Deck 3: The Financial Reporting Process

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

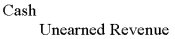

Question

Question

Question

Question

Question

Question

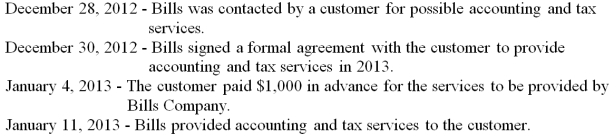

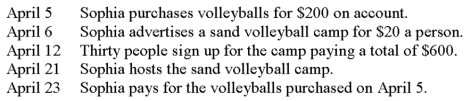

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

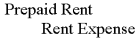

Question

Question

Question

Question

Question

Question

Question

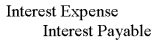

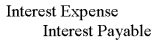

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/183

Play

Full screen (f)

Deck 3: The Financial Reporting Process

1

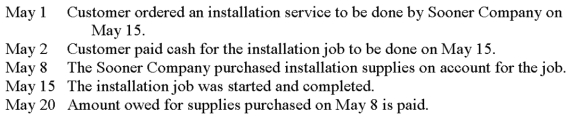

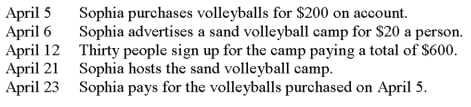

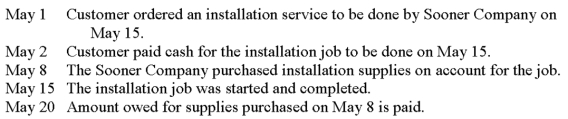

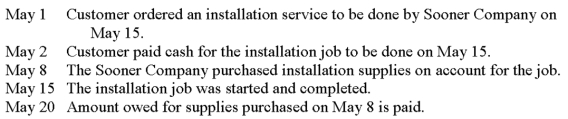

The following information pertains to Sooner Company:  Assuming that Sooner Company uses cash-basis accounting, when would the company record the expense related to the supplies?

Assuming that Sooner Company uses cash-basis accounting, when would the company record the expense related to the supplies?

A) May 2.

B) May 8.

C) May 15.

D) May 20.

Assuming that Sooner Company uses cash-basis accounting, when would the company record the expense related to the supplies?

Assuming that Sooner Company uses cash-basis accounting, when would the company record the expense related to the supplies?A) May 2.

B) May 8.

C) May 15.

D) May 20.

D

Explanation: Cash-basis expenses are recorded at the time cash is pai

Explanation: Cash-basis expenses are recorded at the time cash is pai

2

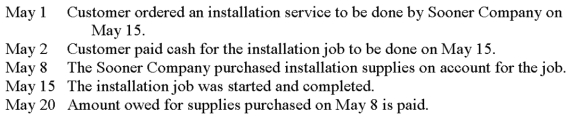

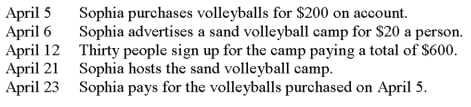

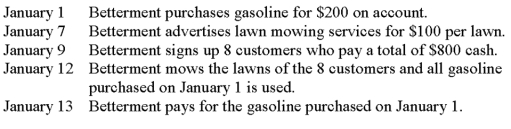

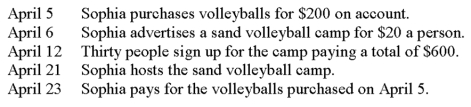

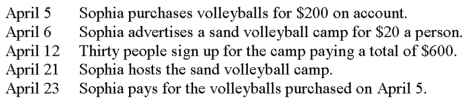

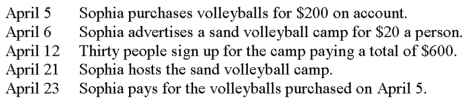

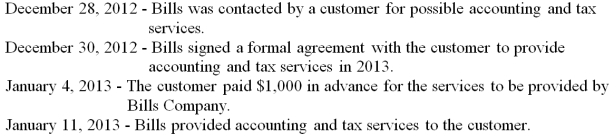

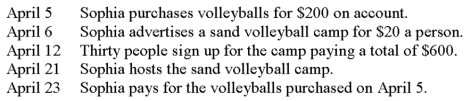

Consider the following events for Sophia Incorporated:  Under accrual-basis accounting, what is the appropriate day to record the expenses related to the sand volleyball camp?

Under accrual-basis accounting, what is the appropriate day to record the expenses related to the sand volleyball camp?

A) April 5.

B) April 12.

C) April 21.

D) April 23.

Under accrual-basis accounting, what is the appropriate day to record the expenses related to the sand volleyball camp?

Under accrual-basis accounting, what is the appropriate day to record the expenses related to the sand volleyball camp?A) April 5.

B) April 12.

C) April 21.

D) April 23.

C

Explanation: Accrual-basis expenses are recorded at the time they help to produce revenue.

Explanation: Accrual-basis expenses are recorded at the time they help to produce revenue.

3

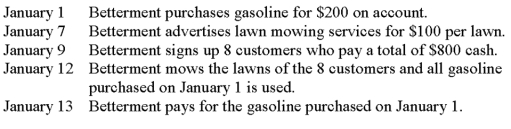

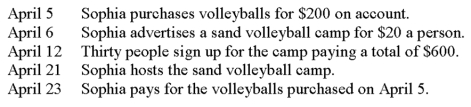

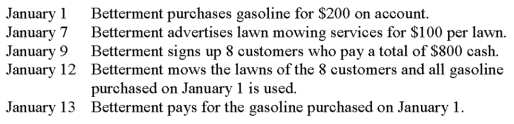

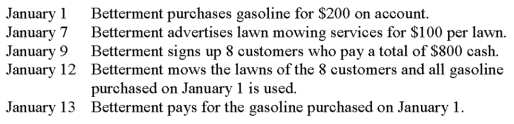

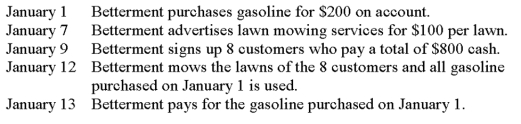

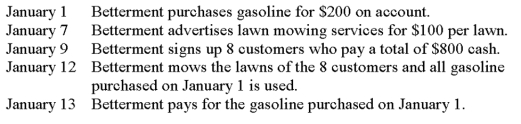

Consider the following events for Betterment Incorporated:  Under cash-basis accounting, what is the appropriate day to record the expenses related to the gasoline?

Under cash-basis accounting, what is the appropriate day to record the expenses related to the gasoline?

A) January 1.

B) January 9.

C) January 12.

D) January 13.

Under cash-basis accounting, what is the appropriate day to record the expenses related to the gasoline?

Under cash-basis accounting, what is the appropriate day to record the expenses related to the gasoline?A) January 1.

B) January 9.

C) January 12.

D) January 13.

D

Explanation: Cash-basis expenses are recorded at the time cash is pai

Explanation: Cash-basis expenses are recorded at the time cash is pai

4

Consider the following events for Sophia Incorporated:  Under accrual-basis accounting, what is the appropriate day to record the revenues from the sand volleyball camp?

Under accrual-basis accounting, what is the appropriate day to record the revenues from the sand volleyball camp?

A) April 5.

B) April 6.

C) April 12.

D) April 21.

Under accrual-basis accounting, what is the appropriate day to record the revenues from the sand volleyball camp?

Under accrual-basis accounting, what is the appropriate day to record the revenues from the sand volleyball camp?A) April 5.

B) April 6.

C) April 12.

D) April 21.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following accounting principles states that expenses are recognized in the same period as the revenues they help to generate?

A) Accounting equation.

B) Revenue recognition.

C) Matching principle.

D) Conservatism.

A) Accounting equation.

B) Revenue recognition.

C) Matching principle.

D) Conservatism.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

6

Which transaction would not be recorded under cash-basis accounting?

A) Providing services to customers for cash.

B) Purchasing one year of rent in advance.

C) Paying salaries to employees.

D) Purchasing supplies on account.

A) Providing services to customers for cash.

B) Purchasing one year of rent in advance.

C) Paying salaries to employees.

D) Purchasing supplies on account.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

7

When the balance of the Unearned Revenue account decreases during an accounting period:

A) Accrual-basis revenues exceed cash collections from customers.

B) Accrual-basis expenses exceed cash collections from customers.

C) Accrual-basis revenues are less than cash collections from customers.

D) Accrual-basis net income is less than cash-basis net income.

A) Accrual-basis revenues exceed cash collections from customers.

B) Accrual-basis expenses exceed cash collections from customers.

C) Accrual-basis revenues are less than cash collections from customers.

D) Accrual-basis net income is less than cash-basis net income.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

8

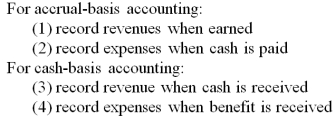

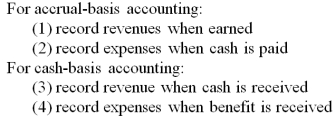

Which of the following statements are correct?

A) (1) and (4)

B) (2) and (3)

C) (1) and (3)

D) (2) and (4)

A) (1) and (4)

B) (2) and (3)

C) (1) and (3)

D) (2) and (4)

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

9

Air France collected cash on February 4 from the sale of a ticket to a customer on January 26.The flight took place on April 5. According to the revenue recognition principle, in which month should Air France have recognized this revenue?

A) January.

B) February.

C) April.

D) Evenly in each of the three months.

A) January.

B) February.

C) April.

D) Evenly in each of the three months.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

10

Consider the following events for Sophia Incorporated:  Under cash-basis accounting, what is the appropriate day to record the expenses related to the sand volleyball camp?

Under cash-basis accounting, what is the appropriate day to record the expenses related to the sand volleyball camp?

A) April 5.

B) April 12.

C) April 21.

D) April 23.

Under cash-basis accounting, what is the appropriate day to record the expenses related to the sand volleyball camp?

Under cash-basis accounting, what is the appropriate day to record the expenses related to the sand volleyball camp?A) April 5.

B) April 12.

C) April 21.

D) April 23.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

11

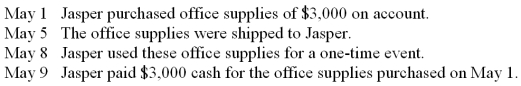

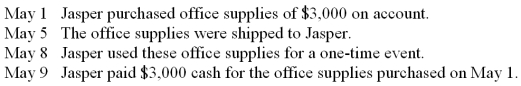

The following information pertains to Sooner Company:  Assuming that Sooner Company uses accrual-basis accounting, when would the company record the expense related to the supplies?

Assuming that Sooner Company uses accrual-basis accounting, when would the company record the expense related to the supplies?

A) May 2.

B) May 8.

C) May 15.

D) May 20.

Assuming that Sooner Company uses accrual-basis accounting, when would the company record the expense related to the supplies?

Assuming that Sooner Company uses accrual-basis accounting, when would the company record the expense related to the supplies?A) May 2.

B) May 8.

C) May 15.

D) May 20.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

12

Consider the following events for Betterment Incorporated:  Under accrual-basis accounting, what is the appropriate day to record the expenses related to the gasoline?

Under accrual-basis accounting, what is the appropriate day to record the expenses related to the gasoline?

A) January 1.

B) January 7.

C) January 12.

D) January 13.

Under accrual-basis accounting, what is the appropriate day to record the expenses related to the gasoline?

Under accrual-basis accounting, what is the appropriate day to record the expenses related to the gasoline?A) January 1.

B) January 7.

C) January 12.

D) January 13.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

13

The primary difference between accrual-basis and cash-basis accounting is:

A) The timing of when revenues and expenses are recorded.

B) Cash-basis accounting is allowed for financial reporting purposes but not accrual-basis accounting.

C) Accrual-basis accounting violates both the revenue recognition and matching principles.

D) Adjusting entries are only a necessary part of cash-basis accounting.

A) The timing of when revenues and expenses are recorded.

B) Cash-basis accounting is allowed for financial reporting purposes but not accrual-basis accounting.

C) Accrual-basis accounting violates both the revenue recognition and matching principles.

D) Adjusting entries are only a necessary part of cash-basis accounting.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

14

On July 1, 2012, Rents-A-Lot Inc. paid $72,000 for 36 months of advance rent on its warehouse. What would be the amount of rent expense in the 2013 financial statements for Rents-A-Lot under both cash-basis and accrual-basis accounting?

A) Cash-basis = $24,000; Accrual-basis = $24,000.

B) Cash-basis = $72,000; Accrual-basis = $12,000.

C) Cash-basis = $0; Accrual-basis = $24,000.

D) Cash-basis = $0; Accrual-basis = $12,000.

A) Cash-basis = $24,000; Accrual-basis = $24,000.

B) Cash-basis = $72,000; Accrual-basis = $12,000.

C) Cash-basis = $0; Accrual-basis = $24,000.

D) Cash-basis = $0; Accrual-basis = $12,000.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

15

A customer purchased a drill press on November 14 on account from Sears. The drill press was delivered two weeks later. The customer paid for the drill press on December 5. When should Sears record the revenue for this transaction according to the revenue recognition principle?

A) November.

B) December.

C) Evenly in each of the two months.

D) One-third in November and two-thirds in December.

A) November.

B) December.

C) Evenly in each of the two months.

D) One-third in November and two-thirds in December.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

16

When the amount of interest receivable decreases during an accounting period:

A) Accrual-basis revenues exceed cash collections from borrowers.

B) Accrual-basis net income exceeds cash-basis net income.

C) Accrual-basis revenues are less than cash collections from borrowers.

D) Accrual-basis expenses are less than cash payments to borrowers.

A) Accrual-basis revenues exceed cash collections from borrowers.

B) Accrual-basis net income exceeds cash-basis net income.

C) Accrual-basis revenues are less than cash collections from borrowers.

D) Accrual-basis expenses are less than cash payments to borrowers.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

17

Consider the following events for Betterment Incorporated:  Under accrual-basis accounting, what is the appropriate day to record the revenues related to lawn services?

Under accrual-basis accounting, what is the appropriate day to record the revenues related to lawn services?

A) January 1.

B) January 7.

C) January 9.

D) January 12.

Under accrual-basis accounting, what is the appropriate day to record the revenues related to lawn services?

Under accrual-basis accounting, what is the appropriate day to record the revenues related to lawn services?A) January 1.

B) January 7.

C) January 9.

D) January 12.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

18

The matching principle is the principle that states:

A) All costs that are used to generate revenue are recorded in the period the revenue is recognized.

B) All transactions are recorded at the exchange price.

C) The business is separate from its owners.

D) The business will continue to operate indefinitely unless there is evidence to the contrary.

A) All costs that are used to generate revenue are recorded in the period the revenue is recognized.

B) All transactions are recorded at the exchange price.

C) The business is separate from its owners.

D) The business will continue to operate indefinitely unless there is evidence to the contrary.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

19

Which accounting principle states that a company should "record revenues when they are earned"?

A) Matching

B) Revenue recognition

C) Conservatism

D) Materiality

A) Matching

B) Revenue recognition

C) Conservatism

D) Materiality

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

20

The revenue recognition principle states that:

A) Revenue should be recognized in the period the cash is received.

B) Revenue should be recognized in the period earned.

C) Revenue should be recognized in the balance sheet.

D) Revenue is a component of common stock.

A) Revenue should be recognized in the period the cash is received.

B) Revenue should be recognized in the period earned.

C) Revenue should be recognized in the balance sheet.

D) Revenue is a component of common stock.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

21

When a magazine sells subscriptions to customers, it is an example of:

A) An accrued expense.

B) An accrued revenue.

C) A prepaid expense.

D) An unearned revenue.

A) An accrued expense.

B) An accrued revenue.

C) A prepaid expense.

D) An unearned revenue.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

22

Pawn Shops Unlimited recorded the following four transactions during April. Which of these transactions would have the same income statement impact in April regardless of whether the company used accrual-basis or cash-basis accounting?

A) Received $600 from customers for services to be provided in May.

B) Paid $1,800 for a six-month insurance policy covering the period July 1-December 31.

C) Paid $700 for an advertisement that appeared in the April 17 edition of the Las Vegas Sun newspaper.

D) Received $300 from customers for services performed in March.

A) Received $600 from customers for services to be provided in May.

B) Paid $1,800 for a six-month insurance policy covering the period July 1-December 31.

C) Paid $700 for an advertisement that appeared in the April 17 edition of the Las Vegas Sun newspaper.

D) Received $300 from customers for services performed in March.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

23

An example of an adjusting entry would not include:

A) Recording the use of office supplies.

B) Recording the expiration of prepaid insurance.

C) Recording unpaid salaries.

D) Paying salaries to company employees.

A) Recording the use of office supplies.

B) Recording the expiration of prepaid insurance.

C) Recording unpaid salaries.

D) Paying salaries to company employees.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following would not typically be used as an adjusting entry?

A)

B)

C)

D) Unearned Revenue

Service Revenue

A)

B)

C)

D) Unearned Revenue

Service Revenue

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

25

Making insurance payments in advance is an example of:

A) An accrued revenue.

B) An accrued expense.

C) An unearned revenue.

D) A prepaid expense.

A) An accrued revenue.

B) An accrued expense.

C) An unearned revenue.

D) A prepaid expense.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is true about adjusting entries?

A) Entries are necessary due to the conservatism principle.

B) Entries can be done at the beginning or end of the accounting period.

C) They zero the balance of all income statement accounts.

D) They are a necessary part of accrual-basis accounting.

A) Entries are necessary due to the conservatism principle.

B) Entries can be done at the beginning or end of the accounting period.

C) They zero the balance of all income statement accounts.

D) They are a necessary part of accrual-basis accounting.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

27

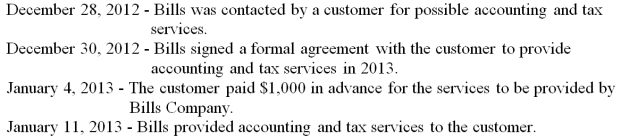

The following events pertain to Bills Company:  Using accrual-basis accounting, on which date should Bills Company record revenue for the accounting and tax services?

Using accrual-basis accounting, on which date should Bills Company record revenue for the accounting and tax services?

A) December 30, 2012.

B) December 31, 2012.

C) January 4, 2013.

D) January 11, 2013.

Using accrual-basis accounting, on which date should Bills Company record revenue for the accounting and tax services?

Using accrual-basis accounting, on which date should Bills Company record revenue for the accounting and tax services?A) December 30, 2012.

B) December 31, 2012.

C) January 4, 2013.

D) January 11, 2013.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

28

Consider the following events for Sophia Incorporated:  Under cash-basis accounting, what is the appropriate day to record the revenues related to the sand volleyball camp?

Under cash-basis accounting, what is the appropriate day to record the revenues related to the sand volleyball camp?

A) April 5.

B) April 12.

C) April 21.

D) April 23.

Under cash-basis accounting, what is the appropriate day to record the revenues related to the sand volleyball camp?

Under cash-basis accounting, what is the appropriate day to record the revenues related to the sand volleyball camp?A) April 5.

B) April 12.

C) April 21.

D) April 23.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

29

When a company makes an end-of-period adjusting entry which includes a debit to Supplies Expense, the usual credit entry is made to:

A) Accounts Payable.

B) Supplies.

C) Cash.

D) Retained Earnings.

A) Accounts Payable.

B) Supplies.

C) Cash.

D) Retained Earnings.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

30

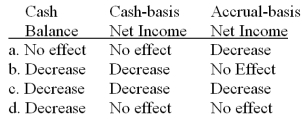

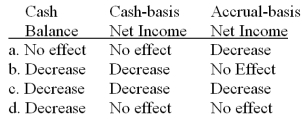

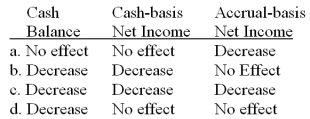

A company paid $900 to workers during May. Of this amount, $600 was for work performed in April, while the other $300 was for work performed during May. What would the impact of this transaction be during May on each of the following three items?

A) Option a

B) Option b

C) Option c

D) Option d

A) Option a

B) Option b

C) Option c

D) Option d

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

31

The following events pertain to Jasper Corporation:  Using cash-basis accounting, on which date should Jasper record supplies expense?

Using cash-basis accounting, on which date should Jasper record supplies expense?

A) May 1.

B) May 5.

C) May 8.

D) May 9.

Using cash-basis accounting, on which date should Jasper record supplies expense?

Using cash-basis accounting, on which date should Jasper record supplies expense?A) May 1.

B) May 5.

C) May 8.

D) May 9.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is a possible adjusting journal entry?

A) Debit Cash, credit Accounts Payable.

B) Debit Service Revenue, credit Cash.

C) Debit Salaries Expense, credit Salaries Payable.

D) Debit Utilities Expense, credit Retained Earnings.

A) Debit Cash, credit Accounts Payable.

B) Debit Service Revenue, credit Cash.

C) Debit Salaries Expense, credit Salaries Payable.

D) Debit Utilities Expense, credit Retained Earnings.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

33

Pawn Shops Unlimited recorded the following four transactions during April. Which of these transactions would have the same income statement impact in April regardless of whether the company used accrual-basis or cash-basis accounting?

A) Purchased $500 of office supplies on account (supplies were used in May and paid for in May).

B) Paid $1,800 for a six-month insurance policy covering the period July 1-December 31.

C) Paid $700 for an advertisement that appeared in the May 17 edition of the Las Vegas Sun newspaper.

D) Received $300 from customers for services performed in March.

A) Purchased $500 of office supplies on account (supplies were used in May and paid for in May).

B) Paid $1,800 for a six-month insurance policy covering the period July 1-December 31.

C) Paid $700 for an advertisement that appeared in the May 17 edition of the Las Vegas Sun newspaper.

D) Received $300 from customers for services performed in March.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

34

Adjusting entries are primarily needed for:

A) Cash-basis accounting.

B) Accrual-basis accounting.

C) Current value accounting.

D) Manual accounting systems.

A) Cash-basis accounting.

B) Accrual-basis accounting.

C) Current value accounting.

D) Manual accounting systems.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

35

Prepayments occur when:

A) Cash payment (or an obligation to pay cash) occurs before the expense recognition.

B) Sales are delayed pending credit approval.

C) Customers are unable to pay the full amount due when goods are delivered.

D) Cash payment occurs after the expense is incurred and liability is recorded.

A) Cash payment (or an obligation to pay cash) occurs before the expense recognition.

B) Sales are delayed pending credit approval.

C) Customers are unable to pay the full amount due when goods are delivered.

D) Cash payment occurs after the expense is incurred and liability is recorded.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

36

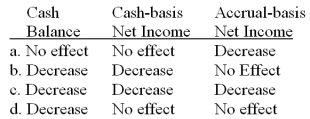

A company purchased $400 of office supplies on account during May. All the supplies were used in May, and the account was paid during June. What would the impact of these transactions be during May on each of the following three items?

A) Option a

B) Option b

C) Option c

D) Option d

A) Option a

B) Option b

C) Option c

D) Option d

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

37

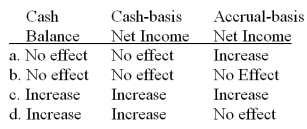

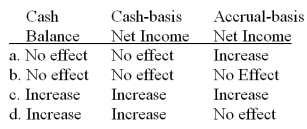

A company provided $1,500 of services to customers during the month of May. The customers paid in June. What would the impact of these transactions be during May on each of the following three items?

A) Option a

B) Option b

C) Option c

D) Option d

A) Option a

B) Option b

C) Option c

D) Option d

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

38

When a company provides services on account, which of the following would be recorded using cash-basis accounting?

A) Debit to Cash.

B) Debit to Service Revenue.

C) Credit to Unearned Revenue.

D) No entry would be recorded.

A) Debit to Cash.

B) Debit to Service Revenue.

C) Credit to Unearned Revenue.

D) No entry would be recorded.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

39

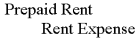

When a company makes an end-of-period adjusting entry which includes a credit to Prepaid Rent, the debit is usually made to:

A) Cash.

B) Rent Expense.

C) Rent Payable.

D) Rent Receivable.

A) Cash.

B) Rent Expense.

C) Rent Payable.

D) Rent Receivable.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

40

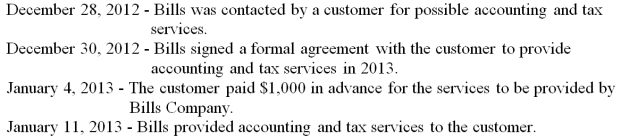

The following events pertain to Bills Company:  Using cash-basis accounting, on which date should Bills Company record revenue for the accounting and tax services?

Using cash-basis accounting, on which date should Bills Company record revenue for the accounting and tax services?

A) December 30, 2012.

B) December 31, 2012.

C) January 4, 2013.

D) January 11, 2013.

Using cash-basis accounting, on which date should Bills Company record revenue for the accounting and tax services?

Using cash-basis accounting, on which date should Bills Company record revenue for the accounting and tax services?A) December 30, 2012.

B) December 31, 2012.

C) January 4, 2013.

D) January 11, 2013.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

41

At the beginning of December, Global Corporation had $2,000 in supplies on hand. During the month, supplies purchased amounted to $3,000, but by the end of the month the supplies balance was only $800. What is the appropriate month-end adjusting entry?

A) Debit Cash $4,200, credit Supplies $4,200.

B) Debit Supplies $4,200, credit Supplies Expense $4,200.

C) Debit Supplies Expense $4,200, credit Supplies $4,200.

D) Debit Cash $800, credit Supplies $800.

A) Debit Cash $4,200, credit Supplies $4,200.

B) Debit Supplies $4,200, credit Supplies Expense $4,200.

C) Debit Supplies Expense $4,200, credit Supplies $4,200.

D) Debit Cash $800, credit Supplies $800.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

42

The following table contains financial information for Trumpeter Inc. before closing entries: What is Trumpeter's net income?

A) $3,500.

B) $2,500.

C) $5,000.

D) $5,500.

A) $3,500.

B) $2,500.

C) $5,000.

D) $5,500.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

43

Eve's Apples opened for business on January 1, 2012, and paid for two insurance policies effective that date. The liability policy was $36,000 for eighteen-months, and the crop damage policy was $12,000 for a two-year term. What was the balance in Eve's Prepaid Insurance account as of December 31, 2012?

A) $9,000.

B) $18,000.

C) $30,000.

D) $48,000.

A) $9,000.

B) $18,000.

C) $30,000.

D) $48,000.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

44

The following financial information is from Shovels Construction Company for 2012: What is the amount of current assets, assuming the accounts above reflect normal activity?

A) $20,000.

B) $60,000.

C) $140,000.

D) $175,000.

A) $20,000.

B) $60,000.

C) $140,000.

D) $175,000.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

45

A list of all accounts and their balances after updating account balances for adjusting entries is referred to as:

A) A trial balance.

B) An adjusted trial balance.

C) A post-closing trial balance.

D) An accounting trial balance.

A) A trial balance.

B) An adjusted trial balance.

C) A post-closing trial balance.

D) An accounting trial balance.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

46

The adjusting entry required to record accrued expenses includes:

A) A credit to Cash.

B) A debit to an asset.

C) A credit to an asset.

D) A credit to liability.

A) A credit to Cash.

B) A debit to an asset.

C) A credit to an asset.

D) A credit to liability.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

47

Yummy Foods purchased a one-year hazard insurance policy on August 1 and recorded the $4,200 premium to prepaid insurance. At its December 31 year-end, Yummy Foods would record which of the following adjusting entries?

A) Insurance Expense

Prepaid Insurance 1,750

B) Prepaid Insurance

Insurance Expense 1,750

C)

D) Insurance Expense

Prepaid Insurance 2,450

A) Insurance Expense

Prepaid Insurance 1,750

B) Prepaid Insurance

Insurance Expense 1,750

C)

D) Insurance Expense

Prepaid Insurance 2,450

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is(are) true regarding the characteristics of adjusting entries?

A) Adjusting entries reduce the balance of revenue, expense, and dividend accounts to zero.

B) Adjusting entries allow for the proper application of the revenue recognition principle.

C) Adjusting entries allow for the proper application of the matching principle.

D) Both b and c are true.

A) Adjusting entries reduce the balance of revenue, expense, and dividend accounts to zero.

B) Adjusting entries allow for the proper application of the revenue recognition principle.

C) Adjusting entries allow for the proper application of the matching principle.

D) Both b and c are true.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

49

During the year, Cheng Company paid salaries of $24,000. In addition, $8,000 in salaries has accrued by the end of the year but has not been paid. The year-end adjusting entry would include which one of the following?

A) Debit to Salaries Expense for $32,000.

B) Credit to Salaries Expense of $8,000.

C) Debit to Salaries Payable for $24,000.

D) Credit to Salaries Payable for $8,000.

A) Debit to Salaries Expense for $32,000.

B) Credit to Salaries Expense of $8,000.

C) Debit to Salaries Payable for $24,000.

D) Credit to Salaries Payable for $8,000.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

50

The employees of Neat Clothes work Monday through Friday. Every other Friday the company issues payroll checks totaling $32,000. The current pay period ends on Friday, January 3. Neat Clothes is now preparing financial statements for the year ended December 31. What is the adjusting entry to record accrued salaries at the end of the year?

A) Salaries Payable

Salaries Expense 22,400

B) Salaries Expense 6,400

Salaries Payable 6,400

C) Salaries Expense 9,600

Salaries Payable 9,600

D) Salaries Expense

Salaries Payable 22,400

A) Salaries Payable

Salaries Expense 22,400

B) Salaries Expense 6,400

Salaries Payable 6,400

C) Salaries Expense 9,600

Salaries Payable 9,600

D) Salaries Expense

Salaries Payable 22,400

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

51

An adjusted trial balance:

A) Is a list of all accounts and their balances after adjusting entries.

B) Is a list of all accounts and their balances before adjusting entries.

C) Is a list of all accounts and their balances after closing entries.

D) Is a trial balance adjusted for cash-basis accounting.

A) Is a list of all accounts and their balances after adjusting entries.

B) Is a list of all accounts and their balances before adjusting entries.

C) Is a list of all accounts and their balances after closing entries.

D) Is a trial balance adjusted for cash-basis accounting.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

52

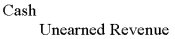

The adjusting entry required when amounts previously recorded as unearned revenues are earned includes:

A) A debit to a liability.

B) A debit to an asset.

C) A credit to a liability.

D) A credit to an asset.

A) A debit to a liability.

B) A debit to an asset.

C) A credit to a liability.

D) A credit to an asset.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following regarding adjusting entries is correct?

A) Adjusting entries are recorded for all external transactions.

B) Adjusting entries are recorded to make sure all cash inflows and outflows are recorded in the current period.

C) Adjusting entries are needed because we use accrual-basis accounting.

D) After adjusting entries, all temporary accounts should have a balance of zero.

A) Adjusting entries are recorded for all external transactions.

B) Adjusting entries are recorded to make sure all cash inflows and outflows are recorded in the current period.

C) Adjusting entries are needed because we use accrual-basis accounting.

D) After adjusting entries, all temporary accounts should have a balance of zero.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

54

Adjusting entries:

A) Often include the Cash account.

B) Usually are recorded at the beginning of the accounting period.

C) Always involve at least one income statement account and one balance sheet account.

D) Adjust the balance of revenue and expense accounts to zero.

A) Often include the Cash account.

B) Usually are recorded at the beginning of the accounting period.

C) Always involve at least one income statement account and one balance sheet account.

D) Adjust the balance of revenue and expense accounts to zero.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

55

On July 1, 2012, Charlie Co. paid $18,000 to Rent-An-Office for rent covering 18 months from July 2012 through December 2013. What adjusting entry should Charlie Co. record on December 31, 2012?

A)

B)

C)

D) Rent Expense 6,000

Prepaid Rent 6,000

A)

B)

C)

D) Rent Expense 6,000

Prepaid Rent 6,000

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

56

The following financial information is from Bronco Company. All debt is due within one year unless stated otherwise. What is the amount of current liabilities?

A) $63,000.

B) $28,000.

C) $45,600.

D) $22,000.

A) $63,000.

B) $28,000.

C) $45,600.

D) $22,000.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

57

On April 1, a $4,800 premium on a one-year insurance policy on equipment was paid and charged to Prepaid Insurance. At the end of the year, the financial statements would report:

A) Insurance Expense, $4,800; Prepaid Insurance $0.

B) Insurance Expense, $3,600; Prepaid Insurance $1,200.

C) Insurance Expense, $3,650; Prepaid Insurance $4,800.

D) Insurance Expense, $1,200; Prepaid Insurance $3,600.

A) Insurance Expense, $4,800; Prepaid Insurance $0.

B) Insurance Expense, $3,600; Prepaid Insurance $1,200.

C) Insurance Expense, $3,650; Prepaid Insurance $4,800.

D) Insurance Expense, $1,200; Prepaid Insurance $3,600.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

58

On September 1, 2012, Gold Magazine sold 400 one-year subscriptions for $90 each. The total amount received was credited to Unearned Revenue. What would be the required adjusting entry at December 31, 2012?

A) Unearned Revenue

Service Revenue 36,000

B) Service Revenue

Unearned Revenue 24,000

C) Unearned Revenue

Service Revenue 24,000

D)

A) Unearned Revenue

Service Revenue 36,000

B) Service Revenue

Unearned Revenue 24,000

C) Unearned Revenue

Service Revenue 24,000

D)

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

59

Resources owned by the company that will provide a benefit for more than one year are called:

A) Current assets.

B) Current liabilities.

C) Long-term assets.

D) Revenues.

A) Current assets.

B) Current liabilities.

C) Long-term assets.

D) Revenues.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

60

Consider the following items: Land

Accounts Receivable

Notes Payable (due in three years)

Accounts Payable

Retained Earnings

Prepaid Rent

Unearned Revenue

Buildings

Notes Payable (due in six months)

Equipment How many of the items listed above are generally long-term assets?

A) Two.

B) Three.

C) Four.

D) Five.

Accounts Receivable

Notes Payable (due in three years)

Accounts Payable

Retained Earnings

Prepaid Rent

Unearned Revenue

Buildings

Notes Payable (due in six months)

Equipment How many of the items listed above are generally long-term assets?

A) Two.

B) Three.

C) Four.

D) Five.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following is a possible closing entry?

A) Debit Cash, credit Service Revenue.

B) Debit Cash, credit Retained Earnings.

C) Debit Service Revenue, credit Retained Earnings.

D) Debit Dividends, credit Retained Earnings.

A) Debit Cash, credit Service Revenue.

B) Debit Cash, credit Retained Earnings.

C) Debit Service Revenue, credit Retained Earnings.

D) Debit Dividends, credit Retained Earnings.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following describes the purpose(s) of closing entries?

A) Adjust the balances of asset and liability accounts for unrecorded activity during the period.

B) Transfer the balances of temporary accounts to common stock.

C) Reduce the balances of the temporary accounts to zero to prepare them for measuring activity in the next period.

D) Both b and c.

A) Adjust the balances of asset and liability accounts for unrecorded activity during the period.

B) Transfer the balances of temporary accounts to common stock.

C) Reduce the balances of the temporary accounts to zero to prepare them for measuring activity in the next period.

D) Both b and c.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

63

Permanent accounts would not include:

A) Accounts Payable.

B) Office Supplies.

C) Utilities Expense.

D) Common Stock.

A) Accounts Payable.

B) Office Supplies.

C) Utilities Expense.

D) Common Stock.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

64

Temporary accounts would not include:

A) Salaries Payable.

B) Advertising Expense.

C) Supplies Expense.

D) Dividends.

A) Salaries Payable.

B) Advertising Expense.

C) Supplies Expense.

D) Dividends.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

65

The following table contains financial information for Fisher Inc. for 2012 before closing entries: How many of the above accounts are permanent?

A) Three.

B) Four.

C) Five.

D) Six.

A) Three.

B) Four.

C) Five.

D) Six.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

66

The purpose of closing entries is to transfer:

A) Accounts Receivable to Retained Earnings when an account is fully paid.

B) Balances in temporary accounts to a permanent account.

C) Inventory to Cost of Goods Sold when merchandise is sold.

D) Assets and liabilities when operations are discontinued.

A) Accounts Receivable to Retained Earnings when an account is fully paid.

B) Balances in temporary accounts to a permanent account.

C) Inventory to Cost of Goods Sold when merchandise is sold.

D) Assets and liabilities when operations are discontinued.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

67

The Retained Earnings account had a beginning credit balance of $26,000. During the period, the business had a net loss $12,000, and the company paid dividends of $8,000. The ending balance in the Retained Earnings account is:

A) $6,000

B) $30,000

C) $22,000

D) $14,000

A) $6,000

B) $30,000

C) $22,000

D) $14,000

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

68

The following table contains financial information for Trumpter's Inc. before closing entries: What is the amount of Trumpter's total liabilities?

A) $5,000

B) $78,500

C) $68,500

D) $83,500

A) $5,000

B) $78,500

C) $68,500

D) $83,500

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

69

Permanent accounts would not include:

A) Interest Expense.

B) Salaries Payable.

C) Prepaid Rent.

D) Unearned Revenues.

A) Interest Expense.

B) Salaries Payable.

C) Prepaid Rent.

D) Unearned Revenues.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is true concerning temporary and permanent accounts?

A) Cash is a temporary account.

B) Permanent accounts represent activity over the entire life of the company.

C) Permanent accounts must be closed at the end of every reporting period.

D) Temporary accounts represent activity over the previous three years.

A) Cash is a temporary account.

B) Permanent accounts represent activity over the entire life of the company.

C) Permanent accounts must be closed at the end of every reporting period.

D) Temporary accounts represent activity over the previous three years.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

71

In the first three years of operations, Lindsey Corporation earned net income/loss of -$150,000, $100,000, and $250,000. At the end of the third year, Lindsey Corporation has a balance of $120,000 for its Retained Earnings account. What is the total amount of dividends Lindsey Corporation paid over the three years?

A) $130,000.

B) $120,000.

C) $80,000.

D) $380,000.

A) $130,000.

B) $120,000.

C) $80,000.

D) $380,000.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

72

The primary purpose of closing entries is to:

A) Prove the equality of the debit and credit entries in the general journal.

B) Ensure that all assets and liabilities are recognized in the appropriate period.

C) Update the balance of Retained Earnings and prepare revenue, expense, and dividend accounts for next period's transactions.

D) Assure that adjusting entries balance.

A) Prove the equality of the debit and credit entries in the general journal.

B) Ensure that all assets and liabilities are recognized in the appropriate period.

C) Update the balance of Retained Earnings and prepare revenue, expense, and dividend accounts for next period's transactions.

D) Assure that adjusting entries balance.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

73

Of the following six accounts, which ones have temporary balances? (1) Service Revenue

(2) Dividends

(3) Salaries Expense

(4) Common Stock

(5) Retained Earnings

(6) Cash

A) (1), (2), and (3)

B) (4), (5), and (6)

C) (2), (4), and (5)

D) (1), (3), and (5)

(2) Dividends

(3) Salaries Expense

(4) Common Stock

(5) Retained Earnings

(6) Cash

A) (1), (2), and (3)

B) (4), (5), and (6)

C) (2), (4), and (5)

D) (1), (3), and (5)

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

74

When a company prepares closing entries, which one of the following is NOT a correct closing entry?

A) Debit Retained Earnings; credit Salaries Expense.

B) Debit Dividends; credit Retained Earnings.

C) Debit Service Revenue; credit Retained earnings.

D) All of the above are correct.

A) Debit Retained Earnings; credit Salaries Expense.

B) Debit Dividends; credit Retained Earnings.

C) Debit Service Revenue; credit Retained earnings.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following accounts will NOT be involved in closing entries?

A) Prepaid Insurance.

B) Service Revenue.

C) Utilities Expense.

D) Retained Earnings.

A) Prepaid Insurance.

B) Service Revenue.

C) Utilities Expense.

D) Retained Earnings.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is a permanent account?

A) Dividends

B) Service Revenue

C) Advertising Expense

D) Retained Earnings

A) Dividends

B) Service Revenue

C) Advertising Expense

D) Retained Earnings

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

77

The following table contains financial information for Trumpeter Inc. before closing entries: What is the amount of Trumpeter's total assets?

A) $81,500

B) $82,500

C) $68,500

D) $83,500

A) $81,500

B) $82,500

C) $68,500

D) $83,500

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

78

For the first three years of operations, the company reports net income of $1,000, $2,000, and $3,000, and pays dividends of $500, $1,000, and $1,000. What is the balance of retained earnings at the end of the third year?

A) $2,000.

B) $2,500.

C) $3,500.

D) $6,000.

A) $2,000.

B) $2,500.

C) $3,500.

D) $6,000.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

79

The ending Retained Earnings balance of Juan's Mexican Restaurant chain increased by $3.2 million from the beginning of the year. The company declared a dividend of $1.3 million during the year. What was the net income earned during the year?

A) $1.9 million

B) $3.2 million

C) $4.5 million

D) $1.3 million

A) $1.9 million

B) $3.2 million

C) $4.5 million

D) $1.3 million

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

80

The closing entry for expenses includes:

A) A debit to Dividends and a credit to all expense accounts.

B) A debit to Retained Earnings and a credit to all expense accounts.

C) A debit to Revenues and a credit to Retained Earnings.

D) A debit to Revenues and a credit to all expense accounts.

A) A debit to Dividends and a credit to all expense accounts.

B) A debit to Retained Earnings and a credit to all expense accounts.

C) A debit to Revenues and a credit to Retained Earnings.

D) A debit to Revenues and a credit to all expense accounts.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck