Deck 4: Completing the Accounting Cycle and Classifying Accounts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/141

Play

Full screen (f)

Deck 4: Completing the Accounting Cycle and Classifying Accounts

1

On a work sheet,adjusted balances of revenues and expenses are sorted to the Income Statement columns.

True

2

Revenue and expense accounts are permanent accounts and should not be closed at the end of the fiscal period.

False

3

If interim financial statements are required,adjusting entries must be journalized and posted to obtain the adjusted data needed for their preparation.

False

4

On the work sheet,a loss is indicated if the total of the Income Statement Debit column exceeds the total of the Income Statement Credit column.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

5

To prepare the balance sheet,all necessary numbers can be found in the balance sheet columns of the work sheet,including ending capital.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

6

A work sheet can be prepared manually or with a computer spreadsheet program.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

7

A work sheet is prepared before entering the adjustments in the accounts.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

8

Revenue accounts should begin each accounting period with zero balances.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

9

A work sheet is a substitute for the financial statements.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

10

Closing entries are normally entered in the General Journal and then recorded on the work sheet.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

11

The closing process is a step in the accounting cycle that prepares accounts for the next accounting period.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

12

The work sheet is used to record transactions as they occur.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

13

Adjusting entries are normally entered in the General Journal before they are recorded on the work sheet.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

14

On the work sheet,a net income is entered in the Income Statement Credit column and in the Statement of Changes in Equity or Balance Sheet Debit column.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

15

Closing revenue and expense accounts at the end of the accounting period serves to make the revenue and expense accounts ready for use in the next period.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

16

A work sheet is a tool of the accountant for bringing together information needed in preparing the statements,adjusting the accounts,and preparing closing entries.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

17

If all columns balance upon completion of a work sheet,you can be sure that no errors were made in preparing the work sheet.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

18

To prepare the income statement all necessary numbers can be found in the income statement columns of the work sheet,including the net income or net loss.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

19

Accounts that appear in the balance sheet are often called permanent or nominal accounts.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

20

Financial statements prepared from a work sheet offer more information than if it is not used and statements are just prepared from an adjusted trial balance.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

21

The third closing entry is to close Withdrawals to Income Summary.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

22

Closing entries accomplish the goal of reflecting revenues and expenses in the owner's capital account.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

23

In a sole proprietorship,the Income Summary account is closed to the capital account

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

24

The Income Summary account is used to close all other temporary accounts at the end of an accounting period.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

25

When expenses exceed revenues,there is a loss and the Income Summary account has a credit balance.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

26

After posting the entries to close all revenue and expense accounts,Hatfield Company's Income Summary account has a credit balance of $6,000,and the Hatfield,Withdrawals account has a debit balance of $2,500.These balances indicate that net income for the accounting period amounted to $3,500.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

27

The aim of a post-closing trial balance is to verify that (1)total debits equal total credits for temporary accounts and (2)all temporary accounts have zero balances.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

28

A post-closing trial balance is a list of permanent accounts and their balances from the ledger after all closing entries are journalized and posted.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

29

The withdrawals account is normally closed by debiting it.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

30

After posting the entries to close all revenue accounts and all expense accounts,the Income Summary account of Waif Services has a $4,000 debit balance.This shows that Waif Services earned a net income of $4,000.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

31

Asset,liability and revenue accounts are not closed as long as a company continues in business.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

32

Sharp's post-closing trial balance has debit totals of $40,350 and credit totals of $40,650.The next step is to review for errors in the closing process.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

33

Closing entries are designed to transfer the end-of-period balances in the revenue accounts,the expense accounts,and the withdrawals account to a balance sheet equity account.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

34

The steps in the closing process are (1)close credit balances in revenue accounts to Income Summary; (2)close credit balances in expense accounts to Income Summary; (3)close Income Summary to Owner's Capital; (4)close Withdrawals to Owner's Capital.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

35

The Income Summary account is a permanent account that will be carried forward year after year.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

36

Income Summary is a temporary account.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

37

The closing process is a two-step process.First revenue,expense,and withdrawals are set to zero balance.Second,the process summarizes a period's assets and expenses.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

38

Closing entries are needed at the end of the fiscal period to close all ledger accounts.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

39

An expense account is normally closed by debiting Income Summary and crediting the expense account.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

40

The first step in the accounting cycle is to analyze and record transactions during the accounting period.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

41

Current assets and current liabilities are expected to be used up or come due within one year or the company's operating cycle.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

42

The accounting cycle refers to the steps in preparing the work sheet for users.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

43

Long-term investments can include land not currently being used in operations.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

44

Sharp has current assets of $15,000 and current liabilities of $9,500.Its current ratio is 1.6 to 1.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

45

Assets are classified into current assets,investments,property,plant and equipment,and intangible assets.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

46

Property,plant and equipment and intangible assets are long-term assets used to produce or sell products and services.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

47

The information on a work sheet can be used to prepare:

A) Year end financial statements.

B) Adjusting entries.

C) Closing entries.

D) Interim financial statements.

E) All of these answers are correct.

A) Year end financial statements.

B) Adjusting entries.

C) Closing entries.

D) Interim financial statements.

E) All of these answers are correct.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

48

Reversing entries are prepared to adjust accrued assets and liabilities that were created by adjusting entries at the end of the previous reporting period.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

49

Reversing entries are optional.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

50

Current liabilities are cash and other resources that are expected to be sold,collected,or used within the longer of one year or the company's operating cycle.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

51

The first five steps in the accounting cycle include analyzing transactions,journalizing,posting,preparing an unadjusted trial balance,and recording adjusting entries.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

52

In order,the last four steps in the accounting cycle include preparing the adjusted trial balance,preparing financial statements,preparing adjusting entries and preparing closing entries.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

53

Harley Ravidson's current ratio is .9 to 1.The industry average current ratio is 1.2.Harley Davidson does not have a problem in covering its current liabilities because of its strong sales and position in its industry.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

54

Current liabilities include accounts receivable,unearned revenues,and taxes owed.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

55

For a partnership,the equity section is called Shareholders Equity.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

56

The current ratio is calculated by dividing current liabilities by current assets.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

57

A classified balance sheet organizes assets and liabilities into important subgroups.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

58

Harley Ravidson's current assets are $400 million and its current liabilities are $250 million.Its current ratio is .63 to 1.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

59

An unclassified balance sheet provides more information to users than a classified balance sheet.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

60

The current ratio is used to evaluate the ability of a business to meet its short-term obligations.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

61

Closing the temporary accounts at the end of each accounting period:

A) Serves to transfer the effects of these accounts to the proper equity account on the balance sheet.

B) Prepares the withdrawals account for use in the next period.

C) Gives the revenue and expense accounts zero balances.

D) Gives the withdrawals account a zero balance.

E) All of these answers are correct.

A) Serves to transfer the effects of these accounts to the proper equity account on the balance sheet.

B) Prepares the withdrawals account for use in the next period.

C) Gives the revenue and expense accounts zero balances.

D) Gives the withdrawals account a zero balance.

E) All of these answers are correct.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is incorrect?

A) Working papers are invaluable tools of the accountant.

B) The work sheet shows the effects of adjustments on the account balances.

C) After the work sheet is completed,the work sheet information is used to prepare the financial statements.

D) On the work sheet,the accountant sorts the adjusted amounts into columns according to whether the accounts are used in preparing the unadjusted trial balance or the adjusted trial balance.

E) The work sheet is an optional step in the accounting cycle.

A) Working papers are invaluable tools of the accountant.

B) The work sheet shows the effects of adjustments on the account balances.

C) After the work sheet is completed,the work sheet information is used to prepare the financial statements.

D) On the work sheet,the accountant sorts the adjusted amounts into columns according to whether the accounts are used in preparing the unadjusted trial balance or the adjusted trial balance.

E) The work sheet is an optional step in the accounting cycle.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

63

Another name for temporary accounts is:

A) Real accounts.

B) Contra accounts.

C) Accrued accounts.

D) Balance column accounts.

E) Nominal accounts.

A) Real accounts.

B) Contra accounts.

C) Accrued accounts.

D) Balance column accounts.

E) Nominal accounts.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

64

The Unadjusted Trial Balance columns of the work sheet show the balance in the Office Supplies account at $750.The Adjustments columns show that $425 of these supplies were used during the period.The amount shown as Office Supplies in the Balance Sheet columns is:

A) $325 debit.

B) $325 credit.

C) $425 debit.

D) $750 debit.

E) $750 credit.

A) $325 debit.

B) $325 credit.

C) $425 debit.

D) $750 debit.

E) $750 credit.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

65

The Unadjusted Trial Balance columns of a work sheet total $84,000.The Adjustments columns contain entries for the following: (1)Office supplies used during the period,$1,200.

(2)Expiration of prepaid rent,$700.

(3)Accrued salaries expense,$500.

(4)Depreciation expense,$800.

(5)Accrued repair service fees receivable,$400.

The Adjusted Trial Balance columns total:

A) $80,400.

B) $84,000.

C) $85,700.

D) $85,900.

E) $87,600.

(2)Expiration of prepaid rent,$700.

(3)Accrued salaries expense,$500.

(4)Depreciation expense,$800.

(5)Accrued repair service fees receivable,$400.

The Adjusted Trial Balance columns total:

A) $80,400.

B) $84,000.

C) $85,700.

D) $85,900.

E) $87,600.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

66

A 10-column spreadsheet used to draft a company's unadjusted trial balance,adjusting entries,adjusted trial balance,and financial statements,and which is an optional step in the accounting process,is a(n):

A) Adjusted trial balance.

B) Work sheet.

C) Post-closing trial balance.

D) Unadjusted trial balance.

E) Book of final entry.

A) Adjusted trial balance.

B) Work sheet.

C) Post-closing trial balance.

D) Unadjusted trial balance.

E) Book of final entry.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

67

Accounts that are used to describe revenues,expenses,and owner's withdrawals,and are closed at the end of the reporting period,are:

A) Real accounts.

B) Temporary accounts.

C) Closing accounts.

D) Permanent accounts.

E) Ledger accounts.

A) Real accounts.

B) Temporary accounts.

C) Closing accounts.

D) Permanent accounts.

E) Ledger accounts.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

68

A company shows an $800 balance in Prepaid Insurance in the Unadjusted Trial Balance columns of the work sheet.The Adjustments columns show expired insurance of $600.This adjusting entry results in:

A) $600 less net income.

B) $600 more net income.

C) $200 difference between the debit and credit columns of the unadjusted trial balance.

D) $400 in the Income Statement Debit column on the work sheet.

E) $400 in the Balance Sheet Credit column on the work sheet.

A) $600 less net income.

B) $600 more net income.

C) $200 difference between the debit and credit columns of the unadjusted trial balance.

D) $400 in the Income Statement Debit column on the work sheet.

E) $400 in the Balance Sheet Credit column on the work sheet.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

69

If the Balance Sheet columns of a work sheet fail to balance when the amount of the net income is added to the Balance Sheet Credit column,the cause could be:

A) An expense amount entered in the Balance Sheet Debit column.

B) A revenue amount entered in the Balance Sheet Credit column.

C) An asset amount entered in the Income Statement Debit column.

D) A liability amount entered in the Balance Sheet Debit column.

E) A liability amount entered in the Income Statement Credit column.

A) An expense amount entered in the Balance Sheet Debit column.

B) A revenue amount entered in the Balance Sheet Credit column.

C) An asset amount entered in the Income Statement Debit column.

D) A liability amount entered in the Balance Sheet Debit column.

E) A liability amount entered in the Income Statement Credit column.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

70

Real accounts are:

A) Another name for temporary accounts.

B) Another name for permanent accounts.

C) Closed at the end of the accounting period.

D) Income statement accounts.

E) Not shown on the balance sheet.

A) Another name for temporary accounts.

B) Another name for permanent accounts.

C) Closed at the end of the accounting period.

D) Income statement accounts.

E) Not shown on the balance sheet.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

71

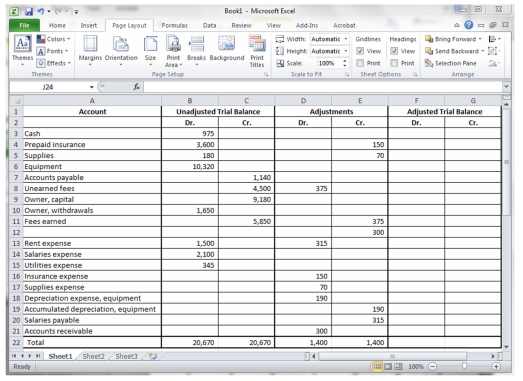

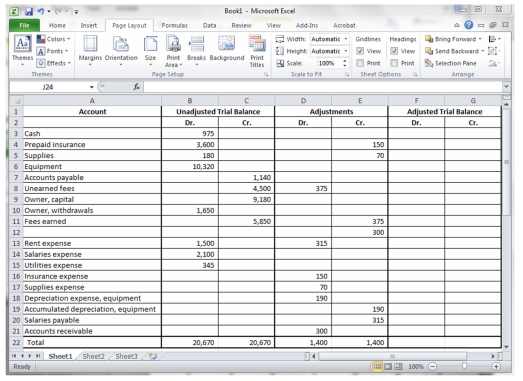

The following items appeared on a December 31 Excel work sheet.Based on the following information,what is net income for the year?

A) $1,725.

B) $1,855.

C) $2,060.

D) $4,125

E) $4,670.

A) $1,725.

B) $1,855.

C) $2,060.

D) $4,125

E) $4,670.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

72

Accounts that are used to describe assets,liabilities,and equity,that are not closed as long as the company continues to own the assets,owe the liabilities,or have equity,and whose balances appear on the balance sheet are called:

A) Nominal accounts.

B) Temporary accounts.

C) Permanent accounts.

D) Contra accounts.

E) Accrued accounts.

A) Nominal accounts.

B) Temporary accounts.

C) Permanent accounts.

D) Contra accounts.

E) Accrued accounts.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

73

Internal documents prepared by accountants when organizing the information presented in formal reports to internal and external decision makers are called:

A) Adjusting papers.

B) Statement papers.

C) Working papers.

D) Closing papers.

E) Business papers.

A) Adjusting papers.

B) Statement papers.

C) Working papers.

D) Closing papers.

E) Business papers.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

74

If,in preparing a work sheet,an adjusted trial balance amount is sorted to the wrong work sheet column,the Balance Sheet columns will balance on completing the work sheet,but with the wrong net income,if the amount sorted in error is:

A) An expense amount entered in the Balance Sheet Credit column.

B) A revenue amount entered in the Balance Sheet Debit column.

C) A liability amount entered in the Income Statement Credit column.

D) An asset amount entered in the Balance Sheet Credit column.

E) A liability amount entered in the Balance Sheet Debit column.

A) An expense amount entered in the Balance Sheet Credit column.

B) A revenue amount entered in the Balance Sheet Debit column.

C) A liability amount entered in the Income Statement Credit column.

D) An asset amount entered in the Balance Sheet Credit column.

E) A liability amount entered in the Balance Sheet Debit column.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following statements is incorrect?

A) Permanent accounts are another name for nominal accounts.

B) Temporary accounts carry a zero balance at the beginning of each accounting period.

C) The Income Summary account is a temporary account.

D) Real accounts remain open as long as the asset,liability,or equity items recorded in the accounts continue in existence.

E) Permanent accounts are another name for real accounts.

A) Permanent accounts are another name for nominal accounts.

B) Temporary accounts carry a zero balance at the beginning of each accounting period.

C) The Income Summary account is a temporary account.

D) Real accounts remain open as long as the asset,liability,or equity items recorded in the accounts continue in existence.

E) Permanent accounts are another name for real accounts.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

76

Accumulated Depreciation,Equipment,Accounts Receivable,and Service Fees Earned would be sorted to which respective columns in completing a work sheet?

A) Statement of changes in equity or Balance Sheet-Credit; Statement of changes in equity or Balance Sheet-Debit; and Income Statement-Credit.

B) Statement of changes in equity or Balance Sheet-Debit; Statement of changes in equity or Balance Sheet-Credit; and Income Statement-Credit.

C) Income Statement-Debit; Statement of changes in equity or Balance Sheet-Debit; and Income Statement-Credit.

D) Income Statement-Debit; Income Statement-Debit; and Statement of changes in equity or Balance Sheet-Credit.

E) Statement of changes in equity or Balance Sheet-Credit; Income Statement-Debit; and Income Statement-Credit.

A) Statement of changes in equity or Balance Sheet-Credit; Statement of changes in equity or Balance Sheet-Debit; and Income Statement-Credit.

B) Statement of changes in equity or Balance Sheet-Debit; Statement of changes in equity or Balance Sheet-Credit; and Income Statement-Credit.

C) Income Statement-Debit; Statement of changes in equity or Balance Sheet-Debit; and Income Statement-Credit.

D) Income Statement-Debit; Income Statement-Debit; and Statement of changes in equity or Balance Sheet-Credit.

E) Statement of changes in equity or Balance Sheet-Credit; Income Statement-Debit; and Income Statement-Credit.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

77

Journal entries recorded at the end of each accounting period to prepare the revenue,expense,and withdrawals accounts for the upcoming year and to update the owner's capital account for the events of the year just finished are:

A) Adjusting entries.

B) Closing entries.

C) Final entries.

D) Work sheet entries.

E) None of these answers is correct.

A) Adjusting entries.

B) Closing entries.

C) Final entries.

D) Work sheet entries.

E) None of these answers is correct.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

78

The Income Summary account is:

A) The account from which the amount of the net income or loss is transferred to the owners' capital accounts in a partnership.

B) A temporary account.

C) Used in the closing process to summarize the amounts of revenues and expenses.

D) Not a permanent account.

E) All of these answers are correct.

A) The account from which the amount of the net income or loss is transferred to the owners' capital accounts in a partnership.

B) A temporary account.

C) Used in the closing process to summarize the amounts of revenues and expenses.

D) Not a permanent account.

E) All of these answers are correct.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

79

When closing entries are made:

A) All ledger accounts are closed to start the new fiscal period.

B) All temporary accounts are closed but not the permanent accounts.

C) All real accounts are closed but not the temporary accounts.

D) All permanent accounts are closed but not the temporary accounts.

E) All balance sheet accounts are closed.

A) All ledger accounts are closed to start the new fiscal period.

B) All temporary accounts are closed but not the permanent accounts.

C) All real accounts are closed but not the temporary accounts.

D) All permanent accounts are closed but not the temporary accounts.

E) All balance sheet accounts are closed.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following errors would cause the balance sheet columns of a work sheet to be out of balance?

A) Entering an asset amount in the Income Statement Debit column.

B) Entering a liability amount in the Income Statement Credit column.

C) Entering an expense amount in the Balance Sheet Debit column.

D) Entering a revenue amount in the Balance Sheet Debit column.

E) Entering a liability amount in the Balance Sheet Credit column.

A) Entering an asset amount in the Income Statement Debit column.

B) Entering a liability amount in the Income Statement Credit column.

C) Entering an expense amount in the Balance Sheet Debit column.

D) Entering a revenue amount in the Balance Sheet Debit column.

E) Entering a liability amount in the Balance Sheet Credit column.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck