McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 44

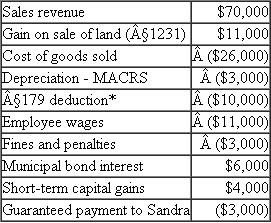

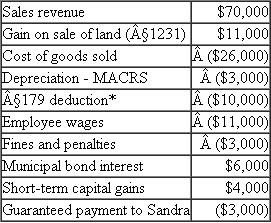

Georgio owns a 20 percent profits and capital interest in Rain Tree LLC. For the current year, Rain Tree had the following revenues, expenses, gains, and losses:

*Assume the §179 property placed in service limitation does not apply.

a. How much ordinary business income (loss) is allocated to Georgio for the year

b. What are Georgio's separately stated items for the year

*Assume the §179 property placed in service limitation does not apply.

a. How much ordinary business income (loss) is allocated to Georgio for the year

b. What are Georgio's separately stated items for the year

Explanation

Partnership Interest:

Partnership inter...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255