Deck 17: An Introduction to Decision Theory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/54

Play

Full screen (f)

Deck 17: An Introduction to Decision Theory

1

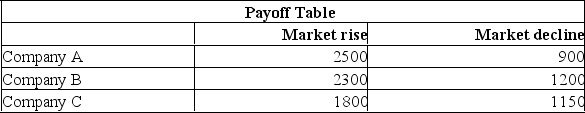

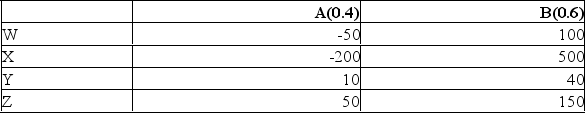

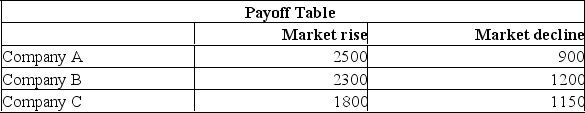

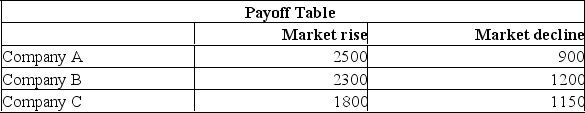

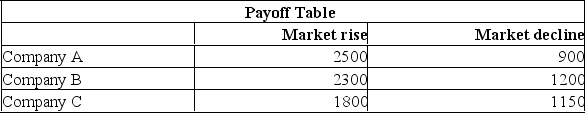

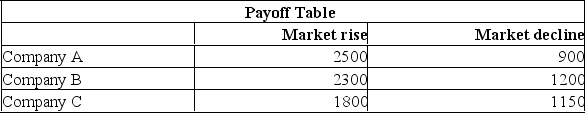

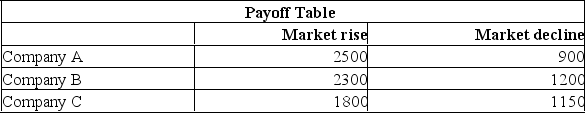

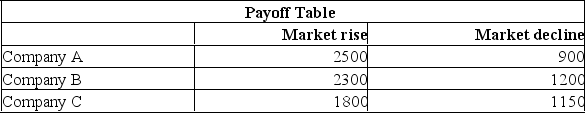

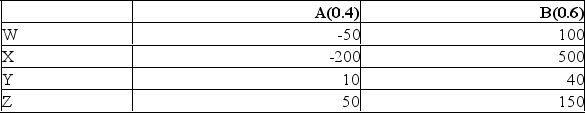

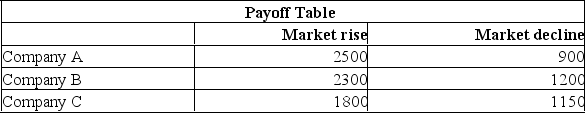

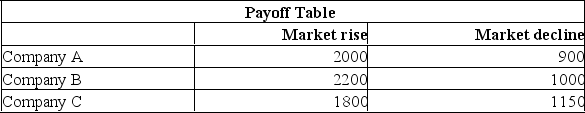

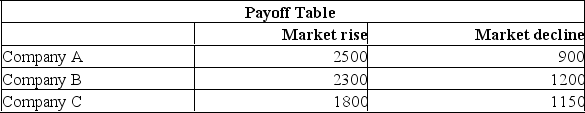

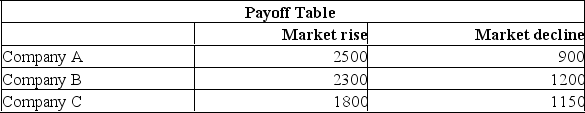

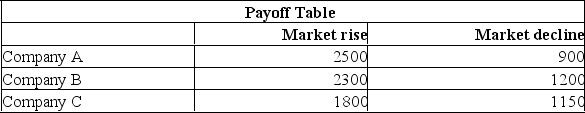

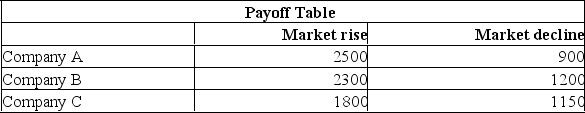

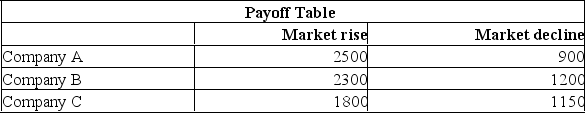

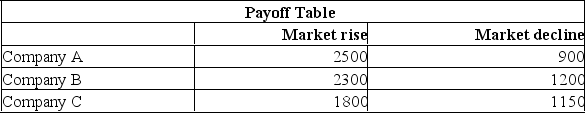

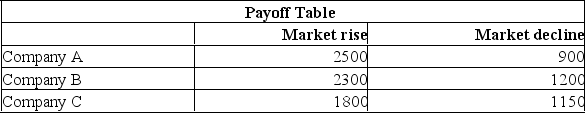

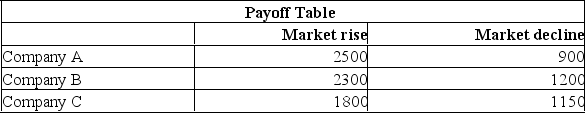

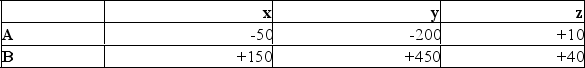

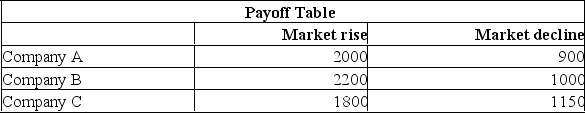

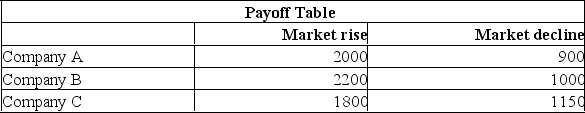

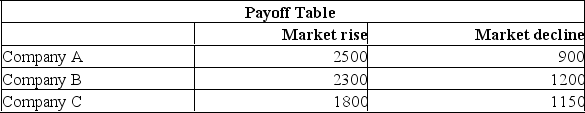

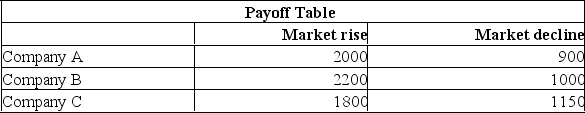

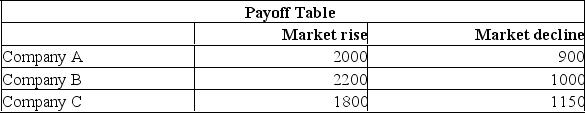

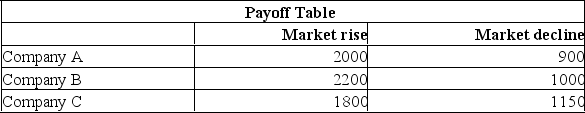

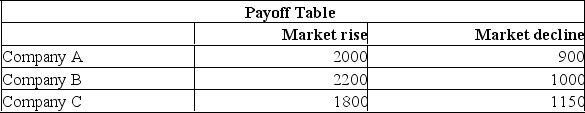

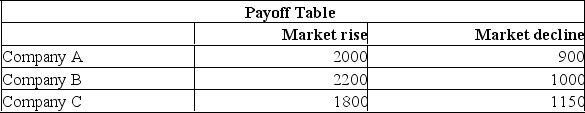

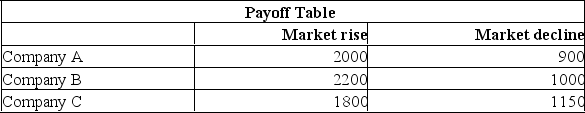

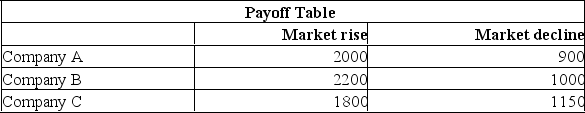

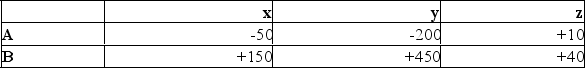

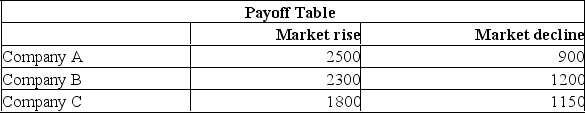

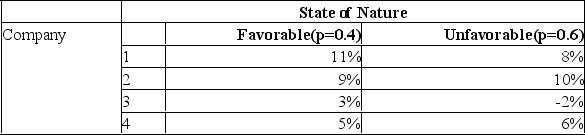

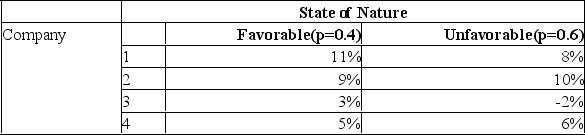

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

i. The Expected Opportunity Loss for Company A is $120.

ii. The Expected Opportunity Loss for Company B is $120.

iii. The Expected Opportunity Loss for Company C is $440.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?i. The Expected Opportunity Loss for Company A is $120.

ii. The Expected Opportunity Loss for Company B is $120.

iii. The Expected Opportunity Loss for Company C is $440.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

(i), (ii), and (iii) are all correct statements.

2

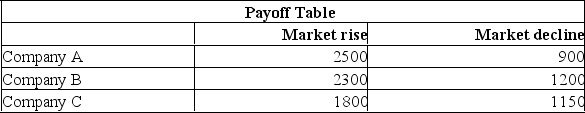

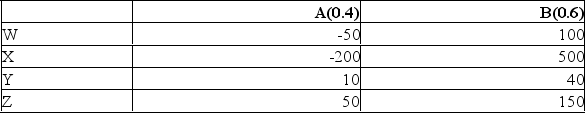

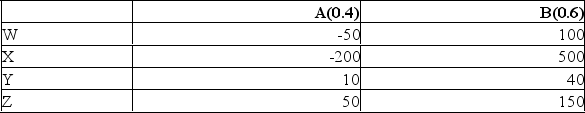

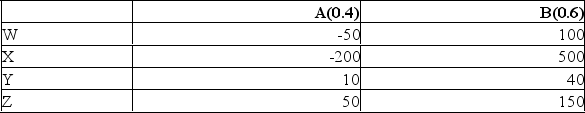

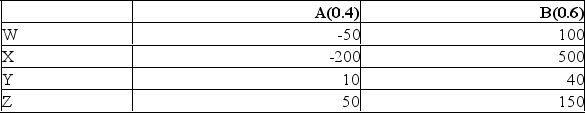

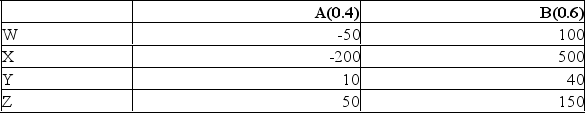

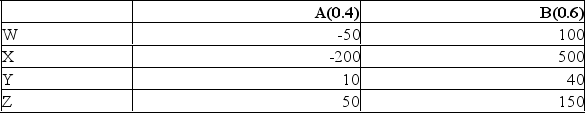

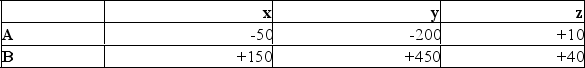

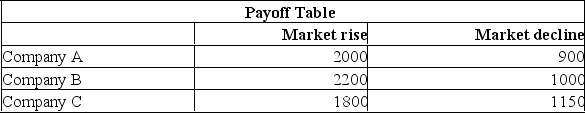

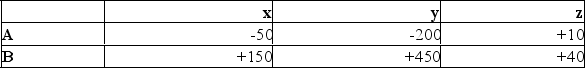

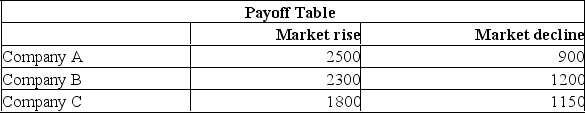

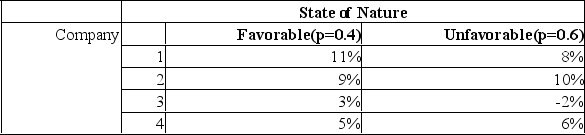

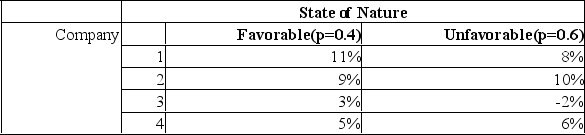

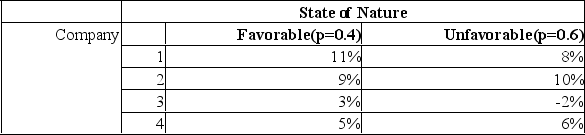

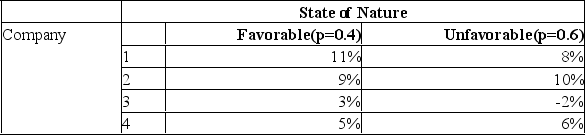

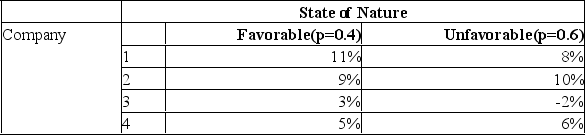

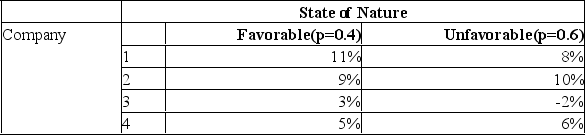

Consider the following decision table in which w, x, y, and z are decision alternatives and A and B are the two possible states of nature, with probabilities 0.40 and 0.60.  The expected value for decision X is ___________.

The expected value for decision X is ___________.

A) 40

B) 75

C) 80

D) 220

E) 30

The expected value for decision X is ___________.

The expected value for decision X is ___________.A) 40

B) 75

C) 80

D) 220

E) 30

220

3

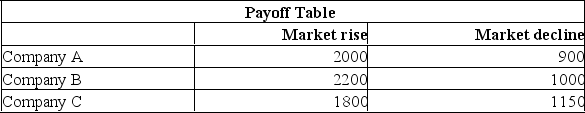

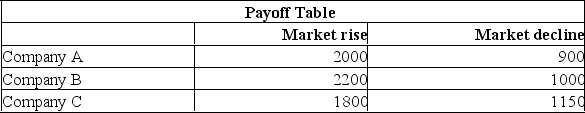

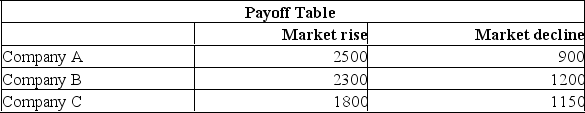

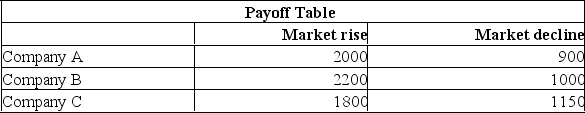

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the Market rising in the next year is 0.60, which of the following statements are correct?

If the probability of the Market rising in the next year is 0.60, which of the following statements are correct?

i. The Opportunity Loss for Company A is $1,860.

ii. The Opportunity Loss for Company B is $1,860.

iii. The Opportunity Loss for Company C is $1,540.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

If the probability of the Market rising in the next year is 0.60, which of the following statements are correct?

If the probability of the Market rising in the next year is 0.60, which of the following statements are correct?i. The Opportunity Loss for Company A is $1,860.

ii. The Opportunity Loss for Company B is $1,860.

iii. The Opportunity Loss for Company C is $1,540.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

(i), (ii), and (iii) are all false statements.

4

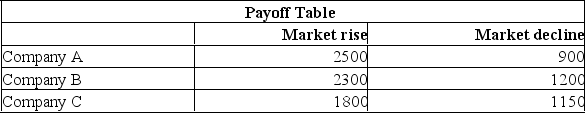

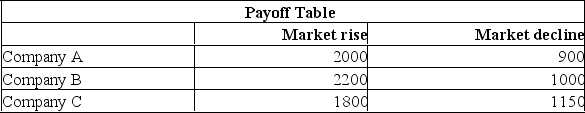

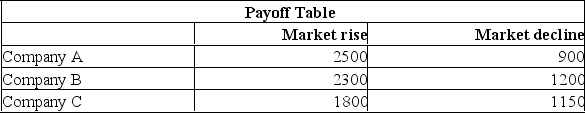

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

i. The Expected Opportunity Loss for Company A is $300.

ii. The Expected Opportunity Loss for Company B is $30.

iii. The Expected Opportunity Loss for Company C is $500.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?i. The Expected Opportunity Loss for Company A is $300.

ii. The Expected Opportunity Loss for Company B is $30.

iii. The Expected Opportunity Loss for Company C is $500.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

5

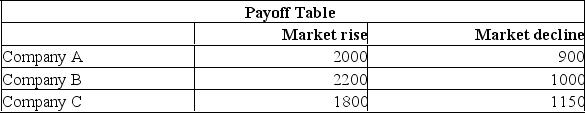

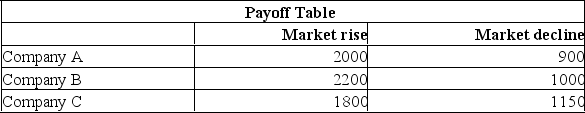

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the Market rising in the next year is 0.60, which of the following statements are correct?

If the probability of the Market rising in the next year is 0.60, which of the following statements are correct?

i. The Expected Monetary Value for Company A is $1,860.

ii. The Expected Monetary Value for Company B is $1,860.

iii. The Expected Monetary Value for Company C is $1,860.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

If the probability of the Market rising in the next year is 0.60, which of the following statements are correct?

If the probability of the Market rising in the next year is 0.60, which of the following statements are correct?i. The Expected Monetary Value for Company A is $1,860.

ii. The Expected Monetary Value for Company B is $1,860.

iii. The Expected Monetary Value for Company C is $1,860.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

6

Consider the following decision table in which w, x, y, and z are decision alternatives and A and B are the two possible states of nature, with probabilities 0.40 and 0.60.  The expected value for decision Z is ___________.

The expected value for decision Z is ___________.

A) 110

B) 200

C) 170

D) 140

E) 150

The expected value for decision Z is ___________.

The expected value for decision Z is ___________.A) 110

B) 200

C) 170

D) 140

E) 150

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

7

An investor has a 35% chance of making $1000 and a 65% chance of making $10 000, what is the expected payoff for this investor?

A) $11 000

B) $6 850

C) $7 500

D) $10 000

A) $11 000

B) $6 850

C) $7 500

D) $10 000

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

8

Consider the following decision table in which w, x, y, and z are decision alternatives and A and B are the two possible states of nature, with probabilities 0.40 and 0.60.  The expected value for decision W is ___________.

The expected value for decision W is ___________.

A) 40

B) 75

C) 80

D) 220

E) 30

The expected value for decision W is ___________.

The expected value for decision W is ___________.A) 40

B) 75

C) 80

D) 220

E) 30

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

9

I You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the market rises in the next year, which of the following statements are correct?

If the market rises in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $200.

ii. The Opportunity Loss for Company B is $200.

ii. The Opportunity Loss for Company C is $700.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

If the market rises in the next year, which of the following statements are correct?

If the market rises in the next year, which of the following statements are correct?i. The Opportunity Loss for Company A is $200.

ii. The Opportunity Loss for Company B is $200.

ii. The Opportunity Loss for Company C is $700.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

10

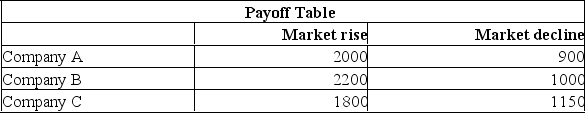

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the Market rising in the next year is 0.50, which of the following statements are correct?

If the probability of the Market rising in the next year is 0.50, which of the following statements are correct?

i. The Expected Monetary Value for Company A is $1,450.

ii. The Expected Monetary Value for Company B is $1,960.

iii. The Expected Monetary Value for Company C is $1,500.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

If the probability of the Market rising in the next year is 0.50, which of the following statements are correct?

If the probability of the Market rising in the next year is 0.50, which of the following statements are correct?i. The Expected Monetary Value for Company A is $1,450.

ii. The Expected Monetary Value for Company B is $1,960.

iii. The Expected Monetary Value for Company C is $1,500.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

11

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the market declines in the next year, which of the following statements are correct?

If the market declines in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $300.

ii. The Opportunity Loss for Company B is $0.

iii. The Opportunity Loss for Company C is $50.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

If the market declines in the next year, which of the following statements are correct?

If the market declines in the next year, which of the following statements are correct?i. The Opportunity Loss for Company A is $300.

ii. The Opportunity Loss for Company B is $0.

iii. The Opportunity Loss for Company C is $50.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

12

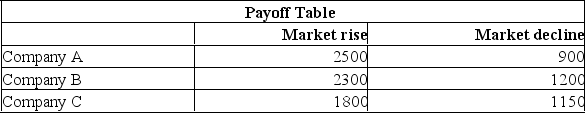

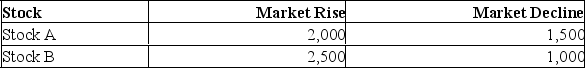

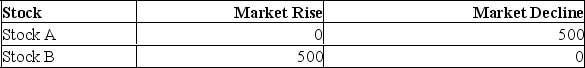

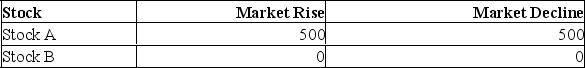

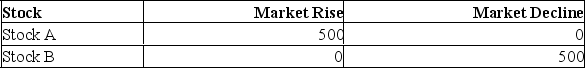

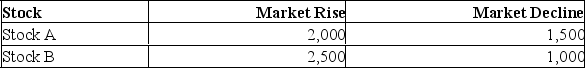

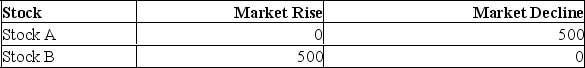

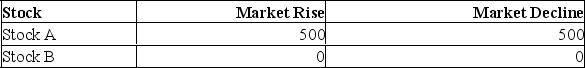

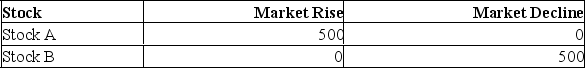

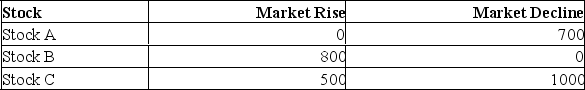

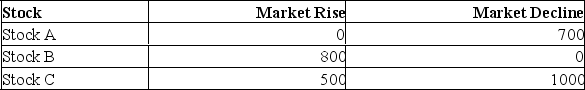

Below is the payoff table for two stocks based on whether the market rises or declines. Which of the following represents the opportunity loss table?

A)

B)

C)

A)

B)

C)

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

13

Consider the following decision table in which w, x, y, and z are decision alternatives and A and B are the two possible states of nature, with probabilities 0.40 and 0.60.  The expected value for decision Y is ___________.

The expected value for decision Y is ___________.

A) 40

B) 28

C) 50

D) 22

E) 15

The expected value for decision Y is ___________.

The expected value for decision Y is ___________.A) 40

B) 28

C) 50

D) 22

E) 15

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

14

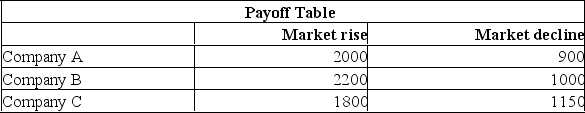

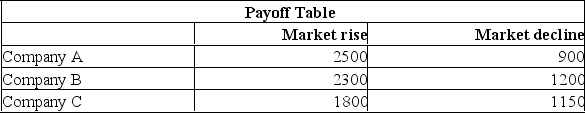

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the Market rising in the next year is 0.50, which of the following statements are correct?

If the probability of the Market rising in the next year is 0.50, which of the following statements are correct?

i. The Expected Monetary Value for Company A is $1,450.

ii. The Expected Monetary Value for Company B is $1,600.

iii. The Expected Monetary Value for Company C is $1,475.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

If the probability of the Market rising in the next year is 0.50, which of the following statements are correct?

If the probability of the Market rising in the next year is 0.50, which of the following statements are correct?i. The Expected Monetary Value for Company A is $1,450.

ii. The Expected Monetary Value for Company B is $1,600.

iii. The Expected Monetary Value for Company C is $1,475.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

15

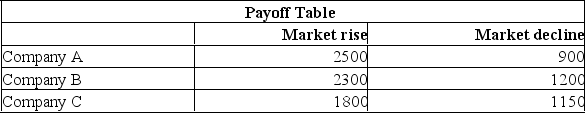

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the Market rising in the next year is 0.60, which of the following statements are correct?

If the probability of the Market rising in the next year is 0.60, which of the following statements are correct?

i. The Expected Monetary Value for Company A is $1,860.

ii. The Expected Monetary Value for Company B is $1,860.

iii. The Expected Monetary Value for Company C is $1,540.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

If the probability of the Market rising in the next year is 0.60, which of the following statements are correct?

If the probability of the Market rising in the next year is 0.60, which of the following statements are correct?i. The Expected Monetary Value for Company A is $1,860.

ii. The Expected Monetary Value for Company B is $1,860.

iii. The Expected Monetary Value for Company C is $1,540.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

16

A payoff table is needed to:

A) control for possible future events.

B) inform the decision maker of the choices available.

C) compare each combination of decision alternative and state of nature.

D) control for possible future events and inform the decision maker of the choices available.

A) control for possible future events.

B) inform the decision maker of the choices available.

C) compare each combination of decision alternative and state of nature.

D) control for possible future events and inform the decision maker of the choices available.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

17

Suppose that the below represents the opportunity loss table for three stocks based on whether the market rises or declines. If there is a 30% chance of the market rising and a 70% chance of it declining, what is the expected opportunity loss for stock C?

A) 490

B) 850

C) 240

D) 910

E) 370

A) 490

B) 850

C) 240

D) 910

E) 370

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

18

The states of nature are:

A) the choices available to the decision maker.

B) the uncontrollable future events.

C) a comparison of each combination of decision alternatives and the state of nature.

A) the choices available to the decision maker.

B) the uncontrollable future events.

C) a comparison of each combination of decision alternatives and the state of nature.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

19

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the market rises in the next year, which of the following statements are correct?

If the market rises in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $200.

ii. The Opportunity Loss for Company B is $200.

iii. The Opportunity Loss for Company C is $200.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

If the market rises in the next year, which of the following statements are correct?

If the market rises in the next year, which of the following statements are correct?i. The Opportunity Loss for Company A is $200.

ii. The Opportunity Loss for Company B is $200.

iii. The Opportunity Loss for Company C is $200.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

20

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the market declines in the next year, which of the following statements are correct?

If the market declines in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $300.

ii. The Opportunity Loss for Company B is $30.

iii. The Opportunity Loss for Company C is $500.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

If the market declines in the next year, which of the following statements are correct?

If the market declines in the next year, which of the following statements are correct?i. The Opportunity Loss for Company A is $300.

ii. The Opportunity Loss for Company B is $30.

iii. The Opportunity Loss for Company C is $500.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

21

Given the following decision table in which x, y, and z are decision alternatives and A and B are states of nature.  Which alternative would be chosen if using the maximax criterion?

Which alternative would be chosen if using the maximax criterion?

A) A

B) B

C) x

D) y

E) z

Which alternative would be chosen if using the maximax criterion?

Which alternative would be chosen if using the maximax criterion?A) A

B) B

C) x

D) y

E) z

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

22

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the market rises in the next year, which of the following statements are correct?

If the market rises in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $200.

ii. The Opportunity Loss for Company B is $0.

iii. The Opportunity Loss for Company C is $400.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

If the market rises in the next year, which of the following statements are correct?

If the market rises in the next year, which of the following statements are correct?i. The Opportunity Loss for Company A is $200.

ii. The Opportunity Loss for Company B is $0.

iii. The Opportunity Loss for Company C is $400.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

23

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,675.

ii. The Expected value of stock purchased under conditions of certainty is $2,200.

iii. The Expected value of stock purchased under conditions of certainty is $1,150.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (iii) is a correct statement but not (i) or (ii).

E) (i), (ii), and (iii) are all false statements.

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?i. The Expected value of stock purchased under conditions of certainty is $1,675.

ii. The Expected value of stock purchased under conditions of certainty is $2,200.

iii. The Expected value of stock purchased under conditions of certainty is $1,150.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (iii) is a correct statement but not (i) or (ii).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

24

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the market declines in the next year, which of the following statements are correct?

If the market declines in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $250.

ii. The Opportunity Loss for Company B is $30.

iii. The Opportunity Loss for Company C is $500.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

If the market declines in the next year, which of the following statements are correct?

If the market declines in the next year, which of the following statements are correct?i. The Opportunity Loss for Company A is $250.

ii. The Opportunity Loss for Company B is $30.

iii. The Opportunity Loss for Company C is $500.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

25

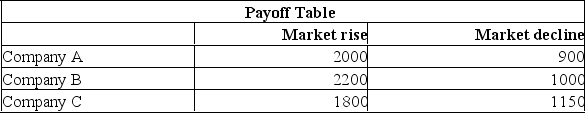

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,980.

ii. The Expected value of stock purchased under conditions of certainty is $120.

iii. The Expected value of stock purchased under conditions of certainty is $440.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (iii) is a correct statement but not (i) or (ii).

E) (i), (ii), and (iii) are all false statements.

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?i. The Expected value of stock purchased under conditions of certainty is $1,980.

ii. The Expected value of stock purchased under conditions of certainty is $120.

iii. The Expected value of stock purchased under conditions of certainty is $440.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (iii) is a correct statement but not (i) or (ii).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

26

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the market declines in the next year, which of the following statements are correct?

If the market declines in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $250.

ii. The Opportunity Loss for Company B is $150.

iii. The Opportunity Loss for Company C is $0.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

If the market declines in the next year, which of the following statements are correct?

If the market declines in the next year, which of the following statements are correct?i. The Opportunity Loss for Company A is $250.

ii. The Opportunity Loss for Company B is $150.

iii. The Opportunity Loss for Company C is $0.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

27

A decision tree:

A) uses a box to indicate the point at which a decision must be made.

B) is a picture of all the possible courses of action and the consequentpossible outcomes.

C) contains branches going out from the box which indicate the alternatives under consideration.

D) is a picture of all the possible courses of action and the consequentpossible outcomes, uses a box to indicate the point at which a decision must be made and contains branches going out from the box which indicate the alternatives under consideration.

A) uses a box to indicate the point at which a decision must be made.

B) is a picture of all the possible courses of action and the consequentpossible outcomes.

C) contains branches going out from the box which indicate the alternatives under consideration.

D) is a picture of all the possible courses of action and the consequentpossible outcomes, uses a box to indicate the point at which a decision must be made and contains branches going out from the box which indicate the alternatives under consideration.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

28

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the Market rising in the next year is 0.50, which of the following statements are correct?

If the probability of the Market rising in the next year is 0.50, which of the following statements are correct?

i. The Opportunity Loss for Company A is $1,460.

ii. The Opportunity Loss for Company B is $1,600.

iii. The Opportunity Loss for Company C is $1,475.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

If the probability of the Market rising in the next year is 0.50, which of the following statements are correct?

If the probability of the Market rising in the next year is 0.50, which of the following statements are correct?i. The Opportunity Loss for Company A is $1,460.

ii. The Opportunity Loss for Company B is $1,600.

iii. The Opportunity Loss for Company C is $1,475.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (i) and (ii) are correct statements but not (iii).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

29

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,980.

ii. The Expected value of perfect information is $120.

iii. The Expected value of perfect information is $180.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (iii) is a correct statement but not (i) or (ii).

E) (i) and (ii) are correct statements but not (iii).

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?i. The Expected value of stock purchased under conditions of certainty is $1,980.

ii. The Expected value of perfect information is $120.

iii. The Expected value of perfect information is $180.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (iii) is a correct statement but not (i) or (ii).

E) (i) and (ii) are correct statements but not (iii).

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

30

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the market rises in the next year, which of the following statements are correct?

If the market rises in the next year, which of the following statements are correct?

i. The Opportunity Loss for Company A is $200.

ii. The Opportunity Loss for Company B is $200.

iii. The Opportunity Loss for Company C is $700.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

If the market rises in the next year, which of the following statements are correct?

If the market rises in the next year, which of the following statements are correct?i. The Opportunity Loss for Company A is $200.

ii. The Opportunity Loss for Company B is $200.

iii. The Opportunity Loss for Company C is $700.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

31

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

i. The Expected Opportunity Loss for Company A is $120.

ii. The Expected Opportunity Loss for Company B is $75.

iii. The Expected Opportunity Loss for Company C is $200.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?i. The Expected Opportunity Loss for Company A is $120.

ii. The Expected Opportunity Loss for Company B is $75.

iii. The Expected Opportunity Loss for Company C is $200.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

32

The maximin strategy:

A) minimizes the maximum gain.

B) maximizes the minimum gain.

C) minimizes the maximum regret.

D) maximizes the minimum regret.

A) minimizes the maximum gain.

B) maximizes the minimum gain.

C) minimizes the maximum regret.

D) maximizes the minimum regret.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

33

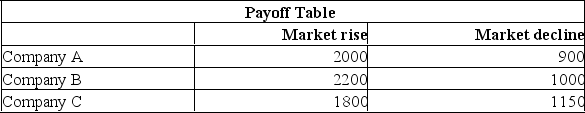

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

i. The Expected Opportunity Loss for Company A is $225.

ii. The Expected Opportunity Loss for Company B is $75.

iii. The Expected Opportunity Loss for Company C is $200.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?i. The Expected Opportunity Loss for Company A is $225.

ii. The Expected Opportunity Loss for Company B is $75.

iii. The Expected Opportunity Loss for Company C is $200.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

34

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

i. The Expected Opportunity Loss for Company A is $20.

ii. The Expected Opportunity Loss for Company B is $75.

iii. The Expected Opportunity Loss for Company C is $440.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?i. The Expected Opportunity Loss for Company A is $20.

ii. The Expected Opportunity Loss for Company B is $75.

iii. The Expected Opportunity Loss for Company C is $440.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

35

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,675.

ii. The Expected value of perfect information is $75.

iii. The Expected value of perfect information is $180.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (iii) is a correct statement but not (i) or (ii).

E) (i) and (ii) are correct statements but not (iii).

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?i. The Expected value of stock purchased under conditions of certainty is $1,675.

ii. The Expected value of perfect information is $75.

iii. The Expected value of perfect information is $180.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (iii) is a correct statement but not (i) or (ii).

E) (i) and (ii) are correct statements but not (iii).

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

36

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,980.

ii. The Expected value of perfect information is $75.

iii. The Expected value of perfect information is $180.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (iii) is a correct statement but not (i) or (ii).

E) (i) and (ii) are correct statements but not (iii).

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?i. The Expected value of stock purchased under conditions of certainty is $1,980.

ii. The Expected value of perfect information is $75.

iii. The Expected value of perfect information is $180.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (iii) is a correct statement but not (i) or (ii).

E) (i) and (ii) are correct statements but not (iii).

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

37

The alternative which offers the lowest EOL is the same as the one which

A) offers the highest.

B) maximizes the minimum gain.

C) minimizes the maximum loss.

D) maximizes the maximum gain.

A) offers the highest.

B) maximizes the minimum gain.

C) minimizes the maximum loss.

D) maximizes the maximum gain.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

38

Given the following decision table in which x, y, and z are decision alternatives and A and B are states of nature.  Which alternative would be chosen if using the maximin criterion?

Which alternative would be chosen if using the maximin criterion?

A) A

B) B

C) x

D) y

E) z

Which alternative would be chosen if using the maximin criterion?

Which alternative would be chosen if using the maximin criterion?A) A

B) B

C) x

D) y

E) z

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

39

i. EVPI = Expected value under conditions of certainty-Optimal decision under conditions of uncertainty.

ii. Three regret strategies that are often used are Maximin, Maximax, and Minimax.

iii. Rankings of the decision alternatives are frequently not highly sensitive to changes in the applied probabilities within a plausible range.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

ii. Three regret strategies that are often used are Maximin, Maximax, and Minimax.

iii. Rankings of the decision alternatives are frequently not highly sensitive to changes in the applied probabilities within a plausible range.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (i) and (iii) are correct statements but not (ii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

40

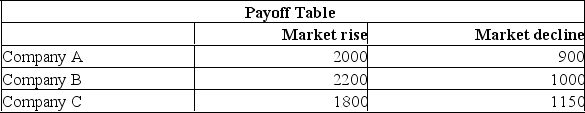

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

i. The Expected Opportunity Loss for Company A is $20.

ii. The Expected Opportunity Loss for Company B is $120.

iii. The Expected Opportunity Loss for Company C is $440.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?

If the probability of the market declining in the next year is 0.4, which of the following statements are correct?i. The Expected Opportunity Loss for Company A is $20.

ii. The Expected Opportunity Loss for Company B is $120.

iii. The Expected Opportunity Loss for Company C is $440.

A) (i), (ii), and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii).

C) (ii) is a correct statement but not (i) or (iii).

D) (ii) and (iii) are correct statements but not (i).

E) (i), (ii), and (iii) are all false statements.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

41

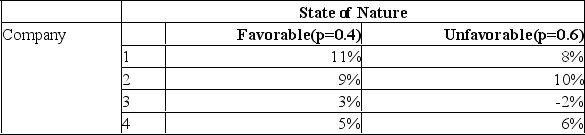

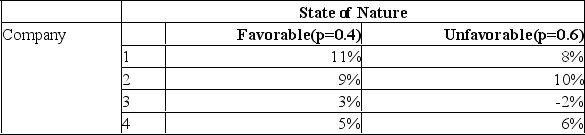

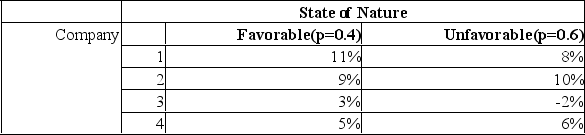

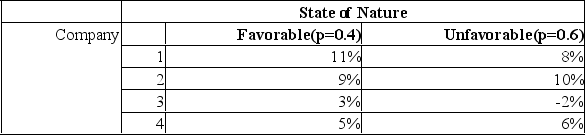

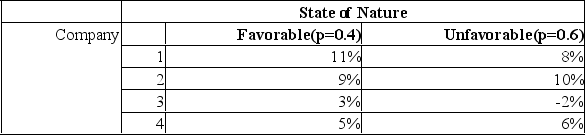

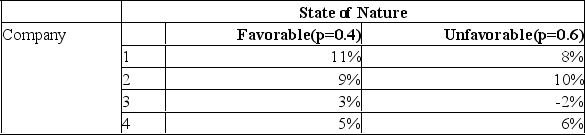

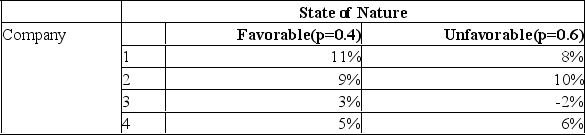

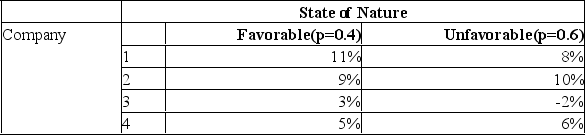

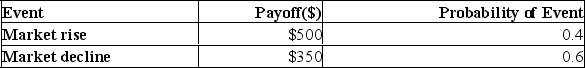

You have a decision to invest $10,000 in any of four different companies. You estimate the probabilities that the economy will be favourable or unfavourable and you estimate the percent returns over the next year.  What is the expected value for Company 4?

What is the expected value for Company 4?

A) 5.20%

B) 5.4%

C) 5.6%

D) 9.4%

What is the expected value for Company 4?

What is the expected value for Company 4?A) 5.20%

B) 5.4%

C) 5.6%

D) 9.4%

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

42

You have a decision to invest $10,000 in any of four different companies. You estimate the probabilities that the economy will be favourable or unfavourable and you estimate the percent returns over the next year.  Based on expected opportunity loss, which company do you choose?

Based on expected opportunity loss, which company do you choose?

A) Company 1

B) Company 2

C) Company 3

D) Company 4

Based on expected opportunity loss, which company do you choose?

Based on expected opportunity loss, which company do you choose?A) Company 1

B) Company 2

C) Company 3

D) Company 4

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

43

You have a decision to invest $10,000 in any of four different companies. You estimate the probabilities that the economy will be favourable or unfavourable and you estimate the percent returns over the next year.  What is the expected value for Company 3?

What is the expected value for Company 3?

A) 0%

B) 3%

C) -2%

D) 1.2%

What is the expected value for Company 3?

What is the expected value for Company 3?A) 0%

B) 3%

C) -2%

D) 1.2%

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

44

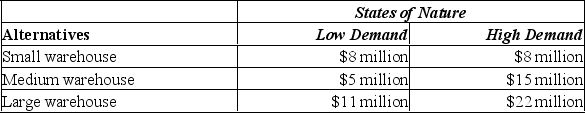

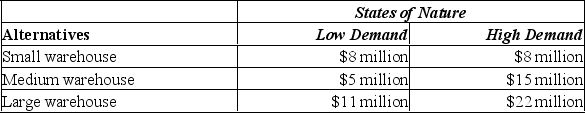

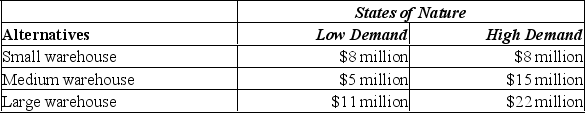

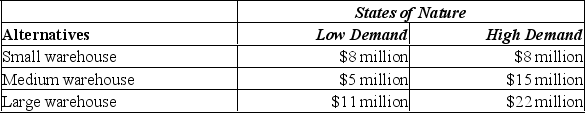

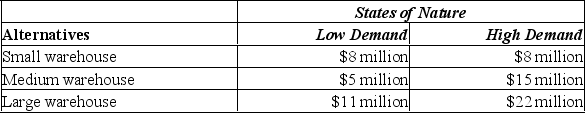

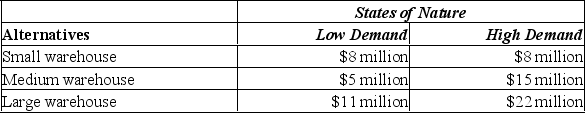

Given the payoff table below, determine the profit and size of warehouse that would be built, using the maximax criterion.

A) $8 million, small warehouse

B) $5 million, medium warehouse

C) $11 million, large warehouse

D) $15 million, medium warehouse

E) $22 million, large warehouse

A) $8 million, small warehouse

B) $5 million, medium warehouse

C) $11 million, large warehouse

D) $15 million, medium warehouse

E) $22 million, large warehouse

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

45

You have a decision to invest $10,000 in any of four different companies. You estimate the probabilities that the economy will be favourable or unfavourable and you estimate the percent returns over the next year.  What is the expected value for Company 1?

What is the expected value for Company 1?

A) 9.20%

B) 9%

C) 9.6%

D) 9.4%

What is the expected value for Company 1?

What is the expected value for Company 1?A) 9.20%

B) 9%

C) 9.6%

D) 9.4%

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

46

You have a decision to invest $10,000 in any of four different companies. You estimate the probabilities that the economy will be favourable or unfavourable and you estimate the percent returns over the next year.  Which company is chosen using the maximax criterion?

Which company is chosen using the maximax criterion?

A) Company 1

B) Company 2

C) Company 3

D) Company 4

Which company is chosen using the maximax criterion?

Which company is chosen using the maximax criterion?A) Company 1

B) Company 2

C) Company 3

D) Company 4

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

47

You have a decision to invest $10,000 in any of four different companies. You estimate the probabilities that the economy will be favourable or unfavourable and you estimate the percent returns over the next year.  Based on the maximin criterion, what is the choice?

Based on the maximin criterion, what is the choice?

A) Company 1

B) Company 2

C) Company 3

D) Company 4

Based on the maximin criterion, what is the choice?

Based on the maximin criterion, what is the choice?A) Company 1

B) Company 2

C) Company 3

D) Company 4

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

48

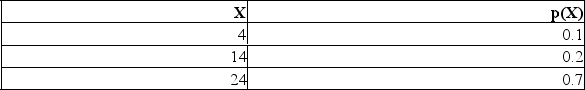

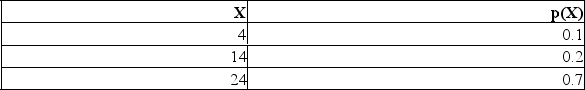

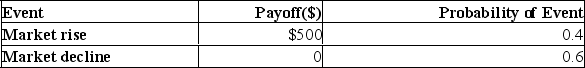

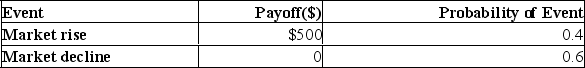

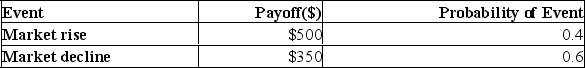

Determine the expected profit for the following distribution.

A) $0

B) $20

C) $30

D) $41

A) $0

B) $20

C) $30

D) $41

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

49

You have a decision to invest $10,000 in any of four different companies. You estimate the probabilities that the economy will be favourable or unfavourable and you estimate the percent returns over the next year.  Based on expected value, what company do you choose?

Based on expected value, what company do you choose?

A) Company 1

B) Company 2

C) Company 3

D) Company 4

Based on expected value, what company do you choose?

Based on expected value, what company do you choose?A) Company 1

B) Company 2

C) Company 3

D) Company 4

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

50

Determine the expected opportunity loss for the following payoff table.

A) $0

B) $200

C) $300

D) $500

A) $0

B) $200

C) $300

D) $500

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

51

You have a decision to invest $10,000 in any of four different companies. You estimate the probabilities that the economy will be favourable or unfavourable and you estimate the percent returns over the next year.  What is the expected value for Company 2?

What is the expected value for Company 2?

A) 9.20%

B) 9%

C) 9.6%

D) 9.4%

What is the expected value for Company 2?

What is the expected value for Company 2?A) 9.20%

B) 9%

C) 9.6%

D) 9.4%

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

52

Determine the expected value for the following payoff table.

A) $0

B) $200

C) $300

D) $410

A) $0

B) $200

C) $300

D) $410

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

53

Given the payoff table below, determine the expected value and size of warehouse that would be built, given a probability of 0.7 and 0.3 to the high and low demands, respectively.

A) $8 million, small warehouse

B) $5 million, medium warehouse

C) $18.7 million, large warehouse

D) $12 million, medium warehouse

E) $22 million, large warehouse

A) $8 million, small warehouse

B) $5 million, medium warehouse

C) $18.7 million, large warehouse

D) $12 million, medium warehouse

E) $22 million, large warehouse

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

54

Given the payoff table below, determine the profit and size of warehouse that would be built, using the maximin criterion.

A) $8 million, small warehouse

B) $5 million, medium warehouse

C) $22 million, large warehouse

D) $15 million, medium warehouse

A) $8 million, small warehouse

B) $5 million, medium warehouse

C) $22 million, large warehouse

D) $15 million, medium warehouse

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck