Deck 12: Income Taxes and the Net Present Value Method

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/147

Play

Full screen (f)

Deck 12: Income Taxes and the Net Present Value Method

1

A capital budgeting project's incremental net income computation for purposes of determining incremental tax expense does not include immediate cash outflows for initial investments in equipment.

True

2

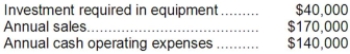

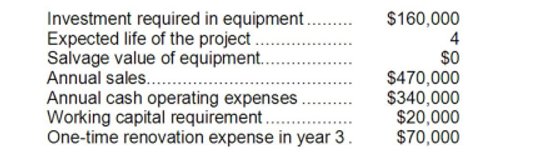

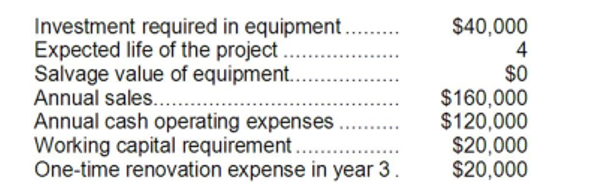

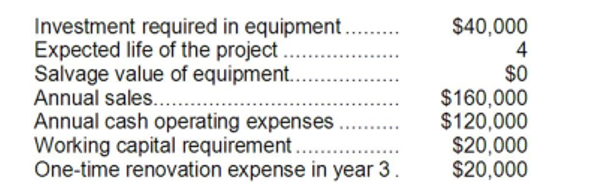

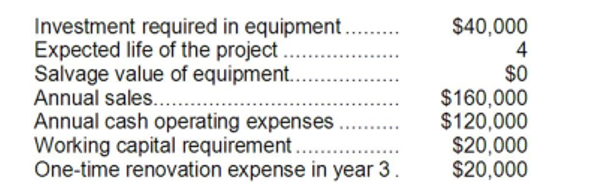

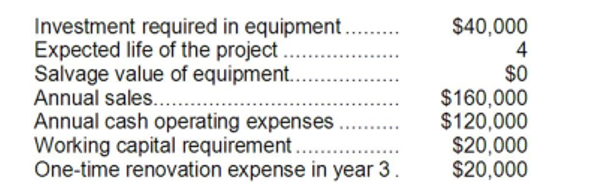

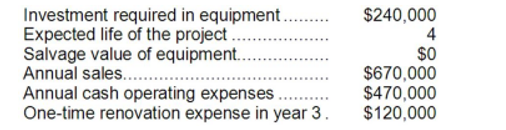

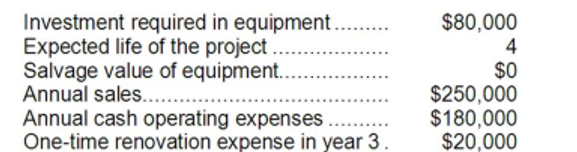

Darnold Corporation has provided the following information concerning a capital budgeting project:  The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 35% and the after-tax discount rate is 9%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $10,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 35% and the after-tax discount rate is 9%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $10,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

A)$74,497

B)$57,170

C)$34,497

D)$52,000

The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 35% and the after-tax discount rate is 9%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $10,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 35% and the after-tax discount rate is 9%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $10,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:A)$74,497

B)$57,170

C)$34,497

D)$52,000

C

3

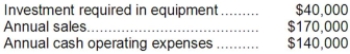

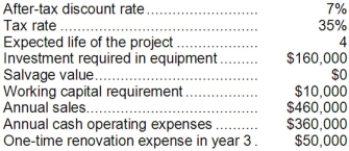

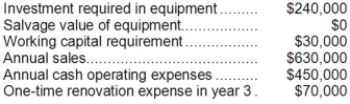

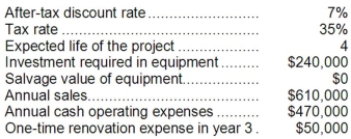

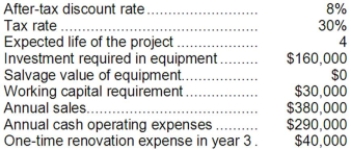

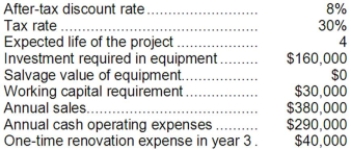

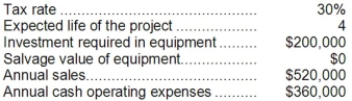

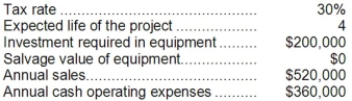

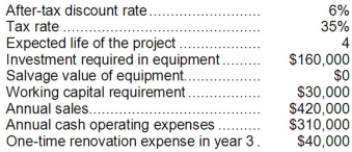

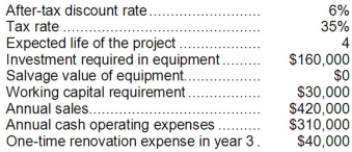

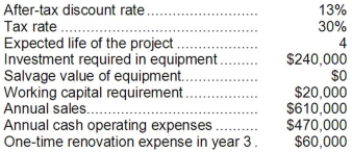

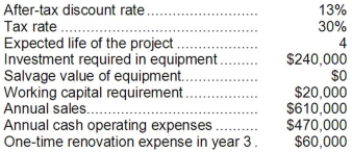

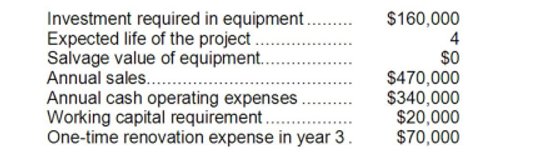

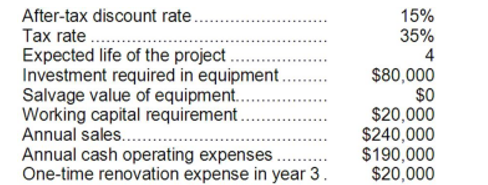

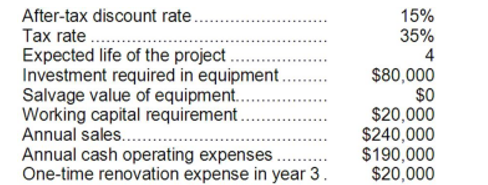

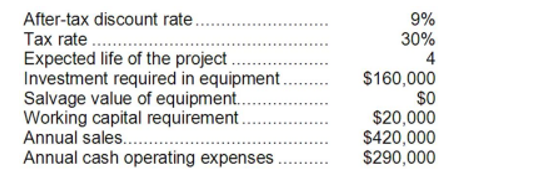

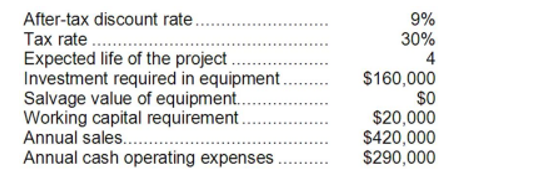

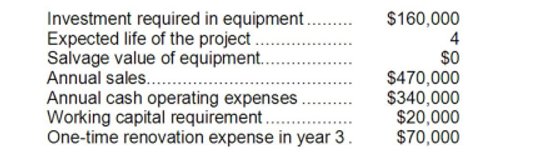

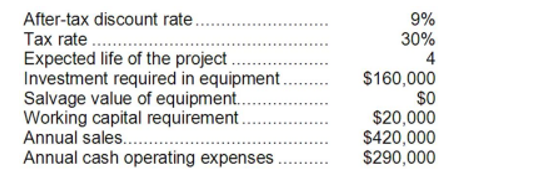

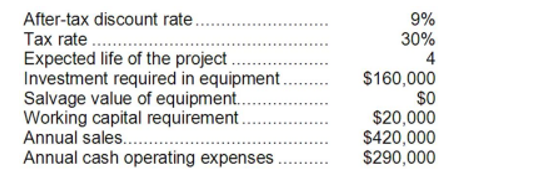

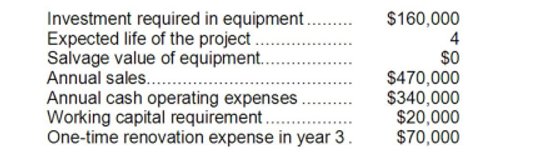

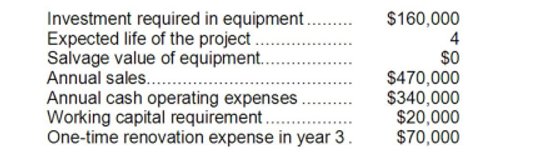

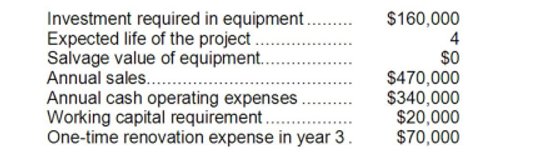

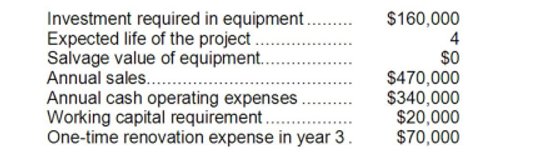

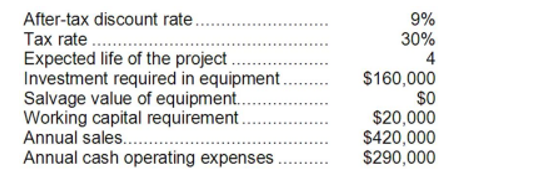

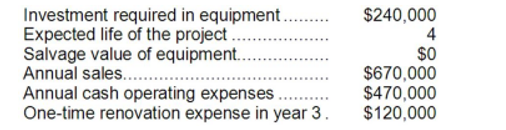

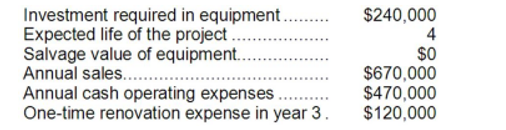

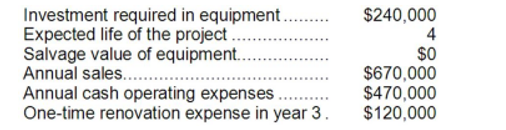

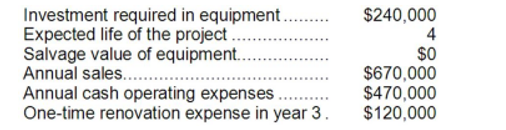

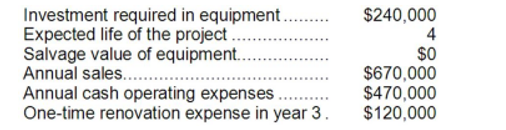

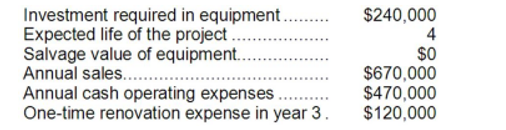

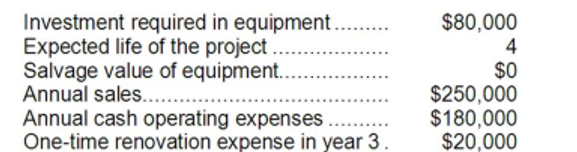

Jessel Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

A)$382,320

B)$227,039

C)$220,209

D)$364,000

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:A)$382,320

B)$227,039

C)$220,209

D)$364,000

B

4

Kellog Corporation is considering a capital budgeting project that would have a useful life of 4 years and would involve investing $160,000 in equipment that would have zero salvage value at the end of the project. Annual incremental sales would be $390,000 and annual cash operating expenses would be $260,000. The company uses straight-line depreciation on all equipment. Its income tax rate is 35%. The income tax expense in year 2 is:

A)$7,000

B)$45,500

C)$31,500

D)$24,500

A)$7,000

B)$45,500

C)$31,500

D)$24,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

5

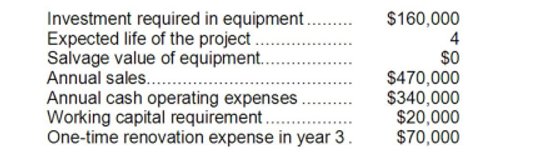

Freiman Corporation is considering investing in a project that would have a 4 year expected useful life. The company would need to invest $160,000 in equipment that will have zero salvage value at the end of the project. Annual incremental sales would be $390,000 and annual cash operating expenses would be $270,000. In year 3 the company would have to incur one-time renovation expenses of $70,000. Working capital in the amount of $10,000 would be required. The working capital would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. The income tax expense in year 2 is:

A)$24,000

B)$21,000

C)$36,000

D)$3,000

A)$24,000

B)$21,000

C)$36,000

D)$3,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

6

Under the simplifying assumptions made in the text, to calculate the amount of income tax expense associated with an investment project, first calculate the incremental net income earned during each year of the project and then multiply each year's incremental net income by the tax rate.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

7

The release of working capital at the end of an investment project is not a taxable cash inflow.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

8

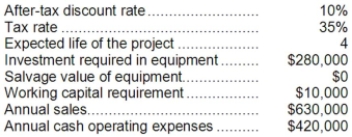

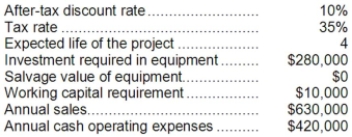

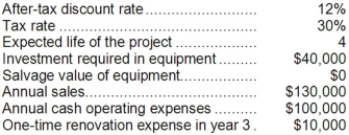

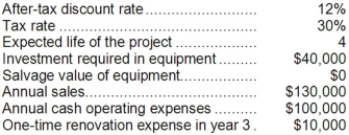

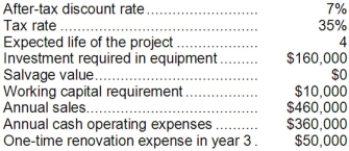

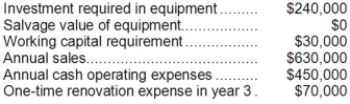

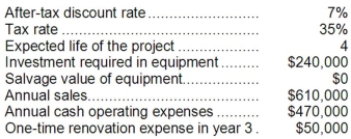

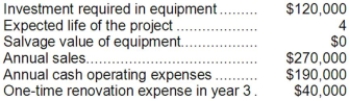

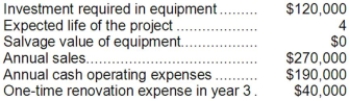

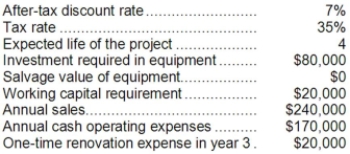

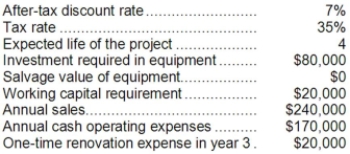

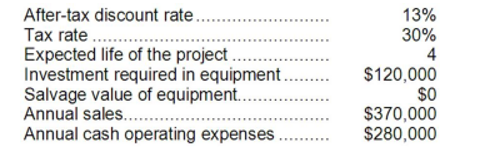

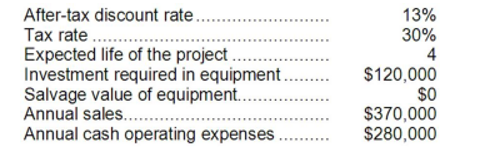

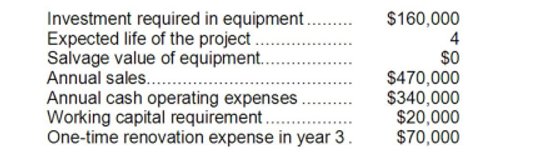

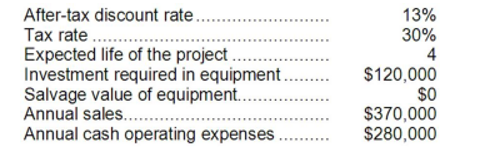

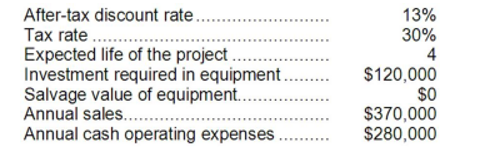

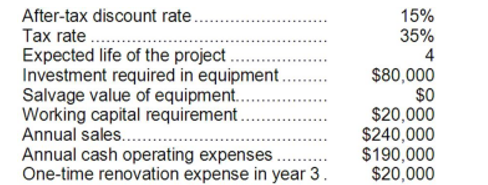

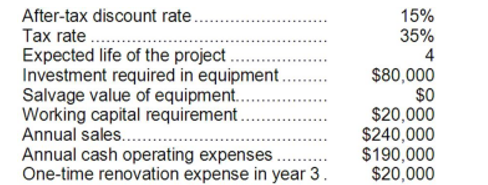

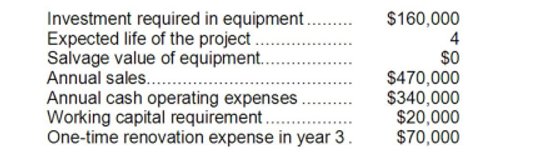

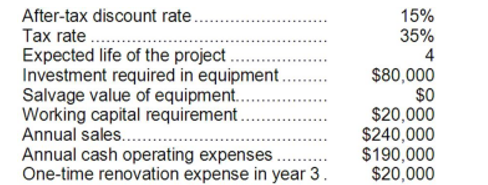

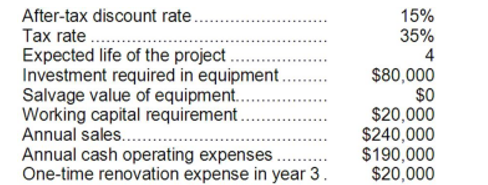

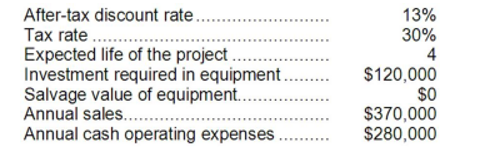

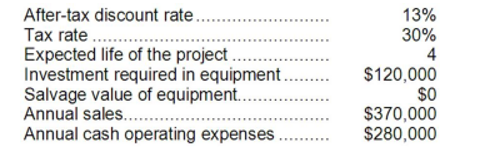

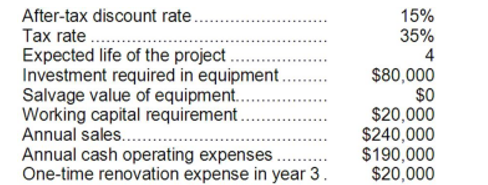

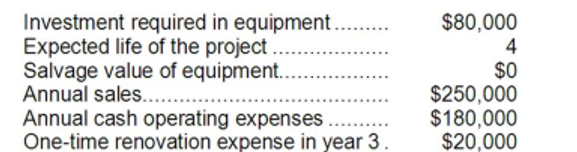

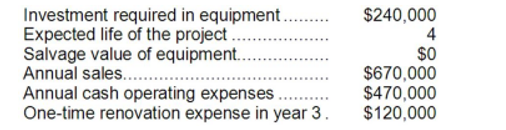

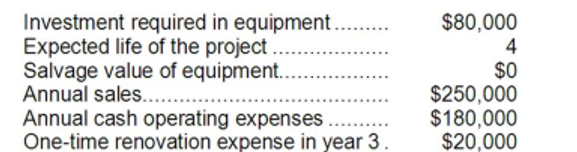

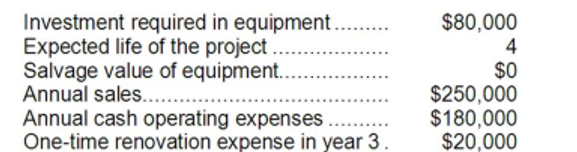

Bourret Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

A)$27,928

B)$67,928

C)$49,000

D)$44,020

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:A)$27,928

B)$67,928

C)$49,000

D)$44,020

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

9

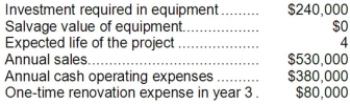

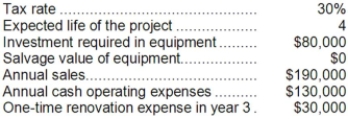

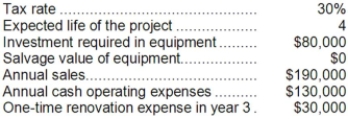

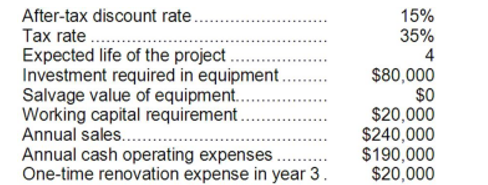

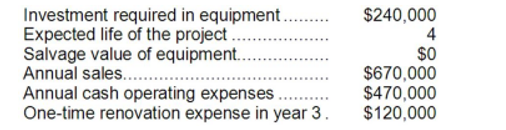

Broxterman Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 3 is:

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 3 is:

A)$89,000

B)$56,500

C)$60,000

D)$39,000

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 3 is:

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 3 is:A)$89,000

B)$56,500

C)$60,000

D)$39,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

10

Lastufka Corporation is considering a capital budgeting project. The project would require an investment of $240,000 in equipment with a 4 year expected life and zero salvage value. The company uses straight-line depreciation and the annual depreciation expense will be $60,000. Annual incremental sales would be $500,000 and annual incremental cash operating expenses would be $390,000. The company's income tax rate is 35% and the after-tax discount rate is 8%. The company takes income taxes into account in its capital budgeting. Assume cash flows occur at the end of the year except for the initial investments. The net present value of the project is closest to:

A)$66,360

B)$306,360

C)$130,000

D)$124,320

A)$66,360

B)$306,360

C)$130,000

D)$124,320

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

11

In capital budgeting computations, discounted cash flow methods:

A)automatically provide for recovery of initial investment.

B)can't be used unless cash flows are uniform from year to year.

C)assume that all cash flows occur at the beginning of a period.

D)ignore all cash flows after the payback period.

A)automatically provide for recovery of initial investment.

B)can't be used unless cash flows are uniform from year to year.

C)assume that all cash flows occur at the beginning of a period.

D)ignore all cash flows after the payback period.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

12

Blier Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The income tax expense in year 2 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 2 is:

A)$17,500

B)$3,500

C)$35,000

D)$21,000

The company uses straight-line depreciation on all equipment. The income tax expense in year 2 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 2 is:A)$17,500

B)$3,500

C)$35,000

D)$21,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

13

Gayheart Corporation is considering a capital budgeting project that would require investing $80,000 in equipment with an expected life of 4 years and zero salvage value. The annual incremental sales would be $260,000 and the annual incremental cash operating expenses would be $190,000. The company's income tax rate is 30%. The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

A)$50,000

B)$55,000

C)$70,000

D)$34,000

A)$50,000

B)$55,000

C)$70,000

D)$34,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

14

The investment in working capital at the start of an investment project can not be deducted from revenues when computing taxable income.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

15

Bosell Corporation has provided the following information concerning a capital budgeting project:  The income tax rate is 30%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The income tax rate is 30%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

A)$142,950

B)$320,499

C)$80,499

D)$196,000

The income tax rate is 30%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The income tax rate is 30%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:A)$142,950

B)$320,499

C)$80,499

D)$196,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

16

Alopecia Hair Tonic Corporation is considering an investment project that is expected to generate net cash inflows of $65,000 per year for 4 years. The only initial investment funds required will be a $150,000 increase in working capital. This will be released at the end of the 4 years. Alopecia's after-tax cost of capital is 12% and its tax rate is 30%. The net present value of this investment project is closest to:

A)$4,622

B)$59,222

C)$83,584

D)$99,964

A)$4,622

B)$59,222

C)$83,584

D)$99,964

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

17

Unless the organization is tax-exempt, income taxes should be considered when using net present value analysis to make capital budgeting decisions.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

18

The following information concerning a proposed capital budgeting project has been provided by Wick Corporation:  The expected life of the project is 4 years. The income tax rate is 35%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The expected life of the project is 4 years. The income tax rate is 35%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

A)$101,282

B)$224,850

C)$119,042

D)$266,500

The expected life of the project is 4 years. The income tax rate is 35%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The expected life of the project is 4 years. The income tax rate is 35%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:A)$101,282

B)$224,850

C)$119,042

D)$266,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

19

Milliner Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

A)$112,824

B)$352,824

C)$193,380

D)$175,500

The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:A)$112,824

B)$352,824

C)$193,380

D)$175,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

20

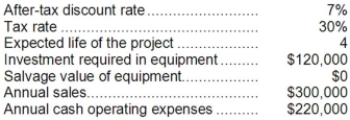

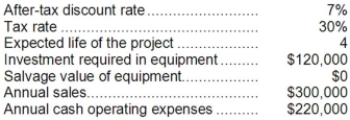

Rieben Corporation is considering a capital budgeting project that would involve investing $120,000 in equipment with an estimated useful life of 4 years and no salvage value at the end of the useful life. Annual incremental sales from the project would be $320,000 and the annual incremental cash operating expenses would be $220,000. A one-time renovation expense of $40,000 would be required in year 3. The company's income tax rate is 30%. The company uses straight-line depreciation on all equipment.

The income tax expense in year 3 is:

A)$9,000

B)$30,000

C)$12,000

D)$21,000

The income tax expense in year 3 is:

A)$9,000

B)$30,000

C)$12,000

D)$21,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

21

Leamon Corporation is considering a capital budgeting project that would require an investment of $240,000 in equipment with a 4 year useful life and zero salvage value. The annual incremental sales would be $630,000 and the annual incremental cash operating expenses would be $480,000. In addition, there would be a one-time renovation expense in year 3 of $40,000. The company's income tax rate is 35%. The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 3 is:

A)$92,500

B)$110,000

C)$78,500

D)$118,500

A)$92,500

B)$110,000

C)$78,500

D)$118,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

22

Gutshall Corporation is considering a capital budgeting project that would involve investing $240,000 in equipment with an estimated useful life of 4 years and no salvage value at the end of the useful life. Annual incremental sales from the project would be $580,000 and the annual incremental cash operating expenses would be $430,000. A one-time renovation expense of $70,000 would be required in year 3. The project would require investing $10,000 of working capital in the project immediately, but this amount would be recovered at the end of the project in 4 years. The company's income tax rate is 30% and its after-tax discount rate is 13%. The company uses straight-line depreciation on all equipment.

The income tax expense in year 3 is:

A)$6,000

B)$45,000

C)$21,000

D)$27,000

The income tax expense in year 3 is:

A)$6,000

B)$45,000

C)$21,000

D)$27,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

23

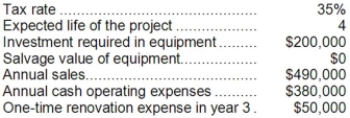

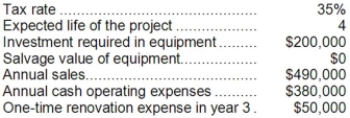

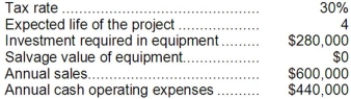

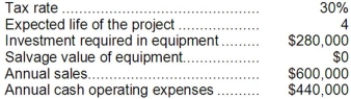

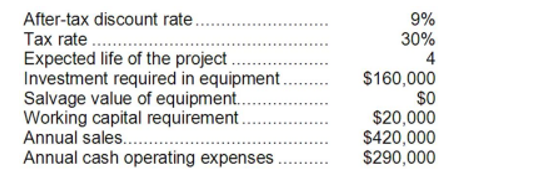

Santistevan Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

A)$58,218

B)$98,370

C)$112,000

D)$36,168

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:A)$58,218

B)$98,370

C)$112,000

D)$36,168

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

24

Folino Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $380,000 and annual incremental cash operating expenses would be $300,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $30,000 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$17,500

B)$7,000

C)$28,000

D)$10,500

-The income tax expense in year 2 is:

A)$17,500

B)$7,000

C)$28,000

D)$10,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

25

The Moab Corporation had sales of $300,000 and expenses of $175,000 last year. All sales were cash sales and all expenses were cash expenses. Moab Corporation's tax rate is 30%. The after-tax net cash inflow at Moab last year was:

A)$210,000

B)$37,500

C)$52,500

D)$87,500

A)$210,000

B)$37,500

C)$52,500

D)$87,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

26

Welti Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $30,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $30,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

A)$140,000

B)$150,960

C)$220,155

D)$100,155

The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $30,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $30,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:A)$140,000

B)$150,960

C)$220,155

D)$100,155

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

27

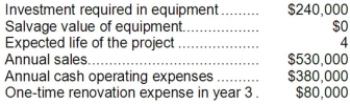

Strathman Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The income tax expense in year 2 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 2 is:

A)$33,000

B)$48,000

C)$9,000

D)$24,000

The company uses straight-line depreciation on all equipment. The income tax expense in year 2 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 2 is:A)$33,000

B)$48,000

C)$9,000

D)$24,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

28

Wollard Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

A)$3,000

B)$12,000

C)$18,000

D)$9,000

The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:A)$3,000

B)$12,000

C)$18,000

D)$9,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

29

Lucarell Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

A)$24,500

B)$14,000

C)$10,500

D)$38,500

The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:A)$24,500

B)$14,000

C)$10,500

D)$38,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

30

Folino Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $380,000 and annual incremental cash operating expenses would be $300,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $30,000 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A)$28,000

B)$10,500

C)$7,000

D)$17,500

-The income tax expense in year 3 is:

A)$28,000

B)$10,500

C)$7,000

D)$17,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

31

Folino Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $380,000 and annual incremental cash operating expenses would be $300,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $30,000 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$62,500

B)$80,000

C)$43,000

D)$50,000

-The total cash flow net of income taxes in year 2 is:

A)$62,500

B)$80,000

C)$43,000

D)$50,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

32

Folino Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $380,000 and annual incremental cash operating expenses would be $300,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $30,000 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

A)$32,500

B)$62,500

C)$43,000

D)$50,000

-The total cash flow net of income taxes in year 3 is:

A)$32,500

B)$62,500

C)$43,000

D)$50,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

33

A company needs an increase in working capital of $20,000 in a project that will last 4 years. The company's tax rate is 30% and its after-tax discount rate is 10%. The present value of the release of the working capital at the end of the project is closest to:

A)$6,000

B)$13,660

C)$9,562

D)$14,000

A)$6,000

B)$13,660

C)$9,562

D)$14,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

34

Lasater Corporation has provided the following information concerning a capital budgeting project:  The company's tax rate is 35%. The company's after-tax discount rate is 15%. The project would require an investment of $10,000 at the beginning of the project. This working capital would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

The company's tax rate is 35%. The company's after-tax discount rate is 15%. The project would require an investment of $10,000 at the beginning of the project. This working capital would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

A)$62,500

B)$36,500

C)$50,000

D)$80,000

The company's tax rate is 35%. The company's after-tax discount rate is 15%. The project would require an investment of $10,000 at the beginning of the project. This working capital would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

The company's tax rate is 35%. The company's after-tax discount rate is 15%. The project would require an investment of $10,000 at the beginning of the project. This working capital would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:A)$62,500

B)$36,500

C)$50,000

D)$80,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

35

Pulkkinen Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

A)$70,000

B)$50,000

C)$52,500

D)$39,500

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:A)$70,000

B)$50,000

C)$52,500

D)$39,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

36

Sader Corporation is considering a capital budgeting project that would require an investment of $160,000 in equipment with a 4 year expected life and zero salvage value. Annual incremental sales will be $420,000 and annual incremental cash operating expenses will be $320,000. The company's income tax rate is 30% and the after-tax discount rate is 8%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $40,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

A)$271,584

B)$111,584

C)$171,200

D)$168,000

A)$271,584

B)$111,584

C)$171,200

D)$168,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

37

A company anticipates incremental net income (i.e., incremental taxable income) of $50,000 in year 4 of a project. The company's tax rate is 30% and its after-tax discount rate is 12%. The present value of this future cash flow is closest to:

A)$22,260

B)$35,000

C)$9,533

D)$15,000

A)$22,260

B)$35,000

C)$9,533

D)$15,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

38

Folino Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $380,000 and annual incremental cash operating expenses would be $300,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $30,000 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$110,500

B)$35,669

C)$84,460

D)$41,389

-The net present value of the entire project is closest to:

A)$110,500

B)$35,669

C)$84,460

D)$41,389

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

39

Onorato Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

A)$133,000

B)$160,000

C)$90,000

D)$98,000

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:A)$133,000

B)$160,000

C)$90,000

D)$98,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

40

Croes Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 3 is:

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 3 is:

A)$116,000

B)$80,000

C)$74,000

D)$56,000

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 3 is:

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 3 is:A)$116,000

B)$80,000

C)$74,000

D)$56,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

41

Dekle Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$94,128

B)$214,128

C)$168,000

D)$147,660

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$94,128

B)$214,128

C)$168,000

D)$147,660

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

42

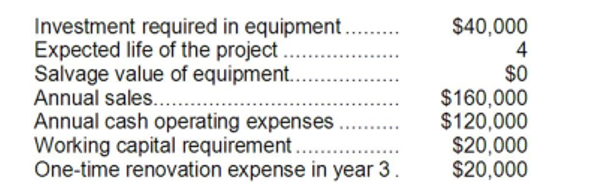

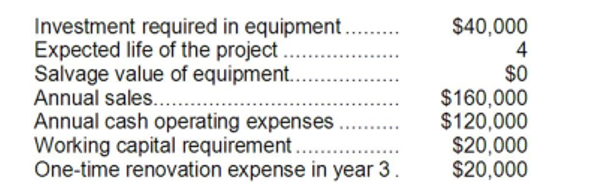

Pont Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$90,000

B)$54,000

C)$130,000

D)$103,000

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$90,000

B)$54,000

C)$130,000

D)$103,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

43

Pont Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$27,000

B)$21,000

C)$39,000

D)$6,000

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$27,000

B)$21,000

C)$39,000

D)$6,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

44

Mitton Corporation is considering a capital budgeting project that would require investing $160,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $440,000 and annual incremental cash operating expenses would be $320,000. The project would also require a one-time renovation cost of $0 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$92,000

B)$28,000

C)$120,000

D)$80,000

-The total cash flow net of income taxes in year 2 is:

A)$92,000

B)$28,000

C)$120,000

D)$80,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

45

Glasco Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$111,500

B)$150,000

C)$46,500

D)$110,000

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$111,500

B)$150,000

C)$46,500

D)$110,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

46

Dekle Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$72,000

B)$90,000

C)$18,000

D)$60,000

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$72,000

B)$90,000

C)$18,000

D)$60,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

47

Boch Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$27,000

B)$12,000

C)$126,000

D)$87,000

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$27,000

B)$12,000

C)$126,000

D)$87,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

48

Glasco Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$4,258

B)$15,698

C)$65,000

D)$41,080

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$4,258

B)$15,698

C)$65,000

D)$41,080

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

49

Lanfranco Corporation is considering a capital budgeting project that would require investing $160,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $480,000 and annual incremental cash operating expenses would be $330,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $100,000 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 6%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$161,748

B)$169,668

C)$221,000

D)$273,670

-The net present value of the entire project is closest to:

A)$161,748

B)$169,668

C)$221,000

D)$273,670

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

50

Lanfranco Corporation is considering a capital budgeting project that would require investing $160,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $480,000 and annual incremental cash operating expenses would be $330,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $100,000 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 6%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

A)$46,500

B)$11,500

C)$111,500

D)$50,000

-The total cash flow net of income taxes in year 3 is:

A)$46,500

B)$11,500

C)$111,500

D)$50,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

51

Pont Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A)$27,000

B)$6,000

C)$21,000

D)$39,000

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A)$27,000

B)$6,000

C)$21,000

D)$39,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

52

Glasco Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$7,000

B)$3,500

C)$10,500

D)$17,500

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$7,000

B)$3,500

C)$10,500

D)$17,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

53

Boch Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$90,000

B)$103,000

C)$27,000

D)$130,000

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$90,000

B)$103,000

C)$27,000

D)$130,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

54

Dekle Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$111,000

B)$84,000

C)$18,000

D)$9,000

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$111,000

B)$84,000

C)$18,000

D)$9,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

55

Pont Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

A)$103,000

B)$33,000

C)$54,000

D)$60,000

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

A)$103,000

B)$33,000

C)$54,000

D)$60,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

56

Mitton Corporation is considering a capital budgeting project that would require investing $160,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $440,000 and annual incremental cash operating expenses would be $320,000. The project would also require a one-time renovation cost of $0 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$14,000

B)$112,000

C)$28,000

D)$154,000

-The income tax expense in year 2 is:

A)$14,000

B)$112,000

C)$28,000

D)$154,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

57

Pont Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$123,268

B)$193,060

C)$109,608

D)$203,000

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$123,268

B)$193,060

C)$109,608

D)$203,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

58

Glasco Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A)$7,000

B)$17,500

C)$3,500

D)$10,500

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A)$7,000

B)$17,500

C)$3,500

D)$10,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

59

Mitton Corporation is considering a capital budgeting project that would require investing $160,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $440,000 and annual incremental cash operating expenses would be $320,000. The project would also require a one-time renovation cost of $0 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$279,496

B)$119,496

C)$208,000

D)$204,560

-The net present value of the entire project is closest to:

A)$279,496

B)$119,496

C)$208,000

D)$204,560

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

60

Boch Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$255,230

B)$167,777

C)$153,617

D)$252,000

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$255,230

B)$167,777

C)$153,617

D)$252,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

61

Skolfield Corporation is considering a capital budgeting project that would require investing $280,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $590,000 and annual incremental cash operating expenses would be $470,000. The project would also require an immediate investment in working capital of $20,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $30,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A)$6,000

B)$15,000

C)$9,000

D)$36,000

-The income tax expense in year 3 is:

A)$6,000

B)$15,000

C)$9,000

D)$36,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

62

Kostka Corporation is considering a capital budgeting project that would require investing $160,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $480,000 and annual incremental cash operating expenses would be $330,000. The project would also require an immediate investment in working capital of $20,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $0 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 9%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$110,000

B)$117,000

C)$150,000

D)$33,000

-The total cash flow net of income taxes in year 2 is:

A)$110,000

B)$117,000

C)$150,000

D)$33,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

63

Shinabery Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$14,000

B)$3,500

C)$7,000

D)$10,500

The company's income tax rate is 35% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$14,000

B)$3,500

C)$7,000

D)$10,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

64

Shinabery Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A)$3,500

B)$14,000

C)$7,000

D)$10,500

The company's income tax rate is 35% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A)$3,500

B)$14,000

C)$7,000

D)$10,500

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

65

Foucault Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$140,000

B)$200,000

C)$151,000

D)$73,000

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A)$140,000

B)$200,000

C)$151,000

D)$73,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

66

Kostka Corporation is considering a capital budgeting project that would require investing $160,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $480,000 and annual incremental cash operating expenses would be $330,000. The project would also require an immediate investment in working capital of $20,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $0 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 9%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$213,123

B)$198,963

C)$308,000

D)$320,010

-The net present value of the entire project is closest to:

A)$213,123

B)$198,963

C)$308,000

D)$320,010

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

67

Trammel Corporation is considering a capital budgeting project that would require investing $280,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $650,000 and annual incremental cash operating expenses would be $450,000. The project would also require a one-time renovation cost of $100,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$9,000

B)$30,000

C)$39,000

D)$60,000

-The income tax expense in year 2 is:

A)$9,000

B)$30,000

C)$39,000

D)$60,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

68

Trammel Corporation is considering a capital budgeting project that would require investing $280,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $650,000 and annual incremental cash operating expenses would be $450,000. The project would also require a one-time renovation cost of $100,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A)$9,000

B)$30,000

C)$39,000

D)$60,000

-The income tax expense in year 3 is:

A)$9,000

B)$30,000

C)$39,000

D)$60,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

69

Credit Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$15,000

B)$6,000

C)$9,000

D)$21,000

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$15,000

B)$6,000

C)$9,000

D)$21,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

70

Trammel Corporation is considering a capital budgeting project that would require investing $280,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $650,000 and annual incremental cash operating expenses would be $450,000. The project would also require a one-time renovation cost of $100,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$208,187

B)$315,800

C)$488,187

D)$294,000

-The net present value of the entire project is closest to:

A)$208,187

B)$315,800

C)$488,187

D)$294,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

71

Foucault Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A)$70,000

B)$42,000

C)$7,000

D)$49,000

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A)$70,000

B)$42,000

C)$7,000

D)$49,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

72

Foucault Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$403,202

B)$282,160

C)$163,202

D)$286,000

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$403,202

B)$282,160

C)$163,202

D)$286,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

73

Skolfield Corporation is considering a capital budgeting project that would require investing $280,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $590,000 and annual incremental cash operating expenses would be $470,000. The project would also require an immediate investment in working capital of $20,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $30,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A)$(2,498)

B)$34,420

C)$(13,938)

D)$119,000

-The net present value of the entire project is closest to:

A)$(2,498)

B)$34,420

C)$(13,938)

D)$119,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

74

Skolfield Corporation is considering a capital budgeting project that would require investing $280,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $590,000 and annual incremental cash operating expenses would be $470,000. The project would also require an immediate investment in working capital of $20,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $30,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$15,000

B)$6,000

C)$9,000

D)$36,000

-The income tax expense in year 2 is:

A)$15,000

B)$6,000

C)$9,000

D)$36,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

75

Foucault Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$70,000

B)$7,000

C)$42,000

D)$49,000

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A)$70,000

B)$7,000

C)$42,000

D)$49,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

76

Credit Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.