Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 61

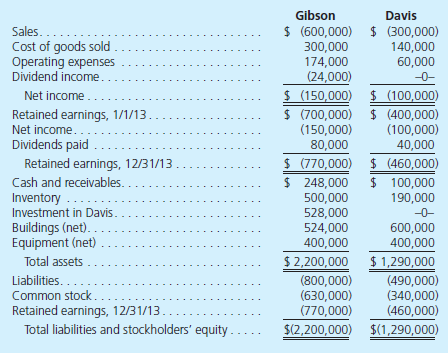

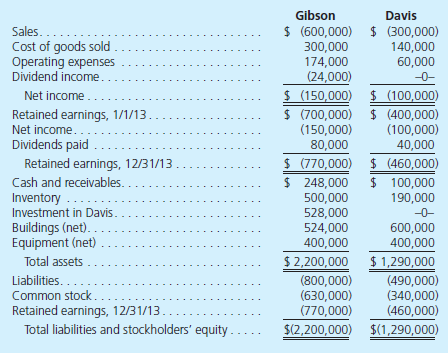

Following are the individual financial statements for Gibson and Davis for the year ending December 31, 2013:

Gibson acquired 60 percent of Davis on April 1, 2013, for $528,000. On that date, equipment owned by Davis (with a five-year remaining life) was overvalued by $30,000. Also on that date, the fair value of the 40 percent noncontrolling interest was $352,000. Davis earned income evenly during the year but paid the entire dividend on November 1, 2013.

a. Prepare a consolidated income statement for the year ending December 31, 2013.

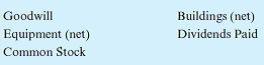

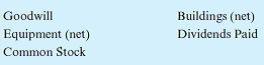

b. Determine the consolidated balance for each of the following accounts as of December 31, 2013:

Gibson acquired 60 percent of Davis on April 1, 2013, for $528,000. On that date, equipment owned by Davis (with a five-year remaining life) was overvalued by $30,000. Also on that date, the fair value of the 40 percent noncontrolling interest was $352,000. Davis earned income evenly during the year but paid the entire dividend on November 1, 2013.

a. Prepare a consolidated income statement for the year ending December 31, 2013.

b. Determine the consolidated balance for each of the following accounts as of December 31, 2013:

Explanation

"Consolidated Financial Statement:"

"The...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255