Deck 20: Performance Measurement in Decentralized Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/41

Play

Full screen (f)

Deck 20: Performance Measurement in Decentralized Organizations

1

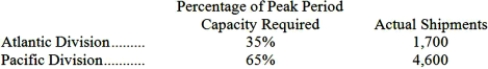

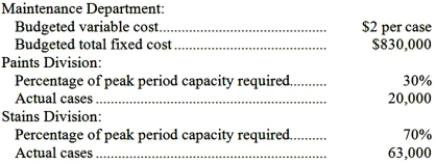

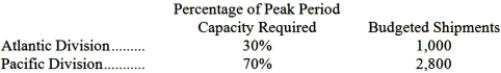

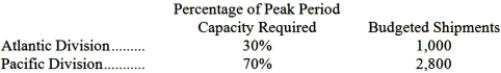

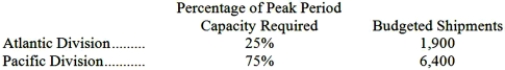

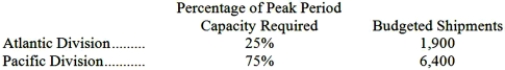

Hilbun Corporation has two operating divisions-an Atlantic Division and a Pacific Division. The company's Logistics Department services both divisions. The variable costs of the Logistics Department are budgeted at $34 per shipment. The Logistics Department's fixed costs are budgeted at $371,700 for the year. The fixed costs of the Logistics Department are determined based on peak-period demand.  How much Logistics Department cost should be charged to the Atlantic Division at the end of the year for performance evaluation purposes?

How much Logistics Department cost should be charged to the Atlantic Division at the end of the year for performance evaluation purposes?

A)$187,895

B)$158,100

C)$292,950

D)$205,065

How much Logistics Department cost should be charged to the Atlantic Division at the end of the year for performance evaluation purposes?

How much Logistics Department cost should be charged to the Atlantic Division at the end of the year for performance evaluation purposes?A)$187,895

B)$158,100

C)$292,950

D)$205,065

A

2

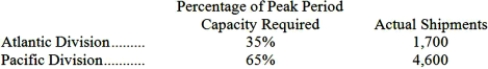

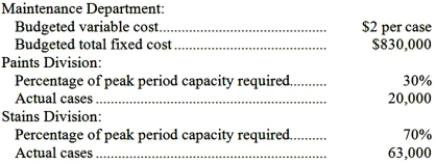

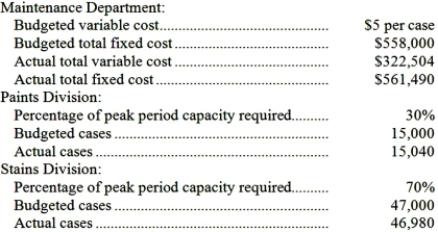

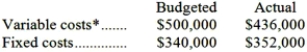

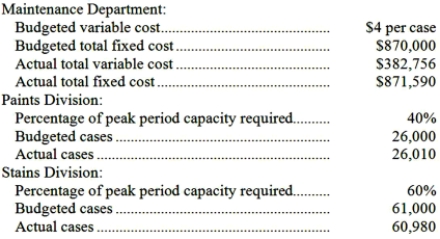

Dunkle Corporation's Maintenance Department provides services to the company's two operating divisions-the Paints Division and the Stains Division. The variable costs of the Maintenance Department are budgeted based on the number of cases produced by the operating departments. The fixed costs of the Maintenance Department are budgeted based on the number of cases produced by the operating departments during the peak period. Data appear below:  For performance evaluation purposes, how much Maintenance Department cost should be charged to the Paints Division at the end of the year?

For performance evaluation purposes, how much Maintenance Department cost should be charged to the Paints Division at the end of the year?

A)$298,800

B)$498,000

C)$289,000

D)$240,000

For performance evaluation purposes, how much Maintenance Department cost should be charged to the Paints Division at the end of the year?

For performance evaluation purposes, how much Maintenance Department cost should be charged to the Paints Division at the end of the year?A)$298,800

B)$498,000

C)$289,000

D)$240,000

C

3

Herriott Corporation has two operating divisions-an Atlantic Division and a Pacific Division. The company's Logistics Department services both divisions. The variable costs of the Logistics Department are budgeted at $43 per shipment. The Logistics Department's fixed costs are budgeted at $209,000 for the year. The fixed costs of the Logistics Department are determined based on peak-period demand.  At the end of the year, actual Logistics Department variable costs totaled $246,960 and fixed costs totaled $217,870. The Atlantic Division had a total of 3,000 shipments and the Pacific Division had a total of 2,600 shipments for the year. For performance evaluation purposes, how much actual Logistics Department cost should NOT be charged to the operating divisions at the end of the year?

At the end of the year, actual Logistics Department variable costs totaled $246,960 and fixed costs totaled $217,870. The Atlantic Division had a total of 3,000 shipments and the Pacific Division had a total of 2,600 shipments for the year. For performance evaluation purposes, how much actual Logistics Department cost should NOT be charged to the operating divisions at the end of the year?

A)$8,870

B)$15,030

C)$6,160

D)$0

At the end of the year, actual Logistics Department variable costs totaled $246,960 and fixed costs totaled $217,870. The Atlantic Division had a total of 3,000 shipments and the Pacific Division had a total of 2,600 shipments for the year. For performance evaluation purposes, how much actual Logistics Department cost should NOT be charged to the operating divisions at the end of the year?

At the end of the year, actual Logistics Department variable costs totaled $246,960 and fixed costs totaled $217,870. The Atlantic Division had a total of 3,000 shipments and the Pacific Division had a total of 2,600 shipments for the year. For performance evaluation purposes, how much actual Logistics Department cost should NOT be charged to the operating divisions at the end of the year?A)$8,870

B)$15,030

C)$6,160

D)$0

B

4

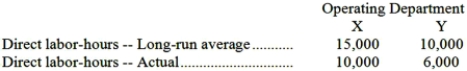

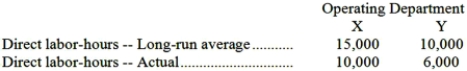

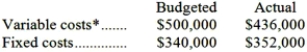

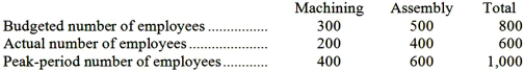

The fixed costs of Baxter Company's personnel department are allocated to operating departments on the basis of direct labor-hours. The following data have been provided:  The fixed costs of the personnel department are budgeted at $56,000 per year and are incurred in order to support long-run average requirements. How much of this fixed cost should be charged to Operating Department X at the end of the year for performance evaluation purposes?

The fixed costs of the personnel department are budgeted at $56,000 per year and are incurred in order to support long-run average requirements. How much of this fixed cost should be charged to Operating Department X at the end of the year for performance evaluation purposes?

A)$35,000

B)$33,600

C)$52,500

D)$22,400

The fixed costs of the personnel department are budgeted at $56,000 per year and are incurred in order to support long-run average requirements. How much of this fixed cost should be charged to Operating Department X at the end of the year for performance evaluation purposes?

The fixed costs of the personnel department are budgeted at $56,000 per year and are incurred in order to support long-run average requirements. How much of this fixed cost should be charged to Operating Department X at the end of the year for performance evaluation purposes?A)$35,000

B)$33,600

C)$52,500

D)$22,400

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

5

The variable costs of service departments should typically be charged to operating departments on the basis of the number of units produced in the operating departments.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

6

For performance evaluation purposes, variable costs of service departments should be charged to operating departments at the end of the period on the basis of:

A)the actual rate based on peak-period service needed.

B)the budgeted rate based on peak-period service needed.

C)the actual rate based on actual service provided.

D)the budgeted rate based on actual service provided.

A)the actual rate based on peak-period service needed.

B)the budgeted rate based on peak-period service needed.

C)the actual rate based on actual service provided.

D)the budgeted rate based on actual service provided.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

7

Lump-sum charges for service department fixed costs should usually be based on budgeted activity for the forthcoming period.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

8

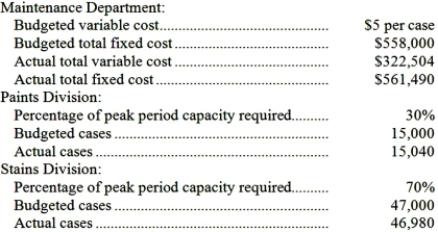

Peake Corporation's Maintenance Department provides services to the company's two operating divisions-the Paints Division and the Stains Division. The variable costs of the Maintenance Department are budgeted based on the number of cases produced by the operating departments. The fixed costs of the Maintenance Department are budgeted based on the number of cases produced by the operating departments during the peak period. Data appear below:  For performance evaluation purposes, how much Maintenance Department cost should be charged to the Stains Division at the end of the year?

For performance evaluation purposes, how much Maintenance Department cost should be charged to the Stains Division at the end of the year?

A)$669,623

B)$637,339

C)$625,500

D)$657,584

For performance evaluation purposes, how much Maintenance Department cost should be charged to the Stains Division at the end of the year?

For performance evaluation purposes, how much Maintenance Department cost should be charged to the Stains Division at the end of the year?A)$669,623

B)$637,339

C)$625,500

D)$657,584

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

9

Piedmont Company has one service department and three operating departments. During a particular year, a substantial variance developed between the actual costs and the budgeted costs of the service department. For performance evaluation purposes, the variance should be:

A)allocated to the operating departments on the basis of usage.

B)allocated to operating departments, but on some basis other than usage.

C)kept in the service department, and not charged to the operating departments at all.

D)shared equitably among all departments.

A)allocated to the operating departments on the basis of usage.

B)allocated to operating departments, but on some basis other than usage.

C)kept in the service department, and not charged to the operating departments at all.

D)shared equitably among all departments.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

10

Since service departments do not engage in production, there can be no variances in service department costs.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

11

Wilson Company maintains a cafeteria for its employees. For June, variable food costs were budgeted at $45 per employee based on a budgeted level of 200 employees in other departments. During the month, an average of 190 employees worked in other departments and actual food costs totaled $9,250. How much food cost should be charged to the other departments at the end of the month for performance evaluation purposes?

A)$9,000

B)$9,250

C)$8,550

D)$9,737

A)$9,000

B)$9,250

C)$8,550

D)$9,737

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

12

Fairview Hospital has a Food Services department that provides food for patients in all other departments of the hospital. For May, variable food costs were budgeted at $3 per meal, based on 15,000 meals served during the month. At the end of the month, it was determined that 16,000 meals had been served at a total cost of $54,000. How much food cost should be charged to the other departments at the end of the month?

A)$45,000

B)$51,200

C)$48,000

D)$50,625

A)$45,000

B)$51,200

C)$48,000

D)$50,625

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

13

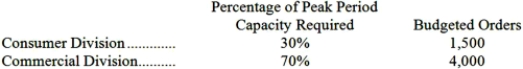

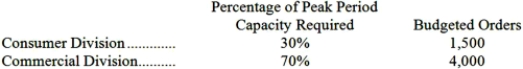

Norgaard Corporation has two operating divisions: a Consumer Division and a Commercial Division. The company's Customer Service Department provides services to both divisions. The variable costs of the Customer Service Department are budgeted at $70 per order. The Customer Service Department's fixed costs are budgeted at $245,000 for the year. The fixed costs of the Customer Service Department are determined based on the peak period orders.  At the end of the year, actual Customer Service Department variable costs totaled $348,920 and fixed costs totaled $259,790. The Consumer Division had a total of 1,520 orders and the Commercial Division had a total of 3,360 orders for the year. For performance evaluation purposes, how much actual Customer Service Department cost should NOT be charged to the operating divisions at the end of the year?

At the end of the year, actual Customer Service Department variable costs totaled $348,920 and fixed costs totaled $259,790. The Consumer Division had a total of 1,520 orders and the Commercial Division had a total of 3,360 orders for the year. For performance evaluation purposes, how much actual Customer Service Department cost should NOT be charged to the operating divisions at the end of the year?

A)$14,790

B)$22,110

C)$7,320

D)$0

At the end of the year, actual Customer Service Department variable costs totaled $348,920 and fixed costs totaled $259,790. The Consumer Division had a total of 1,520 orders and the Commercial Division had a total of 3,360 orders for the year. For performance evaluation purposes, how much actual Customer Service Department cost should NOT be charged to the operating divisions at the end of the year?

At the end of the year, actual Customer Service Department variable costs totaled $348,920 and fixed costs totaled $259,790. The Consumer Division had a total of 1,520 orders and the Commercial Division had a total of 3,360 orders for the year. For performance evaluation purposes, how much actual Customer Service Department cost should NOT be charged to the operating divisions at the end of the year?A)$14,790

B)$22,110

C)$7,320

D)$0

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

14

Omeara Corporation has two operating divisions-an Atlantic Division and a Pacific Division. The company's Logistics Department services both divisions. The variable costs of the Logistics Department are budgeted at $48 per shipment. The Logistics Department's fixed costs are budgeted at $431,600 for the year. The fixed costs of the Logistics Department are determined based on peak-period demand.  At the end of the year, actual Logistics Department variable costs totaled $505,920 and fixed costs totaled $438,080. The Atlantic Division had a total of 3,900 shipments and the Pacific Division had a total of 6,300 shipments for the year. How much Logistics Department cost should be charged to the Pacific Division at the end of the year for performance evaluation purposes?

At the end of the year, actual Logistics Department variable costs totaled $505,920 and fixed costs totaled $438,080. The Atlantic Division had a total of 3,900 shipments and the Pacific Division had a total of 6,300 shipments for the year. How much Logistics Department cost should be charged to the Pacific Division at the end of the year for performance evaluation purposes?

A)$583,059

B)$626,100

C)$641,040

D)$568,976

At the end of the year, actual Logistics Department variable costs totaled $505,920 and fixed costs totaled $438,080. The Atlantic Division had a total of 3,900 shipments and the Pacific Division had a total of 6,300 shipments for the year. How much Logistics Department cost should be charged to the Pacific Division at the end of the year for performance evaluation purposes?

At the end of the year, actual Logistics Department variable costs totaled $505,920 and fixed costs totaled $438,080. The Atlantic Division had a total of 3,900 shipments and the Pacific Division had a total of 6,300 shipments for the year. How much Logistics Department cost should be charged to the Pacific Division at the end of the year for performance evaluation purposes?A)$583,059

B)$626,100

C)$641,040

D)$568,976

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

15

Janner Corporation has two operating divisions-a Consumer Division and a Commercial Division. The company's Order Fulfillment Department provides services to both divisions. The variable costs of the Order Fulfillment Department are budgeted at $79 per order. The Order Fulfillment Department's fixed costs are budgeted at $302,500 for the year. The fixed costs of the Order Fulfillment Department are determined based on the peak period orders.  At the end of the year, actual Order Fulfillment Department variable costs totaled $446,016 and fixed costs totaled $320,930. The Consumer Division had a total of 1,540 orders and the Commercial Division had a total of 3,980 orders for the year. For purposes of evaluation performance, how much Order Fulfillment Department cost should be charged to the Commercial Division at the end of the year?

At the end of the year, actual Order Fulfillment Department variable costs totaled $446,016 and fixed costs totaled $320,930. The Consumer Division had a total of 1,540 orders and the Commercial Division had a total of 3,980 orders for the year. For purposes of evaluation performance, how much Order Fulfillment Department cost should be charged to the Commercial Division at the end of the year?

A)$526,170

B)$546,235

C)$532,527

D)$552,979

At the end of the year, actual Order Fulfillment Department variable costs totaled $446,016 and fixed costs totaled $320,930. The Consumer Division had a total of 1,540 orders and the Commercial Division had a total of 3,980 orders for the year. For purposes of evaluation performance, how much Order Fulfillment Department cost should be charged to the Commercial Division at the end of the year?

At the end of the year, actual Order Fulfillment Department variable costs totaled $446,016 and fixed costs totaled $320,930. The Consumer Division had a total of 1,540 orders and the Commercial Division had a total of 3,980 orders for the year. For purposes of evaluation performance, how much Order Fulfillment Department cost should be charged to the Commercial Division at the end of the year?A)$526,170

B)$546,235

C)$532,527

D)$552,979

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

16

How much Logistics Department cost should be allocated to the West Division at the end of the year?

A)$462,650

B)$477,360

C)$435,267

D)$449,007

A)$462,650

B)$477,360

C)$435,267

D)$449,007

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

17

For performance evaluation purposes, the best way to charge the fixed costs of a service department to operating departments is with an allocation base such as direct labor-hours that reflects the actual level of activity for the period.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

18

All of a service department's actual costs should be allocated or charged to operating departments to ensure that they are fully recovered.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

19

Fixed service department costs should be charged to operating departments at the end of the period according to which one of the following the formulas?

A)Budgeted rate x Budgeted activity.

B)Budgeted rate x Actual activity.

C)Actual rate x Actual activity.

D)Budgeted total cost x Percentage of peak-period capacity required.

A)Budgeted rate x Budgeted activity.

B)Budgeted rate x Actual activity.

C)Actual rate x Actual activity.

D)Budgeted total cost x Percentage of peak-period capacity required.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

20

For performance evaluation purposes, budgeted service department costs, instead of actual service department costs, should be charged to the operating departments.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

21

How much Maintenance Department cost should be allocated to the Stains Division at the end of the year?

A)$578,735

B)$648,836

C)$564,170

D)$664,006

A)$578,735

B)$648,836

C)$564,170

D)$664,006

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

22

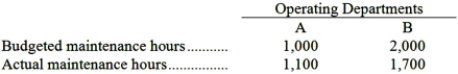

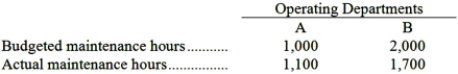

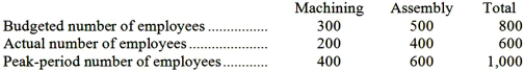

Trenron, Inc. has a maintenance department that provides services to the company's two operating departments. The variable costs of the maintenance department are charged on the basis of the number of maintenance hours logged in each department. Last year, budgeted variable maintenance costs were $8.60 per maintenance hour and actual variable maintenance costs were $8.75 per maintenance hour.

The budgeted and actual maintenance hours for each operating department for last year appear below: Required:

Required:

a. Compute the amount of variable maintenance department cost that should have been charged to each operating department at the end of the year for performance evaluation purposes.

b. Compute the amount of actual variable maintenance department cost that should not have been charged to the operating departments at the end of the year for performance evaluation purposes.

The budgeted and actual maintenance hours for each operating department for last year appear below:

Required:

Required:a. Compute the amount of variable maintenance department cost that should have been charged to each operating department at the end of the year for performance evaluation purposes.

b. Compute the amount of actual variable maintenance department cost that should not have been charged to the operating departments at the end of the year for performance evaluation purposes.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

23

How much of the actual Housekeeping Department costs should not have been charged to the operating departments for performance evaluation purposes?

A)$4,180

B)$0

C)$18,460

D)$3,380

A)$4,180

B)$0

C)$18,460

D)$3,380

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

24

How much of the actual fixed maintenance cost for the year should be kept in the Maintenance Department and not allocated to the other departments for performance evaluation purposes?

A)$0

B)$30,000

C)$90,000

D)$85,000

A)$0

B)$30,000

C)$90,000

D)$85,000

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

25

How much of the actual Food Services cost for June should be kept in the Food Services Department and not be charged to the other departments for performance evaluation purposes?

A)$22,500

B)$3,000

C)$3,750

D)$0

A)$22,500

B)$3,000

C)$3,750

D)$0

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

26

How much Housekeeping Department cost should have been charged to Packaging at the end of last year for performance evaluation purposes?

A)$26,988

B)$25,600

C)$17,340

D)$27,680

A)$26,988

B)$25,600

C)$17,340

D)$27,680

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

27

How much fixed Freight Department costs should be charged to the Emory Plant at the end of the year for performance evaluation purposes?

A)$60,000

B)$65,625

C)$66,000

D)$56,250

A)$60,000

B)$65,625

C)$66,000

D)$56,250

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

28

How much actual Maintenance Department cost should not be allocated to the operating divisions at the end of the year?

A)$22,632

B)$0

C)$17,602

D)$5,030

A)$22,632

B)$0

C)$17,602

D)$5,030

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

29

How much variable Freight Department costs should be charged to the Salina Plant at the end of the year for performance evaluation purposes?

A)$30,000

B)$33,000

C)$25,000

D)$22,500

A)$30,000

B)$33,000

C)$25,000

D)$22,500

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

30

Redder Company has a purchasing department that provides services to two factories located in Fargo and the other in Custer. Budgeted costs for the purchasing department consist of $55,000 per year of fixed costs and $8 per purchase order for variable costs. The level of budgeted fixed costs is determined by the peak-period requirements. The Fargo factory requires 40% of the peak-period capacity and the Custer factory requires 60%.

During the coming year, 1,800 purchase orders were processed for the Fargo factory and 2,700 purchase orders for the Custer factory.

Required:

Compute the amount of purchasing department cost that should be charged to each factory for the year.

During the coming year, 1,800 purchase orders were processed for the Fargo factory and 2,700 purchase orders for the Custer factory.

Required:

Compute the amount of purchasing department cost that should be charged to each factory for the year.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

31

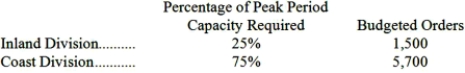

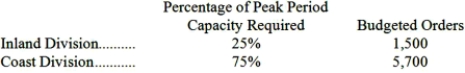

Scuderi Corporation has two operating divisions-an Inland Division and a Coast Division. The company's Customer Service Department provides services to both divisions. The variable costs of the Customer Service Department are budgeted at $29 per order. The Customer Service Department's fixed costs are budgeted at $381,600 for the year. The fixed costs of the Customer Service Department are determined based on the peak period orders.  At the end of the year, actual Customer Service Department variable costs totaled $219,905 and fixed costs totaled $383,860. The Inland Division had a total of 1,520 orders and the Coast Division had a total of 5,690 orders for the year.

At the end of the year, actual Customer Service Department variable costs totaled $219,905 and fixed costs totaled $383,860. The Inland Division had a total of 1,520 orders and the Coast Division had a total of 5,690 orders for the year.

Required:

a. Prepare a report showing how much of the Customer Service Department's costs should be charged to each of the operating divisions at the end of the year.

b. How much of the actual Customer Service Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

At the end of the year, actual Customer Service Department variable costs totaled $219,905 and fixed costs totaled $383,860. The Inland Division had a total of 1,520 orders and the Coast Division had a total of 5,690 orders for the year.

At the end of the year, actual Customer Service Department variable costs totaled $219,905 and fixed costs totaled $383,860. The Inland Division had a total of 1,520 orders and the Coast Division had a total of 5,690 orders for the year.Required:

a. Prepare a report showing how much of the Customer Service Department's costs should be charged to each of the operating divisions at the end of the year.

b. How much of the actual Customer Service Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

32

How much of the actual Freight Department cost should not be charged to either plant at the end of the year for performance evaluation purposes?

A)$0

B)$15,000

C)$17,800

D)$27,800

A)$0

B)$15,000

C)$17,800

D)$27,800

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

33

How much Order Fulfillment Department cost should be allocated to the Commercial Division at the end of the year?

A)$284,441

B)$274,018

C)$293,492

D)$265,360

A)$284,441

B)$274,018

C)$293,492

D)$265,360

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

34

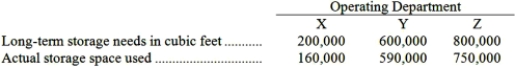

Warehouse Services is a service department in the Werner Company, providing storage service to three operating departments. The company charges the costs of this department to operating departments on the basis of cubic feet occupied.

Last year, Warehouse Services budgeted variable storage cost of $0.15 per cubic foot occupied. The budgeted total fixed cost was $120,000, and was determined by the long-term storage needs of the operating departments. Actual storage space occupied during the year, along with long-term storage needs of operating departments, is given below: Actual variable storage costs amounted to $0.16 per cubic foot occupied. Actual fixed storage costs were $123,000.

Actual variable storage costs amounted to $0.16 per cubic foot occupied. Actual fixed storage costs were $123,000.

Required:

a. Compute the amount of variable storage cost that should be charged to each operating department at the end of the year for performance evaluation purposes.

b. Compute the amount of fixed storage cost that should be charged to each operating department at the end of the year for performance evaluation purposes.

Last year, Warehouse Services budgeted variable storage cost of $0.15 per cubic foot occupied. The budgeted total fixed cost was $120,000, and was determined by the long-term storage needs of the operating departments. Actual storage space occupied during the year, along with long-term storage needs of operating departments, is given below:

Actual variable storage costs amounted to $0.16 per cubic foot occupied. Actual fixed storage costs were $123,000.

Actual variable storage costs amounted to $0.16 per cubic foot occupied. Actual fixed storage costs were $123,000.Required:

a. Compute the amount of variable storage cost that should be charged to each operating department at the end of the year for performance evaluation purposes.

b. Compute the amount of fixed storage cost that should be charged to each operating department at the end of the year for performance evaluation purposes.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

35

How much actual Order Fulfillment Department cost should not be allocated to the operating divisions at the end of the year?

A)$0

B)$5,780

C)$13,550

D)$7,770

A)$0

B)$5,780

C)$13,550

D)$7,770

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

36

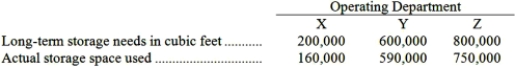

Leslie Company operates a cafeteria for the benefit of its employees. The company subsidizes the cafeteria heavily by allowing employees to purchase meals at greatly reduced prices. Budgeted and actual costs in the cafeteria for the year just ended are as follows:  *Unrecovered cost after deducting amounts received from employees.

*Unrecovered cost after deducting amounts received from employees.

Costs of the cafeteria are charged to producing departments on the basis of the number of employees in these departments. Fixed costs are charged on the basis of the peak-period number of employees. Data on employees in the company's producing departments follows: Required:

Required:

a. Compute the dollar amount of variable and fixed costs that should be charged to each of the producing departments at the end of the year for purposes of evaluating performance.

b. Identify the amount, if any, of actual costs that should not be charged to the operating departments.

*Unrecovered cost after deducting amounts received from employees.

*Unrecovered cost after deducting amounts received from employees.Costs of the cafeteria are charged to producing departments on the basis of the number of employees in these departments. Fixed costs are charged on the basis of the peak-period number of employees. Data on employees in the company's producing departments follows:

Required:

Required:a. Compute the dollar amount of variable and fixed costs that should be charged to each of the producing departments at the end of the year for purposes of evaluating performance.

b. Identify the amount, if any, of actual costs that should not be charged to the operating departments.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

37

How much actual Logistics Department cost should not be allocated to the operating divisions at the end of the year?

A)$0

B)$20,610

C)$11,640

D)$8,970

A)$0

B)$20,610

C)$11,640

D)$8,970

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

38

How much Food Services cost should be charged to the Surgical Department at the end of June for performance evaluation purposes?

A)$71,250

B)$74,100

C)$50,000

D)$52,000

A)$71,250

B)$74,100

C)$50,000

D)$52,000

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

39

How much fixed maintenance cost should be charged to the Assembly Department at the end of the year for purposes of measuring performance?

A)$320,000

B)$340,000

C)$360,000

D)$382,500

A)$320,000

B)$340,000

C)$360,000

D)$382,500

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

40

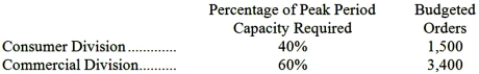

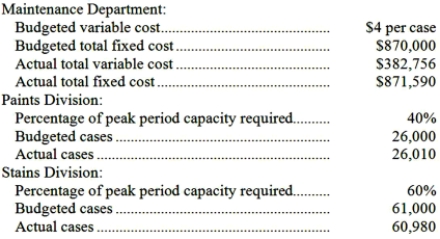

Kosek Corporation's Maintenance Department provides services to the company's two operating divisions-the Paints Division and the Stains Division. The variable costs of the Maintenance Department are budgeted based on the number of cases produced by the operating departments. The fixed costs of the Maintenance Department are determined based on the number of cases produced by the operating departments during the peak period. Data appear below:  Required:

Required:

a. Prepare a report showing how much of the Maintenance Department's costs should be charged to each of the operating divisions at the end of the year.

b. How much of the actual Maintenance Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

Required:

Required:a. Prepare a report showing how much of the Maintenance Department's costs should be charged to each of the operating divisions at the end of the year.

b. How much of the actual Maintenance Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

41

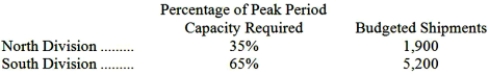

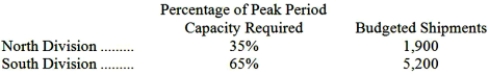

Zindell Corporation has two operating divisions-a North Division and a South Division. The company's Logistics Department services both divisions. The variable costs of the Logistics Department are budgeted at $33 per shipment. The Logistics Department's fixed costs are budgeted at $369,200 for the year. The fixed costs of the Logistics Department are determined based on peak-period demand.  At the end of the year, actual Logistics Department variable costs totaled $307,050 and fixed costs totaled $374,720. The North Division had a total of 3,900 shipments and the South Division had a total of 5,000 shipments for the year.

At the end of the year, actual Logistics Department variable costs totaled $307,050 and fixed costs totaled $374,720. The North Division had a total of 3,900 shipments and the South Division had a total of 5,000 shipments for the year.

Required:

a. Prepare a report showing how much of the Logistics Department's costs should be charged to each of the operating divisions at the end of the year.

b. How much of the actual Logistics Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

At the end of the year, actual Logistics Department variable costs totaled $307,050 and fixed costs totaled $374,720. The North Division had a total of 3,900 shipments and the South Division had a total of 5,000 shipments for the year.

At the end of the year, actual Logistics Department variable costs totaled $307,050 and fixed costs totaled $374,720. The North Division had a total of 3,900 shipments and the South Division had a total of 5,000 shipments for the year.Required:

a. Prepare a report showing how much of the Logistics Department's costs should be charged to each of the operating divisions at the end of the year.

b. How much of the actual Logistics Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck