McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 26

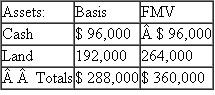

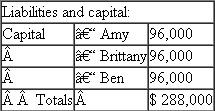

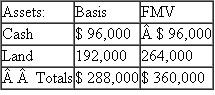

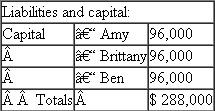

Michelle pays $120,000 cash for Brittany's one-third interest in the Westlake Partnership.Just prior to the sale, Brittany's interest in Westlake is $96,000.Westlake reports the following balance sheet:

?a.What is the amount and character of Brittany's recognized gain or loss on the sale?

?b.What is Michelle's basis in her partnership interest? What is Michelle's inside basis?

?c.If Westlake were to sell the land for $264,000 shortly after the sale of Brittany's partnership interest, how much gain or loss would the partnership recognize?

?d.How much gain or loss would Michelle recognize?

?e.Suppose Westlake has a §754 election in place.What is Michelle's special basis adjustment? How much gain or loss would Michelle recognize on a subsequent sale of the land in this situation?

?a.What is the amount and character of Brittany's recognized gain or loss on the sale?

?b.What is Michelle's basis in her partnership interest? What is Michelle's inside basis?

?c.If Westlake were to sell the land for $264,000 shortly after the sale of Brittany's partnership interest, how much gain or loss would the partnership recognize?

?d.How much gain or loss would Michelle recognize?

?e.Suppose Westlake has a §754 election in place.What is Michelle's special basis adjustment? How much gain or loss would Michelle recognize on a subsequent sale of the land in this situation?

Explanation

In the current scenario of W Partnership...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255