit more than the break-even point is sold?

A) $60

B) $150

C) $1,500,150

D) $600,060

What is the profit when one unit more than the break-even point is sold?

What is the profit when one unit more than the break-even point is sold?A) $60

B) $150

C) $1,500,150

D) $600,060

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

45

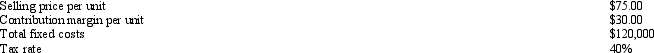

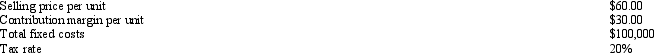

Assume the following information:  How many units must be sold to generate a before-tax profit of $54,000?

How many units must be sold to generate a before-tax profit of $54,000?

A) 4,000 units

B) 2,750 units

C) 3,570 units

D) 3,750 units

How many units must be sold to generate a before-tax profit of $54,000?

How many units must be sold to generate a before-tax profit of $54,000?A) 4,000 units

B) 2,750 units

C) 3,570 units

D) 3,750 units

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

46

Figure 16 - 1 The Cumberland Company provides the following information:

Refer to Figure 16-1. What is the contribution margin ratio for Cumberland?

Refer to Figure 16-1. What is the contribution margin ratio for Cumberland?

A) 0.16

B) 0.76

C) 0.50

D) 0.34

Refer to Figure 16-1. What is the contribution margin ratio for Cumberland?

Refer to Figure 16-1. What is the contribution margin ratio for Cumberland?A) 0.16

B) 0.76

C) 0.50

D) 0.34

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

47

Figure 16 - 1 The Cumberland Company provides the following information:

Refer to Figure 16-1. What is the variable product cost per unit for Cumberland?

Refer to Figure 16-1. What is the variable product cost per unit for Cumberland?

A) $2.50

B) $1.25

C) $0.40

D) $0.85

Refer to Figure 16-1. What is the variable product cost per unit for Cumberland?

Refer to Figure 16-1. What is the variable product cost per unit for Cumberland?A) $2.50

B) $1.25

C) $0.40

D) $0.85

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

48

Summersville Production Company had the following projected information for 2014:  What level of sales dollars is needed to obtain a target before-tax profit of $75,000?

What level of sales dollars is needed to obtain a target before-tax profit of $75,000?

A) $375,000

B) $625,000

C) $750,000

D) $937,500

What level of sales dollars is needed to obtain a target before-tax profit of $75,000?

What level of sales dollars is needed to obtain a target before-tax profit of $75,000?A) $375,000

B) $625,000

C) $750,000

D) $937,500

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

49

Jamie Quinn, a sole proprietor, has the following projected figures for next year:  What is the contribution margin ratio?

What is the contribution margin ratio?

A) 0.300

B) 1.429

C) 0.429

D) 3.333

What is the contribution margin ratio?

What is the contribution margin ratio?A) 0.300

B) 1.429

C) 0.429

D) 3.333

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

50

Figure 16 - 1 The Cumberland Company provides the following information:

Refer to Figure 16-1. What is the contribution margin per unit for Cumberland?

Refer to Figure 16-1. What is the contribution margin per unit for Cumberland?

A) $1.25

B) $0.85

C) $2.50

D) $1.65

Refer to Figure 16-1. What is the contribution margin per unit for Cumberland?

Refer to Figure 16-1. What is the contribution margin per unit for Cumberland?A) $1.25

B) $0.85

C) $2.50

D) $1.65

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

51

The income statement for Symbiosis Manufacturing Company for 2014 is as follows:  What is the contribution margin per unit?

What is the contribution margin per unit?

A) $7.20

B) $1.20

C) $4.80

D) $120,000

What is the contribution margin per unit?

What is the contribution margin per unit?A) $7.20

B) $1.20

C) $4.80

D) $120,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

52

Figure 16 - 1 The Cumberland Company provides the following information:

Refer to Figure 16-1. What is the break-even point in sales dollars for Cumberland?

Refer to Figure 16-1. What is the break-even point in sales dollars for Cumberland?

A) $125,000

B) $100,000

C) $37,500

D) $300,000

Refer to Figure 16-1. What is the break-even point in sales dollars for Cumberland?

Refer to Figure 16-1. What is the break-even point in sales dollars for Cumberland?A) $125,000

B) $100,000

C) $37,500

D) $300,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

53

Jamie Quinn, a sole proprietor, has the following projected figures for next year:  How many units must be sold to obtain a target before-tax profit of $270,000?

How many units must be sold to obtain a target before-tax profit of $270,000?

A) 6,000 units

B) 20,000 units

C) 8,572 units

D) 14,000 units

How many units must be sold to obtain a target before-tax profit of $270,000?

How many units must be sold to obtain a target before-tax profit of $270,000?A) 6,000 units

B) 20,000 units

C) 8,572 units

D) 14,000 units

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

54

The DesMaris Company had the following income statement for the month of November 2014:  What is the sales volume required to earn an operating profit of $9,000?

What is the sales volume required to earn an operating profit of $9,000?

A) 3,300 units

B) 10,000 units

C) 4,300 units

D) 7,300 units

What is the sales volume required to earn an operating profit of $9,000?

What is the sales volume required to earn an operating profit of $9,000?A) 3,300 units

B) 10,000 units

C) 4,300 units

D) 7,300 units

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

55

Summersville Production Company had the following projected information for 2014:  What is the contribution margin ratio?

What is the contribution margin ratio?

A) 0.400

B) 1.667

C) 2.500

D) 0.600

What is the contribution margin ratio?

What is the contribution margin ratio?A) 0.400

B) 1.667

C) 2.500

D) 0.600

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

56

The contribution margin at the break-even point

A) equals total fixed costs.

B) is zero.

C) plus total fixed costs equals total revenues.

D) is greater than variable costs.

A) equals total fixed costs.

B) is zero.

C) plus total fixed costs equals total revenues.

D) is greater than variable costs.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

57

Figure 16 - 1 The Cumberland Company provides the following information:

Refer to Figure 16-1. What is the operating income for Cumberland?

Refer to Figure 16-1. What is the operating income for Cumberland?

A) $625,000

B) $312,500

C) $250,000

D) $62,500

Refer to Figure 16-1. What is the operating income for Cumberland?

Refer to Figure 16-1. What is the operating income for Cumberland?A) $625,000

B) $312,500

C) $250,000

D) $62,500

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following items would NOT be considered in cost-volume-profit analysis?

A) units of production

B) fixed costs

C) product mix

D) gross profit margin

A) units of production

B) fixed costs

C) product mix

D) gross profit margin

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

59

Summersville Production Company had the following projected information for 2014:  What is the break-even point in units?

What is the break-even point in units?

A) 2,000 units

B) 5,000 units

C) 3,333 units

D) 60,000 units

What is the break-even point in units?

What is the break-even point in units?A) 2,000 units

B) 5,000 units

C) 3,333 units

D) 60,000 units

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

60

Figure 16 - 1 The Cumberland Company provides the following information:

Refer to Figure 16-1. What is the variable cost per unit for Cumberland?

Refer to Figure 16-1. What is the variable cost per unit for Cumberland?

A) $1.25

B) $0.85

C) $0.40

D) $0.75

Refer to Figure 16-1. What is the variable cost per unit for Cumberland?

Refer to Figure 16-1. What is the variable cost per unit for Cumberland?A) $1.25

B) $0.85

C) $0.40

D) $0.75

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

61

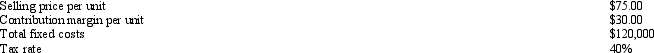

Hologram Printing Company projected the following information for next year:  What is the break-even point in dollars?

What is the break-even point in dollars?

A) $200,000

B) $120,000

C) $300,000

D) $500,000

What is the break-even point in dollars?

What is the break-even point in dollars?A) $200,000

B) $120,000

C) $300,000

D) $500,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

62

Nonesuch Company sells only one product at a regular price of $7.50 per unit. Variable expenses are 60 percent of sales and fixed expenses are $30,000. Management has decided to decrease the selling price to $6.00 in hopes of increasing its volume of sales. What is the sales dollars level required to break even at the old price of $7.50?

A) $50,000

B) $12,000

C) $18,000

D) $75,000

A) $50,000

B) $12,000

C) $18,000

D) $75,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

63

Jamie Quinn, a sole proprietor, has the following projected figures for next year:  What is the break-even point in dollars?

What is the break-even point in dollars?

A) $426,000

B) $900,000

C) $189,000

D) $2,100,000

What is the break-even point in dollars?

What is the break-even point in dollars?A) $426,000

B) $900,000

C) $189,000

D) $2,100,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

64

Assume the following cost behavior data for Graphic Arts Company:  What volume of sales dollars is required to earn a before-tax income of $27,000?

What volume of sales dollars is required to earn a before-tax income of $27,000?

A) $90,000

B) $180,000

C) $198,000

D) $270,000

What volume of sales dollars is required to earn a before-tax income of $27,000?

What volume of sales dollars is required to earn a before-tax income of $27,000?A) $90,000

B) $180,000

C) $198,000

D) $270,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

65

In 2014, Samantha's Bath and Body Shop had variable costs of $27,000, fixed costs of $18,000, and a net loss of $4,500. The annual sales volume required for Samantha's to have a before-tax income of $18,000 is

A) $126,000.

B) $84,000.

C) $73,500.

D) $42,000.

A) $126,000.

B) $84,000.

C) $73,500.

D) $42,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

66

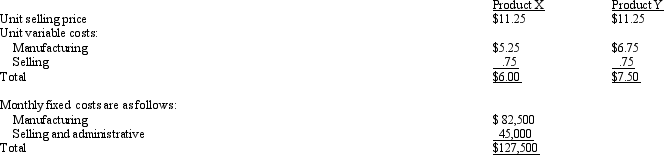

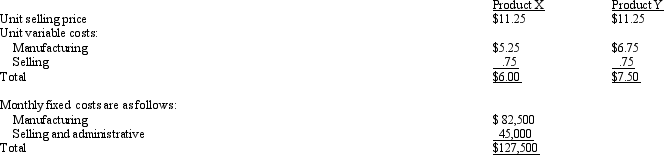

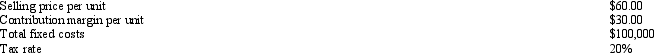

Information about the Harmonious Company's two products includes:  What is the total monthly sales volume in units required to break even when the sales mix in units is 70 percent Product X and 30 percent Product Y?

What is the total monthly sales volume in units required to break even when the sales mix in units is 70 percent Product X and 30 percent Product Y?

A) 4,333 units

B) 26,563 units

C) 8,667 units

D) 28,667 units

What is the total monthly sales volume in units required to break even when the sales mix in units is 70 percent Product X and 30 percent Product Y?

What is the total monthly sales volume in units required to break even when the sales mix in units is 70 percent Product X and 30 percent Product Y?A) 4,333 units

B) 26,563 units

C) 8,667 units

D) 28,667 units

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

67

Assume the following cost behavior data for Graphic Arts Company:  What volume of sales dollars is required to earn an after-tax income of $40,500?

What volume of sales dollars is required to earn an after-tax income of $40,500?

A) $360,000

B) $90,000

C) $252,000

D) $495,000

What volume of sales dollars is required to earn an after-tax income of $40,500?

What volume of sales dollars is required to earn an after-tax income of $40,500?A) $360,000

B) $90,000

C) $252,000

D) $495,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

68

Hologram Printing Company projected the following information for next year:  How many units must be sold to obtain an after-tax profit of $67,500?

How many units must be sold to obtain an after-tax profit of $67,500?

A) 3,750 units

B) 5,167 units

C) 5,625 units

D) 7,750 units

How many units must be sold to obtain an after-tax profit of $67,500?

How many units must be sold to obtain an after-tax profit of $67,500?A) 3,750 units

B) 5,167 units

C) 5,625 units

D) 7,750 units

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

69

In 2014, Samantha's Bath and Body Shop had variable costs of $27,000, fixed costs of $18,000, and a net loss of $4,500. Samantha's 2014 break-even sales volume was

A) $36,000.

B) $54,000.

C) $49,500.

D) $37,500.

A) $36,000.

B) $54,000.

C) $49,500.

D) $37,500.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

70

Sales mix refers to

A) the different volume of sales achieved during the year.

B) the contribution margins achieved on the different products during the year.

C) the relative proportions of different products that constitute total sales.

D) the mix of variable and fixed costs.

A) the different volume of sales achieved during the year.

B) the contribution margins achieved on the different products during the year.

C) the relative proportions of different products that constitute total sales.

D) the mix of variable and fixed costs.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

71

Assume the following information:  What volume of sales dollars is needed to break even?

What volume of sales dollars is needed to break even?

A) $75,000

B) $300,000

C) $48,000

D) $12,000

What volume of sales dollars is needed to break even?

What volume of sales dollars is needed to break even?A) $75,000

B) $300,000

C) $48,000

D) $12,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

72

The income statement for Symbiosis Manufacturing Company for 2014 is as follows:  What is the contribution margin ratio?

What is the contribution margin ratio?

A) 30%

B) 60%

C) 100%

D) 40%

What is the contribution margin ratio?

What is the contribution margin ratio?A) 30%

B) 60%

C) 100%

D) 40%

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following equations is TRUE?

A) Contribution margin = Sales revenue ´ Variable cost ratio

B) Contribution margin ratio = Contribution margin/Variable costs

C) Contribution margin = Fixed costs

D) Contribution margin ratio = 1 - Variable cost ratio

A) Contribution margin = Sales revenue ´ Variable cost ratio

B) Contribution margin ratio = Contribution margin/Variable costs

C) Contribution margin = Fixed costs

D) Contribution margin ratio = 1 - Variable cost ratio

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is a TRUE statement about sales mix?

A) Profits may decline with an increase in total dollars of sales if the sales mix shifts to sell more of the high contribution margin product.

B) Profits may decline with an increase in total dollars of sales if the sales mix shifts to sell more of the lower contribution margin product.

C) Profits will remain constant with an increase in total dollars of sales if the total sales in units remains constant.

D) Profits will remain constant with a decrease in total dollars of sales if the sales mix also remains constant.

A) Profits may decline with an increase in total dollars of sales if the sales mix shifts to sell more of the high contribution margin product.

B) Profits may decline with an increase in total dollars of sales if the sales mix shifts to sell more of the lower contribution margin product.

C) Profits will remain constant with an increase in total dollars of sales if the total sales in units remains constant.

D) Profits will remain constant with a decrease in total dollars of sales if the sales mix also remains constant.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

75

Information about the Harmonious Company's two products includes:  If the sales mix in units is 50 percent Product X and 50 percent Product Y, the monthly break-even total sales dollars is

If the sales mix in units is 50 percent Product X and 50 percent Product Y, the monthly break-even total sales dollars is

A) $75,000.

B) $318,746.

C) $275,000.

D) $315,000.

If the sales mix in units is 50 percent Product X and 50 percent Product Y, the monthly break-even total sales dollars is

If the sales mix in units is 50 percent Product X and 50 percent Product Y, the monthly break-even total sales dollars isA) $75,000.

B) $318,746.

C) $275,000.

D) $315,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

76

Tiramisu Company projected the following information for next year:  How many units must be sold to obtain an after-tax profit of $40,000?

How many units must be sold to obtain an after-tax profit of $40,000?

A) 3,750 units

B) 5,625 units

C) 5,000 units

D) 5,167 units

How many units must be sold to obtain an after-tax profit of $40,000?

How many units must be sold to obtain an after-tax profit of $40,000?A) 3,750 units

B) 5,625 units

C) 5,000 units

D) 5,167 units

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

77

In the cost-volume-profit analysis, income taxes

A) are treated as a fixed cost.

B) increase the sales volume required to break even.

C) increase the sales volume required to earn a desired profit.

D) are treated as a fixed cost.

A) are treated as a fixed cost.

B) increase the sales volume required to break even.

C) increase the sales volume required to earn a desired profit.

D) are treated as a fixed cost.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

78

Victoria Company produces two products, X and Y, which account for 60 percent and 40 percent, respectively, of total sales dollars. Contribution margin ratios are 50 percent for X and 25 percent for Y. Total fixed costs are $120,000. What is Patricia's break-even point in sales dollars?

A) $328,767

B) $300,000

C) $342,856

D) $375,000

A) $328,767

B) $300,000

C) $342,856

D) $375,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

79

In multiple-product analysis, direct fixed costs are

A) fixed costs that are not traceable to the segments and would remain even if one of the segments were eliminated.

B) fixed costs which can be traced to each segment and would remain even if one of the segments were eliminated.

C) fixed costs that are not traceable to the segments and would be avoided if the segment did not exist.

D) the fixed costs which can be traced to each segment and would be avoided if the segment did not exist.

A) fixed costs that are not traceable to the segments and would remain even if one of the segments were eliminated.

B) fixed costs which can be traced to each segment and would remain even if one of the segments were eliminated.

C) fixed costs that are not traceable to the segments and would be avoided if the segment did not exist.

D) the fixed costs which can be traced to each segment and would be avoided if the segment did not exist.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

80

Nonesuch Company sells only one product at a regular price of $7.50 per unit. Variable expenses are 60 percent of sales and fixed expenses are $30,000. Management has decided to decrease the selling price to $6.00 in hopes of increasing its volume of sales. What is the contribution margin ratio when the selling price is reduced to $6 per unit?

A) 40%

B) 25%

C) 75%

D) 60%

A) 40%

B) 25%

C) 75%

D) 60%

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck