Deck 7: Financial Instruments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 7: Financial Instruments

1

Which of the following is an example where derecognition of a financial instrument is NOT justified?

A)The contractual rights to cash flows from the financial asset have expired.

B)The entity has transferred the financial asset so that it no longer has control of the asset.

C)Sale of short-term receivables by an entity accompanied by a guarantee to compensate the purchaser for any credit losses that are likely to occur.

D)The entity has transferred the financial asset in such a way that it is no longer subject to the risks and rewards of ownership.

A)The contractual rights to cash flows from the financial asset have expired.

B)The entity has transferred the financial asset so that it no longer has control of the asset.

C)Sale of short-term receivables by an entity accompanied by a guarantee to compensate the purchaser for any credit losses that are likely to occur.

D)The entity has transferred the financial asset in such a way that it is no longer subject to the risks and rewards of ownership.

C

2

Which of the following is NOT an example of a derivative financial instrument?

A)A futures contract.

B)An option contract.

C)A commercial bill contract.

D)A forward exchange contract.

A)A futures contract.

B)An option contract.

C)A commercial bill contract.

D)A forward exchange contract.

C

3

All of the following would be regarded as financial instruments except:

A)cash on hand.

B)bank overdraft.

C)forward exchange contracts.

D)property,plant and equipment.

A)cash on hand.

B)bank overdraft.

C)forward exchange contracts.

D)property,plant and equipment.

D

4

Which of the following categories of financial instruments is NOT subsequently measured at amortised cost?

A)Purchased bonds.

B)Purchased secured loans.

C)Purchased unsecured loans.

D)Financial assets held for trading.

A)Purchased bonds.

B)Purchased secured loans.

C)Purchased unsecured loans.

D)Financial assets held for trading.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

An entity must recognise a financial asset or a financial liability when it becomes subject to the contractual provisions of the instrument.Which of the following are NOT recognised?

A)Trade debtors.

B)Forward contracts at commitment date.

C)Planned future transactions.

D)Option contracts when the holder becomes a party to the contract.

A)Trade debtors.

B)Forward contracts at commitment date.

C)Planned future transactions.

D)Option contracts when the holder becomes a party to the contract.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

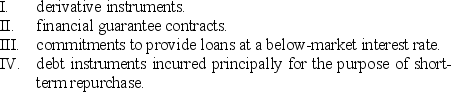

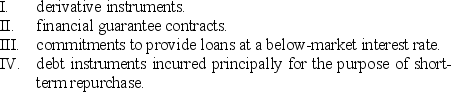

Financial liabilities classified as subsequently measured at fair value through profit and loss (FVTPL)are:

A)I only

B)I and IV

C)II and III

D)I,II and III

A)I only

B)I and IV

C)II and III

D)I,II and III

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following are regarded as financial instruments?

I Ordinary shares

II Raw materials inventories

III Property,plant and equipment

IV Deposits held by a financial institution

V Accounts receivable and accounts payable

A)I,II,IV and V only

B)II,III and IV only

C)I,II and V only

D)I,IV and V only

I Ordinary shares

II Raw materials inventories

III Property,plant and equipment

IV Deposits held by a financial institution

V Accounts receivable and accounts payable

A)I,II,IV and V only

B)II,III and IV only

C)I,II and V only

D)I,IV and V only

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Company A issues preference shares to Company B,the terms of which entitle Company B to redeem the preference shares for cash if Company A's revenues fall below a specified level.From Company A's perspective the preference shares are:

A)a financial asset.

B)a financial liability.

C)an equity instrument.

D)a compound financial instrument.

A)a financial asset.

B)a financial liability.

C)an equity instrument.

D)a compound financial instrument.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

Dividends or gains and losses on redemption of equity instruments are recognised:

A)as an asset.

B)as an expense in the profit or loss.

C)as income in the profit or loss.

D)directly in equity.

A)as an asset.

B)as an expense in the profit or loss.

C)as income in the profit or loss.

D)directly in equity.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

According to AASB 132 Financial Instruments: Presentation and Disclosure,which of the following items would be regarded as a financial liability?

A)Debentures issued.

B)Promissory notes held.

C)Ordinary shares held in another entity.

D)An option to purchase shares below the market price.

A)Debentures issued.

B)Promissory notes held.

C)Ordinary shares held in another entity.

D)An option to purchase shares below the market price.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following items is classified as a financial asset?

A)Buildings.

B)Loans payable.

C)Trade receivables.

D)Ordinary shares held in a subsidiary.

A)Buildings.

B)Loans payable.

C)Trade receivables.

D)Ordinary shares held in a subsidiary.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

AASB 132 requires an entity to offset a financial asset and a financial liability and present the net amount in the statement of financial position when two conditions are satisfied.Conditions for offsetting are generally NOT satisfied when:

A)financial assets and liabilities have the same primary risk exposure that involve different counterparties.

B)financial assets are pledged as collateral for non-recourse financial liabilities.

C)obligations are expected to be recovered from a third party because of claims under insurance contracts.

D)all of the above situations.

A)financial assets and liabilities have the same primary risk exposure that involve different counterparties.

B)financial assets are pledged as collateral for non-recourse financial liabilities.

C)obligations are expected to be recovered from a third party because of claims under insurance contracts.

D)all of the above situations.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

The definition of a derivative requires which of the following characteristics to be met?

I Its value changes in response to a change in an underlying variable such as a specified interest rate,price or foreign exchange rate.

II It must be settled on a net basis.

III It requires no initial net investment or it is smaller than for other types of contracts expected to have a similar response to changes in market factors.

IV It is to be settled at a future date.

A)I,II and III

B)I,II and IV

C)I,III and IV

D)II,III and IV

I Its value changes in response to a change in an underlying variable such as a specified interest rate,price or foreign exchange rate.

II It must be settled on a net basis.

III It requires no initial net investment or it is smaller than for other types of contracts expected to have a similar response to changes in market factors.

IV It is to be settled at a future date.

A)I,II and III

B)I,II and IV

C)I,III and IV

D)II,III and IV

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

AASB 9 requires that on initial recognition,financial assets and liabilities be measured at:

A)fair value.

B)historical cost.

C)net present value.

D)lower of cost or market value.

A)fair value.

B)historical cost.

C)net present value.

D)lower of cost or market value.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

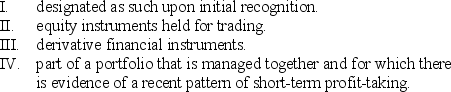

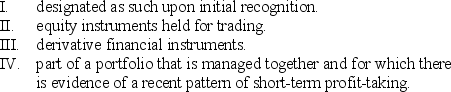

Financial assets classified as subsequently measured at fair value through profit and loss (FVTPL)are:

A)I,II and III

B)I,II and IV

C)I,III and IV

D)I,II,III and IV

A)I,II and III

B)I,II and IV

C)I,III and IV

D)I,II,III and IV

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

Company A issued convertible notes 3 years ago and accounted for them as a compound financial instrument.Complete the following: at the end of the three year period the portion of the ______ component that relates to the notes which have been converted ______.

A)liability; remains as a liability

B)liability; is transferred to equity

C)equity; is transferred to profit or loss

D)liability; is transferred to profit or loss

A)liability; remains as a liability

B)liability; is transferred to equity

C)equity; is transferred to profit or loss

D)liability; is transferred to profit or loss

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

Cathy Limited buys an option that entitles it to purchase 3000 shares in Colin Limited at $6 per share at any time in the next 6 months.The derivative financial instrument in this transaction is the:

A)shares in Cathy Limited.

B)shares in Colin Limited.

C)option priced at $6 per share.

D)market price of the shares in Colin Limited after 6 months have elapsed.

A)shares in Cathy Limited.

B)shares in Colin Limited.

C)option priced at $6 per share.

D)market price of the shares in Colin Limited after 6 months have elapsed.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

The appropriate accounting treatment for incremental costs directly attributable to an equity transaction that would otherwise have been avoided is to recognise it as:

A)a deduction in equity.

B)an addition in equity.

C)an expense in profit or loss.

D)a liability.

A)a deduction in equity.

B)an addition in equity.

C)an expense in profit or loss.

D)a liability.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

All of the following are equity instruments except:

A)forward rate agreements.

B)non-puttable ordinary shares.

C)preference shares that do not carry an unconditional right to cash.

D)call options that allow the holder to purchase a fixed number of non-puttable ordinary shares for a fixed amount of cash.

A)forward rate agreements.

B)non-puttable ordinary shares.

C)preference shares that do not carry an unconditional right to cash.

D)call options that allow the holder to purchase a fixed number of non-puttable ordinary shares for a fixed amount of cash.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

The classification of a financial instrument on the statement of financial position of an entity is governed by the principle of:

A)fair value.

B)legal form.

C)net present value.

D)substance over form.

A)fair value.

B)legal form.

C)net present value.

D)substance over form.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck