Deck 13: Time Value of Money

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Match between columns

Question

Question

Question

Question

Question

Question

Match between columns

Question

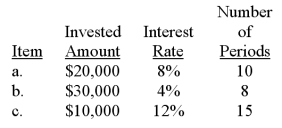

Question

Question

Question

Question

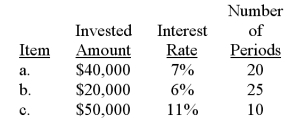

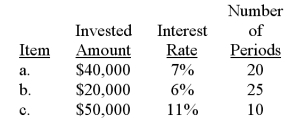

Question

Question

Question

Question

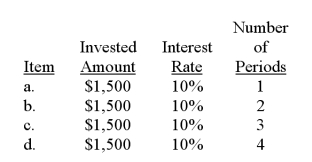

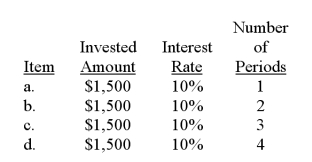

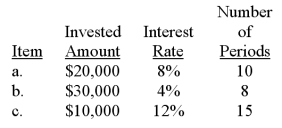

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/74

Play

Full screen (f)

Deck 13: Time Value of Money

1

15)Carol wants to invest money in a 6% CD that compounds semiannually.Carol would like the account to have a balance of $50,000 five years from now.How much must Carol deposit to accomplish her goal?

A)$35,069.

B)$43,131.

C)$37,205.

D)$35,000.

A)$35,069.

B)$43,131.

C)$37,205.

D)$35,000.

C

2

13)Davenport Inc.offers a new employee a lump-sum signing bonus at the date of employment.Alternatively,the employee can take $30,000 at the date of employment and another $50,000 two years later.Assuming the employee's time value of money is 8% annually,what lump-sum at employment date would make her indifferent between the two options?

A)$60,000.

B)$62,867.

C)$72,867.

D)$80,000.

A)$60,000.

B)$62,867.

C)$72,867.

D)$80,000.

C

3

11)What is the value today of receiving $2,500 at the end of three years,assuming an interest rate of 9% compounded annually?

A)$1,984.

B)$1,930.

C)$2,104.

D)$3,238.

A)$1,984.

B)$1,930.

C)$2,104.

D)$3,238.

B

4

12)What is the value today of receiving $5,000 at the end of six years,assuming an interest rate of 8% compounded semiannually?

A)$3,151.

B)$3,203.

C)$3,428.

D)$3,123.

A)$3,151.

B)$3,203.

C)$3,428.

D)$3,123.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

5

20)How much must be invested now at 9% interest to accumulate to $10,000 in five years?

A)$9,176.

B)$6,499.

C)$5,500.

D)$5,960.

A)$9,176.

B)$6,499.

C)$5,500.

D)$5,960.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

6

2)The value today of receiving an amount in the future is referred to as the:

A)Future value of a single amount.

B)Present value of a single amount.

C)Future value of an annuity.

D)Present value of an annuity.

A)Future value of a single amount.

B)Present value of a single amount.

C)Future value of an annuity.

D)Present value of an annuity.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

7

3)The value that an amount today will grow to in the future is referred to as the:

A)Future value of a single amount.

B)Present value of a single amount.

C)Future value of an annuity.

D)Present value of an annuity.

A)Future value of a single amount.

B)Present value of a single amount.

C)Future value of an annuity.

D)Present value of an annuity.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

8

5)LeAnn wishes to know how much she should set aside now at 7% interest in order to accumulate a sum of $5,000 in four years.She should use a table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

9

1)The concept that interest causes the value of money received today to be greater than the value of that same amount of money received in the future is referred to as the:

A)Monetary unit assumption.

B)Historical cost principle.

C)Time value of money.

D)Matching principle.

A)Monetary unit assumption.

B)Historical cost principle.

C)Time value of money.

D)Matching principle.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

10

6)Samuel is trying to determine what it's worth today to receive $10,000 in four years at a 7% interest rate.He should use a table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

11

10)How much will $8,000 grow to in five years,assuming an interest rate of 8% compounded quarterly?

A)$10,989.

B)$11,755.

C)$11,888.

D)$12,013.

A)$10,989.

B)$11,755.

C)$11,888.

D)$12,013.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

12

16)Shane wants to invest money in a 6% CD that compounds semiannually.Shane would like the account to have a balance of $100,000 four years from now.How much must Shane deposit to accomplish his goal?

A)$88,848.

B)$78,941.

C)$25,336.

D)$22,510.

A)$88,848.

B)$78,941.

C)$25,336.

D)$22,510.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

13

Below are excerpts from interest tables for 8% interest.

Column 3 is an interest table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Column 3 is an interest table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

14

14)Today,Thomas deposited $100,000 in a three-year,12% CD that compounds quarterly.What is the maturity value of the CD?

A)$109,270.

B)$119,410.

C)$142,576.

D)$309,090.

A)$109,270.

B)$119,410.

C)$142,576.

D)$309,090.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

15

18)At the end of the next four years,a new machine is expected to generate net cash flows of $8,000,$12,000,$10,000,and $15,000,respectively.What are the cash flows worth today if a 3% interest rate properly reflects the time value of money in this situation?

A)$41,557.

B)$47,700.

C)$32,403.

D)$38,108.

A)$41,557.

B)$47,700.

C)$32,403.

D)$38,108.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

16

19)Monica wants to sell her share of an investment to Barney for $50,000 in three years.If money is worth 6% compounded semiannually,what would Monica accept today?

A)$8,375.

B)$41,874.

C)$11,941.

D)$41,000.

A)$8,375.

B)$41,874.

C)$11,941.

D)$41,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

17

17)Bill wants to give Maria a $500,000 gift in seven years.If money is worth 6% compounded semiannually,what is Maria's gift worth today?

A)$66,110.

B)$81,310.

C)$406,550.

D)$330,560.

A)$66,110.

B)$81,310.

C)$406,550.

D)$330,560.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

18

4)Reba wishes to know how much would be in her savings account in five years if she deposits a given sum in an account that earns 6% interest.She should use a table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

19

9)How much will $25,000 grow to in seven years,assuming an interest rate of 12% compounded annually?

A)$55,267.

B)$46,000.

C)$61,899.

D)$52,344.

A)$55,267.

B)$46,000.

C)$61,899.

D)$52,344.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

20

Below are excerpts from interest tables for 8% interest.

Column 2 is an interest table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Column 2 is an interest table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

21

26)What is the value today of receiving $5,000 at the end of each year for the next 10 years,assuming an interest rate of 12% compounded annually?

A)$87,744.

B)$28,251.

C)$50,000.

D)$15,529.

A)$87,744.

B)$28,251.

C)$50,000.

D)$15,529.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

22

24)How much will $5,000 invested at the end of each year grow to in six years,assuming an interest rate of 7% compounded annually?

A)$35,766.

B)$26,813.

C)$23,833.

D)$7,504.

A)$35,766.

B)$26,813.

C)$23,833.

D)$7,504.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

23

23)A series of equal periodic payments is referred to as:

A)The time value of money.

B)An annuity.

C)The future value.

D)Interest.

A)The time value of money.

B)An annuity.

C)The future value.

D)Interest.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

24

Below are excerpts from interest tables for 8% interest.

Column 4 is an interest table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Column 4 is an interest table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

25

39.The value of $1 today is worth more than $1 one year from now.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

26

21)The value today of receiving a series of payments in the future is referred to as the:

A)Future value of a single amount.

B)Present value of a single amount.

C)Future value of an annuity.

D)Present value of an annuity.

A)Future value of a single amount.

B)Present value of a single amount.

C)Future value of an annuity.

D)Present value of an annuity.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

27

28)Tammy wants to buy a car that costs $10,000 and wishes to know the amount of the monthly payments,which will be made at the end of the month,with interest of 12% on the unpaid balance.She should use a table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

28

22)The value that a series of payments will grow to in the future is referred to as the:

A)Future value of a single amount.

B)Present value of a single amount.

C)Future value of an annuity.

D)Present value of an annuity.

A)Future value of a single amount.

B)Present value of a single amount.

C)Future value of an annuity.

D)Present value of an annuity.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

29

37)Claudine Corporation will deposit $5,000 into a money market account at the end of each year for the next five years.How much will accumulate by the end of the fifth and final payment if the account earns 9% interest?

A)$32,617.

B)$29,924.

C)$27,250.

D)$26,800.

A)$32,617.

B)$29,924.

C)$27,250.

D)$26,800.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

30

Below are excerpts from interest tables for 8% interest.

Column 1 is an interest table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Column 1 is an interest table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

31

25)How much will $1,000 invested at the end of each year grow to in 20 years,assuming an interest rate of 10% compounded annually?

A)$6,728.

B)$8,514.

C)$83,159.

D)$57,275.

A)$6,728.

B)$8,514.

C)$83,159.

D)$57,275.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

32

27)What is the value today of receiving $3,000 at the end of each year for the next three years,assuming an interest rate of 3% compounded annually?

A)$8,486.

B)$8,251.

C)$9,000.

D)$9,273.

A)$8,486.

B)$8,251.

C)$9,000.

D)$9,273.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

33

31)Sandra won $5,000,000 in the state lottery which she has elected to receive at the end of each month over the next thirty years.She will receive 7% interest on unpaid amounts.To determine the amount of her monthly check,she should use a table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

34

35)At the end of each quarter,Patti deposits $500 into an account that pays 12% interest compounded quarterly.How much will Patti have in the account in three years?

A)$7,096.

B)$7,013.

C)$7,129.

D)$8,880.

A)$7,096.

B)$7,013.

C)$7,129.

D)$8,880.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

35

38)What is the value today of receiving five annual payments of $500,000,beginning one year from now,assuming an 11% discount rate?

A)$2,500,000.

B)$2,225,000.

C)$1,847,950.

D)$2,115,270.

A)$2,500,000.

B)$2,225,000.

C)$1,847,950.

D)$2,115,270.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

36

40.The time value of money is a concept which means that the value of $1 increases over time.

Time value of money means that interest causes the value of money received today to be greater than the value of that same amount of money received in the future.

Time value of money means that interest causes the value of money received today to be greater than the value of that same amount of money received in the future.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

37

30)Zulu Corporation hires a new chief executive officer and promises to pay her a signing bonus of $2 million per year for 10 years,starting at the end of the first year.The value of this signing bonus is:

A)The present value of the annuity.

B)The future value of the annuity.

C)$20 million.

D)$0 because no cash is owed immediately.

A)The present value of the annuity.

B)The future value of the annuity.

C)$20 million.

D)$0 because no cash is owed immediately.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

38

29)George Jones is planning on a cruise for his 70th birthday party.He wants to know how much he should set aside at the end of each month at 6% interest to accumulate the sum of $4,800 in five years.He should use a table for the:

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

A)Future value of $1.

B)Present value of $1.

C)Future value of an annuity of $1.

D)Present value of an annuity of $1.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

39

34)Quaker State Inc.offers a new employee a lump-sum signing bonus at the date of employment.Alternatively,the employee can take $8,000 at the date of employment plus $20,000 at the end of each of his first three years of service.Assuming the employee's time value of money is 10% annually,what lump-sum at employment date would make him indifferent between the two options?

A)$23,026.

B)$57,737.

C)$62,711.

D)None of the above is correct.

A)$23,026.

B)$57,737.

C)$62,711.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

40

36)Miller borrows $300,000 to be paid off in three years.The loan payments are semiannual with the first payment due in six months,and interest is at 6%.What is the amount of each payment?

A)$55,379.

B)$106,059.

C)$30,138.

D)$60,276.

A)$55,379.

B)$106,059.

C)$30,138.

D)$60,276.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

41

Match between columns

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

42

42.If you put $500 into a savings account that pays simple interest of 8% per year and then withdraw the money two years later,you will earn interest of $80.

Simple interest = ($500 8%)+ ($500 8%)= $80.

Simple interest = ($500 8%)+ ($500 8%)= $80.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

43

52.The future value of $1,000 invested today for three years that earns 10% compounded annually is greater than the future value of a $500 annuity with the same interest rate over the same period.

The three-year annuity represents three payments of $500 (= $1,500),so the annuity is greater.

The three-year annuity represents three payments of $500 (= $1,500),so the annuity is greater.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

44

57.Anthony would like to have $18,000 to buy a new car in three years.Currently,he has saved $15,000.If he puts $15,000 in an account that earns 6% interest,compounded annually,will he be able to buy the car in three years?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

45

47.Future value is how much an amount today will grow to be in the future.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

46

45.If you put $200 into a savings account that pays annual compound interest of 8% per year and then withdraw the money two years later,you will earn interest of $32.

Compound interest = ($200 8%)+ ($216 8%)= $33.28.

Compound interest = ($200 8%)+ ($216 8%)= $33.28.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

47

Match between columns

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

48

46.If you put $300 into a savings account that pays annual compound interest of 10% per year and then withdraw the money two years later,you will earn interest of $63.

($300 10%)+ ($330 10%)= $63.

($300 10%)+ ($330 10%)= $63.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

49

48.The more frequent the rate of compounding,the more interest that is earned on previous interest,resulting in a higher future value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

50

51.An annuity is a series of equal cash payments over equal time intervals.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

51

60.Compute the present value of the following single amounts to be received at the end of the specified period at the given interest rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

52

58.Michaela would like to have $10,000 for a European vacation in four years.Currently,she has saved $8,000.If she puts $8,000 in an account that earns 6% interest,compounded annually,will she be able to take the vacation in four years?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

53

43.If you put $600 into a savings account that pays simple interest of 10% per year and then withdraw the money two years later,you will earn interest of $126.

Simple interest = ($600 10%)+ ($600 10%)= $120.

Simple interest = ($600 10%)+ ($600 10%)= $120.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

54

50.The discount rate is the rate at which someone is willing to give up current dollars for future dollars.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

55

59.Compute the present value of the following single amounts to be received at the end of the specified period at the given interest rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

56

44.Compound interest is interest you earn on the initial investment and on previous interest.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

57

49.Present value indicates how much a present amount of money will grow to in the future.

Present value indicates the value today of receiving some larger amount in the future.

Present value indicates the value today of receiving some larger amount in the future.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

58

53.The present value of $1,000 received three years from today with a discount rate of 10% is less than the present value of a $500 annuity with the same discount rate over the same period.

The three-year annuity represents three payments of $500 (= $1,500),so the present value of the annuity is greater.

The three-year annuity represents three payments of $500 (= $1,500),so the present value of the annuity is greater.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

59

56.Compute the future value of the following invested amounts at the specified periods and interest rates.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

60

41.Simple interest is interest earned on the initial investment only.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

61

68.Incognito Company is contemplating the purchase of a machine that provides it with net after-tax cash savings of $80,000 per year for 5 years.Assuming an 8% discount rate,calculate the present value of the cash savings.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

62

64.Hillsdale is considering two options for comparable computer software.Option A will cost $25,000 plus annual license renewals of $1,000 for three years,which includes technical support.Option B will cost $20,000 with technical support being an add-on charge.The estimated cost of technical support is $4,000 the first year,$3,000 the second year,and $2,000 the third year.Assume the software is purchased and paid for at the beginning of year one,but that technical support is paid for at the end of each year.The discount rate is 8%.Ignore income taxes.Determine which option should be chosen based on present value considerations.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

63

74.Which three factors are necessary in calculating the present value of a single amount?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

64

75.What is the relationship between the present value of a single amount and the present value of an annuity?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

65

71.Briefly describe the difference between simple interest and compound interest.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

66

73.Explain the difference between present value and future value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

67

72.Two banks each have stated CD rates of 12%.Bank A compounds quarterly and Bank B compounds semiannually.Explain which bank offers the better CD.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

68

70.Briefly explain why the value of $100 received today is greater than the value of $100 received one year from now.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

69

67.Dobson Contractors is considering buying equipment at a cost of $75,000.The equipment is expected to generate cash flows of $15,000 per year for eight years and can be sold at the end of eight years for $5,000.The discount rate is 12%.Assume the equipment would be paid for on the first day of year one,but that all other cash flows occur at the end of the year.Ignore income tax considerations.Determine if Dobson should purchase the machine.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

70

61.If you had an investment opportunity that promises to pay you $20,000 in three years and you could earn a 10% annual return investing your money elsewhere,what is the most you should be willing to invest today in this opportunity?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

71

62.Touche Manufacturing is considering a rearrangement of its manufacturing operations.A consultant estimates that the rearrangement should result in after-tax cash savings of $6,000 the first year,$10,000 for the next two years,and $12,000 for the next two years.Assuming a 12% discount rate,calculate the total present value of the cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

72

69.Samson Inc.is contemplating the purchase of a machine that will provide it with net after-tax cash savings of $100,000 per year for 8 years.Assuming a 10% discount rate,calculate the present value of the cash savings.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

73

65.DON Corp.is contemplating the purchase of a machine that will produce net after-tax cash savings of $20,000 per year for 5 years.At the end of five years,the machine can be sold to realize after-tax cash flows of $5,000.Assuming a 12% discount rate,calculate the total present value of the cash savings.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

74

66.Baird Bros.Construction is considering the purchase of a machine at a cost of $125,000.The machine is expected to generate cash flows of $20,000 per year for ten years and can be sold at the end of ten years for $10,000.The discount rate is 10%.Assume the machine would be paid for on the first day of year one,but that all other cash flows occur at the end of the year.Ignore income tax considerations.Determine if Baird should purchase the machine.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck