Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Edition 7ISBN: 978-0073376301

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Edition 7ISBN: 978-0073376301 Exercise 23

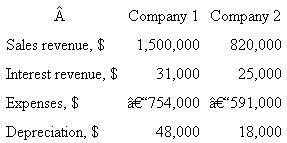

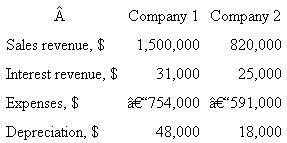

Two companies have the following values on their annual tax returns.

a) Calculate the federal income tax for the year for each company.

b) Determine the percent of sales revenue each company will pay in federal income tax.

c) Estimate the taxes using an effective rate of 34% of the entire TI. Determine the percentage error made relative to the exact taxes in part

a).

a) Calculate the federal income tax for the year for each company.

b) Determine the percent of sales revenue each company will pay in federal income tax.

c) Estimate the taxes using an effective rate of 34% of the entire TI. Determine the percentage error made relative to the exact taxes in part

a).

Explanation

Net operating income is gross income min...

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255