Deck 3: Business Combinations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/73

Play

Full screen (f)

Deck 3: Business Combinations

1

How should the acquisition cost of a Business Combination be allocated prior to preparing Consolidated Financial Statements?

A)The difference between the Purchase Price and the Fair Values of the acquirer's identifiable assets should be treated as goodwill.

B)The acquisition cost should be allocated to the acquirer's interest in the fair values of the acquired company's identifiable assets and liabilities.

C)The acquisition cost should be reflected as an increase in the acquirer's Investment (in the subsidiary)account.

D)The treatment of the acquisition cost depends largely on the type of consideration given by the acquirer.

A)The difference between the Purchase Price and the Fair Values of the acquirer's identifiable assets should be treated as goodwill.

B)The acquisition cost should be allocated to the acquirer's interest in the fair values of the acquired company's identifiable assets and liabilities.

C)The acquisition cost should be reflected as an increase in the acquirer's Investment (in the subsidiary)account.

D)The treatment of the acquisition cost depends largely on the type of consideration given by the acquirer.

B

2

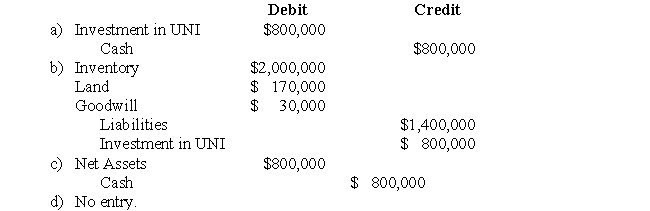

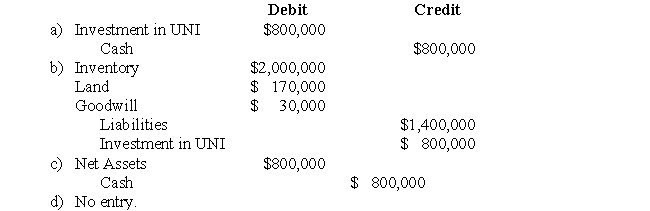

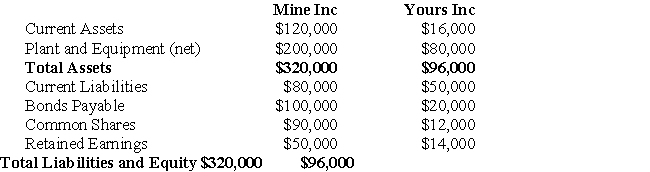

The following data pertains to Questions

IOU Inc.purchased all of the outstanding common shares of UNI Inc.for $800,000.On the date of acquisition,UNI's assets included $2,000,000 of Inventory and Land with a Book value of $120,000.UNI also had $1,400,000 in Liabilities on that date.UNI's book values were equal to their fair market values,with the exception of the company's Land,which was estimated to have a fair market value which was $50,000 higher than its book value.

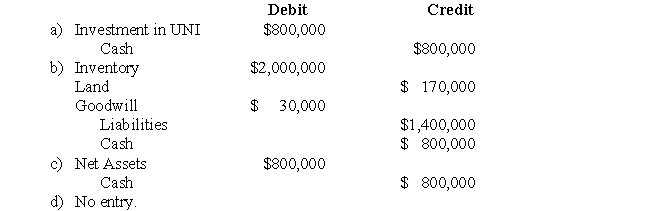

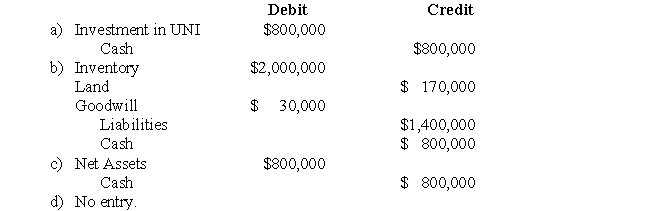

Which of the following is the correct journal entry to record IOU's acquisition of UNI?

IOU Inc.purchased all of the outstanding common shares of UNI Inc.for $800,000.On the date of acquisition,UNI's assets included $2,000,000 of Inventory and Land with a Book value of $120,000.UNI also had $1,400,000 in Liabilities on that date.UNI's book values were equal to their fair market values,with the exception of the company's Land,which was estimated to have a fair market value which was $50,000 higher than its book value.

Which of the following is the correct journal entry to record IOU's acquisition of UNI?

A

3

In a Business Combination involving two companies,when can a company ALWAYS be deemed to be the acquirer?

A)The company is significantly larger than the other.

B)The company holds more than 50% of the voting shares of the combined entity.

C)The company has a larger Board of Directors

D)A company can be deemed to be the acquirer only when it holds 50% of the voting shares of the combined entity AND has a larger Board of Directors than the other company.

A)The company is significantly larger than the other.

B)The company holds more than 50% of the voting shares of the combined entity.

C)The company has a larger Board of Directors

D)A company can be deemed to be the acquirer only when it holds 50% of the voting shares of the combined entity AND has a larger Board of Directors than the other company.

B

4

The process of preparing Consolidated Financial Statements involves the elimination of inter-company transactions between a Parent Company and its subsidiary.Where would these entries be recorded?

A)On the Parent's books only.

B)On the Subsidiary's books.

C)The entries are not recorded in the books of either company.The entries are only made on the working papers.

D)The effect of any inter-company transaction must be reflected on the books of both companies.

A)On the Parent's books only.

B)On the Subsidiary's books.

C)The entries are not recorded in the books of either company.The entries are only made on the working papers.

D)The effect of any inter-company transaction must be reflected on the books of both companies.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

5

Company Y purchases a controlling interest in Company Z on January 1,2002.Which of the following would appear as the Shareholder Equity amount on Company Y's Consolidated Balance Sheet on the date of acquisition?

A)Company Y's Shareholder Equity

B)The sum of the Shareholder Equity of both companies.

C)Company Y's Shareholder Equity as well as Company Y's proportional share of company Z's net assets at book value.

D)Company Y's Shareholder Equity as well as Company Y's proportional share of company Z's net assets at Fair Market Value.

A)Company Y's Shareholder Equity

B)The sum of the Shareholder Equity of both companies.

C)Company Y's Shareholder Equity as well as Company Y's proportional share of company Z's net assets at book value.

D)Company Y's Shareholder Equity as well as Company Y's proportional share of company Z's net assets at Fair Market Value.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following would NOT be included in the Acquisition Cost?

A)Share issue costs.

B)The Fair Market Value of any Shares Issued)

C)Contingent Consideration.

D)Direct expenses arising from a Business Combination.

A)Share issue costs.

B)The Fair Market Value of any Shares Issued)

C)Contingent Consideration.

D)Direct expenses arising from a Business Combination.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

7

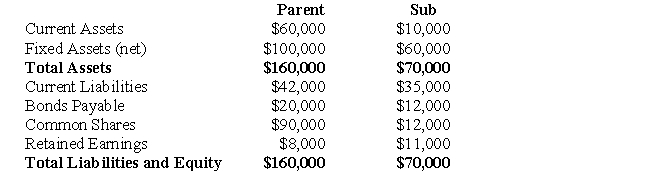

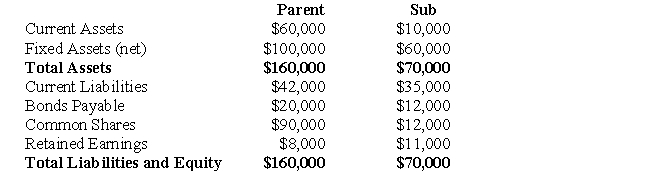

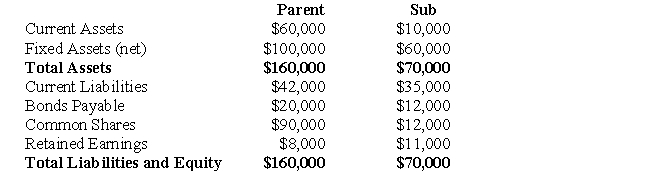

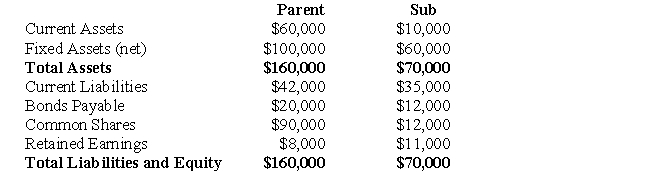

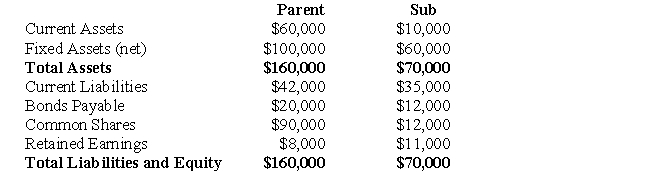

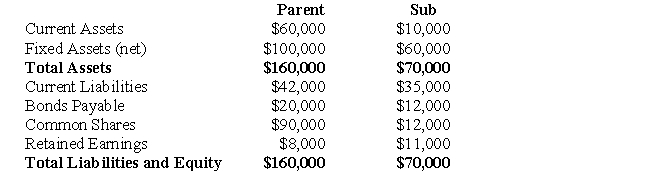

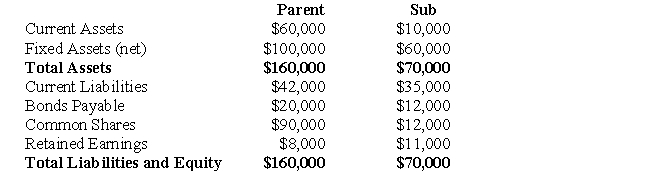

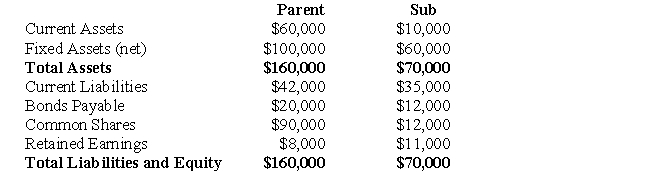

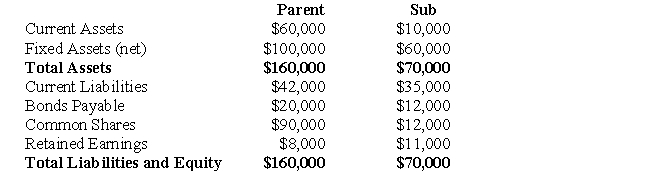

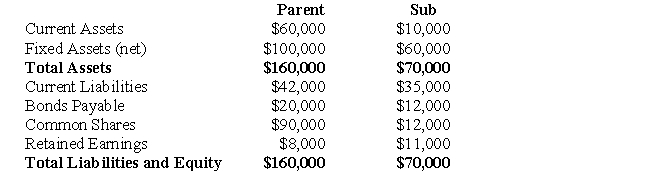

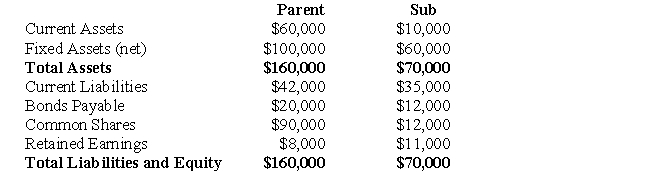

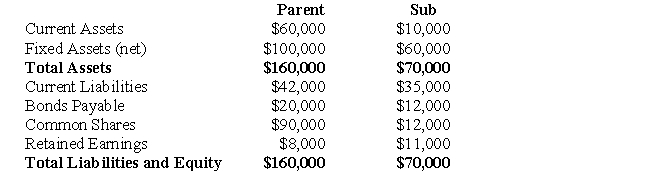

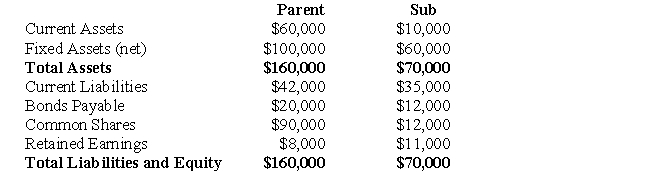

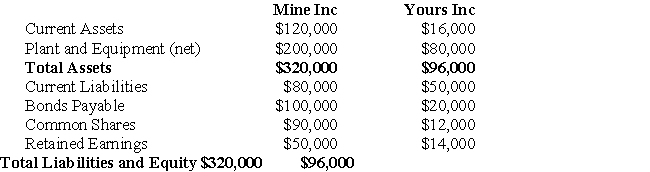

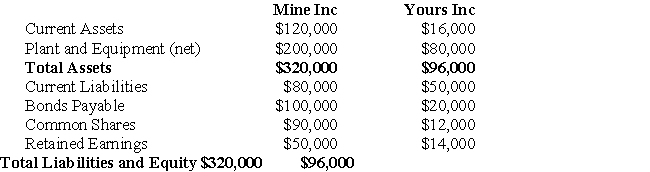

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on December 31,2008: On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

The Goodwill arising from this Business Combination would be:

A)$7,000

B)($17,000)

C)$17,000

D)$120,000

Parent and Sub Inc had the following balance sheets on December 31,2008:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:The Goodwill arising from this Business Combination would be:

A)$7,000

B)($17,000)

C)$17,000

D)$120,000

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following pertaining to Consolidated Financial Statements is correct?

A)The preparation of consolidated Financial Statements means that the companies involved cease to operate as separate legal entities.

B)The preparation of Consolidated Financial Statements is at the Parent Company's discretion.

C)When one company has control over another,Consolidated Financial Statements must be prepared for the combined entity.

D)Before preparing Consolidated Financial Statements,a subsidiary's Financial Statements prior to the date of acquisition must be restated)

A)The preparation of consolidated Financial Statements means that the companies involved cease to operate as separate legal entities.

B)The preparation of Consolidated Financial Statements is at the Parent Company's discretion.

C)When one company has control over another,Consolidated Financial Statements must be prepared for the combined entity.

D)Before preparing Consolidated Financial Statements,a subsidiary's Financial Statements prior to the date of acquisition must be restated)

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

9

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on December 31,2008: On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

The Shareholder's Equity section of the Consolidated Balance Sheet would show what amount?

A)$121,000

B)$90,000

C)$19,000

D)$98,000

Parent and Sub Inc had the following balance sheets on December 31,2008:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:The Shareholder's Equity section of the Consolidated Balance Sheet would show what amount?

A)$121,000

B)$90,000

C)$19,000

D)$98,000

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

10

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on December 31,2008: On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

The Current Assets of the combined entity should be valued at:

A)$7,000

B)$170,000

C)$86,000

D)$114,000

Parent and Sub Inc had the following balance sheets on December 31,2008:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:The Current Assets of the combined entity should be valued at:

A)$7,000

B)$170,000

C)$86,000

D)$114,000

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statement(s)pertaining to Business Combinations is FALSE?

A)They are long-term in nature.

B)They cannot include unincorporated entities.

C)They can never arise from the purchase of assets.

D)They can never arise from the purchase of assets nor can they include unincorporated entities.

A)They are long-term in nature.

B)They cannot include unincorporated entities.

C)They can never arise from the purchase of assets.

D)They can never arise from the purchase of assets nor can they include unincorporated entities.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

12

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on December 31,2008: On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

The Fixed Assets of the combined entity should be valued at:

A)$70,000

B)$154,000

C)$160,000

D)$120,000

Parent and Sub Inc had the following balance sheets on December 31,2008:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:The Fixed Assets of the combined entity should be valued at:

A)$70,000

B)$154,000

C)$160,000

D)$120,000

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

13

The following data pertains to Questions

IOU Inc.purchased all of the outstanding common shares of UNI Inc.for $800,000.On the date of acquisition,UNI's assets included $2,000,000 of Inventory and Land with a Book value of $120,000.UNI also had $1,400,000 in Liabilities on that date.UNI's book values were equal to their fair market values,with the exception of the company's Land,which was estimated to have a fair market value which was $50,000 higher than its book value.

Assuming that the acquisition was properly recorded at cost,which of the following journal entries is required to prepare Consolidated Financial Statements the day following the acquisition?

IOU Inc.purchased all of the outstanding common shares of UNI Inc.for $800,000.On the date of acquisition,UNI's assets included $2,000,000 of Inventory and Land with a Book value of $120,000.UNI also had $1,400,000 in Liabilities on that date.UNI's book values were equal to their fair market values,with the exception of the company's Land,which was estimated to have a fair market value which was $50,000 higher than its book value.

Assuming that the acquisition was properly recorded at cost,which of the following journal entries is required to prepare Consolidated Financial Statements the day following the acquisition?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

14

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on December 31,2008: On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

Assuming this Business Combination was to be accounted for under the Pooling of Interests Method,the Shareholder's Equity section of the Consolidated Balance Sheet would show what amount?

A)$121,000

B)$90,000

C)$19,000

D)$98,000

Parent and Sub Inc had the following balance sheets on December 31,2008:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:Assuming this Business Combination was to be accounted for under the Pooling of Interests Method,the Shareholder's Equity section of the Consolidated Balance Sheet would show what amount?

A)$121,000

B)$90,000

C)$19,000

D)$98,000

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

15

Company A has made an offer to purchase all of the outstanding shares of Company B for $10 per share (the current market value of the shares).In response to Company A's offer,the shareholders of Company B were given rights to purchase additional shares at $8 per share.Which of the following tactics was employed by Company B to prevent Company A from acquiring control of Company B?

A)Pac-man defence.

B)Selling the crown jewels.

C)Poison Pill.

D)A Reverse-takeover.

A)Pac-man defence.

B)Selling the crown jewels.

C)Poison Pill.

D)A Reverse-takeover.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

16

Parent Company acquires Sub Company's common shares for cash.On the date of acquisition,Sub had Goodwill of $100,000 on its books.Which of the following statements regarding Sub's Goodwill on the date of acquisition is correct?

A)Sub's goodwill is considered an identifiable asset and should therefore be included in Parent Company's Acquisition Differential calculation.

B)Sub's goodwill is considered an identifiable asset and should therefore be excluded from Parent Company's Acquisition Differential calculation.

C)Sub's goodwill is not considered an identifiable asset and should therefore be excluded from Parent Company's Acquisition Differential calculation.

D)Sub's goodwill is not considered an identifiable asset and should therefore be included in Parent Company's Acquisition Differential calculation.

A)Sub's goodwill is considered an identifiable asset and should therefore be included in Parent Company's Acquisition Differential calculation.

B)Sub's goodwill is considered an identifiable asset and should therefore be excluded from Parent Company's Acquisition Differential calculation.

C)Sub's goodwill is not considered an identifiable asset and should therefore be excluded from Parent Company's Acquisition Differential calculation.

D)Sub's goodwill is not considered an identifiable asset and should therefore be included in Parent Company's Acquisition Differential calculation.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

17

A Inc.has purchased all of the outstanding voting shares of B Inc on January 1,20X1.On the date of acquisition,the book value of B's identifiable assets was equal to their fair market values with the exception B's Plant and Equipment,which had a Fair Market Value of $1,200,000.On the date of acquisition,A and B had Plant and Equipment with book values of $2,000,000 and $1,000,000 respectively.Both companies' Plant and Equipment are fully depreciated)Assuming that any excess fair market value on Plant and Equipment is to be amortized over ten years,the Plant and Equipment would be shown on A's Consolidated Balance Sheet in what amount on December 31,20x3?

A)$3,200,000

B)$3,140,000

C)$3,000,000

D)$2,940,000

A)$3,200,000

B)$3,140,000

C)$3,000,000

D)$2,940,000

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

18

During an acquisition,when should intangible assets NOT be recognized apart from Goodwill?

A)The assets have been identified but not accounted for by the subsidiary.

B)The assets have been identified and accounted for by the subsidiary.

C)The assets can be sold,licensed or exchanged)

D)The assets have been accounted for by the subsidiary but have no Fair Value on the date of acquisition.

A)The assets have been identified but not accounted for by the subsidiary.

B)The assets have been identified and accounted for by the subsidiary.

C)The assets can be sold,licensed or exchanged)

D)The assets have been accounted for by the subsidiary but have no Fair Value on the date of acquisition.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

19

The following data pertains to Questions

IOU Inc.purchased all of the outstanding common shares of UNI Inc.for $800,000.On the date of acquisition,UNI's assets included $2,000,000 of Inventory and Land with a Book value of $120,000.UNI also had $1,400,000 in Liabilities on that date.UNI's book values were equal to their fair market values,with the exception of the company's Land,which was estimated to have a fair market value which was $50,000 higher than its book value.

How much goodwill would be created by IOU's acquisition of UNI?

A)$30,000

B)$50,000.

C)$80,000.

D)Nil.

IOU Inc.purchased all of the outstanding common shares of UNI Inc.for $800,000.On the date of acquisition,UNI's assets included $2,000,000 of Inventory and Land with a Book value of $120,000.UNI also had $1,400,000 in Liabilities on that date.UNI's book values were equal to their fair market values,with the exception of the company's Land,which was estimated to have a fair market value which was $50,000 higher than its book value.

How much goodwill would be created by IOU's acquisition of UNI?

A)$30,000

B)$50,000.

C)$80,000.

D)Nil.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements regarding the Pooling of Interests Method is false?

A)It will result in a higher net income being shown when the Fair Market Values of a company's assets exceeds its book values.

B)It is currently the required method for accounting for Business Combinations in Canada when an acquirer cannot be identified)

C)It is more widely used in the United States than in Canada)

D)The Purchase Method was created under the assumption that all parties involved in a Business Combination would essentially be considered equal.

A)It will result in a higher net income being shown when the Fair Market Values of a company's assets exceeds its book values.

B)It is currently the required method for accounting for Business Combinations in Canada when an acquirer cannot be identified)

C)It is more widely used in the United States than in Canada)

D)The Purchase Method was created under the assumption that all parties involved in a Business Combination would essentially be considered equal.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

21

The net income generated by the net assets of the acquired company is adjusted for:

A)Amortization of goodwill.

B)The amortization of the fair values of the assets and liabilities purchased)

C)Any goodwill losses due to impairment.

D)(b)and (c).

A)Amortization of goodwill.

B)The amortization of the fair values of the assets and liabilities purchased)

C)Any goodwill losses due to impairment.

D)(b)and (c).

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following acquirees assets and liabilities are not valued at the date of acquisition?

A)Patents and Trademarks.

B)Long term leases.

C)Unearned revenue.

D)Deferred tax assets and liabilities.

A)Patents and Trademarks.

B)Long term leases.

C)Unearned revenue.

D)Deferred tax assets and liabilities.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

23

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on December 31,2008: On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

IAS 27 outlines the requirements for identifying the company that is the acquirer in a business combination when it's not clear who that is.Which is not a consideration in determining which company is the acquirer??

A)If the means of payment is cash,which party is paying the cash.

B)Relative holdings of voting shares in the combined entity.

C)Voting rights of the respective parties after the combination of their businesses.

D)Any by-laws or provisions of the incorporation acts of each company that details the manner in which a business combination will occur at law .

Parent and Sub Inc had the following balance sheets on December 31,2008:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:IAS 27 outlines the requirements for identifying the company that is the acquirer in a business combination when it's not clear who that is.Which is not a consideration in determining which company is the acquirer??

A)If the means of payment is cash,which party is paying the cash.

B)Relative holdings of voting shares in the combined entity.

C)Voting rights of the respective parties after the combination of their businesses.

D)Any by-laws or provisions of the incorporation acts of each company that details the manner in which a business combination will occur at law .

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

24

One company is considering entering into a business combination with another.The potential acquirer wishes to acquire the subsidiary's assets and liabilities but wishes to prepare Consolidated Financial Statements using the Fair Market Values of its own assets and liabilities as well of those of its potential subsidiary.Can this be accomplished?

A)Yes,this is permissible under the Pooling of Interests method)

B)Yes,this is permissible under the Purchase Method under certain circumstances.

C)Yes,this would be possible,but only if the New Entity Method is used)

D)No,this would not be possible under any circumstances as it would be a violation of GAAP.

A)Yes,this is permissible under the Pooling of Interests method)

B)Yes,this is permissible under the Purchase Method under certain circumstances.

C)Yes,this would be possible,but only if the New Entity Method is used)

D)No,this would not be possible under any circumstances as it would be a violation of GAAP.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

25

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on December 31,2008: On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

How much Goodwill was amortized during 2003?

A)$700

B)($1,700)

C)$1,700

D)None - Goodwill is never amortized.

Parent and Sub Inc had the following balance sheets on December 31,2008:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:How much Goodwill was amortized during 2003?

A)$700

B)($1,700)

C)$1,700

D)None - Goodwill is never amortized.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

26

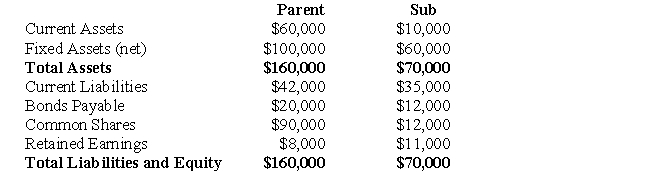

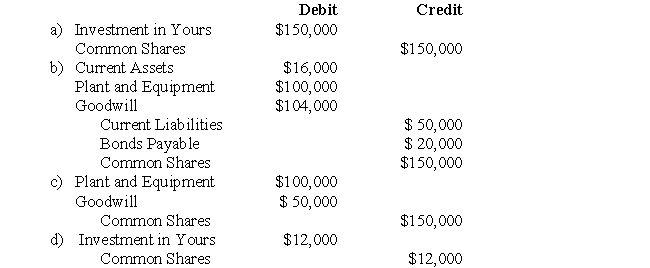

The following data pertains to questions

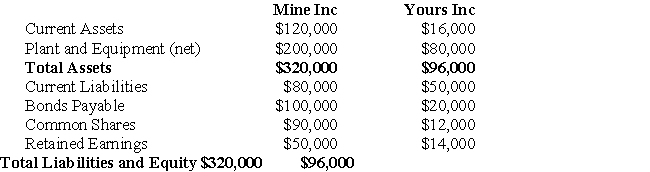

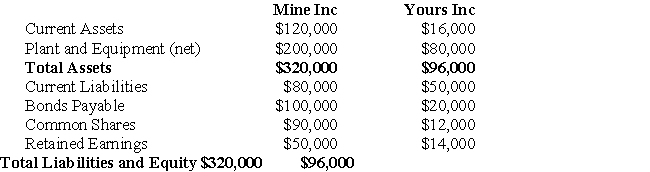

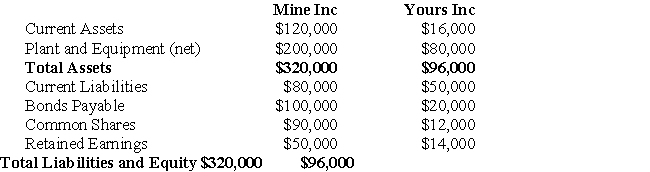

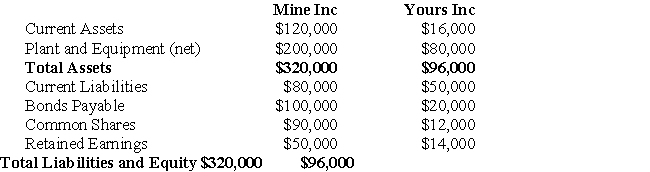

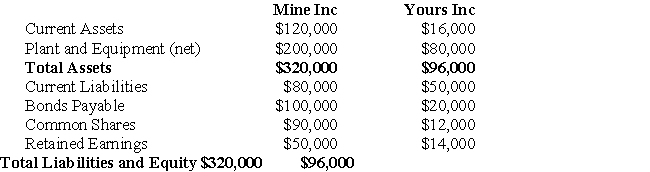

Parent and Sub Inc had the following balance sheets on July 31,2006: Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

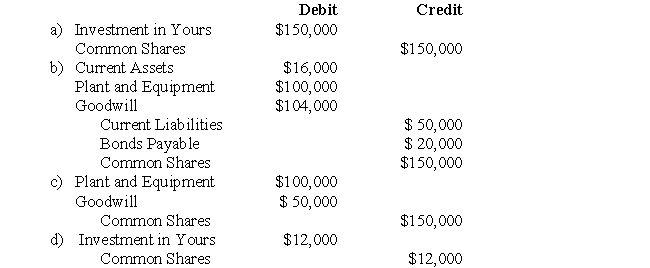

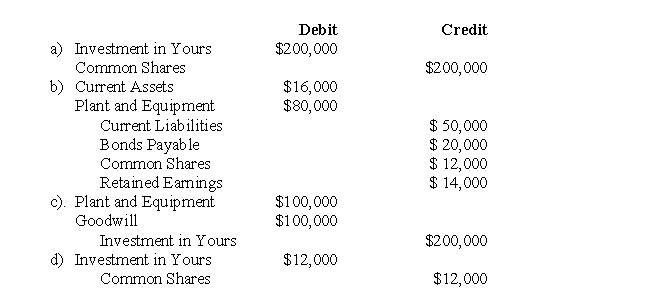

Assume that Mine Inc issued 10,000 shares for all of Yours Inc's Common Shares.Mine Inc's shares had a fair market value of $15 per share on that date.What entry would be made on Mine Inc's book on that date?

Parent and Sub Inc had the following balance sheets on July 31,2006:

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.Assume that Mine Inc issued 10,000 shares for all of Yours Inc's Common Shares.Mine Inc's shares had a fair market value of $15 per share on that date.What entry would be made on Mine Inc's book on that date?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

27

A Company wishes to acquire control of B Company as cheaply as possible.For economic reasons,a consultant recommended that A Inc do this through a purchase of assets,rather than a purchase of shares.Which of the following statements regarding the above scenario is correct?

A)A Inc must purchase all of B's assets and liabilities.

B)A only needs to acquire control of B's net assets.

C)A only needs to acquire control of B's fixed assets.

D)The consideration given by A must exceed 50% of the Fair Market Value of B's Net Assets.

A)A Inc must purchase all of B's assets and liabilities.

B)A only needs to acquire control of B's net assets.

C)A only needs to acquire control of B's fixed assets.

D)The consideration given by A must exceed 50% of the Fair Market Value of B's Net Assets.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

28

How should intangible assets which are readily identifiable but not accurately measured be accounted for?

A)They should be ignored since they can't be accurately measured)

B)They should be independently appraised and accounted for at their appraised value.

C)They should be included in Goodwill.

D)They should be accounted for at an amount deemed reasonable by management.

A)They should be ignored since they can't be accurately measured)

B)They should be independently appraised and accounted for at their appraised value.

C)They should be included in Goodwill.

D)They should be accounted for at an amount deemed reasonable by management.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

29

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2006: Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

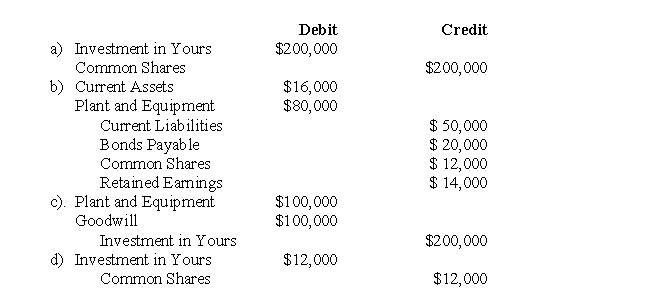

Assume Mine and Yours engage in a Business Combination which qualifies as a Pooling of Interests.On August 1,2006,Mine Inc issues 10,000 shares with a fair market value of $20 each to acquire the assets and liabilities of Yours Inc.What entry would be made in Mine's books on that date?

Parent and Sub Inc had the following balance sheets on July 31,2006:

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.Assume Mine and Yours engage in a Business Combination which qualifies as a Pooling of Interests.On August 1,2006,Mine Inc issues 10,000 shares with a fair market value of $20 each to acquire the assets and liabilities of Yours Inc.What entry would be made in Mine's books on that date?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

30

The shareholders of 123 Inc.and 456 Inc.wish to engage in a Business Combination whereby each of the companies would acquire all of the voting shares of the other.On that date,123 Inc had 120,000 shares outstanding with a book value of $2,000,000,while 456 Inc had 100,000 shares outstanding,also with a book value of $2,000,000.On that date the fair market values of 123 Inc.and 456 Inc.were $2,200,000 and $1,500,000 respectively.Assuming that each share entitles the shareholder to one vote,which company (if any)can be identified as the acquirer?

A)No acquirer can be identified,since the Book values of both companies are the same.

B)456 Inc.is deemed to be the acquirer since it will own a majority of the voting shares of the combined entity.

C)123 Inc is deemed to be the acquirer since it holds more voting shares on the date of acquisition.

D)456 Inc is deemed to be the acquirer since its shares will have a greater market value than those of 123 Inc after the acquisition.

A)No acquirer can be identified,since the Book values of both companies are the same.

B)456 Inc.is deemed to be the acquirer since it will own a majority of the voting shares of the combined entity.

C)123 Inc is deemed to be the acquirer since it holds more voting shares on the date of acquisition.

D)456 Inc is deemed to be the acquirer since its shares will have a greater market value than those of 123 Inc after the acquisition.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements about the Pooling of Interests Method is incorrect?

A)It ignores the fair market values of any shares issued in a business combination.

B)It is less complete than the Purchase Method due to the omission of any acquired assets and liabilities that were not recorded prior to the acquisition

C)Cash flows will always be significantly higher under the Pooling of Interests Method than under the Purchase Method)

D)Cash can never be exchanged under a Pooling of Interests business combination.

A)It ignores the fair market values of any shares issued in a business combination.

B)It is less complete than the Purchase Method due to the omission of any acquired assets and liabilities that were not recorded prior to the acquisition

C)Cash flows will always be significantly higher under the Pooling of Interests Method than under the Purchase Method)

D)Cash can never be exchanged under a Pooling of Interests business combination.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

32

1234567 Inc is contemplating a Business Combination with 7654321 Inc.One company is incorporated under Federal law,the other under provincial law.Is a statutory amalgamation permissible under these circumstances?

A)Yes,provided the combination is accounted for using the Acquisition Method)

B)Yes,provided the surviving corporation would have had control of the purchased company.

C)No,a statutory amalgamation would not be possible,since one company is incorporated under federal law and the other under provincial law.

D)Cannot be determined from the information given.

A)Yes,provided the combination is accounted for using the Acquisition Method)

B)Yes,provided the surviving corporation would have had control of the purchased company.

C)No,a statutory amalgamation would not be possible,since one company is incorporated under federal law and the other under provincial law.

D)Cannot be determined from the information given.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

33

Assume that two companies wish to engage in a Business Combination involving a share exchange.Once the share exchange is consummated,each shareholder group will have an equal number of voting shares.Which of the following statements best describes the course of action that must be taken under these circumstances?

A)No acquirer can be identified since no shareholder group has majority voting control,so the share exchange must be annulled)

B)The company with the largest net assets (at fair market value)is deemed to be the acquirer.

C)Other factors must be examined to determine which shareholder group is more dominant.

D)The Boards of Directors of both companies must enter into discussions to agree on which party will be the acquirer.

A)No acquirer can be identified since no shareholder group has majority voting control,so the share exchange must be annulled)

B)The company with the largest net assets (at fair market value)is deemed to be the acquirer.

C)Other factors must be examined to determine which shareholder group is more dominant.

D)The Boards of Directors of both companies must enter into discussions to agree on which party will be the acquirer.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

34

The new IASB standard issued with respect to the treatment of negative goodwill requires that:

A)it must be recognized in income immediately as an extraordinary item.

B)it must be recognized in income immediately but not necessarily as an extraordinary item.

C)it can be deferred and amortized over a maximum of 40 years.

D)it must be reflected as an increase in Liabilities and a Reduction in Capital for the Parent Company.

A)it must be recognized in income immediately as an extraordinary item.

B)it must be recognized in income immediately but not necessarily as an extraordinary item.

C)it can be deferred and amortized over a maximum of 40 years.

D)it must be reflected as an increase in Liabilities and a Reduction in Capital for the Parent Company.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

35

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2006: Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

What would be the balance in Yours Inc's Retained Earnings Account after the Pooling of Interests in Question 29 has taken place?

A)$200,000

B)$188,000

C)$120,000

D)$100,000

Parent and Sub Inc had the following balance sheets on July 31,2006:

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.What would be the balance in Yours Inc's Retained Earnings Account after the Pooling of Interests in Question 29 has taken place?

A)$200,000

B)$188,000

C)$120,000

D)$100,000

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements best describes the current treatment of negative Goodwill in Canada and the U.S?

A)A reduction of assets with any unallocated portion appearing on the Income Statement as an extraordinary item.

B)A reduction of assets with any unallocated portion to be amortized over a maximum of forty years.

C)An increase in liabilities with any unallocated portion appearing on the Income Statement as an extraordinary item.

D)An increase in liabilities with any unallocated portion to be amortized over a maximum of forty years.

A)A reduction of assets with any unallocated portion appearing on the Income Statement as an extraordinary item.

B)A reduction of assets with any unallocated portion to be amortized over a maximum of forty years.

C)An increase in liabilities with any unallocated portion appearing on the Income Statement as an extraordinary item.

D)An increase in liabilities with any unallocated portion to be amortized over a maximum of forty years.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

37

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2006: Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

What amount would appear in Yours' Investment Account after the Pooling of Interests in Question 29 has taken place?

A)$200,000

B)$12,000

C)$100,000

D)Nil

Parent and Sub Inc had the following balance sheets on July 31,2006:

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.What amount would appear in Yours' Investment Account after the Pooling of Interests in Question 29 has taken place?

A)$200,000

B)$12,000

C)$100,000

D)Nil

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following regarding the preparation of Consolidated Financial Statement(s)is/are correct?

A)Once the parent company prepares Consolidated Financial Statements,it no longer needs to prepare financial statements for its own activities.

B)Only the subsidiaries are required to prepare Financial Statements.

C)Consolidated Financial Statements are required by the Parent Company for reporting purposes only;each company must continue to prepare its own Financial Statements.

D)Consolidated Financial Statements are required only when both companies are publicly traded)

A)Once the parent company prepares Consolidated Financial Statements,it no longer needs to prepare financial statements for its own activities.

B)Only the subsidiaries are required to prepare Financial Statements.

C)Consolidated Financial Statements are required by the Parent Company for reporting purposes only;each company must continue to prepare its own Financial Statements.

D)Consolidated Financial Statements are required only when both companies are publicly traded)

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

39

Company A makes a hostile take-over bid for control of Company B.In response,Company B makes a counter-offer to purchase shares from Company A's shareholders.Which of the following best describes Company B's response?

A)Pac-man defence.

B)Selling the crown jewels.

C)Poison Pill.

D)A Hostile Defence.

A)Pac-man defence.

B)Selling the crown jewels.

C)Poison Pill.

D)A Hostile Defence.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

40

DEF Inc.is contemplating a business combination involving GHI Inc.DEF can either purchase the assets and liabilities of GHI Inc,or it can engage in a Pooling of Interests with GHI Inc.Assuming that the Fair Market Values of GHI's identifiable assets are equal to their book values,which method would show a higher net income for the consolidated entity (assume that the Pooling of Interests Method is allowable)?

A)The Purchase Method)

B)The Pooling of Interests Method)

C)The Purchase Method and The Pooling of Interests Method would show the same income.

D)It depends on the accounting policies used by each company.

A)The Purchase Method)

B)The Pooling of Interests Method)

C)The Purchase Method and The Pooling of Interests Method would show the same income.

D)It depends on the accounting policies used by each company.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following must be possible in order for a business combination to exist?

A)Control of a subsidiary's net assets.

B)Ownership of 100 % of a subsidiary's voting shares.

C)Ownership of all of a subsidiary's assets.

D)Ownership of all of a subsidiary's operating assets.

A)Control of a subsidiary's net assets.

B)Ownership of 100 % of a subsidiary's voting shares.

C)Ownership of all of a subsidiary's assets.

D)Ownership of all of a subsidiary's operating assets.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is closest to IAS 27 definition of control?

A)A company is deemed to have control over another only when it owns a majority of the voting shares of another company.

B)A company is deemed to have control when it can elect a majority of the Board members of another company.

C)Control is the power of one company to govern the financial and operating policies of an entity so as to obtain the benefits of its activities.

D)Control exists only when a company has the continuing power to determine the operating and financing policies of another company and attempts to exercise such powers.

A)A company is deemed to have control over another only when it owns a majority of the voting shares of another company.

B)A company is deemed to have control when it can elect a majority of the Board members of another company.

C)Control is the power of one company to govern the financial and operating policies of an entity so as to obtain the benefits of its activities.

D)Control exists only when a company has the continuing power to determine the operating and financing policies of another company and attempts to exercise such powers.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

43

In order for one company to establish control over another,

A)consideration given must include cash or voting shares.

B)it must have elected the majority of the members of the Board of Directors of that company.

C)the acquisition cost must be disbursed to the subsidiary prior to exercising its control.

D)consideration of some kind must be given.However,the consideration given is irrelevant to the substance of the relationship between the two companies.

A)consideration given must include cash or voting shares.

B)it must have elected the majority of the members of the Board of Directors of that company.

C)the acquisition cost must be disbursed to the subsidiary prior to exercising its control.

D)consideration of some kind must be given.However,the consideration given is irrelevant to the substance of the relationship between the two companies.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

44

XYZ Inc.owns 55% of DEF's 100,000 outstanding voting shares.Another company,GHI Inc,owns 40%,with the remaining shares being held by many individual investors.GHI Inc.also owns $25,000,000 worth of DEF Inc's $1,000 par value bonds,each of which is convertible to one voting share of DEF Inc.Which of the following statements regarding the control of DEF Inc.is correct?

A)XYZ Inc has control over DEF Inc as it owns a majority of the latter's currently outstanding voting shares.

B)XYZ Inc does not have control over DEF Inc,as it cannot exercise control over DEF's strategic operating,investing and Financing activities without the cooperation of GHI Inc.

C)GHI Inc has de facto control over DEF Inc.

D)As long as GHI does not exercise its option to convert its bonds to voting shares,XYZ Inc.has control over DEF Inc.

A)XYZ Inc has control over DEF Inc as it owns a majority of the latter's currently outstanding voting shares.

B)XYZ Inc does not have control over DEF Inc,as it cannot exercise control over DEF's strategic operating,investing and Financing activities without the cooperation of GHI Inc.

C)GHI Inc has de facto control over DEF Inc.

D)As long as GHI does not exercise its option to convert its bonds to voting shares,XYZ Inc.has control over DEF Inc.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following would not be considered a Business Combination?

A)A Company purchases B Company's only manufacturing facility for $1,000,000 or 80% of B's total assets.

B)A company purchases one of B's old/abandoned warehouses.

C)Two of Company A's subsidiaries engage in a share exchange without consulting the Parent Company.

D)Neither the purchase of an old abandoned warehouse,nor the exchanging of shares between subsidiaries of the same Parent Company qualify as Business Combinations.

A)A Company purchases B Company's only manufacturing facility for $1,000,000 or 80% of B's total assets.

B)A company purchases one of B's old/abandoned warehouses.

C)Two of Company A's subsidiaries engage in a share exchange without consulting the Parent Company.

D)Neither the purchase of an old abandoned warehouse,nor the exchanging of shares between subsidiaries of the same Parent Company qualify as Business Combinations.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

46

The carrying value of Depreciable Assets on a potential subsidiary's books is only of concern when:

A)The Purchase Method is used to account for the Business Combination.

B)The companies are contemplating using the Pooling of Interests Method to account for the Business Combination.

C)The New Entity method will be used to account for the Business Combination.

D)The carrying value of a subsidiary's depreciable assets is irrelevant to any business combination.

A)The Purchase Method is used to account for the Business Combination.

B)The companies are contemplating using the Pooling of Interests Method to account for the Business Combination.

C)The New Entity method will be used to account for the Business Combination.

D)The carrying value of a subsidiary's depreciable assets is irrelevant to any business combination.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

47

A Inc.purchases 100% of the voting shares of B Inc on July 1,2008.On that date,A Inc would be required to prepare which of the following statements?

A)No statement preparation is required)

B)A Consolidated Income Statement.

C)A Consolidated Balance Sheet.

D)A Consolidated Income Statement and a Consolidated Balance Sheet.

A)No statement preparation is required)

B)A Consolidated Income Statement.

C)A Consolidated Balance Sheet.

D)A Consolidated Income Statement and a Consolidated Balance Sheet.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following methods of accounting for Business Combinations is/are consistent with the Historical Cost Principle?

A)The Pooling of Interests Method

B)The Purchase Method)

C)The New Entity Method)

D)The Acquisition Method)

A)The Pooling of Interests Method

B)The Purchase Method)

C)The New Entity Method)

D)The Acquisition Method)

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

49

A Company owns 80% of the voting shares of B Company,which in turn owns 70% of the shares of C Company.There are no outstanding warrants or options which would enable holders of other instruments to acquire additional voting shares of any of these companies.In this scenario,

A)A has no control over C because it does not own any shares of C Company.

B)A has direct control over C.

C)A has indirect control over C.

D)control cannot be determined from the information given.

A)A has no control over C because it does not own any shares of C Company.

B)A has direct control over C.

C)A has indirect control over C.

D)control cannot be determined from the information given.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

50

One common criticism of the Purchase Method is that:

A)Fair market values can never be accurately assessed)

B)The Consolidated Balance Sheet contains both Book Values and Fair Market Values.

C)The Fair Values of a Subsidiary's assets cannot be adjusted to reflect changes in valuation.

D)The use of the term "Purchase" can mislead users of the Consolidated Financial Statements,since it implies that cash has been exchanged)

A)Fair market values can never be accurately assessed)

B)The Consolidated Balance Sheet contains both Book Values and Fair Market Values.

C)The Fair Values of a Subsidiary's assets cannot be adjusted to reflect changes in valuation.

D)The use of the term "Purchase" can mislead users of the Consolidated Financial Statements,since it implies that cash has been exchanged)

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

51

Under which of the following scenarios would the preparation of Consolidated Financial Statements NOT be justified?

A)A Company owns enough convertible securities,which,when exercised would provide it with more than 50% of B's voting shares.

B)A Company has purchased all of the assets of B Company.

C)50% of B's assets have been placed under the custody of a trustee.

D)The workers of a Subsidiary's plant went on strike for an undetermined period of time.

A)A Company owns enough convertible securities,which,when exercised would provide it with more than 50% of B's voting shares.

B)A Company has purchased all of the assets of B Company.

C)50% of B's assets have been placed under the custody of a trustee.

D)The workers of a Subsidiary's plant went on strike for an undetermined period of time.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

52

A Inc purchased 100% of B Inc's voting shares for cash on January 1,20X1.The Assets and Liabilities reported Consolidated Balance Sheet of A Inc prepared on the date of acquisition will include

A)The book value of A's assets and liabilities plus the book value of B's assets and liabilities.

B)The fair market value of A's assets and liabilities plus the book value of B's assets and liabilities.

C)The book value of A's assets and liabilities plus the fair market value of B's assets and liabilities.

D)The fair market value of A's assets and liabilities plus the fair market value of B's assets and liabilities.

A)The book value of A's assets and liabilities plus the book value of B's assets and liabilities.

B)The fair market value of A's assets and liabilities plus the book value of B's assets and liabilities.

C)The book value of A's assets and liabilities plus the fair market value of B's assets and liabilities.

D)The fair market value of A's assets and liabilities plus the fair market value of B's assets and liabilities.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

53

A company has decided to purchase 100% of the voting shares of B Company for $100,000 on January 1,20x2.Immediately before the acquisition,A and B reported cash balances of $300,000 and 150,000 respectively.If Consolidated Financial Statements were prepared immediately following the acquisition,how much Cash would be reported on A's consolidated balance sheet?

A)$250,000

B)$350,000

C)$550,000

D)$450,000

A)$250,000

B)$350,000

C)$550,000

D)$450,000

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is correct?

A)Under the purchase method,the company's net assets are recorded at the price paid for these assets on the date of acquisition.

B)Under the acquisition method,the company's net assets are recorded at the price paid for these assets on the date of acquisition.

C)As of January 1st,2008,the Purchase method must be used to account for business combinations where an acquirer can be identified)

D)The acquisition method is consistent with the historical cost principle while the purchase method is not.

A)Under the purchase method,the company's net assets are recorded at the price paid for these assets on the date of acquisition.

B)Under the acquisition method,the company's net assets are recorded at the price paid for these assets on the date of acquisition.

C)As of January 1st,2008,the Purchase method must be used to account for business combinations where an acquirer can be identified)

D)The acquisition method is consistent with the historical cost principle while the purchase method is not.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

55

A Inc.is contemplating a Business combination with B Inc.However,A Inc's management is uncertain as to whether it should purchase B's assets or a majority of B's voting shares.The fair market values of B's assets far exceed their book values.A's management should be advised that IN MOST CASES:

A)A purchase of B's shares would likely be the cheaper method of acquiring control.However,it would be less advantageous to the consolidated entity from a Tax standpoint.

B)A purchase of B's shares would likely be the cheaper method of acquiring control.It would also be more advantageous to the consolidated entity from a Tax standpoint.

C)A purchase of B's shares would likely be the costlier method of acquiring control.However,it would be more advantageous to the consolidated entity from a Tax standpoint.

D)A purchase of B's shares would likely be the costlier method of acquiring control.It would also be less advantageous to the consolidated entity from a Tax standpoint.

A)A purchase of B's shares would likely be the cheaper method of acquiring control.However,it would be less advantageous to the consolidated entity from a Tax standpoint.

B)A purchase of B's shares would likely be the cheaper method of acquiring control.It would also be more advantageous to the consolidated entity from a Tax standpoint.

C)A purchase of B's shares would likely be the costlier method of acquiring control.However,it would be more advantageous to the consolidated entity from a Tax standpoint.

D)A purchase of B's shares would likely be the costlier method of acquiring control.It would also be less advantageous to the consolidated entity from a Tax standpoint.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

56

Goodwill can best be described as:

A)The difference between the acquisition price and the fair value of the net assets acquired)

B)The difference between the acquisition price and the fair value of the net assets acquired,when the Purchase Price exceeds the fair value of the net assets acquired)

C)The difference between the acquisition price and the acquirer's pro rata share of the fair value of the net assets acquired)

D)Any unallocated portion of the difference between the acquisition price and the fair value of the net assets acquired)

A)The difference between the acquisition price and the fair value of the net assets acquired)

B)The difference between the acquisition price and the fair value of the net assets acquired,when the Purchase Price exceeds the fair value of the net assets acquired)

C)The difference between the acquisition price and the acquirer's pro rata share of the fair value of the net assets acquired)

D)Any unallocated portion of the difference between the acquisition price and the fair value of the net assets acquired)

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

57

Under the new entity method,

A)the net assets of the acquiring company remain at book value while those of the acquired company are recorded at fair value.

B)the net assets of the acquiring company are recorded at fair value while those of the acquired company are recorded at book value.

C)the net assets of both companies are recorded at fair market value.

D)the net assets of both companies are recorded at book value.

A)the net assets of the acquiring company remain at book value while those of the acquired company are recorded at fair value.

B)the net assets of the acquiring company are recorded at fair value while those of the acquired company are recorded at book value.

C)the net assets of both companies are recorded at fair market value.

D)the net assets of both companies are recorded at book value.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements is correct?

A)Since 2002,the only acceptable method of accounting for Business Combinations is the Pooling of Interests Method)

B)Since 2002,the only acceptable method of accounting for Business Combinations is the Purchase Method)

C)In the future,all Business Combinations shall be accounted for using the New Entity Method only.

D)The Purchase Method can only be used when Cash is the sole consideration offered by the acquirer in a Business Combination.

A)Since 2002,the only acceptable method of accounting for Business Combinations is the Pooling of Interests Method)

B)Since 2002,the only acceptable method of accounting for Business Combinations is the Purchase Method)

C)In the future,all Business Combinations shall be accounted for using the New Entity Method only.

D)The Purchase Method can only be used when Cash is the sole consideration offered by the acquirer in a Business Combination.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

59

How is negative goodwill treated under the acquisition method?

A)The acquiring company will report a gain on acquisition.

B)The acquiring company will report a loss on acquisition.

C)The negative goodwill will be included in other comprehensive income,as it is essentially an unrealized gain.

D)The negative goodwill is prorated using the fair values of the acquired company's net assets.

A)The acquiring company will report a gain on acquisition.

B)The acquiring company will report a loss on acquisition.

C)The negative goodwill will be included in other comprehensive income,as it is essentially an unrealized gain.

D)The negative goodwill is prorated using the fair values of the acquired company's net assets.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

60

Zen Inc.owns 35% of Sun Inc's voting shares.Zen is by far the largest single shareholder of Sun Inc's shares,with the rest of Sun's shares being very widely held by individual investors.There was a very poor turnout at Sun Inc's recent annual meeting,enabling Zen Inc to elect the majority of Sun's Board of Directors.Does Zen control Sun?

A)No,Zen does not control Sun because it cannot exercise control over Sun without the cooperation of Sun's other shareholders.

B)Yes,Zen controls Sun because it is Sun's single largest shareholder group.

C)Yes,Zen controls Sun because it has elected a majority of Sun's Board members.

D)Zen could only control Sun if it owned 50% of Sun's voting shares.

A)No,Zen does not control Sun because it cannot exercise control over Sun without the cooperation of Sun's other shareholders.

B)Yes,Zen controls Sun because it is Sun's single largest shareholder group.

C)Yes,Zen controls Sun because it has elected a majority of Sun's Board members.

D)Zen could only control Sun if it owned 50% of Sun's voting shares.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

61

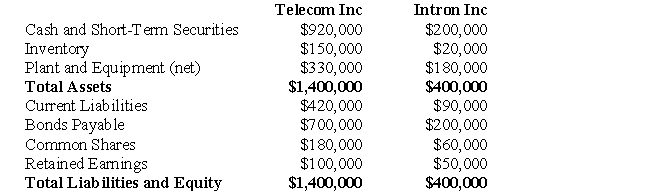

The following information pertains to Questions

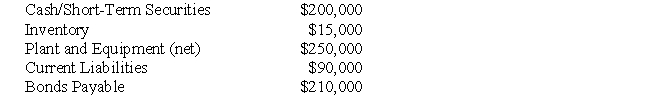

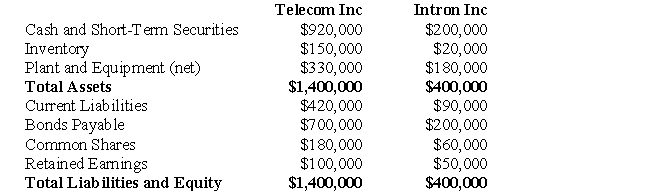

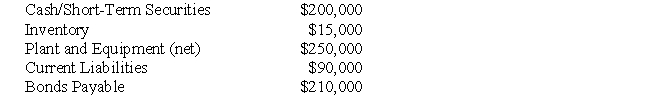

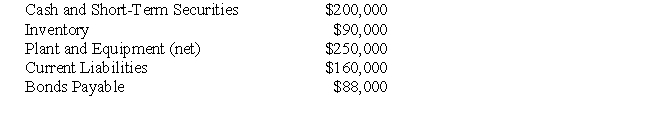

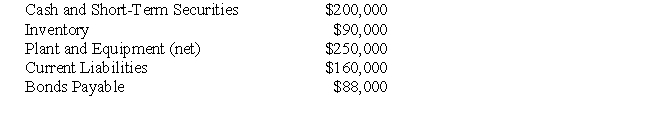

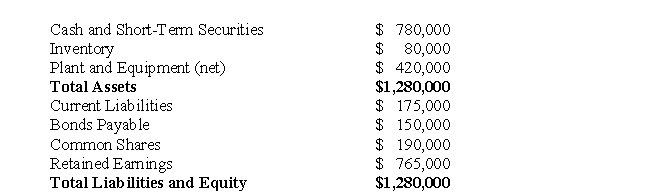

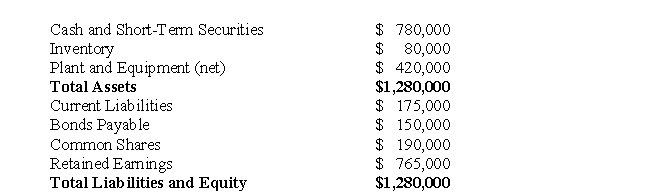

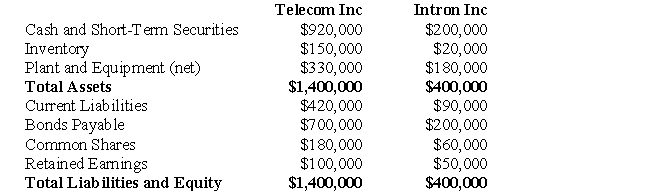

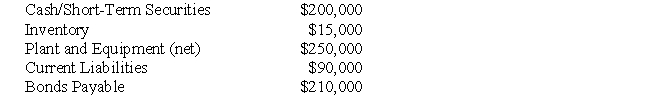

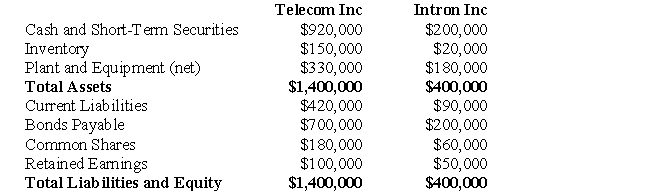

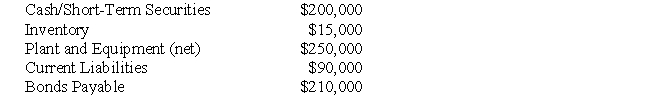

Telecom Inc has decided to purchase the shares of Intron Inc.for $300,000 in Cash on July 1,2009.On the date,the balance sheets of each of these companies were as follows: On that date,the fair values of Intron's Assets and Liabilities were as follows:

On that date,the fair values of Intron's Assets and Liabilities were as follows:

Assume that Intron's Assets and Liabilities were purchased instead of its shares for $300,000.Prepare the journal entry to record this purchase.

Telecom Inc has decided to purchase the shares of Intron Inc.for $300,000 in Cash on July 1,2009.On the date,the balance sheets of each of these companies were as follows:

On that date,the fair values of Intron's Assets and Liabilities were as follows:

On that date,the fair values of Intron's Assets and Liabilities were as follows:

Assume that Intron's Assets and Liabilities were purchased instead of its shares for $300,000.Prepare the journal entry to record this purchase.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

62

The following information pertains to Questions

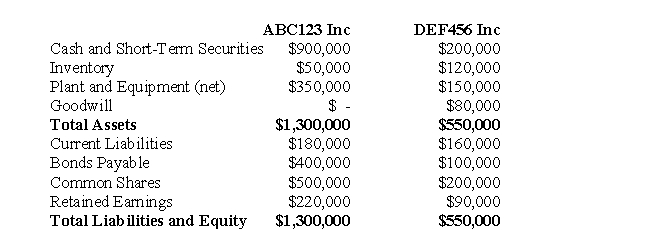

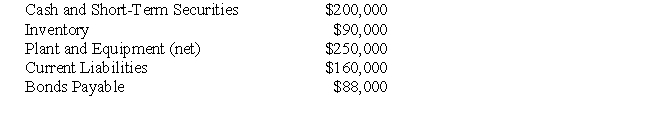

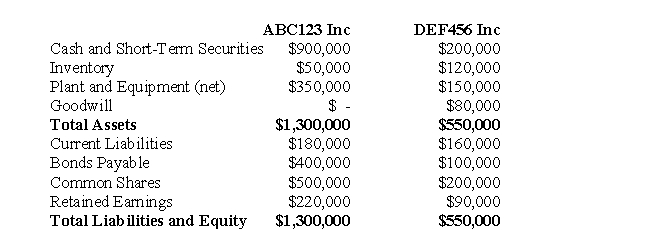

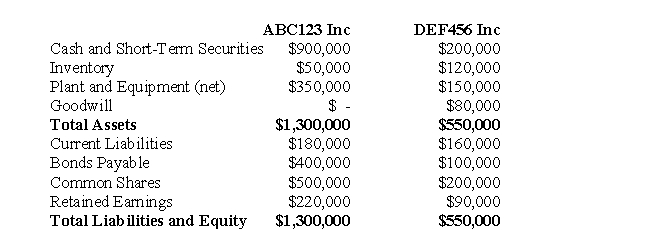

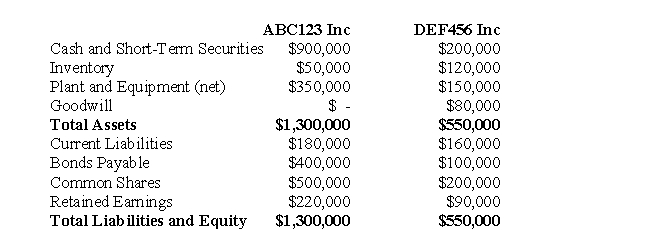

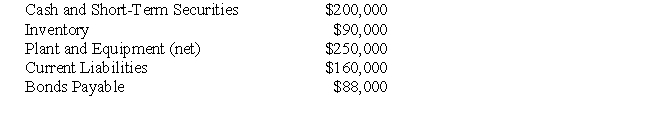

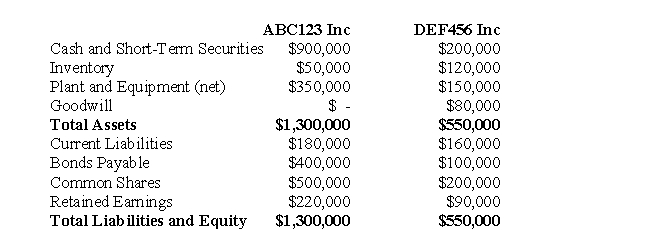

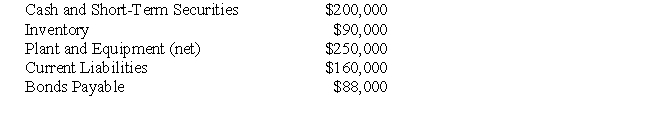

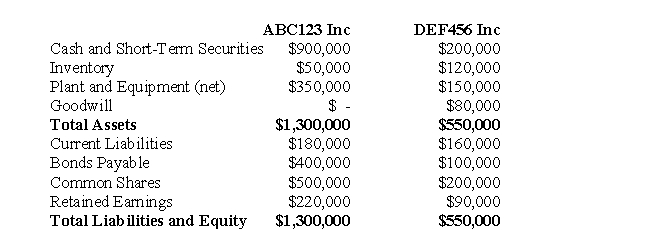

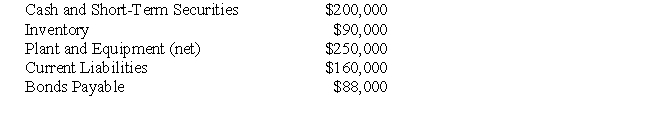

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July1,2008.On the date,the balance sheets of each of these companies were as follows: On that date,the fair values of DEF456 Assets and Liabilities were as follows:

On that date,the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.

In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.

Assuming that DEF456's Plant and Equipment was only worth $500,000.Briefly explain how your response to Question 65 would change.Do not prepare Consolidated Financial Statements.

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July1,2008.On the date,the balance sheets of each of these companies were as follows:

On that date,the fair values of DEF456 Assets and Liabilities were as follows:

On that date,the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.

In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.Assuming that DEF456's Plant and Equipment was only worth $500,000.Briefly explain how your response to Question 65 would change.Do not prepare Consolidated Financial Statements.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

63

George Peterson is the President of Alpha Beta Corporation ("ABC").ABC is a very active non-public corporation.The senior executives of ABC are anxious to institute and executive stock/equity compensation plan.This is difficult to do given that ABC is currently privately owned)George has contacted you as he understands that there is a method available to go public without incurring the substantial costs of doing so.Prepare a memorandum outlining how ABC might achieve this goal.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

64

Company Inc.owns all of the outstanding voting shares of Firm Inc.On January 1st,20X1.Firm Inc.would like to purchase all of the voting shares of its main competitor,N-CORP Inc.Briefly discuss the purported accounting implications of this transaction.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

65

The following information pertains to Questions

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July1,2008.On the date,the balance sheets of each of these companies were as follows: On that date,the fair values of DEF456 Assets and Liabilities were as follows:

On that date,the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.

In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.

Assume that both companies would be wound up and a new company called ABCDEF Inc.was created in its place.Prepare the Balance Sheet to reflect this occurrence as at July 1,2008.The new entity would have10,000 voting shares issued to the current shareholders for a total market value of $1,222,000.

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July1,2008.On the date,the balance sheets of each of these companies were as follows:

On that date,the fair values of DEF456 Assets and Liabilities were as follows:

On that date,the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.

In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.Assume that both companies would be wound up and a new company called ABCDEF Inc.was created in its place.Prepare the Balance Sheet to reflect this occurrence as at July 1,2008.The new entity would have10,000 voting shares issued to the current shareholders for a total market value of $1,222,000.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

66

Assume that X inc)wishes to enter into a Business Combination with Y Inc.on January 1,20X1.X is unsure whether it should purchase Y's assets or liabilities or whether it should purchase all of Y's outstanding voting shares.X and Y are incorporated in different jurisdictions.On January 1,Y Inc was estimated to have various intangibles estimated to be worth a total of $ 1,000,000.Of this amount,$250,000 can be attributable to a Trademark owned by Y.

Required:

In the absence of any other figures,prepare a brief report explaining anything that would be of interest the Board of Directors of X Inc.

Required:

In the absence of any other figures,prepare a brief report explaining anything that would be of interest the Board of Directors of X Inc.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

67

The following information pertains to Questions

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July1,2008.On the date,the balance sheets of each of these companies were as follows: On that date,the fair values of DEF456 Assets and Liabilities were as follows: