Deck 9: Reporting and Interpreting Liabilities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/129

Play

Full screen (f)

Deck 9: Reporting and Interpreting Liabilities

1

The accounts payable turnover ratio is difficult to manipulate.

False

2

Cash received from customers may result in a current liability.

True

3

An employee has an obligation to pay his payroll taxes to the employer.

False

4

Wages expense is an example of an accrued liability account.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

5

A contingent liability is reported on the balance sheet if it is probable and can be estimated.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

6

A liability that is estimated because the final settlement amount is unknown cannot be reported on the balance sheet.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

7

The accounts payable turnover ratio is calculated by dividing accounts payable by cash payments to suppliers.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

8

Purchasing inventory on account increases the accounts payable turnover ratio.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

9

Accounts payable and accrued liabilities are interchangeable account titles.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

10

A contingent liability is disclosed in a note to the financial statements when the liability is reasonably possible and can be estimated.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

11

The journal entry to record a contingent liability creates an accrued liability on the balance sheet and a loss on the income statement.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

12

The FICA (social security) tax is a matching tax with a portion paid by both the employer and the employee.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

13

The choice of inventory method has an impact on the accounts payable turnover ratio.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

14

A current liability is created when a customer pays cash for services to be provided in the future.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

15

A company borrowed $100,000 at 6% interest on September 1, 2016. Assuming adjusting entries have not been made during the year, the entry to record interest accrued on December 31, 2016 would include a debit to interest expense and a credit to interest payable for $2,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

16

A current liability is always a short-term obligation expected to be paid within one year of the balance sheet date.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

17

When a liability is initially recorded, it is recorded at the future amount of all payments.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

18

The accrual of interest on a short-term note payable decreases working capital and current assets.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

19

Income taxes payable is an example of an accrued liability.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

20

The accrual of interest results in an increase liabilities and a decrease in cash.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

21

Working capital is a measure of long-term liquidity and is calculated by subtracting the current liabilities from the current assets.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

22

Working capital increases when a company accrues sales revenue at year-end.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

23

An annuity is a series of consecutive and unequal payments over time.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

24

Working capital increases when a company purchases equipment and signs a 2-year note payable.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements is correct?

A)Social Security tax is paid only by the employer.

B)The pay period always ends in conjunction with the company's fiscal year-end.

C)Employee benefits such as vacation time and sick days should be recognized when the employees earn the benefit and not when they take the days off from work.

D)Unemployment taxes are paid by the employee only.

A)Social Security tax is paid only by the employer.

B)The pay period always ends in conjunction with the company's fiscal year-end.

C)Employee benefits such as vacation time and sick days should be recognized when the employees earn the benefit and not when they take the days off from work.

D)Unemployment taxes are paid by the employee only.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

26

Working capital is a measure of short-run liquidity and is measured by dividing current assets by current liabilities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

27

Working capital decreases when a company pays taxes payable.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

28

Operating leases are reported on the balance sheet at an amount equal to the present value of the future cash flows.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

29

In order to calculate the cost of a long-term asset that is financed with long-term debt, present values concepts would be used.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is correct?

A)Unearned revenues are considered increases to stockholders' equity.

B)Working capital is measured as current liabilities minus current assets.

C)Working capital increases when a company pays the principal on a long-term note.

D)Unearned revenues will eventually become revenue earneD.Unearned revenues are considered a liability account until the company has provided the services at which time the revenue will be recognized.

A)Unearned revenues are considered increases to stockholders' equity.

B)Working capital is measured as current liabilities minus current assets.

C)Working capital increases when a company pays the principal on a long-term note.

D)Unearned revenues will eventually become revenue earneD.Unearned revenues are considered a liability account until the company has provided the services at which time the revenue will be recognized.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

31

Long-term liabilities are reported on the balance sheet at an amount equal to the future cash flows.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is not a current liability?

A)A liability due within one year for a business with a fifteen-month operating cycle.

B)A liability due within three months for a business with a two-month operating cycle.

C)A liability due within one year for a business with a nine-month operating cycle.

D)A liability due within fifteen months for a business with a one-year operating cycle.

A)A liability due within one year for a business with a fifteen-month operating cycle.

B)A liability due within three months for a business with a two-month operating cycle.

C)A liability due within one year for a business with a nine-month operating cycle.

D)A liability due within fifteen months for a business with a one-year operating cycle.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

33

A contingent liability can not be disclosed in a note to the financial statements unless it can be estimated.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

34

An annuity is a series of consecutive payments, each one increasing by a fixed dollar amount over the payment amount of the prior year.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following describes an accrued liability?

A)It is an expense that has been both incurred and paid.

B)It is an expense that has been incurred but not yet paid.

C)It is an expense that has been prepaid but not yet consumed.

D)It is a liability where the cash flow has taken place but the revenue has yet to be earneD.An accrued liability is recorded when an expense is incurred but not yet paid.

A)It is an expense that has been both incurred and paid.

B)It is an expense that has been incurred but not yet paid.

C)It is an expense that has been prepaid but not yet consumed.

D)It is a liability where the cash flow has taken place but the revenue has yet to be earneD.An accrued liability is recorded when an expense is incurred but not yet paid.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

36

Working capital decreases when accrued wages expense is recorded at year-end.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is correct?

A)Current liabilities are initially recorded at the amount of their principal plus interest.

B)Current liabilities are those liabilities due within one year.

C)Liquidity refers to the ability to pay all debts within one year.

D)Current liabilities affect working capital and the cash flows from operating activities.

A)Current liabilities are initially recorded at the amount of their principal plus interest.

B)Current liabilities are those liabilities due within one year.

C)Liquidity refers to the ability to pay all debts within one year.

D)Current liabilities affect working capital and the cash flows from operating activities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is incorrect?

A)Current liabilities are those that will be satisfied within one year or the operating cycle, whichever is longer.

B)Liquidity is the ability of the company to meet its total obligations.

C)Current liabilities impact a company's liquidity.

D)Working capital is equal to current assets minus current liabilities.

A)Current liabilities are those that will be satisfied within one year or the operating cycle, whichever is longer.

B)Liquidity is the ability of the company to meet its total obligations.

C)Current liabilities impact a company's liquidity.

D)Working capital is equal to current assets minus current liabilities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

39

When a company receives cash before products or services are provided the following results:

A)Assets and stockholders' equity increase.

B)Assets and revenue increase.

C)Liabilities and revenues increase.

D)Liabilities and assets increase.

A)Assets and stockholders' equity increase.

B)Assets and revenue increase.

C)Liabilities and revenues increase.

D)Liabilities and assets increase.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

40

For the present value of a single amount, the compounding period may only be once a year.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements is incorrect?

A)The currently maturing portion of long-term debt must be classified as a current liability.

B)The non-current portion of long-term debt will be correctly reported as a long-term liability.

C)Even when a company plans to refinance the currently maturing debt on a long-term basis, and has the ability to do so, it must still report the currently maturing debt as a current liability.

D)The currently maturing portion of long-term debt is a current liability if it is due within one year or from the date of the balance sheet, or within the operating cycle, whichever is longer.

A)The currently maturing portion of long-term debt must be classified as a current liability.

B)The non-current portion of long-term debt will be correctly reported as a long-term liability.

C)Even when a company plans to refinance the currently maturing debt on a long-term basis, and has the ability to do so, it must still report the currently maturing debt as a current liability.

D)The currently maturing portion of long-term debt is a current liability if it is due within one year or from the date of the balance sheet, or within the operating cycle, whichever is longer.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following would not be a result of the adjusting entry to record accrued interest on a note payable?

A)A decrease in net income.

B)A decrease in stockholders' equity.

C)An increase in liabilities.

D)A decrease in current assets.

A)A decrease in net income.

B)A decrease in stockholders' equity.

C)An increase in liabilities.

D)A decrease in current assets.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

43

Mission Corp. borrowed $50,000 cash on April 1, 2016, and signed a one-year 12%, interest-bearing note payable. The interest and principal are both due on March 31, 2017. What is the amount to be paid to the bank on March 31, 2017 for interest and principal?

A)$50,000.

B)$51,500.

C)$54,000.

D)$56,000.

A)$50,000.

B)$51,500.

C)$54,000.

D)$56,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

44

Mission Corp. borrowed $50,000 cash on April 1, 2016, and signed a one-year 12%, interest-bearing note payable. The interest and principal are both due on March 31, 2017. Assume that no adjusting entries had been made before December 31, 2016. Which of the following would be the required adjusting entry on December 31, 2016?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

45

Landseeker's Restaurants reported cost of goods sold of $322 million and accounts payable of $84 million for 2017. In 2016, cost of goods sold was $258 million and accounts payable was $72 million. Landseeker's accounts payable turnover ratio in 2017 is closest to:

A)4.25

B)4.13

C)3.45

D)3.31

A)4.25

B)4.13

C)3.45

D)3.31

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

46

The accrual of interest results in the following:

A)Increase in assets and liabilities.

B)Increase in assets and stockholders' equity.

C)Increase in liabilities and decrease in stockholders' equity.

D)Increase in liabilities and increase in stockholders' equity.

A)Increase in assets and liabilities.

B)Increase in assets and stockholders' equity.

C)Increase in liabilities and decrease in stockholders' equity.

D)Increase in liabilities and increase in stockholders' equity.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

47

Mission Corp. borrowed $50,000 cash on April 1, 2016, and signed a one-year 12%, interest-bearing note payable. The interest and principal are both due on March 31, 2017. The amount of interest expense for the year ended December 31, 2016 is:

A)$6,000.

B)$4,500.

C)$4,000.

D)$1,500.

A)$6,000.

B)$4,500.

C)$4,000.

D)$1,500.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following best describes the accrual of interest?

A)Assets and stockholders' equity decrease.

B)Assets and liabilities decrease.

C)Net income and expenses decrease.

D)Expenses and liabilities increase.

A)Assets and stockholders' equity decrease.

B)Assets and liabilities decrease.

C)Net income and expenses decrease.

D)Expenses and liabilities increase.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

49

Phipps Company borrowed $25,000 cash on October 1, 2016, and signed a nine-month, 8% interest-bearing note payable with interest payable at maturity. Assuming that adjusting entries have not been made during the year, the amount of accrued interest payable to be reported on the December 31, 2016 balance sheet is which of the following?

A)$250.

B)$300.

C)$500.

D)$750.

A)$250.

B)$300.

C)$500.

D)$750.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

50

Mission Corp. borrowed $50,000 cash on April 1, 2016, and signed a one-year 12%, interest-bearing note payable. The interest and principal are both due on March 31, 2017. Assume that the appropriate adjusting entry was made on December 31, 2016 and that no adjusting entries have been made during 2017. Which of the following would be the required journal entry to pay the entire amount due on March 31, 2017?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements incorrectly describes the accounts payable turnover ratio?

A)A high ratio indicates that suppliers are being paid in a timely manner.

B)The ratio increases when inventory is sold on account regardless of the sales price.

C)The ratio can be manipulated by aggressively paying off accounts payable at year-end.

D)The ratio is not affected by the choice of inventory accounting methods.

A)A high ratio indicates that suppliers are being paid in a timely manner.

B)The ratio increases when inventory is sold on account regardless of the sales price.

C)The ratio can be manipulated by aggressively paying off accounts payable at year-end.

D)The ratio is not affected by the choice of inventory accounting methods.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

52

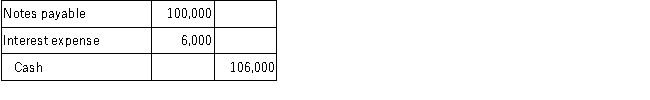

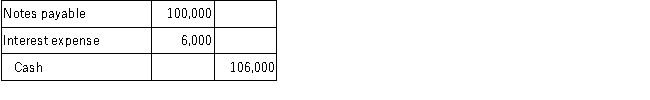

Melanie Corp. borrowed $100,000 cash on September 1, 2016, and signed a one-year 6%, interest-bearing note payable. The interest and principal are both due on August 31, 2017. Assume that the appropriate adjusting entry was made on December 31, 2016 and that no adjusting entries have been made during 2017. Which of the following would be the required journal entry to pay the note on August 31, 2017?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

53

Miranda Company borrowed $100,000 cash on September 1, 2016, and signed a one-year 6%, interest-bearing note payable. Assume no adjusting entries have been made during the year. Which of the following would be the required adjusting entry at the end of the December 31, 2016 accounting period?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

54

Purdum Farms borrowed $10 million by signing a five-year note on December 31, 2015. Repayments of the principal are payable annually in installments of $2 million each. Purdum Farms makes the first payment on December 31, 2016 and then prepares its balance sheet. What amount will be reported as current and long-term liabilities, respectively, in connection with the note at December 31, 2016, after the first payment is made?

A)$2 million in current liabilities and $8 million in long-term liabilities.

B)$2 million in current liabilities and $6 million in long-term liabilities.

C)Zero in current liabilities and $8 million in long-term liabilities.

D)Zero in current liabilities and $10 million in long-term liabilities.

A)$2 million in current liabilities and $8 million in long-term liabilities.

B)$2 million in current liabilities and $6 million in long-term liabilities.

C)Zero in current liabilities and $8 million in long-term liabilities.

D)Zero in current liabilities and $10 million in long-term liabilities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

55

Thomas Company decided to borrow $30,000 on March 1st, 2016. Thomas signed a 2-year 6% interest-bearing note. What is the adjustment amount to accrue interest on December 31, 2017?

A)$1,800.

B)$3,600.

C)$300.

D)$1,200.

A)$1,800.

B)$3,600.

C)$300.

D)$1,200.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

56

Failure to make a necessary adjusting entry for accrued interest on a note payable would result in which of the following?

A)Liabilities and stockholders' equity would both be understated.

B)Net income would be overstated and assets would be understated.

C)Net income would be understated and liabilities would be understated.

D)Net income and stockholders' equity would be overstated and liabilities would be understateD.The adjusting entry increases interest payable and interest expense, which increases liabilities and decreases both net income and stockholders' equity.Failure to make the entry causes both net income and stockholders' equity to be overstated and liabilities to be understated.

A)Liabilities and stockholders' equity would both be understated.

B)Net income would be overstated and assets would be understated.

C)Net income would be understated and liabilities would be understated.

D)Net income and stockholders' equity would be overstated and liabilities would be understateD.The adjusting entry increases interest payable and interest expense, which increases liabilities and decreases both net income and stockholders' equity.Failure to make the entry causes both net income and stockholders' equity to be overstated and liabilities to be understated.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following transactions will decrease the accounts payable turnover ratio?

A)Using cash to pay an accounts payable balance.

B)Selling inventory on account.

C)Selling inventory for cash.

D)A customer returning inventory sold on account.

A)Using cash to pay an accounts payable balance.

B)Selling inventory on account.

C)Selling inventory for cash.

D)A customer returning inventory sold on account.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

58

Phipps Company borrowed $25,000 cash on October 1, 2016, and signed a nine-month, 8% interest-bearing note payable with interest payable at maturity. The amount of interest expense to be reported during 2017 is which of the following?

A)$1,000.

B)$300.

C)$500.

D)$750.

A)$1,000.

B)$300.

C)$500.

D)$750.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

59

On October 1, 2016, Donna Equipment signed a one-year, 8% interest-bearing note payable for $50,000. Assuming that Donna Equipment maintains its books on a calendar year basis, how much interest expense should be reported in the 2017 income statement?

A)$1,000.

B)$2,000.

C)$3,000.

D)$4,000.

A)$1,000.

B)$2,000.

C)$3,000.

D)$4,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

60

Mission Corp. borrowed $50,000 cash on April 1, 2016, and signed a one-year 12%, interest-bearing note payable. The interest and principal are both due on March 31, 2017. Assume that the appropriate adjusting entry was made on December 31, 2016 and that no adjusting entries have been made during 2017. What is the amount of interest expense to be recorded when the interest and principal are paid on March 31, 2017?

A)$6,000.

B)$4,500.

C)$4,000.

D)$1,500.

A)$6,000.

B)$4,500.

C)$4,000.

D)$1,500.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

61

SRJ Corporation entered into the following transactions: • The accrual of interest expense on a six-month note payable.

• Collected cash for services to be provided within the next six months.

• The reclassification of short-term debt to long-term debt.

Which of the transactions for SRJ Corporation resulted in a decrease in working capital?

A)The accrual of interest expense.

B)Collecting cash for services to be provided in the future.

C)The reclassification of short-term debt to long-term debt.

D)Both the accrual of interest expense and the reclassification of short-term debt to long-term debt.

• Collected cash for services to be provided within the next six months.

• The reclassification of short-term debt to long-term debt.

Which of the transactions for SRJ Corporation resulted in a decrease in working capital?

A)The accrual of interest expense.

B)Collecting cash for services to be provided in the future.

C)The reclassification of short-term debt to long-term debt.

D)Both the accrual of interest expense and the reclassification of short-term debt to long-term debt.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

62

SRJ Corporation entered into the following transactions: • The accrual of interest expense on a six-month note payable.

• Collected cash for services to be provided within the next six months.

• The reclassification of short-term debt to long-term debt.

Which of the following statements is correct with respect to determining the net cash flow from operating activities on a statement of cash flows?

A)The increase in interest payable for the accrual of interest expense is added to net income.

B)Collecting cash for services to be provided in the future is subtracted from net income.

C)The reclassification of short-term debt to long-term debt is subtracted from net income.

D)Collecting cash for services to be provided in the future does not require an adjustment to net income.

• Collected cash for services to be provided within the next six months.

• The reclassification of short-term debt to long-term debt.

Which of the following statements is correct with respect to determining the net cash flow from operating activities on a statement of cash flows?

A)The increase in interest payable for the accrual of interest expense is added to net income.

B)Collecting cash for services to be provided in the future is subtracted from net income.

C)The reclassification of short-term debt to long-term debt is subtracted from net income.

D)Collecting cash for services to be provided in the future does not require an adjustment to net income.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

63

Houston Company is involved in a lawsuit. In which of the following situations is only a note disclosure of the contingent liability reported within the financial statements?

A)When the loss is remote and the amount cannot be reasonably estimated.

B)When the loss is probable and the amount can be reasonably estimated.

C)When the loss is reasonably possible and the amount can be reasonably estimated.

D)When the loss is remote and the amount can be reasonably estimateD.A contingent liability that is reasonably possible and can reasonably be estimated is disclosed in the notes to the financial statements.

A)When the loss is remote and the amount cannot be reasonably estimated.

B)When the loss is probable and the amount can be reasonably estimated.

C)When the loss is reasonably possible and the amount can be reasonably estimated.

D)When the loss is remote and the amount can be reasonably estimateD.A contingent liability that is reasonably possible and can reasonably be estimated is disclosed in the notes to the financial statements.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

64

SRJ Corporation entered into the following transactions: • The accrual of interest expense on a six-month note payable.

• Collected cash for services to be provided within the next six months.

• The reclassification of short-term debt to long-term debt.

Which of the transactions for SRJ Corporation resulted in an increase in working capital?

A)The accrual of interest expense.

B)Collecting cash for services to be provided in the future.

C)The reclassification of short-term debt to long-term debt.

