Deck 5: The Time Value of Money

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/113

Play

Full screen (f)

Deck 5: The Time Value of Money

1

The process of finding present values is frequently called

A) annualizing

B) compounding

C) discounting

D) leasing

A) annualizing

B) compounding

C) discounting

D) leasing

C

2

The amount of simple interest is equal to the product of the principal times ____ times ____.

A) (1 + rate per time period), the number of time periods

B) (1 + rate per time period), (the number of time periods -1)

C) rate per time period, the number of time periods

D) rate per time period, (the number of time periods - 1)

A) (1 + rate per time period), the number of time periods

B) (1 + rate per time period), (the number of time periods -1)

C) rate per time period, the number of time periods

D) rate per time period, (the number of time periods - 1)

C

3

If the present value of a given sum is equal to its future value, then

A) the discount rate must be very high

B) there is no inflation

C) the discount rate must be zero

D) none of the answers is correct

A) the discount rate must be very high

B) there is no inflation

C) the discount rate must be zero

D) none of the answers is correct

C

4

The values shown in ordinary annuity tables (either present value or compound value) can be adjusted to the annuity due form by ____ the ordinary annuity interest factor by ____.

A) dividing, (1 + i)

B) dividing, (1 + i)n

C) multiplying, (1 + i)

D) multiplying, (1 + i)n

A) dividing, (1 + i)

B) dividing, (1 + i)n

C) multiplying, (1 + i)

D) multiplying, (1 + i)n

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

5

Finding the discounted current value of $1,000 to be received at the end of each of the next 5 years requires calculating the

A) future value of an annuity

B) future value of an annuity due

C) present value of an annuity

D) present value of an annuity due

A) future value of an annuity

B) future value of an annuity due

C) present value of an annuity

D) present value of an annuity due

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

6

The effective rate of interest will always be ____ the nominal rate.

A) greater than

B) equal to

C) less than

D) equal to or greater than

A) greater than

B) equal to

C) less than

D) equal to or greater than

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

7

The more frequent the compounding the

A) greater the present value

B) greater the amount deposited

C) greater the effective interest rate

D) lesser the future value

A) greater the present value

B) greater the amount deposited

C) greater the effective interest rate

D) lesser the future value

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

8

Finding the compound sum of $1,000 to be received at the beginning of each of the next 5 years requires calculating the

A) future value of an annuity

B) present value of an annuity

C) future value of an annuity due

D) present value of an annuity due

A) future value of an annuity

B) present value of an annuity

C) future value of an annuity due

D) present value of an annuity due

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

9

When using a present value of an annuity table(e.g.,Table IV at the back of the book),

A) payments are assumed to be made at the beginning of each period

B) PVIFA factors decrease with an increase in the interest rate

C) PVIFA factors increase with an increase in the number of periods

D) b and c only

A) payments are assumed to be made at the beginning of each period

B) PVIFA factors decrease with an increase in the interest rate

C) PVIFA factors increase with an increase in the number of periods

D) b and c only

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

10

The present value of a single amount can be represented as

A) PV0 = FVn(PVIFi,n)

B) PV0 = FVn(PVIFAi,n)

C) PV0 = FVn[1/(1 + i)n]

D) a and c

A) PV0 = FVn(PVIFi,n)

B) PV0 = FVn(PVIFAi,n)

C) PV0 = FVn[1/(1 + i)n]

D) a and c

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

11

An annuity due is one in which

A) payments or receipts occur at the end of each period.

B) payments or receipts occur at the beginning of each period.

C) payments or receipts occur forever.

D) cash flows occur continuously.

A) payments or receipts occur at the end of each period.

B) payments or receipts occur at the beginning of each period.

C) payments or receipts occur forever.

D) cash flows occur continuously.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

12

When a loan is amortized over a five year term, the

A) rate of interest is reduced each year

B) amount of interest paid is reduced each year

C) payment is reduced each year

D) balance is paid as a balloon payment in the fifth year

A) rate of interest is reduced each year

B) amount of interest paid is reduced each year

C) payment is reduced each year

D) balance is paid as a balloon payment in the fifth year

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

13

You have just calculated the present value of the expected cash flows of a potential investment. Management thinks your figures are too low. Which of the following actions would improve the present value of your cash flows?

A) extend the cash flows over a longer period of time

B) increase the discount rate

C) decrease the discount rate

D) extend the cash flows over a longer period of time, and decrease the discount rate

A) extend the cash flows over a longer period of time

B) increase the discount rate

C) decrease the discount rate

D) extend the cash flows over a longer period of time, and decrease the discount rate

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

14

You have just won a $5 million lottery to be received in twenty annual equal payments of $250,000. What will happen to the present value of your winnings if the interest rate increases during the next 20 years.

A) it will be worth less

B) it will be worth more

C) it will not change

D) it will increase during the first ten years

A) it will be worth less

B) it will be worth more

C) it will not change

D) it will increase during the first ten years

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

15

A(n) ____ is a financial instrument that agrees to pay an equal amount of money per period into the indefinite future (i.e. forever)

A) annuity

B) annuity due

C) sinking fund

D) perpetuity

A) annuity

B) annuity due

C) sinking fund

D) perpetuity

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

16

When using a future value of an annuity table (e.g., Table III at the back of the book),

A) payments are assumed to be made at the end of each period

B) FVIFA factors increase with an increase in the interest rate

C) FVIFA factors increase with an increase in the number of periods

D) all of the above

A) payments are assumed to be made at the end of each period

B) FVIFA factors increase with an increase in the interest rate

C) FVIFA factors increase with an increase in the number of periods

D) all of the above

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

17

Using the "Rule of 72," about how long will it take a sum of money to double in value if the annual interest rate is 9 percent?

A) 9 years

B) 7 years

C) 8 years

D) 10 years

A) 9 years

B) 7 years

C) 8 years

D) 10 years

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

18

The present value of an ordinary annuity is the

A) sum of the present value of a series of equal periodic payments

B) future value of an equal series of payments

C) receipt of equal cash flows for a specified amount of time

D) sum of the future value of an equal series of payments

A) sum of the present value of a series of equal periodic payments

B) future value of an equal series of payments

C) receipt of equal cash flows for a specified amount of time

D) sum of the future value of an equal series of payments

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

19

Annuity due calculations are especially important when dealing with

A) term loans

B) lease contracts

C) capital investments

D) capital recovery problems

A) term loans

B) lease contracts

C) capital investments

D) capital recovery problems

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

20

The basic future value equation is given by

A) FVn = PV0(PVIFi,n)

B) FVn = PV0(FVIFAi,n)

C) FVn = PV0(1/(1+ i)n)

D) FVn = PV0(FVIFi,n)

A) FVn = PV0(PVIFi,n)

B) FVn = PV0(FVIFAi,n)

C) FVn = PV0(1/(1+ i)n)

D) FVn = PV0(FVIFi,n)

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

21

Determine how much $1,000 deposited in a savings account paying 8% (compounded annually) will be worth after 5 years.

A) $5,526

B) $ 784

C) $1,400

D) $1,469

A) $5,526

B) $ 784

C) $1,400

D) $1,469

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

22

Air Atlantic (AA) has been offered a 3-year old jet airliner under a 12-year lease arrangement. The lease requires AA to make annual lease payments of $500,000 at the beginning of each of the next 12 years. Determine the present value of the lease payments if the opportunity cost of funds is 14 percent.

A) $2,830,000

B) $13,635,500

C) $6,000,000

D) $3,226,200

A) $2,830,000

B) $13,635,500

C) $6,000,000

D) $3,226,200

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

23

Determine how much you would be willing to pay for a bond that pays $60 annual interest indefinitely and never matures (i.e. a perpetuity), assuming you require an 8 percent rate of return on this investment.

A) $480

B) $743

C) $1,000

D) $750

A) $480

B) $743

C) $1,000

D) $750

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is worth more?

A) Future value of an ordinary annuity of PMT dollars per year for n years discounted at i percent.

B) Future value of an annuity due of PMT dollars per year for n years discounted at i percent.

C) Both are worth the same amount.

D) Cannot be determined from the information given.

A) Future value of an ordinary annuity of PMT dollars per year for n years discounted at i percent.

B) Future value of an annuity due of PMT dollars per year for n years discounted at i percent.

C) Both are worth the same amount.

D) Cannot be determined from the information given.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

25

Determine (to the nearest dollar) the amount you would be willing to pay for a $1,000 par value bond paying $80 interest each year and maturing in 12 years, assuming you wanted to earn a 9 percent rate of return.

A) $929

B) $573

C) $1,316

D) $1,960

A) $929

B) $573

C) $1,316

D) $1,960

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

26

You sold 100 shares of stock today for $30 per share that you paid $20 for 6 years ago. Determine the average annual rate of return on your investment, assuming the stock paid no dividends.

A) 25%

B) 8.33%

C) 150%

D) 7%

A) 25%

B) 8.33%

C) 150%

D) 7%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

27

The ____ of a perpetual stream of equal, annual returns (PMT) discounted at i% per year is equal to ____.

A) present value; PMT/i

B) present value; PMT * i

C) future value; PMT/i

D) future value; PMT * i

A) present value; PMT/i

B) present value; PMT * i

C) future value; PMT/i

D) future value; PMT * i

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

28

The annual effective rate of interest (i?ff ) is a function of:

A) the annual nominal rate of interest (inom)

B) the number of compounding intervals per year (m)

C) the number of years (n)

D) a and b

A) the annual nominal rate of interest (inom)

B) the number of compounding intervals per year (m)

C) the number of years (n)

D) a and b

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

29

Annuity due calculations are most common when dealing with:

A) cash dividends

B) loan repayments

C) lease contracts

D) interest payments

A) cash dividends

B) loan repayments

C) lease contracts

D) interest payments

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

30

____ is the return earned by someone who has forgone current consumption.

A) the present value

B) principle

C) an annuity

D) interest

A) the present value

B) principle

C) an annuity

D) interest

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

31

More frequent compounding results in ____ future values and ____ present values than less frequent compounding at the same interest rate.

A) higher, higher

B) lower, higher

C) higher, lower

D) lower, lower

A) higher, higher

B) lower, higher

C) higher, lower

D) lower, lower

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

32

The difference between an ordinary annuity and an annuity due is:

A) the interest rate

B) the timing of the payments

C) the amount of the payments

D) the number of periods

A) the interest rate

B) the timing of the payments

C) the amount of the payments

D) the number of periods

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

33

Comet Powder Company has purchased a piece of equipment costing $100,000. It is expected to generate a ten-year stream of benefits amounting to $16,273 per year. Determine the rate of return Comet expects to earn from this equipment.

A) 16.3%

B) 62.7%

C) 10%

D) 20%

A) 16.3%

B) 62.7%

C) 10%

D) 20%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

34

The earnings of Omega Supply Company have grown from $2.00 per share to $4.00 per share over a nine year time period. Determine the compound annual growth rate.

A) 11.1%

B) 8%

C) 22.2%

D) 100%

A) 11.1%

B) 8%

C) 22.2%

D) 100%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

35

____ is interest that is paid not only on the principal, but also on any interest earned but not withdrawn during earlier periods.

A) basic interest

B) simple interest

C) future interest

D) compound interest

A) basic interest

B) simple interest

C) future interest

D) compound interest

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

36

Mr. Moore is 35 years old today and is beginning to plan for his retirement. He wants to set aside an equal amount at the end of each of the next 25 years so that he can retire at age 60. He expects to live to the maximum age of 80 and wants to be able to withdraw $25,000 per year from the account on his 61st through 80th birthdays. The account is expected to earn 10 percent per annum for the entire period of time. Determine the size of the annual deposits that must be made by Mr. Moore.

A) $212,850

B) $23,449

C) $2,164

D) $8,514

A) $212,850

B) $23,449

C) $2,164

D) $8,514

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

37

An annuity that begins more than 1 year in the future is referred to as a(n) ____.

A) perpetuity

B) annuity due

C) uneven annuity

D) deferred annuity

A) perpetuity

B) annuity due

C) uneven annuity

D) deferred annuity

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

38

The present value of a(n) ____ is determined by dividing the annual cash flow by the interest rate.

A) annuity

B) annuity due

C) perpetuity

D) lease

A) annuity

B) annuity due

C) perpetuity

D) lease

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

39

If you invest $10,000 in a 4-year certificate of deposit (CD) paying 10 percent interest compounded annually, determine how much the CD will be worth at the end of 4 years.

A) $13,600

B) $45,730

C) $14,640

D) $15,958

A) $13,600

B) $45,730

C) $14,640

D) $15,958

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

40

The payment or receipt of a series of equal cash flows per period, at the end of each period, for a specified amount of time is called a(n):

A) annuity due

B) perpetuity

C) ordinary annuity

D) simple interest

A) annuity due

B) perpetuity

C) ordinary annuity

D) simple interest

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

41

John is 25 years old and wishes to retire in 30 years. His plan is to invest in a mutual fund earning a 12 percent annual return and have a $1 million retirement fund at age 55. How much must he invest at the end of each year to achieve this goal?

A) $7,499.96

B) $5,024.60

C) $4,143.65

D) $33,333.33

A) $7,499.96

B) $5,024.60

C) $4,143.65

D) $33,333.33

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

42

An insurance company offers you an end of year annuity of $48,000 per year for the next 20 years. They claim your return on the annuity is 9 percent. What should you be willing to pay today for this annuity?

A) $429,600

B) $438,144

C) $408,672

D) $398,144

A) $429,600

B) $438,144

C) $408,672

D) $398,144

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

43

Columbia Bank & Trust has just given you a $20,000 term loan to pay for a new concrete mixer. The loan requires five equal annual end of the year payments. If the loan provides the bank with a 12 percent return, what will be your annual payments?

A) $5,548

B) $3,148.12

C) $6,000

D) $1,666.67

A) $5,548

B) $3,148.12

C) $6,000

D) $1,666.67

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

44

The lease on a new office requires an immediate payment of $24,000 plus $24,000 per year at the end of each of the next 10 years. At a discount rate of 14 percent, what is the present value of this stream of lease payments?

A) $130,872

B) $149,194

C) $142,710

D) $264,000

A) $130,872

B) $149,194

C) $142,710

D) $264,000

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

45

In six years, your daughter will be going to college. You wish to have a fund that will provide her $10,000 per year (end of year) for each of her four years in college. How much must you put into that fund today if the fund will earn 10 percent in each of the 10 years?

A) $29,744.65

B) $29,783.76

C) $17,878.80

D) $21,651.10

A) $29,744.65

B) $29,783.76

C) $17,878.80

D) $21,651.10

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

46

What is the effective rate of interest on a CD that has a nominal rate of 9.5 percent with interest compounded monthly?

A) 9.92%

B) 9.74%

C) 10.02%

D) 9.86%

A) 9.92%

B) 9.74%

C) 10.02%

D) 9.86%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

47

What is the future value of a $10,000 college tuition fund if the nominal rate of interest is 12 percent compounded monthly for five years?

A) $17,623.42

B) $18,170

C) $16,105.10

D) $16,122.26

A) $17,623.42

B) $18,170

C) $16,105.10

D) $16,122.26

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

48

Your grandparents put $1,000 into a savings account for you when you were born 20 years ago. This account has been earning interest at a compound rate of 7 percent. What is its value today?

A) $3,870

B) $1,967

C) $3,026

D) $3,583

A) $3,870

B) $1,967

C) $3,026

D) $3,583

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

49

Alabama Power has preferred stock that pays an annual dividend of $9.44. If the security has no maturity, what is it's value to an investor who wishes to obtain a 9 percent rate of return?

A) $84.96

B) $104.89

C) $95.34

D) $94.40

A) $84.96

B) $104.89

C) $95.34

D) $94.40

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

50

Designs Now is opening a showcase office to display and sell it's computer designed poster art. Designs expects cash flows to be $120,000 in the first year, $180,000 in the second year, $240,000 in the third year. If Designs uses 11 percent as its discount rate, what is the present value of the cash flows?

A) $429,720

B) $457,620

C) $456,000

D) $424,820

A) $429,720

B) $457,620

C) $456,000

D) $424,820

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

51

BB&C bank has agreed to lend you $30,000 today, but you must repay $42,135 in 3 years. What rate is the bank charging you?

A) 10%

B) 11%

C) 12%

D) 13%

A) 10%

B) 11%

C) 12%

D) 13%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

52

Baggos has seen their EPS increase from $0.30 to $3.16 in seven years. What has been the growth rate of Baggos's EPS?

A) about 30%

B) about 40%

C) about 20%

D) about 10%

A) about 30%

B) about 40%

C) about 20%

D) about 10%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

53

Idlewild Bank has granted you a seven year loan for $50,000. If your seven annual end of the year payments are $11,660.45, what is the rate of interest Idlewild is charging?

A) 14%

B) 23%

C) 12.6%

D) 11%

A) 14%

B) 23%

C) 12.6%

D) 11%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

54

New Jersey Mutual has offered you a single premium annuity that will pay you $12,000 per year (end of year) for the next 15 years. If you must pay $109,296 today for this annuity, what is your expected rate of return?

A) 8%

B) 9%

C) 7%

D) 10%

A) 8%

B) 9%

C) 7%

D) 10%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

55

Your firm, New Sunrise, has just leased a $28,000 BMW for you. The lease requires six beginning of the year payments that will fully amortize the cost of the car. What is the amount of the payments if the interest rate is 12 percent?

A) $6,810.99

B) $7,766.99

C) $6,423.74

D) $6,081.25

A) $6,810.99

B) $7,766.99

C) $6,423.74

D) $6,081.25

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

56

Many IRA funds argue that investors should invest at the beginning of the year rather than at the end. What is the difference to an investor who invests $2,000 per year at 11 percent over a 30 year period?

A) $43,785

B) $36,189

C) $54,244

D) There is no difference

A) $43,785

B) $36,189

C) $54,244

D) There is no difference

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

57

Billy Bob has decided to put $2,400 a year (at the end of each year) into an IRA over his 40 year working life and then retire. What will Billy have if the account will earn 10 percent compounded annually?

A) $394,786

B) $ 23,470

C) $1,062,223

D) $810,917

A) $394,786

B) $ 23,470

C) $1,062,223

D) $810,917

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

58

The Florida lottery agrees to pay the winner $250,000 at the end of each year for the next 20 years. What is the future value of this lottery if you plan to put each payment in an account earning 9 percent?

A) $2.28 million

B) $12.79 million

C) $14.32 million

D) $ 5.00 million

A) $2.28 million

B) $12.79 million

C) $14.32 million

D) $ 5.00 million

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

59

Jane wants to have $200,000 in an account in 20 years. If her account earns 11 percent per annum over the accumulation period, how much must she save per year (end of year) to have the $200,000?

A) $25,116

B) $3,115

C) $10,000

D) $3,492

A) $25,116

B) $3,115

C) $10,000

D) $3,492

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

60

You have just won a $50,000 bond that pays no interest and matures in 20 years. If the discount rate is 10%, what is the present value of your bond?

A) $7,450

B) $8,175

C) $8,900

D) $1,490

A) $7,450

B) $8,175

C) $8,900

D) $1,490

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

61

You just purchased a new $25,000 car and agreed to pay for the car in 50 monthly payments. If the monthly interest rate is 1 percent, what is your total financing cost?

A) $637.82

B) $12,500

C) $574.25

D) $6,891

A) $637.82

B) $12,500

C) $574.25

D) $6,891

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

62

You purchased a piece of property for $30,000 nine years ago and sold it today for $83,190. What was your rate of return on your investment?

A) 12%

B) 11%

C) 10%

D) 9%

A) 12%

B) 11%

C) 10%

D) 9%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

63

Your brother, who is 6 years old, just received a trust fund that will be worth $25,000 when he is 21 years old. If the fund earns 10 percent interest compounded annually, what is the value of the fund today?

A) $104,602

B) $6,575

C) $5,975

D) $6,875

A) $104,602

B) $6,575

C) $5,975

D) $6,875

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

64

John borrowed $20,000 to finance his college education. If the finance charge on the loan is 6 percent, and he will pay off the loan in 10 equal, annual, end of year payments, how much total interest will he pay?

A) $7,173.90

B) $2,717.39

C) $12,000.00

D) $25,924.23

A) $7,173.90

B) $2,717.39

C) $12,000.00

D) $25,924.23

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

65

Your local bank offers 4-year certificates of deposit (CD) at a 12 percent annual nominal interest rate compounded quarterly. Determine how much additional interest you will earn over 4 years on a $10,000 CD that is compounded quarterly compared with one that is compounded annually.

A) $6,050

B) $0

C) $310

D) $220

A) $6,050

B) $0

C) $310

D) $220

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

66

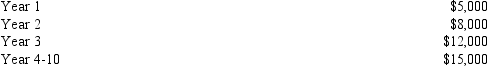

What is the most you should pay to receive the following cash flows if your required rate of return is 12 percent?

A) $58,580

B) $104,135

C) $68,105

D) $40,000

A) $58,580

B) $104,135

C) $68,105

D) $40,000

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

67

Joe Brady just won a $450,000 lottery in Pennsylvania. Instead of receiving a lump sum, he found that he would receive $22,500 annually (end of year) for 20 years. Joe is 75 years old and wants his money now. He has been offered $140,827 to sell his ticket. What rate of return is the buyer expecting to make if Joe accepts the offer?

A) less than 1%

B) 15%

C) 18%

D) 12%

A) less than 1%

B) 15%

C) 18%

D) 12%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

68

Five years after an accident, you received $100,000 to pay the medical expenses incurred at the time of the accident. What is the present value (at the time of the accident) of the payment? Assume interest rates are 9%.

A) $153,900

B) $ 68,100

C) $ 65,000

D) $ 70,800

A) $153,900

B) $ 68,100

C) $ 65,000

D) $ 70,800

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

69

You wish to save $500,000 in the next 25 years. You notice that a corporate bond fund earns about 11 percent per year and that is where you put your savings. How much must you save each year to obtain your goal?

A) $20,000.00

B) $ 3,749.98

C) $ 4,370.13

D) $ 2,000.00

A) $20,000.00

B) $ 3,749.98

C) $ 4,370.13

D) $ 2,000.00

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

70

California Life has just offered you a single premium annuity for $5,000 that will pay $5,144.12 per year for 20 years, the first payment being received exactly 31 years from today. What is the implied rate of return on this annuity?

A) 7%

B) 8%

C) 9%

D) 6.5%

A) 7%

B) 8%

C) 9%

D) 6.5%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

71

Sales for Triad Inc. have grown from $2 million to $8.092 million in 10 years. What is the implied growth rate of sales for Triad?

A) 24.72%

B) 4.05%

C) 15.0%

D) 12.2%

A) 24.72%

B) 4.05%

C) 15.0%

D) 12.2%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

72

Seebee makes quarterly (end of period) payments of $30,000 into a pension fund earning 12 percent per year compounded quarterly for 10 years. How much interest will they have earned in 10 years?

A) $2,262,030

B) $2,105,880

C) $905,880

D) $1,062,030

A) $2,262,030

B) $2,105,880

C) $905,880

D) $1,062,030

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

73

A bank has agreed to loan you $10,000 at 11% for 5 years. You are required to make equal, annual, end-of-year payments that include both principal and interest on the outstanding balance. Determine the amount of these annual payments (to the nearest dollar).

A) $2,000

B) $3,100

C) $2,706

D) $1,100

A) $2,000

B) $3,100

C) $2,706

D) $1,100

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

74

Jackie plans to open her own book store in 10 years. To raise the "seed" money she has committed $10,000 she now has in a mutual fund. In addition, she plans to save $2,000 per year (end of year) for the next 5 years and $3,000 per year (end of year) for the following 5 years. How much "seed" money will Jackie have in 10 years if the investments earn 10 percent per year compounded annually?

A) $76,129

B) $63,925

C) $44,255

D) $159,370

A) $76,129

B) $63,925

C) $44,255

D) $159,370

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

75

If you invest the $10,000 you receive at graduation (age 22) in a mutual fund that averages a 12% annual return, how much will you have at retirement in 40 years?

A) $909,090

B) $930,510

C) $783,879

D) $510,285

A) $909,090

B) $930,510

C) $783,879

D) $510,285

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

76

Roy, who has just turned 40, would like to have an annual annuity of $20,000 paid over a 20 year period, the first payment occurring on his 66th birthday. How much must Roy save each year (end of year) for the next 25 years to have this annuity, if the investment will earn 12 percent compounded annually?

A) $16,000

B) $19,046

C) $1,120

D) $944.10

A) $16,000

B) $19,046

C) $1,120

D) $944.10

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

77

A zero coupon bond with a $1,000 par value is selling for $356 and matures in 12 years. What is the implied discount rate (yield to maturity)?

A) 9%

B) 9.36%

C) 9.12%

D) 9.4%

A) 9%

B) 9.36%

C) 9.12%

D) 9.4%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

78

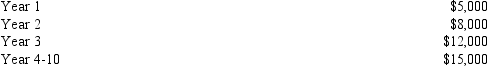

What is the present value of the following net cash flows if the discount rate is 12%:

A) $151,400

B) $ 86,462

C) $144,037

D) $ 79,252

A) $151,400

B) $ 86,462

C) $144,037

D) $ 79,252

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

79

How much will you have at the end of 5 years in a European vacation account if you deposit $200 a month in an account that is paying a nominal 12 percent per year, compounded monthly?

A) $16,334

B) $15,247

C) $16,497

D) $15,817

A) $16,334

B) $15,247

C) $16,497

D) $15,817

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

80

You plan to lease a Saab automobile that sells for $22,657 and has no salvage value. If the monthly lease is $499, with the first of 60 payments due immediately. What is the implied annual interest rate on your lease?

A) 10%

B) 11.5%

C) 12%

D) 13.5%

A) 10%

B) 11.5%

C) 12%

D) 13.5%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck