Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

Edition 1ISBN: 978-0077332648

Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

Edition 1ISBN: 978-0077332648 Exercise 26

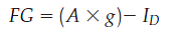

The following equation provides an alternative calculation to determine a developing country's financing gap:

In this equation, FG is the financing gap; A is a variable that captures the country's starting income together with its ability to turn investment into growth (expressed in dollars) ; g is the targeted growth rate; and I D is the amount of domestic investment currently in the economy. Assume that A = $50,000,000,000, g = 0.08, and I D = $500,000,000, and answer the questions that follow.

a. What is the size of the financing gap?

b. Assume that the population of the United States is 300 million. How much would each U.S. citizen have to pay to fill the financing gap?

c. What percentage of GDP per capita in the United States does your answer from (b) represent if GDP per capita is currently $45,000?

Now assume that the United States decides to donate the amount of the financing gap to the developing country as aid. Assume also that there are administrative and competitive costs associated with receiving aid. Specifically, 23 cents of every dollar spent on aid will go to administrative costs. Also, for every dollar received from abroad intended to be used for investment, 50 cents will be used for noninvestment purposes.

d. Calculate the real increase in investment dollars the aid from the United States will provide in the recipient country.

In this equation, FG is the financing gap; A is a variable that captures the country's starting income together with its ability to turn investment into growth (expressed in dollars) ; g is the targeted growth rate; and I D is the amount of domestic investment currently in the economy. Assume that A = $50,000,000,000, g = 0.08, and I D = $500,000,000, and answer the questions that follow.

a. What is the size of the financing gap?

b. Assume that the population of the United States is 300 million. How much would each U.S. citizen have to pay to fill the financing gap?

c. What percentage of GDP per capita in the United States does your answer from (b) represent if GDP per capita is currently $45,000?

Now assume that the United States decides to donate the amount of the financing gap to the developing country as aid. Assume also that there are administrative and competitive costs associated with receiving aid. Specifically, 23 cents of every dollar spent on aid will go to administrative costs. Also, for every dollar received from abroad intended to be used for investment, 50 cents will be used for noninvestment purposes.

d. Calculate the real increase in investment dollars the aid from the United States will provide in the recipient country.

Explanation

Given Information:

• •

•

• Populatio...

Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255