D)Both the reclassification of short-term debt to long-term debt and the collection of cash for future services.

• Collected cash for services to be provided within the next six months.

• The reclassification of short-term debt to long-term debt.

Which of the transactions for SRJ Corporation resulted in an increase in working capital?

A)The accrual of interest expense.

B)Collecting cash for services to be provided in the future.

C)The reclassification of short-term debt to long-term debt.

D)Both the reclassification of short-term debt to long-term debt and the collection of cash for future services.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

65

Smith Corporation entered into the following transactions: • Purchased inventory on account.

• Collected an account receivable.

• Purchased equipment using cash.

Which of the following statements about Smith's transactions is correct?

A)The inventory purchase on account increased working capital.

B)Collecting an account receivable increases working capital.

C)The equipment purchase decreases working capital.

D)The inventory purchase on account decreases working capital.

• Collected an account receivable.

• Purchased equipment using cash.

Which of the following statements about Smith's transactions is correct?

A)The inventory purchase on account increased working capital.

B)Collecting an account receivable increases working capital.

C)The equipment purchase decreases working capital.

D)The inventory purchase on account decreases working capital.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

66

With regard to reporting of contingent liabilities, U.S. GAAP and International Financial Reporting Standards (IFRS) differ in defining the term "probable". Which of the following is correct with regard to defining "probable"?

A)Under U.S.GAAP, "probable" means an event is more likely than not to occur.

B)Under IFRS, "probable" means an event is likely to occur.

C)Under IFRS, "probable" means an event is more likely than not to occur.

D)Under U.S.GAAP, "probable" means an event is more than likely to occur.

A)Under U.S.GAAP, "probable" means an event is more likely than not to occur.

B)Under IFRS, "probable" means an event is likely to occur.

C)Under IFRS, "probable" means an event is more likely than not to occur.

D)Under U.S.GAAP, "probable" means an event is more than likely to occur.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

67

Short Company purchased land by paying $10,000 cash on the purchase date and agreeing to pay $10,000 for each of the next ten years beginning one-year from the purchase date. Short's incremental borrowing rate is 10%. The land reported on the balance sheet is closest to:

A)$100,000.

B)$38,550.

C)$110,000.

D)$71,446.

A)$100,000.

B)$38,550.

C)$110,000.

D)$71,446.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

68

Rice Corporation's attorney has provided the following summaries of three lawsuits against Rice: • Lawsuit A: The loss is probable, but the loss cannot be reasonably estimated.

• Lawsuit B: The loss is reasonably possible, but the loss cannot be reasonably estimated.

• Lawsuit C: The loss is reasonably possible and can be reasonably estimated.

Which of the following statements is incorrect?

A)A disclosure note is required for lawsuit A.

B)A disclosure note is required for lawsuit B.

C)A disclosure note is required for lawsuit C.

D)Lawsuit A is reported on the balance sheet as a liability.

• Lawsuit B: The loss is reasonably possible, but the loss cannot be reasonably estimated.

• Lawsuit C: The loss is reasonably possible and can be reasonably estimated.

Which of the following statements is incorrect?

A)A disclosure note is required for lawsuit A.

B)A disclosure note is required for lawsuit B.

C)A disclosure note is required for lawsuit C.

D)Lawsuit A is reported on the balance sheet as a liability.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following results in a decrease in working capital?

A)Supplies purchases with cash.

B)Purchase of a truck in exchange for factory machinery.

C)Acquisition of land in exchange for stock.

D)Purchase of equipment with cash.

A)Supplies purchases with cash.

B)Purchase of a truck in exchange for factory machinery.

C)Acquisition of land in exchange for stock.

D)Purchase of equipment with cash.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

70

Short Company purchased land by paying $10,000 cash on the purchase date and agreeing to pay $10,000 for each of the next ten years beginning one-year from the purchase date. Short's incremental borrowing rate is 10%. On the balance sheet as of the purchase date, after the initial $10,000 payment was made, the liability reported is closest to:

A)$100,000.

B)$38,550.

C)$61,446.

D)$71,446.

A)$100,000.

B)$38,550.

C)$61,446.

D)$71,446.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

71

Darwin Corporation's attorney has provided the following summaries of three lawsuits against Darwin: • Lawsuit A: The loss is probable and the loss can be reasonably estimated.

• Lawsuit B: The loss is reasonably possible and the loss cannot be reasonably estimated.

• Lawsuit C: The loss is reasonably possible and the loss can be reasonably estimated.

Which of the following statements is incorrect?

A)A disclosure note is required for lawsuit A.

B)A disclosure note is required for lawsuit C.

C)A disclosure note is not required for lawsuit B.

D)Lawsuit A is reported on the balance sheet as a liability.

• Lawsuit B: The loss is reasonably possible and the loss cannot be reasonably estimated.

• Lawsuit C: The loss is reasonably possible and the loss can be reasonably estimated.

Which of the following statements is incorrect?

A)A disclosure note is required for lawsuit A.

B)A disclosure note is required for lawsuit C.

C)A disclosure note is not required for lawsuit B.

D)Lawsuit A is reported on the balance sheet as a liability.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following statements about contingent liabilities is incorrect?

A)A disclosure note is required when the loss is reasonably possible and the amount cannot be reasonably estimated.

B)A disclosure note is required when the loss is probable and the amount can be reasonably estimated.

C)A disclosure note is required when the loss is reasonably possible and the amount can be reasonably estimated.

D)A disclosure note is required when the loss is remote and the amount can be reasonably estimateD.A disclosure note is not required when the loss probability is remote.

A)A disclosure note is required when the loss is reasonably possible and the amount cannot be reasonably estimated.

B)A disclosure note is required when the loss is probable and the amount can be reasonably estimated.

C)A disclosure note is required when the loss is reasonably possible and the amount can be reasonably estimated.

D)A disclosure note is required when the loss is remote and the amount can be reasonably estimateD.A disclosure note is not required when the loss probability is remote.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

73

Libby Company purchased equipment by paying $5,000 cash on the purchase date and agreeing to pay $5,000 every six months during the next four years. The first payment is due six months after the purchase date. Libby's incremental borrowing rate is 8%. The liability reported on the balance sheet as of the purchase date, after the initial $5,000 payment was made, is closest to:

A)$45,000.

B)$33,664.

C)$38,664.

D)$40,000.

A)$45,000.

B)$33,664.

C)$38,664.

D)$40,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

74

How should a contingent liability that is reasonably possible but cannot reasonably be estimated be reported within the financial statements?

A)It must be recorded and reported as a liability.

B)It does not need to be recorded or reported as a liability.

C)It must only be disclosed as a note to the financial statements.

D)It must be reported as a liability, but not disclosed in a note.

A)It must be recorded and reported as a liability.

B)It does not need to be recorded or reported as a liability.

C)It must only be disclosed as a note to the financial statements.

D)It must be reported as a liability, but not disclosed in a note.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

75

Black Corporation entered into the following transactions: • The accrual of wages and salaries expense.

• The cash sale of equipment for a loss.

• The cash payment in advance for a one-year insurance policy.

Which of the following statements is correct with respect to determining Black's cash flows from operating activities on the statement of cash flows?

A)The accrual of wages and salaries expense is subtracted from net income.

B)The loss on the equipment sale is subtracted from net income.

C)The cash payment to purchase the insurance policy is subtracted from net income.

D)The accrual of wages and the equipment loss are both subtracted from net income.

• The cash sale of equipment for a loss.

• The cash payment in advance for a one-year insurance policy.

Which of the following statements is correct with respect to determining Black's cash flows from operating activities on the statement of cash flows?

A)The accrual of wages and salaries expense is subtracted from net income.

B)The loss on the equipment sale is subtracted from net income.

C)The cash payment to purchase the insurance policy is subtracted from net income.

D)The accrual of wages and the equipment loss are both subtracted from net income.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

76

Rice Corporation's attorney has provided the following summaries of three lawsuits against Rice: • Lawsuit A: The loss is probable, but the loss cannot be reasonably estimated.

• Lawsuit B: The loss is reasonably possible, but the loss cannot be reasonably estimated.

• Lawsuit C: The loss is reasonably possible and can be reasonably estimated.

Which of the following statements is correct?

A)A disclosure note is required for each of the three lawsuits.

B)A disclosure note is required only for lawsuits A & C.

C)A disclosure note is required only for lawsuit A.

D)A disclosure note is required only for lawsuits B & C.

• Lawsuit B: The loss is reasonably possible, but the loss cannot be reasonably estimated.

• Lawsuit C: The loss is reasonably possible and can be reasonably estimated.

Which of the following statements is correct?

A)A disclosure note is required for each of the three lawsuits.

B)A disclosure note is required only for lawsuits A & C.

C)A disclosure note is required only for lawsuit A.

D)A disclosure note is required only for lawsuits B & C.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

77

Young Company is involved in a lawsuit. When would the lawsuit be recorded as a liability on the balance sheet?

A)When the loss probability is remote and the amount can be reasonably estimated.

B)When the loss is probable and the amount can be reasonably estimated.

C)When the loss probability is reasonably possible and the amount can be reasonably estimated.

D)When the loss is probable regardless of whether the loss can be reasonably estimateD.A contingent liability that is probable and can be reasonably estimated is reported as a liability on the balance sheet.

A)When the loss probability is remote and the amount can be reasonably estimated.

B)When the loss is probable and the amount can be reasonably estimated.

C)When the loss probability is reasonably possible and the amount can be reasonably estimated.

D)When the loss is probable regardless of whether the loss can be reasonably estimateD.A contingent liability that is probable and can be reasonably estimated is reported as a liability on the balance sheet.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

78

Smith Corporation entered into the following transactions: • Purchased inventory on account.

• Collected an account receivable.

• Purchased equipment using cash.

Which of the transactions for Smith Corporation resulted in an increase in working capital?

A)The inventory purchase on account.

B)Collecting an account receivable.

C)The purchase of equipment using cash.

D)None of the transactions resulted in an increase in working capital.

• Collected an account receivable.

• Purchased equipment using cash.

Which of the transactions for Smith Corporation resulted in an increase in working capital?

A)The inventory purchase on account.

B)Collecting an account receivable.

C)The purchase of equipment using cash.

D)None of the transactions resulted in an increase in working capital.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

79

Rocket Corporation entered into the following transactions: • The accrual of wages and salaries expense.

• The cash payment of a six-month note payable.

• The cash payment in advance for a one-year insurance policy.

Which of the following statements is correct with respect to determining Rocket's working capital? Assume that Rocket's operating cycle is four months.

A)The accrual of wages and salaries expense decreases working capital.

B)The cash payment of the note payable decreases working capital.

C)The purchase of the insurance policy increases working capital.

D)The cash payments for the note and insurance both decrease working capital.

• The cash payment of a six-month note payable.

• The cash payment in advance for a one-year insurance policy.

Which of the following statements is correct with respect to determining Rocket's working capital? Assume that Rocket's operating cycle is four months.

A)The accrual of wages and salaries expense decreases working capital.

B)The cash payment of the note payable decreases working capital.

C)The purchase of the insurance policy increases working capital.

D)The cash payments for the note and insurance both decrease working capital.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

80

Libby Company purchased equipment by paying $5,000 cash on the purchase date and agreeing to pay $5,000 every six months during the next four years. The first payment is due six months after the purchase date. Libby's incremental borrowing rate is 8%. The equipment reported on the balance sheet as of the purchase date is closest to:

A)$45,000.

B)$38,664.

C)$33,664.

D)$40,000.

A)$45,000.

B)$38,664.

C)$33,664.

D)$40,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck