Deck 14: PPA: Reporting and Interpreting Investments in Other Corporations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/115

Play

Full screen (f)

Deck 14: PPA: Reporting and Interpreting Investments in Other Corporations

1

A decline in the fair value of the available-for-sale securities portfolio reduces assets and net income.

False

2

Investments in bonds intended to be sold before they reach maturity should be reported under the fair value method.

True

3

An unrealized holding loss is reported on the income statement when the fair value of a trading security is less than its fair value reported in the prior period.

True

4

The extent of influence and control over another company is a critical factor in determining the proper method of accounting for an investment in the common stock of another company.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

5

Use of the equity method is required for investments between 20 and 50% of a company's voting common stock regardless of the investor's ability to influence the affiliate.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

6

The equity method is required to be used when an investor has the ability to exert significant influence over the affiliate.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

7

Ocean Corporation owns 30% of Woods Corp. for which it paid $5.5 million and uses the equity method to account for the investment. Woods Corp. paid stockholders a $100,000 dividend. Therefore, the Investment in Woods Corp. account will decrease by Ocean's $30,000 proportionate share of the Woods. Corp. dividend.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

8

Passive investments other than held-to-maturity investments are reported on the balance sheet at fair value.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

9

Barnum Company owns an investment and uses the equity method of accounting. Under the equity method of accounting, Barnum would decrease the Investment in Affiliates account for the proportionate share of the affiliate's reported net loss.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

10

Under the equity method, dividends received are recognized by increasing the Investment Revenue account.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

11

All investments other than held-to-maturity bond investments are reported on the balance sheet at their fair value as of the balance sheet date.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

12

An unrealized holding gain is reported within other comprehensive income when the fair value of a trading security exceeds its fair value reported in the prior period.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

13

For all periods in which a security is held in the available-for-sale securities portfolio, the only income reported on the income statement is dividend revenue.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

14

An unrealized holding gain is reported on the income statement when the fair value of an available-for-sale security exceeds its fair value reported in the prior period.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

15

An increase in the fair value of the trading securities portfolio increases both assets and net income.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

16

A realized gain or loss is reported on the income statement when a trading security is sold.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

17

Held-to-maturity bond investments must be reported on the balance sheet at fair value.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

18

A realized gain or loss is reported on the income statement when an investment account is adjusted to reflect changes in fair value.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

19

The sale of a stock from the available-for-sale securities portfolio creates a gain or loss on the income statement based on the difference between the stock's original cost and its selling price.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

20

Management must have the intent and ability to hold a bond investment until maturity if it is to be classified as a held-to-maturity security.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

21

Subsequent to a merger, the assets and liabilities of the acquired company will continue to be accounted for within the acquired company's books.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

22

Libby Company purchased equity securities for $100,000 and classified them as available-for-sale securities on September 15, 2016. At December 31, 2016, the current fair value of the securities was $105,000. How should the investment be reported in the 2016 financial statements?

A)The investment in available-for-sale securities would be reported on the balance sheet at its $100,000 cost.

B)The $5,000 unrealized gain is reported within the income statement.

C)The $5,000 realized gain is reported within the income statement.

D)The investment in available-for-sale securities would be reported in the balance sheet at its $105,000 fair value and an unrealized holding gain on available-for-sale securities would be reported in the stockholders' equity section of the balance sheet.

A)The investment in available-for-sale securities would be reported on the balance sheet at its $100,000 cost.

B)The $5,000 unrealized gain is reported within the income statement.

C)The $5,000 realized gain is reported within the income statement.

D)The investment in available-for-sale securities would be reported in the balance sheet at its $105,000 fair value and an unrealized holding gain on available-for-sale securities would be reported in the stockholders' equity section of the balance sheet.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

23

On January 1, 2016, Entertainment Company acquired 15% of the outstanding voting stock of Rocker Company as a long-term investment in available-for-sale securities. During 2016, Rocker Company reported net income of $1,500,000 and dividends were declared and paid in the amount of $250,000. How much income will be reported during 2016 from the Rocker investment?

A)$225,000.

B)$37,500.

C)$187,500.

D)$250,000.

A)$225,000.

B)$37,500.

C)$187,500.

D)$250,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

24

An investment accounted for under the equity method is always reported on the balance sheet at fair value.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

25

The assets of a subsidiary are depreciated and amortized over their remaining useful lives as a part of the consolidation process.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is the best description of investments in available-for-sale securities?

A)Investments in bonds that management intends to hold to maturity.

B)Investments in stocks or bonds that are held primarily for the purpose of selling them in the near future.

C)Investments in more than fifty percent of the voting stock of another company.

D)Investments in securities that are passive investments other than trading securities and held-to-maturity investments and are accounted for under the fair value methoD.Available-for-sale securities are passive investments other than trading securities and held-to-maturity debt securities.

A)Investments in bonds that management intends to hold to maturity.

B)Investments in stocks or bonds that are held primarily for the purpose of selling them in the near future.

C)Investments in more than fifty percent of the voting stock of another company.

D)Investments in securities that are passive investments other than trading securities and held-to-maturity investments and are accounted for under the fair value methoD.Available-for-sale securities are passive investments other than trading securities and held-to-maturity debt securities.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

27

Goodwill is reported on a consolidated balance sheet only if it was acquired in the merger or acquisition.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

28

Lyrical Company purchased equity securities for $500,000 and classified them as trading securities on September 15, 2016. On December 31, 2016, the current fair value of the securities was $481,000. How should the investment be reported within the 2016 financial statements?

A)The investment in trading securities would be reported in the balance sheet at its $481,000 fair value.

B)The investment in trading securities would be reported in the balance sheet at its $500,000 cost.

C)A realized holding loss on the trading securities would be reported on the income statement.

D)The investment in trading securities would be reported in the balance sheet at its $481,000 fair value and a realized holding loss on the trading securities would be reported on the income statement.

A)The investment in trading securities would be reported in the balance sheet at its $481,000 fair value.

B)The investment in trading securities would be reported in the balance sheet at its $500,000 cost.

C)A realized holding loss on the trading securities would be reported on the income statement.

D)The investment in trading securities would be reported in the balance sheet at its $481,000 fair value and a realized holding loss on the trading securities would be reported on the income statement.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

29

For an investment accounted for under the equity method, the Investment in Affiliates account along with an investment income account would be increased for an amount equal to the investor's proportionate share of the affiliate's reported net income.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

30

Madison Inc. acquires 100% of the voting stock of Allison Corp. for $10.0 million. Allison's total assets at fair value equaled $12.5 million and Allison had liabilities at fair value equal to $3.4 million. Madison will report goodwill of $0.9 million.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

31

Chang Corp. purchased $1,000,000 of bonds at par value on April 1, 2016. The bonds pay interest at the rate of 10%. Chang intends to hold these bonds to maturity. Which of the following statements is false?

A)Since the bonds were issued at par value, the cash interest will be the same as interest revenue.

B)The bonds will earn $75,000 of interest by December 31, 2016.

C)The bond investment must be accounted for using the fair value method.

D)Since the bonds were classified as held-to-maturity, the company would not recognize unrealized gains or losses on the bonds during the period held by Chang.

A)Since the bonds were issued at par value, the cash interest will be the same as interest revenue.

B)The bonds will earn $75,000 of interest by December 31, 2016.

C)The bond investment must be accounted for using the fair value method.

D)Since the bonds were classified as held-to-maturity, the company would not recognize unrealized gains or losses on the bonds during the period held by Chang.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

32

From an economic standpoint of investment returns, the capital gain or loss includes unrealized gains and losses as well as realized gains and losses.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

33

Any unrealized gains or losses on trading securities would have to be added back to or subtracted from net income on the statement of cash flows under the indirect method of determining cash flows from operating activities.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

34

On the date that one company acquires 100% of the voting stock of another company, the book value of the acquired assets and liabilities will be combined with book values of the assets and liabilities of the acquiring company.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

35

If a bond is bought at a discount, then interest revenue using the effective interest method will be less than the cash interest received.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

36

Idaho Company purchased, as a long-term investment, 30% of the outstanding nonvoting preferred stock of Potato Corporation. Which of the following classifications should be used by Idaho Company in accounting for the investment?

A)Trading securities.

B)Held-to-maturity.

C)Available-for-sale.

D)Consolidation.

A)Trading securities.

B)Held-to-maturity.

C)Available-for-sale.

D)Consolidation.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

37

When an investment accounted for under the equity method is sold, the gain or loss reported on the income statement is the difference between the selling price and the original cost of the investment.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is correct?

A)Any unrealized holding gain or loss on investments in trading securities is reported on the income statement.

B)Any unrealized holding gain or loss on investments in available-for-sale securities is reported on the income statement.

C)All unrealized gains and losses are reported on the income statement regardless of the method used to account for the investment.

D)Any unrealized holding gain or loss on investments in trading securities or in available-for-sale securities is reported on the income statement.

A)Any unrealized holding gain or loss on investments in trading securities is reported on the income statement.

B)Any unrealized holding gain or loss on investments in available-for-sale securities is reported on the income statement.

C)All unrealized gains and losses are reported on the income statement regardless of the method used to account for the investment.

D)Any unrealized holding gain or loss on investments in trading securities or in available-for-sale securities is reported on the income statement.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is the best description of investments in trading securities?

A)Investments in bonds that management intends to hold to maturity.

B)Investments in stocks or bonds that are held primarily for the purpose of selling them in the near future.

C)Investments in more than fifty percent of the voting stock of another company.

D)Investments that provide the investor significant influence over the investee, but not control over the investee.

A)Investments in bonds that management intends to hold to maturity.

B)Investments in stocks or bonds that are held primarily for the purpose of selling them in the near future.

C)Investments in more than fifty percent of the voting stock of another company.

D)Investments that provide the investor significant influence over the investee, but not control over the investee.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

40

If a bond is bought at a discount, the amortized book value of the bond investment will increase as the bond approaches maturity.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

41

Rye Company purchased 15% of Lena Company's common stock during 2016 for $150,000. The Investment in Lena had a $160,000 fair value at the end of 2016 and a $140,000 fair value at the end of 2017. Which of the following statements is correct if Rye classifies the investment as an available-for-sale security and sold it at the beginning of 2018 for $148,000?

A)The 2018 realized loss is $2,000 and is included in Rye's 2018 income statement.

B)The 2018 realized gain is $8,000 and is included in Rye's 2018 income statement.

C)The 2018 unrealized gain is $8,000 and is included in Rye's 2018 income statement.

D)The 2018 unrealized loss is $2,000 and is included in Rye's 2018 income statement.

A)The 2018 realized loss is $2,000 and is included in Rye's 2018 income statement.

B)The 2018 realized gain is $8,000 and is included in Rye's 2018 income statement.

C)The 2018 unrealized gain is $8,000 and is included in Rye's 2018 income statement.

D)The 2018 unrealized loss is $2,000 and is included in Rye's 2018 income statement.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is true about a passive investment in common stock?

A)The investing company usually owns less than 20% of the voting stock in the affiliate and the investment is reported on the balance sheet at cost.

B)The investment must not have any voting rights.

C)The fair value method requires unrealized gains and losses to be recognized on the income statement.

D)The investing company usually owns less than 20% of the voting stock in the affiliate and the investment must be reported at fair value on the balance sheet.

A)The investing company usually owns less than 20% of the voting stock in the affiliate and the investment is reported on the balance sheet at cost.

B)The investment must not have any voting rights.

C)The fair value method requires unrealized gains and losses to be recognized on the income statement.

D)The investing company usually owns less than 20% of the voting stock in the affiliate and the investment must be reported at fair value on the balance sheet.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

43

McGinn Company purchased 10% of RJ Company's common stock during 2016 for $100,000. The 10% investment in RJ had a $90,000 fair value at the end of 2016 and a $105,000 fair value at the end of 2017. Which of the following statements is correct if McGinn classified the investment as an available-for-sale security and sold it at the beginning of 2018 for $102,000?

A)The 2018 realized loss reported on the income statement is $3,000.

B)The 2018 realized gain reported on the income statement is $2,000.

C)The 2018 unrealized gain reported on the income statement is $2,000.

D)The 2018 unrealized loss reported on the income statement is $3,000.

A)The 2018 realized loss reported on the income statement is $3,000.

B)The 2018 realized gain reported on the income statement is $2,000.

C)The 2018 unrealized gain reported on the income statement is $2,000.

D)The 2018 unrealized loss reported on the income statement is $3,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

44

McGinn Company purchased 10% of RJ Company's common stock during 2016 for $100,000. The 10% investment in RJ had a $90,000 fair value at the end of 2016 and a $105,000 fair value at the end of 2017. Which of the following statements is correct if McGinn classifies the investment as a trading security?

A)The 2016 unrealized loss is $10,000, but is not included in McGinn's 2016 net income.

B)The 2017 unrealized gain is $15,000, but is not included in McGinn's 2017 net income.

C)The 2017 unrealized gain is $15,000 and is included in McGinn's 2017 net income.

D)The 2016 unrealized loss is $10,000 and is reported on McGinn's balance sheet as a component of stockholders' equity and is not reported on the income statement.

A)The 2016 unrealized loss is $10,000, but is not included in McGinn's 2016 net income.

B)The 2017 unrealized gain is $15,000, but is not included in McGinn's 2017 net income.

C)The 2017 unrealized gain is $15,000 and is included in McGinn's 2017 net income.

D)The 2016 unrealized loss is $10,000 and is reported on McGinn's balance sheet as a component of stockholders' equity and is not reported on the income statement.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

45

The primary difference in accounting for available-for-sale investments in stock and accounting for trading investments in stock is which of the following?

A)Measuring the fair value of the long-term and short-term investment portfolios on the balance sheet.

B)Determination of the acquisition cost.

C)Reporting of the unrealized holding gain or loss on investments within the financial statements.

D)Determination of the unrealized holding gain or loss.

A)Measuring the fair value of the long-term and short-term investment portfolios on the balance sheet.

B)Determination of the acquisition cost.

C)Reporting of the unrealized holding gain or loss on investments within the financial statements.

D)Determination of the unrealized holding gain or loss.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

46

Phillips Corporation purchased 1,000,000 shares of Martin Corporation's common stock, which constitutes 10% of Martin's voting stock on June 30, 2016 for $42 per share. Phillips' intent is to keep these shares beyond the current year. On December 20, 2016, Martin paid a $4,000,000 cash dividend. On December 31, Martin's stock was trading at $45 per share and Martin reported 2016 net income of $52 million. What investment value will be reflected on Phillips' balance sheet at December 31, 2016?

A)$42,000,000.

B)$45,000,000.

C)$46,800,000.

D)$47,200,000.

A)$42,000,000.

B)$45,000,000.

C)$46,800,000.

D)$47,200,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

47

McGinn Company purchased 10% of RJ Company's common stock during 2016 for $100,000. The 10% investment in RJ had a $90,000 fair value at the end of 2016 and a $105,000 fair value at the end of 2017. Which of the following statements is incorrect if McGinn classifies the investment as an available-for-sale security?

A)The 2016 unrealized loss is $10,000, but is not included in McGinn's 2016 net income.

B)The 2017 unrealized gain is $15,000, but is not included in McGinn's 2017 net income.

C)The 2017 unrealized gain is $10,000 and is included in McGinn's 2017 net income.

D)The 2016 unrealized loss is $10,000 and is reported on McGinn's balance sheet as a component of stockholders' equity.

A)The 2016 unrealized loss is $10,000, but is not included in McGinn's 2016 net income.

B)The 2017 unrealized gain is $15,000, but is not included in McGinn's 2017 net income.

C)The 2017 unrealized gain is $10,000 and is included in McGinn's 2017 net income.

D)The 2016 unrealized loss is $10,000 and is reported on McGinn's balance sheet as a component of stockholders' equity.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

48

Rye Company purchased 15% of Lena Company's common stock during 2016 for $150,000. The Investment in Lena had a $160,000 fair value at the end of 2016 and a $140,000 fair value at the end of 2017. Which of the following statements is correct if Rye classifies the investment as a trading security and sold it at the beginning of 2018 for $148,000?

A)The 2018 realized loss is $2,000 and is included in Rye's 2018 income statement.

B)The 2018 realized gain is $8,000 and is included in Rye's 2018 income statement.

C)The 2018 unrealized gain is $8,000 and is included in Rye's 2018 income statement.

D)The 2018 unrealized loss is $2,000 and is included in Rye's 2018 income statement.

A)The 2018 realized loss is $2,000 and is included in Rye's 2018 income statement.

B)The 2018 realized gain is $8,000 and is included in Rye's 2018 income statement.

C)The 2018 unrealized gain is $8,000 and is included in Rye's 2018 income statement.

D)The 2018 unrealized loss is $2,000 and is included in Rye's 2018 income statement.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

49

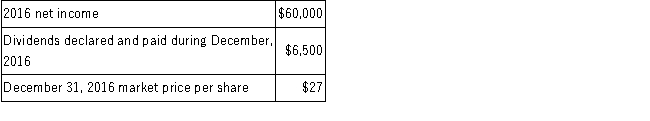

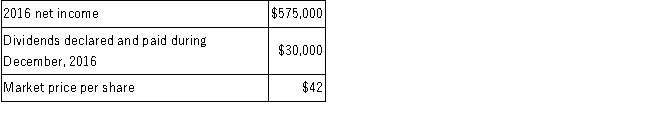

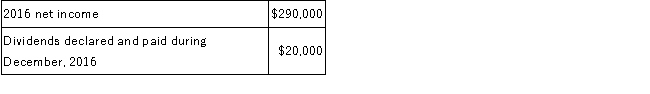

On July 1, 2016, as a long-term investment in available-for-sale securities, Wildlife Supply Company purchased 6,000 of the 18,000 outstanding shares of the nonvoting preferred stock of Nature Company for $30 per share. The records of Nature Company reflect the following:  The amount reported on the balance sheet by Wildlife Company for its investment at December 31, 2016 would be which of the following?

The amount reported on the balance sheet by Wildlife Company for its investment at December 31, 2016 would be which of the following?

A)$179,800.

B)$162,000.

C)$182,000.

D)$197,800.

The amount reported on the balance sheet by Wildlife Company for its investment at December 31, 2016 would be which of the following?

The amount reported on the balance sheet by Wildlife Company for its investment at December 31, 2016 would be which of the following?A)$179,800.

B)$162,000.

C)$182,000.

D)$197,800.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

50

On July 1, 2016, Carter Company purchased trading securities as follows: Dark Corporation common stock (par $1) 10,000 shares at $25 per share.

Janin Corporation preferred stock (par $100) 2,000 shares at $105 per share.

The quoted market prices per share on December 31, 2016 were as follows:

Dark Corporation stock, $27 per share

Janin Corporation stock, $104 per share

Each of the investments represented 5% of the total shares outstanding. The carrying value amount of the investments at December 31, 2016 should be

A)$478,000.

B)$460,000.

C)$458,000.

D)$480,000.

Janin Corporation preferred stock (par $100) 2,000 shares at $105 per share.

The quoted market prices per share on December 31, 2016 were as follows:

Dark Corporation stock, $27 per share

Janin Corporation stock, $104 per share

Each of the investments represented 5% of the total shares outstanding. The carrying value amount of the investments at December 31, 2016 should be

A)$478,000.

B)$460,000.

C)$458,000.

D)$480,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

51

When accounting for investments in trading securities, any decline in fair value below the cost of the investments is reported in which of the following ways?

A)On the income statement as a realized loss.

B)On the income statement as an unrealized holding loss.

C)On the balance sheet as a realized loss.

D)On the balance sheet as an unrealized holding loss in the stockholders' equity section.

A)On the income statement as a realized loss.

B)On the income statement as an unrealized holding loss.

C)On the balance sheet as a realized loss.

D)On the balance sheet as an unrealized holding loss in the stockholders' equity section.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

52

On July 1, 2016, Surf Company purchased long-term investments in available-for-sale securities as follows: Blue Corporation common stock (par $5) 2,000 shares at $16 per share.

Black Company preferred stock (par $20) 1,500 shares at $30 per share.

The quoted market prices per share on December 31, 2016 were as follows:

Blue Corporation stock, $15 per share

Black Company stock, $30 per share

Each of the long-term investments represents 10% of the total shares outstanding. The combined carrying value of the long-term investments reported in the balance sheet at December 31, 2016 would be which of the following?

A)$77,000.

B)$73,500.

C)$71,500.

D)$75,000.

Black Company preferred stock (par $20) 1,500 shares at $30 per share.

The quoted market prices per share on December 31, 2016 were as follows:

Blue Corporation stock, $15 per share

Black Company stock, $30 per share

Each of the long-term investments represents 10% of the total shares outstanding. The combined carrying value of the long-term investments reported in the balance sheet at December 31, 2016 would be which of the following?

A)$77,000.

B)$73,500.

C)$71,500.

D)$75,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

53

McGinn Company purchased 10% of RJ Company's common stock during 2016 for $100,000. The 10% investment in RJ had a $90,000 fair value at the end of 2016 and a $105,000 fair value at the end of 2017. Which of the following statements is correct if McGinn classified the investment as a trading security and sold it at the beginning of 2018 for $102,000?

A)The 2018 realized loss reported on the income statement is $3,000.

B)The 2018 realized gain reported on the income statement is $2,000.

C)The 2018 unrealized gain reported on the income statement is $2,000.

D)The 2018 unrealized loss reported on the income statement is $3,000.

A)The 2018 realized loss reported on the income statement is $3,000.

B)The 2018 realized gain reported on the income statement is $2,000.

C)The 2018 unrealized gain reported on the income statement is $2,000.

D)The 2018 unrealized loss reported on the income statement is $3,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following best describes the numerator of the economic return from investing ratio?

A)Dividends received plus interest received minus interest paid.

B)Dividends received plus unrealized gain minus unrealized loss.

C)Dividends received plus interest received plus unrealized gain plus realized gain.

D)Dividends received plus interest received plus unrealized gain minus unrealized loss plus realized gain minus unrealized loss.

A)Dividends received plus interest received minus interest paid.

B)Dividends received plus unrealized gain minus unrealized loss.

C)Dividends received plus interest received plus unrealized gain plus realized gain.

D)Dividends received plus interest received plus unrealized gain minus unrealized loss plus realized gain minus unrealized loss.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

55

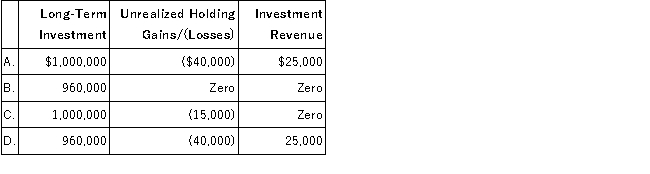

On January 1, 2016, Short Company purchased as an available-for-sale investment, 20,000 shares (15% of the outstanding voting shares) of Daniel Corporation's $1 par value common stock at a cost of $50 per share. During November 2016, Daniel declared and paid a cash dividend of $1.25 per share. At December 31, 2016, end of the accounting period, Daniel's shares were selling at $48. The 2016 financial statements for Short Company should report the following amounts:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

56

Rye Company purchased 15% of Lena Company's common stock during 2016 for $150,000. The Investment in Lena had a $160,000 fair value at the end of 2016 and a $140,000 fair value at the end of 2017. Which of the following statements is correct if Rye classifies the investment as a trading security?

A)The 2016 unrealized gain is $10,000 and is included in Rye's 2016 net income.

B)The 2017 unrealized loss is $20,000, but is not included in Rye's 2017 net income.

C)The 2017 unrealized loss is $10,000 and is included in Rye's 2017 net income.

D)The 2016 unrealized gain is $10,000 and is reported on Rye's balance sheet as a component of other comprehensive income.

A)The 2016 unrealized gain is $10,000 and is included in Rye's 2016 net income.

B)The 2017 unrealized loss is $20,000, but is not included in Rye's 2017 net income.

C)The 2017 unrealized loss is $10,000 and is included in Rye's 2017 net income.

D)The 2016 unrealized gain is $10,000 and is reported on Rye's balance sheet as a component of other comprehensive income.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

57

Phillips Corporation purchased 1,000,000 shares of Martin Corporation's common stock, which constitutes 10% of Martin's voting stock on June 30, 2016 for $42 per share. Phillips' intent is to keep these shares beyond the current year. On December 20, 2016, Martin paid a $4,000,000 cash dividend. On December 31, Martin's stock was trading at $45 per share and Martin reported 2016 net income of $52 million. What method of accounting will Phillips use to account for this investment?

A)Amortized cost method.

B)Equity method.

C)Fair value method.

D)Consolidation.

A)Amortized cost method.

B)Equity method.

C)Fair value method.

D)Consolidation.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

58

Rye Company purchased 15% of Lena Company's common stock during 2016 for $150,000. The Investment in Lena had a $160,000 fair value at the end of 2016 and a $140,000 fair value at the end of 2017. Which of the following statements is incorrect if Rye classifies the investment as an available-for-sale security?

A)The 2016 unrealized gain is $10,000, but is not included in Rye's 2016 net income.

B)The 2017 unrealized loss is $20,000, but is not included in Rye's 2017 net income.

C)The 2017 unrealized loss is $10,000 and is included in Rye's 2017 net income.

D)The 2016 unrealized gain is $10,000 and is reported on Rye's balance sheet as a component of stockholders' equity.

A)The 2016 unrealized gain is $10,000, but is not included in Rye's 2016 net income.

B)The 2017 unrealized loss is $20,000, but is not included in Rye's 2017 net income.

C)The 2017 unrealized loss is $10,000 and is included in Rye's 2017 net income.

D)The 2016 unrealized gain is $10,000 and is reported on Rye's balance sheet as a component of stockholders' equity.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

59

Allyn Company owns 10% of the Cordon Company common stock. The economic return from investing ratio that Allyn calculates contains which of the following components?

A)Net income of the Cordon Company.

B)Market price of the Cordon company stock.

C)Capital gain from the Cordon investment.

D)Interest received on the Cordon investment.

A)Net income of the Cordon Company.

B)Market price of the Cordon company stock.

C)Capital gain from the Cordon investment.

D)Interest received on the Cordon investment.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

60

Phillips Corporation purchased 1,000,000 shares of Martin Corporation's common stock, which constitutes 10% of Martin's voting stock on June 30, 2016 for $42 per share. Phillips' intent is to keep these shares beyond the current year. On December 20, 2016, Martin paid a $4,000,000 cash dividend. On December 31, Martin's stock was trading at $45 per share and Martin reported 2016 net income of $52 million. What effect will the dividend have on Phillips' 2016 financial statements?

A)It would increase cash and increase investment income.

B)It would increase cash and decrease investment in associated companies.

C)It would increase cash and increase net unrealized gains/losses.

D)It would increase cash and increase the investment account.

A)It would increase cash and increase investment income.

B)It would increase cash and decrease investment in associated companies.

C)It would increase cash and increase net unrealized gains/losses.

D)It would increase cash and increase the investment account.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

61

Significant influence over the operating and financial policies of another company would not be indicated by:

A)Participation on its board of directors.

B)Participation in its policy-making process.

C)Evidence of material transactions between the two companies.

D)Both firms using the services of the same law firms and investment advisors.

A)Participation on its board of directors.

B)Participation in its policy-making process.

C)Evidence of material transactions between the two companies.

D)Both firms using the services of the same law firms and investment advisors.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

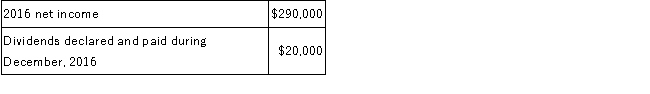

62

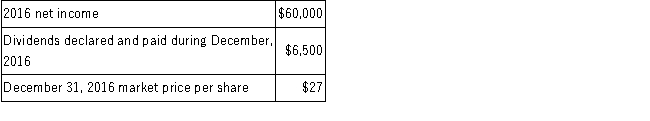

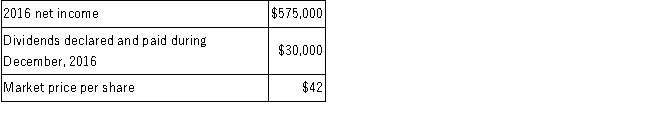

Gilman Company purchased 100,000 of the 250,000 shares of common stock of Burke Corporation on January 1, 2016, at $40 per share as a long-term investment. The records of Burke Corporation showed the following on December 31, 2016:  At what amount should Gilman Company report the Burke investment on the December 31, 2016 balance sheet?

At what amount should Gilman Company report the Burke investment on the December 31, 2016 balance sheet?

A)$4,218,000.

B)$4,000,000.

C)$4,124,000.

D)$3,800,000.

At what amount should Gilman Company report the Burke investment on the December 31, 2016 balance sheet?

At what amount should Gilman Company report the Burke investment on the December 31, 2016 balance sheet?A)$4,218,000.

B)$4,000,000.

C)$4,124,000.

D)$3,800,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

63

Heartfelt Company owns a 40% interest in the voting common stock of Candle Corporation, and Heartfelt accounts for the investment using the equity method. During 2016, Candle Corporation reported net income of $100,000 and declared and paid cash dividends of $10,000. The carrying value of the Candle investment was $500,000 on January 1, 2016. At what amount is the Candle investment reported on the December 31, 2016 balance sheet of Heartfelt Company?

A)$496,000.

B)$500,000.

C)$536,000.

D)$540,000.

A)$496,000.

B)$500,000.

C)$536,000.

D)$540,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

64

Photo Finish Corporation bought a 40% interest in Click-It Corporation's $1 par value voting common stock on March 31, 2017. On that date, Click-It paid $20 million for 2 million shares at a $10 market price per share. On December 31, 2017, Click-It paid a $1 million cash dividend declared earlier in 2017, and reported net income for the year ended 2017 of $10 million. On December 31, 2017, Click-It's stock was trading at $11.50 per share. At what amount will the Click-It investment be reported on Photo Finish's December 31, 2017 balance sheet?

A)$20,000,000.

B)$23,000,000.

C)$23,600,000.

D)$24,000,000.

A)$20,000,000.

B)$23,000,000.

C)$23,600,000.

D)$24,000,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

65

On January 1, 2016, Turtle Inc. bought 30% of the outstanding shares of Shell Corporation common stock at a cost of $150,000. Turtle uses the equity method of accounting for this investment is used. During 2016, Shell Corporation reported $40,000 of net income and paid a total of $5,000 in cash dividends. At the end of 2016, the shares had a fair value of $160,000. At the end of 2016, the shares of Shell Corporation had a fair value of $160,000. What investment balance will be reported on Turtle's December 31, 2016 balance sheet?

A)$150,000.

B)$162,000.

C)$160,500.

D)$170,500.

A)$150,000.

B)$162,000.

C)$160,500.

D)$170,500.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

66

Gilman Company purchased 100,000 of the 250,000 shares of common stock of Burke Corporation on January 1, 2016, at $40 per share as a long-term investment. The records of Burke Corporation showed the following on December 31, 2016:  How much should Gilman Company report as investment income from the Burke investment during 2016?

How much should Gilman Company report as investment income from the Burke investment during 2016?

A)$230,000.

B)$218,000.

C)$12,000.

D)$30,000.

How much should Gilman Company report as investment income from the Burke investment during 2016?

How much should Gilman Company report as investment income from the Burke investment during 2016?A)$230,000.

B)$218,000.

C)$12,000.

D)$30,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

67

When is the equity method not used to account for a long-term investment in common stock?

A)When the investment is 30% of the voting stock and significant influence can be achieved.

B)When the investment is 15% and significant influence can be achieved.

C)When the investment is greater than 50% of the voting stock and control is achieved.

D)When the investment is 40% of the voting stock and significant influence can be achieveD.The investment must be 50% or less of the voting stock and the ability to exert significant influence must exist.

A)When the investment is 30% of the voting stock and significant influence can be achieved.

B)When the investment is 15% and significant influence can be achieved.

C)When the investment is greater than 50% of the voting stock and control is achieved.

D)When the investment is 40% of the voting stock and significant influence can be achieveD.The investment must be 50% or less of the voting stock and the ability to exert significant influence must exist.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

68

On January 1, 2016, Palmer, Inc. bought 40% of the outstanding shares of Arnold Corporation at a cost of $137,000. Palmer uses the equity method of accounting for this investment. During 2016, Arnold Corporation reported $30,000 of net income and paid a total of $10,000 in cash dividends. At the end of 2016, the shares had a fair value of $150,000. At the end of 2016, the shares had a fair value of $150,000. What is the amount of Equity in Affiliate Earnings for 2016?

A)$4,000.

B)$12,000.

C)$13,000.

D)$21,000.

A)$4,000.

B)$12,000.

C)$13,000.

D)$21,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements is correct with regard to investments and the statement of cash flows?

A)When the equity method is used to account for an investment in a company's common stock, the reported share of affiliate net income must be added to net income in the operating activities section of the statement of cash flows.

B)When the equity method is used to account for an investment in a company's common stock, the cash dividends received are a cash inflow from investing activities.

C)Any realized or unrealized gains or losses that were reported on the income statement under the fair value method of accounting for investments must be removed from net income in the operating activities section of the statement of cash flows.

D)When the equity method is used to account for an investment in a company's common stock, the reported share of affiliate dividends must be deducted from net income in the operating activities section of the statement of cash flows.

A)When the equity method is used to account for an investment in a company's common stock, the reported share of affiliate net income must be added to net income in the operating activities section of the statement of cash flows.

B)When the equity method is used to account for an investment in a company's common stock, the cash dividends received are a cash inflow from investing activities.

C)Any realized or unrealized gains or losses that were reported on the income statement under the fair value method of accounting for investments must be removed from net income in the operating activities section of the statement of cash flows.

D)When the equity method is used to account for an investment in a company's common stock, the reported share of affiliate dividends must be deducted from net income in the operating activities section of the statement of cash flows.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

70

On January 1, 2016, Palmer, Inc. bought 40% of the outstanding shares of Arnold Corporation at a cost of $137,000. Palmer uses the equity method of accounting for this investment. During 2016, Arnold Corporation reported $30,000 of net income and paid a total of $10,000 in cash dividends. At the end of 2016, the shares had a fair value of $150,000. At what amount should the Arnold investment be reported at on the December 31, 2016 balance sheet of Palmer, Inc.?

A)$150,000.

B)$157,000.

C)$145,000.

D)$163,000.

A)$150,000.

B)$157,000.

C)$145,000.

D)$163,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

71

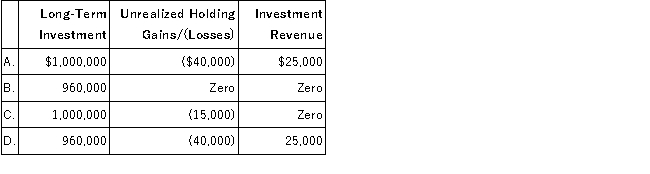

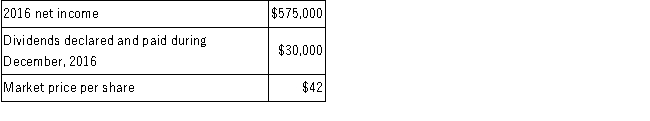

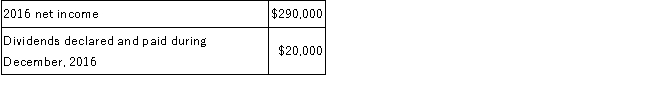

JDR Company purchased 40% of the common stock of YRK Corporation on January 1, 2016, for $2,000,000 as a long-term investment. The records of YRK Corporation showed the following on December 31, 2016:  At what amount should JDR report the YRK investment on the December 31, 2016 balance sheet?

At what amount should JDR report the YRK investment on the December 31, 2016 balance sheet?

A)$2,116,000.

B)$2,000,000.

C)$2,096,000.

D)$2,108,000.

At what amount should JDR report the YRK investment on the December 31, 2016 balance sheet?

At what amount should JDR report the YRK investment on the December 31, 2016 balance sheet?A)$2,116,000.

B)$2,000,000.

C)$2,096,000.

D)$2,108,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following statements regarding the accounting for a common stock investment using the equity method is incorrect?

A)The equity method is used for investments of ownership between 20% and 50% of the outstanding voting stock when the investor has the ability to exert significant influence.

B)The investment account is increased by the proportionate share of affiliate net income.

C)The investment account is decreased by the proportionate share of affiliate dividends.

D)Investment income equals the proportionate share of affiliate dividends.

A)The equity method is used for investments of ownership between 20% and 50% of the outstanding voting stock when the investor has the ability to exert significant influence.

B)The investment account is increased by the proportionate share of affiliate net income.

C)The investment account is decreased by the proportionate share of affiliate dividends.

D)Investment income equals the proportionate share of affiliate dividends.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

73

Heartfelt Company owns a 40% interest in the voting common stock of Candle Corporation, and Heartfelt accounts for the investment using the equity method. During 2016, Candle Corporation reported net income of $100,000 and declared and paid cash dividends of $10,000. The carrying value of the Candle investment was $500,000 on January 1, 2016. How much investment income should Heartfelt report during 2016 from the Candle investment?

A)$36,000.

B)$40,000.

C)$4,000.

D)$10,000.

A)$36,000.

B)$40,000.

C)$4,000.

D)$10,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

74

Photo Finish Corporation bought a 40% interest in Click-It Corporation's $1 par value voting common stock on March 31, 2017. On that date, Click-It paid $20 million for 2 million shares at a $10 market price per share. On December 31, 2017, Click-It paid a $1 million cash dividend declared earlier in 2017, and reported net income for the year ended 2017 of $10 million. On December 31, 2017, Click-It's stock was trading at $11.50 per share. What effect will the dividend have on the Photo Finish financial statements?

A)It would increase cash and increase equity in affiliate earnings.

B)It would increase cash and decrease the investment account.

C)It would increase cash and increase net unrealized gains/losses.

D)It would increase cash and increase the investment account.

A)It would increase cash and increase equity in affiliate earnings.

B)It would increase cash and decrease the investment account.

C)It would increase cash and increase net unrealized gains/losses.

D)It would increase cash and increase the investment account.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following statements is false with regard to investments and the cash flow statement?

A)Dividends received from stock investments increase cash flows from investing activities.

B)Income from investments accounted for using the equity method does not create cash flows.

C)Sale of stock investments is a cash inflow from investing activities.

D)Dividends received from stock investments accounted for using the equity method are not reported as income but are reported as cash flows.

A)Dividends received from stock investments increase cash flows from investing activities.

B)Income from investments accounted for using the equity method does not create cash flows.

C)Sale of stock investments is a cash inflow from investing activities.

D)Dividends received from stock investments accounted for using the equity method are not reported as income but are reported as cash flows.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

76

Sandor Company owns an investment portfolio of available-for-sale securities. During 2016, Sandor received $3,000 of dividends and $1,000 of interest from the securities in the portfolio. The fair value of the portfolio on January 1, 2016 was $86,000 and the fair value of the portfolio at December 31, 2016 was $98,000. The economic return from investing ratio is closest to:

A)16.3.

B)33.3.

C)18.6.

D)17.4.

A)16.3.

B)33.3.

C)18.6.

D)17.4.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

77

On January 1, 2016, Calas Company acquired 40% of the outstanding voting common stock of Nick Company as a long-term investment. During 2016, Nick reported net income of $10,000 and declared and paid dividends of $4,000. During 2016, Calas Company should report equity in affiliate earnings of:

A)$5,600.

B)$4,000.

C)$2,400.

D)$10,000.

A)$5,600.

B)$4,000.

C)$2,400.

D)$10,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

78

When is the equity method used to account for long-term investments in common stock?

A)When the investment is between 20% and 50% of the voting stock, regardless of whether or not significant influence can be achieved.

B)When the investment is greater than 50% of the voting stock, regardless of whether or not significant influence can be achieved.

C)When the investment is greater than 50% of the voting stock and significant influence can be achieved.

D)When the investment is between 20% and 50% of the voting stock and significant influence can be achieveD.The equity method of accounting is used when an investment is between 20% and 50% of the voting stock of an affiliate and significant influence has been achieved.

A)When the investment is between 20% and 50% of the voting stock, regardless of whether or not significant influence can be achieved.

B)When the investment is greater than 50% of the voting stock, regardless of whether or not significant influence can be achieved.

C)When the investment is greater than 50% of the voting stock and significant influence can be achieved.

D)When the investment is between 20% and 50% of the voting stock and significant influence can be achieveD.The equity method of accounting is used when an investment is between 20% and 50% of the voting stock of an affiliate and significant influence has been achieved.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

79

On January 1, 2016, Turtle Inc. bought 30% of the outstanding shares of Shell Corporation common stock at a cost of $150,000. Turtle uses the equity method of accounting for this investment is used. During 2016, Shell Corporation reported $40,000 of net income and paid a total of $5,000 in cash dividends. At the end of 2016, the shares had a fair value of $160,000. How much investment income will Turtle report for equity in affiliate earnings during 2016?

A)$12,000.

B)$22,000.

C)$10,500.

D)$1,500.

A)$12,000.

B)$22,000.

C)$10,500.

D)$1,500.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

80

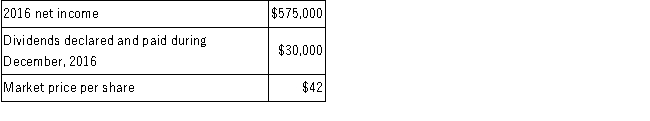

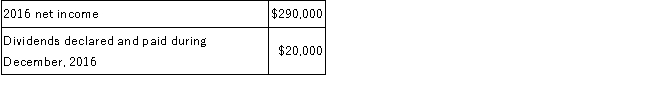

Copper Company purchased 40% of the common stock of York Corporation on January 1, 2016, for $2,000,000 as a long-term investment. The records of York Corporation showed the following on December 31, 2016:  How much investment income should Copper report from the York investment during 2016?

How much investment income should Copper report from the York investment during 2016?

A)$290,000.

B)$108,000.

C)$116,000.

D)$8,000.

How much investment income should Copper report from the York investment during 2016?

How much investment income should Copper report from the York investment during 2016?A)$290,000.

B)$108,000.

C)$116,000.

D)$8,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck