Deck 6: Time Value of Money Concepts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

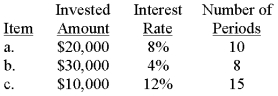

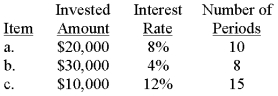

Question

Question

Question

Question

Question

Question

Question

Question

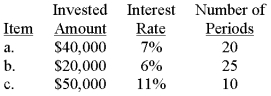

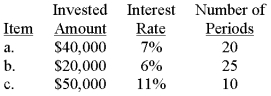

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/111

Play

Full screen (f)

Deck 6: Time Value of Money Concepts

1

The calculation of future value requires the removal of interest.

False

2

Given identical current amounts owed and identical interest rates, annual payments of an ordinary annuity will be greater than annual payments of an annuity due.

True

3

When interest is compounded, the stated rate of interest exceeds the effective rate of interest.

False

4

Shane wants to invest money in a 6% CD account that compounds semiannually. Shane would like the account to have a balance of $100,000 four years from now. How much must Shane deposit to accomplish his goal?

A)$88,848.

B)$78,941.

C)$25,336.

D)$22,510.PV = $100,000 x .78941* = $78,941 *PV of $1: n=8; i=3%

A)$88,848.

B)$78,941.

C)$25,336.

D)$22,510.PV = $100,000 x .78941* = $78,941 *PV of $1: n=8; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

5

With an ordinary annuity, a payment is made or received on the date the agreement begins.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

6

A deferred annuity is one in which interest charges are deferred for a stated time period.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

7

Other things being equal, the present value of an annuity due will be less than the present value of an ordinary annuity.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

8

An annuity is a series of equal periodic payments.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

9

An annuity consists of level principal payments plus interest on the unpaid balance.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

10

The calculation of present value eliminates interest from future cash flows.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

11

Today Thomas deposited $100,000 in a three-year, 12% CD that compounds quarterly. What is the maturity value of the CD?

A)$109,270.

B)$119,410.

C)$142,576.

D)$309,090.FV = $100,000 x 1.42576* = $142,576 *FV of $1: n = 12; i = 3%

A)$109,270.

B)$119,410.

C)$142,576.

D)$309,090.FV = $100,000 x 1.42576* = $142,576 *FV of $1: n = 12; i = 3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

12

Compound interest includes interest earned on interest.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

13

The company's credit-adjusted risk-free rate of interest is used when computing present value applying the expected cash flow approach.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

14

In the future value of an ordinary annuity, the last cash payment will not earn any interest.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

15

Carol wants to invest money in a 6% CD account that compounds semiannually. Carol would like the account to have a balance of $50,000 five years from now. How much must Carol deposit to accomplish her goal?

A)$35,069.

B)$43,131.

C)$37,205.

D)$35,000.PV = $50,000 x .744409* = $37,205 *PV of $1: n=10; i=3%

A)$35,069.

B)$43,131.

C)$37,205.

D)$35,000.PV = $50,000 x .744409* = $37,205 *PV of $1: n=10; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

16

Bill wants to give Maria a $500,000 gift in seven years. If money is worth 6% compounded semiannually, what is Maria's gift worth today?

A)$ 66,110.

B)$ 81,310.

C)$406,550.

D)$330,560.PV = $500,000 x .66112* = $330,560 *PV of $1: n=14; i=3%

A)$ 66,110.

B)$ 81,310.

C)$406,550.

D)$330,560.PV = $500,000 x .66112* = $330,560 *PV of $1: n=14; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

17

Monetary assets include only cash and cash equivalents.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

18

Most, but not all, liabilities are monetary liabilities.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

19

With an annuity due, a payment is made or received on the date the agreement begins.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

20

Monica wants to sell her share of an investment to Barney for $50,000 in three years. If money is worth 6% compounded semiannually, what would Monica accept today?

A)$ 8,375.

B)$41,874.

C)$11,941.

D)$41,000.PV = $50,000 x .83748* = $41,874 *PV of $1: n=6; i=3%

A)$ 8,375.

B)$41,874.

C)$11,941.

D)$41,000.PV = $50,000 x .83748* = $41,874 *PV of $1: n=6; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

21

Column 3 is an interest table for the:

A)Present value of 1.

B)Future value of 1.

C)Present value of an ordinary annuity of 1.

D)Present value of an annuity due of 1.

A)Present value of 1.

B)Future value of 1.

C)Present value of an ordinary annuity of 1.

D)Present value of an annuity due of 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

22

Shelley wants to cash in her winning lottery ticket. She can either receive ten, $100,000 semiannual payments starting today, or she can receive a lump-sum payment now based on a 6% annual interest rate. What is the equivalent lump-sum payment?

A)$853,020.

B)$801,971.

C)$744,090.

D)$878,611.PVAD = $100,000 x 8.78611* = $878,611 *PVAD of $1: n=10; i=3%

A)$853,020.

B)$801,971.

C)$744,090.

D)$878,611.PVAD = $100,000 x 8.78611* = $878,611 *PVAD of $1: n=10; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

23

Ajax Company purchased a five-year certificate of deposit for their building fund in the amount of $220,000. How much should the certificate of deposit be worth at the end of five years if interest is compounded at an annual rate of 9%?

A)$857,230.

B)$142,985.

C)$319,000.

D)$338,496.FV = $220,000 x 1.53862* = $338,496 *FV of $1: n=5; i=9%

A)$857,230.

B)$142,985.

C)$319,000.

D)$338,496.FV = $220,000 x 1.53862* = $338,496 *FV of $1: n=5; i=9%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

24

On January 1, 2009, you are considering making an investment that will pay three annual payments of $10,000. The first payment is not expected until December 31, 2012. You are eager to earn 3%. What is the present value of the investment on January 1, 2009?

A)$28,286.

B)$25,886.

C)$26,662.

D)$27,300.PVA = $10,000 x (5.41719* - 2.82861**) = $25,886 *PVA of $1: n=6; i=3% **PVA of $1: n=3; i=3%

A)$28,286.

B)$25,886.

C)$26,662.

D)$27,300.PVA = $10,000 x (5.41719* - 2.82861**) = $25,886 *PVA of $1: n=6; i=3% **PVA of $1: n=3; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

25

Debbie has $368,882 accumulated in a 401K plan. The fund is earning a low, but safe, 3% a year. The withdrawals will take place annually starting today. How soon will the fund be exhausted if Debbie withdraws $30,000 each year?

A)15 years.

B)16 years.

C)14 years.

D)12.3 years.$368,882 $30,000 = 12.29607 For PVAD of $1 factor of 12.29607 and i of 3%, n = 15

A)15 years.

B)16 years.

C)14 years.

D)12.3 years.$368,882 $30,000 = 12.29607 For PVAD of $1 factor of 12.29607 and i of 3%, n = 15

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

26

Reba wishes to know how much would be in her savings account if she deposits a given sum in an account and leaves it there at 6% interest for five years. She should use a table for the:

A)Future value of an ordinary annuity of 1.

B)Future value of 1.

C)Future value of an annuity of 1.

D)Present value of an annuity due of 1.

A)Future value of an ordinary annuity of 1.

B)Future value of 1.

C)Future value of an annuity of 1.

D)Present value of an annuity due of 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

27

Column 5 is an interest table for the:

A)Present value of 1.

B)Future value of 1.

C)Present value of an ordinary annuity of 1.

D)Present value of an annuity due of 1.

A)Present value of 1.

B)Future value of 1.

C)Present value of an ordinary annuity of 1.

D)Present value of an annuity due of 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

28

Column 1 is an interest table for the:

A)Present value of an ordinary annuity of 1.

B)Future value of an ordinary annuity of 1.

C)Present value of an annuity due of 1.

D)Future value of an annuity due of 1.

A)Present value of an ordinary annuity of 1.

B)Future value of an ordinary annuity of 1.

C)Present value of an annuity due of 1.

D)Future value of an annuity due of 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

29

On January 1, 2009, you are considering making an investment that will pay three annual payments of $10,000. The first payment is not expected until December 31, 2011. You are eager to earn 3%. What is the present value of the investment on January 1, 2009?

A)$26,662.

B)$27,462.

C)$28,286.

D)$29,135.PVA = $10,000 x ( 4.57971* - 1.91347**) = $26,662 *PVA of $1: n=5; i=3% **PVA of $1: n=2; i=3%

A)$26,662.

B)$27,462.

C)$28,286.

D)$29,135.PVA = $10,000 x ( 4.57971* - 1.91347**) = $26,662 *PVA of $1: n=5; i=3% **PVA of $1: n=2; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

30

At the end of each quarter, Patti deposits $500 into an account that pays 12% interest compounded quarterly. How much will Patti have in the account in three years?

A)$7,096.

B)$7,013.

C)$7,129.

D)$8,880.FVA = $500 x 14.1920* = $7,096 *FVA of $1: n=12; i=3%

A)$7,096.

B)$7,013.

C)$7,129.

D)$8,880.FVA = $500 x 14.1920* = $7,096 *FVA of $1: n=12; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

31

Column 4 is an interest table for the:

A)Present value of an ordinary annuity of 1.

B)Future value of an ordinary annuity of 1.

C)Present value of an annuity due of 1.

D)Future value of an annuity due of 1.

A)Present value of an ordinary annuity of 1.

B)Future value of an ordinary annuity of 1.

C)Present value of an annuity due of 1.

D)Future value of an annuity due of 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

32

Sondra deposits $2,000 in an IRA account on April 15, 2009. Assume the account will earn 3% annually. If she repeats this for the next nine years, how much will she have on deposit on April 14, 2019?

A)$20,600.

B)$20,728.

C)$23,616.

D)$24,715.FVAD = $2,000 x 11.8078* = $23,616 *FVAD of $1: n=10; i=3%

A)$20,600.

B)$20,728.

C)$23,616.

D)$24,715.FVAD = $2,000 x 11.8078* = $23,616 *FVAD of $1: n=10; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

33

Jose wants to cash in his winning lottery ticket. He can either receive five, $5,000 semiannual payments starting today, or he can receive a lump-sum payment now based on a 6% annual interest rate. What would be the lump-sum payment?

A)$23,586.

B)$22,899.

C)$21,565.

D)$23,000.PVAD = $ 5,000 x 4.71710* = $23,586 *PVAD of $1: n=5; i=3%

A)$23,586.

B)$22,899.

C)$21,565.

D)$23,000.PVAD = $ 5,000 x 4.71710* = $23,586 *PVAD of $1: n=5; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

34

Micro Brewery borrows $300,000 to be paid off in three years. The loan payments are semiannual with the first payment due in six months, and interest is at 6%. What is the amount of each payment?

A)$ 55,379.

B)$106,059.

C)$ 30,138.

D)$ 60,276.$300,000 5.41719* = $55,379 *PVA of $1: n=6; i=3%

A)$ 55,379.

B)$106,059.

C)$ 30,138.

D)$ 60,276.$300,000 5.41719* = $55,379 *PVA of $1: n=6; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

35

A firm leases equipment under a capital lease (analogous to an installment purchase) that calls for twelve semiannual payments of $39,014.40. The first payment is due at the inception of the lease. The annual rate on the lease is 6%. What is the value of the leased asset at inception of the lease?

A)$388,349.

B)$400,000.

C)$454,128.

D)$440,082.PVAD = $39,014.40 x 10.25262 * = $400,000 *PVAD of $1: n=12; i=3%

A)$388,349.

B)$400,000.

C)$454,128.

D)$440,082.PVAD = $39,014.40 x 10.25262 * = $400,000 *PVAD of $1: n=12; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

36

Jimmy has $255,906 accumulated in a 401K plan. The fund is earning a low, but safe, 3% a year. The withdrawals will take place at the end of each year starting a year from now. How soon will the fund be exhausted if Jimmy withdraws $30,000 each year?

A)11 years.

B)10 years.

C)8.5 years.

D)8.8 years.$255,906 $30,000 = 8.5302 For PVA of $1 factor of 8.5302 and i of 3%, n = 10

A)11 years.

B)10 years.

C)8.5 years.

D)8.8 years.$255,906 $30,000 = 8.5302 For PVA of $1 factor of 8.5302 and i of 3%, n = 10

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

37

Rosie's Florist borrows $300,000 to be paid off in six years. The loan payments are semiannual with the first payment due in six months, and interest is at 6%. What is the amount of each payment?

A)$25,750.

B)$29,761.

C)$30,139.

D)$25,500.$300,000 9.95400* = $30,139 *PVA of $1: n=12; i=3%

A)$25,750.

B)$29,761.

C)$30,139.

D)$25,500.$300,000 9.95400* = $30,139 *PVA of $1: n=12; i=3%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

38

Column 2 is an interest table for the:

A)Present value of an ordinary annuity of 1.

B)Future value of an ordinary annuity of 1.

C)Present value of an annuity due of 1.

D)Future value of an annuity due of 1.

A)Present value of an ordinary annuity of 1.

B)Future value of an ordinary annuity of 1.

C)Present value of an annuity due of 1.

D)Future value of an annuity due of 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

39

Column 6 is an interest table for the:

A)Present value of an ordinary annuity of 1.

B)Future value of an ordinary annuity of 1.

C)Present value of an annuity due of 1.

D)Future value of an annuity due of 1.

A)Present value of an ordinary annuity of 1.

B)Future value of an ordinary annuity of 1.

C)Present value of an annuity due of 1.

D)Future value of an annuity due of 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

40

At the end of the next four years, a new machine is expected to generate net cash flows of $8,000, $12,000, $10,000, and $15,000, respectively. What are the cash flows worth today if a 3% interest rate properly reflects the time value of money in this situation?

A)$41,556.

B)$47,700.

C)$32,400.

D)$38,100.($8,000 x .97087) + ($12,000 x .94260) + ($10,000 x .91514) + ($15,000 x .88849) = $7,767 + 11,311 + 9,151 + 13,327 = $41,556

A)$41,556.

B)$47,700.

C)$32,400.

D)$38,100.($8,000 x .97087) + ($12,000 x .94260) + ($10,000 x .91514) + ($15,000 x .88849) = $7,767 + 11,311 + 9,151 + 13,327 = $41,556

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

41

A series of equal periodic payments that starts more than one period after the agreement is called:

A)An annuity due.

B)An ordinary annuity.

C)A future annuity.

D)A deferred annuity.

A)An annuity due.

B)An ordinary annuity.

C)A future annuity.

D)A deferred annuity.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

42

To determine the future value factor for an annuity due for period n when given tables only for an ordinary annuity:

A)Obtain the FVA factor for n+1 and deduct 1.

B)Obtain the FVA factor for n and deduct 1.

C)Obtain the FVA factor for n-1 and add 1.

D)Obtain the FVA factor for n+1 and add 1.

A)Obtain the FVA factor for n+1 and deduct 1.

B)Obtain the FVA factor for n and deduct 1.

C)Obtain the FVA factor for n-1 and add 1.

D)Obtain the FVA factor for n+1 and add 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

43

Zulu Corporation hires a new chief executive officer and promises to pay her a signing bonus of $2 million per year for 10 years, starting five years after she joins the company. The liability for this bonus when the CEO is hired:

A)Is the present value of a deferred annuity.

B)Is the present value of an annuity due.

C)Is $20 million.

D)Is zero because no cash is owed for five years.

A)Is the present value of a deferred annuity.

B)Is the present value of an annuity due.

C)Is $20 million.

D)Is zero because no cash is owed for five years.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

44

How much must be deposited at the beginning of each year in order to accumulate to $10,000 in four years if interest is at 9%?

A)$1,671.

B)$2,570.

C)$2,358.

D)$2,006.$10,000 4.9847* = $2,006 *FVAD of $1: n=4; i=9%

A)$1,671.

B)$2,570.

C)$2,358.

D)$2,006.$10,000 4.9847* = $2,006 *FVAD of $1: n=4; i=9%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

45

Claudine Corporation will deposit $5,000 into a money market sinking fund at the end of each year for the next five years. How much will accumulate by the end of the fifth and final payment if the sinking fund earns 9% interest?

A)$32,617.

B)$29,924.

C)$27,250.

D)$26,800.FVA = $5,000 x 5.9847* = $29,924 *FVA of $1: n=5; i=9%

A)$32,617.

B)$29,924.

C)$27,250.

D)$26,800.FVA = $5,000 x 5.9847* = $29,924 *FVA of $1: n=5; i=9%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

46

Davenport Inc. offers a new employee a lump sum signing bonus at the date of employment. Alternatively, the employee can take $30,000 at the date of employment and another $50,000 two years later. Assuming the employee's time value of money is 8% annually, what lump sum at employment date would make her indifferent between the two options?

A)$60,000.

B)$62,867.

C)$72,867.

D)$80,000.The lump sum equivalent would be $30,000 + the present value of $50,000 where n=2 and i=8%.That is, $30,000 + ($50,000 x 0.85734 from Table 2) = $72,867.

A)$60,000.

B)$62,867.

C)$72,867.

D)$80,000.The lump sum equivalent would be $30,000 + the present value of $50,000 where n=2 and i=8%.That is, $30,000 + ($50,000 x 0.85734 from Table 2) = $72,867.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

47

Simpson Mining is obligated to restore leased land to its original condition after its excavation activities are over in three years. The cash flow possibilities and probabilities for the restoration costs in three years are as follows: The company's credit-adjusted risk-free interest rate is 5%. The liability that Simpson must record at the beginning of the project for the restoration costs is:

A)$ 129,576.

B)$ 145,000.

C)$ 125,257.

D)$ 172,768.

A)$ 129,576.

B)$ 145,000.

C)$ 125,257.

D)$ 172,768.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following must be known to compute the interest rate paid from financing an asset purchase with an annuity?

A)Fair value of the asset purchased, number and dollar amount of the annuity payments.

B)Present value of the annuity, dollar amount and timing of the annuity payments.

C)Fair value of the asset and timing of the annuity payments.

D)Number of annuity payments and future value of the annuity.

A)Fair value of the asset purchased, number and dollar amount of the annuity payments.

B)Present value of the annuity, dollar amount and timing of the annuity payments.

C)Fair value of the asset and timing of the annuity payments.

D)Number of annuity payments and future value of the annuity.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

49

An investment product promises to pay $42,000 at the end of ten years. If an investor feels this investment should produce a rate of return of 12 percent, compounded annually, what's the most the investor should be willing to pay for the investment?

A)$ 15,146.

B)$ 13,523.

C)$ 42,000.

D)$130,446.$42,000 x .32197* = $13,523 (rounded) *PV of $1: n=10; i=12%

A)$ 15,146.

B)$ 13,523.

C)$ 42,000.

D)$130,446.$42,000 x .32197* = $13,523 (rounded) *PV of $1: n=10; i=12%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

50

Polo Publishers purchased a multi-color offset press with terms of $50,000 down and a noninterest-bearing note requiring payment of $20,000 at the end of each year for five years. The interest rate implicit in the purchase contract is 11%. Polo would record the asset at:

A)$109,618.

B)$123,918.

C)$130,000.

D)$169,560.$50,000 + ($20,000 x 3.69590) = $123,918 *PVA of $1: n=5; i=11%

A)$109,618.

B)$123,918.

C)$130,000.

D)$169,560.$50,000 + ($20,000 x 3.69590) = $123,918 *PVA of $1: n=5; i=11%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

51

Mustard's Inc. sold the rights to use one of their patented processes that will result in cash receipts of $2,500 at the end of each of the next four years and a lump sum receipt of $4,000 at the end of the fifth year. The total present value of these payments if interest is at 9% is:

A)$10,699.

B)$11,468.

C)$12,100.

D)$14,000.

A)$10,699.

B)$11,468.

C)$12,100.

D)$14,000.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

52

An investor purchases a 20-year, $1,000 par value bond that pays semiannual interest of $40. If the semiannual market rate of interest is five percent, what is the current market value of the bond?

A)$ 858.

B)$1,686 .

C)$1,000.

D)$ 893.*PVA of $1: n=40; i=5% **PV of $1: n=40; i=5%

A)$ 858.

B)$1,686 .

C)$1,000.

D)$ 893.*PVA of $1: n=40; i=5% **PV of $1: n=40; i=5%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

53

LeAnn wishes to know how much she should set aside now at 7% interest in order to accumulate a sum of $5,000 in four years. She should use a table for the:

A)Present value of 1.

B)Future value of 1.

C)Present value of an ordinary annuity of 1.

D)Future value of an annuity due of 1.

A)Present value of 1.

B)Future value of 1.

C)Present value of an ordinary annuity of 1.

D)Future value of an annuity due of 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

54

Yamaha Inc. hires a new chief financial officer and promises to pay him a lump sum bonus four years after he joins the company. The new CFO insists that the company invest an amount of money at the beginning of each year in a 7% fixed rate investment fund to insure the bonus will be available. To determine the amount that must be invested each year, a computation must be made using the formula for:

A)The future value of a deferred annuity.

B)The future value of an ordinary annuity.

C)The future value of an annuity due.

D)None of these is correct.

A)The future value of a deferred annuity.

B)The future value of an ordinary annuity.

C)The future value of an annuity due.

D)None of these is correct.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

55

Mary Alice just won the lottery and is trying to decide between the annual cash flow payment option of $250,000 per year for 25 years beginning today and the lump sum option. Mary Alice can earn 6 percent investing his money. At what lump-sum payment amount would she be indifferent between the two alternatives?

A)$6,250,000.

B)$3,195,840.

C)$3,637,590.

D)$3,387,590.$250,000 x 13.55036* = $3,387,590 *PVAD of $1: n=25; i=6%

A)$6,250,000.

B)$3,195,840.

C)$3,637,590.

D)$3,387,590.$250,000 x 13.55036* = $3,387,590 *PVAD of $1: n=25; i=6%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

56

Titanic Corporation leased executive limos under terms of $20,000 down and four equal annual payments of $30,000 on the anniversary date of the lease. The interest rate implicit in the lease is 11%. The first year's interest expense would be:

A)$13,200.

B)$10,238.

C)$33,200.

D)$15,543.PVA = $30,000 x 3.10245* = $93,074 $93,074 x 11% = $10,238

*PVA of $1: n=4; i=11%

A)$13,200.

B)$10,238.

C)$33,200.

D)$15,543.PVA = $30,000 x 3.10245* = $93,074 $93,074 x 11% = $10,238

*PVA of $1: n=4; i=11%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

57

A series of equal periodic payments in which the first payment is made one compounding period after the date of the contract is:

A)A deferred annuity.

B)An ordinary annuity.

C)An annuity due.

D)A delayed annuity.

A)A deferred annuity.

B)An ordinary annuity.

C)An annuity due.

D)A delayed annuity.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

58

How much must be invested now at 9% interest to accumulate to $10,000 in five years?

A)$9,176.

B)$6,499.

C)$5,500.

D)$5,960.PV = $10,000 x .64993* = $6,499 *PV of $1: n=5; i=9%

A)$9,176.

B)$6,499.

C)$5,500.

D)$5,960.PV = $10,000 x .64993* = $6,499 *PV of $1: n=5; i=9%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

59

Spielberg Inc. signed a $200,000 noninterest-bearing note due in five years from a production company eager to do business. Comparable borrowings have carried an 11% interest rate. At what amount should this debt be valued at its inception?

A)$200,000.

B)$178,000.

C)$118,690.

D)$222,000.PV = $200,000 x .59345* = $118,690 *PV of $1: n=5; i=11%

A)$200,000.

B)$178,000.

C)$118,690.

D)$222,000.PV = $200,000 x .59345* = $118,690 *PV of $1: n=5; i=11%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

60

On October 1, 2009, Justine Company purchased equipment from Napa Inc. in exchange for a noninterest-bearing note payable in five equal annual payments of $500,000, beginning Oct 1, 2010. Similar borrowings have carried an 11% interest rate. The equipment would be recorded at:

A)$2,500,000.

B)$2,225,000.

C)$1,847,950.

D)$2,115,270.PVA = $500,000 x 3.69590* = $1,847,950 *PVA of $1: n=5; i=11%

A)$2,500,000.

B)$2,225,000.

C)$1,847,950.

D)$2,115,270.PVA = $500,000 x 3.69590* = $1,847,950 *PVA of $1: n=5; i=11%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

61

Koko Company pays $10 million at the beginning of each year for 10 years to Mocha Inc. for a building with a fair value of $75 million. What interest rate is Mocha earning on financing this land sale?

A)Between 13% and 14%.

B)Between 7% and 8%.

C)Between 5.5% and 6%.

D)Cannot be determined from the given information.That is, the present value of a 10-year annuity due of $10 million is $75 million, when the discount factor (from Table 6) equals 7.5000.That point is between 7% and 8% in the table.

A)Between 13% and 14%.

B)Between 7% and 8%.

C)Between 5.5% and 6%.

D)Cannot be determined from the given information.That is, the present value of a 10-year annuity due of $10 million is $75 million, when the discount factor (from Table 6) equals 7.5000.That point is between 7% and 8% in the table.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

62

DON Corp. is contemplating the purchase of a machine that will produce net after-tax cash savings of $20,000 per year for 5 years. At the end of five years, the machine can be sold to realize after-tax cash flows of $5,000. Interest is 12%. Assume the cash flows occur at the end of each year.

Required: Calculate the total present value of the cash savings.

Required: Calculate the total present value of the cash savings.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

63

George Jones is planning on a cruise for his 70th birthday party. He wants to know how much he should set aside at the beginning of each month at 6% interest to accumulate the sum of $4,800 in five years. He should use a table for the:

A)Future value of an ordinary annuity of 1.

B)Future value of an annuity due of 1.

C)Future value of 1.

D)Present value of an annuity due of 1.

A)Future value of an ordinary annuity of 1.

B)Future value of an annuity due of 1.

C)Future value of 1.

D)Present value of an annuity due of 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

64

You borrow $20,000 to buy a boat. The loan is to be paid off in monthly installments over one year at 18 percent interest annually. The first payment is due one month from today. What is the amount of each monthly payment?

A)$1,667.

B)$1,511.

C)$1,834.

D)None of these.$20,000 10.90751* = $1,834 (rounded) *PVA of $1: n=12; i=1.5%

A)$1,667.

B)$1,511.

C)$1,834.

D)None of these.$20,000 10.90751* = $1,834 (rounded) *PVA of $1: n=12; i=1.5%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

65

Suppose that Healdsburg renegotiates the 8% notes on December 31, 2014 when the going interest rate is 8%. Healdsburg agrees to make 12 equal annual installments, commencing on December 31, 2015, rather than pay the $225 million in a lump sum at maturity. What would the annual payments be?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

66

Compute the future value of the following invested amounts at the specified periods and interest rates.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

67

Quaker State Inc. offers a new employee a lump sum signing bonus at the date of employment. Alternatively, the employee can take $8,000 at the date of employment plus $20,000 at the end of each of his first three years of service. Assuming the employee's time value of money is 10% annually, what lump sum at employment date would make him indifferent between the two options?

A)$23,026.

B)$57,737.

C)$62,711.

D)None of these is correct.The lump sum equivalent would be $8,000 + the present value of a $20,000 ordinary annuity where n=3 and i=10%.That is, $8,000 + ($20,000 x 2.48685 from Table 4) = $57,737.

A)$23,026.

B)$57,737.

C)$62,711.

D)None of these is correct.The lump sum equivalent would be $8,000 + the present value of a $20,000 ordinary annuity where n=3 and i=10%.That is, $8,000 + ($20,000 x 2.48685 from Table 4) = $57,737.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

68

Tammy wants to buy a car that costs $10,000 and wishes to know the amount of the monthly payments, which will be made at the first of the month, with interest of 12% on the unpaid balance. She should use a table for the:

A)Present value of 1.

B)Present value of an ordinary annuity of 1.

C)Present value of an annuity due of 1.

D)Future value of an annuity due of 1.

A)Present value of 1.

B)Present value of an ordinary annuity of 1.

C)Present value of an annuity due of 1.

D)Future value of an annuity due of 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

69

First Financial Auto Loan Department wishes to know the payment required at the first of each month on a $10,500, 48-month, 11% auto loan. To determine this amount, First Financial would:

A)Multiply $10,500 by the present value of 1.

B)Divide $10,500 by the future value of an ordinary annuity of 1.

C)Divide $10,500 by the present value of an annuity due of 1.

D)Multiply $10,500 by the present value of an ordinary annuity of 1.

A)Multiply $10,500 by the present value of 1.

B)Divide $10,500 by the future value of an ordinary annuity of 1.

C)Divide $10,500 by the present value of an annuity due of 1.

D)Multiply $10,500 by the present value of an ordinary annuity of 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

70

The total cash interest payments in 2009 for these notes.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

71

Sandra won $5,000,000 in the state lottery which she has elected to receive at the end of each month over the next thirty years. She will receive 7% interest on unpaid amounts. To determine the amount of her monthly check, she should use a table for the:

A)Present value of an annuity of 1.

B)Future value of an annuity due of 1.

C)Present value of an ordinary annuity of 1.

D)Future value of an ordinary annuity of 1.

A)Present value of an annuity of 1.

B)Future value of an annuity due of 1.

C)Present value of an ordinary annuity of 1.

D)Future value of an ordinary annuity of 1.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

72

Suppose that Healdsburg wants to buy back the 7.75% notes on December 31, 2009 (i.e., 5 years early) when the going interest rate is 6%, thereby retiring the $345,154,000 in debt. How much would Healdsburg have to pay for the notes (principal only)?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

73

Suppose that Healdsburg enters into a sales contract with an auto manufacturer on January 1, 2009, to provide tires that cost Healdsburg $18 million to produce. The buyer offers Healdsburg $6 million in cash and agrees to take over the principal payment only on Healdsburg 's 6.55% debt notes. Assume that the going market interest is 7% at the time. What would Healdsburg's gross profit be on the sale?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

74

Compute the present value of the following single amounts to be received at the end of the specified period at the given interest rate.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

75

Garland Inc. offers a new employee a lump sum signing bonus at the date of employment, June 1, 2009. Alternatively, the employee can take $39,000 at the date of employment plus $10,000 each June 1 for five years, beginning in 2013. Assuming the employee's time value of money is 9% annually, what lump sum at employment date would make him indifferent between the two options?

A)$44,035.

B)$40,855.

C)$69,035.

D)$65,855.The lump sum equivalent would be $39,000 + the present value of a $10,000 deferred annuity.The present value of the deferred annuity on June 1, 2010 is an annuity due with n=5 and i=9%.That is, ($10,000 x 4.23972 from Table 6) = $42,397.To compute the equivalent of that amount at employment date, we take the present value of $42,397 where n=4 and i=9% from Table 2, which is $42,397 x 0.70843 = $30,035.Therefore, the lump sum equivalent would be $39,000 + $30,035 = $69,035.

A)$44,035.

B)$40,855.

C)$69,035.

D)$65,855.The lump sum equivalent would be $39,000 + the present value of a $10,000 deferred annuity.The present value of the deferred annuity on June 1, 2010 is an annuity due with n=5 and i=9%.That is, ($10,000 x 4.23972 from Table 6) = $42,397.To compute the equivalent of that amount at employment date, we take the present value of $42,397 where n=4 and i=9% from Table 2, which is $42,397 x 0.70843 = $30,035.Therefore, the lump sum equivalent would be $39,000 + $30,035 = $69,035.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

76

Chancellor Ltd. sells an asset with a $1 million fair value to Sophie Inc. Sophie agrees to make 6 equal payments, one year apart, commencing on the date of sale. The payments include principal and 6% annual interest. Compute the annual payments.

A)$166,651.

B)$135,252.

C)$203,351.

D)$191,852.We compute the annual payments in the present value of an annuity due formula, where the present value is $1 million, n=6 and i=6%.The discount factor (from table 6) is 5.21236.Dividing $1 million by this factor gives payments of $191,852.

A)$166,651.

B)$135,252.

C)$203,351.

D)$191,852.We compute the annual payments in the present value of an annuity due formula, where the present value is $1 million, n=6 and i=6%.The discount factor (from table 6) is 5.21236.Dividing $1 million by this factor gives payments of $191,852.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

77

Kunkle Company wishes to earn 20% annually on its investments. If it makes an investment that equals or exceeds that rate, it considers it a success. Assume that it invests $2 million and gets $500,000 in return at the end of each year fox X years. What is the minimum value of X for which it will consider the investment a success? Assume that it can't invest for fractional parts of a year.

A)4 years.

B)6 years.

C)7 years.

D)9 years.The investment is successful when the present value of the ordinary annuity = $2 million.This is when the PV factor (from Table 4) is at least 4.0, so that multiplied by $500,000; it is at least $2 million.In Table 4, at i=20%, the factor passes the 4.0 level in year 9.

A)4 years.

B)6 years.

C)7 years.

D)9 years.The investment is successful when the present value of the ordinary annuity = $2 million.This is when the PV factor (from Table 4) is at least 4.0, so that multiplied by $500,000; it is at least $2 million.In Table 4, at i=20%, the factor passes the 4.0 level in year 9.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

78

On January 1, 2009, Glanville Company sold goods to Otter Corporation. Otter signed a noninterest-bearing note requiring payment of $15,000 annually for six years. The first payment was made on January 1, 2009. The prevailing rate of interest for this type of note at date of issuance was 8%. Glanville should record the sales revenue in January 2009 of:

A)$90,000.

B)$69,343.

C)$74,891.

D)None of these.$15,000 x 4.99271* = $74,891 (rounded) *PVAD of $1: n=6; i=8%

A)$90,000.

B)$69,343.

C)$74,891.

D)None of these.$15,000 x 4.99271* = $74,891 (rounded) *PVAD of $1: n=6; i=8%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

79

Fenland Co. plans to retire $100 million in bonds in five years, so it wishes to create a fund by making equal investments at the beginning of each year during that period in an account it expects to earn 8% annually. What amount does Fenland need to invest each year?

A)$15,783,077.

B)$17,045,650.

C)$23,190,400.

D)Cannot be determined from the given information.This is the amount in the future value of an annuity due formula, where $100 million = investment amount x factor from Table 5 where n=5 and i=8%.Thus, Investment amount = $100 million 6.3359 = $15,783,077.

A)$15,783,077.

B)$17,045,650.

C)$23,190,400.

D)Cannot be determined from the given information.This is the amount in the future value of an annuity due formula, where $100 million = investment amount x factor from Table 5 where n=5 and i=8%.Thus, Investment amount = $100 million 6.3359 = $15,783,077.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

80

Touche Manufacturing is considering a rearrangement of its manufacturing operations. A consultant estimates that the rearrangement should result in after-tax cash savings of $6,000 the first year, $10,000 for the next two years, and $12,000 for the next two years. Interest is at 12%. Assume cash flows occur at the end of the year.

Required: Calculate the total present value of the cash flows.

Required: Calculate the total present value of the cash flows.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck